Market Outlook

June 09, 2016

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian Markets are expected to open in green tracking SGX Nifty & Global Markets.

BSE Sensex

0.0

11

27,021

U.S. stocks closed higher Wednesday, with materials and industrial stocks leading,

Nifty

0.1

7

8,273

as the Dow and S&P neared their 52-week intraday highs touched last summer. Dow

Mid Cap

0.5

59

11,476

Jones industrial average closed above the psychological mark of 18,000 level for

Small Cap

0.9

100

11,381

the first time since April 27. United Health contributed the most to gains. Both

Bankex

0.1

24

20,560

indexes posted their third-straight day of gains.

U.K. stocks advanced for a fourth session Wednesday aided by gains for miners and

Global Indices

Chg (%)

(Pts)

(Close)

supermarkets while rising oil prices lifted energy shares. FTSE 100, closed up 0.3%

Dow Jones

0.4

67

18,005

at 6,301.5, having darted between small gains and losses throughout the session.

Shares of energy majors were higher as Brent crude prices trading in London was

Nasdaq

0.3

13

4,975

above $52 a barrel. BP PLC climbed 0.9%, and Royal Dutch Shell PLC bounced

FTSE

0.3

17

6,302

2.5% higher. Mining shares pushed higher Wednesday after data showed declines

Nikkei

0.9

155

16,831

in Chinese imports and exports in May weren’t as steep as expected. Copper miner

Hang Seng

(0.1)

(30)

21,298

Fresnillo PLC rose 4.2%, Glencore PLC added 4.1%, and Anglo American PLC

Shanghai Com

(0.3)

(9)

2,927

rallied on 4.8%.

Benchmark indices ended flat amid consolidation and mixed global cues on

Advances / Declines

BSE

NSE

Wednesday after a rally in previous session discounted the RBI policy while the

broader markets outperformed. Volatility is likely to continue with some profit

Advances

1,605

1,028

booking as the market rallied 7% in last two weeks. Federal Reserve meeting on

Declines

1,046

541

June 14-15 and Britain's referendum on June 23 will be next key events to watch out

Unchanged

155

65

for along with monsoon that hit southwest Kerala today.

News Analysis

Volumes (` Cr)

Good days ahead for Defence stocks

BSE

2,536

Detailed analysis on Pg2

NSE

16,620

Investor’s Ready Reckoner

Net Inflows (` Cr)

Net

Mtd

Ytd

Key Domestic & Global Indicators

FII

543

3,167

17,535

Top Picks

MFs

(154)

(342)

9,089

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Amara Raja

Auto/Auto Ancillary

Buy

844

1,076

27.5

Top Gainers

Price (`)

Chg (%)

HCL Tech

IT

Buy

744

1,000

34.5

Jswenergy

80

13.5

LIC Housing

Financials

Buy

480

592

23.4

Rdel

65

10.3

Bharat Electronics

Capital Goods

Accumulate

1,289

1,414

9.7

Gati

147

9.6

Navkar Corporation Others

Buy

198

265

33.8

Punjlloyd

19

8.7

More Top Picks on Pg4

Hcc

20

7.6

Key Upcoming Events

Previous

Consensus

Date

Region

Event Description

Top Losers

Price (`)

Chg (%)

Reading

Expectations

Vakrangee

169

(2.2)

June 09 US

Initial Jobless claims

267.0

270.0

June 09 India

Industrial Production YoY

0.10

(0.60)

Sunasian

10

(1.9)

June 10 CAD

Employment Change (May)

-2.1K

3.8K

J&Kbank

63

(1.8)

June 14 GBP

CPI (YoY) (May)

0.3%

Pel

1,379

(1.7)

Tvsmotor

290

(1.5)

As on June 8, 2016

Market Outlook

June 09, 2016

Good days ahead for Defence stocks

Defense stocks like Reliance Defence & Eng, Astra Microwave and Bharat

Electronics rose in the range of 6-11% in yesterday’s trade.

