Market Outlook

March 17, 2016

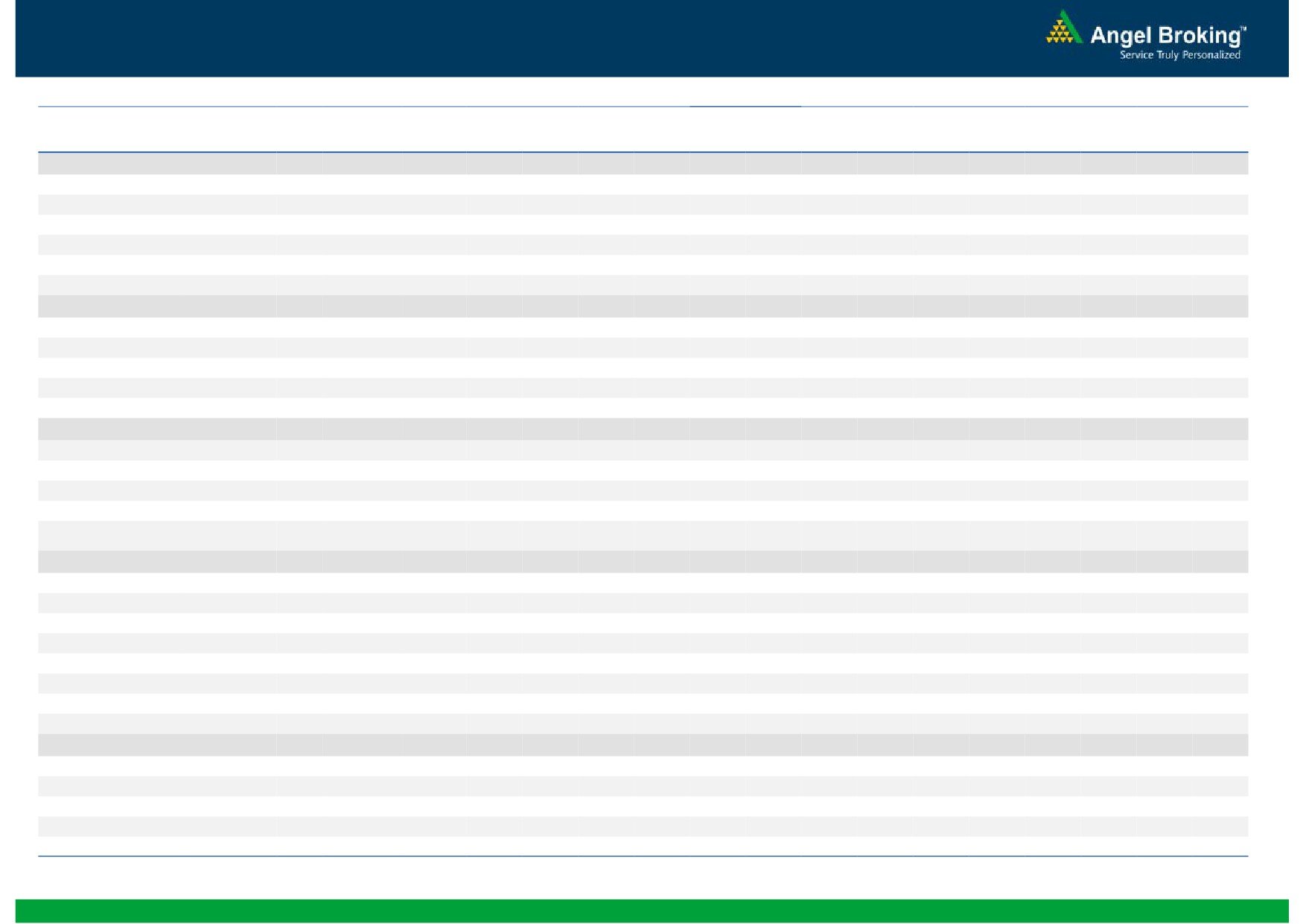

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian market is expected to open in green tracking SGX Nifty & other global peers.

BSE Sensex

0.5

131

24,682

Nifty

0.5

38

7,499

U.S. markets moved up on Wednesday, with S&P 500 and Dow reaching new highs

Mid Cap

(0.4)

(42)

10,180

of 2016, after Fed kept its key interest rates unchanged and downgraded its forecast

Small Cap

(0.2)

(17)

10,239

for number of rate increases to 2 in 2016 from the earlier projected 4. Also, U.S.

inflation increased more than expected in Feb as rents and medical costs maintained

Bankex

0.9

154

17,603

their upward trend. Further, housing market continued its strength last month and

manufacturing stabilized. Rise in energy shares, as oil futures climbed up on hopes

Global Indices

Chg (%)

(Pts)

(Close)

of output freeze, lifted up the S&P 500.

Dow Jones

0.4

74

17,326

FTSE 100 moved upwards, helped by upward movement seen across oil giants, BP

Nasdaq

0.7

35

4,764

and Royal Dutch Shell. Movement in the Energy companies was owing to run-up in

FTSE

0.6

36

6,175

the oil prices.

Nikkei

(0.8)

(143)

16,974

Indian markets bounced back in the last hour of trade with Nifty reclaiming 7,500

Hang Seng

(0.2)

(31)

20,258

intraday mark on Wednesday, ahead of the outcome of Fed's meeting. Private sector

Shanghai Com

0.2

6

2,870

banks, FMCG and select technology stocks helped the market re-bound.

News & Result Analysis

Advances / Declines

BSE

NSE

M-Life wins arbitrage case relating to acquisition of property

Advances

1,150

506

OVL, IOC consortium to buy Russian oil fields for $4.2bn

Declines

1,435

1,037

Detailed analysis on Pg2

Unchanged

161

79

Investor’s Ready Reckoner

Volumes (` Cr)

Key Domestic & Global Indicators

BSE

2,369

Stock Watch: Latest investment recommendations on 150+ stocks

NSE

14,528

Refer Pg5 onwards

Top Picks

Net Inflows (` Cr)

Net

Mtd

Ytd

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

FII

(27)

11,238

(22,610)

Amara Raja Batteries Auto & Auto Ancillary

Buy

901

1,040

15.4

MFs

(275)

(3,364)

77,282

HCL Tech

IT

Buy

815

1,038

27.4

LIC Housing Finance Financials

Buy

446

592

32.7

Top Gainers

Price (`)

Chg (%)

Bharat Electronics

Capital Goods

Buy

1,065

1,414

32.8

Aloktext

5

20.0

Navkar Corporation Others

Buy

168

265

58.1

Den

96

15.2

More Top Picks on Pg4

Persistent

663

8.3

Key Upcoming Events

Hathway

40

6.9

Previous

Consensus

Date

Region

Event Description

Alstomt&D

420

6.0

Reading

Expectations

Mar 17 EUR

Core CPI (YoY) (Feb)

0.7%

0.7%

Mar 17 GBP

Interest Rate Decision (Mar)

0.50%

0.50%

Top Losers

Price (`)

Chg (%)

Mar 17 USD

Initial Jobless Claims

259k

268k

Rajeshexpo

573

(11.7)

Mar 17 USD

Philadelphia Fed Manufacturing Index (Mar)

-2.8

-1.7

Eichermot

18,703

(4.3)

6.(

Punjlloyd

22

(3.7)

Wabag

508

(3.5)

Finolexind

357

(3.3)

As on March 16, 2016

Market Outlook

March 17, 2016

M-Life wins arbitrage case relating to acquisition of property

M-Lifespace (M-Life) has informed that it has won favourable arbitrage ruling with

regards to the acquisition of South Mumbai property. Since 2011, M-Life is

pursuing arbitration proceedings with Orbit Corp., Rishi Gagan Trust & others

(‘vendors”), with regards to this property acquisition.

Earlier M-Life had acquired the redevelopment rights to this property on closing

the deal which was valued at `270cr. Of the total transaction, already `100cr of

the payment has been made.

With such favourable ruling, M-Life can go ahead with the acquisition of this

13,000 sq ft. property. The company is waiting to start the re-development activity

before obligations are completed by the vendors.

Also, in another development, M-Life is planning to build 300 acres industrial park

near Ahmedabad, Gujarat. All the approvals with regard to this project are in

place. Currently this project is in advanced stages and is in the land pooling

phase. This project would be majorly manufacturing hub, with homes for medium

and junior management workers.

