1

1

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

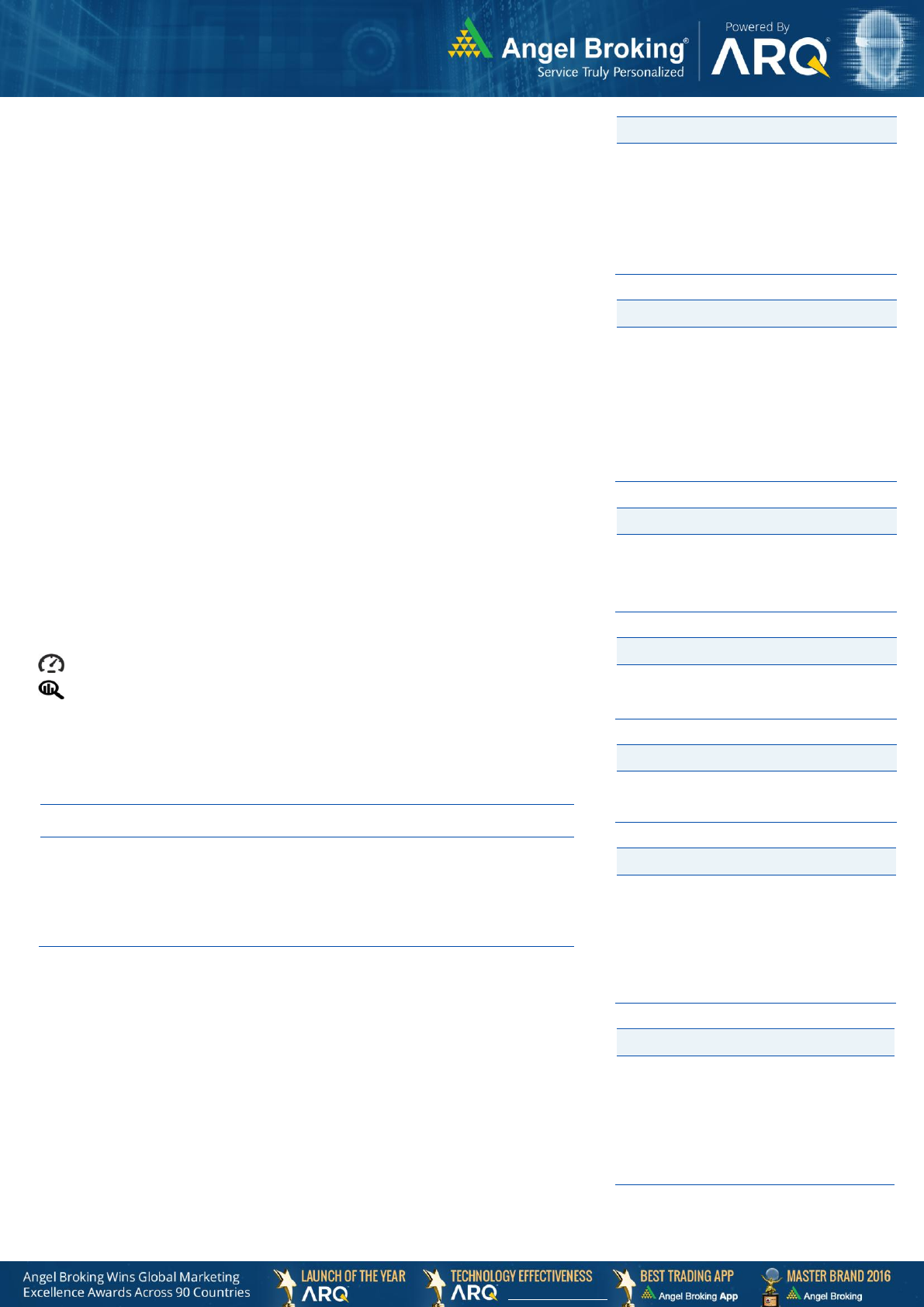

Market Cues

Indian markets are likely to open negative tracking global indices and SGX Nifty.

The US stocks staged a recovery attempt in afternoon trading on Friday after coming

under pressure early in the session but pulled back sharply going into the close. The

Dow posted a steep loss after recording its biggest three-day spike since 1931. The

Dow plunged 4.1 percent to 21,636 and the Nasdaq tumbled 3.8 percent to 7,502.

UK stocks fell on Friday as investors booked some profits after a three-day rally on

stimulus expectations. The FTSE 100 was down by 3.9 percent to 5,585.

On domestic front, Indian shares gave up early gains to end mixed on Friday

as coronavirus worries persisted and Moody's Investors Service slashed India's

economic growth projection for 2020 to 2.5 percent from 5.3 percent earlier, saying

the 21-day lockdown would result in a sharp loss in incomes and further weigh on

domestic demand and the pace of recovery. The benchmark BSE Sensex was down

by 0.4 percent to 29,815.

News Analysis

RBI measures amid COVID-19

Detailed analysis on Pg2

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Top Picks

Company

Sector

Rating

CMP

(`)

Target

(`)

Upside

(%)

