Market Outlook

September 28, 2018

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open positive tracking global indices and SGX Nifty.

BSE Sensex

(0.6)

(218)

36,324

U.S. stocks gave back some ground in afternoon trading on Thursday. The major

Nifty

(0.7)

(76)

10,977

averages pulled back off their highs of the session but managed to remain in

Mid Cap

(2.2)

(336)

15,005

positive territory. The Dow edged up 0.2 percent to 26,439 and the Nasdaq climbed

Small Cap

(2.0)

(299)

14,939

0.7 percent to 8,041.

Bankex

(1.5)

(439)

27,983

UK stocks market is up in positive territory Thursday morning, even as a few

major markets in Europe trade weak amid cautious moves by investors. The FTSE

Global Indices

Chg (%)

(Pts)

(Close)

100 was up by 0.2 percent at 7,524.

Dow Jones

0.2

54

26,439

On domestic front, Indian stocks extending previous session's slide, as investors

Nasdaq

0.7

51

8,041

avoided making significant moves after the government hiked import duties on

FTSE

0.2

12

7,524

about 19 items, aiming to halt the rupee's slide. The BSE Sensex dipped by 0.6% to

36,324.

Nikkei

(1.0)

(237)

23,796

Hang Seng

(0.4)

(101)

27,715

Shanghai Com

(0.5)

(15)

2,791

News Analysis

Blue Star aims to be $1-bn-plus company in next 5 years

Advances / Declines

BSE

NSE

Advances

768

473

Detailed analysis on Pg2

Declines

1,814

1,282

Investor’s Ready Reckoner

Unchanged

156

303

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Volumes (` Cr)

Refer Pg5 onwards

BSE

1,820

NSE

853

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Buy

588

867

47.4

FII

(1,077)

(1,418)

(6,857)

Dewan Housing Finance

Financials

Buy

290

555

91.4

Parag Milk Foods

Others

Buy

249

410

64.7

*MFs

1,125

3,967

80,584

Bata India

Others

Buy

979

1,243

27.0

KEI Industries

Capital Goods

Buy

344

589

71.2

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg4

PRESTIGE

239

9.0

Key Upcoming Events

HFCL

21

6.4

Previous

Consensus

Date

Region

Event Description

VANKRANGEE

29

5.0

ReadingExpectations

Sep 28, 2018 Germany Unemployment change (000's)

(8.00)

NIACL

231

4.7

Sep 28, 2018 UK

GDP (YoY)

1.30

NILKAMAL

1734

4.2

Sep 30, 2018 China

PMI Manufacturing

51.30

Oct 01, 2018 UK

PMI Manufacturing

52.80

Top Losers

Price (`)

Chg (%)

Oct 05, 2018 US

Change in Nonfarm payrolls

201.00

More Events on Pg7

SREINFRA

33

-17.0

IBREALEST

101

-10.4

EDELWEISS

190

-10.3

203

-9.1

228

-8.5

As on Sept 27, 2018

Market Outlook

September 28, 2018

News Analysis

Blue Star aims to be $1-bn-plus company in next 5 years

consolidate its position in the room air-conditioning segment as it aims to be $1

billion plus company in the next five years, said a top company official. The home-

grown Bluestar, which on Thursday turned 75 years old, is also bullish on its

growth outlook in the overseas market. The company has plans to expand its size

markets, where it is operating, and is aiming to have a turnover of Rs 10 billion in

the next three years. "We have a goal that from five years from now, we as an 80-

year old company should have a turnover of Rs 80 billion ($ 1.1 billion). "The

growth would come from all segments B2B and B2C from the domestic and

international markets."

Bluestar is also in the process of fast indigenisation and backward integration.

"Massive focus in the next 2-3 years would be on the backward integration as the

trade barriers would continue to bother us," Thiagarajan said. The company would

also improve its electro mechanical business and special refrigeration projects in

B2B segment as the market seems to be reviving, he said. Bluestar, which presently

gets around Rs 6 billion from the international markets, has plans to increase the

global contribution to around Rs 10 billion in the next three years.

Economic and Political News

Corporate News

Market Outlook

September 28, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur

well for Cooling products business which is out

Blue Star

5,663

588

867

47.4

pacing the market growth. EMPPAC division's

profitability

to

improve once operating

environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

9,104

290

555

91.4

presence in tier-II & III cities where the growth

opportunity is immense.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

ICICI Bank

197,319

306

416

35.9

resolution of NPA would reduce provision cost,

which would help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

2,700

344

589

71.2

B2C sales and higher exports to boost the

revenues and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

1,813

317

475

49.8

requirement and 15 year long radio broadcast

licensing.