In ongoing bilateral summit, both, the Indian Prime Minister and the US President

have expressed desire to explore agreements which would facilitate expansion of

bilateral defense cooperation in practical ways. In this regard, both the leaders

welcomed finalization of text of Logistics Exchange Memorandum of Agreement

(LEMOA).

Both the leaders reached an understanding under which India would receive

license-free access to a wide range of dual-use technologies in conjunction with

steps that India has committed to take to advance its export control objectives. In

support of India's 'Make In India' initiative and to support the development of

robust defense industries and their integration into global supply chain, the US will

continue to facilitate export of goods and technologies, consistent with US law, for

projects, programs and joint ventures in support of official US-India defense

cooperation. The two leaders also committed to enhance cooperation in support of

the Government of India's Make in India initiative and expand the co-production

and co-development of technologies under the Defense Technology and Trade

Initiative (DTTI).

Also, 2 other agreements- one to provide access to advanced radio and satellite

communications systems, and another to provide exchange of geospatial data for

military and civilian use - are pending.

Media reports suggest that India is on its way to become member of the Missile

Technology Control Regime (MTCR), an international proliferation group. This

membership of MTCR is expected to pave way for increase in defense trade and

technology transfer between India and USA.

These are positive developments for the Indian defense sector, as new avenues

open up for access to defense technology. Indian defense companies would be

able to absorb advanced technologies with minimal ease. Such absorption of new

technologies would lead to near-term increase in R&D expenses for defense

companies but in the long run it will contribute to higher realizations and return

ratios, as new products made would have higher realizations. Further, these

developments could lead to the Indian Defense sector emerging as a potential

export hub. On a whole, in the long run it would improve the perception of Indian

Defense players in the global market.

Post yesterday’s run-up, we have an ACCUMULATE rating on BEL with a price

target of `1,414.

Market Outlook

June 09, 2016

Economic and Political News

US firms pledge $45bn investments

Tamil Nadu allows unions in information technology sector

Power minister estimates 1.1% energy surplus in FY17

Cyprus agrees to amend tax treaty ahead of GAAR with caveat

FY17 raw jute production pegged at 10.2mn bales

Corporate News

Bajaj Finance ties up with retailers for loans to buyers for clothes, shoes,

watches

Drug regulator finds Alkem Labs drug substandard, again

Lupin recalls over 54,000 vials of anti-bacterial injection in US

Apollo expects biz from foreign patients to double

Bharti InfraTel in talks to acquire Tower Vision India

Market Outlook

June 09, 2016

Large Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

To outpace battery industry growth due to better

Amara Raja Batteries

14,411

844

1,076

27.5

technological products leading to market share gains in both

the automotive OEM and replacement segments.

Uptick in defense capex by government, coupled with BELs

Bharat Electronics

30,941

1,289

1,414

9.7

strong market positioning, indicate good times ahead for

BEL.

Stock is trading at attractive valuations & factors all bad

HCL Tech

104,882

744

1,000

34.5

news.

Strong visibility for a robust 20% earnings trajectory, coupled

HDFC Bank

294,290

1,162

1,262

8.6

with high quality of earnings on account of high quality retail

business and strategic focus on highly rated corporates.

Back on the growth trend, expect a long term growth of 14%

Infosys

284,431

1,238

1,374

11.0

to be a US$20bn in FY2020.

Continues to grow its retail loan book at healthy pace with

improvement in asset quality. Expect LICHF to post a healthy

LIC Housing Finance

24,206

480

592

23.4

loan book which is likely to reflect in a strong earnings

growth.

Huge bid pipeline of re-development works at Delhi and

NBCC

11,337

189

220

16.4

other State Governments and opportunity from Smart City,

positions NBCC to report strong growth, going forward.

Strong market positioning within the domestic AC markets to

Voltas

11,133

336

407

21.0

continue, EMP business set to revive

Source: Company, Angel Research

Mid Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Among the top 4 players in the consumer durables segment.

