Market Outlook

September 11, 2015

Dealer’s Diary

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

(0.4)

(97)

25,622

Indian markets are expected to open on a Positive note tracking the SGX Nifty and

most of global markets.

Nifty

(0.4)

(30)

7,788

MID CAP

0.7

68

10,503

The US markets remained volatile throughout Thursday’s trading session but largely

SMALL CAP

(0.4)

(43)

10,632

managed to maintain a positive bias. Traders also reacted to U.S. economic data

BSE HC

(0.1)

(10)

16,892

that included Weekly Initial Jobless Claims. The report showed that jobless claims

BSE PSU

(0.8)

(50)

6,598

were in-line with estimates, coming in at 275,000.

BANKEX

(0.1)

(25)

18,994

The European markets closed in the negative territory after 3-session winning streak

AUTO

0.7

123

17,699

on Thursday. The pull back was attributed to profit taking, after the recent run up in

METAL

(0.8)

(56)

7,310

equities. Disappointing economic data from China where inflation accelerated to

OIL & GAS

(0.2)

(15)

8,648

2.0% in August as compared to 1.6% in July on soaring food prices.

BSE IT

(0.7)

(82)

10,980

The Indian markets dipped on account of profit booking on Thursday after rallying

Global Indices

Chg (%)

(Pts)

(Close)

sharply in the previous two sessions. Sustained capital outflows by foreign funds,

Dow Jones

0.5

77

16,330

monsoon concerns, disappointment over the delay in enacting the Goods and

NASDAQ

0.8

40

4,796

Services Tax (GST) Bill and news that Standard & Poor's has downgraded Brazil's

FTSE

(1.2)

(73)

6,156

investment-grade rating to BB+ also weighed on the markets.

Nikkei

(2.5)

(471)

18,300

Hang Sang

(2.6)

(569)

21,563

News & Result Analysis

Straits Times

(1.4)

(40)

2,888

August Auto sales

Shanghai Com

(1.4)

(45)

3,198

Wonderla Holiodays to invest `300cr to set up amusement park in Tamil Nadu

Refer detailed news analysis on the following page

Indian ADR

Chg (%)

(Pts)

(Close)

Markets Today

The trend deciding level for the day is 25,548 / 7,762 levels. If NIFTY trades above

INFY

1.9

0.3

$17.6

this level during the first half-an-hour of trade then we may witness a further rally up

WIT

1.5

0.2

$11.6

to 25,808 - 25,994 / 7,846 - 7,904 levels. However, if NIFTY trades below

IBN

(0.5)

(0.0)

$8.4

25,548 / 7,762 levels for the first half-an-hour of trade then it may correct towards

HDB

0.5

0.3

$57.2

25,362 - 25,102 / 7,704 - 7,621 levels.

Advances / Declines

BSE

NSE

Indices

S2

S1

PIVOT

R1

R2

Advances

1,080

1,245

SENSEX

25,102

25,362

25,548

25,808

25,994

Declines

1,543

284

NIFTY

7,621

7,704

7,762

7,846

7,904

Unchanged

102

49

Net Inflows (September 09, 2015)

Volumes (` cr)

` cr

Purch

Sales

Net

MTD

YTD

BSE

2,500

FII

4,141

4,559

(418)

(5,514)

118,246

NSE

15,364

MFs

1,477

444

1,033

4,182

74,830

FII Derivatives (September 10, 2015)

` cr

Purch

Sales

Net

Open Interest

Index Futures

1,768

2,042

(273)

22,343

Stock Futures

2,360

2,048

312

45,765

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

WOCKPHARMA

1,316

8.1

SUNTV

344

(7.3)

BAJAJ-AUTO

1,218

6.9

SUNASIAN

148

(5.0)

WELCORP

105

6.4

TORNTPHARM

1,418

(4.8)

FORTIS

167

6.4

COX&KINGS

218

(4.7)

CONCOR

1,492

6.3

UPL

496

(4.5)

Market Outlook

September 11, 2015

Passenger car sales up by 6% in August, Two-wheelers struggle

The passenger car sales managed to post a decent growth rate of 6% yoy in the

month of August as per the data released by Society of Indian Automobile

Manufacturers (Siam). The MHCV which account for

~40% of the total

Commercial Vehicle sales posted growth of 35% yoy during the period while light

commercial performance remain subdued resulting in total Commercial Vehicle

sales growth of 7.6% yoy. Owing to poor monsoon and dampened rural

sentiment, Two-wheelers sales declined by 3% yoy. Amongst the Two-wheelers,

scooters sales grew by 16% yoy while motorcycle sales declined by close to

10% yoy.