This would be company’s fourth industrial park project, after their flagship

Chennai SEZ project, North Chennai project (work is yet to start) and Jaipur SEZ

project.

Also, M-Life signed memorandum of understanding with Gujarat government in

2011 for another 3,000acre industrial project in Dholera and is still awaiting land

from state government. The plan is to set up integrated business city at Dholera

special investment region with investment of ~`2,000cr.

Acquisition of Mumbai re-development project and Ahmedabad Industrial park in

our view would take few more quarters to materialise. We do not expect any

material impact from these projects in the near term, except for payments with

regards to completion of the acquisition.

We maintain our BUY rating on the stock with price target of `554.

OVL, IOC consortium to buy Russian oil fields for $4.2bn

ONGC Videsh Ltd (OVL) and Indian Oil Corp (IOCL) led consortium today signed

agreement to buy stake in 2 Russian oilfields in Siberia for an estimated $4.2bn

(over `28,253cr).

In Sep-2015, OVL had bought 15% stake in Vankor for $1.26bn. The MoU had

envisaged stake going-up in Siberian oilfield to 26% by paying an additional $925

mn.

IOC, Oil India (OIL) and a unit of Bharat Petroleum Corp Ltd (BPCL) signed the

purchase agreement for 29.9% stake in Tass-Yuriakh oilfield from Russia's Rosneft

for $1.28bn. These 3 firms would equally split 29.9% the Rosneft’s stake in Taas-

Yuriah oilfield. The consortium also signed Heads of Agreement (HoA) with Rosneft

for taking 23.9% stake in Vankor oilfield for just over $2bn. IOC-led consortium

also signed another MoU with Rosneft for exploring taking stake in development of

Vankor cluster fields of Suzunskoye, Tagulskoye and Lodochnoye.

Market Outlook

March 17, 2016

The IOC-OIL-BPCL deal for 29.9% stake in Tass-Yuriakh oilfield is concluded

agreement, consortium's Vankor deal is initial pact and sale purchase agreement

is yet to be concluded. Similarly, OVL's increase in stake in Vankor too is yet to be

concluded.

Taas-Yuriah oilfield, holds recoverable reserves of 137mn tons, currently produces

20,000 bpd (barrels per day). The output is slated to rise to 100,000 bpd in 2

years, with IOC-OIL-BPCL expected to pay another $180mn as its share of future

capex.

We currently have BUY rating on IOCL with price target of `455.

Economic and Political News

Land Bill panel granted 6th extension

I-T dept eases rules to woo offshore fund managers

Gas-based power plants forego subsidy in reverse auction

Corporate News

Blackstone emerges as strong contender to acquire Mphasis

Idea completes deployment of 4G services in 10 of the 22 license areas

CTU separation from Power Grid under cloud

VST Tillers signs MoU with Karnataka govt.

