Market Outlook

May 6, 2016

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Cl ose)

BSE Sensex

0.6

160

25,262

Indian markets are expected to open on a negative note tracking the SGX Nifty.

Nifty

0.4

29

7,736

US markets ended little changed in a relatively lackluster performance over the

Mid Cap

(0.1)

(9)

10,925

course of the trading session. The tech-heavy Nasdaq saw a modest drop on the

Small Cap

(0.0)

(4)

10,921

day, falling to its lowest closing level in almost two months. The choppy trading seen

throughout much of the session came as traders seemed reluctant to make

Bankex

0.0

5

18,510

significant moves ahead of the monthly jobs report on Friday.

The European markets ended session with mixed results in light holiday trading

Global Indices

Chg (%)

(Pts)

(Cl ose)

action. Several markets were closed today for the Ascension Day holiday, including

Dow Jones

0.1

9

17,661

Switzerland, Denmark and Austria.

Nasdaq

(0.2)

(9)

4,717

Indian shares ended in green for the first time in four days as oil prices jumped on

FTSE

0.1

5

6,117

concerns about production cuts in Canada's oil sands region and a rally in bond

Nikkei

(3.1)

(519)

16,147

markets fizzled out ahead of the all-important U.S. jobs report due today. Investors

Hang Seng

(0.4)

(76)

20,450

also cheered comments by Finance Minister Arun Jaitley that the Indian economy

Shanghai Com

0.2

7

2,998

can grow even faster pace this year if predictions of good monsoon hold up.

News & Result Analysis

A dvances / Declines

BSE

NSE

Lok Sabha passes bankruptcy bill

Advances

1,228

732

RBI releases Draft Guidelines for ‘on tap’ Licensing of Universal Banks in the

Private Sector

Declines

1,320

799

Result Review: Proctor & Gamble

Unchanged

156

91

Detailed analysis on Pg2

Volumes (` Cr)

Investor’s Ready Reckoner

BSE

2,336

Key Domestic & Global Indicators

NSE

16,298

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg6 onwards

Net Inflows (` Cr)

Ne t

Mtd

Ytd

Top Picks

FII

(31)

(430)

11,361

C MP

Target

Upside

C ompany

Sector

R ating

MFs

82

98

2,693

(`)

(`)

(%)

Amara Raj a

Auto & Auto Ancillary

Buy

931

1,076

15.6

HCL Tech

IT

Buy

734

1,038

41.5

Top Gainers

Price (`)

Chg (%)

LIC Housing

Financials

Buy

450

592

31.5

Castrolind

412

5.9

Bharat Electronics

Capital Goods

Buy

1,147

1,414

23.3

Ibrealest

72

5.7

Navkar Corporation Others

Buy

174

265

51.9

Unitdspr

2,595

5.0

More Top Picks on Pg4

Atul

1,875

4.3

Key Upcoming Events

Crompgreav

59

4.1

Previous

C onsensus

D ate

Region

Event Description

Reading

Expectations

Top Losers

Price (`)

Chg (%)

May 6 US

Change in N onfarm payrolls (thousands)

215

200

May 8 China

Exports YoY%

11.5

1.3

Balkri sind

648

(6.4)

May 10 India

Exports YoY%

(5.47)

--

Geship

308

(5.4)

May 10 India

Imports YoY%

(21.56)

--

Amtekauto

34

(5.3)

6. (

More Events on Pg5

Idea

114

(5.0)

Redington

100

(4.8)

As on May 5, 2016

Market Outlook

May 6, 2016

Lok Sabha passes bankruptcy bill

Bankruptcy bill has been passed by Lok Sabha. The bill will now go to the Rajya

Sabha for its consent. The government expects the bill to pass through the Rajya

Sabha as well, since members from that house were also a part of the joint

committee.

This code will replace the existing obsolete bankruptcy laws and provide a time-

bound process for resolving insolvency issues. It will cover individuals, companies,

limited liability partnerships and partnership firms. It will also amend laws

including the Companies Act to become the overarching legislation to deal with

corporate insolvency. It will help in faster debt recovery for creditors.

The bill proposes a new class of insolvency professionals who will specialize in

helping sick companies. It also provides for information utilities that will collate all

information about debtors to prevent serial defaulters from misusing the system.

The bill proposes to set up the Insolvency and Bankruptcy Board of India to act as

a regulator for these utilities and professionals.