Bajaj Electricals

2,284

226

268

18.6

Improved profitability backed by turn around in E&P segment.

Strong order book lends earnings visibility.

Favourable outlook for AC industry to augur well for Cooling

Blue Star

3,969

441

495

12.2

products business. EMPPAC division's profitability to improve

once operating environment turns around.

With a focus on the low and medium income (LMI) consumer

Dewan Housing

5,849

200

270

34.7

segment, the company has increased its presence in tier-II &

III cities where the growth opportunity is immense.

Strong loan growth backed by diversified loan portfolio and

Equitas Holdings

5,951

177

235

32.4

adequate CAR. ROE & ROA likely to remain decent as risk of

dilution remains low. Attractive valuations considering growth.

Commencement of new projects, downtrend in the interest

IL&FS Transport

2,352

72

93

30.1

rate cycle, to lead to stock re-rating

Economic recovery to have favourable impact on advertising

& circulation revenue growth. Further, the acquisition of a

Jagran Prakashan

5,665

173

205

18.3

radio business (Radio City) would also boost the company's

revenue growth.

Speedier execution and speedier sales, strong revenue

Mahindra Lifespace

1,853

452

554

22.6

visibility in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,824

198

265

33.8

as well CFS augurs well for the company

Earnings boost on back of stable material prices and

Radico Khaitan

1,237

93

125

34.4

favourable pricing environment. Valuation discount to peers

provides additional comfort

Strong brands and distribution network would boost growth

Siyaram Silk Mills

985

1,051

1,347

28.2

going ahead. Stock currently trades at an inexpensive

valuation.