Hawkins Cooker

Others

Buy

3,864

6,200

60.5

KEI Industries

Miscellaneous

Buy

255

400

56.7

Asian Paints

Paints

Buy

1,606

2,118

31.9

Bata India

Cement

Buy

1,228

1,800

46.6

More Top Picks on Pg4

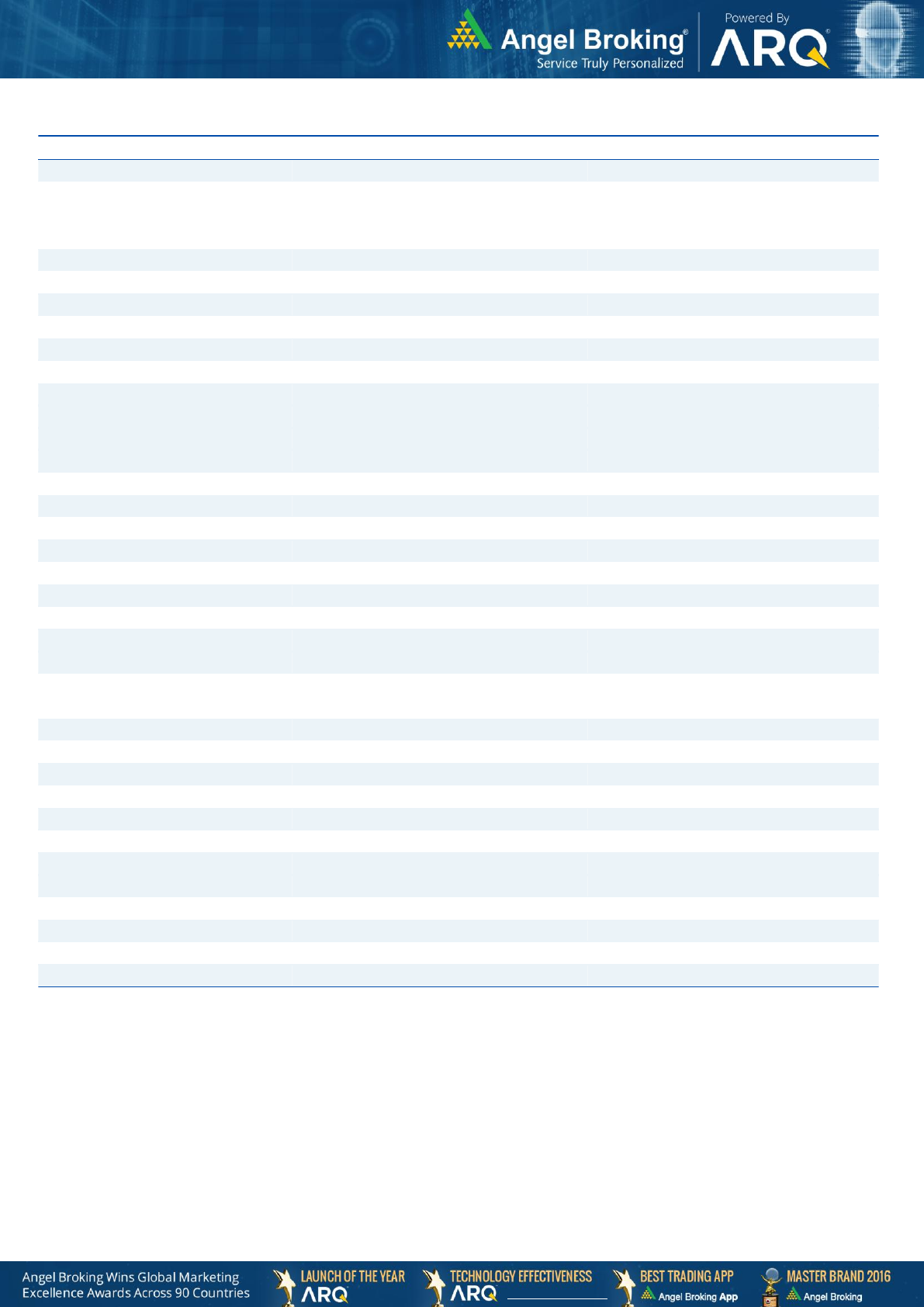

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

(0.4)

(131)

29,815

Nifty

0.2

19

8,660

Mid Cap

(0.3)

(30)

10,538

Small Cap

0.3

27

9,497

Bankex

0.9

218

22,966

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

(4.1)

(915)

21,636

Nasdaq

(3.8)

(295)

7,502

FTSE

(3.9)

(228)

5,585

Nikkei

3.9

725

19,389

Hang Seng

0.6

132

23,484

Shanghai Com

0.3

7

2,772

Advances / Declines

BSE

NSE

Advances

1,133

1,025

Declines

1,171

806

Unchanged

177

114

Volumes (` Cr)

BSE

14,342

NSE

47,056

Net Inflows (` Cr)

Net

Mtd

Ytd

FII

(3,453)

(49619)

(39,421)

*MFs

1,198

19,043

27,477

Top Gainers

Price (₹)

Chg (%)

BANDHANBNK

250

15.1

MMTC

12

12.6

SUNDRMFAST

285

12.1

CEATLTD

733

11.1

SRTRANSFIN

724

11.0

Top Losers

Price (

`

)

Chg (%)

MAHSEAMLES

208

-15.1

TEAMLEASE

1,529

-9.9

JAMNAAUTO

25

-9.2

ADANIENT

128

-8.9

BAJFINANCE

2,545

-8.8

As on Mar 27, 2020

2

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

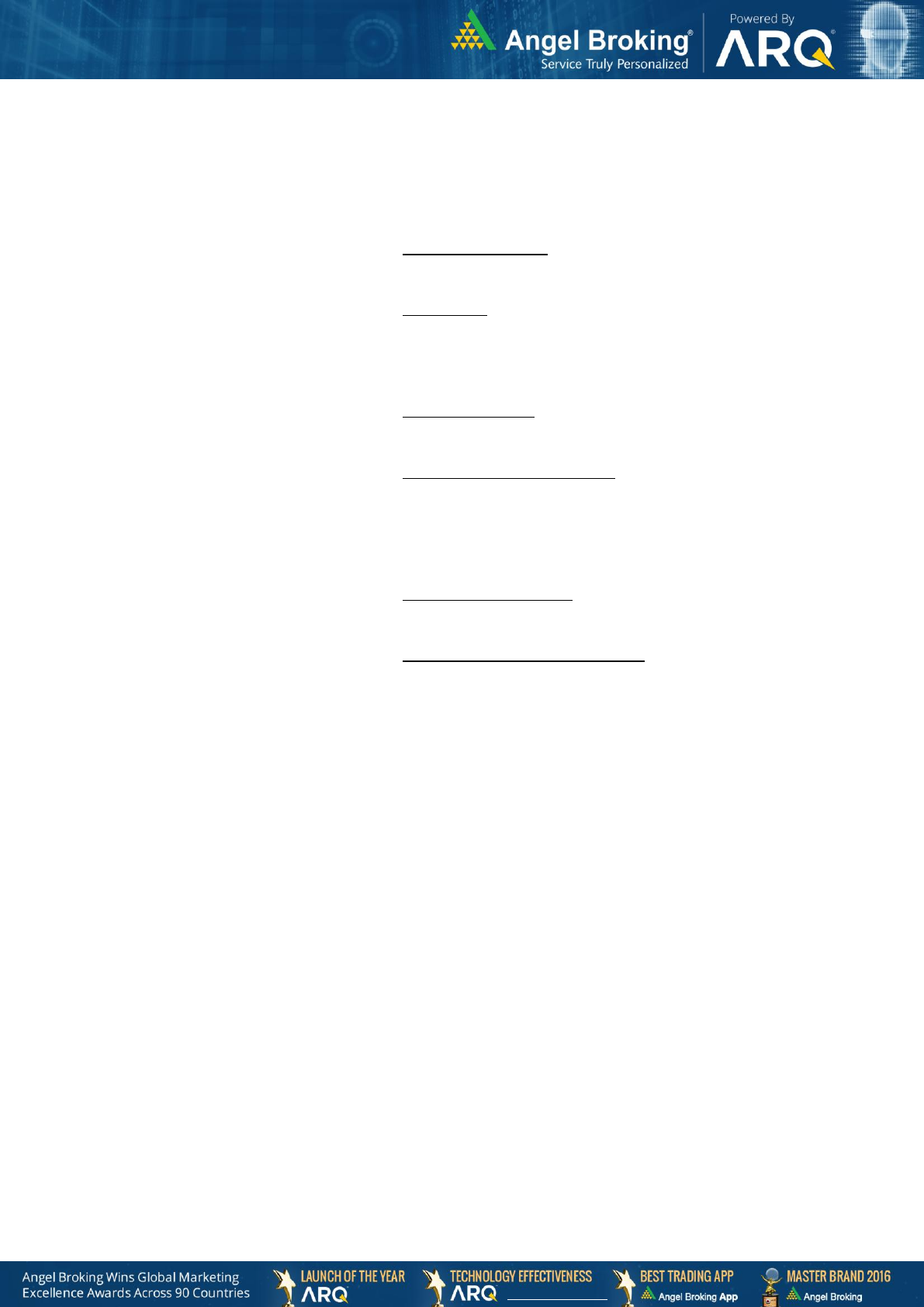

News Analysis:

RBI measures amid COVID-19

RBI preponed its 7

th

bi-monthly monetary policy meeting to 27

th

March,2020

instead of having the meeting on 31

st

March and 3

rd

April, 2020 in view of the

deteriorating economic situation. The central bank has brought in measures as

mentioned below to ensure adequate liquidity is available and to ease the liquidity

constraints related to COVID-19.

1) Reduced interest rates: The RBI reduced repo rate by 75 bps to 4.4 per

cent and reverse repo rate by 90 bps to 4 per cent to maintain financial

stability and revive growth.

2) Lowered CRR: The Cash Reserve Ratio (CRR) of all banks was also cut

down by 100 basis points to 3% of net demand and time liabilities (NDTL)

with effect from 28 March, 2020 for a period of 1 year. This reduction

would release liquidity of nearly `1.4 lakh crore and this dispensation

would be available till 26 March, 2021.

3) MSF rate increased: The borrowing limit under marginal standing facility

(MSF) is now increased to 3 per cent of SLR from 2 per cent. This

applicable with immediate effect up till 30 June, 2020.

4) Relaxation on EMIs for 3 months:: All commercial and co-operative

banks, NBFCs and all-India Financial Institutions are permitted to allow a

moratorium of 3 months on EMI payments except in case of credit-card

outstanding. Lending institutions can also allow deferment of interest

payments on working capital loans and overdrafts for three months. Such

deferment won’t be considered as NPAs

5) Postponed NSFR execution: RBI has also deferred implementation of Net

Stable Funding Ratio (NSFR) by six months to 1 October, 2020. As per the

BCBS, banks in India are required to maintain NSFR of 100 per cent.

