Market Outlook

August 4, 2015

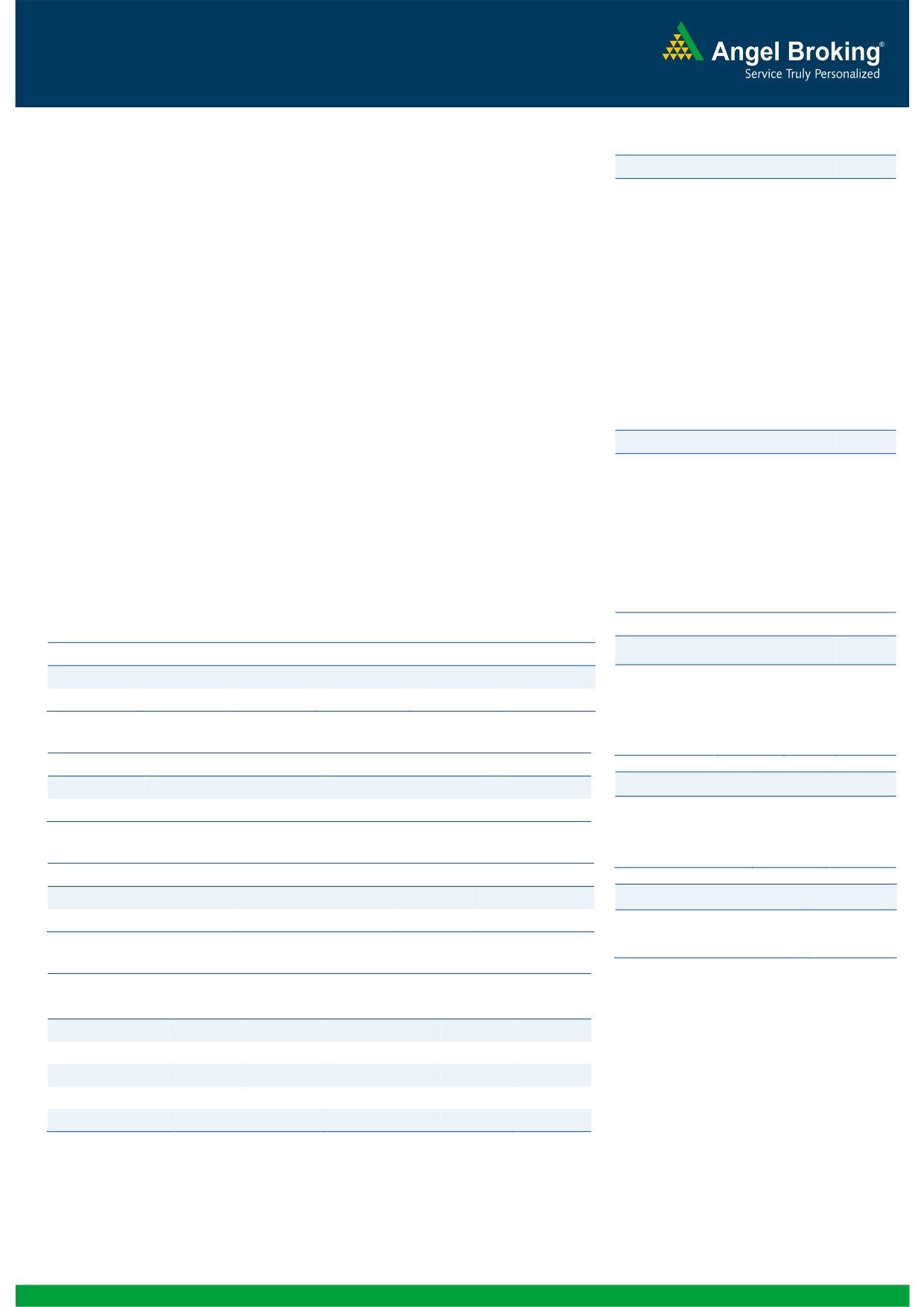

Dealer’s Diary

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

0.3

73

28,187

Indian markets are expected to open in red tracking SGX Nifty.

