Market Outlook

August 3, 2015

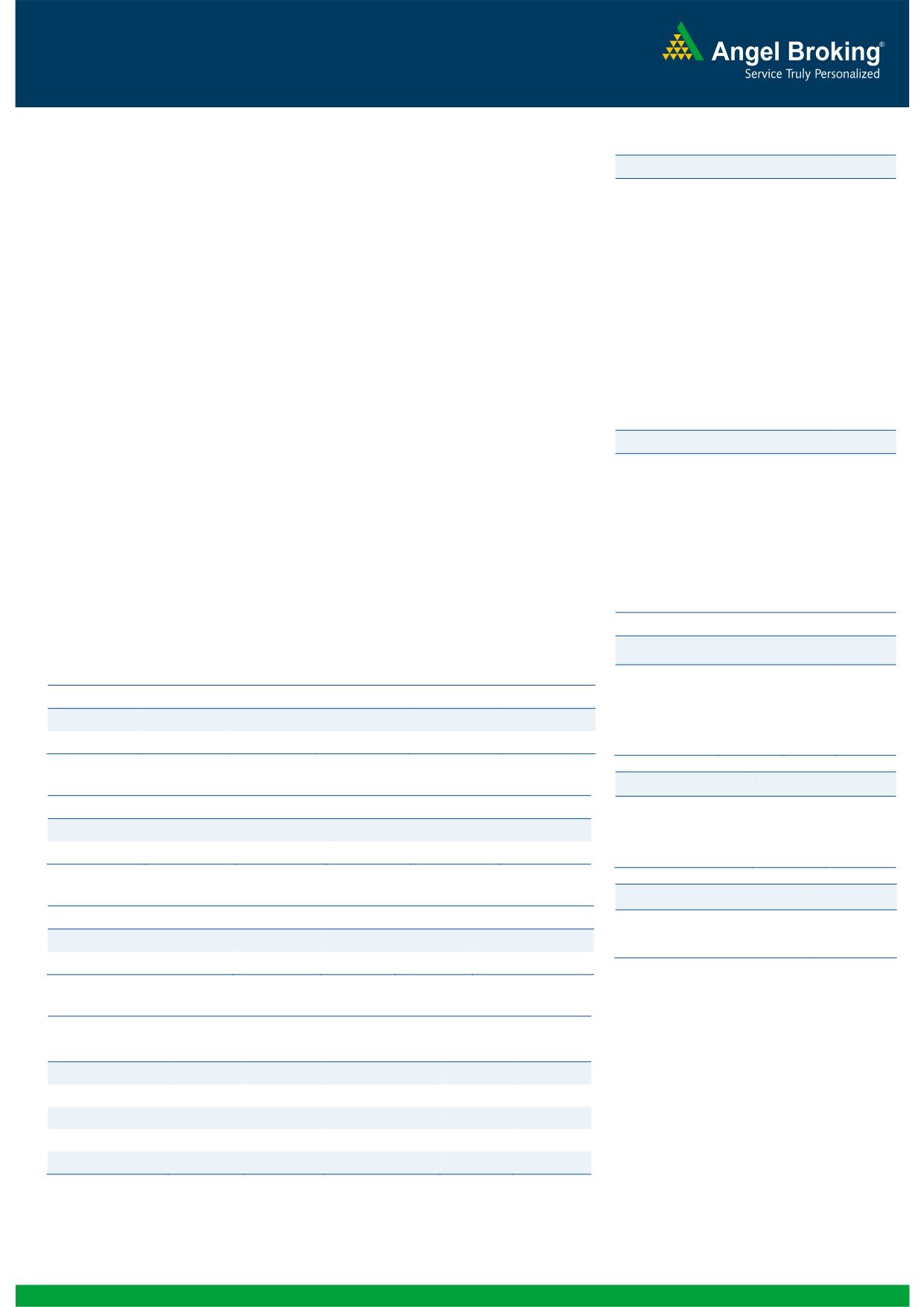

Dealer’s Diary

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

1.5

409

28,115

Indian markets are expected to open in green tracking SGX Nifty.