Financial Technologies exits its 13% stake in DGCX

Market Outlook

March 17, 2016

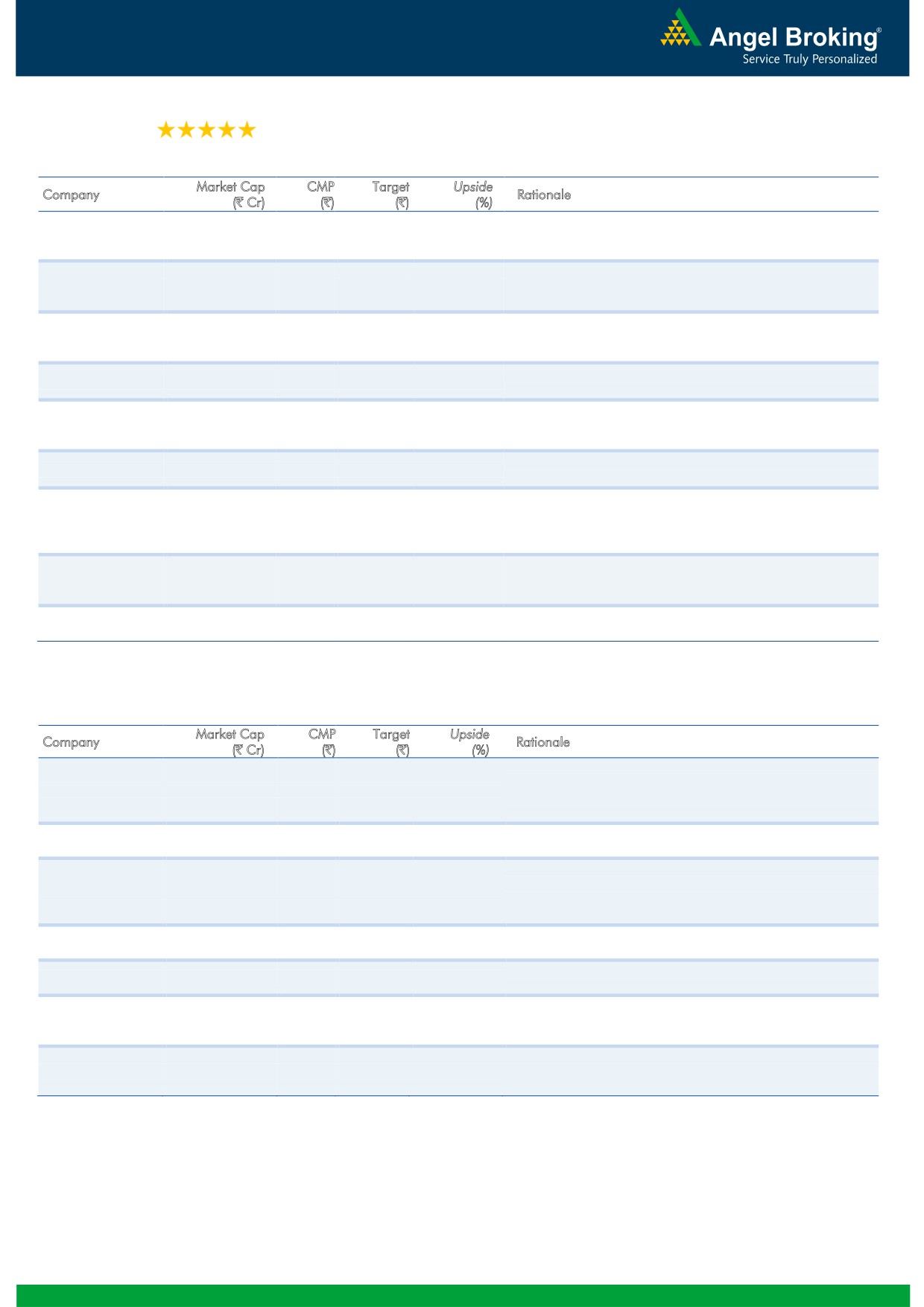

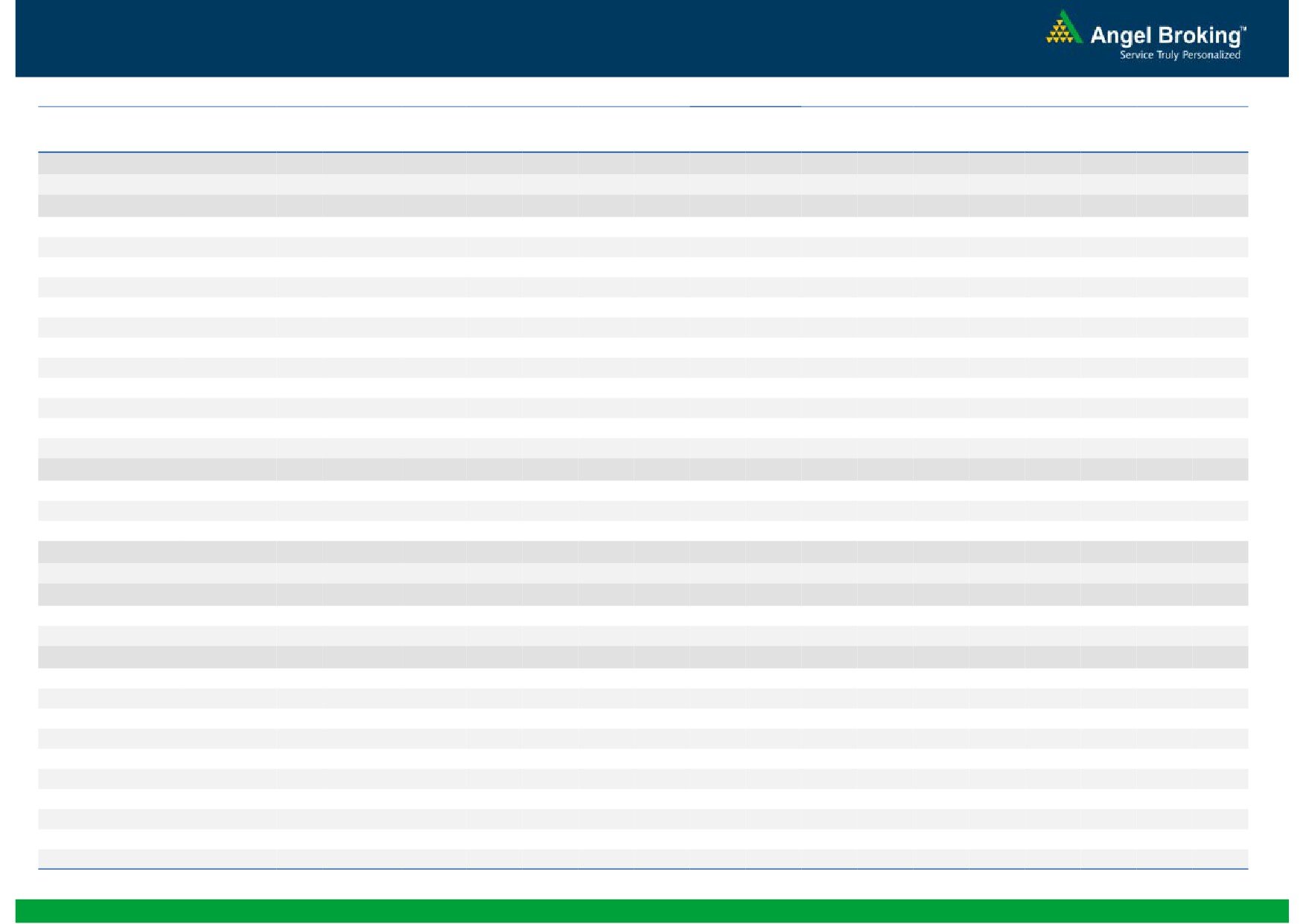

Top Picks

Large Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

To outpace battery industry growth due to better technological

Amara Raja Batteries

15,397

901

1,040

15.4

products leading to market share gains in both the automotive

OEM and replacement segments.

Earnings to grow strongly given the MHCV cyclical upturn.

Ashok Leyland

27,335

96

111

15.6

Focus on exports and LCV's provides additional growth

avenue.

Uptick in defense capex by government when coupled with

Bharat Electronics

25,562

1,065

1,414

32.8

BELs strong market positioning, indicate that good times are

ahead for BEL.

The stock is trading at attractive valuations and is factoring all

HCL Tech

114,848

815

1,038

27.4

the bad news.

Strong visibility for a robust 20% earnings trajectory, coupled

HDFC Bank

260,533

1,031

1,262

22.5

with high quality of earnings on account of high quality retail

business and strategic focus on highly rated corporates.

Back on the growth trend, expect a long term growth of 14%

Infosys

265,472

1,152

1,347

16.9

to be a US$20bn in FY2020.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC Housing Finance

22,503

446

592

32.7

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Huge bid pipeline of re-development works at Delhi and other

NBCC

11,497

958

1,089

13.7

State Governments and opportunity from Smart City, positions

NBCC to report strong growth, going forward.

New launches to enable outpace industry growth; margins

TVS Motors

13,488

284

330

16.2

expansion to boost earnings.

Source: Company, Angel Research

Mid Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

3,199

356

439

23.4

growth. EMPPAC division's profitability to improve once

operating environment turns around.

Commencement of new projects, downtrend in the interest rate

IL&FS Transport

2,327

71

93

31.4

cycle, to lead to stock re-rating

Economic recovery to have favourable impact on advertising &

circulation revenue growth. Further, the acquisition of a radio

Jagran Prakashan

4,783

146

189

29.2

business (Radio City) would also boost the company's revenue

growth.

Speedier execution and speedier sales, strong revenue visibilty

Mahindra Lifespace

1,770

431

554

28.4

in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,391

168

265

58.1

as well CFS augurs well for the company

Earnings boost on back of stable material prices and

Radico Khaitan

1,291

97

156

60.7

favourable pricing environment. Valuation discount to peers

provides additional comfort

Strong brands and distribution network would boost growth

Siyaram Silk Mills

919

980

1,354

38.2

going ahead. Stock currently trades at an inexpensive

valuation.

