Market Outlook

September 7, 2015

Dealer’s Diary

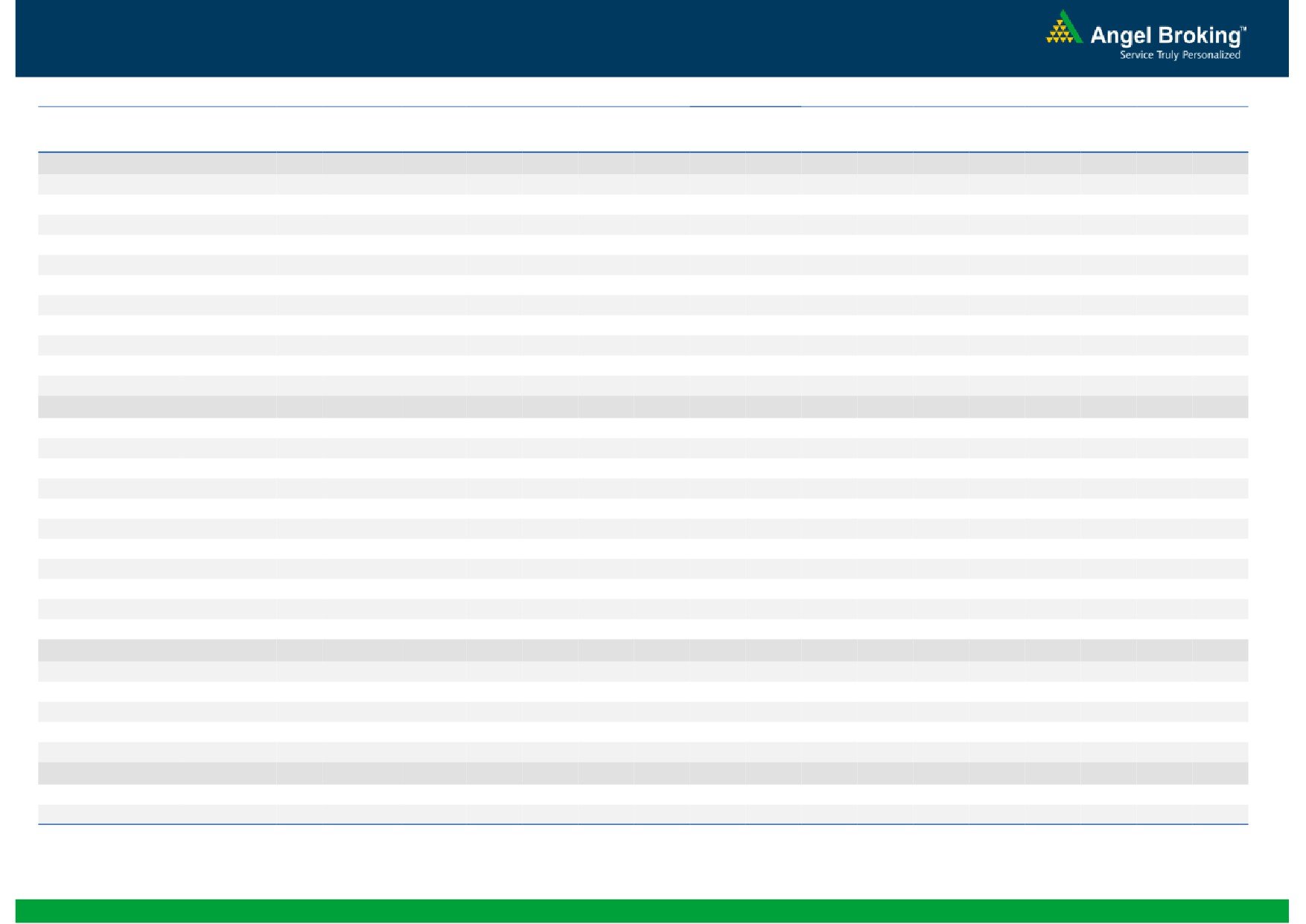

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

(2.2)

(563)

25,202

Indian markets are expected to open on negative tracking the SGX Nifty and global

cues.

Nifty

(2.1)

(168)

7,655

MID CAP

(1.9)

(200)

10,360

US markets moved lower during trading on Friday following the release of the

SMALL CAP

(2.5)

(268)

10,605

closely watched monthly employment report. The Dow dropped 272.38 points or

BSE HC

(2.4)

(425)

17,136

1.7 percent to 16,102.38, the Nasdaq slid 49.58 points or 1.1 percent to 4,683.92

BSE PSU

(1.9)

(125)

6,522

and the S&P 500 fell 29.91 points or 1.5 percent to 1,921.22.

BANKEX

(2.7)

(503)

18,438

The European markets ended Friday's session solidly to the downside. The highly

AUTO

(2.3)

(400)

16,983

anticipated U.S. employment report showed disappointing job growth, which

METAL

(2.3)

(165)

7,117

triggered uncertainty among investors.

OIL & GAS

(1.4)

(122)

8,540

Indian markets tumbled on Friday, mirroring weak cues from Wall Street, Asia and

BSE IT

(2.3)

(263)

10,970

Europe as anxiety ahead of U.S. jobs data due out tonight overshadowed optimism

Global Indices

Chg (%)

(Pts)

(Close)

over the prospects of further ECB stimulus.

Dow Jones

(1.7)

(272)

16,102

NASDAQ

(1.0)

(50)

4,684

News & Result Analysis

FTSE

(2.4)

(151)

6,043

India's mega power projects grind to a slow halt

Refer detailed news analysis on the following page

Nikkei

(2.1)

(390)

17,792

Hang Sang

(0.5)

(94)

20,841

Markets Today

Straits Times

(1.5)

(43)

2,864

The trend deciding level for the day is 25,365 / 7,696 levels. If NIFTY trades above

Shanghai Com

(0.2)

(6)

3,160

this level during the first half-an-hour of trade then we may witness a further rally up

to 25,612 - 26,022 / 7,764 - 7,874 levels. However, if NIFTY trades below

Indian ADR

Chg (%)

(Pts)

(Close)

25,365 / 7,696 levels for the first half-an-hour of trade then it may correct towards

24,956 - 24,709 / 7,586 - 7,518 levels.

INFY

(3.6)

(0.6)

$16.9

WIT

(3.9)

(0.5)

$11.5

Indices

S2

S1

PIVOT

R1

R2

IBN

(2.9)

(0.2)

$8.3

SENSEX

24,709

24,956

25,365

25,612

26,022

HDB

(1.9)

(1.1)

$56.3

NIFTY

7,518

7,586

7,696

7,764

7,874

Advances / Declines

BSE

NSE

Net Inflows (September 03, 2015)

Advances

548

1,099

` cr

Purch

Sales

Net

MTD

YTD

Declines

2,161

406

FII

3,337

3,672

(336)

(2,541)

121,219

Unchanged

77

66

MFs

1,279

980

299

299

70,947

Volumes (` cr)

FII Derivatives (September 04, 2015)

` cr

Purch

Sales

Net

Open Interest

BSE

2,690

Index Futures

2564

2920

(356)

20629

NSE

16,813

Stock Futures

2627

2137

490

43716

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

PMCFIN

2

4.5

NCC

58

(12.2)

PGHH

387

4.0

WELCORP

101

(8.8)

AMTEKAUTO

33

3.8

HDIL

57

(7.8)

SHRIRAMCIT

1,671

2.2

PFC

206

(6.4)

TITAN

333

2.0

FRL

109

(6.3)

Market Outlook

September 7, 2015

India's mega power projects grind to a slow halt

At `1.19 a unit, power generated from the Sasan ultra mega power project

(UMPP) in Madhya Pradesh is perhaps one of the cheapest in the country. Yet,

Reliance Power wants state-owned Power Finance Corporation to buy it for "breach

of representation" - the de-allocation of the Chhatrasal coal block, which was

linked to the project. The company has already given up the Tilaiya UMPP because

of the slow pace of land acquisition by the Jharkhand government and has not

made progress on the Krishnapatnam UMPP in Tamil Nadu. Tata Power's UMPP at

Mundra in Gujarat, based on imported coal is in financial trouble for selling power

at Rs 2.26 a unit. That's not all. The Union government had to cancel the two-year

long bidding process for two UMPPs in Tamil Nadu and Odisha after all private

companies pulled out and government-controlled NTPC and NHPC emerged as

the winning bidders. For the Tamil Nadu UMPP, Adani Power, CLP India, Jindal

Steel & Power, JSW Energy, Sterlite Energy and Tata Power were in the fray, but

only four of them bought the 'request for proposal' document and none decided to

proceed further. NTPC submitted its bid, which wasn't opened since it was felt that

at least three quotes should be available for choosing the final winner.

Similarly, the Odisha UMPP saw nine interested bidders but finally only NTPC and

NHPC were left as the rest pulled out, which led to the cancellation of the auction.

Despite Mundra and Sasan producing 8,000 Mw of power, the inescapable

inference is that the UMPP experiment, launched with much fanfare during the first

tenure of the Manmohan Singh-led United Progressive Alliance government, has

failed.