Nifty

1.3

111

8,533

U.S. markets ended on a sour note on Friday as drop in energy prices eclipsed wage

MID CAP

1.0

115

11,273

data that supported expectations that Fed might hold off interest rates. Exxon Mobil

SMALL CAP

0.9

107

11,831

and Chevron shares were down over 4% after they reported poor earnings due to

BSE HC

2.0

333

17,048

weak oil prices.

BSE PSU

1.4

109

7,719

FTSE 100 again held its ground on Friday with narrow gains after it felt the influence

BANKEX

1.7

354

21,499

of Greek debt crisis. IMF said they are cautious about contributing to Greece’s

AUTO

1.8

338

19,108

current bailout plan and said that current debt needs to be restructured.

METAL

1.7

146

8,668

OIL & GAS

(0.3)

(27)

9,902

Capital infusion in banks, some clarity on retrospective tax on capital gains cheered

BSE IT

1.3

145

11,073

investors and led to over 1% rally in Indian equity markets on Friday.

Global Indices

Chg (%)

(Pts)

(Close)

News & Result Analysis

Dow Jones

(0.3)

(56)

17,690

July 2014 Auto sales update

NASDAQ

(0.0)

(5)

5,128

Result Review: Alembic Pharma, Glaxo Pharmaceuticals

FTSE

0.4

27

6,696

Refer detailed news & result analysis on the following page

Nikkei

0.3

62

20,585

Markets Today

Hang Sang

0.6

138

24,636

The trend deciding level for the day is 28,030 / 8,510 levels. If NIFTY trades above

Straits Times

(1.4)

(47)

3,203

this level during the first half-an-hour of trade then we may witness a further rally up

Shanghai Com

(1.1)

(42)

3,664

to 28,246 - 28,377 / 8,572 - 8,611 levels. However, if NIFTY trades below

28,030 / 8,510 levels for the first half-an-hour of trade then it may correct towards

Indian ADR

Chg (%)

(Pts)

(Close)

27,899 - 27,683 / 8,471 - 8,409 levels.

INFY

(0.2)

(0.0)

$16.9

Indices

S2

S1

PIVOT

R1

R2

WIT

0.1

0.8

$12.4

SENSEX

27,683

27,899

28,030

28,246

28,377

IBN

4.9

0.5

$10.0

NIFTY

8,409

8,471

8,510

8,572

8,611

HDB

1.2

0.7

$62.5

Net Inflows (July 30, 2015)

Advances / Declines

BSE

NSE

` cr

Purch

Sales

Net

MTD

YTD

Advances

1,666

892

FII

5,688

5,485

203

5,814

141,195

Declines

1,222

615

MFs

2,279

1,924

356

4,339

57,948

Unchanged

127

55

FII Derivatives (July 31, 2015)

Volumes (` cr)

` cr

Purch

Sales

Net

Open Interest

BSE

3,928

Index Futures

2,508

1,353

1,155

14,763

NSE

21,358

Stock Futures

3,380

3,039

341

48,655

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

RAJESHEXPO

519

12.5

GATI

181

(8.6)

SUNTV

337

9.0

KAILASH

6

(4.8)

UNIONBANK

177

8.0

APLLTD

711

(4.7)

INDIACEM

93

7.0

TITAN

324

(4.7)

SANOFI

4,276

6.6

TATACHEM

489

(3.4)

Market Outlook

August 3, 2015

July 2014 auto sales update

Maruti Suzuki: Maruti Suzuki sales grew 20% yoy to 121,712 units and were above

estimates. Domestic sales grew 22% yoy to 110,405 units while export sales

remained flat at 11,307 units.