Source: Company, Angel Research

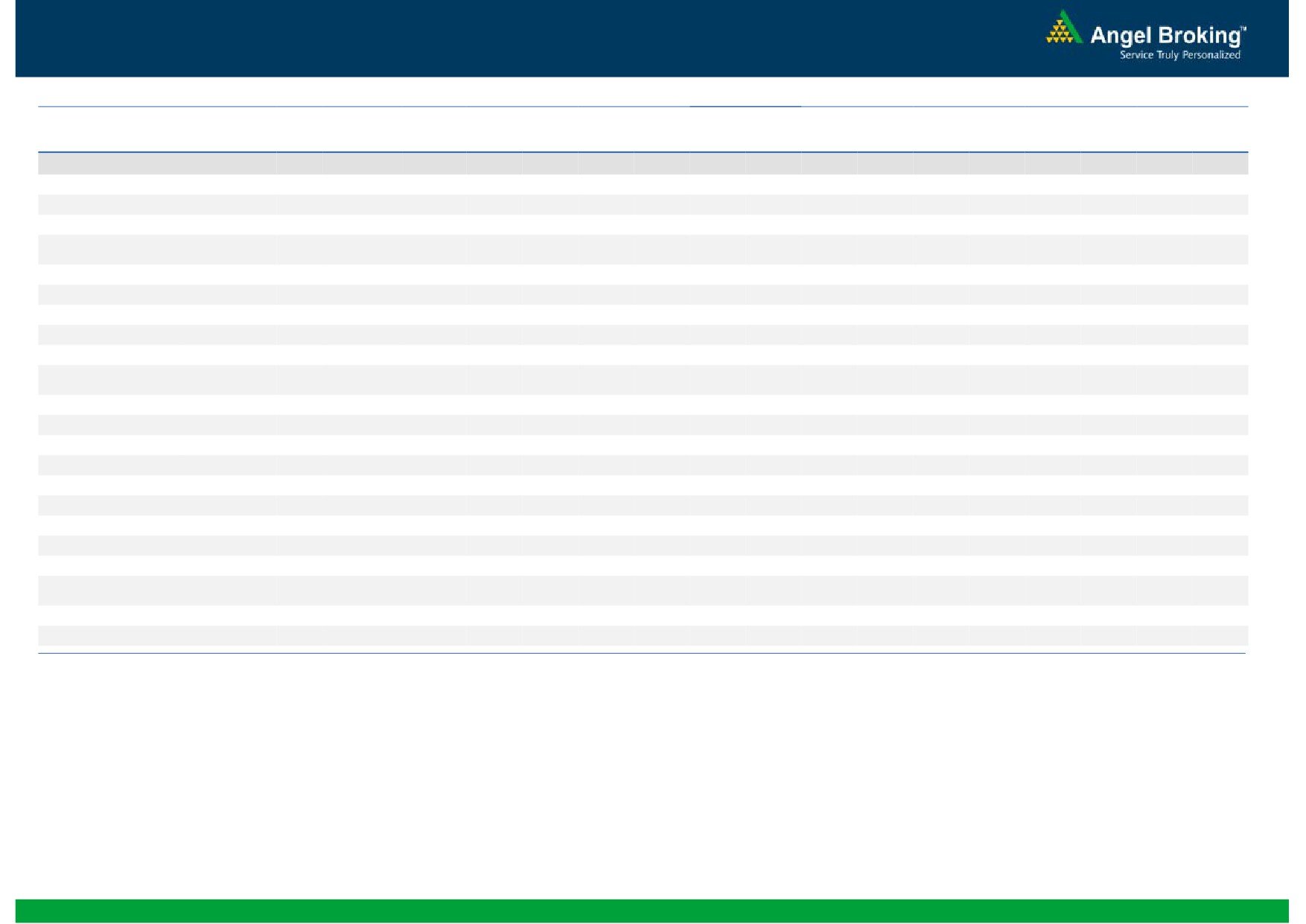

Market Outlook

March 17, 2016

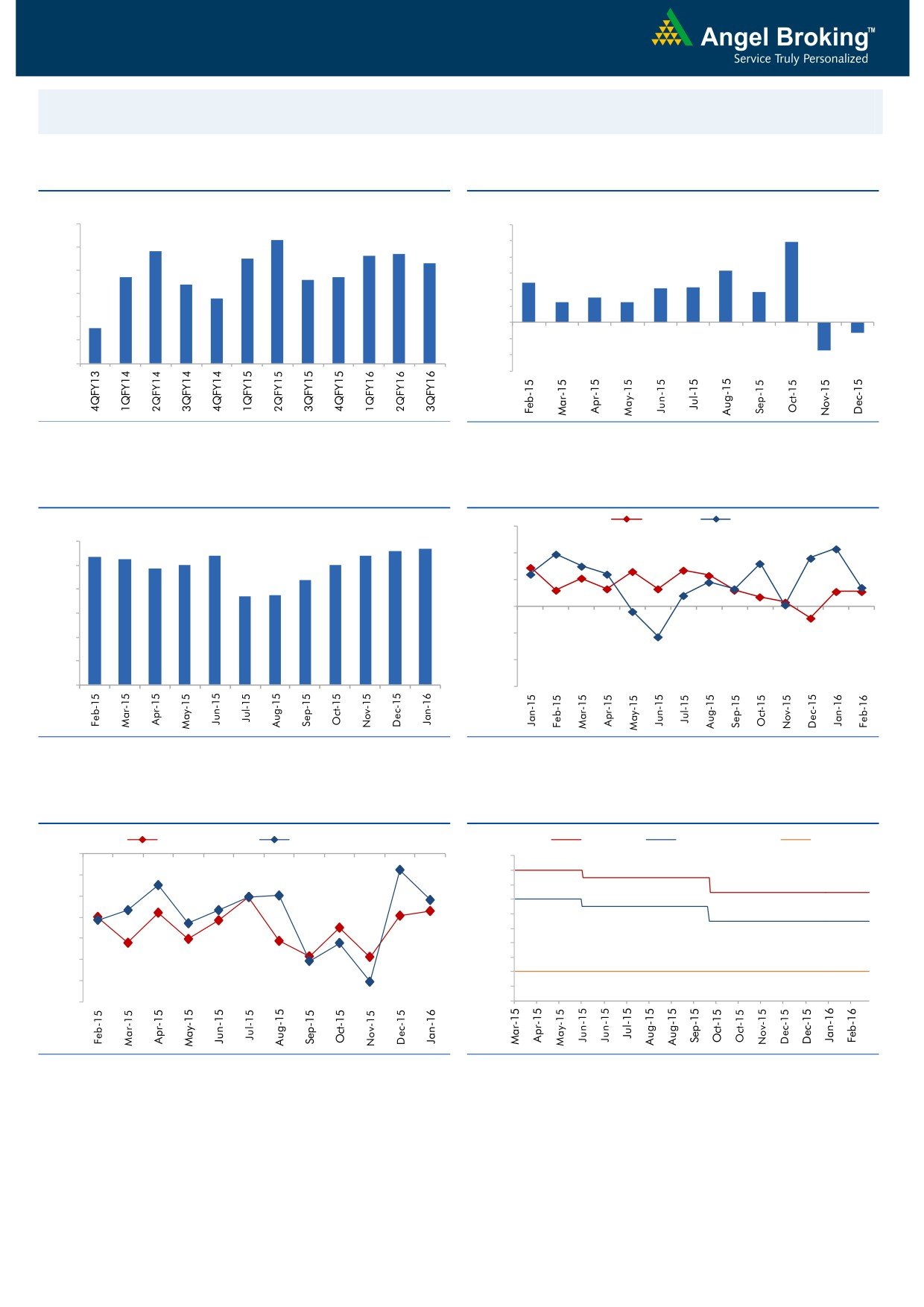

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

12.0

8.3

9.9

7.8

7.6

7.7

10.0

8.0

7.5

7.3

8.0

6.3

6.7

6.6

6.7

7.0

6.4

4.8

6.0

4.2

4.3

3.7

5.8

3.0

4.0

2.5

2.5

6.0

2.0

5.0

4.5

-

4.0

(2.0)

(1.3)

(4.0)

3.0

(3.4)

(6.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

Mfg. PMI

Services PMI

(%)

56.0