Wonderla Holiodays to invest `300cr to set up amusement park

in Tamil Nadu

Wonderla Holidays Ltd has signed Memorandum Of Understanding (MOU) with

the Government of Tamil Nadu to set up a large scale amusement park at

Chennai. As per the MOU the government of Tamil Nadu will facilitate speedy

clearance to the project through single window clearance and will provide

uninterrupted power and water supply. The company has been alotted land for the

same and it proposes to make an investment of `300cr in the project over a

period of next three years. The Company proposes to fund the project through

combination of debt (~`120cr)and internal accruals. We maintain our Buy rating

on the stock.

Economic and Political News

Domestic car sales rise 6% in August

Trai to come out with recommendations on call drops by Oct 15

Gold monetisation scheme: 2% interest likely on gold deposits

Corporate News

BPCL to spend `1 lakh crore in next 5 years: S Varadarajan

Sun Pharma looking to divest Ireland plant

Tata Motors, Total Lubrifiants sign pact for lubricants supply

Market Outlook

September 11, 2015

Top Picks

Large Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Aurobindo

Pharma

41,546

Buy

711

872

22.6

Axis Bank

Financials

1,14,797

Buy

483

701

45.1

ICICI Bank

Financials

1,55,277

Buy

267

370

38.3

Infosys

IT

2,48,150

Buy

1,080

1,306

20.9

Inox Wind

Capital Goods

8,444

Buy

381

505

32.7

LIC HFL

Financials

21,690

Buy

430