Ashok Leyland: Ashok Leyland sales grew strongly 40% yoy to 11,022 units and

were slightly ahead of estimates. MHCV sales grew 53% yoy to 8,803 units while

the LCV sales grew marginally 5% yoy to 2,219 units.

Hero Motocorp: Hero Motocorp sales declined 8% yoy to 487,580 units and were

below estimates

TVS Motors: TVS Motors sales grew slightly 2% yoy to 218,321 units and were

marginally below estimates. Two wheeler sales grew 1% yoy to 208,044 units

while three wheeler sales grew healthy 15% yoy to 10,277 units

Tata Motors: Tata Motors sales grew marginally 1% yoy to 40,154 units and were

in line with estimates. Passenger vehicle sales grew strongly 13% yoy while the

commercial vehicle sales dipped marginally 5%.

M&M: M&M sales declined 5% yoy to 50,112 units and were in line with estimates.

Automotive sales declined 3% yoy to 34,652 units while the tractor volumes

continued to decline in double digits by 11% yoy to 15,460 units.

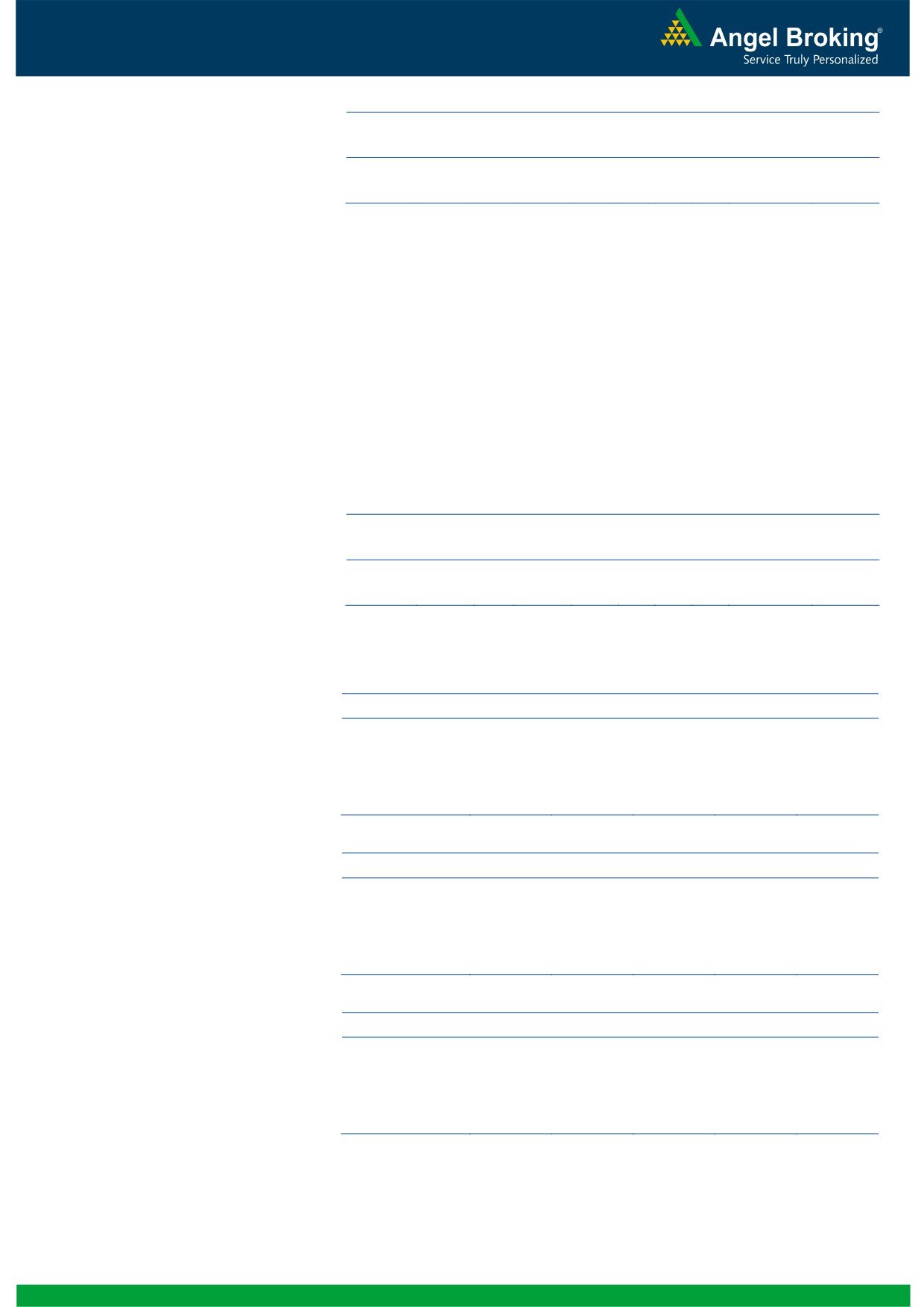

Result Review

Alembic Pharma (CMP: `711/ TP: /Upside: )

Alembic Pharma, for its 1QFY2016 results, posted results lower than expected, more

on the OPM and net profit front, while sales were marginally lower than expected.

On topline, the company posted sales of `583cr V/s `601cr expected and V/s

`492cr in 1QFY2015, posting a yoy growth of 18.4%. The growth was driven by

domestic formulation (`291cr) and export formulation (`176cr) markets, which

posted a yoy growth of 17.2% and 29.0% respectively. The API sales (`117cr),

posted a yoy growth of 10%.

The Indian formulation sales (`263cr), posted a yoy growth of 18.0% yoy. The