Nifty

0.1

10

8,543

U.S. stocks closed lower on Monday, as investors weighed mostly on the lackluster

MID CAP

0.5

58

11,331

ISM manufacturing data and renewed decline in the oil. Notably, Apple & Twitter

SMALL CAP

0.9

110

11,941

stocks fell 2.4% and 5.6%, respectively.

BSE HC

0.3

56

17,104

U.K. stocks edged lower Monday, hurt by selloff in mining stocks, after data showed

BSE PSU

0.5

39

7,758

decline in the factory activity at China, a key market for the group.

BANKEX

1.0

212

21,712

AUTO

0.7

139

19,247

Markets closed higher for fourth consecutive session on Monday, aided by ICICI

METAL

(1.0)

(94)

8,575

Bank, SBI and ITC. Broader markets outperformed benchmarks with BSE Midcap

OIL & GAS

(0.5)

(50)

9,852

and Smallcap indices rising 0.5% and 0.9%, respectively.

BSE IT

(0.5)

(59)

11,014

News & Result Analysis

Global Indices

Chg (%)

(Pts)

(Close)

Result Review: Hero, HCL Tech, Styrolution ABS, Nilkamal

Dow Jones

(0.5)

(92)

17,598

Refer detailed news & result analysis on the following page

NASDAQ

(0.3)

(13)

5,115

Markets Today

FTSE

(0.1)

(8)

6,689

The trend deciding level for the day is 28,174 / 8,538 levels. If NIFTY trades above

Nikkei

(0.2)

(37)

20,548

this level during the first half-an-hour of trade then we may witness a further rally up

Hang Sang

(0.9)

(225)

24,411

to 28,276 - 28,366 / 8,569 - 8,594 levels. However, if NIFTY trades below

Straits Times

(0.3)

(10)

3,193

28,174 / 8,538 levels for the first half-an-hour of trade then it may correct towards

Shanghai Com

(1.1)

(41)

3,623

28,085 - 27,982 / 8,513 - 8,483 levels.

Indian ADR

Chg (%)

(Pts)

(Close)

Indices

S2

S1

PIVOT

R1

R2

SENSEX

27,982

28,085

28,174

28,276

28,366

INFY

0.3

0.1

$17.0

NIFTY

8,483

8,513

8,538

8,569

8,594

WIT

(0.1)

(0.7)

$12.3

IBN

3.1

0.3

$10.4

Net Inflows (July 31, 2015)

HDB

0.8

0.5

$63.0

` cr

Purch

Sales

Net

MTD

YTD

FII

5,594

5,819

(225)

5,589

140,970

Advances / Declines

BSE

NSE

MFs

2,279

1,924

356

4,339

57,948

Advances

1,805

927

Declines

1,117

511

FII Derivatives (August 3, 2015)

Unchanged

111

124

` cr

Purch

Sales

Net

Open Interest

Index Futures

933

1,121

(188)

14,735

Volumes (` cr)

Stock Futures

3,270

2,808

463

49,109

BSE

3,728

NSE

19,171

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

JPASSOCIAT

11

18.3

HCLTECH

937

(5.9)

SUZLON

24

11.6

GPPL

223

(5.3)

SUNTV

374

11.2

FSL

33

(5.3)

ALOKTEXT

7

10.6

KAILASH

6

(4.9)

RAJESHEXPO

567

9.1

JINDALSTEEL

76

(3.5)

Market Outlook

August 4, 2015

Result Review

Hero Motocorp Ltd (CMP: `2,698/ TP: /Upside:)

Hero Motocorp 1QFY2016 results were ahead of our estimates. Revenues declined

marginally 1% yoy to `6,955cr in line with our expectations of `7,095cr. Volumes

declined 4% yoy due to weak rural sentiments. Realisation/vehicle grew 3% yoy to

`42,267/unit due to price hikes. Hero’s operating margins at 15.1% improved

160 bp yoy and were ahead of our estimates of 13%. During the quarter, raw

material costs were lower on account of subdued commodity prices coupled with

raw material cost reduction measures under the programme “Leap”. Also

reduction in marketing expenses due to seasonality further aided in margin

improvement. Given the strong operating performance, Net profit at `750cr grew

33% yoy, beating our expectations of `679cr. We currently have Neutral rating on

the stock and would review estimates post management interaction.