Source: Company, Angel Research

Market Outlook

June 09, 2016

Macro watch

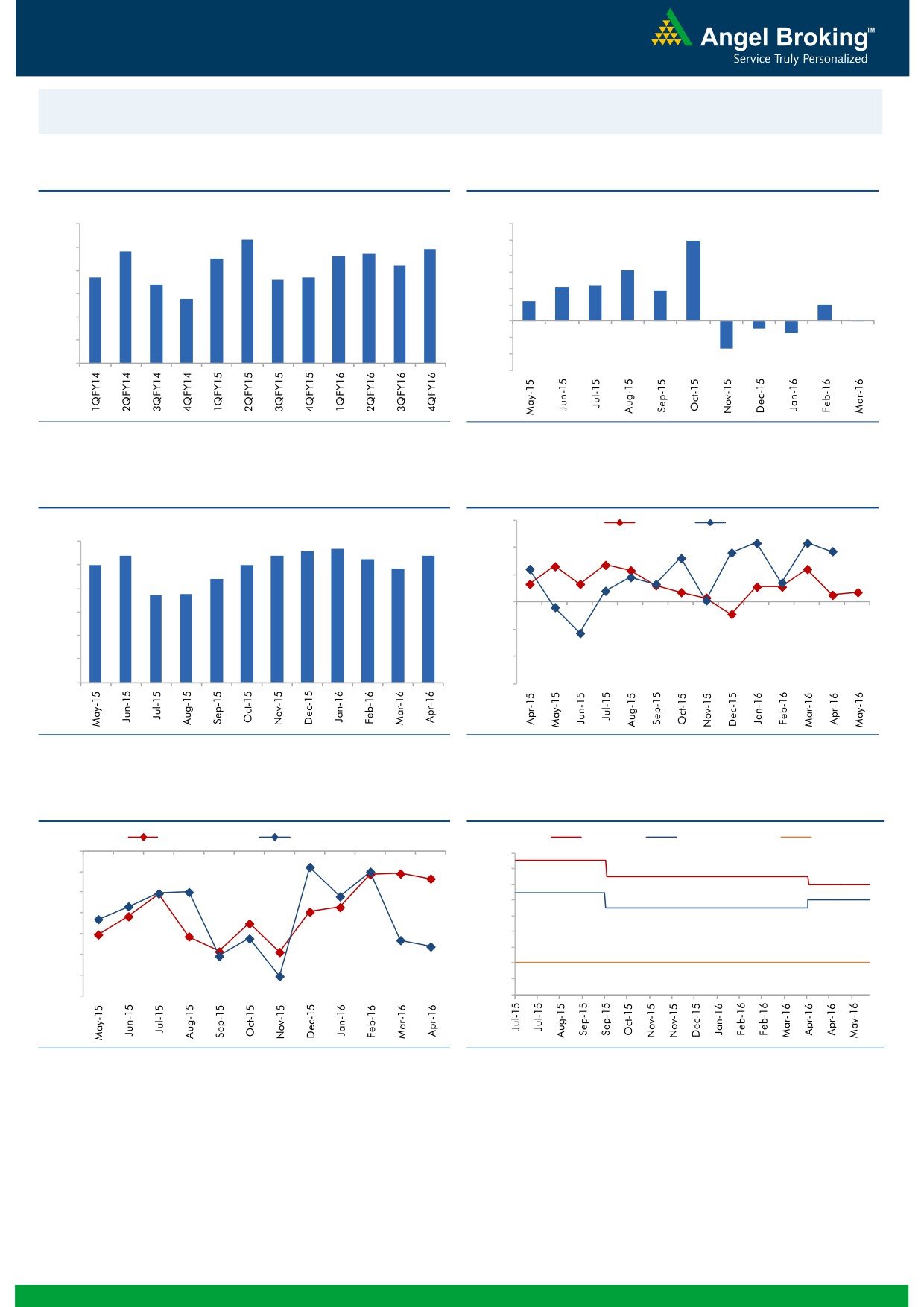

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.3

12.0

9.9

7.8

7.7

7.9

10.0

8.0

7.5

7.6

7.2

8.0

6.3

6.7

6.6

6.7

7.0

6.4

6.0

4.2

4.3

3.7

5.8

4.0

2.5

6.0

2.0

2.0

0.1

5.0

-

4.0

(2.0)

(0.9)

(1.5)

(4.0)

3.0

(3.4)

(6.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

5.6

5.7

6.0

5.4

5.4

5.4

5.3

54.0

5.0

5.0

4.8

5.0

4.4

52.0

3.7

3.7

4.0

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

0.0

7.50

(5.0)

7.00

6.50

(10.0)

6.00

(15.0)

5.50

(20.0)

5.00

4.50

(25.0)

4.00

(30.0)