RBI releases Draft Guidelines for ‘on tap’ Licensing of Universal

Banks in the Private Sector

The Reserve Bank of India (RBI) proposed granting on-tap universal banking

licences to individuals, groups or entities and companies. The proposed licensing

policy is a change from the current policy where RBI opens the window for bank

licences only for a certain period. Existing NBFCs that are controlled by residents

and have a successful track record for at least 10 years are among those that can

apply for on-tap licences. In addition, individuals and professionals, who are

residents and have 10 years of banking experience, can also now apply for a

licence. As per the draft guidelines, the initial minimum paid-up voting equity

capital required is `500cr, and thereafter the bank should maintain a minimum

net worth of `500cr at all times.

Result Review

Proctor & Gamble (CMP: `6,404/ TP: `7,369/Upside:15.1%)

Procter & Gamble Hygiene and Health Care (P&G)’s 3QFY2016 results are

broadly in-line with our estimates. The company’s top-line grew by ~11% YoY to

~`614cr (against our estimate of ~ `624cr), mainly due to growth in female

hygiene segment. On the operating front, the company reported margin

contraction (down by 41bp YoY to 21.7%), primarily on account of higher other

expenses. The reported net profit grew by ~12% YoY to ~`97cr (our estimate was

of ~`98cr) on account of healthy sales growth.

On the top-line front, we expect the company to report ~13% CAGR and on the

bottom-line front, we expect ~15% CAGR over FY2015-18E on the back of strong

brands and distribution network. We have buy rating on the stock with a target

price of `7,369.

Market Outlook

May 6, 2016

Economic and Political News

FM Jaitley rules out rollback of excise duty on jewellery

Clean energy projects get `86,000cr investment: Piyush Goyal

Delhi-NCR stuck with highest unsold housing inventory: Report

Corporate News

ITC shuts down cigarette factories again

Reliance Defence receives

16 new industrial licenses for

equipment

manufacture

SBI launches card-less payment solution for offline transactions

Quarterly Bloomberg Brokers Consensus Estimate

Reliance Capital Ltd. - May 6, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY15

q-o- q (%)

Net sales

1,940

2,469

(21.4)

2,315

(16.2)

EBITDA

243

1,125

(78.4)

1,091

(77.7)

EBITDA margin (%)

12.5

45.6

47.1

Net profit

360

407

(11.5)

235

53.2

Siemens Ltd. - May 6, 2016

Particulars (` cr)

2QSY15E

2QSY14

y-o-y (%)

1QSY15

q-o- q (%)

Net sales

2,793

2589

7.9

2265

23.3

EBITDA

260

294

(11.4)

235

10.6

EBITDA margin (%)

9.3

11.3

10.4

Net profit

159

162

(1.8)

114

39.5

Titan company Ltd. - May 6, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY15

q-o- q (%)

Net sales

2,823

2,474

14.1

3,398

(16.9)

EBITDA

294

270

8.8

324

(9.2)

EBITDA margin (%)

10.4

10.9

9.5

Net profit

215

215

0.0

225

(4.5)

Grasim Industries Ltd. - May 7, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY15

q-o- q (%)

Net sales

9,452

8,706

8.6

8,924

5.9

EBITDA

1,676

1,549

8.2

1,718

(2.4)

EBITDA margin (%)

17.7

17.8

19.2

Net profit

640

507

26.3

650

(1.5)

Hindustan Unilever Ltd. - May 9, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY15

q-o- q (%)

Net sales

7,977

7,555

5.6

7823

2

EBITDA

1,425

1,318

8.1

1,491

(4.4)

EBITDA margin (%)

17.9

17.4

19.1

Net profit

1,010

1,018

(0.8)

971

4

Market Outlook

May 6, 2016

Top Picks

Large Cap

Market Cap

C MP

Target

Upside

C ompany

R ationale

(` Cr)

(`)

(`)

(%)

To outpace battery industry growth due to better technological

Amara Raj a Batteries

15,905

931

1,076

15.6

products leading to market share gains in both the automotive

OEM and replacement segments.

Uptick in defense capex by government whe n coupled with

Bharat Electronics

27,516

1,147

1,414

23.3

BELs strong market positioning, indicate that good times are

ahead for BEL.

The stock i s trading at attractive valuations and is factoring all

HCL Tech

1,03,465

734

1,038

41.5

the bad news.