570

32.6

Power Grid

Power

64,375

Buy

123

170

38.2

TCS

IT

4,97,977

Buy

2,542

3,168

24.6

Tech Mahindra IT

51,329

Buy

534

646

21.1

Yes Bank

Financials

29,841

Buy

713

953

33.6

Sun Pharma

Pharma

2,02,201 Accumulate

840

950

13.1

Source: Angel Research, Bloomberg

Mid Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Bajaj Electricals

Others

2,436

Buy

242

341

41.2

Garware Wall RopesOthers

613

Buy

280

390

39.2

JK Tyre

Auto Ancillary

2,410

Buy

106

129

21.4

MBL Infrastructures Construction

1,004

Buy

242

360

48.6

Minda Industries

Auto Ancillary

809

Buy

510

652

27.8

MT Educare

Others

492

Buy

124

169

36.8

Radico Khaitan

Others

1,133

Buy

85

112

31.5

Surya Roshni

Others

510

Buy

116

183

57.3

Tree House

Others

1,608

Buy

380

449

18.2

Source: Angel Research, Bloomberg

Market Outlook

September 11, 2015

Macro watch

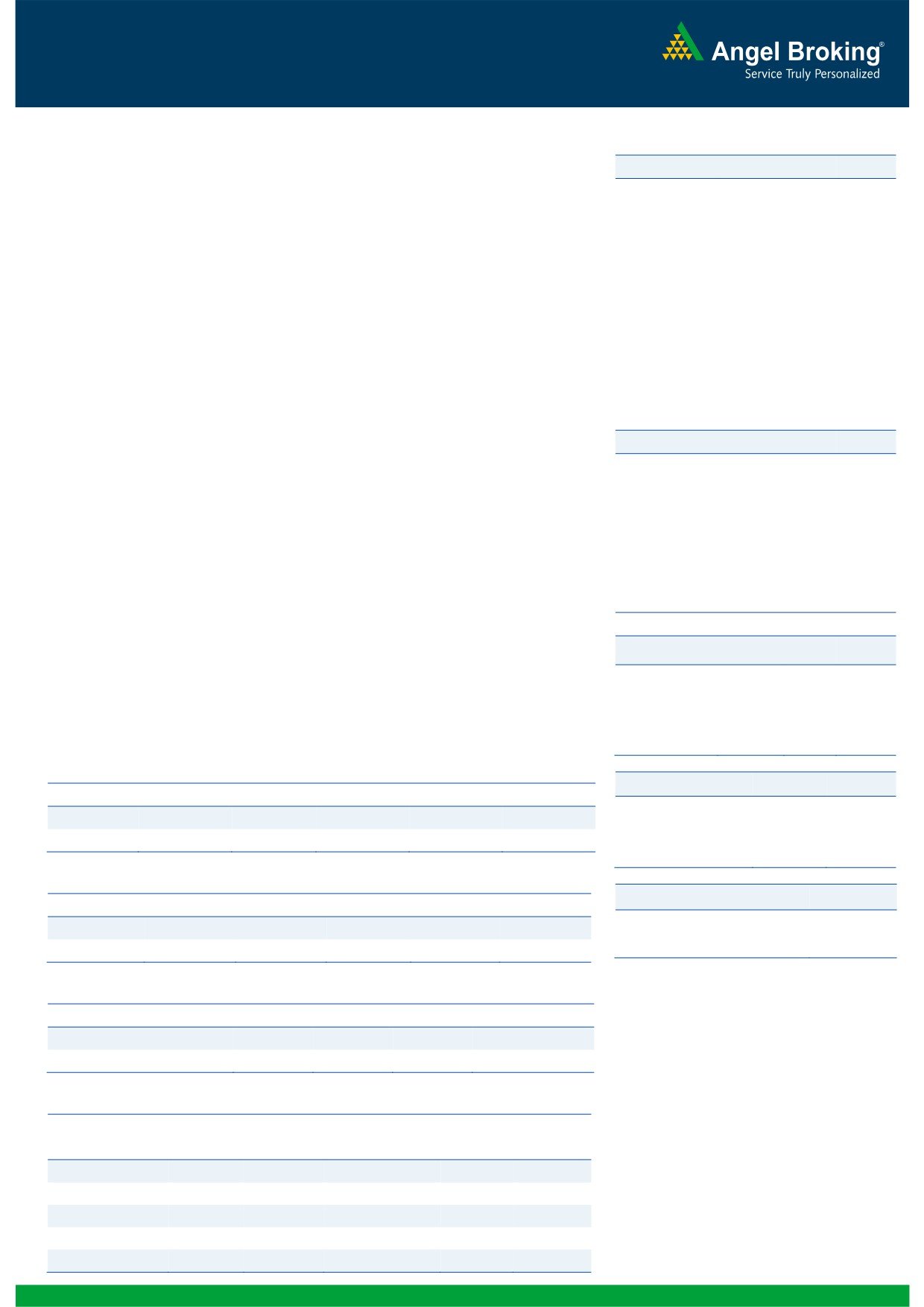

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

6.0

5.2

4.8

7.5

7.5

5.0

3.8

8.0

3.6

3.4

7.0

7.0

4.0

2.8

6.7

6.7

2.6

2.5

2.5

7.0

6.3

6.4

6.6

3.0

2.0

6.0

0.5

1.0

5.0

4.7

-

5.0

(1.0)

4.0

(2.0)

(3.0)

3.0

(2.7)

(4.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

8.0

7.0

54.0

7.0

5.6

5.4

6.0

5.2

5.4

5.3

5.0

52.0

4.6

4.9

5.0

4.3

3.8

4.0

3.3

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

30.0

9.00

20.0

8.00

10.0

7.00

0.0

6.00

(10.0)

5.00

(20.0)