Economic and Political News

Govt saves $1.8 billion on fertiliser subsidies, but no reform planned

India's Iran oil imports fall to 5-month low in August

IMF says room for RBI to cut rates, but warns of risks to inflation

Corporate News

Aurobindo gets USFDA nod for generic hypertension tablets

Suzlon seeks shareholders nod to raise `5,000 cr

Cipla to acquire two US-based pharma cos for $550 million

Reduction in iron ore freight rates won't help us: Vedanta

Market Outlook

September 7, 2015

Top Picks

Large Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Axis Bank

Financials

1,11,434

Buy

469

704

50.2

ICICI Bank

Financials

1,49,698

Buy

258

373

44.7

Infosys

IT

2,46,646

Buy

1,074

1,306

21.6

Inox Wind

Capital Goods

8,369

Buy

377

505

33.9

LIC HFL

Financials

20,865

Buy

413

570

37.9

Power Grid

Power

64,558

Buy

123

170

37.8

TCS

IT

4,99,368

Buy

2,549

3,168

24.3

Tech Mahindra IT

50,788

Buy

528

646

22.3

Yes Bank

Financials

27,046

Buy

646

951

47.1

Source: Angel Research, Bloomberg

Mid Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Bajaj Electricals

Others

2,385

Buy

236

341

44.2

Garware Wall RopesOthers

644

Buy

294

390

32.6

HMVL

Media

1,593

Buy

217

292

34.5

JK Tyre

Auto Ancillary

2,303

Buy

102

129

27.0

MBL Infra

Construction

958

Buy

231

360

55.7

Minda Industries

Auto Ancillary

796

Buy

502

652

29.9

MT Educare

Others

501

Buy

126

169

34.4

Radico Khaitan

Others

1,129

Buy

85

112

32.0

Surya Roshni

Others

509

Buy

116

183

57.7

Source: Angel Research, Bloomberg

Market Outlook

September 07, 2015

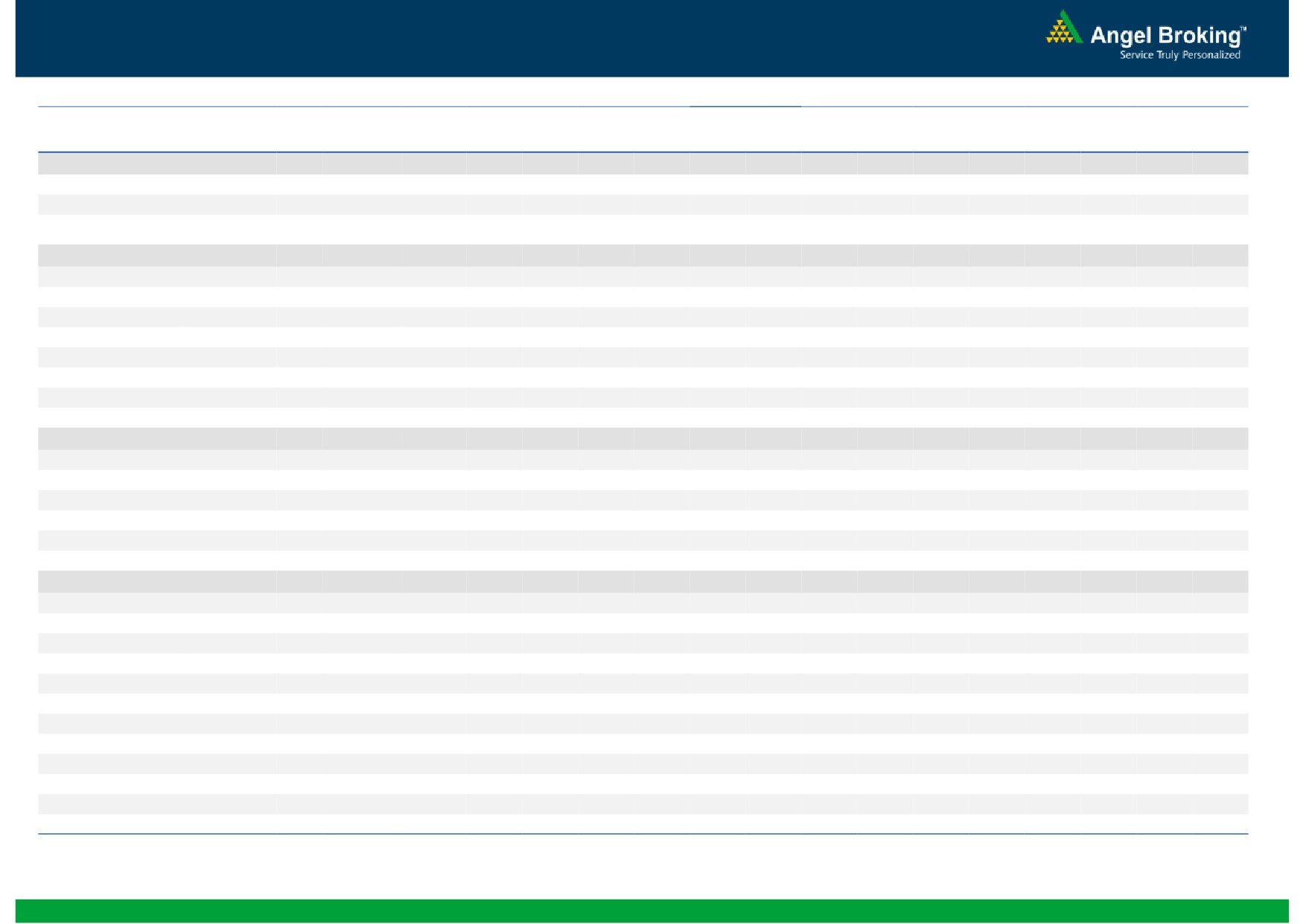

Global economic events release calendar

Date

Time

Country Event Description

Unit

Period

Bloomberg Data

Last Reported Estimated

September 8, 2015

2:30PM

Euro Zone Euro-Zone GDP s.a. (QoQ)

% Change

2Q P

0.30

0.30

China

Exports YoY%

% Change

Aug

(8.30)

(6.70)

September 9, 2015

2:00PM

UK

Industrial Production (YoY)

% Change

Jul

1.50

1.50

September 10, 2015

6:00PM

US

Initial Jobless claims

Thousands

Sep 5

282.00

275.00

India

Imports YoY%

% Change

Aug

(10.28)

--

India

Exports YoY%

% Change

Aug

(10.30)

--

7:00AM

China

Consumer Price Index (YoY)

% Change

Aug

1.60

1.90

4:30PM

UK

BOE Announces rates

% Ratio

Sep 10

0.50

0.50

September 11, 2015

5:30PM

India

Industrial Production YoY

% Change

Jul

3.80

--

September 13, 2015

11:00AM

China

Industrial Production (YoY)

% Change

Aug

6.00

6.30

September 14, 2015

12:00PM

India

Monthly Wholesale Prices YoY%

% Change

Aug

(4.05)

--

September 15, 2015

6:45PM

US

Industrial Production

%

Aug

0.56

--

2:00PM

UK

CPI (YoY)

% Change

Aug

0.10

--

September 16, 2015

2:00PM

UK

Jobless claims change

% Change

Aug

(4.90)

--

2:30PM

Euro Zone Euro-Zone CPI (YoY)

%

Aug F

0.20

--

6:00PM

US

Consumer price index (mom)

% Change

Aug

0.10

--

September 17, 2015

6:00PM

US

Building permits

Thousands

Aug

1,130.00

--

6:00PM

US

Housing Starts

Thousands

Aug

1,206.00

--

11:30PM

US

FOMC rate decision

%

Sep 17

0.25

0.50

September 21, 2015

7:30PM

US

Existing home sales

Million

Aug

5.59

--

September 22, 2015

7:30PM

Euro Zone Euro-Zone Consumer Confidence

Value

Sep A

(6.90)

--

September 23, 2015

1:00PM

Germany PMI Services

Value

Sep P

54.90

--

1:00PM

Germany PMI Manufacturing

Value

Sep P

53.30

--

September 24, 2015

7:30PM

US

New home sales

Thousands

Aug

507.00

--

September 25, 2015

6:00PM

US

GDP Qoq (Annualised)

% Change

2Q T

3.70

--

September 29, 2015

7:30PM

US

Consumer Confidence

S.A./ 1985=100

Sep

101.54

--

11:00AM

India

RBI Reverse Repo rate

%

Sep 29

6.25

--

11:00AM

India

RBI Repo rate

%

Sep 29

7.25

--

11:00AM

India

RBI Cash Reserve ratio

%

Sep 29

4.00

--

September 30, 2015

1:25PM

Germany Unemployment change (000's)

Thousands

Sep

(7.00)

--

2:00PM

UK

GDP (YoY)