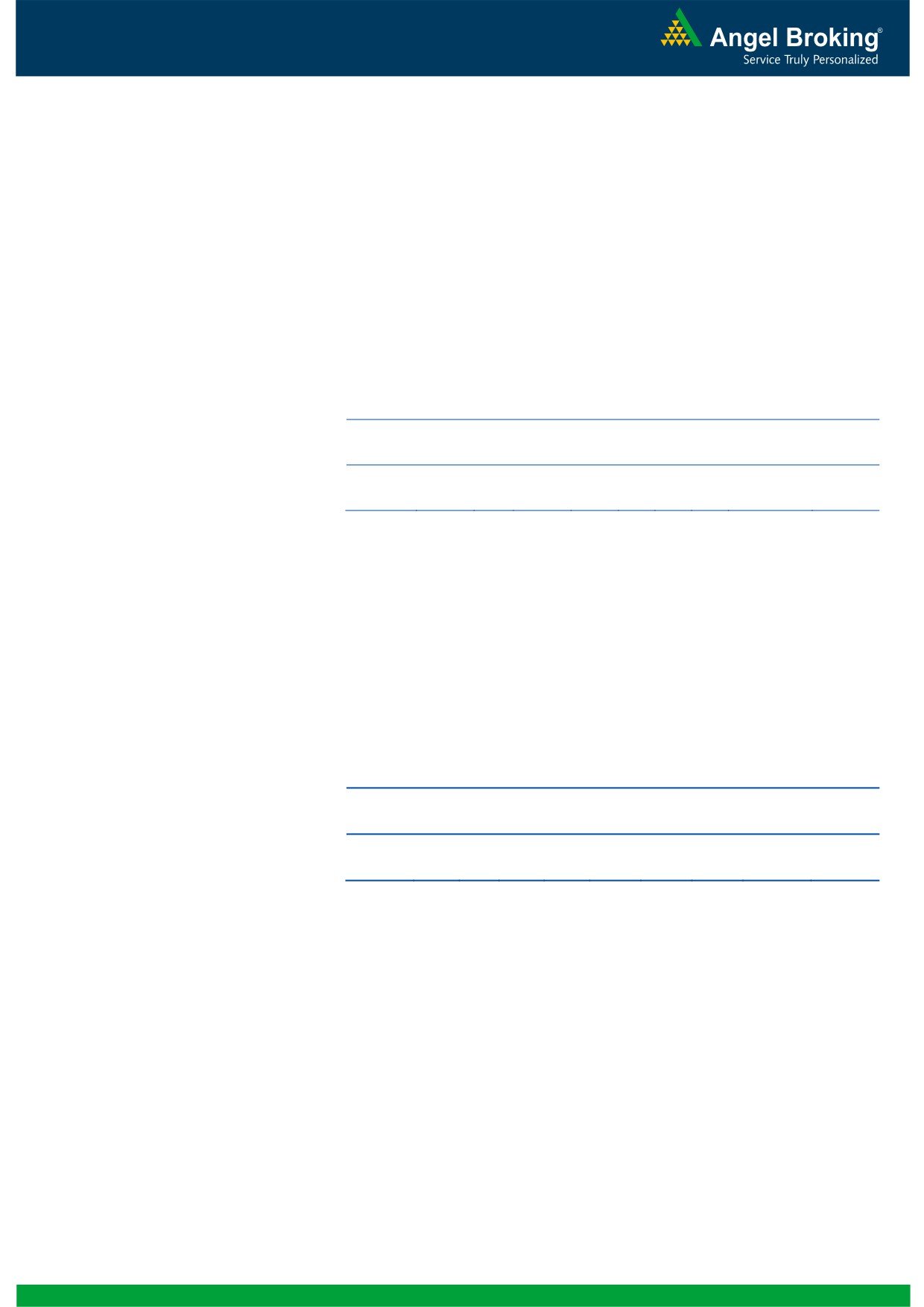

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

30,053

12.8

2,821

141.3

36.1

19.1

6.9

12.7

1.6

FY2017E

34,565

13.4

3,297

165.1

35.9

16.3

5.9

10.3

1.4

HCL Tech (CMP: `937/ TP: `1,100/Upside: 17.4%)

HCL Tech posted results better than expected on the top-line, while the OPM came

below expectations, and net profit just in line with expectations. HCL Tech posted a

growth of

3.2% qoq in USD revenues to US$1,538mn in 4QFY2015 V/s

US$1,535mn expected V/s US$1491mn in 3QFY2015. On constant Currency

terms (CC) the company posted a 2.9% qoq growth during the period. In rupee

terms, the revenues came in at `9,777cr V/s `9,724cr expected and V/s `9,267cr

in 3QFY2015, a qoq growth of 5.5%.