3.50

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

June 09, 2016

Global watch

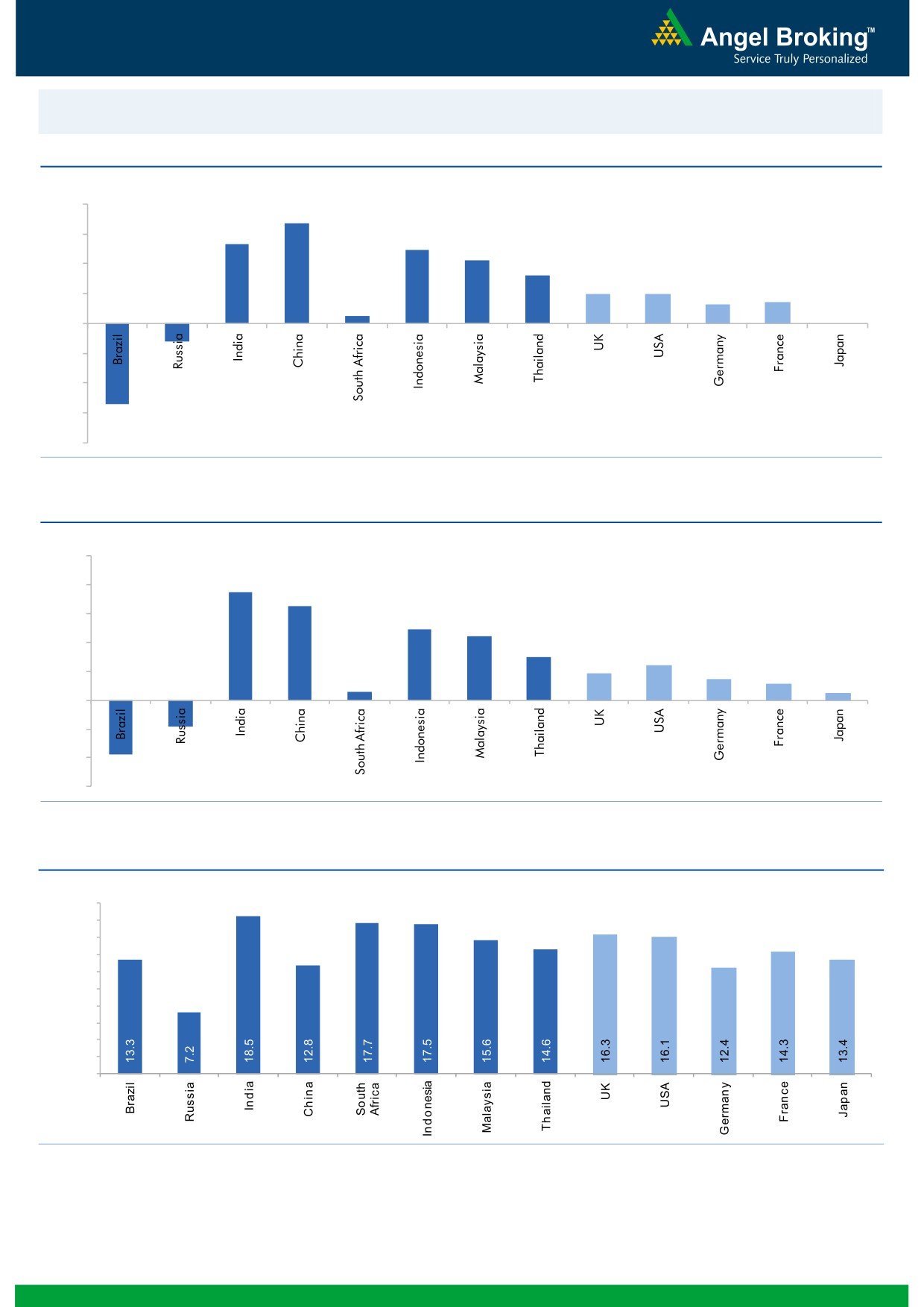

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.7

6.0

5.3

4.9

4.2

4.0

3.2

2.0

2.0

1.3

1.4

2.0

0.5

-

-

(2.0)

(4.0)

(1.2)

(6.0)

(5.4)

(8.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.5

8.0

6.5

6.0

4.9

4.4

4.0

3.0

2.4

1.9

1.5

2.0

1.1

0.6

0.5

(3.8)

(1.8)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

June 09, 2016

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

51,629

(2.3)

2.9

(4.3)

Russia

Micex

1,952

2.4

3.7

18.2

India

Nifty

8,273

5.2

12.3

1.7

China

Shanghai Composite

2,927

3.4

0.9

(39.4)

South Africa

Top 40

47,716

5.7

3.9

3.9

Mexico

Mexbol

46,264

2.0

2.8

3.6

Indonesia

LQ45

845

3.6

(0.5)

(7.2)

Malaysia

KLCI

1,658

1.6

(1.7)

(5.2)

Thailand

SET 50

923

4.6

8.5

(6.3)

USA

Dow Jones

18,005

1.6

5.1

1.0

UK

FTSE

6,302

2.9

1.6

(8.0)

Japan

Nikkei

16,831

3.8

(0.8)

(18.2)

Germany

DAX

10,217

3.7

4.7

(8.6)

France

CAC

4,449

3.1

1.2

(6.9)

Source: Bloomberg, Angel Research

Market Outlook

June 09, 2016

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.