% Change

2Q F

2.60

--

October 1, 2015

6:30AM

China

PMI Manufacturing

Value

Sep

49.70

--

2:00PM

UK

PMI Manufacturing

Value

Sep

51.50

--

Source: Bloomberg, Angel Research

Market Outlook

September 7, 2015

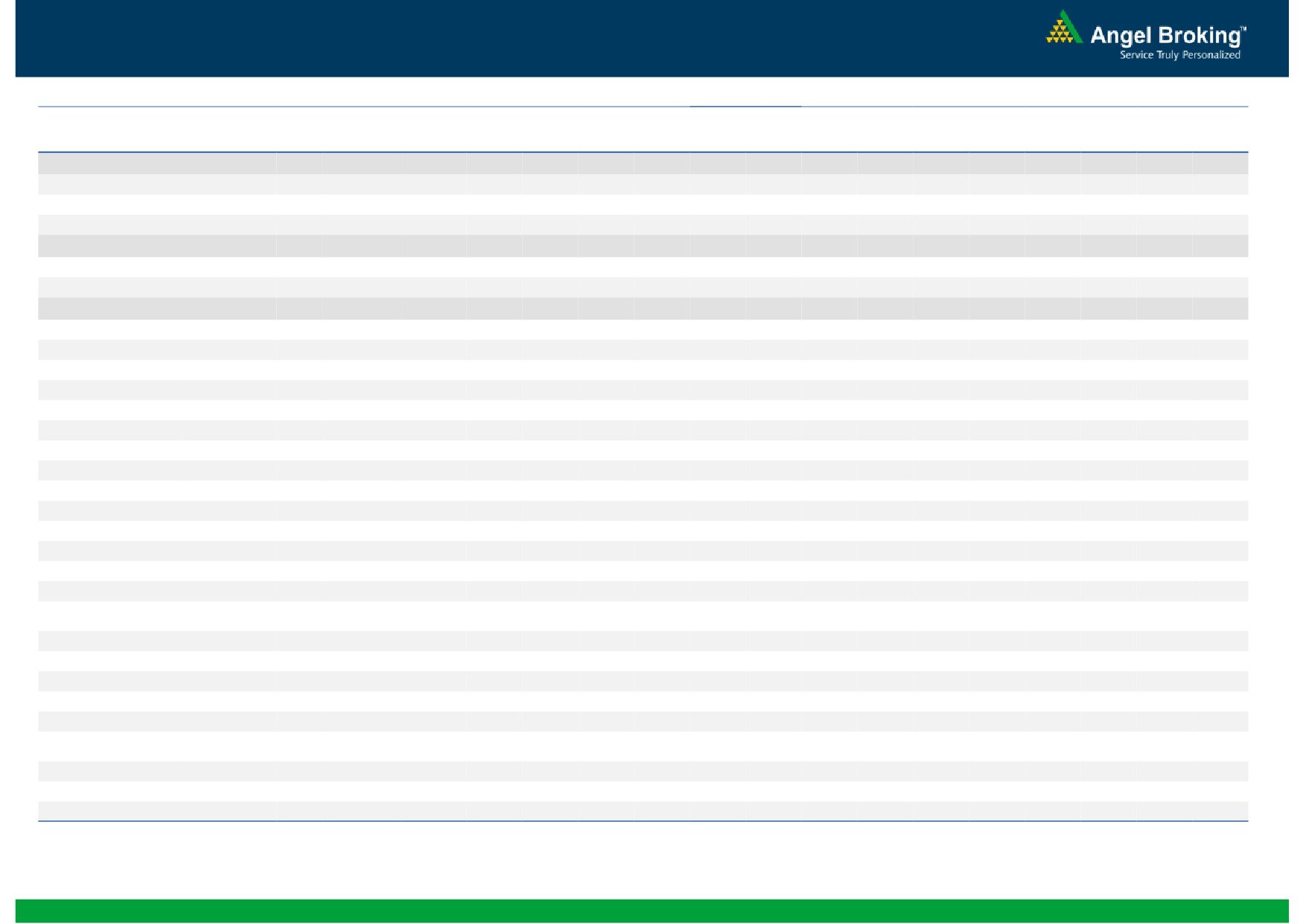

Macro watch

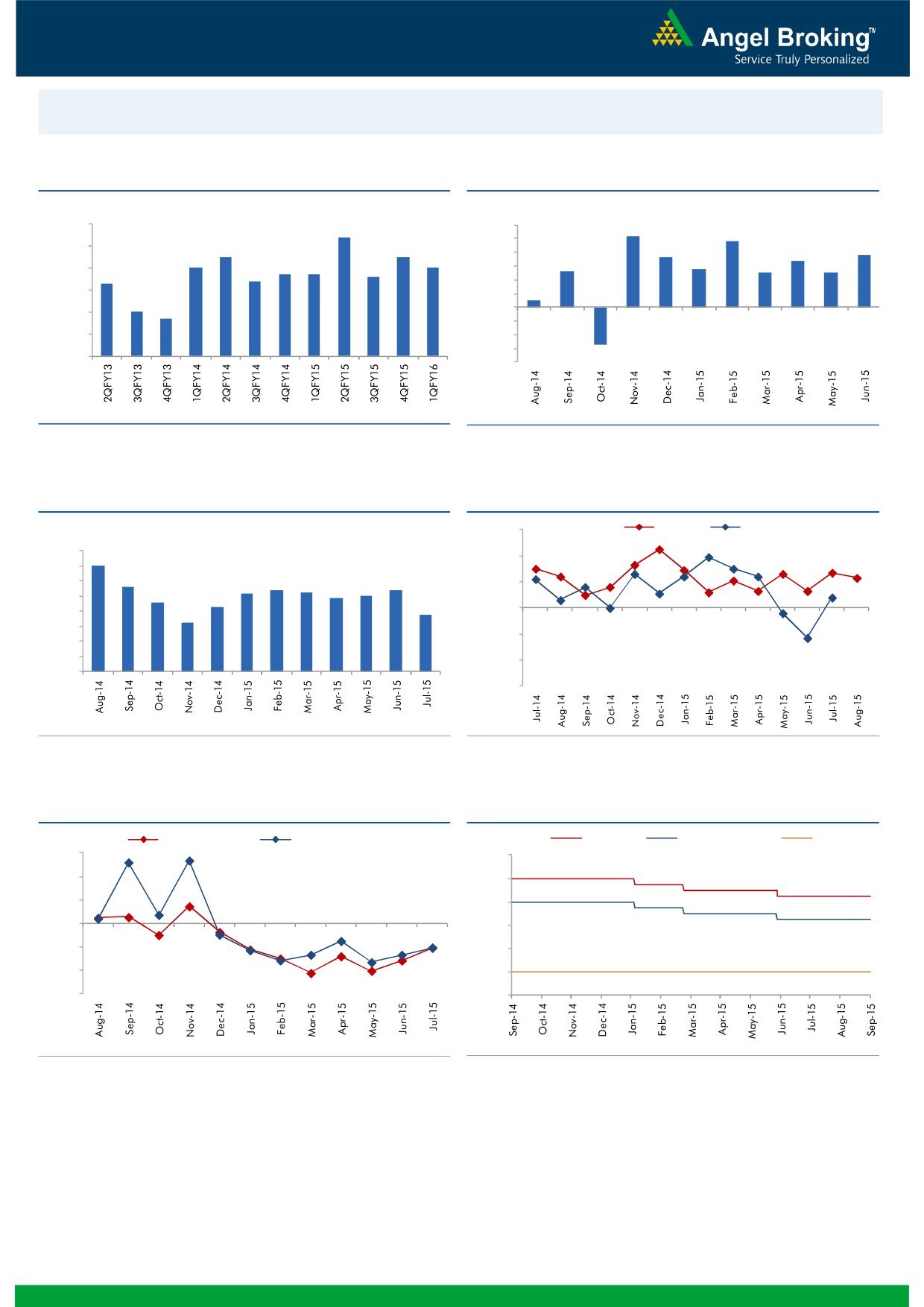

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

6.0

5.2

4.8

7.5

7.5

5.0

3.8

8.0

3.6

3.4

7.0

7.0

4.0

2.8

6.7

6.7

2.6

2.5

2.5

7.0

6.3

6.4

6.6

3.0

2.0

6.0

0.5

1.0

5.0

4.7

-

5.0

(1.0)

4.0

(2.0)

(3.0)

3.0

(2.7)

(4.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

8.0

7.0

54.0

7.0

5.6

5.4

6.0

5.2

5.4

5.3

5.0

52.0

4.6

4.9

5.0

4.3

3.8

4.0

3.3

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

30.0

9.00

20.0

8.00

10.0

7.00

0.0

6.00

(10.0)

5.00

(20.0)