In terms of geography, the US (57.5% of sales) posted a robust CC growth of 5.1%

qoq and Europe (31.4% of sales) was CC growth of 0.1% qoq, while ROW (11.2%

of sales) posted a 0.1% qoq CC dip in the revenue. In terms of Verticals, the

financial services (26.0% of sales), posted qoq CC growth of 2.1%. The best

performing verticals during the quarter were Life sciences & Healthcare (12.0% of

sales), Retail & CPG (8.8% of sales) and Telecommunications, Media, Publishing &

Entertainment (9.5% of sales) which posted CC qoq growth of 10.2%, 7.1% and

9.6% qoq respectively. In terms, of services, Infrastructure Services and Business

Services posted a CC qoq growth of 5.2% and 4.0% respectively.

On the operating front the EBDITA margins came in at 21.5% V/s 22.8% expected

and V/s 22.6% in 3QFY2015, a qoq dip of 108bps. EBIT, on the other hand,

came in around 20.2% V/s 21.3% in 3QFY2015, registering a dip of 113bp. The

margins came under pressure, on back of wage hikes during the quarter. The

utilization rate moved up to 83.5% V/s 81.9% in 3QFY2015, while attrition rate

was 16.5% V/s 16.2% in 3QFY2015. The PAT, came in at `1,783cr V/s `1,782cr

expected and `1,624cr in 3QFY2015 a qoq growth of 5.9%. PAT came in line with

expectations in spite of the EBDITA contraction, more than expected, on back of

higher than expected other income. Other income came in at

`212cr in

4QFY2015 V/s `179cr in 3QFY2015.

Market Outlook

August 4, 2015

On client additions, the company added 1 client in USD 100mn+ category, 5

Clients in USD 40mn+ category being driven by increased momentum in large

deal signings in ITO and Engineering and R&D Services. It added 10 clients in

USD 10 mn+ category, 24 clients in USD 5 mn+ category and 47 clients in USD

1mn+ category reflective of our increased participation in engagements in

digitalization and modern apps.

Overall, HCL Tech has signed 58 transformational engagements during the

FY2014-15 with US$5bn+ of Total Contract Value. These Bookings saw significant

momentum driven by Next-gen ITO, Engineering Services Outsourcing, Digital and

Modern Apps deals, each of which had a component of new technology constructs

like Digitalization, Cloud etc. These engagements reflected a broad-based spread

across verticals, service lines and geographies. We maintain our accumulate rating

on the stock with a target price of `1,100.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

41,535

24.0

7,991

56.6

20.8

17.6

3.7

10.0

2.4

FY2017E

46,519

23.4

8,626

61.1

17.7

16.3

2.9

8.3

1.9

Styrolution ABS (CMP: `779/ TP: / Upside -)

Styrolution ABS (Styrolution) reported muted set of numbers for 1QFY2016. Top

line for the quarter declined by 1.6% yoy to `314cr, which is lower than our

estimates of`347cr. EBITDA grew by 128.2% on yoy basis and came in at `34cr.

The EBIDTA margins improved by 614bp yoy to 10.8%. This was on account of

lower raw material cost which declined by 970bp yoy to 69.2% of sales. However,

part of it was offset by 300bp yoy increase in other expense to 16.7% of sales. We

had built in EBITDA margin estimate of 11.7%. As a result, the net profit increased

by 246.7% yoy to `18cr. At current market price, the stock is trading at 19.2x its

FY2017E earnings. We have a Neutral view on the stock.

