Market Outlook

February 12, 2016

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are expected to open on a Flat to Positive note tracking the SGX

BSE Sensex

(3.4)

(807)

22,952

Nifty.

Nifty

(3.3)

(239)

6,976

After opening sharply lower on Thursday, US markets recovered but managed to

Mid Cap

(3.3)

(327)

9,691

close in the red. The markets were weighed down by the concerns over state of

Small Cap

(4.6)

(476)

9,801

global economy.

Bankex

(3.8)

(629)

15,890

European shares declined to touch its 2-1/2 year low on Thursday as continued

weakness in crude and sharp decline in Asian stocks weighed on the markets.

Global Indices

Chg (%)

(Pts)

(Close)

Concerns about slowing global growth also added to the negative sentiment.

Dow Jones

(4.4)

(684)

15,029

Much like European and Asian markets, Indian markets slid sharply yesterday on

Nasdaq

(0.6)

(109)

18,437

plunging oil prices, on going global concerns over state of global banks, and steady

FTSE

(0.6)

(18)

2,763

FII outflows.

Nikkei

(2.3)

(372)

15,713

News & Result Analysis

Hang Seng

(3.9)

(742)

18,546

Wipro buys US-based HealthPlan Services for $460 million

Shanghai Com

(0.6)

(18)

2,763

Result Review: Tata Motors, Voltas

Result Preview: Sun Pharma

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Advances

300

121

Investor’s Ready Reckoner

Declines

2,405

1,478

Key Domestic & Global Indicators

Unchanged

87

29

Stock Watch: Latest investment recommendations on 150+ stocks

Refer P6 onwards

Volumes (` Cr)

Top Picks

BSE

2,972

CMP

Target

Upside

Company

Sector

Rating

NSE

18,956

(`)

(`)

(%)

Amara Raja Batteries Auto & Auto Ancillary

Buy

861

1,040

20.8

HCL Tech

IT

Buy

809

1,038

28.3

Net Inflows (` Cr)

Net

Mtd

Ytd

Larsen & Toubro

Construction

Buy

1,092

1,310

20.0

FII

(505)

(1,804)

(10,450)

LIC Housing Finance Financials

Buy

406

592

45.6

MFs

10

(94)

76,670

Navkar Corporation Others

Buy

174

265

52.6

More Top Picks on Pg5

Top Gainers

Price (`)

Chg (%)

Abb

1,079

1.8

Key Upcoming Events

Previous

Consensus

Natcopharm

446

1.4

Date

Region

Event Description

Reading

Expectations

Mphasis

431

0.9

Feb 12 India

Exports YoY% (% Change)

(14.70)

--

Idea

101

0.8

Feb 12 India

Imports YoY% (% Change)

(3.90)

--

Prestige

161

0.6

Feb 12 India

Industrial Production YoY (% Change)

(3.20)

--

Feb 12 Euro Zone

GDP s.a. (QoQ)

0.30

0.30

6.(

Top Losers

Price (`)

Chg (%)

Unitech

4

(16.4)

Pipavavdoc

56

(14.2)

Jubilant

295

(13.8)

Sci

64

(13.2)

Gmrinfra

11

(12.4)

As on February 11, 2016

Market Outlook

February 12, 2016

Wipro buys US-based HealthPlan Services for $460 million

Wipro signed a definitive agreement to acquire HealthPlan Services from Water

Street Capital Partners for a consideration of USD$460mn making it one of

Wipros’s largest acquisition in the past decade. HealthPlan is leading independent

technology and Business Process as a Service provider in the US Health Insurance

market. HealthPlan Services will strengthen Wipro’s position in the health

insurance exchange market while offering synergies with Wipro’s presence in the

Managed Medicare and Commercial Group Insurance market. We currently have

a Positive view on the stock.

Result Review

Tata Motors - 3QFY2016 (CMP: `276/ TP: - `409/ Upside: - 48%)

Tata Motors 3QFY2016 results were in line with estimates on the operating front.

However lower taxation led to the net profit coming ahead of estimates.