4.00

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

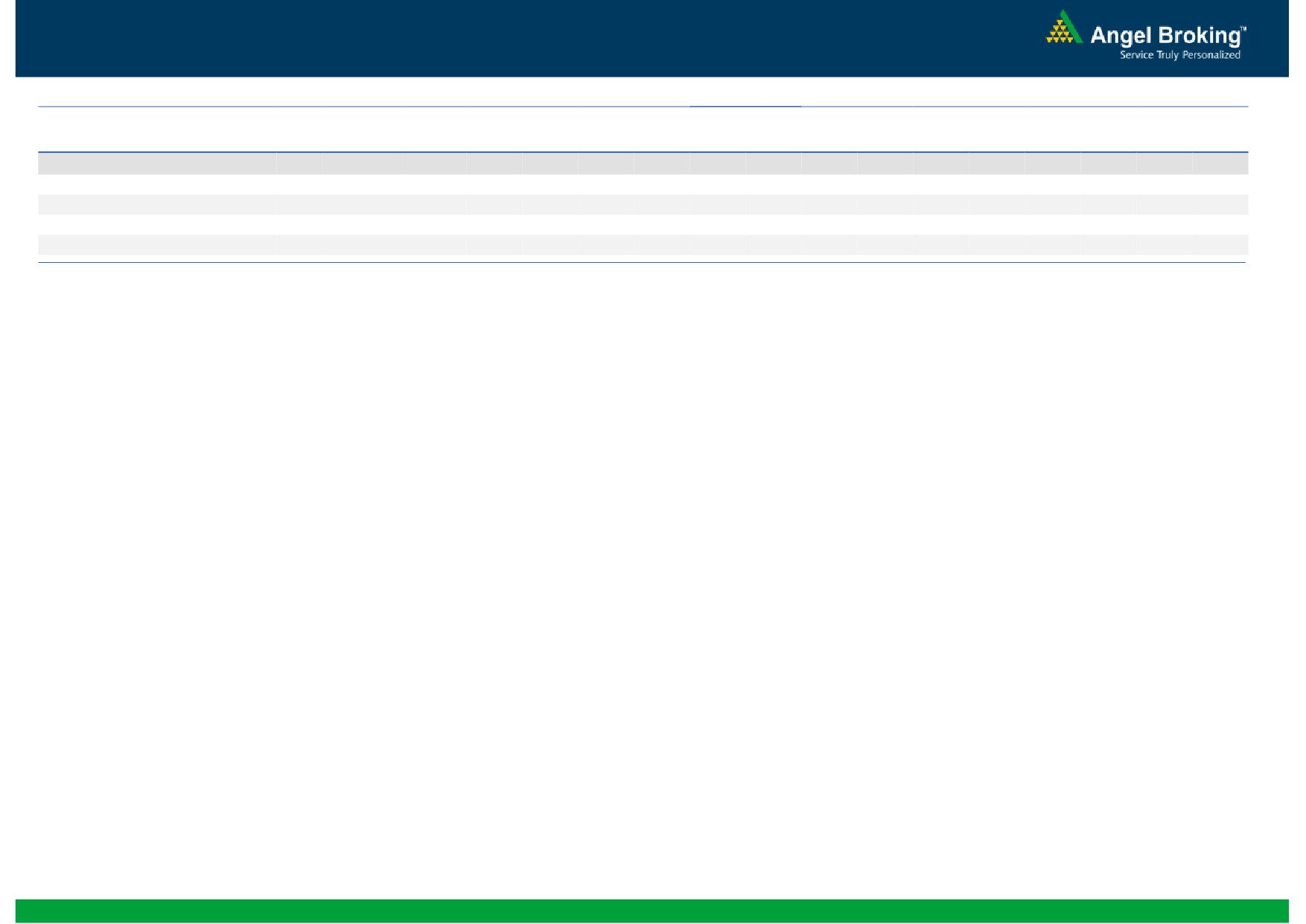

Market Outlook

September 7, 2015

Global watch

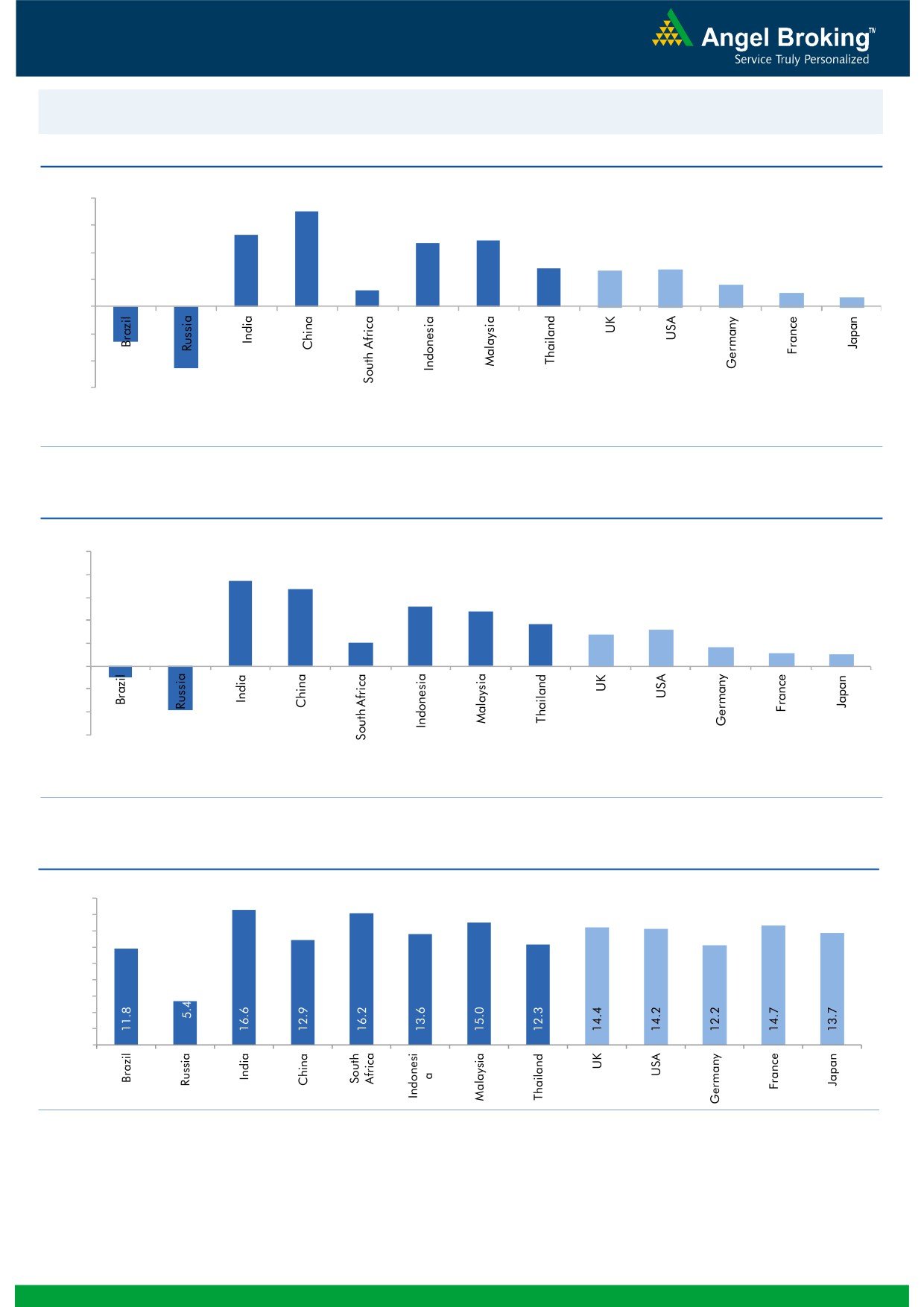

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

7.0

6.0

5.3

4.9

4.7

4.0

2.8

2.6

2.7

1.6

2.0

1.2

1.0

0.7

(2.6)

(4.6)

-

(2.0)

(4.0)

(6.0)