5.6

5.7

6.0

5.4

5.4

5.4

5.3

4.9

5.0

5.0

54.0

5.0

4.4

3.7

3.7

52.0

4.0

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

0.0

8.00

7.50

(5.0)

7.00

(10.0)

6.50

6.00

(15.0)

5.50

(20.0)

5.00

(25.0)

4.50

4.00

(30.0)

3.50

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

March 17, 2016

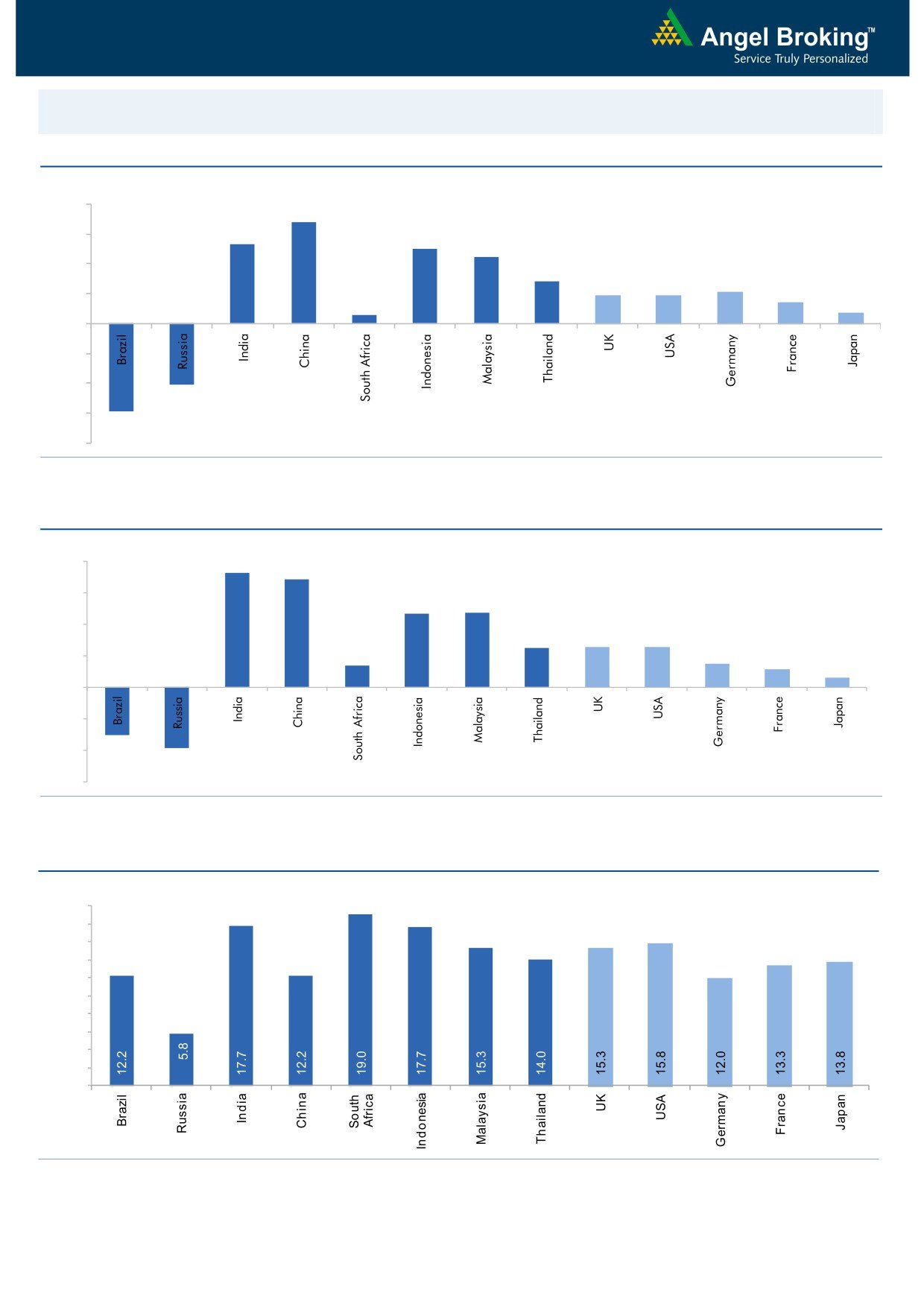

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.8

6.0

5.3

5.0

4.5

4.0

2.8

1.9

1.9

2.1

1.4

2.0

0.6

0.7

-

(2.0)