growth in the domestic formulation market was driven by specialty segment, which

posted a 22% yoy and acute segment posted a yoy growth of 12% yoy. The Indian

generic segment (`29cr), posted a yoy growth of 13%.

In export formulation markets, the generic formulation exports (`168cr) posted a yoy

growth of 47%. The export formulation branded market (`84cr) posted a yoy dip of 63%.

On the operating front, the gross margins came in at 63.4% v/s 64.0% in

1QFY2015, which lead the OPM’s to dip from 17.4% V/s 19.8% expected V/s

19.5% in 1QFY2015, a dip of 216bps yoy. The gross margins dipped, on back of

sales mix change. The Formulation: API moved to 80:20 in 1QFY2016 V/s 79:21

in 1QFY2015. OPM dip was sharper than the gross margin contraction, on back

of the R&D expenditure, which was 8.2% of sales in 1QFY2016 V/s 6.0% of sales

in 1QFY2015. Consequently, the PAT came in at `70cr V/s `86cr expected V/s

`65cr in 1QFY2015, a growth of 8% yoy. We maintain our neutral rating on the

stock, on back of valuations.

Market Outlook

August 3, 2015

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,405

19.9

334

17.7

32.6

40.1

11.5

27.9

5.6

FY2017E

2,859

20.4

415

22.0

30.9

32.3

8.8

22.6

4.6

Glaxo Pharmaceuticals (CMP: `3,508/ TP: /Upside:)

Glaxo Pharmaceuticals 1QFY2016 posted results lower than expected, on sales,

OPM and net profit front. On sales, the company posted sales of `622cr V/s

`700cr expected and V/s `655cr in 2QCY2015, de-growth of 5.1% yoy. The sales

during the quarter, was impacted on back of supply constraints.