6) Banks permitted to participate in NDF: Banks in India, which operate

International Financial Centre Banking Units are permitted to participate

in non-deliverable fund (NDF) market from 1 June, 2020.

Economic and Political News

Industry calls for extended financial year due to coronavirus pandemic

Covid-19 impact: Fruit, veggie exports to fall 30-40% on global lockdown

Government ends FY20 divestment programme with Rs 14,700-cr shortfall

Forex reserves fall by $12 bn to $499 bn; rupee hits all-time low: RBI data

Govt approves additional Rs 5,751 cr to 8 states as calamity relief

Corporate News

Sun Pharma's product approvals at risk as USFDA labels Halol plant as OAI

JSW Group pledges Rs 100 cr to PM-CARES Fund for Covid-19 relief efforts

Tatas open their vault, commit Rs 1,500 crore to fight coronavirus

JICA grants Rs 11,033-cr ODA loan for Freight Corridor, Mumbai Metro

Govt raises Rs 11,500 cr from strategic sale of THDC, NEEPCO to NTPC

3

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Top Picks

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

KEI Industries

2,284

255

400

56.7

High order book execution in EPC segment, rising

B2C sales and higher exports to boost the revenues

and profitability

Hawkins Cooker

2,044

3,864

6,200

60.5

We forecast HCL to report healthy top-line CAGR

of ~14% to `976cr over FY19-22E on the back of

government initiatives, new product launches,

strong brand name and wide distribution network.

On the bottom-line front, we estimate ~23% CAGR

to `100cr due to strong revenue and operating

margin improvement

GMM Pfaudler

3,645

2,493

3,437

37.8

Post the GMM Pfaudler (CMP INR 2542.5) Q3FY20

numbers we are introducing our FY22 EPS estimate

of INR 114.5. We raise our target price to INR

2864 (25xFY22E EPS estimate)

ICICI Bank

2,20,131

340

590

73.5

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

resolution of NPA would reduce provision cost,

which would help to report better ROE.

Asian Paints

1,54,066

1,606

2,118

31.9

Asian Paints (APL) is India's largest paints company.

We expect APL to report healthy bottom-line CAGR

of ~19% over FY2019-22E due to leadership

position, strong brand, wide distribution network

(60,000+ dealers across the country) and

improvement in operating margins (back of falling

crude prices).

Bata India

15,778

1,228

1,800

46.6

We expect Bata India to report net revenue CAGR

of ~11% to ~`3,974cr over FY2019-22E mainly

due to increasing brand consciousness among

Indian consumers, new product launches, higher

number of store additions in tier II/ III cities and

focus on high growth women’s segment. Further,

on the bottom-line front, we expect CAGR of ~20%

to `562cr over the same period on the back of

margin improvement (increasing premium product

sales).

Nestle India

1,45,500

15,091

17,355

15.1

Nestle India Ltd (Nestle) manufactures and sells a

variety of food products such as Milk & Nutrition,

Prepared Dishes & Cooking Aids, Powdered &

Liquid Beverages and Confectionery. Going

forward, we expect healthy growth and profitability

on the back of strong brand recall, wide

distribution network (4.6mn outlets across

India) and new product launches.

Hindustan Unilever

4,63,336

2,140

2,461

15.0

Hindustan Unilever Ltd (HUL) is engaged in

manufacturing of branded and packaged FMCG

products. We expect HUL to report healthy bottom-

line CAGR of ~12% over FY2019-22E due to

healthy volume growth on the back of strong

brand, wide distribution network

Colgate Palmolive

31,323

1,152

1,325

15.1

We believe that the company should ultimately be

able to see sharper market share gain in

toothpastes segment on the back of higher ad-

spend and re-launch of Colgate Strong Teeth

(decent traction seen in last quarter)

Avenue Supermarts

1,34,950

2,038

2,395

17.5

Avenue Supermarts owns and operates the

supermarket chain ‘D-MART’. Focused on value

retailing, it offers a wide range of fast-moving

consumer (food and non-food) products, general

merchandise and apparel.We expect DMART to

report consolidated revenue/PAT CAGR

of 18%/26%, respectively over FY2019-22E.

4

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Fundamental Call

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

CCL Products

2,329

175

360

105.7

CCL is likely to maintain the strong growth

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

LT Finance Holding

10,656

53

150

182.2

L&T Fin’s new management is on track to achieve

ROE of 18% by 2020 and recent capital infusion

of `3000cr would support advance growth.

Inox Wind

384

17

NA

NA

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable

energy industry dynamics in favor of wind energy

segment viz. changes in auction regime from

Feed-In-Tariff (FIT) to reverse auction regime and

Government’s guidance for 10GW auction in

FY19 and FY20 each.

Jindal Steel & Power Limited

9,058

89

NA

NA

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

RBL Bank

8,160

160

NA

NA

We believe advance to grow at a healthy CAGR of

35% over FY18-20E. Below peers level ROA (1.2%

FY18) to expand led by margin expansion and

lower credit cost.

Shriram Transport Finance

16,436

724

NA

NA

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by rising

bond yields on the back of stronger pricing power

and an enhancing ROE by 750bps over FY18-

20E, supported by decline in credit cost.

Amber Enterprise

3,839

1,221

1,830

49.9

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in. It is a one-

stop solutions provider for the major brands in the

RAC industry and currently serves eight out of the

10 top RAC brands in India

Safari Industries

878

392

492

25.4

Third largest brand play in luggage segment

Increased product offerings and improving

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

Ultratech Cement

90,858

3,148

5,373

70.7

Post merger of Century textile’s cement division of

13.4mn TPA from H2FY20 company will have

~110mn TPA of capacity with a dominant position

in West and central India. We are positive on the

long term prospects of the Company given ramp

up from acquired capacities and pricing discipline

in the industry. Reduction in tax rate for domestic

companies to 22% from 30% will improve

profitability for the company.