(4.0)

(4.1)

(6.0)

(5.9)

(8.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

8.0

7.3

6.8

6.0

4.7

4.7

4.0

2.5

2.5

2.6

1.4

1.5

2.0

1.2

0.6

-

(2.0)

(3.0)

(4.0)

(3.8)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

March 17, 2016

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

47,763

19.1

7.5

(2.9)

Russia

Micex

1,871

9.3

8.0

16.2

India

Nifty

7,499

7.4

(2.0)

(14.6)

China

Shanghai Composite

2,870

1.5

(16.7)

(12.4)

South Africa

Top 40

46,826

5.5

7.9

1.2

Mexico

Mexbol

44,751

3.6

6.8

0.9

Indonesia

LQ45

849

3.0

11.6

(10.9)

Malaysia

KLCI

1,693

2.6

1.4

(5.4)

Thailand

SET 50

883

9.8

8.9

(14.5)

USA

Dow Jones

17,326

8.5

0.4

(4.2)

UK

FTSE

6,175

6.0

5.1

(11.3)

Japan

Nikkei

16,974

5.9

(10.9)

(9.7)

Germany

DAX

9,983

8.4

(3.4)

(16.1)

France

CAC

4,463

8.5

(3.3)

(12.3)

Source: Bloomberg, Angel Research

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Agri / Agri Chemical

Rallis

Neutral

165

-

3,205

2,097

2,415

14.4

14.4

9.5

11.0

17.4

15.0

3.5

3.0

21.1

21.3

1.5

1.3

United Phosphorus

Accumulate

431

480

18,462

12,500

14,375

18.3

18.3

29.8

35.9

14.5

12.0

2.7

2.2

20.0

20.3

1.6

1.3

Auto & Auto Ancillary

Ashok Leyland

Accumulate

96

111

27,335

17,995

21,544

11.4

11.6

3.4

4.7

28.3

20.4

5.0

4.6

17.7

22.2

1.5

1.2

Bajaj Auto

Accumulate

2,250

2,585

65,097

22,709

25,860

20.9

20.1

129.0

143.6

17.4

15.7

5.4

4.6

30.7

29.4

2.5

2.2

Bharat Forge

Accumulate

809

875

18,833

7,351

8,318

19.9

19.7

31.2

36.5

25.9

22.2

4.6

3.9

19.3

19.2

2.7

2.4

Eicher Motors

Neutral

18,693

-

50,774

15,556

16,747

15.5

17.3

464.8

597.5

40.2

31.3

14.7

10.8

36.2

34.3

3.4

3.1

Gabriel India

Buy

85

101

1,223

1,415

1,544

8.7

9.0

4.6

5.4

18.5

15.8

3.4

3.0

18.1

18.9

0.9

0.8

Hero Motocorp

Neutral

2,798

-

55,872

28,244

30,532

15.5

15.9

156.7

168.5

17.9

16.6

7.1

6.1

39.9

36.4

1.8

1.7

Jamna Auto Industries Buy

129

160

1,032

1,281

1,473

11.2

11.5

7.6

9.2

17.0

14.0

4.3

3.5

25.4

25.2

0.9

0.8

L G Balakrishnan & Bros Neutral

425

-

668

1,254

1,394

11.6

11.8

35.9

41.7

11.9

10.2

1.6

1.4

13.5

13.8

0.6

0.6

Mahindra and Mahindra Accumulate

1,212

1,364

75,298

38,416

42,904

13.7

13.9

54.8

63.4

22.1

19.1

3.4

3.0

15.4

15.8

1.6

1.4

Maruti

Neutral

3,666

-

110,753

57,865

68,104

16.4

16.7

176.3

225.5

20.8

16.3

4.0

3.4

19.4

21.2

1.7

1.4

Minda Industries

Accumulate

936

1,047

1,484

2,523

2,890

8.7

9.0

55.0

65.4

17.0

14.3

3.3

2.7

19.3

18.7

0.7

0.6

Motherson Sumi

Buy

242

313

31,950

39,343

45,100

8.8

9.1

10.1

12.5

23.9

19.3

7.6

5.9

35.3

34.4

0.9

0.8

Rane Brake Lining

Buy

367

465

291

454

511

11.5

12.0

25.2

31.0

14.6

11.9

2.2

2.0

14.9

16.6

0.8

0.7

Setco Automotive

Neutral

33

-

434

594

741

12.7

13.7

1.7

3.2

19.1

10.2

2.0

1.7

10.4

16.9

1.1

0.9

Tata Motors

Neutral

360

-

103,896

259,686

273,957

13.0

13.4

25.9

29.5

13.9

12.2

1.8

1.6

8.0

9.0

0.6

0.6

TVS Motor

Accumulate

284

330

13,488

11,263

13,122

6.9

8.5

9.2

15.0

30.9

18.9

7.0

5.6

22.7

29.6

1.2

1.0

Amara Raja Batteries

Buy

901

1,040

15,397

4,892

5,871

17.4

17.6

28.8

37.1

31.3

24.3

7.3

5.9

23.4

24.1

3.1

2.5

Exide Industries

Buy

135

162

11,437

6,950

7,784

14.4

14.8

6.6

7.3

20.4

18.4

2.6

2.3

12.6

12.8

1.3

1.2

Apollo Tyres

Accumulate

168

183

8,572

12,056

12,714

17.2

16.4

23.0

20.3

7.3

8.3

1.3

1.1

17.7

13.6

0.8

0.8

Ceat

Accumulate

1,079

1,119

4,363

6,041

6,597

14.1

13.7

99.5

111.9

10.8

9.6

2.1

1.8

19.6

18.5

0.9

0.7

JK Tyres

Neutral

79

-

1,795

7,446

7,669

15.2

14.0

19.6

18.4

4.0

4.3

1.0

0.8

25.2

19.5

0.6

0.6

Swaraj Engines

Accumulate

845

919

1,049

552

630

14.2

14.7

44.6

54.1

18.9

15.6

4.4

4.0

23.2

25.6

1.8

1.5

Subros

Neutral

84

-

506

1,293

1,527

11.8

11.9

4.2

6.7

20.1

12.6

1.5

1.4

7.7

11.5

0.7

0.6

Indag Rubber

Neutral

168

-

441

283

329

17.0

17.2

13.0

15.4

13.0

10.9

2.8

2.4

21.8

21.6

1.3

1.1

Capital Goods

ACE

Neutral

37

-

364

660

839

4.7

8.2

1.0

3.9

36.8

9.4

1.2

1.0

3.2

11.3

0.7

0.6

BEML

Accumulate

1,032

1,157

4,299

3,277

4,006

6.0

8.9

36.2

64.3

28.5

16.1

2.0

1.8

5.7

11.7

1.4

1.1

Bharat Electronics

Buy

1,065

1,414

25,562

7,737

8,634

16.8

17.2

54.0

61.5

19.7

17.3

2.8

2.5

39.3

45.6

2.5

2.1

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Capital Goods

Voltas

Buy

247

353

8,184

5,363

5,963

8.0

9.1

11.0

13.8

22.5

17.9

3.5

3.0

16.2

17.9

1.5

1.3

BGR Energy

Neutral

102

-

736

3,615

3,181

9.5

9.4

16.7

12.4

6.1

8.2

0.6

0.6

10.0

7.0

0.6

0.8

BHEL

Neutral

106

-

26,030

33,722

35,272

10.8

11.7

10.5

14.2

10.1

7.5

0.8

0.7

7.0

9.0

0.8

0.8

Blue Star

Buy

356

439

3,199

3,548

3,977

6.3

6.9

13.7

17.2

26.0

20.7

6.5

4.2

26.1

25.4

0.9

0.8

Crompton Greaves

Neutral

47

-

2,933

13,484

14,687

4.9

6.2

4.5

7.1

10.4

6.6

0.7

0.7

7.2

10.8

0.8

0.7

Greaves Cotton

Neutral

123

-

3,010

1,655

1,755

16.6

16.8

7.4

7.8

16.7

15.8

3.3

3.2

21.1

20.6

1.8

1.7

Inox Wind

Buy

266

458

5,902

4,980

5,943

17.0

17.5

26.6

31.6

10.0

8.4

3.0

2.2

35.0

30.0

1.3

1.0

KEC International

Neutral

118

-

3,039

8,791

9,716

6.1

6.8

5.4

8.2

21.9

14.4

2.2

2.0

10.0

14.0

0.6

0.5

Thermax

Neutral

761

-

9,071

6,413

7,525

7.4

8.5

30.5

39.3

25.0

19.4

3.8

3.3

15.0

17.0

1.4

1.1

Cement

ACC

Neutral

1,238

-

23,234

13,151

14,757

16.4

18.3

63.9

83.4

19.4

14.8

2.5

2.3

13.3

16.1

1.6

1.3

Ambuja Cements

Neutral

206

-

31,938

11,564

12,556

19.4

20.7

8.9

10.1

23.1

20.4

2.9

2.7

12.8

13.8

2.3

2.1

HeidelbergCement

Neutral

73

-

1,657

1,772

1,926

13.3

15.4

1.0

3.0

73.1

24.4

1.9

1.7

2.6

7.9

1.5

1.3

India Cements

Neutral

77

-

2,365

4,216

4,840

18.0

19.5

4.0

9.9

19.3

7.8

0.8

0.7

4.0

9.5

0.9

0.7

JK Cement

Neutral

598

-

4,182

3,661

4,742

10.1

15.8

7.5

28.5

79.8

21.0

2.4

2.1

7.5

22.9

1.6

1.2

J K Lakshmi Cement

Neutral

305

-

3,591

2,947

3,616

16.7

19.9

11.5

27.2

26.5

11.2

2.5

2.2

9.8

20.8

1.6

1.3

Mangalam Cements

Neutral

192

-

512

1,053

1,347

10.5

13.3

8.4

26.0

22.8

7.4

1.0

0.9

4.3

12.5

0.8

0.6

Orient Cement

Neutral

137

-

2,803

1,854

2,524

21.2

22.2

7.7

11.1

17.8

12.3

2.6

2.2

13.3

15.7

2.3

1.6

Ramco Cements

Neutral

390

-

9,287

4,036

4,545

20.8

21.3

15.1

18.8

25.8

20.8

3.2

2.8

12.9

14.3

2.8

2.4

Shree Cement^

Neutral

11,448

-

39,883

7,150

8,742

26.7

28.6

228.0

345.5

50.2

33.1

7.4

6.2

15.7

20.3

5.2

4.2

UltraTech Cement

Neutral

2,974

-

81,625

24,669

29,265

18.2

20.6

82.0

120.0

36.3

24.8

3.9

3.4

11.3

14.7

3.4

2.9

Construction

ITNL

Buy

71

93

2,327

7,360

8,825

34.0

35.9

7.0

9.0

10.1

7.9

0.3

0.3

3.2

3.7

3.7

3.6

KNR Constructions

Buy

499

603

1,402

937

1,470

14.3

14.0

44.2

38.6

11.3

12.9

2.3

2.0

15.4

15.4

1.6

1.1

Larsen & Toubro

Accumulate

1,183

1,310

110,180

58,870

65,708

8.3

10.3

42.0

53.0

28.2

22.3

2.0

1.8

8.8

11.2

2.1

1.9

Gujarat Pipavav Port

Neutral

159

-

7,694

629

684

51.0

52.2

6.4

5.9

24.9

27.0

3.3

3.0

15.9

12.7

11.8

10.7

MBL Infrastructures

Buy

132

285

548

2,313

2,797

12.2

14.6

19.0

20.0

7.0

6.6

0.7

0.7

11.3

10.6

1.0

0.9

Nagarjuna Const.