Source: Bloomberg, Angel Research

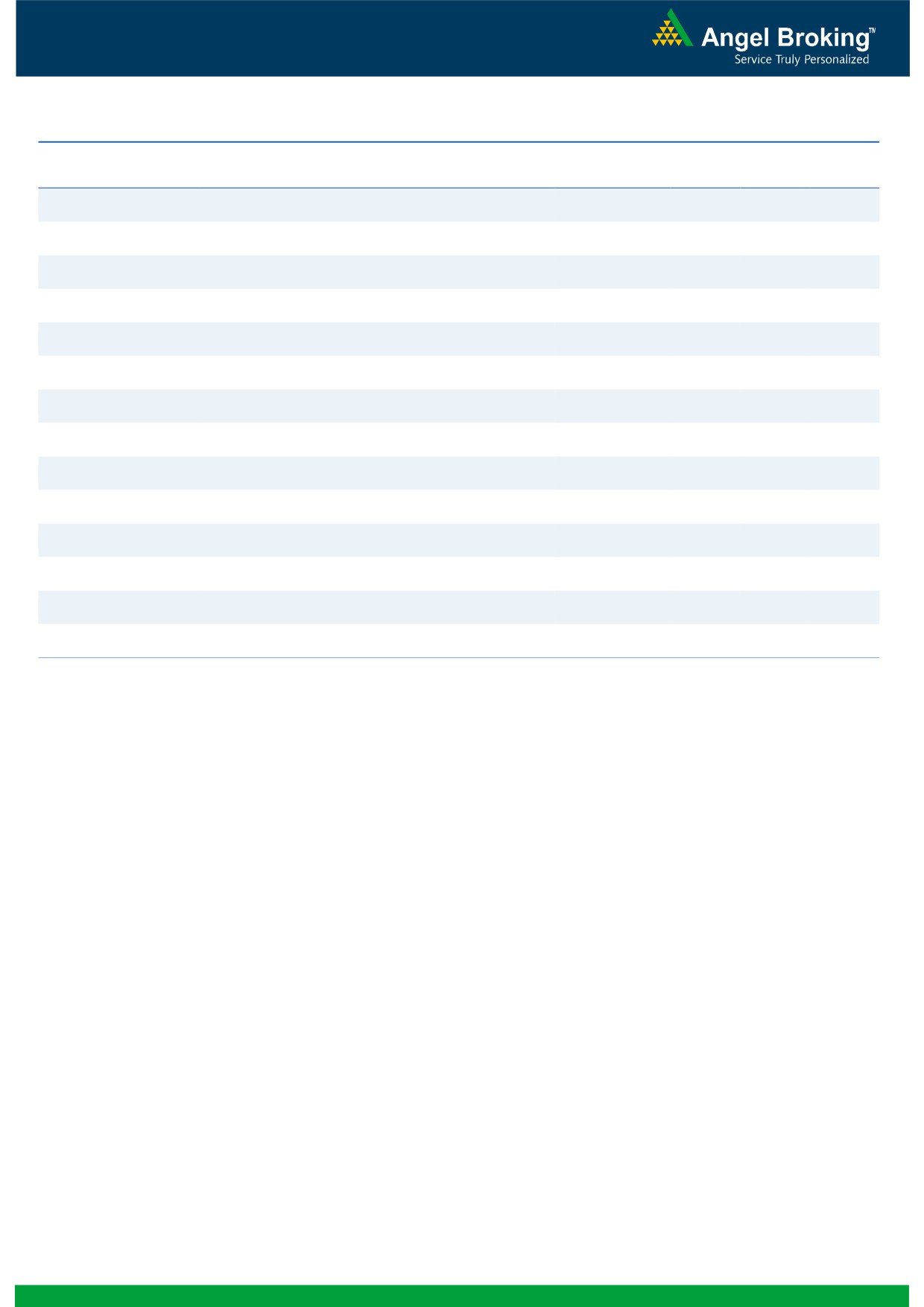

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.5

8.0

6.8

5.2

6.0

4.8

3.7

3.1

4.0

2.7

2.0

1.6

1.2

1.0

2.0

(3.8)

(1.0)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

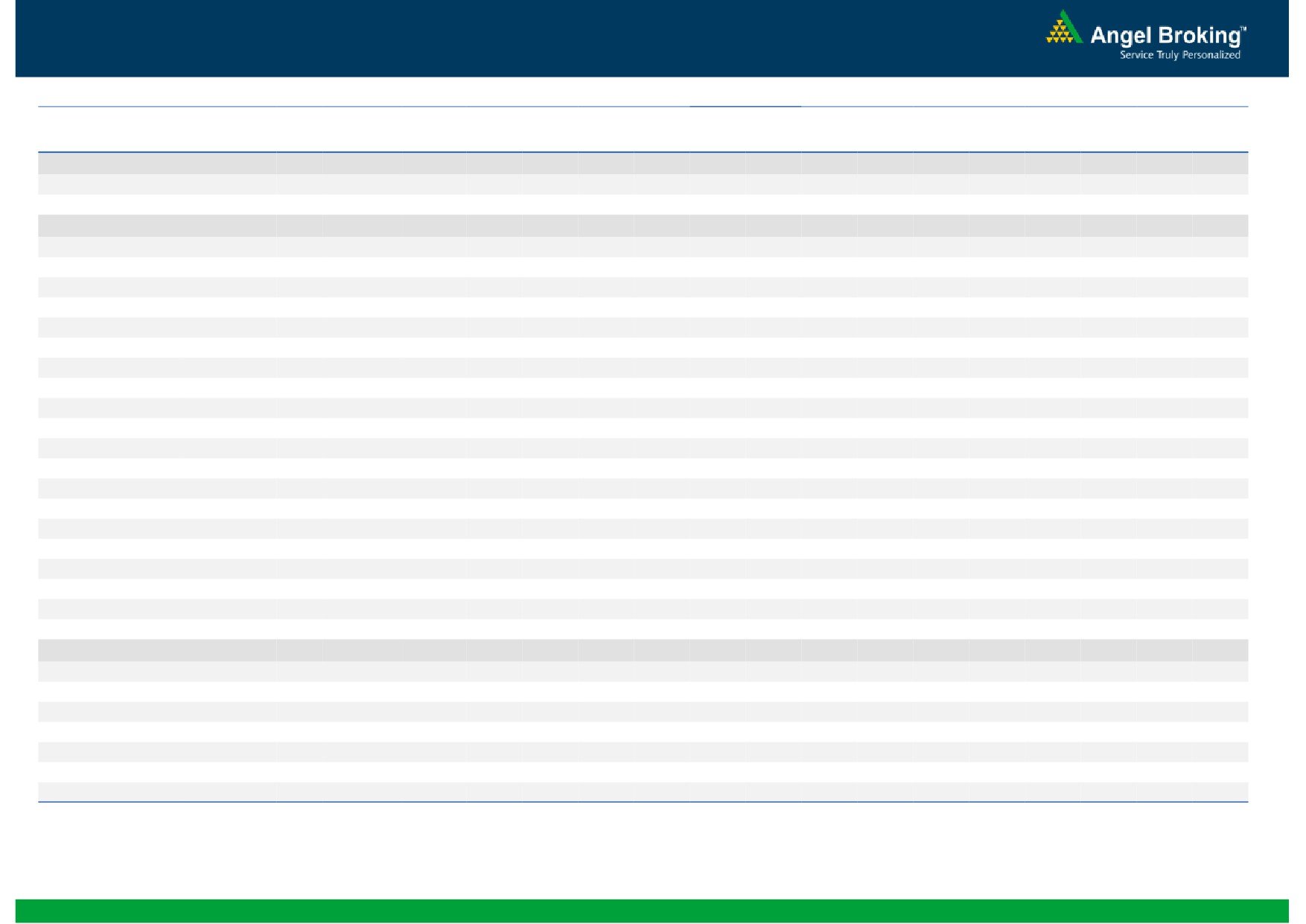

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: Bloomberg, Angel Research

Market Outlook

September 7, 2015

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

46,498

(7.5)

(12.2)

(24.9)

Russia

Micex

1,698

0.3

2.8

17.2

India

Nifty

7,655

(10.7)

(4.8)

(3.8)

China

Shanghai Composite

3,160

(15.1)

(35.5)

44.5

South Africa

Top 40

43,547

(7.2)

(4.5)

(6.1)

Mexico

Mexbol

42,743

(4.9)

(4.0)

(7.7)

Indonesia

LQ45

750

(10.7)

(18.3)

(16.0)

Malaysia

KLCI

1,589

(7.8)

(8.7)

(14.8)

Thailand

SET 50

892

(5.2)

(8.6)

(14.9)

USA

Dow Jones

16,102

(8.2)

(9.8)

(5.9)

UK

FTSE

6,043

(9.6)

(11.2)

(11.6)

Japan

Nikkei

17,792

(13.7)

(13.0)

14.5

Germany

DAX

10,038

(13.7)

(9.3)

3.2

France

CAC

4,523

(13.0)

(6.9)