Consolidated revenues grew marginally 3% yoy to `72,256cr (slightly lower than

our estimate of `73,068cr). JLR revenues (forming 80% of the topline) declined

marginally by 2% while the standalone revenues grew 10% yoy. Operating

margins at 13% were broadly in line with our estimates of 12.8%. JLR EBIDTA

margins at 14.4% improved 220bp sequentially (were in line with estimates) on

account of operating leverage due to higher volumes and favorable currency

movement. Standalone operating margins at 4.6% (as against operating loss in

3QFY2015) were ahead of our estimates of 2.3%. Soft raw material prices,

favourable product mix and cost control initiatives helped in margin improvement.

EBIDTA at `9,380cr was in line with our estimates of `9,324 cr. However lower tax

provison (Tax/PBT of 16%) resulted in Tata Motors reporting Adjusted Net Profit of

`3,462 cr which is ahead of our estimates of `2,914 cr. We will review our

estimates post management interaction.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

Mar

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

266,022

12.8

17,863

26.3

8.4

10.5

1.5

4.7

0.5

FY2017E

312,667

13.1

26,014

38.3 12.1

7.2

1.2

4.3

0.4

Voltas - 3QFY2016 (CMP: `241/ TP: - `353/ Upside: - 46.5%)

Voltas reported mix set of numbers, with better than expected top-line numbers

and disappointment at the PAT level. Voltas reported 38.6% YoY increase in its

top-line to INR 1,301cr, ahead of our estimate of `1,247cr. Top-line growth was

driven by EMP segment, which reported 56.5% YoY increase (55% of 3QFY2016

revenues). Further, on the back of strong festive season, the UCP segment reported

13.6% YoY increase in its revenues (33% of 3QFY2016 revenues).

Despite strong execution, Voltas disappointed us on the EBITDA front. Voltas

reported EBITDA margin of 4.0%, below our estimates and year ago levels of

4.8%. Losses at the EMP segment level led to disappointment at the consol. EBITDA

level. Impact of poor operating performance trickled down to the PAT level too.

Adj. PAT margins for the quarter declined from 6.7% a year ago to 4.0% in

3QFY2016.

Market Outlook

February 12, 2016

Order book for the EMP segment at 3QFY2016 stood at `3,514cr (OB to LTM

ratio of 1.4x). We continue to maintain our positive view towards the stock.

Result Preview

Sun (CMP: `831/ TP: `950 / Upside: 14.3%)

Sun pharmaceuticals, is expected to post sales of `7,000cr in 3QFY2016 (no

corresponding period data available). On the operating front, the Gross Profit

margin is expected to come in at 73.7%, enabling the OPM’s to come in at 25.6%.

The R&D expenditure during the period is expected to be around 7.0% of sales.

Thus, Adj. net profit is expected to come in at `1,145cr. Overall, we maintain our

accumulate rating on the stock with a price target of `950.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

Mar

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

28,163

25.8

4,179

17.4

13.0

47.7

4.5

25.5

6.6

FY2017E

32,610

30.7

6,483

26.9 16.6 30.9

3.9

17.8

5.5

Economic and Political News

Odisha to commission 10-Mw solar power plant

RBI allows 3% more of SLR for LCR

Naidu to launch 'Smart City' project for Indore tomorrow

Corporate News

Domestic steel firms raise product prices up to 4% post MIP imposition

TBZ ties up with Amazon to sell diamond jewellery and gold coins

Lanco books profit second quarter in running

Quarterly Bloomberg Brokers Consensus Estimate

Mahindra & Mahindra Ltd - February 12, 2016

Particulars (` cr)

3QFY16E

3QFY15

y-o-y (%)

2QFY16

q-o-q (%)

Net sales

10,958

9,466

15.8

9,122

20.1

EBITDA

1,426

994

43.4

1,026

38.9

EBITDA margin (%)

13.0

10.5

11.3

Net profit

914

942

(3.0)

924

(1.0)

Nestle India Ltd - February 12, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

2,192

2,516

(12.9)

1,736

26.3

EBITDA

424

550

(22.9)

243

74.6

EBITDA margin (%)