Neutral

72

-

3,980

7,892

8,842

8.8

9.1

3.0

5.3

23.9

13.5

1.2

1.1

5.0

8.5

0.7

0.6

PNC Infratech

Accumulate

488

558

2,503

1,873

2,288

13.2

13.5

24.0

32.0

20.3

15.2

2.0

1.8

12.1

12.3

1.5

1.2

Simplex Infra

Neutral

215

-

1,065

5,955

6,829

10.3

10.5

16.0

31.0

13.5

7.0

0.7

0.7

5.3

9.9

0.7

0.6

Power Mech Projects

Neutral

565

-

832

1,539

1,801

12.8

12.7

59.0

72.1

9.6

7.8

1.4

1.2

18.6

16.8

0.6

0.5

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Construction

Sadbhav Engineering

Buy

263

289

4,505

3,481

4,219

10.7

10.8

8.2

11.7

32.0

22.5

3.1

2.7

10.3

13.5

1.5

1.2

NBCC

Buy

958

1,089

11,497

5,816

7,382

6.9

7.7

29.6

39.8

32.4

24.1

5.8

4.6

24.1

26.7

1.7

1.3

MEP Infra

Neutral

39

-

631

1,956

1,876

28.1

30.5

1.3

3.0

29.9

12.9

6.3

4.2

21.2

32.8

1.7

1.7

SIPL

Neutral

87

-

3,054

675

1,042

62.4

64.7

-

-

3.3

3.7

-

-

16.4

11.0

Financials

Allahabad Bank

Neutral

52

-

3,120

8,569

9,392

2.8

2.9

16.3

27.5

3.2

1.9

0.3

0.2

7.6

11.9

-

-

Axis Bank

Buy

424

494

101,044

26,473

31,527

3.5

3.6

35.7

43.5

11.9

9.8

2.0

1.7

17.9

18.9

-

-

Bank of Baroda

Neutral

143

-

32,961

18,485

21,025

1.9

2.0

13.5

21.1

10.6

6.8

0.8

0.7

7.3

10.6

-

-

Bank of India

Neutral

96

-

7,766

15,972

17,271

1.9

2.0

15.3

33.4

6.3

2.9

0.3

0.2

3.6

7.6

-

-

Canara Bank

Neutral

188

-

10,197

15,441

16,945

2.0

2.1

46.6

70.4

4.0

2.7

0.4

0.3

8.0

11.2

-

-

Dena Bank

Neutral

29

-

1,849

3,440

3,840

2.1

2.3

7.3

10.0

4.0

2.9

0.3

0.2

6.1

7.9

-

-

Federal Bank

Neutral

48

-

8,306

3,477

3,999

3.0

3.0

5.0

6.2

9.6

7.8

1.0

0.9

10.6

11.9

-

-

HDFC

Neutral

1,126

-

177,825

10,358

11,852

3.3

3.3

41.1

47.0

27.4

23.9

5.2

4.7

24.7

24.9

-

-

HDFC Bank

Buy

1,031

1,262

260,533

38,309

47,302

4.3

4.3

49.3

61.1

20.9

16.9

3.6

3.1

18.5

19.7

-

-

ICICI Bank

Buy

226

254

131,651

34,279

39,262

3.3

3.3

21.0

24.4

10.8

9.3

1.8

1.5

14.4

14.7

-

-

IDBI Bank

Neutral

66

-

12,464

9,625

10,455

1.8

1.8

8.5

14.2

7.7

4.6

0.5

0.4

5.9

9.3

-

-

Indian Bank

Neutral

99

-

4,748

6,160

6,858

2.5

2.5

24.5

29.8

4.0

3.3

0.3

0.3

7.7

8.6

-

-

LIC Housing Finance

Buy

446

592

22,503

3,101

3,745

2.5

2.5

33.0

40.2

13.5

11.1

2.5

2.2

19.7

20.5

-

-

Oriental Bank

Neutral

90

-

2,684

7,643

8,373

2.4

2.4

37.2

45.4

2.4

2.0

0.2

0.2

8.2

9.4

-

-

Punjab Natl.Bank

Neutral

83

-

16,268

23,638

26,557

2.8

2.8

17.9

27.2

4.6

3.0

0.5

0.4

8.5

12.0

-

-

South Ind.Bank

Neutral

17

-

2,329

1,965

2,185

2.5

2.5

2.5

3.3

6.9

5.2

0.7

0.6

9.5

11.7

-

-

St Bk of India

Neutral

185

-

143,689

79,958

86,061

2.6

2.6

13.4

20.7

13.8

9.0

1.1

1.1

11.5

12.8

-

-

Union Bank

Neutral

126

-

8,682

12,646

14,129

2.3

2.4

31.0

39.1

4.1

3.2

0.4

0.4

9.8

11.4

-

-

Vijaya Bank

Neutral

31

-

2,698

3,536

3,827

1.9

1.9

5.5

6.7

5.7

4.7

0.5

0.4

7.8

8.8

-

-

Yes Bank

Neutral

804

-

33,812

7,190

9,011

3.2

3.3

58.2

69.7

13.8

11.6

2.5

2.1

19.2

19.6

-

-

FMCG

Asian Paints

Neutral

867

-

83,148

16,553

19,160

16.0

16.2

17.7

21.5

49.0

40.3

13.0

11.7

29.4

31.2

5.0

4.3

Britannia

Neutral

2,719

-

32,621

8,481

9,795

14.0

14.1

65.5

78.3

41.5

34.7

19.7

16.1

38.3

41.2

3.9

3.3

Colgate

Neutral

835

-

22,723

4,836

5,490

19.5

19.7

48.5

53.2

17.2

15.7

12.6

11.0

99.8

97.5

4.5

3.9

Dabur India

Accumulate

247

267

43,398

9,370

10,265

17.1

17.2

7.3

8.1

33.6

30.5

10.2

8.3

33.7

30.6

4.6

4.2

GlaxoSmith Con*

Accumulate

5,727

6,118

24,084

4,919

5,742

17.2

17.4

168.3

191.2

34.0

30.0

9.7

8.2

28.8

28.9

4.4

3.8

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FMCG

Godrej Consumer

Neutral

1,281

-

43,626

10,168

12,886

16.1

16.1

32.1

38.4

39.9

33.4

8.1

7.5

19.7

21.0

4.5

3.5

HUL

Neutral

844

-

182,544

34,940

38,957

17.5

17.7

20.8

24.7

40.6

34.2

45.1

36.1

110.5

114.2

5.1

4.5

ITC

Accumulate

322

359

258,912

36,804

38,776

37.9

37.9

12.2

12.9

26.4

25.0

7.3

6.5

27.7

25.8

6.6

6.2

Marico

Neutral

240

-

30,990

6,551

7,766

15.7

16.0

10.4

12.5

23.1

19.2

6.7

5.6

33.2

32.4

4.8

4.0

Nestle*

Buy

5,026

6,646

48,462

11,291

12,847

22.2

22.3

158.9

184.6

31.6

27.2

16.5

14.9

55.0

57.3

4.3

3.7

Tata Global

Buy

115

144

7,264

8,635

9,072

9.8

9.9

6.5

7.6

17.7

15.1

1.8

1.7

6.8

7.4

0.8

0.7

IT

HCL Tech^

Buy

815

1,038

114,848

42,038

47,503

21.2

21.5

51.5

57.7

15.8

14.1

3.4

2.6

21.5

18.8

2.4

1.9

Infosys

Buy

1,152

1,347

265,472

61,850

69,981

27.5

27.5

59.4

65.7

19.4

17.5

4.1

3.5

21.2

20.1

3.5

3.0

TCS

Buy

2,327

2,854

458,588

108,487

122,590

28.3

28.5

122.8

138.4

19.0

16.8

7.2

6.5

38.0

38.9

3.9

3.4

Tech Mahindra

Buy

466

530

45,085

26,524

29,177

16.2

17.0

28.8

33.6

16.2

13.9

3.1

2.7

19.3

19.1

1.4

1.2

Wipro

Buy

539

680

133,154

50,808

56,189

23.7

23.8

37.3

40.7

14.5

13.2

2.8

2.5

19.2

17.7

2.1

1.7

Media

D B Corp

Accumulate

312

356

5,735

2,241

2,495

27.8

27.9

21.8

25.6

14.3

12.2

3.7

3.3

26.7

28.5

2.6

2.3

HT Media

Neutral

80

-

1,853

2,495

2,603

11.2

11.2

7.3

8.6

10.9

9.3

0.9

0.8

7.4

8.1

0.3

0.2

Jagran Prakashan

Buy

146

189

4,783

2,170

2,355

27.2

26.2

8.9

9.9

16.4

14.8

3.5

3.0

20.9

20.5

2.2

2.0

Sun TV Network

Neutral

363

-

14,286

2,779

3,196

70.2

70.5

22.8

27.3

15.9

13.3

3.9

3.5

26.7

28.3

4.6

4.0

Hindustan Media

Neutral

253

-

1,858

920

1,031

20.0

20.0

19.2

20.9

13.2

12.1

2.2

1.9

16.4

15.3

1.6

1.4

Ventures

Metals & Mining

Coal India

Buy

296

380

186,712

76,167

84,130

19.9

22.3

22.4

25.8

13.2

11.5

4.8

4.6

35.5

41.0

2.0

1.8

Hind. Zinc

Neutral

169

-

71,323

14,641

14,026

50.4

50.4

17.7

16.0

9.6

10.6

1.5

1.3

16.2

13.2

2.5

2.4

Hindalco

Neutral

81

-

16,819

104,356

111,186

8.7

9.5

6.7

11.1

12.1

7.4

0.4

0.4

3.5

5.9

0.7

0.6

JSW Steel

Neutral

1,198

-

28,956

42,308

45,147

16.4

20.7

(10.3)

49.5

24.2

1.3

1.3

(1.0)