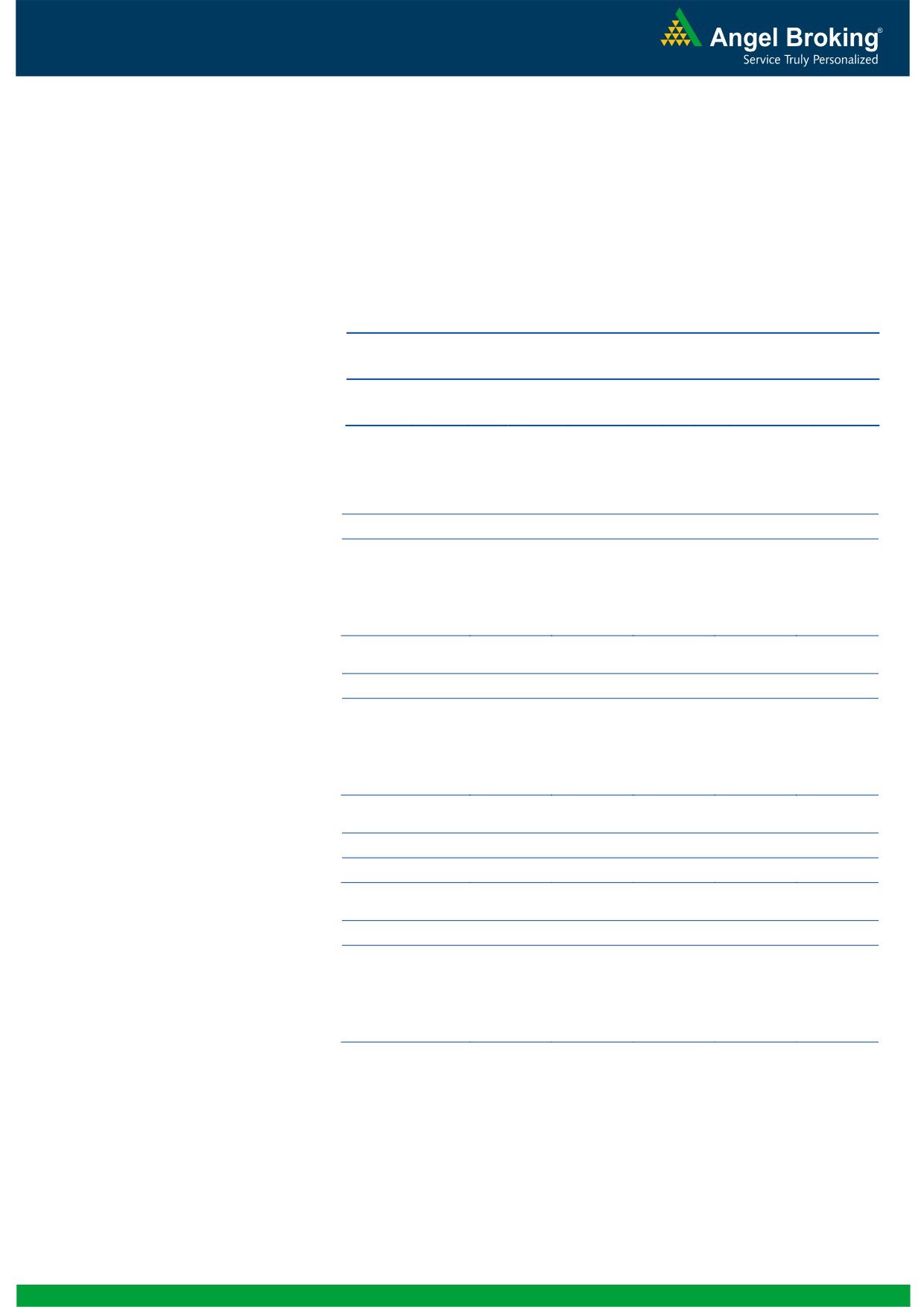

Y/E

Sales OPM PAT

EPS

ROE

P/E

P/BV EV/Sales EV/EBITDA

Mar

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,271

8.6

56

31.6

10.5

24.6

2.5

1.0

12.1

FY2017E

1,440

9.2

71

40.6

12.3

19.2

2.2

0.9

9.8

Nilkamal (CMP: `921/ TP: `1,005/ Upside: 9.1%)

For 1QFY2016, Nilkamal reported a good set of numbers. The standalone top-

line for the quarter witnessed 9.6% yoy increase to `458cr, which is in-line with our

estimate of `455cr. The company benefitted from lower raw material prices for the

quarter as the polymer prices witnessed c.8% decline on yoy basis. Raw material

cost as a percentage of sales declined by 590bp yoy to 58.8% of sales. Employee

expense and other expenses increased by 25bp yoy and 110bp yoy to 6.8% of

sales and 23.0% of sales respectively. As a result, the EBITDA margin expanded by

455bp yoy to 11.3%, against our estimate of 10.0%.