4.00

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

September 11, 2015

Global watch

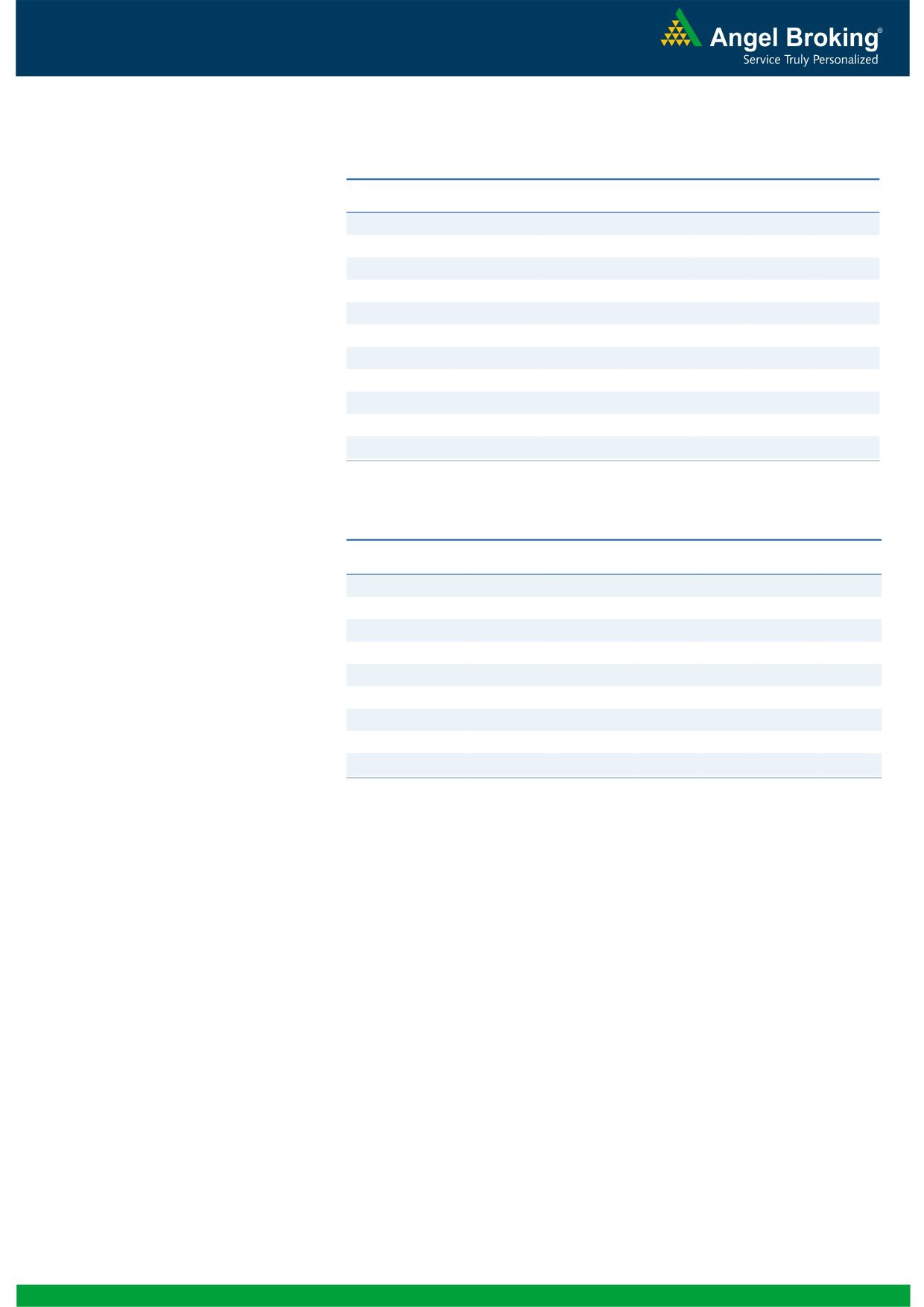

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

7.0

6.0

5.3

4.9

4.7

4.0

2.8

2.6

2.7

1.6

2.0

1.2

1.0

0.7

(2.6)

(4.6)

-

(2.0)

(4.0)

(6.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.5

8.0

6.8

5.2

6.0

4.8

3.7

3.1

4.0

2.7

2.0

1.6

1.2

1.0

2.0

(3.8)

(1.0)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: Bloomberg, Angel Research