4

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

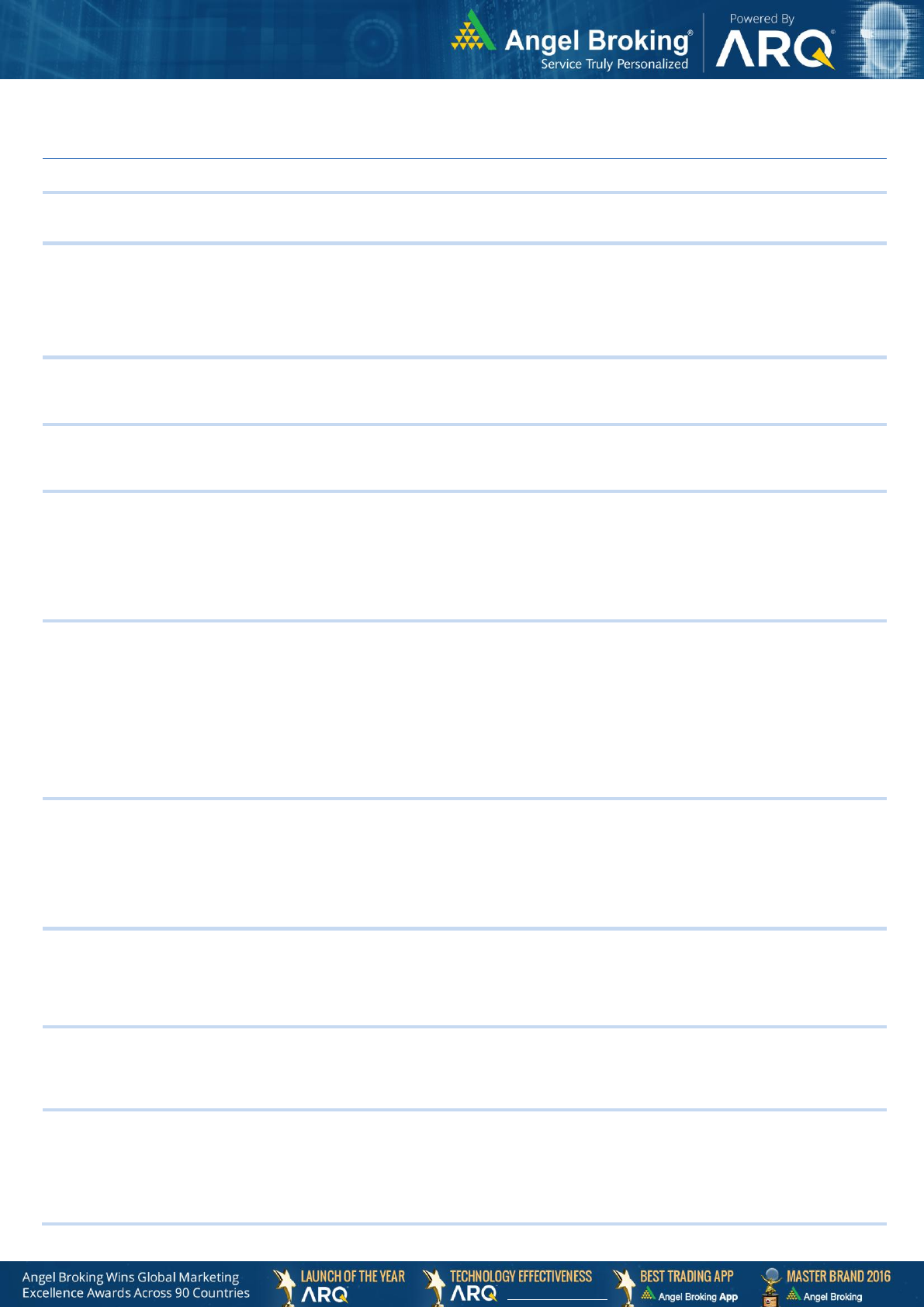

Macro watch

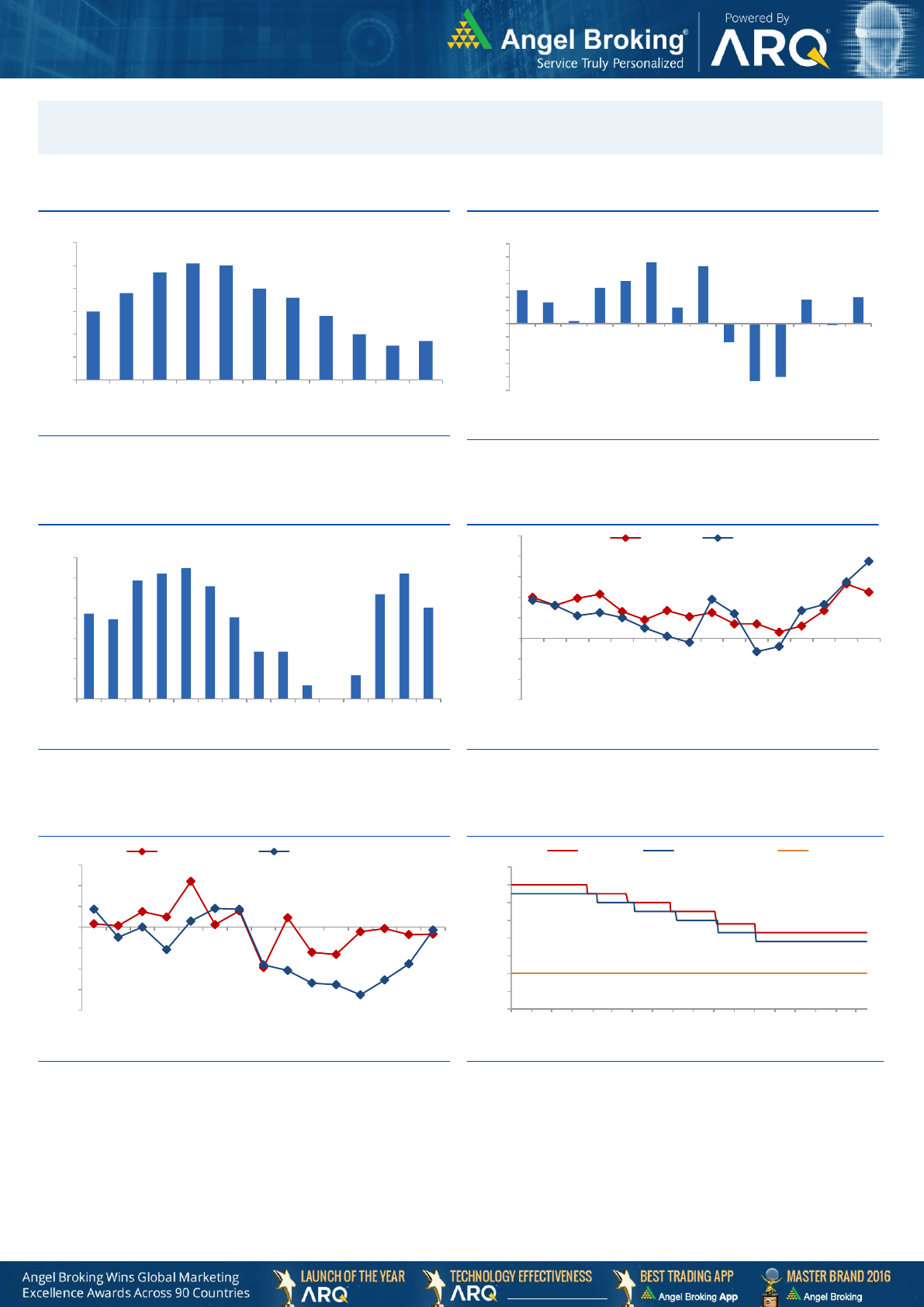

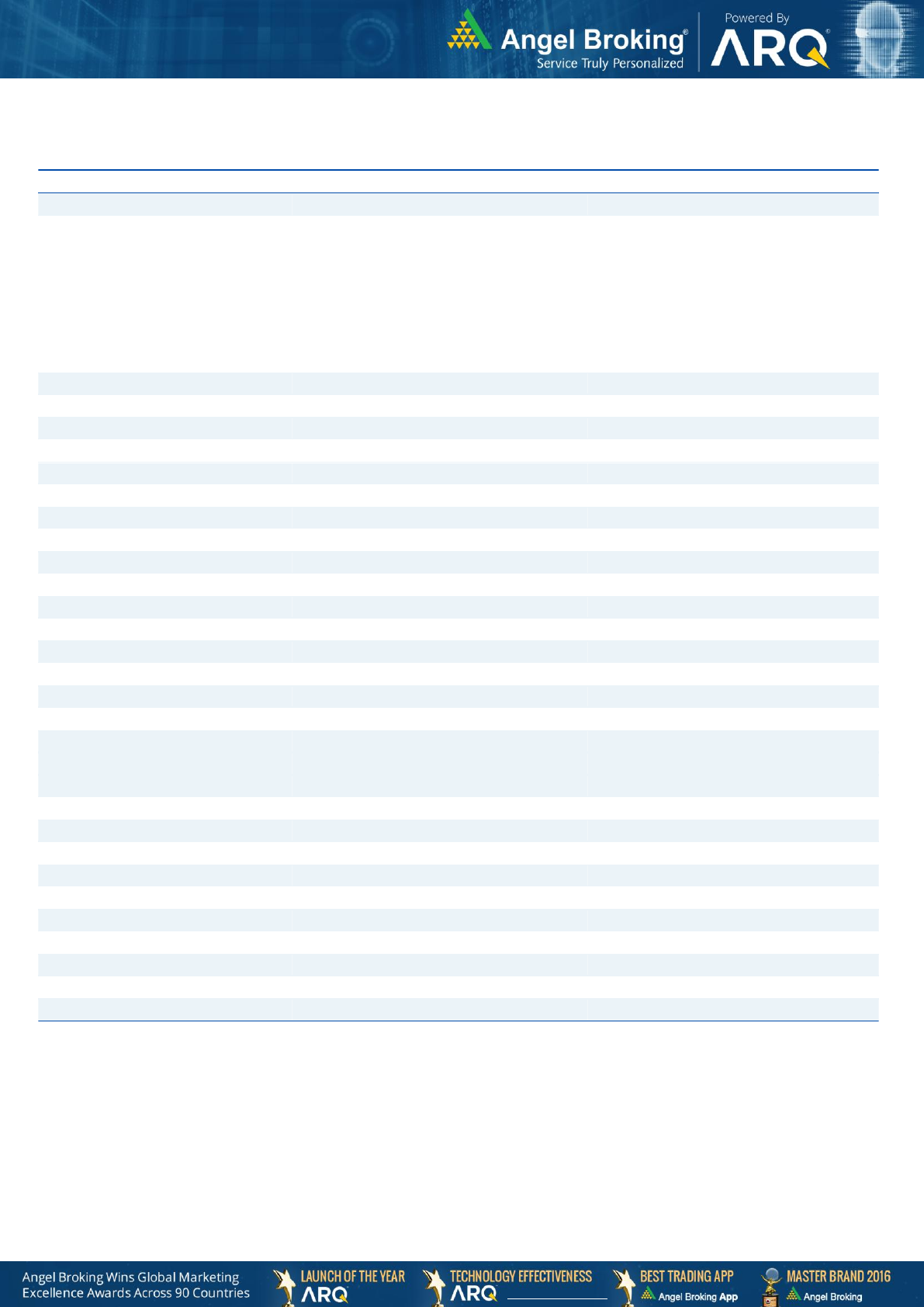

Exhibit 1: Quarterly GDP trends

Source: CSO, Angel Research

Exhibit 2: IIP trends

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Source: MOSPI, Angel Research

Exhibit 4: Manufacturing and services PMI

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Source: Bloomberg, Angel Research As of 18 March, 2020

Exhibit 6: Key policy rates

Source: RBI, Angel Research

6.0

6.8

7.7

8.1

8.0

7.0

6.6

5.8

5.0

4.5

4.7

3.0

4.0

5.0

6.0

7.0

8.0

9.0

1QFY18

2QFY18

3QFY18

4QFY18

1QFY19

2QFY19

3QFY19

4QFY19

1QFY20

2QFY20

3QFY20

(%)

2.5

1.6

0.2

2.7

3.2

4.6

1.2

4.3

(1.4)

(4.3)

(4.0)

1.8

(0.1)

2.0

(5.0)

(4.0)

(3.0)

(2.0)

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

(%)

2.11

1.97

2.9

3.1

3.24

2.79

2.0

1.2

1.2

0.3

0.0

0.6

2.6

3.1

2.3

0

0.5

1

1.5

2

2.5

3

3.5

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

(%)

44

46

48

50

52

54

56

58

60

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mfg. PMI

Services PMI

(20.0)

(15.0)

(10.0)

(5.0)

0.0

5.0

10.0

15.0

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Exports yoy growth

Imports yoy growth

(%)

3

3.5

4

4.5

5

5.5

6

6.5

7

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Repo rate

Reverse Repo rate

CRR

(%)