The company has reduced its debt over the past year, which seems to be paying

off as interest expense has declined to `5cr against `8cr in 1QFY2015. Aided by

better operating performance, lower interest outgo and higher other income, the

net profit grew by an impressive 362.8% yoy to `25cr.

Market Outlook

August 4, 2015

As far as segmental performance is concerned, the plastics division witnessed 9.0%

yoy growth to `402cr and the margins for the segment improved by 546bp yoy to

11.7%. The lifestyle segments’ revenues grew by 21.0% yoy to `50cr but the

segment reported a loss of `2cr. Others, which is includes the mattress business,

saw revenue decline of 11.0% on yoy basis to `8cr while the segment reported loss

of `0.1cr.

At current market price, the stock is trading at 13.7x its FY2017E earnings. We

have an Accumulate rating on the stock with a revised target price of `1,005

based on a target P/E of 15.0x for FY2017E.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

Mar

(` cr)

(%)

(` cr)

(`)

(%) (x)

(x)

(x)

(x)

FY2016E

1,948

10.6

90

60.0 16.8 15.4

2.4

7.1

0.8

FY2017E

2,147

10.3

100

67.0 16.1 13.7

2.1

6.3

0.7

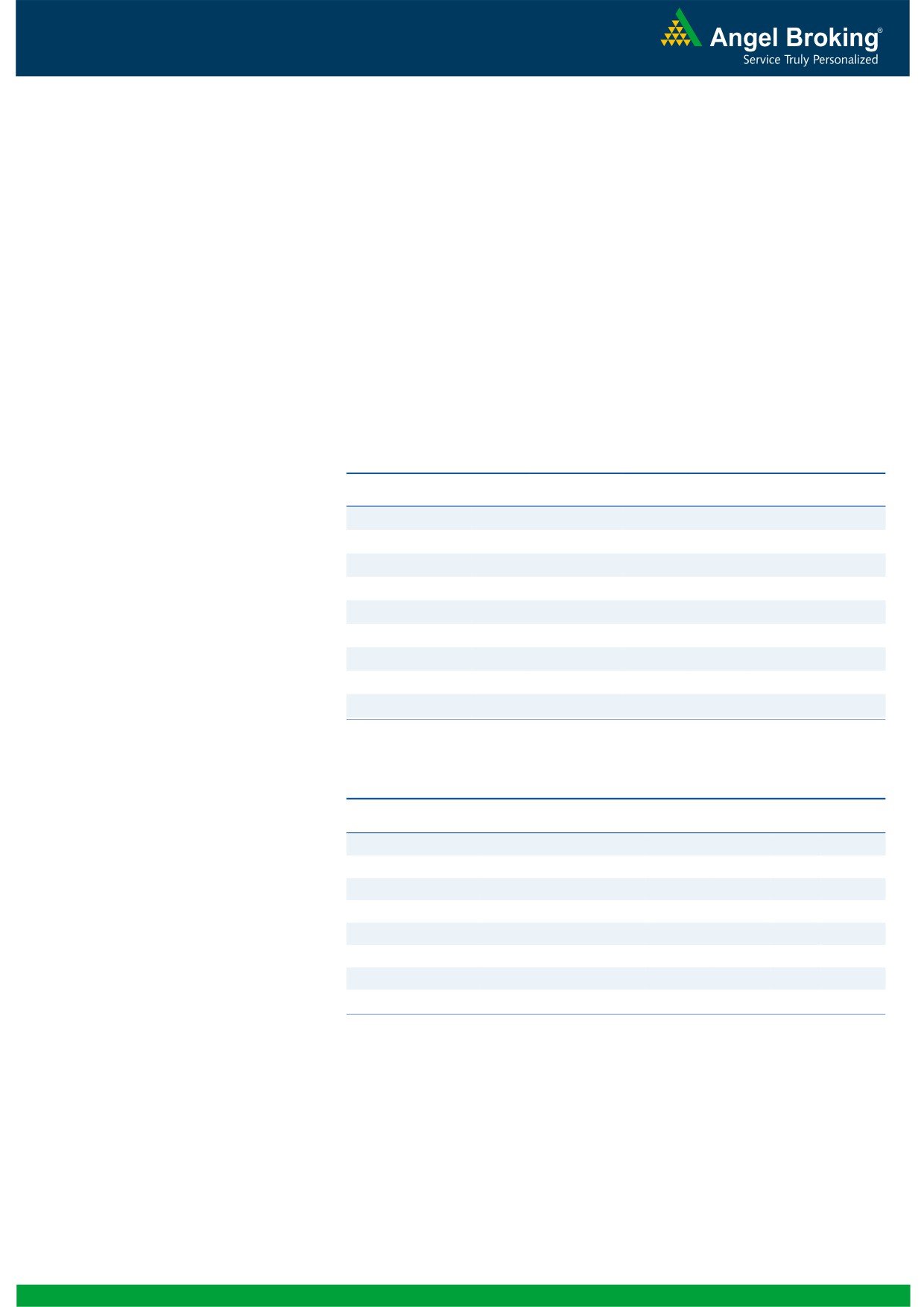

Quarterly Bloomberg Brokers Consensus Estimate

Tata Chemicals Ltd (Consol)- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

4,118

3,803

8.3

3,658

12.6

EBITDA

564

504

12.0

411

37.1

EBITDA margin (%)

13.7

13.2

11.2

Net profit

222

176

26.3

(74)

0.0

Siemens Ltd- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

2,438

2,319

5.1

2,589

(5.8)

EBITDA

225

53

325.7

250

(10.1)

EBITDA margin (%)

9.2

2.3

9.7

Net profit

127

13

878.2

162

(21.4)

Canara Bank- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

PAT

585

807

(27.5)

613

(4.5)

Tata Global Beverages Ltd (Consol)- August 06, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,987