On the operating front, the gross margins came in at 55.0% V/s 57.5% expected

and V/s 51.5% in 2QCY2015. Inspite of the same, the OPM’s came in at 16.7%

V/s 20.9% expected and V/s 16.7% in 2QCY2015, almost flat. This was mainly on

back of lower sales during the quarter. Consequently, the Adj. PAT came in at

`95cr V/s `135cr expected V/s `98cr in 2QCY2015, a de-growth of 3.5% yoy. We

maintain our neutral rating on the stock, on back of valuations.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,870

20.0

504

59.5

28.5

59.0

17.4

48.8

9.7

FY2017E

3,158

20.1

536

63.2

32.2

55.5

18.3

44.5

8.9

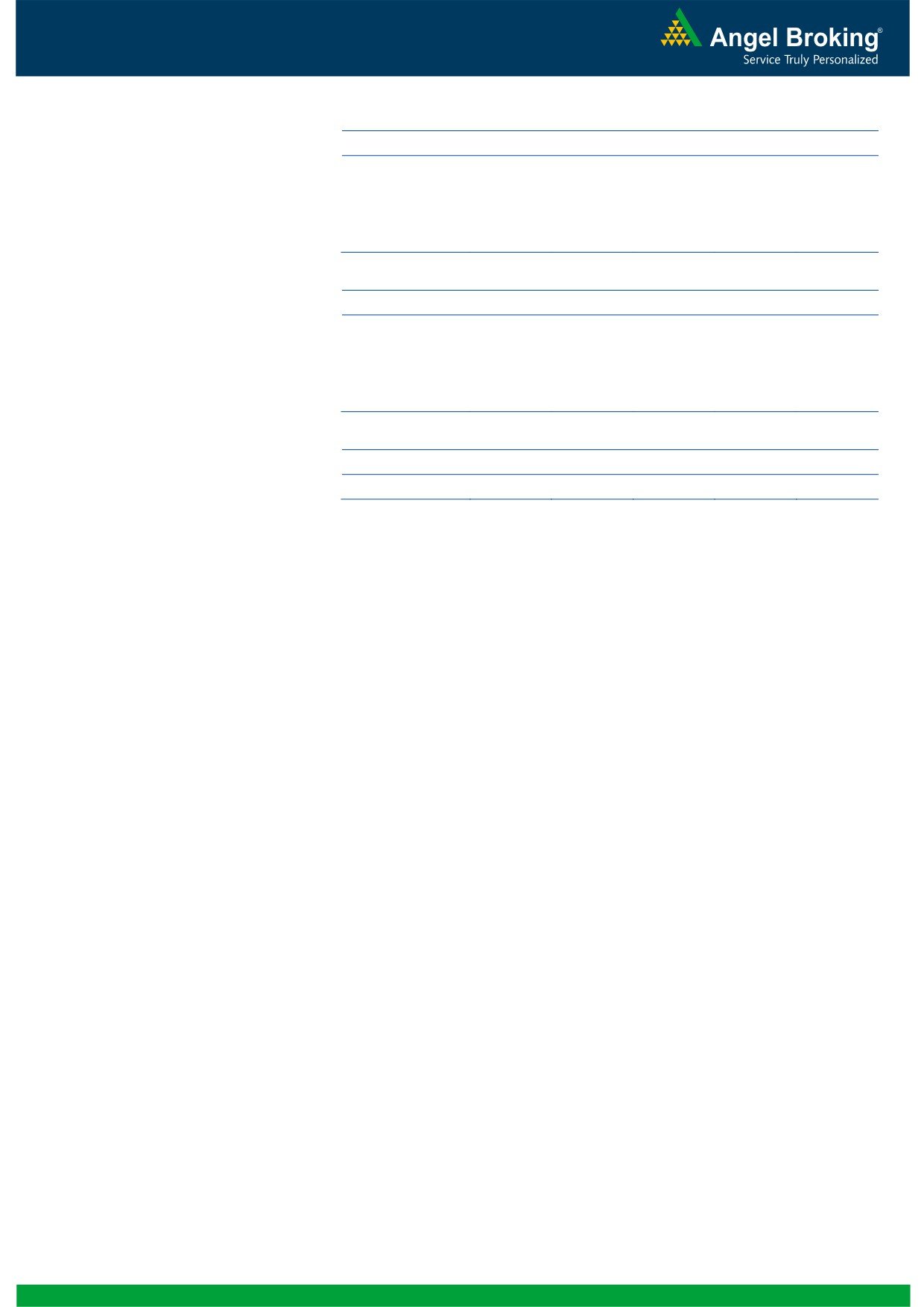

Quarterly Bloomberg Brokers Consensus Estimate

Hero MotoCorp Ltd- August 03, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