5

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Global watch

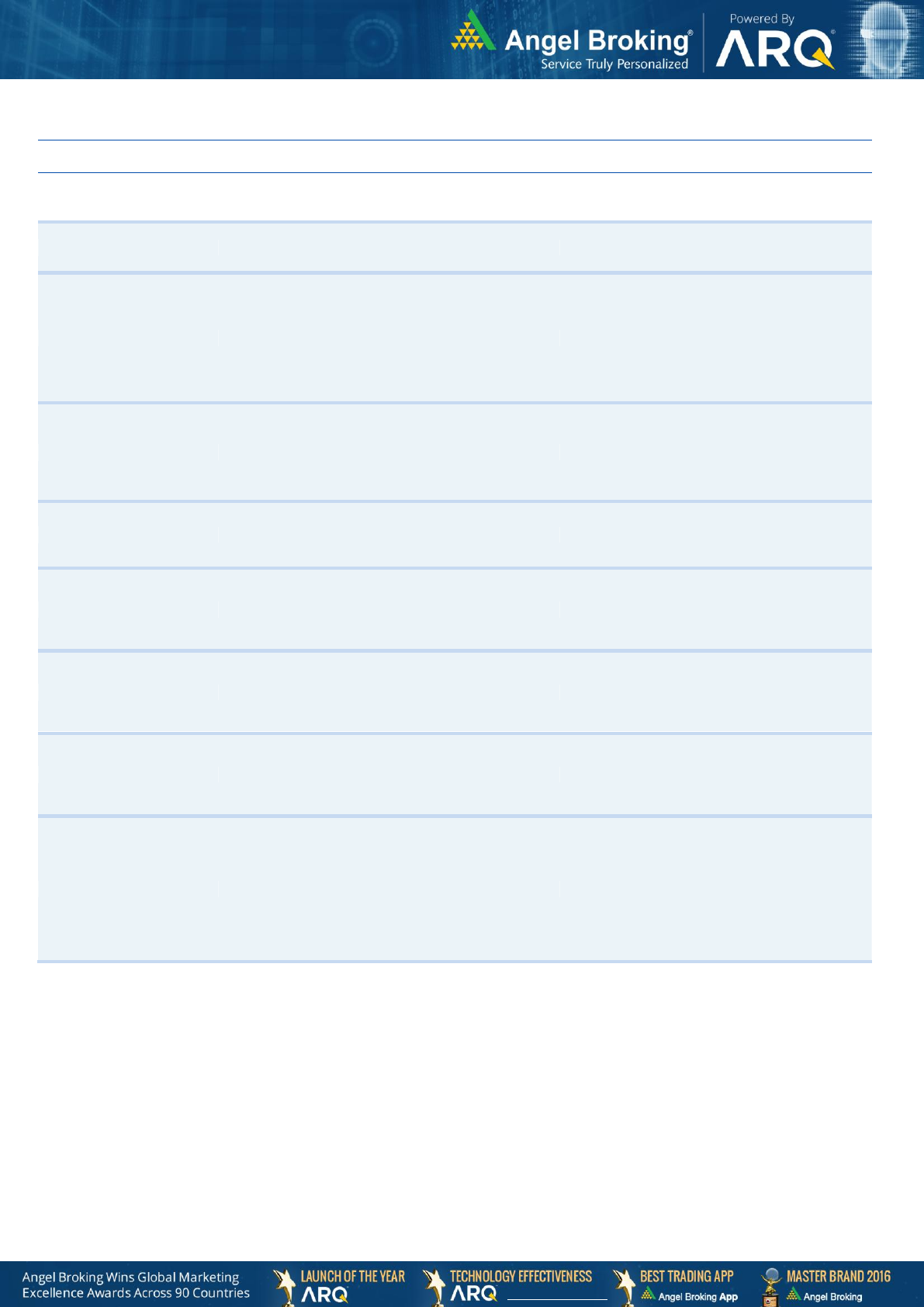

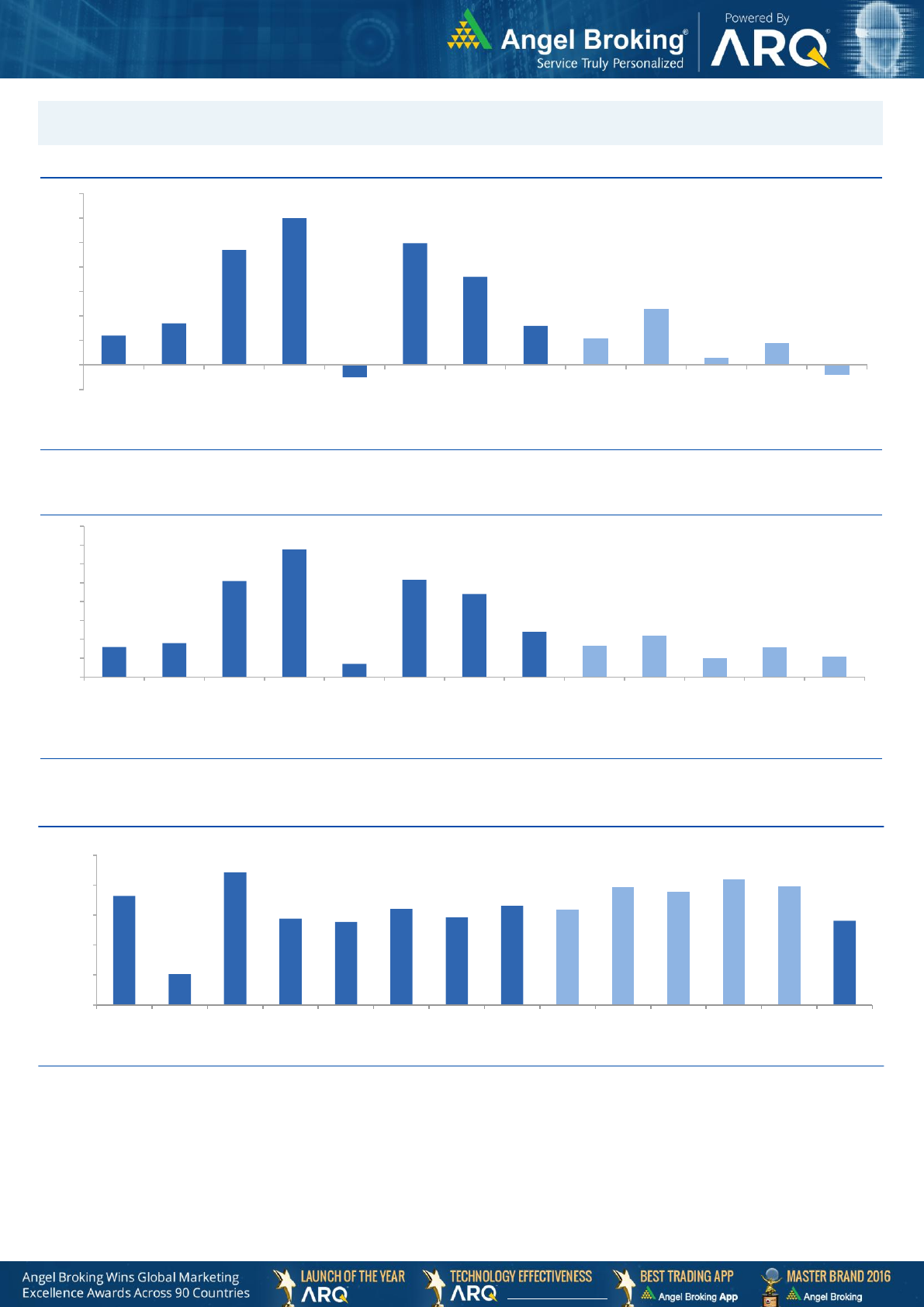

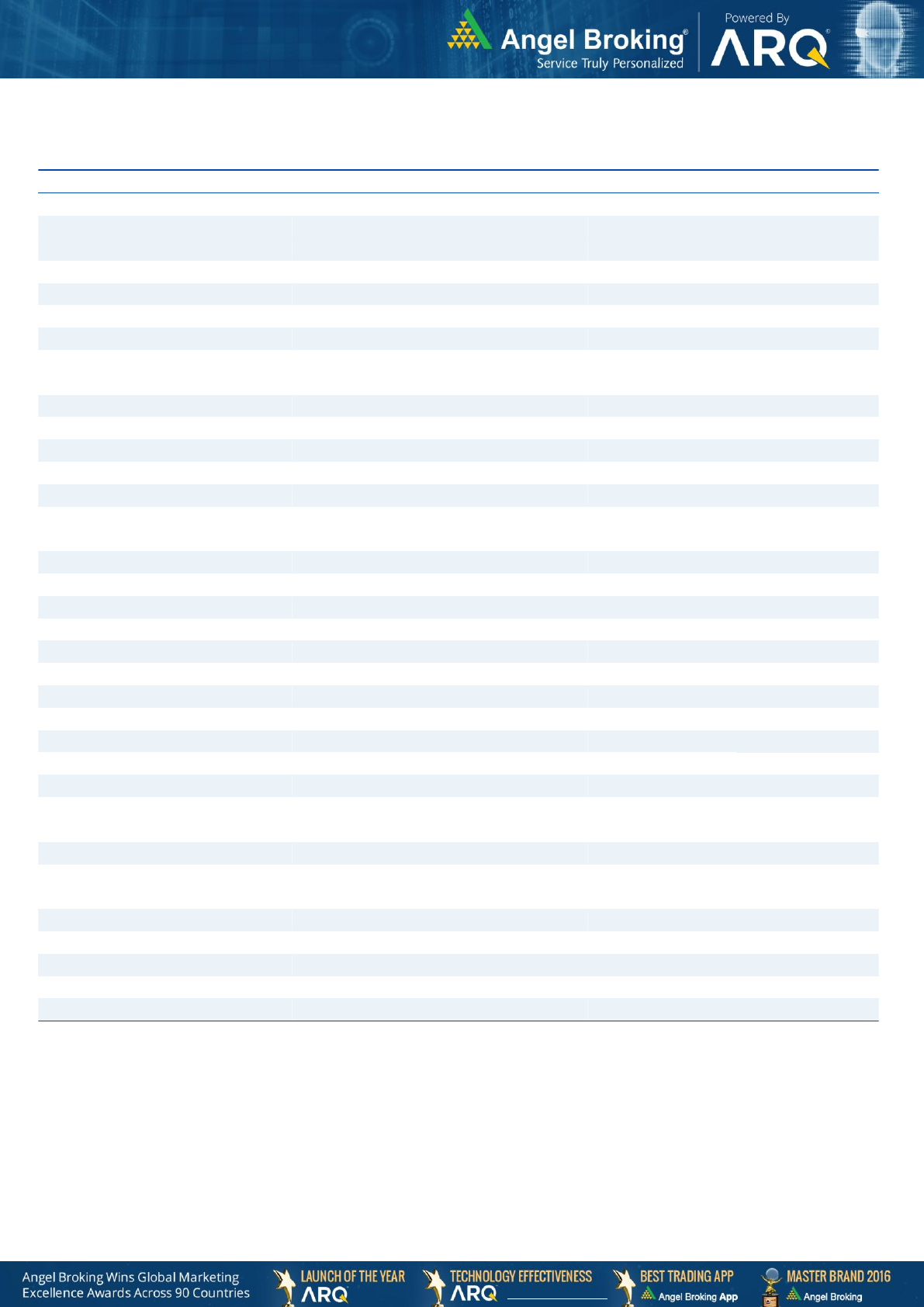

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

Source: IMF, Angel Research As of 18 March, 2020

1.2

1.7

4.7

6.0

(0.5)

5.0

3.6

1.6

1.1

2.3

0.3

0.9

(0.4)

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Brazil

Russia

India

China

South Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

1.6

1.8

5.1

6.8

0.7

5.2

4.4

2.4

1.7

2.2

1.0

1.6

1.1

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Brazil

Russia

India

China

South Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

18.2

5.1

22.1

14.4

13.9

16.0

14.7

16.5

15.9

19.7

18.9

21.0

19.8

14.0

-

5.0

10.0

15.0

20.0

25.0

Brazil

Russia

India

China

South

Africa

Mexico

Indonesi

a

Malaysi

a

Thailan

d

UK

USA

German

y

France

Japan

(x)