19.3

21.9

14.0

Net profit

237

326

(27.4)

124

90.8

Canara Bank - February 12, 2016

Particulars (` cr)

3QFY16E

3QFY15

y-o-y (%)

2QFY16

q-o-q (%)

PAT

518

302

71.3

658

(21.3)

Market Outlook

February 12, 2016

NMDC Ltd - February 12, 2016

Particulars (` cr)

3QFY16E

3QFY15

y-o-y (%)

2QFY16

q-o-q (%)

Net sales

1,565

2,944

(46.8)

1,602

(2.3)

EBITDA

765

1,948

(60.7)

887

(13.8)

EBITDA margin (%)

48.9

66.2

55.4

Net profit

764

1,593

(52.0)

810

(5.7)

IDBI Bank Ltd - February 12, 2016

Particulars (` cr)

3QFY16E

3QFY15

y-o-y (%)

2QFY16

q-o-q (%)

PAT

140

302

(53.7)

658

(78.7)

Adani Ports and Special Economic Zone Lt - February 12, 2016

Particulars (` cr)

3QFY16E

3QFY15

y-o-y (%)

2QFY16

q-o-q (%)

Net sales

1,711

1,534

11.6

1,820

(6.0)

EBITDA

1,089

935

16.5

1,205

(9.6)

EBITDA margin (%)

63.6

61.0

66.2

Net profit

584

512

14.1

651

(10.3)