1.6

Source: Bloomberg, Angel Research

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Agri / Agri Chemical

Rallis

Neutral

210

-

4,084

2,075

2,394

14.4

14.4

9.5

11.0

22.1

19.1

4.4

3.8

21.1

21.3

2.0

1.7

United Phosphorus

Neutral

530

-

22,703

13,698

15,752

17.6

17.6

32.1

38.5

16.5

13.8

3.2

2.7

21.4

21.3

1.8

1.5

Auto & Auto Ancillary

Ashok Leyland

Accumulate

85

97

24,204

18,186

21,529

10.8

11.2

3.3

4.5

25.8

18.9

4.4

4.1

17.3

21.6

1.3

1.1

Bajaj Auto

Accumulate

2,208

2,438

63,888

23,544

27,245

19.8

19.8

127.0

143.4

17.4

15.4

5.3

4.5

30.3

29.4

2.3

1.9

Eicher Motors

Buy

18,178

22,859

49,339

11,681

15,550

15.3

16.9

358.5

564.3

50.7

32.2

15.2

11.3

29.8

34.9

4.2

3.1

Hero Motocorp

Accumulate

2,293

2,672

45,779

28,500

32,764

14.1

14.3

146.9

167.0

15.6

13.7

5.9

5.0

37.8

36.5

1.5

1.3

L G Balakrishnan & Bros Neutral

469

-

736

1,254

1,394

11.6

11.8

35.9

41.7

13.1

11.3

1.8

1.6

13.5

13.8

0.7

0.6

Mahindra and Mahindra Buy

1,112

1,383

69,078

38,337

43,069

13.0

13.4

52.9

63.5

21.0

17.5

3.2

2.8

15.0

15.9

1.5

1.3

Maruti

Buy

4,069

4,735

122,922

58,102

68,587

16.7

16.9

182.0

225.5

22.4

18.1

4.4

3.8

19.9

21.0

1.9

1.5

Minda Industries

Buy

502

652

796

2,567

2,965

7.3

8.0

38.8

54.3

12.9

9.2

1.9

1.6

14.4

16.8

0.4

0.3

Rane Brake Lining

Buy

279

366

221

454

511

11.1

11.4

23.8

28.1

11.7

9.9

1.7

1.5

14.2

15.3

0.6

0.6

Setco Automotive

Neutral

220

-

588

594

741

12.7

13.7

8.4

15.8

26.2

13.9

2.7

2.4

10.4

16.9

1.4

1.2

Tata Motors

Buy

323

391

93,213

264,038

297,882

13.8

13.9

34.5

38.9

9.4

8.3

1.6

1.3

17.6

16.8

0.5

0.5

TVS Motor

Neutral

223

-

10,594

11,702

13,713

6.8

7.7

10.1

14.5

22.1

15.4

5.4

4.4

24.5

28.3

0.9

0.7

Amara Raja Batteries

Neutral

946

-

16,161

5,101

6,224

17.8

17.6

31.1

39.2

30.4

24.1

7.6

6.0

24.8

24.8

3.2

2.6

Exide Industries

Accumulate

148

159

12,567

7,363

8,247

13.7

14.5

6.6

7.7

22.4

19.2

2.8

2.6

12.6

13.3

1.5

1.3

Apollo Tyres

Neutral

170

-

8,636

12,576

12,978

16.8

16.1

22.3

19.9

7.6

8.5

1.3

1.1

17.2

13.4

0.8

0.8

Ceat

Neutral

1,092

-

4,416

6,041

6,597

14.3

14.2

101.5

116.6

10.8

9.4

2.2

1.8

20.0

19.1

0.9

0.8

JK Tyres

Buy

102

129

2,303

7,446

7,669

15.2

14.0

19.6

18.4

5.2

5.5

1.3

1.1

25.2

19.5

0.7

0.6

Swaraj Engines

Neutral

858

-

1,066

593

677

14.5

14.8

51.2

60.8

16.8

14.1

3.9

3.5

23.3

24.8

1.7

1.4

Subros

Neutral

80

-

478

1,268

1,488

11.6

11.9

3.7

6.6

21.6

12.1

1.4

1.3

6.8

11.4

0.7

0.6

Indag Rubber

Neutral

175

-

459

283

329

17.0

17.2

13.0

15.4

13.5

11.4

2.9

2.5

21.8

21.6

1.4

1.1

Capital Goods

ACE

Neutral

38

-

374

660

839

4.7

8.2

1.0

3.9

37.9

9.7

1.2

1.1

3.2

11.3

0.7

0.6

BEML

Neutral

1,214

-

5,057

3,277

4,006

6.0

8.9

29.2

64.3

41.6

18.9

2.3

2.1

5.7

11.7

1.6

1.3

BGR Energy

Neutral

103

-

743

3,615

3,181

9.5

9.4

16.7

12.4

6.2

8.3

0.6

0.6

10.0

7.0

0.6

0.8

BHEL

Neutral

207

-

50,580

33,722

35,272

10.8

11.7

10.5

14.2

19.7

14.6

1.5

1.4

7.0

9.0

1.6

1.5

Blue Star

Accumulate

344

387

3,094

3,649

4,209

5.0

5.9

9.2

14.7

37.6

23.4

6.8

6.4

9.1

17.5

0.9

0.8

Crompton Greaves

Buy

162

204

10,166

13,484

14,687

4.9

6.2

4.5

7.1

36.0

22.9

2.6

2.4

7.2

10.8

0.9

0.8

Inox Wind

Buy

377

505

8,369

4,980

5,943

17.0

17.5

26.6

31.6

14.2

11.9

4.2

3.1

35.0

30.0

1.8

1.5

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Capital Goods

KEC International

Neutral

129

-

3,313

8,791

9,716

6.1

6.8

5.4

8.2

23.9

15.7

2.4

2.2

10.0

14.0

0.6

0.6

Thermax

Neutral

939

-

11,190

6,413

7,525

7.4

8.5

30.5

39.3

30.8

23.9

4.7

4.1

15.0

17.0

1.8

1.5

Cement

ACC

Accumulate

1,351

1,548

25,362

11,856

14,092

14.5

17.8

47.6

76.1

28.4

17.8

2.9

2.7

10.6

15.7

2.0

1.6

Ambuja Cements

Accumulate

212

233

32,885

10,569

12,022

20.7

22.2

8.7

10.7

24.4

19.8

3.1

2.9

13.0

15.2

2.7

2.4

India Cements

Buy

70

112

2,144

4,716

5,133

15.9

16.9

3.7

7.5

18.9

9.3

0.7

0.7

3.8

7.3

0.8

0.6

JK Cement

Buy

610

767

4,265

4,056

4,748

14.5

17.0

22.6

41.1

27.0

14.8

2.4

2.2

9.3

15.3

1.5

1.2

J K Lakshmi Cement

Buy

355

430

4,180

2,947

3,616

16.7

19.9

11.5

27.2

30.9

13.1

2.9

2.5

9.8

20.8

1.8

1.4

Mangalam Cements

Neutral

209

-

557

1,053

1,347

10.5

13.3

8.4

26.0

24.8

8.0

1.1

1.0

4.3

12.5

0.9

0.7

Orient Cement

Accumulate

165

183

3,380

1,854

2,524

21.2

22.2

7.7

11.1

21.4

14.9

3.1

2.7

13.3

15.7

2.6

1.8

Ramco Cements

Accumulate

318

350

7,578

4,036

4,545

20.8

21.3

15.1

18.8

21.1

16.9

2.6

2.3

12.9

14.3

2.4

2.0

Shree Cement^

Neutral

10,825

-

37,713

7,150

8,742

26.7

28.6

228.0

345.5

47.5

31.3

7.0

5.9

15.7

20.3

5.1

4.1

UltraTech Cement

Accumulate

2,917

3,282

80,042

27,562

31,548

20.4

22.3

111.9

143.3

26.1

20.4

3.7

3.2

15.2

16.8

2.9

2.5

Construction

ITNL

Neutral

88

-

2,170

7,360

8,825

34.0

35.9

1.0

5.0

88.0

17.6

0.4

0.4

0.3

1.4

3.7

3.6

KNR Constructions

Neutral

545

-

1,531

915

1,479

14.3

13.9

20.3

37.2

26.8

14.6

2.5

2.1

9.6

15.6

1.8

1.2

Larsen & Toubro

Buy

1,534

2,013

142,750

68,920

82,446

10.9

11.5

57.0

73.0

26.9

21.0

2.5

2.3

13.6

15.5

2.3

1.9

Gujarat Pipavav Port

Neutral

180

-

8,683

721

784

53.1

53.6

8.2

9.1

21.9

19.7

3.5

2.9

20.0

18.3

11.4

10.1

MBL Infrastructures

Buy

231

360

958

2,313

2,797

12.2

14.6

19.0

20.0

12.2

11.6

1.3

1.2

11.3

10.6

1.1

1.0

Nagarjuna Const.