Market Outlook

September 11, 2015

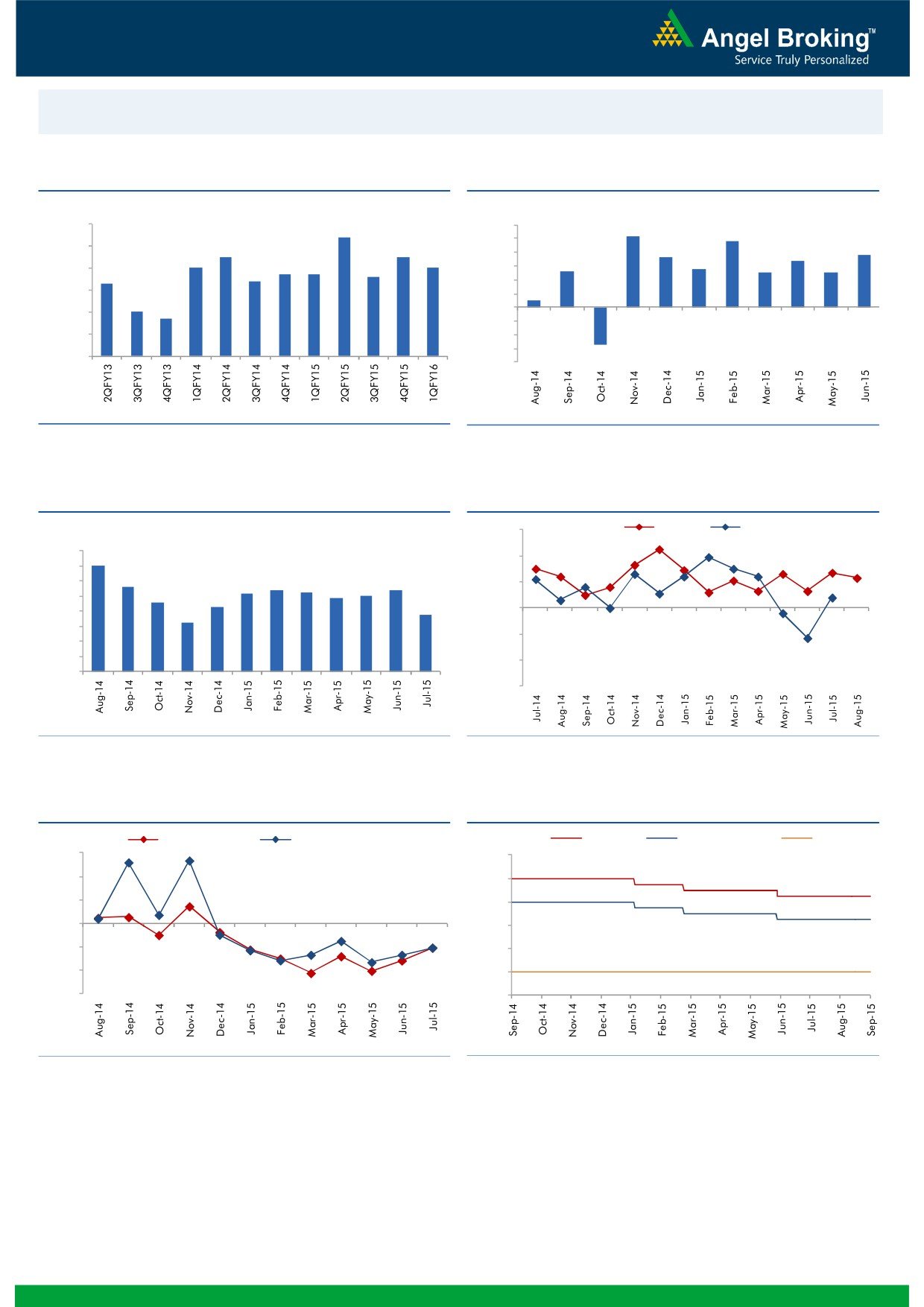

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

46,504

(5.8)

(13.7)

(23.4)

Russia

Micex

1,719

1.2

4.0

17.1

India

Nifty

7,788

(8.0)

(2.4)

(3.8)

China

Shanghai Composite

3,198

(18.2)

(37.1)

43.7

South Africa

Top 40

44,026

(5.6)

(4.8)

(5.0)

Mexico

Mexbol

42,889

(3.4)

(4.0)

(6.5)

Indonesia

LQ45

731

(5.7)

(14.7)

(16.9)

Malaysia

KLCI

1,614

(2.4)

(7.0)

(13.6)

Thailand

SET 50

908

(2.2)

(7.4)

(13.0)

USA

Dow Jones

16,330

(7.3)

(9.3)

(4.2)

UK

FTSE

6,156

(8.6)

(10.1)

(9.6)

Japan

Nikkei

18,300

(11.7)

(10.2)

16.8

Germany

DAX

10,210

(9.6)

(8.8)

5.3

France

CAC

4,597

(9.9)

(6.2)

4.2

Source: Bloomberg, Angel Research

Market Outlook

September 11, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.