7,068

6,999

1.0

6,695

5.6

EBITDA

925

947

(2.4)

838

10.3

EBITDA margin (%)

13.1

13.5

12.5

Net profit

679

563

20.7

477

42.6

Bharat Forge Ltd- August 03, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,189

964

23.3

1,195

(0.5)

EBITDA

346

283

22.3

360

(3.7)

EBITDA margin (%)

29.1

29.4

30.1

Net profit

191

145

31.8

203

(6.0)

HCL Technologies Ltd (Consol)- August 03, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

9,756

8,424

15.8

9,267

5.3

EBITDA

2,270

2,217

2.4

2,090

8.6

EBITDA margin (%)

23.3

26.3

22.6

Net profit

1,831

1,834

(0.2)

1,683

8.8

Market Outlook

August 3, 2015

Tata Chemicals Ltd (Consol)- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

4,118

3,803

8.3

3,658

12.6

EBITDA

564

504

12.0

411

37.1

EBITDA margin (%)

13.7

13.2

11.2

Net profit

222

176

26.3

(74)

0.0

Siemens Ltd- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

2,438

2,319

5.1

2,589

(5.8)

EBITDA

225

53

325.7

250

(10.1)

EBITDA margin (%)

9.2

2.3

9.7

Net profit

127

13

878.2

162

(21.4)

Canara Bank- August 05, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

PAT

585

807

(27.5)

613

(4.5)