Market Outlook

February 12, 2016

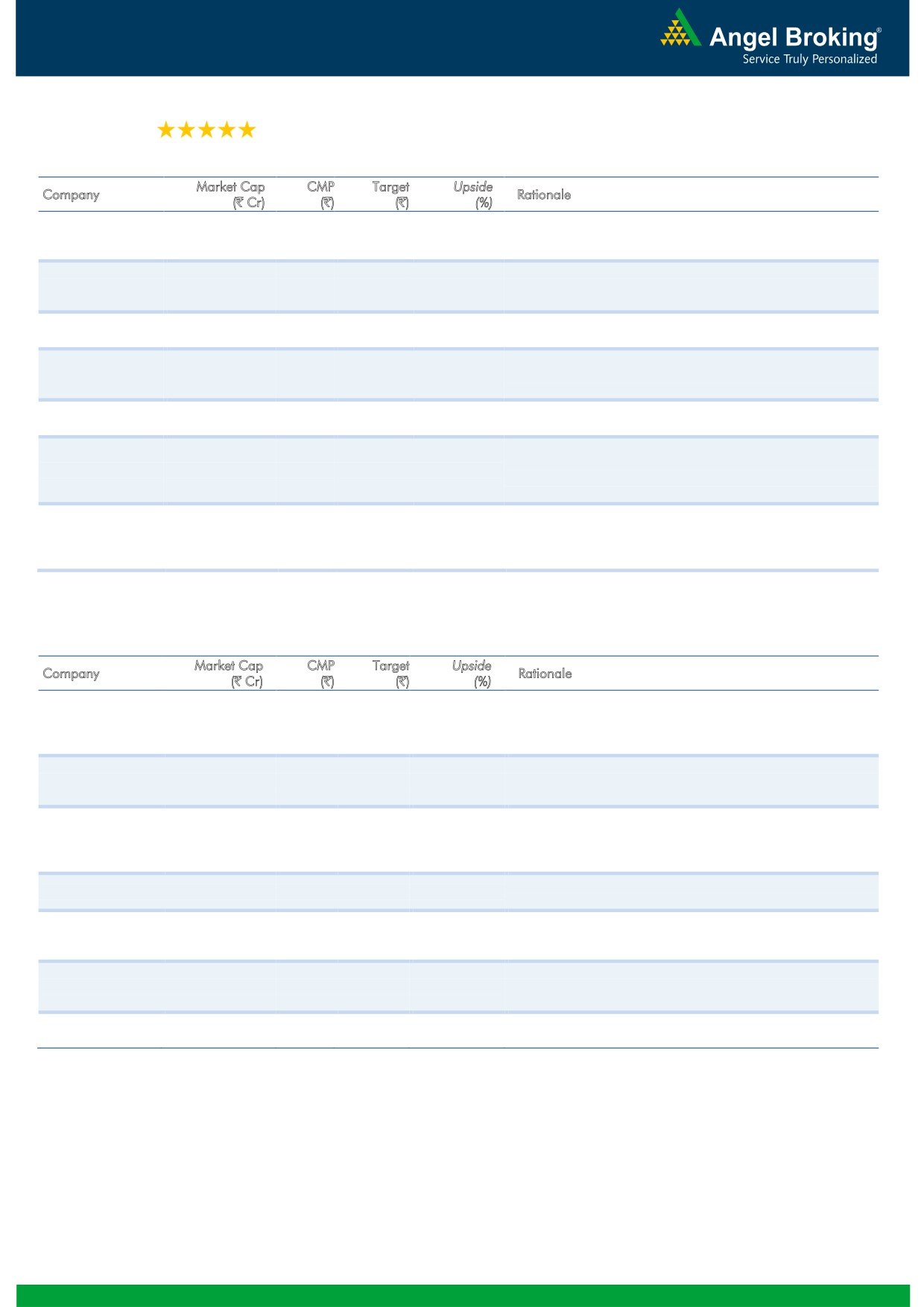

Top Picks

Large Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

To outpace battery industry growth due to better technological

Amara Raja Batteries

14,707

861

1,040

20.8

products leading to market share gains in both the automotive

OEM and replacement segments.

Earnings to grow strongly given the MHCV cyclical upturn.

Ashok Leyland

23,080

81

111

36.9

Focus on exports and LCV's provides additional growth

avenue.

The stock is trading at attractive valuations and is factoring all

HCL Tech

1,14,028

809

1,038

28.3

the bad news.

Strong visibility for a robust 20% earnings trajectory, coupled

HDFC Bank

2,46,559

976

1,262

29.3

with high quality of earnings on account of high quality retail

business and strategic focus on highly rated corporates.

Back on the growth trend, expect a long term growth of 14%

Infosys

2,48,334

1,081

1,347

24.6

to be a US$20bn in FY2020.

Well positioned to benefit from such expected gradual

recovery in the overall domestic capex cycle, given its presence

Larsen & Toubro

1,01,745

1,092

1,310

20.0

across various infrastructure segments, its execution

capabilities, and its strong balance sheet.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC Housing Finance

20,510

406

592

45.6

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Source: Company, Angel Research

Mid Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

2,957

329

439

33.5

growth. EMPPAC division's profitability to improve once

operating environment turns around.

Change in business focus towards high-margin chronic &

Garware Wall Ropes

677

310

473

52.8

lifestyle segments and increasing penetration in Europe and

US

Economic recovery to have favourable impact on advertising &

circulation revenue growth. Further, the acquisition of a radio

Jagran Prakashan

5,110

156

189

20.9

business (Radio City) would also boost the company's revenue

growth.

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,477

174

265

52.6

as well CFS augurs well for the company

Earnings boost on back of stable material prices and

Radico Khaitan

1,298

98

156

59.8

favourable pricing environment. Valuation discount to peers

provides additional comfort

Strong brands and distribution network would boost growth

Siyaram Silk Mills

934

997

1,354

35.9

going ahead. Stock currently trades at an inexpensive

valuation.

Structural shift in the Lighting industry towards LED lighting will

Surya Roshni

570

130

201

54.4

drive growth.

Source: Company, Angel Research

Market Outlook

February 12, 2016

Key Upcoming Events

Result Calendar

Date

Company

M&M, FAG Bearings, CEAT, Canara Bank, IDBI Bank, Andhra Bank, Corporation Bank, Nestle, Sun TV

February 12, 2016

Network, NMDC, Bhushan Steel, Monnet Ispat, IOC, BPCL, HPCL, Cravatex, Sun Pharma, Adani Power,

Anant Raj

February 13, 2016

Jyoti Structures, Bank of Baroda, Jindal Steel, MM Forging, HDIL, Competent Automobiles