5.6

1.7

1.6

NMDC

Neutral

93

-

36,912

8,237

10,893

46.6

44.5

10.0

11.7

9.4

8.0

1.0

0.9

12.5

13.0

4.3

3.3

SAIL

Neutral

43

-

17,553

45,915

53,954

7.2

10.5

1.5

4.4

28.2

9.7

0.4

0.4

2.3

4.1

1.0

0.9

Vedanta

Neutral

86

-

25,585

71,445

81,910

26.2

26.3

12.9

19.2

6.7

4.5

0.5

0.4

7.2

8.9

0.8

0.6

Tata Steel

Neutral

299

-

29,059

126,760

137,307

8.9

11.3

6.4

23.1

47.0

13.0

0.9

0.9

2.0

7.1

0.8

0.8

Oil & Gas

Cairn India

Neutral

148

-

27,814

11,323

12,490

49.4

51.0

20.7

20.7

7.2

7.2

0.5

0.4

6.4

6.1

1.5

0.9

GAIL

Neutral

339

-

43,052

64,856

70,933

9.1

9.6

24.0

28.9

14.2

11.8

1.2

1.1

8.8

9.6

0.9

0.8

ONGC

Neutral

206

-

176,628

154,564

167,321

36.8

37.4

28.6

32.5

7.2

6.4

0.9

0.8

12.7

13.5

1.3

1.3

Petronet LNG

Neutral

248

-

18,600

29,691

31,188

5.8

6.2

12.8

13.4

19.4

18.5

2.9

2.6

15.8

14.8

0.7

0.7

Indian Oil Corp

Buy

389

455

94,350

359,607

402,760

5.9

6.1

42.5

48.7

9.2

8.0

1.2

1.1

14.1

14.4

0.4

0.3

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Oil & Gas

Reliance Industries

Accumulate

1,022

1,150

331,059

304,775

344,392

12.6

13.4

91.3

102.6

11.2

10.0

1.3

1.1

11.8

12.0

1.0

0.8

Pharmaceuticals

Alembic Pharma

Neutral

622

-

11,734

3,274

3,802

26.9

19.4

35.0

28.7

17.8

21.7

7.9

5.9

55.6

31.2

3.5

3.0

Aurobindo Pharma

Buy

727

856

42,513

14,923

17,162

22.0

23.0

35.7

42.8

20.4

17.0

6.0

4.5

34.0

30.2

3.2

2.8

Aventis*

Neutral

4,294

-

9,890

2,082

2,371

17.4

20.8

118.2

151.5

36.3

28.3

5.3

4.3

19.9

25.5

4.5

3.8

Cadila Healthcare

Neutral

338

-

34,628

10,224

11,840

21.0

22.0

14.6

17.6

23.2

19.2

6.4

5.0

30.8

29.0

3.5

2.9

Cipla

Accumulate

533

605

42,792

13,979

16,447

20.2

18.6

25.7

27.5

20.7

19.4

3.4

2.9

17.6

16.1

3.1

2.5

Dr Reddy's

Buy

3,155

3,933

53,811

16,838

19,575

25.0

23.1

167.5

178.8

18.8

17.7

4.0

3.3

23.1

20.4

3.2

2.7

Dishman Pharma

Neutral

338

-

2,727

1,733

1,906

21.5

21.5

17.0

19.9

19.9

17.0

2.0

1.8

10.5

11.2

2.2

1.9

GSK Pharma*

Neutral

3,319

-

28,111

2,870

3,158

20.0

22.1

59.5

68.3

55.8

48.6

16.5

16.9

28.5

34.3

9.1

8.3

Indoco Remedies

Neutral

274

-

2,527

1,033

1,199

15.9

18.2

9.4

13.6

29.2

20.2

4.3

3.7

15.7

19.7

2.6

2.2

Ipca labs

Buy

532

900

6,710

3,363

3,909

12.9

18.6

13.4

28.0

39.7

19.0

2.8

2.5

7.4

14.0

2.3

2.0

Lupin

Neutral

1,749

-

78,780

13,092

16,561

25.0

27.0

50.4

68.3

34.7

25.6

7.2

5.7

22.8

24.7

6.1

4.7

Sun Pharma

Accumulate

837

950

201,354

28,163

32,610

25.8

30.7

17.4

26.9

48.1

31.1

4.6

4.0

13.0

16.6

6.9

5.7

Power

Tata Power

Neutral

59

-

15,917

35,923

37,402

22.6

22.8

4.1

5.2

14.5

11.4

1.1

1.0

7.5

9.3

1.4

1.3

NTPC

Buy

128

146

105,130

87,271

99,297

23.5

23.5

11.8

13.3

10.9

9.6

1.2

1.1

11.5

12.2

2.2

2.0

Power Grid

Buy

139

170

72,536

20,702

23,361

86.7

86.4

12.1

13.2

11.5

10.5

1.7

1.5

15.6

15.1

8.4

7.8

Real Estate

MLIFE

Buy

431

554

1,770

697

1,011

14.9

19.3

13.8

20.1

31.3

21.5

1.2

1.1

3.8

5.3

3.8

2.6

Telecom

Bharti Airtel

Neutral

340

-

135,772

101,748

109,191

32.1

31.7

12.0

12.5

28.3

27.2

1.9

1.8

6.9

6.7

2.0

1.8

Idea Cellular

Neutral

98

-

35,411

34,282

36,941

32.0

31.5

5.9

6.2

16.7

15.9

1.5

1.4

9.9

9.3

1.6

1.6

zOthers

Abbott India

Neutral

4,809

-

10,219

2,715

3,153

14.5

14.1

134.3

152.2

35.8

31.6

8.9

7.4

27.4

25.6

3.5

3.0

Bajaj Electricals

Buy

188

237

1,895

4,719

5,287

5.2

5.8

8.6

12.7

21.9

14.8

2.5

2.2

11.4

14.8

0.4

0.4

Finolex Cables

Neutral

244

-

3,730

2,520

2,883

12.2

12.0

12.7

14.2

19.3

17.2

2.6

2.3

13.6

13.5

1.1

1.0

Goodyear India*

Buy

472

582

1,089

1,800

1,600

11.7

11.5

58.7

52.9

8.0

8.9

1.8

1.6

24.6

18.7

0.4

0.4

Hitachi

Neutral

1,148

-

3,122

1,779

2,081

7.8

8.8

21.8

33.4

52.7

34.4

8.5

6.9

17.4

22.1

1.8

1.5

Jyothy Laboratories

Neutral

286

-

5,171

1,620

1,847

11.5

11.5

7.3

8.5

39.2

33.7

5.1

4.7

13.3

14.4

3.1

2.6

MRF

Buy

33,428

45,575

14,177

20,316

14,488

21.4

21.1

5,488.0

3,798.0

6.1

8.8

2.1

1.7

41.1

21.2

0.7

0.9

Page Industries

Neutral

11,146

-

12,432

1,929

2,450

19.8

20.1

229.9

299.0

48.5

37.3

21.4

14.9

52.1

47.1

6.6

5.2

Relaxo Footwears

Neutral

379

-

4,545

1,767

2,152

12.3

12.5

19.3

25.1

19.7

15.1

4.8

3.7

27.7

27.8

2.7

2.2

Siyaram Silk Mills

Buy

980

1,354

919

1,636

1,815

11.5

11.5

89.9

104.1

10.9

9.4

1.8

1.6

17.9

17.8

0.7

0.7

Stock Watch

March 17, 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

zOthers

Styrolution ABS India* Neutral

544

-

957

1,271

1,440

8.6

9.2

32.0

41.1

17.0

13.3

1.7

1.6

10.7

12.4

0.7

0.6

TVS Srichakra

Buy

2,438

3,217

1,867

2,035

2,252

15.9

15.3

248.6

268.1

9.8

9.1

4.3

3.1

43.6

33.9

0.9

0.8

HSIL

Accumulate

281

302

2,029

2,123

2,384

16.1

16.5

15.0

18.9

18.7

14.9

1.5

1.4

8.0

9.4

1.3

1.1

Kirloskar Engines India

Neutral

210

-

3,030

2,403

2,554

8.6

9.9

9.2

10.5

22.8

20.0

2.2

2.1

9.7

10.7

0.9

0.8

Ltd

M M Forgings

Buy

425

614

513

511

615

21.7

21.6

43.1

55.8

9.9

7.6

1.8

1.5

19.9

21.2

1.2

0.9

Banco Products (India) Neutral

99

-

705

1,208

1,353

11.0

12.3

10.8

14.5

9.2

6.8

1.1

0.9

11.9

14.5

0.6

0.5

Competent Automobiles Neutral

128

-

79

1,040

1,137

3.2

3.1

25.7

28.0

5.0

4.6

0.7

0.7

15.0

14.3

0.1

0.1

Nilkamal

Neutral

1,108

-

1,653

1,871

2,031

10.7

10.5

63.2

69.8

17.5

15.9

2.9

2.5

17.6

16.6

0.9

0.8

Visaka Industries

Buy

107

144

170

1,086

1,197

9.9

10.3

21.5

28.8

5.0

3.7

0.5

0.4

9.6

11.6

0.4

0.3

Transport Corporation of

Neutral

273

-

2,078

2,830

3,350

8.8

9.0

14.4

18.3

19.0

14.9

2.9

2.6

15.4

17.1

0.9

0.7

India

Elecon Engineering

Neutral

57

-

619

1,359

1,482

10.3

13.7

0.8

3.9

70.7

14.6

1.2

1.1

1.6

7.8

0.8

0.8

Surya Roshni

Buy

133

201

585

2,992

3,223

8.1

8.4

14.7

18.3

9.1

7.3

0.9

0.8

9.7

11.0

0.5

0.4

MT Educare

Neutral

157

-

623

286

366

18.3

17.7

7.7

9.4

20.3

16.7

4.3

3.7

20.2

21.1

2.1

1.6

Radico Khaitan

Buy

97

156

1,291

1,517

1,635

12.7

13.4

5.8

7.1

16.7

13.7

1.4

1.3

8.6

9.6

1.4

1.2

Garware Wall Ropes

Buy

320

473

700

862

974

11.2

11.2

24.9

29.6

12.9

10.8

1.9

1.7

15.1

15.4

0.8

0.6

Wonderla Holidays

Neutral

362

-

2,043

206

308

44.0

43.6

9.0

12.9

40.2

28.0

5.5

5.0

13.7

17.8

10.0

6.6

Linc Pen & Plastics

Neutral

182

-

270

340

371

8.3

8.9

10.8

13.2

16.9

13.8

2.7

2.4

16.0

17.1

0.8

0.8

The Byke Hospitality

Neutral

152

-

611

222

287

20.5

20.5

5.6

7.6

27.0

20.2

5.1

4.2

18.9

20.8

2.8

2.2

Interglobe Aviation

Neutral

802

-

28,895

17,022

21,122

20.7

14.5

63.9

53.7

12.6

14.9

18.8

15.4

149.9

103.2

1.8

1.4

Coffee Day Enterprises

Neutral

225

-

4,636

2,692

2,964

17.0

18.6

-

4.7

-

47.5

2.8

2.6

0.2

5.5

2.1

2.0

Ltd

Navneet Education

Neutral

82

-

1,959

998

1,062

24.1

24.0

5.8

6.1

14.3

13.5

3.2

2.8

22.0

20.6

2.0

1.9

Navkar Corporation

Buy

168

265

2,391

365

436

38.3

37.5

5.6

5.9

29.7

28.5

1.9

1.8

6.3

6.1

7.2

6.2

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on March 16, 2016

Market Outlook

March 17, 2016

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitian Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership

of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation / managed or co

-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst has not served as

an officer, director or employee of company covered by Analyst and has not been engaged in market making activity of the company

covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any

loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt.

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance,

or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have

investment positions in the stocks recommended in this report.