Economic and Political News

India likely to export dairy products to Russia by Dec

First river info system in August

Jet fuel prices fall 9.5%, hit lowest level in over four years

Corporate News

Production from GSPC fields in KG basin faces delay

Apollo Hospitals to start three hospitals by December end

KKR to Invest $150mn in JBF Ind for a 20% stake

Godrej Consumer eyes more overseas buys

Market Outlook

August 3, 2015

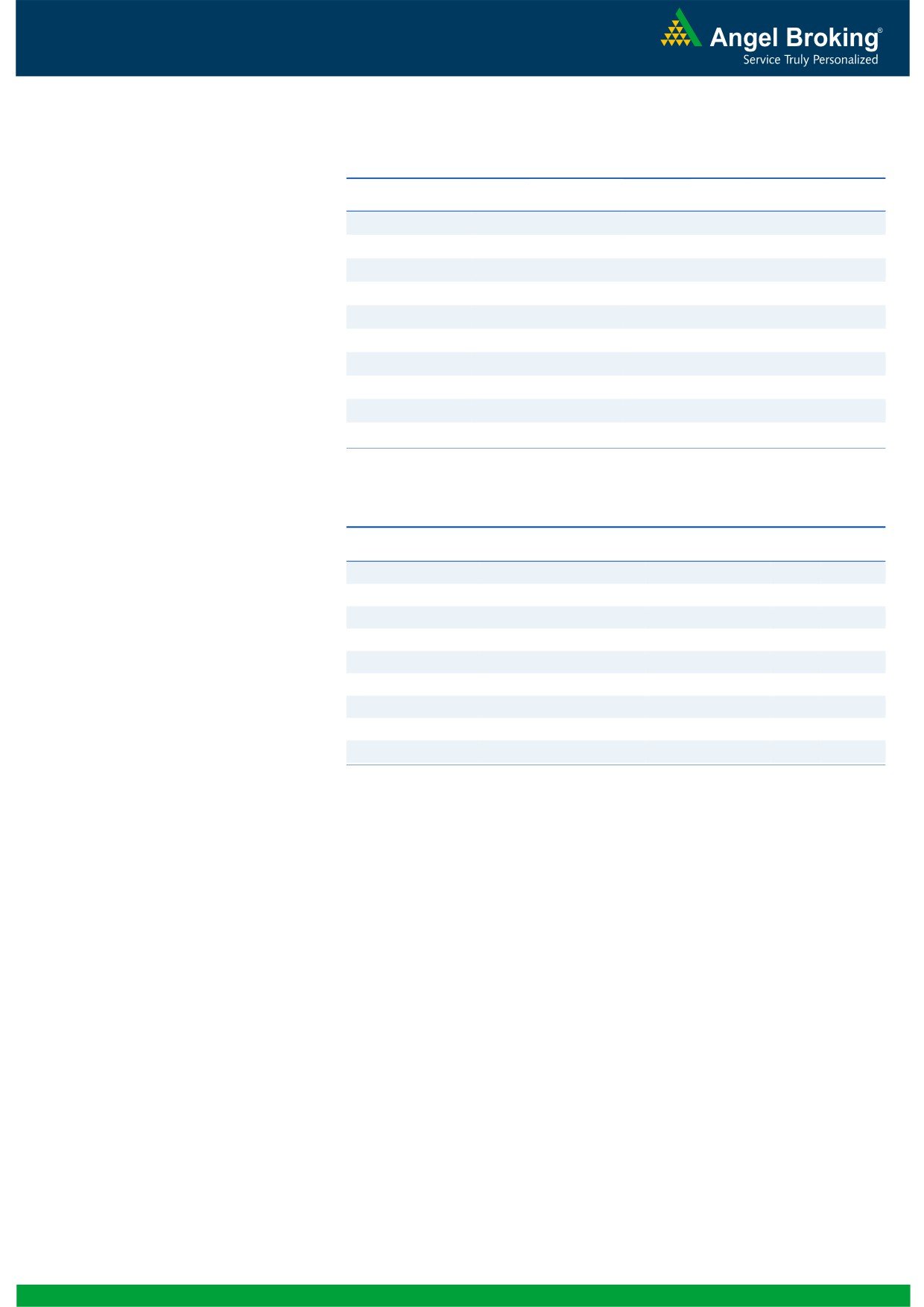

Top Picks

Large Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Cr)

(`)

(`)

(%)

Axis Bank

Financials

136,300

Buy

574

716

24.8

ICICI Bank

Financials

175,593

Buy

303

370

29.6

Infosys

IT

247,622

Buy

1,078

1,306

21.1

Power Grid

Power

74,053

Buy

142

170

20.1

Sun Pharma

Pharma

197,984

Buy

823

950

15.5

TCS

IT

491,641

Buy

2,510

3,168

26.2

Tech Mahindra

IT

50,932

Buy

530

646

22.0

Yes Bank

Financials

34,649

Buy

829

1,006

21.4

LIC Housing Fin.

Financials

24,612 Accumulate

498

553

11.0

MRF

Others

17,325 Accumulate

40,849

43,439

6.3

Source: Angel Research, Bloomberg

Mid Cap

Market

CMP

Target

Upside

Company

Sector

Rating

Cap (` Cr)

(`)

(`)

(%)

Bajaj Electricals

Others

2,609

Buy

259

341

31.8

Garware Wall Rope Others

697

Buy

294

390

32.6

Hindustan Media Ven. Media

1,768

Buy

241

292

21.2

MBL Infrastructures Construction

1,170

Buy

282

395

39.8

Mangalam Cements Cement

718

Buy

269

349

29.7

Minda Industries

Auto Ancillary

850

Buy

536

652

21.6

MT Educare

Others

462

Buy

116

141

21.4

Radico Khaitan

Others

1,252

Buy

94

112

19.0

JK Tyre

Auto Ancillary

2,599 Accumulate

115

127

10.8

Source: Angel Research, Bloomberg

Market Outlook

August 3, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.