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country Event Description

Unit

Period

Last Reported

Estimated

Feb 12, 2016

India

Imports YoY%

% Change Jan

(3.90)

India

Exports YoY%

% Change Jan

(14.70)

5:30 PM

India

Industrial Production YoY

% Change Dec

(3.20)

-

3:30 PM Euro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

4Q A

0.30

0.30

12:30 PM Germany

GDP nsa (YoY)

% Change

4Q P

1.80

1.70

Feb 15, 2016

12:00 PM

India Monthly Wholesale Prices YoY%

% Change Jan

(0.73)

(0.11)

China

Exports YoY%

% Change Jan

(1.40)

(2.00)

Feb 16, 2016

3:00 PM

UK

CPI (YoY)

% Change Jan

0.20

Feb 17, 2016

7:00 PM

US

Housing Starts

Thousands Jan

1,149.00

1,175.00

7:00 PM

US

Building permits

Thousands Jan

1,204.00

1,200.00

3:00 PM

UK

Jobless claims change

% Change Jan

(4.30)

7:45 PM

US

Industrial Production

% Jan

(0.36)

0.30

US

Producer Price Index (mom)

% Change Jan

(0.70)

Feb 18, 2016

7:00 AM

China

Consumer Price Index (YoY)

% Change Jan

1.60

1.90

Feb 19, 2016

7:00 PM

US Consumer price index (mom)

% Change Jan

(0.10)

(0.10)

8:30 PM Euro Zone Euro-Zone Consumer Confidence

Value

Feb A

(6.30)