Neutral

58

-

3,233

7,892

8,842

8.3

9.1

2.4

5.3

24.2

11.0

1.0

0.9

4.2

8.6

0.7

0.6

PNC Infratech

Neutral

478

-

2,455

1,798

2,132

13.2

13.5

22.0

30.0

21.8

16.0

2.0

1.8

11.5

11.4

1.5

1.2

Simplex Infra

Neutral

279

-

1,382

6,241

7,008

10.4

10.7

20.0

36.0

14.0

7.8

1.1

1.0

6.8

11.1

0.7

0.6

Financials

Allahabad Bank

Neutral

77

-

4,377

8,859

9,817

3.0

3.0

23.7

30.1

3.2

2.5

0.4

0.3

10.6

12.3

-

-

Axis Bank

Buy

469

704

111,434

26,522

31,625

3.6

3.6

36.2

45.4

13.0

10.3

2.5

2.2

18.2

19.6

-

-

Bank of Baroda

Neutral

174

-

38,524

18,934

21,374

2.0

2.0

13.2

15.1

13.2

11.5

1.0

0.9

7.1

7.7

-

-

Bank of India

Neutral

129

-

8,564

17,402

20,003

2.0

2.1

40.3

50.7

3.2

2.5

0.3

0.3

9.0

10.4

-

-

Canara Bank

Neutral

257

-

13,215

15,805

17,745

2.0

2.2

64.3

73.5

4.0

3.5

0.5

0.4

10.8

11.3

-

-

Dena Bank

Neutral

39

-

2,208

3,580

4,040

2.1

2.2

8.4

10.9

4.7

3.6

0.4

0.3

6.8

8.4

-

-

Federal Bank

Neutral

58

-

9,889

3,522

4,045

3.2

3.2

12.2

14.1

4.7

4.1

0.6

0.5

12.9

13.4

-

-

HDFC

Neutral

1,142

-

180,038

11,198

13,321

3.5

3.5

45.1

53.7

25.3

21.3

5.2

4.7

27.2

28.2

-

-

HDFC Bank

Buy

996

1,255

250,306

38,629

47,500

4.5

4.7

52.6

66.4

18.9

15.0

3.5

2.9

19.6

21.2

-

-

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Financials

ICICI Bank

Buy

258

373

149,698

36,037

41,647

3.5

3.6

22.9

26.7

11.2

9.7

1.9

1.6

15.7

15.9

-

-

IDBI Bank

Neutral

56

-

8,910

9,806

11,371

1.7

1.9

10.0

16.3

5.6

3.4

0.4

0.4

6.8

10.4

-

-

Indian Bank

Neutral

126

-

6,064

6,454

7,321

2.5

2.6

26.4

33.3

4.8

3.8

0.4

0.4

8.1

9.6

-

-

LIC Housing Finance

Buy

413

570

20,865

2,934

3,511

2.3

2.3

30.9

36.8

13.4

11.2

2.2

1.9

16.8

17.5

-

-

Oriental Bank

Neutral

125

-

3,733

7,930

8,852

2.5

2.5

51.8

57.1

2.4

2.2

0.3

0.2

9.3

9.5

-

-

Punjab Natl.Bank

Neutral

130

-

24,183

24,160

27,777

2.9

3.0

18.5

24.6

7.1

5.3

0.7

0.6

8.8

10.8

-

-

South Ind.Bank

Neutral

20

-

2,673

1,999

2,249

2.4

2.4

3.5

4.0

5.7

4.9

0.7

0.6

12.6

13.1

-

-

St Bk of India

Buy

225

309

170,278

86,900

100,550

3.1

3.1

22.1

27.7

10.2

8.1

1.3

1.1

12.7

14.3

-

-

Union Bank

Neutral

157

-

9,966

12,995

14,782

2.4

2.4

32.3

40.9

4.9

3.8

0.6

0.5

10.7

12.3

-

-

Vijaya Bank

Neutral

35

-

3,020

3,474

3,932

1.8

1.9

5.9

7.2

6.0

4.9

0.5

0.5

8.1

9.3

-

-

Yes Bank

Buy

646

951

27,046

7,006

8,825

3.1

3.3

61.4

77.1

10.5

8.4

2.0

1.6

20.1

21.3

-

-

FMCG

Asian Paints

Neutral

813

-

77,935

16,553

19,160

16.0

16.2

17.7

21.5

46.0

37.8

12.2

11.0

29.4

31.2

4.5

3.9

Britannia

Neutral

2,985

-

35,818

8,065

9,395

9.6

10.2

47.2

65.5

63.2

45.6

21.0

19.9

38.3

41.2

4.3

3.7

Colgate

Neutral

1,887

-

25,660

4,836

5,490

19.5

19.7

48.5

53.2

38.9

35.5

28.5

24.8

99.8

97.5

5.3

4.7

Dabur India

Neutral

285

-

50,096

9,370

10,265

17.1

17.2

7.3

8.1

38.9

35.2

11.7

9.5

33.7

30.6

5.1

4.7

GlaxoSmith Con*

Neutral

6,036

-

25,383

4,919

5,742

17.2

17.4

168.3

191.2

35.9

31.6

10.2

8.7

28.8

28.9

4.8

4.1

Godrej Consumer

Neutral

1,233

-

41,993

10,168

12,886

16.1

16.1

32.1

38.4

38.4

32.1

7.8

7.2

19.7

21.0

4.5

3.6

HUL

Neutral

830

-

179,676

34,940

38,957

17.5

17.7

20.8

24.7

39.9

33.6

44.4

35.5

110.5

114.2

5.0

4.4

ITC

Buy

316

409

253,901

41,068

45,068

37.8

37.4

13.9

15.9

22.7

19.9

7.6

6.7

34.1

33.8

5.9

5.3

Marico

Neutral

404

-

26,039

6,551

7,766

15.7

16.0

10.4

12.5

38.9

32.3

11.3

9.4

33.2

32.4

3.9

3.3

Nestle*

Accumulate

5,995

6,646

57,796

11,291

12,847

22.2

22.3

158.9

184.6

37.7

32.5

19.7

17.7

55.0

57.3

4.9

4.3

Tata Global

Buy

120

152

7,580

8,635

9,072

9.8

9.9

6.5

7.6

18.5

15.8

1.8

1.8

6.8

7.4

0.8

0.8

IT

HCL Tech^

Buy

941

1,132

132,364

42,038

47,503

23.5

23.5

56.4

62.9

16.7

15.0

3.9

3.0

23.2

19.8

2.8

2.2

Infosys

Buy

1,074

1,306

246,646

60,250

66,999

28.0

28.0

58.3

63.7

18.4

16.9

3.9

3.3

20.9

19.7

3.5

3.0

TCS

Buy

2,549

3,168

499,368

108,420

123,559

28.8

28.7

127.2

143.9

20.0

17.7

8.0

7.4

39.9

41.8

4.3

3.7

Tech Mahindra

Buy

528

646

50,788

25,566

28,890

16.0

17.0

26.3

31.9

20.1

16.6

3.6

3.1

17.9

18.6

1.8

1.5

Wipro

Buy

554

719

136,744

52,414

58,704

23.7

23.8

38.4

42.3

14.4

13.1

2.8

2.5

19.5

18.0

2.2

1.8

Media

D B Corp

Buy

309

356

5,680

2,241

2,495

27.8

27.9

21.8

25.6

14.2

12.1

3.7

3.3

26.7

28.5

2.5

2.2

HT Media

Neutral

77

-

1,790

2,495

2,603

11.2

11.2

7.3

8.6

10.5

8.9

0.8

0.8

7.4

8.1

0.2

0.2

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Media

Jagran Prakashan

Buy

136

156

4,441

1,939

2,122

26.0

26.0

8.3

9.2

16.4

14.8

2.8

2.5

17.5

17.1

2.2

2.0

Sun TV Network

Neutral

387

-

15,263

2,779

3,196

70.2

70.5

22.8

27.3

17.0

14.2

4.2

3.8

26.7

28.3

5.0

4.4

Hindustan Media

Buy

217

292

1,593

920

1,031

20.0

20.0

19.2

20.9

11.3

10.4

1.9

1.6

16.4

15.3

1.3

1.1

Ventures

Metals & Mining

Coal India

Buy

347

400

219,020

72,015

78,415

21.2

21.5

21.7

25.3

16.0

13.7

5.4

5.3

33.1

39.1

2.3

2.1

Hind. Zinc

Neutral

132

-

55,795

15,546

16,821

47.5

49.0

19.7

20.3

6.7

6.5

1.1

1.0

17.2

16.6

1.2

0.8

Hindalco

Neutral

74

-

15,250

112,328

119,817

7.7

7.9

16.3

20.1

4.5

3.7

0.3

0.3

8.0

8.5

0.6

0.5

JSW Steel

Neutral

903

-

21,817

48,125

53,595

18.8

21.0

46.9

97.5

19.2

9.3

0.9

0.9

4.4

9.5

1.3

1.1

NMDC

Neutral

98

-

39,033

12,544

13,330

59.5

59.7

16.3

16.5

6.0

6.0

1.1

1.0

5.1

9.9

1.9

1.9

SAIL

Neutral

47

-

19,515

56,365

63,383

6.9

8.0

7.1

8.2

6.6

5.8

0.4

0.4

7.0

7.1

0.9

0.8

Vedanta

Neutral

93

-

27,646

81,842

88,430

30.6

32.8

20.2

25.7

4.6

3.6

0.3

0.3

7.5

8.5

0.7

0.5

Tata Steel

Neutral

219

-

21,265

136,805

149,228

11.3

11.9

26.4

36.8

8.3

6.0

0.7

0.6

6.0

8.0

0.7

0.6

Oil & Gas

Cairn India

Neutral

147

-

27,495

12,617

14,513

33.7

40.0

25.5

27.7

5.8

5.3

0.4

0.4

7.4

7.7

0.8

0.6

GAIL

Neutral

281

-

35,632

75,595

85,554

8.6

8.0

31.8

36.1

8.8

7.8

1.0

0.9

10.7

11.4

0.6

0.5

ONGC

Neutral

226

-

193,012

174,773

192,517

22.7

24.8

34.6

38.2

6.5

5.9

0.9

0.9

14.2

14.9

1.2

1.1

Petronet LNG

Buy

176

210

13,181

39,007

40,785

3.8

4.2

9.2

11.0

19.2

16.0

2.1

2.0

11.6

12.7