Strong visibility for a robust 20% earnings trajectory, coupled

HDFC Bank

2,86,550

1,133

1,262

11.4

with high quality of earnings on account of high quality retail

busine ss and strate gic focus on highly rated corporates.

Back on the growth trend, expect a long term growth of 14%

Infosys

2,74,794

1,192

1,374

15.2

to be a US $20bn in FY2020.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC Housing Finance

22,712

450

592

31.5

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Huge bid pi peline of re-development works at Delhi and other

NBCC

11,746

979

1,089

11.3

State Governments and opportunity from Smart City, positions

NBCC to report strong growth, going forward.

Source: Company, Angel Research

Mid Cap

Market Cap

C MP

Target

Upside

C ompany

R ationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well for

Cooling products business which is out paci ng the market

Blue Star

3,724

414

481

16.2

growth. EMPPAC division' s profitability to i mprove once

operating environme nt turns around.

With a focus on the low and medium income (LMI) consumer

Dewan Housi ng

5,872

201

270

34.2

segment, the company has incre ase d its prese nce in tier-II &

III cities where the growth opportunity is immense.

Commence ment of new projects, downtrend in the interest

IL&FS Transport

2,441

74

93

25.3

rate cycle, to lead to stock re-rating

Economic recovery to have favourable impact on advertising

& circulation revenue growth. Further, the acquisition of a

Jagran Prakashan

5,420

166

205

23.6

radio business (Radi o City) would also boost the company' s

revenue growth.

Speedier execution and speedier sales, strong revenue vi sibilty

Mahindra Lifespace

1,747

426

554

30.1

in short-to-l ong run, attractive valuations

Massive capacity expansi on along with rail advantage at ICD

Navkar Corporation

2,487

174

265

51.9

as well CFS augurs well for the company

Earnings boost on back of stable material prices and

Radico Khaitan

1,188

89

156

74.7

favourable pricing e nvironment. Valuation di scount to peers

provide s additional comfort

Strong brands and distribution network would boost growth

Siyaram Silk Mills

1,013

1,080

1,354

25.3

going ahead. Stock currently trades at an inexpe nsive

valuation.

Source: Company, Angel Research

Market Outlook

May 6, 2016

Key Upcoming Events

Result Calendar

D ate

C ompany

May 06, 2016

Siemens, KEC International, Reliance Capital

May 07, 2016

Andhra Bank

May 09, 2016

HUL, MM Forging

May 10, 2016

Automotive Axle, NIIT, Visaka Industries, Radico Khaitan

Apollo Tyres, Kotak Mah. Bank, Indian Bank, Oriental Bank, South Ind.Bank, Asian Paints, TVS Srichakra,

May 11, 2016

Quick Heal

May 12, 2016

Vijaya Bank, Bank of Maharashtra, Nestle, ITD Cementation, Dr Reddy's, Glenmark Pharma.

May 13, 2016

Central Bank, Indraprasth Gas, Cadila Healthcare

May 14, 2016

Electrosteel Castings, Relaxo

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country Event Description

Unit

Period

Last Reported Estimated

May 06, 2016

6:00 PM

US

Change in Nonfarm payrolls

Thousands

Apr

215.00

200.00

China

Exports YoY%

% Change Apr

11.50

(0.50)

May 08, 2016

6:00 PM

US

Unnemployment rate

% Apr

5.00

4.90

May 10, 2016

India

Imports YoY%

% Change Apr

(21.56)

2:00 PM

UK

Industrial Production (YoY)

% Change Mar

(0.50)

India

Exports YoY%

% Change Apr

(5.47)

May 11, 2016

7:00 AM

China

Consumer Price Index (YoY)

% Change Apr

2.30

2.30

May 12, 2016

5:30 PM

India

Industrial Production YoY

% Change Mar

2.00

4:30 PM

UK

BOE Announces rates

% RatioMay 12

0.50

0.50

May 13, 2016

2:30 PM Euro Zone

Euro-Zone GDP s.a. (QoQ)

% Change 1Q P

0.60

0.60

US

Producer Price Index (mom)

% Change Apr

0.20

11:30 AM Germany

GDP nsa (YoY)

% Change 1Q P

2.10

May 14, 2016

11:00 AM

China

Industrial Production (YoY)

% Change Apr

6.80

6.50

May 16, 2016

12:00 PM

India Monthly Wholesale Prices YoY%

% Change Apr

(0.85)

May 17, 2016

2:00 PM

UK

CPI (YoY)