1,884

5.4

1,875

6.0

EBITDA

205

201

2.0

188

9.0

EBITDA margin (%)

10.3

10.7

10.0

Net profit

104

97

6.4

4

2,553.8

Market Outlook

August 4, 2015

Economic and Political News

Manufacturing PMI grows at fastest pace in 6 months in July

Odisha seeks `3,500cr assistance via Niti Aayog

NCLT provisions to be notified in phases

Foreign Investment Promotion Board clears 18 FDI proposals

Corporate News

NTPC to reduce dependence on fossil fuels to 56% by 2032

Bata India and Relaxo Footwear settle litigation over Sparx trademark

Viacom Inc Acquires 50% Stake In Prism TV for `940cr

Top Picks

Large Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Axis Bank

Financials

136,975

Buy

577

716

24.2

ICICI Bank

Financials

181,573

Buy

313

370

25.3

Infosys

IT

247,852

Buy

1,079

1,306

21.0

Power Grid

Power

73,556

Buy

141

170

20.9

Sun Pharma

Pharma

199,861

Buy

831

950

14.4

TCS

IT

491,239

Buy

2,508

3,168

26.3

Tech Mahindra

IT

50,350

Buy

524

646

23.4

Yes Bank

Financials

34,774

Buy

832

1,006

21.0

LIC Housing Fin.

Financials

25,806 Accumulate

511

553

8.1

Source: Angel Research, Bloomberg

Mid Cap

Market

CMP

Target

Upside

Company

Sector

Rating

Cap (` Cr)

(`)

(`)

(%)

Bajaj Electricals

Others

2,642

Buy

262

341

30.1

Garware Wall Rope Others

702

Buy

296

390

31.7

Hindustan Media Ven. Media

1,808

Buy

246

292

18.5

MBL Infrastructures Construction

1,133

Buy

273

395

44.3

Mangalam Cements Cement

705

Buy

264

349

32.1

Minda Industries

Auto Ancillary

888

Buy

560

652

16.4

MT Educare

Others

474

Buy

119

141

18.3

Radico Khaitan

Others

1,237

Buy

93

112

20.4

Source: Angel Research, Bloomberg

Market Outlook

August 4, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.