0.4

0.4

Indian Oil Corp

Buy

409

455

99,267

359,607

402,760

5.9

6.1

42.5

48.7

9.6

8.4

1.3

1.1

14.1

14.4

0.4

0.3

Reliance Industries

Accumulate

836

930

270,580

339,083

384,014

7.8

9.5

75.7

94.5

11.1

8.8

1.1

1.1

10.7

12.2

1.1

1.0

Pharmaceuticals

Alembic Pharma

Neutral

679

-

12,797

2,601

3,115

21.2

20.2

20.8

23.9

32.6

28.4

10.5

7.9

37.2

31.8

5.2

4.2

Aurobindo Pharma

Buy

723

872

42,209

14,923

17,162

23.0

23.0

38.2

43.6

18.9

16.6

5.8

4.4

36.0

30.2

3.2

2.7

Aventis*

Neutral

3,906

-

8,996

2,156

2,455

15.1

16.8

109.7

133.9

35.6

29.2

4.9

4.0

18.4

22.5

3.8

3.2

Cadila Healthcare

Neutral

1,817

-

37,204

10,224

11,840

20.0

21.0

71.0

85.6

25.6

21.2

6.9

5.4

30.1

28.5

3.8

3.2

Cipla

Neutral

649

-

52,154

14,051

16,515

20.4

18.7

26.6

28.4

24.4

22.9

4.1

3.5

18.2

16.5

3.7

3.1

Dr Reddy's

Neutral

4,056

-

69,152

17,903

20,842

22.7

22.8

160.5

189.5

25.3

21.4

5.1

4.2

22.2

21.7

4.0

3.3

Dishman Pharma

Accumulate

254

290

2,049

1,716

1,888

20.2

20.2

16.3

21.6

15.6

11.8

1.5

1.3

9.7

11.7

1.4

1.1

GSK Pharma*

Neutral

3,364

-

28,495

2,870

3,158

20.0

22.1

59.5

68.3

56.5

49.3

16.7

17.1

28.5

34.3

9.4

8.6

Indoco Remedies

Neutral

337

-

3,102

1,088

1,262

18.2

18.2

13.1

15.5

25.7

21.7

5.0

4.2

21.2

21.1

2.9

2.5

Ipca labs

Neutral

761

-

9,605

3,507

4,078

17.6

18.6

25.8

32.0

29.5

23.8

3.8

3.3

13.8

14.9

3.1

2.7

Lupin

Neutral

1,859

-

83,682

14,864

17,244

26.9

26.9

62.1

71.1

29.9

26.2

7.3

5.8

27.4

24.6

5.4

4.5

Sun Pharma

Accumulate

859

950

206,605

28,163

32,610

25.8

30.7

17.4

26.9

49.3

31.9

4.7

4.1

13.0

16.6

7.1

5.9

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Power

Tata Power

Neutral

57

-

15,295

38,302

38,404

14.1

13.1

5.1

6.0

11.0

9.5

1.1

1.0

9.2

10.3

1.3

1.3

NTPC

Buy

114

157

94,369

87,064

98,846

23.5

23.5

11.7

13.2

9.8

8.7

1.1

1.0

11.4

12.1

2.1

1.9

Power Grid

Buy

123

170

64,558

20,702

23,361

86.7

86.4

12.1

13.2

10.2

9.3

1.5

1.3

15.6

15.1

8.1

7.5

Telecom

Bharti Airtel

Neutral

350

-

139,849

101,748

109,191

32.1

31.7

12.0

12.5

29.2

28.0

2.0

1.9

6.9

6.7

2.0

1.8

Idea Cellular

Neutral

149

-

53,648

34,282

36,941

32.0

31.5

5.9

6.2

25.3

24.0

2.3

2.1

9.9

9.3

2.2

2.1

zOthers

Abbott India

Neutral

5,228

-

11,110

2,715

3,153

14.5

14.1

134.3

152.2

38.9

34.3

9.7

8.0

27.4

25.6

3.6

3.1

Bajaj Electricals

Buy

236

341

2,385

4,719

5,287

5.2

5.8

8.6

12.7

27.6

18.7

3.2

2.8

11.4

14.8

0.5

0.5

Finolex Cables

Neutral

234

-

3,577

2,728

3,036

10.8

11.0

14.4

16.8

16.2

14.0

2.5

2.1

15.2

15.3

1.1

0.9

Goodyear India*

Buy

534

655

1,232

1,953

1,766

12.4

12.0

67.4

59.6

7.9

9.0

2.0

1.7

27.7

20.2

0.4

0.4

Hitachi

Neutral

1,313

-

3,571

1,806

2,112

9.0

9.2

28.6

29.1

45.9

45.2

11.4

9.2

28.1

22.6

2.1

1.8

Jyothy Laboratories

Neutral

321

-

5,807

1,620

1,847

11.5

11.5

7.3

8.5

44.0

37.9

5.7

5.3

13.3

14.4

3.3

2.8

MRF

Accumulate

38,742

43,575

16,431

20,727

14,841

19.3

18.6

4,905.8

3,351.9

7.9

11.6

2.5

2.1

37.6

19.6

0.8

1.0

Page Industries

Neutral

14,046

-

15,667

1,929

2,450

19.8

20.1

229.9

299.0

61.1

47.0

27.0

18.7

52.1

47.1

8.3

6.5

Relaxo Footwears

Neutral

498

-

5,974

1,767

2,152

12.3

12.5

19.3

25.1

25.9

19.9

6.3

4.9

27.7

27.8

3.5

2.9

Siyaram Silk Mills

Accumulate

1,032

1,221

967

1,653

1,873

11.7

12.2

99.3

122.1

10.4

8.5

1.9

1.6

19.5

20.2

0.8

0.7

Styrolution ABS India*

Neutral

760

-

1,336

1,271

1,440

8.6

9.2

32.0

41.1

23.7

18.5

2.4

2.2

10.7

12.4

1.0

0.9

Tree House

Buy

385

449

1,630

259

324

56.8

56.8

17.0

21.7

22.6

17.8

2.3

2.1

10.1

11.5

6.3

5.2

TVS Srichakra

Buy

2,416

3,210

1,850

2,127

2,388

15.2

14.9

237.7

267.5

10.2

9.0

4.3

3.1

51.7

39.8

1.0

0.8

HSIL

Buy

243

434

1,758

2,085

2,436

18.5

18.6

21.7

28.9

11.2

8.4

1.1

1.0

10.0

12.1

1.0

0.8

Kirloskar Engines India

Accumulate

269

297

3,891

2,634

3,252

10.1

12.0

10.9

17.4

24.7

15.4

2.8

2.5

11.4

16.8

1.1

0.9

Ltd

M M Forgings

Buy

569

797

687

563

671

22.1

22.9

51.0

66.5

11.2

8.6

2.3

1.9

23.1

24.1

1.4

1.1

Banco Products (India)

Neutral

114

-

813

1,208

1,353

11.0

12.3

10.8

14.5

10.6

7.9

1.2

1.1

11.9

14.5

0.7

0.6

Competent Automobiles Neutral

144

-

88

1,007

1,114

3.1

3.1

23.7

28.2

6.1

5.1

0.9

0.7

13.9

14.6

0.1

0.1

Nilkamal

Neutral

957

-

1,428

1,948

2,147

10.6

10.3

60.0

67.0

16.0

14.3

2.5

2.1

16.8

16.1

0.8

0.7

Visaka Industries

Buy

138

166

218

1,158

1,272

8.6

9.5

23.7

32.7

5.8

4.2

0.6

0.5

10.1

12.5

0.4

0.3

Transport Corporation of

Buy

229

293

1,740

2,830

3,350

8.8

9.0

14.4

18.3

15.9

12.5

2.5

2.1

15.4

17.1

0.8

0.7

India

Elecon Engineering

Buy

68

87

739

1,452

1,596

14.0

14.7

4.4

6.2

15.4

10.9

1.3

1.2

8.6

11.2

0.8

0.7

Surya Roshni

Buy

116

183

509

2,992

3,223

8.3

8.5

14.7

18.3

7.9

6.4

0.7

0.7

9.8

11.0

0.5

0.4

MT Educare

Buy

126

169

501

286

366

18.3

17.7

7.7

9.4

16.3

13.4

3.4

3.0

20.2

21.1

1.7

1.3

Market Outlook

September 07, 2015

Stock Watch

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E FY16E FY17E FY16E FY17E FY16E FY17E FY16E FY17E FY16E FY17E FY16E FY17E

zOthers

Radico Khaitan

Buy

85

112

1,129

1,565

1,687

11.9

12.4

5.4

6.6

15.7

12.9

1.3

1.2

8.0

9.0

1.2

1.2

Garware Wall Ropes

Buy

294

390

644

875

983

10.4

10.6

23.1

27.8

12.7

10.6

1.8

1.6

14.1

14.8

0.7

0.6

Wonderla Holidays

Buy

275

322

1,555

206

308

44.0

43.6

9.0

12.9

30.6

21.3

4.2

3.8

13.7

17.8

7.4

4.9

Linc Pen & Plastics

Buy

148

185

218

340

371

8.3

8.9

10.8

13.2

13.7

11.2

2.2

1.9

16.0

17.1

0.7

0.6

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on September 04, 2015

Market Outlook

September 07, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in

the company covered by Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer,

director or employee of company covered by Analyst and has not been engaged in market making activity of the company covered by

Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any

loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt.

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance,

or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have

investment positions in the stocks recommended in this report.