6

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

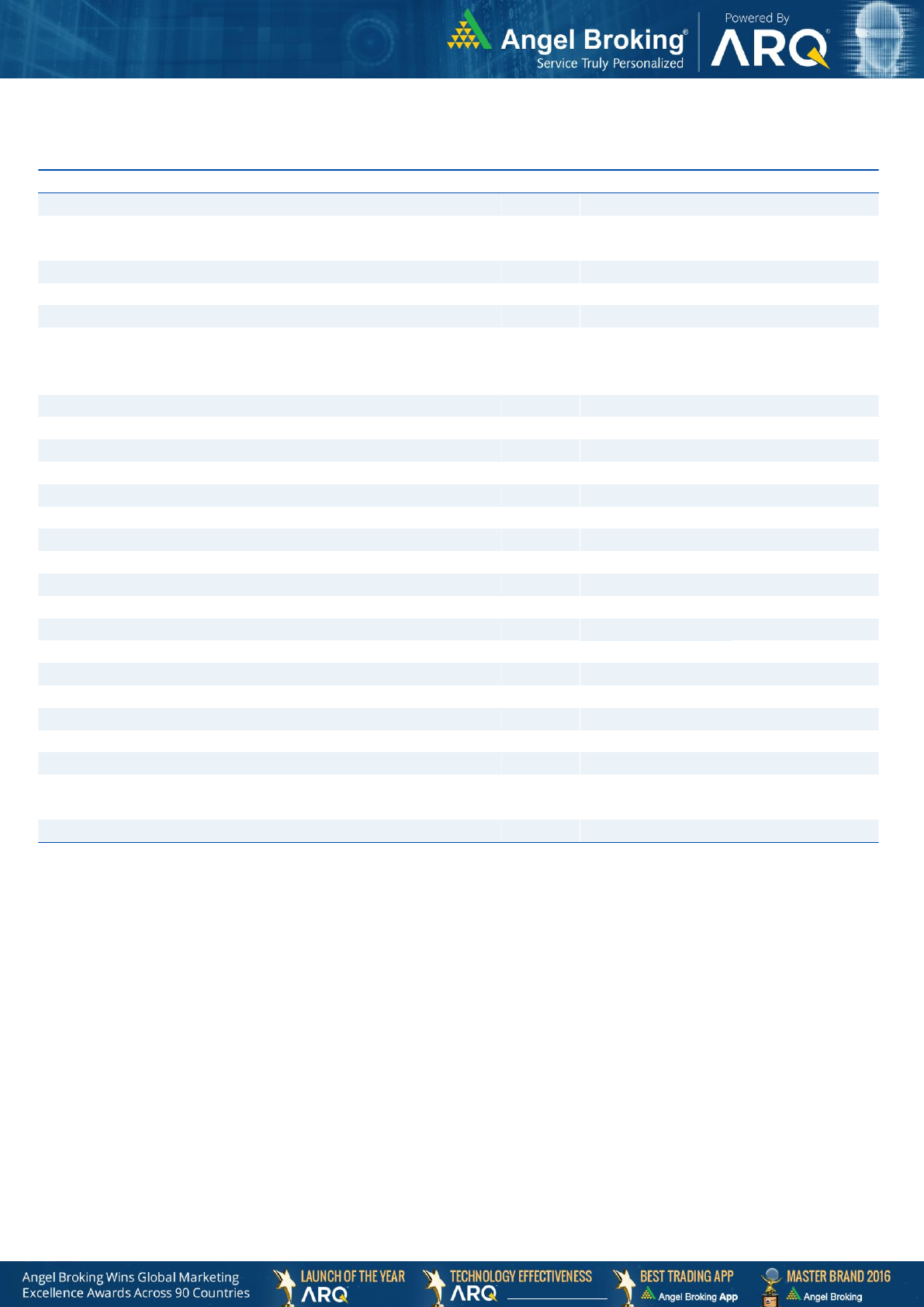

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

82678

-28.3

-24.1

-17.3

Russia

Micex

2267

-27.1

-24.8

-9.1

India

Nifty

9197

-24.1

-23.7

-19.5

China

Shanghai Composite

2789

-6.5

-7.7

-9.9

South Africa

Top 40

36444

-30.2

-28.2

-26.8

Mexico

Mexbol

36637

-18.5

-17.5

-13.3

Indonesia

LQ45

732

-23.3

-27.4

-28.6

Malaysia

KLCI

1281

-16.7

-19.9

-24.2

Thailand

SET 50

689

-32.8

-34.4

-35.9

USA

Dow Jones

23185

-20.7

-18.0

-10.5

UK

FTSE

5366

-27.8

-28.7

-26.5

Japan

Nikkei

17002

-26.7

-29.4

-21.2

Germany

DAX

9232

-33.0

-30.5

-20.8

France

CAC

4118

-32.3

-31.0

-23.9

Source: Bloomberg, Angel Research As of 18 March, 2020

7

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

11-03-2020

Top Picks

Asian Paints

1,864

2,118

Open

30-03-2020

Fundamental

Ultratech Cement

3,148

5,373

Hold

30-10-2019

Top Picks

Ultratech Cement

4,481

5,373

Open

25-02-2020

Top Picks

Larsen Toubro

1,250

Closed(25/02/2020)

29-10-2019

Top Picks

Larsen Toubro

1,365

1,689

Open

28-01-2020

Top Picks

Hawkins Cooker

4,332

4,732

Open

13-01-2020

Top Picks

Hawkins Cooker

3,591

4,353

Open

06-06-2019

Fundamental

Inox Wind

55

Hold

10-08-2018

Top Picks

Inox Wind

107

127

Open

08-11-2019

Top Picks

TTK Prestige

6075

Closed(08/11/2019)

30-11-2018

Top Picks

TTK Prestige

7,206

8,200

Open

09-08-2018

Top Picks

TTK Prestige

6,206

7,500

Open

07-10-2019

Fundamental

Aurobindo Pharma

460

Closed(07/10/2019)

26-09-2019

Fundamental

Aurobindo Pharma

610

Hold

07-09-2019

Top Picks

Aurobindo Pharma

759

870

Open

06-07-2018

Top Picks

Aurobindo Pharma

603

780

Open

11-03-2020

Top Picks

RBL Bank

227

Hold

31-10-2019

Top Picks

RBL Bank

312

410

Open

22-07-2019

Top Picks

RBL Bank

500

650

Open

04-04-2019

Top Picks

RBL Bank

649

775

Open

30-08-2018

Top Picks

RBL Bank

626

690

Open

06-07-2018

Top Picks

RBL Bank

565

670

Open

02-12-2019

Fundamental

Yes Bank

64

Closed(02/12/2019)

18-07-2019

Fundamental

Yes Bank

98

Hold

30-04-2019

Fundamental

Yes Bank

168

Hold

25-01-2019

Top Picks

Yes Bank

214

280

Open

27-07-2019

Top Picks

Yes Bank

370

435

Open

06-07-2018

Top Picks

Yes Bank

348

418

Open

05-10-2019

Fundamental

Jindal Steel & Power

94

Hold

24-05-2019

Top Picks

Jindal Steel & Power

152

250

Open

07-02-2019

Top Picks

Jindal Steel & Power

135

249

Open

15-11-2018

Top Picks

Jindal Steel & Power

175

320

Open

30-06-2018

Top Picks

Jindal Steel & Power

222

350

Open

11-03-2020

Top Picks

Shriram Transport Finance Com

987

Hold

05-02-2020

Top Picks

Shriram Transport Finance Com

1,047

1410

Open

22-01-2020

Fundamental

Shriram Transport Finance Com

1,090

1410

Hold

30-10-2019

Top Picks

Shriram Transport Finance Com

1,156

1410

Open

07-08-2019

Top Picks

Shriram Transport Finance Com

1,000

1385

Open

25-05-2019

Top Picks

Shriram Transport Finance Com

1,106

1470

Open

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

Source: Company, Angel Research

8

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

12-03-2020

Top Picks

Bata India

1,411

1800

Open

06-02-2020

Fundamental

Bata India

1,856

Closed(06/02/2020)