Feb 22, 2016

2:00 PM Germany

PMI Services

Value

Feb P

55.00

2:00 PM Germany

PMI Manufacturing

Value

Feb P

52.30

Feb 23, 2016

8:30 PM

US

Existing home sales

Million

Jan

5.46

8:30 PM

US

Consumer ConfidenceS.A./ 1985=100 Feb

98.10

Source: Bloomberg, Angel Research

Market Outlook

February 12, 2016

Macro watch

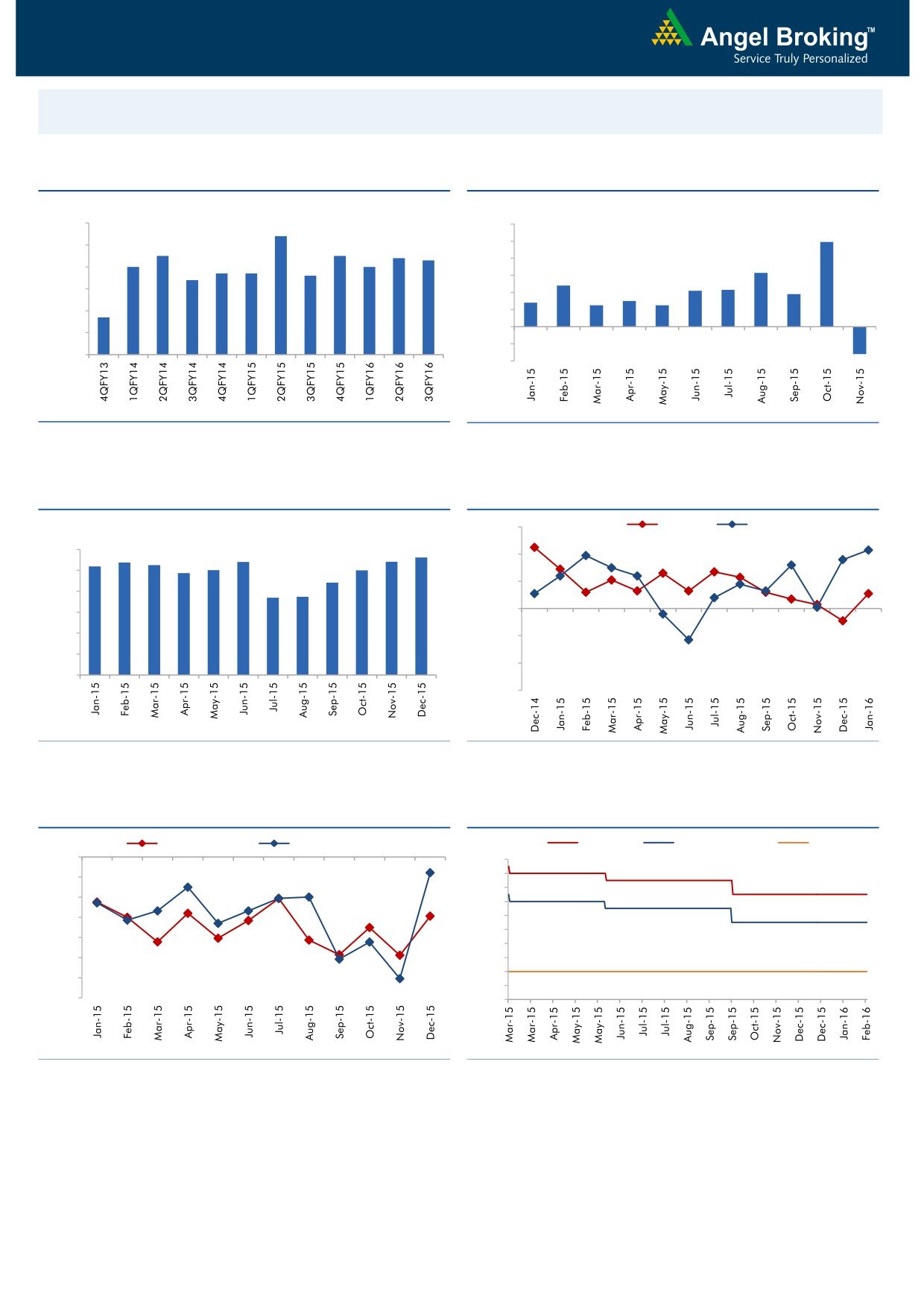

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

12.0

9.9

7.5

7.5

10.0

8.0

7.4

7.3

7.0

7.0

6.7

6.7

6.6

8.0

6.3

7.0

6.4

6.0

4.8

4.3

4.2

3.8

6.0

2.8

3.0

4.0

2.5

2.5

4.7

5.0

2.0

(3.2)

-

4.0

(2.0)

3.0

(4.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

5.4

5.4

5.6

6.0

5.2

5.4

5.3

54.0

4.9

5.0

5.0

5.0

4.4

3.7

3.7

52.0

4.0

3.0

50.0

2.0

48.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

0.0

8.00

7.50

(5.0)

7.00

(10.0)

6.50

(15.0)

6.00

5.50

(20.0)

5.00

(25.0)

4.50

4.00

(30.0)