% Change Apr

0.50

Source: Bloomberg, Angel Research

Market Outlook

May 6, 2016

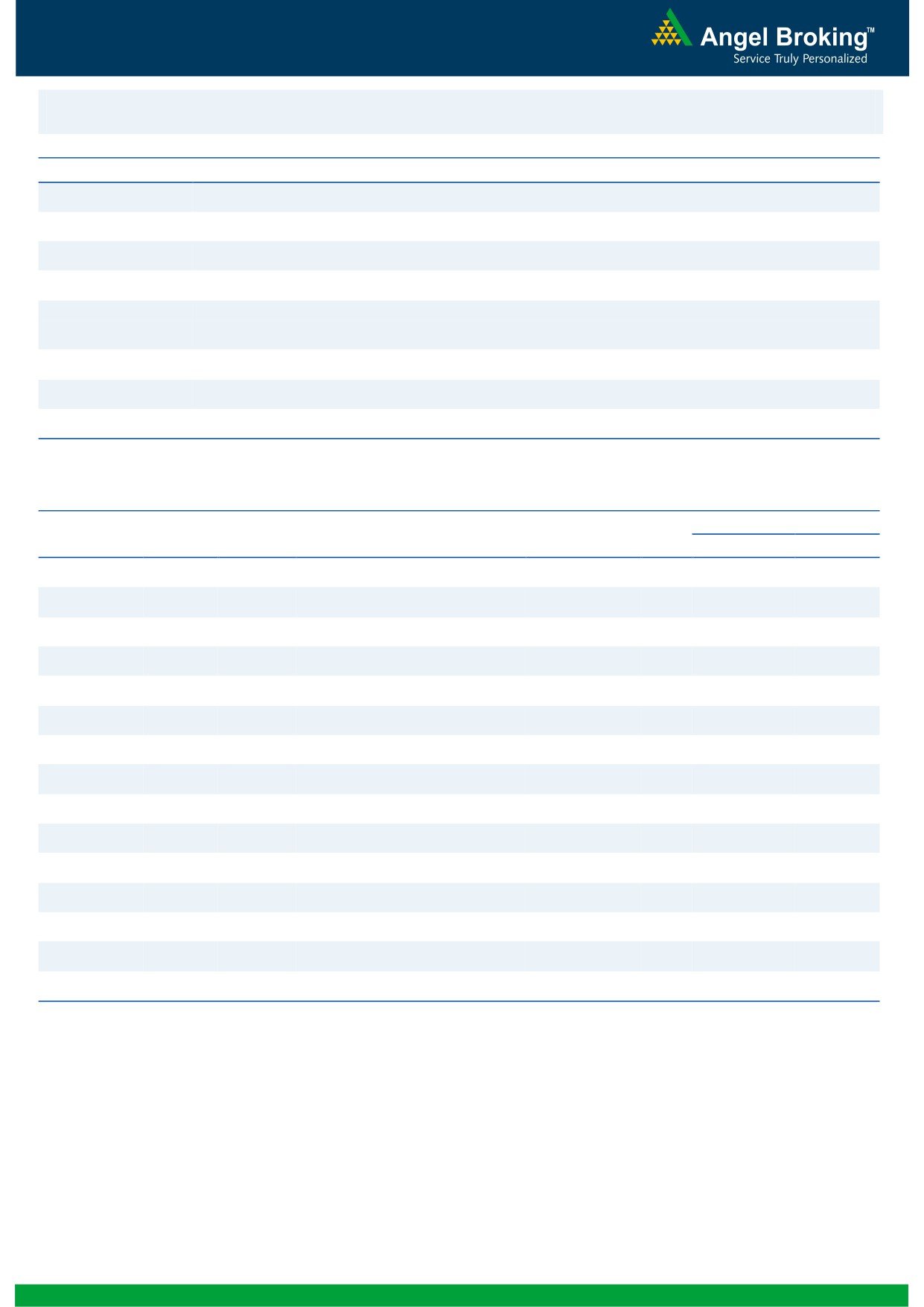

Macro watch

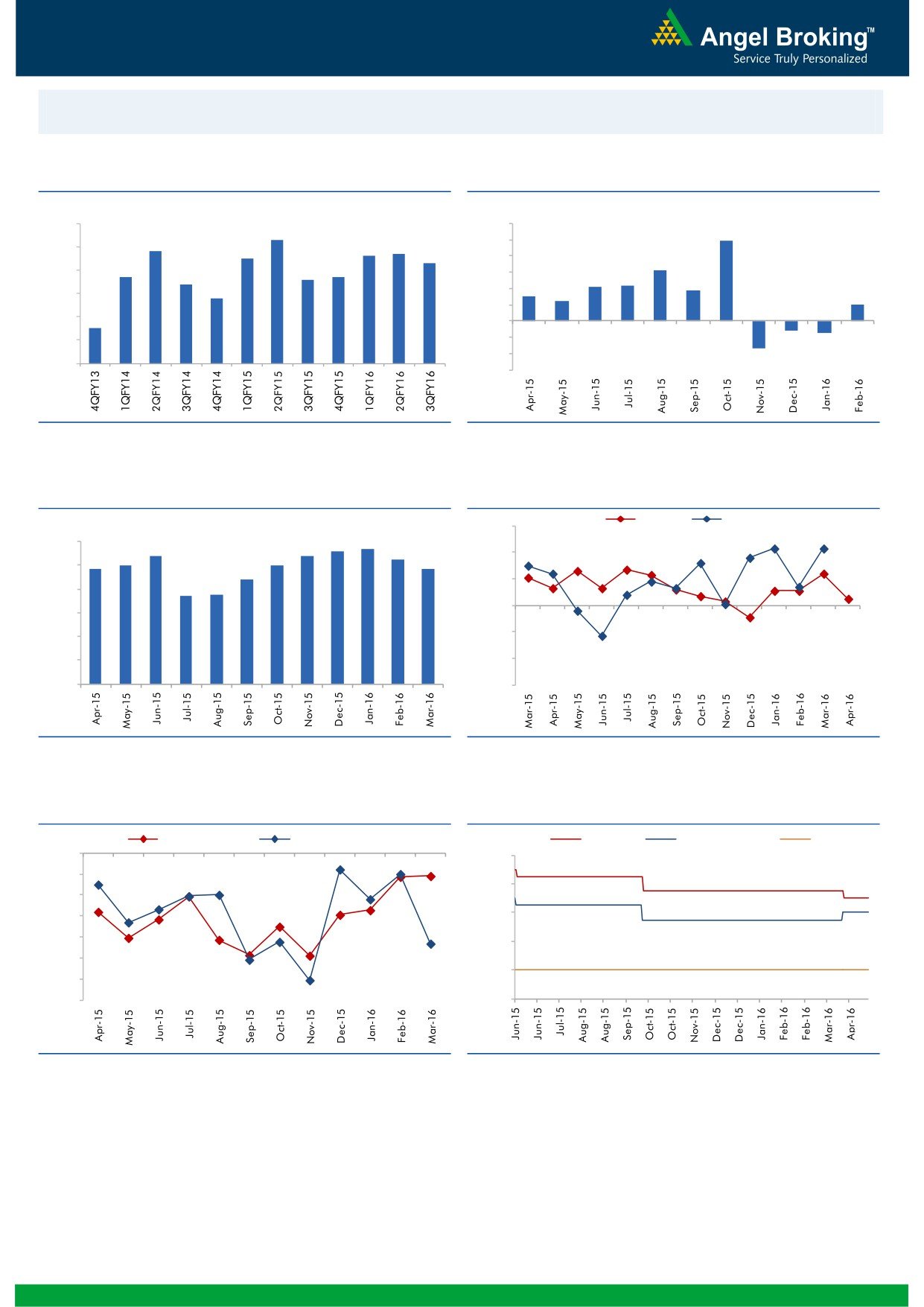

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.3

12.0

9.9

7.8

7.7

10.0

8.0

7.5

7.6

7.3

8.0

6.3

6.7

6.6

6.7

7.0

6.4

6.0

4.2

4.3

3.7

5.8

3.0

2.5

6.0

4.0

2.0

2.0

5.0

4.5

-

4.0

(2.0)

(1.2)

(1.5)

(4.0)

3.0

(3.4)

(6.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

Mfg. PMI

Services PMI

(%)

56.0

5.6

5.7

6.0

5.4

5.4

5.3

4.9

5.0

5.0

4.8

54.0

5.0

4.4

3.7

3.7

52.0

4.0

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

0.0

8.00

(5.0)

7.00

(10.0)

(15.0)

6.00

(20.0)

5.00

(25.0)

4.00

(30.0)

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 6, 2016

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/ben eficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any in vestment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, informati on or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that ma y arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please r efer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.