03-09-2019

Fundamental

Bata India

1,538

1,865

Hold

03-08-2019

Top Picks

Bata India

1,310

1,525

Open

13-02-2019

Top Picks

Bata India

1,189

1,479

Open

03-11-2018

Top Picks

Bata India

1,008

1,243

Open

30-07-2018

Top Picks

Bata India

918

1,007

Open

23-07-2018

Top Picks

Bata India

842

955

Open

01-07-2018

Top Picks

Bata India

862

948

Open

18-06-2018

Top Picks

Bata India

779

896

Open

30-03-2020

Fundamental

Amber Enterprises

1,221

1,830

Hold

31-01-2020

Top Picks

Amber Enterprises

1,540

1,830

Open

09-01-2020

Fundamental

Amber Enterprises

1,209

Hold

25-09-2019

Top Picks

Amber Enterprises

901

1100

Open

16-02-2019

Top Picks

Amber Enterprises

637

910

Open

08-08-2018

Top Picks

Amber Enterprises

939

1135

Open

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-11-2019

Top Picks

M&M

580

Closed(07/11/2019)

09-08-2019

Top Picks

M&M

550

724

Open

15-02-2019

Top Picks

M&M

626

850

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

Open

22-01-2020

Fundamental

HDFC Bank

1244

Closed(22/01/2020)

20-01-2020

Fundamental

HDFC Bank

1278

1390

Hold

23-10-2019

Top Picks

HDFC Bank

1241

1390

Open

23-07-2019

Top Picks

HDFC Bank

2264

2620

Open

22-01-2019

Top Picks

HDFC Bank

2145

2500

Open

24-07-2018

Top Picks

HDFC Bank

2158

2350

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

573

1016

Closed(17/08/2018)

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

Open

31-01-2020

Top Picks

Parag Milk Foods Limited

138

Closed(31/01/2020)

25-10-2019

Top Picks

Parag Milk Foods Limited

149

200

Open

07-08-2019

Top Picks

Parag Milk Foods Limited

190

306

Open

12-02-2019

Top Picks

Parag Milk Foods Limited

211

359

Open

06-11-2018

Top Picks

Parag Milk Foods Limited

256

330

Open

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

Source: Company, Angel Research

9

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Exhibit 9: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

Open

29-02-2020

Top Picks

GMM Pfaudler Limited

2,528

3,437

Open

19-02-2020

Fundamental

GMM Pfaudler Limited

3,255

3,437

Hold

07-02-2020

Top Picks

GMM Pfaudler Limited

2,925

3,437

Open

04-02-2020

Fundamental

GMM Pfaudler Limited

2,979

Hold

29-01-2020

Top Picks

GMM Pfaudler Limited

2,528

2,864

Open

15-01-2020

Fundamental

GMM Pfaudler Limited

1,986

Hold

19-11-2019

Top Picks

GMM Pfaudler Limited

1688

2059

Open

23-09-2019

Top Picks

GMM Pfaudler Limited

1520

1740

Open

11-06-2019

Top Picks

GMM Pfaudler Limited

1470

1570

Open

13-03-2019

Top Picks

GMM Pfaudler Limited

1265

1400

Open

27-08-2018

Top Picks

GMM Pfaudler Limited

1,170

1,287

Open

18-08-2018

Top Picks

GMM Pfaudler Limited

1,024

1,200

Open

07-08-2018

Top Picks

GMM Pfaudler Limited

984

1,100

Open

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

Open

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

Open

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

Open

06-12-2019

Fundamental

Ashok Leyland

75

Closed(06/12/2019)

06-06-2019

Fundamental

Ashok Leyland

70

Hold

17-08-2018

Top Picks

Ashok Leyland

128

156

Open

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

16-12-2019

Fundamental

Greenply Industries

160

Closed(16/12/2019)

31-05-2018

Fundamental

Greenply Industries

256

364

Open

03-03-2018

Fundamental

Greenply Industries

340

395

Open

30-03-2020

Fundamental

Safari Industries

392

492

Hold

24-03-2020

Top Picks

Safari Industries

328

492

Open

43816

Top Picks

Safari Industries

623

807

Open

27-08-2018

Top Picks

Safari Industries

974

1,071

Open

14-08-2018

Top Picks

Safari Industries

868

1,000

Open

07-08-2018

Top Picks

Safari Industries

788

870

Open

16-07-2018

Top Picks

Safari Industries

693

800

Open

16-04-2018

Top Picks

Safari Industries

651

750

Open

21-02-2018

Top Picks

Safari Industries

532

650

Open

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

Open

04-11-2019

Fundamental

Elantas Beck India Ltd.

2500

Closed(04/11/2019)

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

Source: Company, Angel Research

10

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Exhibit 10: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

02-03-2020

Top Picks

ICICI Bank

497

590

Open

27-01-2020

Fundamental

ICICI Bank

536

590

Hold

09-12-2019

Top Picks

ICICI Bank

526

590

Open

29-10-2019

Top Picks

ICICI Bank

437

532

Open

25-05-2019

Top Picks

ICICI Bank

431

490

Open

15-02-2019

Top Picks

ICICI Bank

343

460

Open

30-07-2018

Top Picks

ICICI Bank

307

411

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

06-03-2020

Fundamental

Aditya Birla Capital

75

Closed(06/03/2020)

06-09-2019

Fundamental

Aditya Birla Capital

93

118

Open

09-08-2019

Top Picks

Aditya Birla Capital

89

118

Open

04-06-2019

Top Picks

Aditya Birla Capital

102

130

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1,449

Closed (29/01/2020)

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

09-05-2018

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental

Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

Open

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

Fundamental

Endurance Technologies Ltd

1111

1277

Closed (01/12/2017)

30/01/2020

Fundamental

GIC Housing

154

Closed (30/01/2020)

06-06-2019

Fundamental

GIC Housing

252

Hold

11-09-2017

Top Picks

GIC Housing

533

655

Open

28-01-2020

Fundamental

Music Broadcast Limited

29

Closed (28/01/2020)

06-06-2019

Fundamental

Music Broadcast Limited

58

Hold

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

Open

Fundamental

L&T Finance Holding

Hold

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

07-07-2017

Fundamental

L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

Source: Company, Angel Research

11

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Exhibit 11: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

28-01-2020

Top Picks

Maruti

7,065

Closed(28/01/2020)

30-07-2019

Top Picks

Maruti

5558

7,783

Open

29-10-2018

Top Picks

Maruti

6705

8,552

Open

27-07-2017

Top Picks

Maruti

9315

10820

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

19-03-2020

Top Picks

KEI Industries

257

400

Open

21-01-2020

Top Picks

KEI Industries

517

658

Open

13-11-2019

Fundamental

KEI Industries

542

Hold

07-08-2019

Top Picks

KEI Industries

464

556

Open

12-02-2019

Top Picks

KEI Industries

349

486

Open

23-05-2018

Top Picks

KEI Industries

481

589

Open

21-05-2018

Top Picks

KEI Industries

433

508

Open

25-01-2018

Top Picks

KEI Industries

400

486

Open

04-01-2017

Top Picks

KEI Industries

167

207

Open

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

Open

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

Open

30-01-2019

Fundamental

DHFL

162

Closed(30/01/2019)

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

09-12-2019

Top Picks

Blue Star

813

Closed(09/12/2019)

08-12-2015

Top Picks

Blue Star

357

867

Open

29-01-2020

Fundamental

Siyaram Silk Mills

229

Closed(28/01/2020)

06-06-2019

Fundamental

Siyaram Silk Mills

337

Hold

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company, Angel Research

12

www.angelbroking.com

Market Outlook

March 30, 2020

www.angelbroking.com

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.