3.50

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

February 12, 2016

Global watch

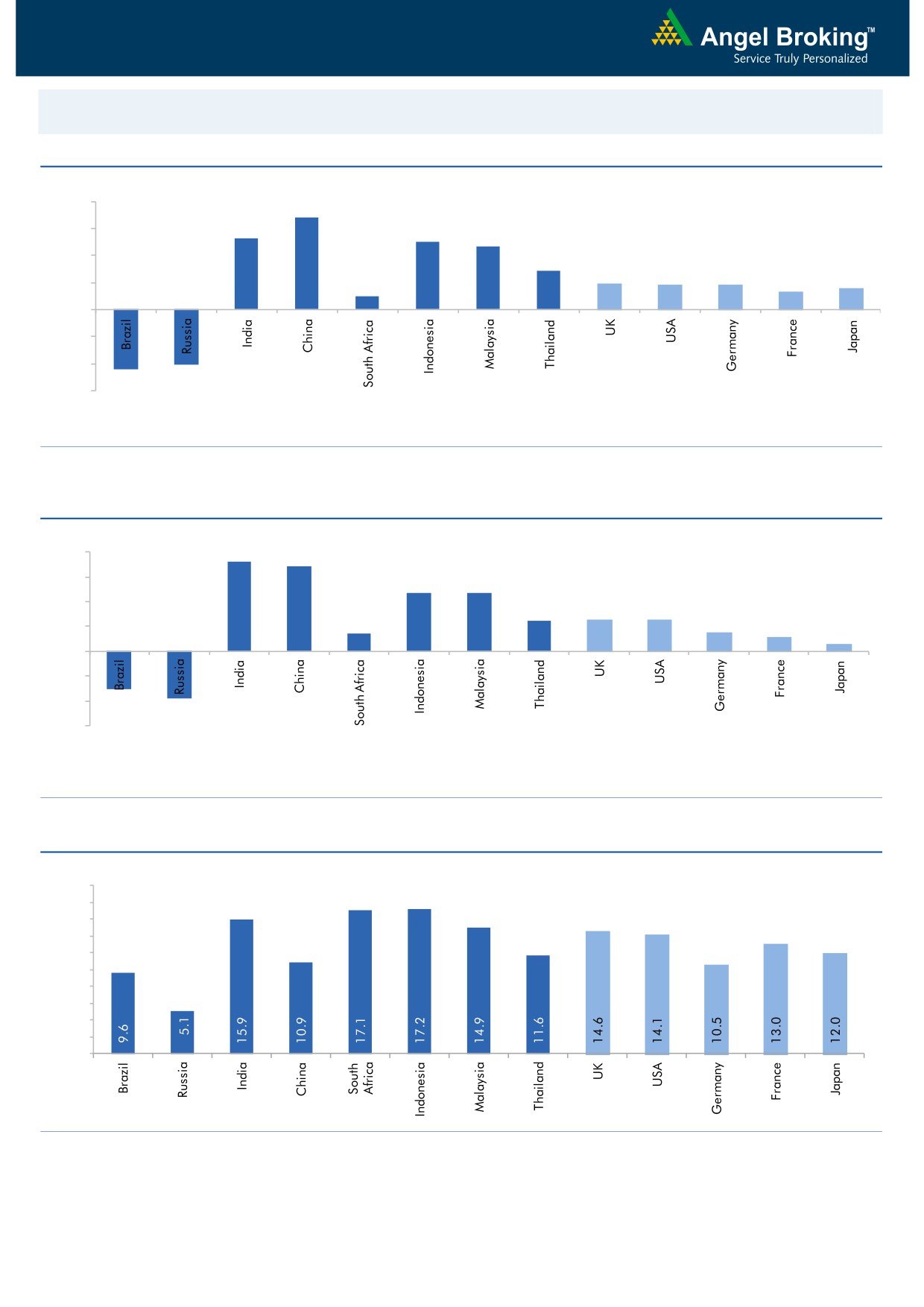

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.8

5.3

6.0

5.0

4.7

4.0

2.9

1.9

1.8

1.8

1.3

1.6

2.0

1.0

(4.5)

(4.1)

-

(2.0)

(4.0)

(6.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.3

8.0

6.8

6.0

4.7

4.7

4.0

2.5

2.5

2.6

1.4

1.5

2.0

1.2

0.6

(3.0)

(3.8)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

February 12, 2016

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

39,318

(3.4)

(18.2)

(16.2)

Russia

Micex

1,712

1.3

(2.3)

(1.8)

India

Nifty

6,976

(7.8)

(11.9)

(19.5)

China

Shanghai Composite

2,763

(17.8)

(23.0)

(16.4)

South Africa

Top 40

42,054

(3.3)

(10.9)

(8.4)

Mexico

Mexbol

42,359

4.1

(4.8)

1.0

Indonesia

LQ45

839

6.1

6.5

(8.1)

Malaysia

KLCI

1,644

(1.4)

(2.0)

(7.8)

Thailand

SET 50

805

2.3

(11.0)

(23.5)

USA

Dow Jones

15,660

(4.5)

(11.7)

(12.9)

UK

FTSE

5,537

(6.6)

(11.8)

(19.4)

Japan

Nikkei

15,713

(11.2)

(17.8)

(10.5)

Germany

DAX

8,753

(12.3)

(19.1)

(20.2)

France

CAC

3,897

(11.0)

(21.3)

(18.8)

Source: Bloomberg, Angel Research

Market Outlook

February 12, 2016

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.