Strong brands and distribution network would

Siyaram Silk Mills

2,184

466

851

82.6

boost growth going ahead. Stock currently trades

at an inexpensive valuation.

GST regime and the Gujarat plant are expected to

Maruti Suzuki

228,253

7,556

10,820

43.2

improve the company’s sales volume and

margins, respectively.

We expect loan book to grow at 24.3% over next

GIC Housing

1,432

259

486

87.6

two year; change in borrowing mix will help in

NIM improvement

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,640

736

1,071

45.5

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect financialisation of savings and

Aditya Birla Capital

26,283

116

218

87.9

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,096

249

410

64.7

Value Added Products and reduction in interest

cost is likely to boost margins and earnings in next

few years.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

537,443

1,977

2,350

18.9

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

Source: Company, Angel Research

Market Outlook

September 28, 2018

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect strong PAT growth on back of

healthy growth in automobile segment (on

back of new launches and facelifts in some of

M&M

108,922

876

1,050

19.9

the model ) and strong growth in Tractors

segment coupled by its strong brand recall

and improvement in rural sentiment

Market leader in the room air conditioner

(RAC) outsourced manufacturing space in India

with a market share of 55.4%. It is a one-stop

Amber Enterprises

2,963

942

1,230

30.6

solutions provider for the major brands in the

RAC industry and currently serves eight out of

the 10 top RAC brands in India

BIL is the largest footwear retailer in India,

offering footwear, accessories and bags across

brands. We expect BIL to report net PAT CAGR

of

~16% to

~`3115cr over FY2018-20E

Bata India

12,594

979

1,243

27.0

mainly due to new product launches, higher

number of stores addition and focus on

women’s high growth segment and margin

improvement

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by

Shriram Transport Finance

rising bond yields on the back of stronger

26,098

1,150

1,764

53.4

pricing power and an enhancing ROE by

750bps over FY18-20E, supported by decline

in credit cost.

We expect JSPL’s top line to grow at

27%

CAGR over FY19-FY20 on the back of strong

steel demand and capacity addition. On the

Jindal Steel & Power Limited

21,778

225

327

45.3

bottom line front, we expect JSPL to turn in to

profit by FY19 on back of strong operating

margin improvement.

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

GMM Pfaulder

1,476

1,010

1,287

27.4

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

Aurobindo Pharmaceuticals, amongst the

Indian Pharmaceutical companies, is well

placed to face the challenging generic markets,

given its focus on achieving growth through

Aurobindo Pharmaceuticals

43,439

741

870

17.4

productivity. Aurobindo will report net revenue

& net profit CAGR of ~13% & ~8% resp.

during FY2018-20E. Valuations are cheap V/s

its peers and own fair multiples of 17-18x.

Well planned strategy to grow small business

loans and cross-selling would propel fees

Yes Bank

46,924

203

365

79.8

income. We expect YES to grow its advance

much higher than industry and improvement in

asset quality to support profitability.

We believe advance to grow at a healthy

CAGR of 35% over FY18-20E. Below peers

RBL Bank

22,258

524

670

27.9

level ROA

(1.2% FY18) to expand led by

margin expansion and lower credit cost.

TTK Prestige has emerged as one of the

leading brands in kitchen appliances in India

after its successful transformation from a single

TTK Prestige

7,526

6,460

8,200

26.9

product company to offering an entire gamut

of home and kitchen appliances. We are

expecting a CAGR of 18% in revenue and 25%

in PAT over FY2018-20.

Source: Company, Angel Research

Market Outlook

September 28, 2018

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect Inox Wind to report exponential

growth in top-line and bottom-line over FY19-

20E. The growth would be led by changing

renewable energy industry dynamics in favor of

Inox Winds

1,950

88

127

44.3

wind energy segment viz. changes in auction

regime from Feed-In-Tariff (FIT) to reverse

auction regime and Government’s guidance for

10GW auction in FY19 and FY20 each.

Considering the strong CV demand due to

change in BS-VI emission norms (will trigger

pre-buying activities), pick up in construction

Ashok Leyland

35,431

120

156

30.0

activities and no significant impact on industry

due to recent axle load norms, we recommend

BUY on Ashok Leyland at current valuations.

Source: Company, Angel Research

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,378

254

360

41.7

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,587

1,734

2,178

25.6

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,567

1,977

2,500

26.5

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

2,022

165

333

101.8

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

25,033

125

210

68.0

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Market Outlook

September 28, 2018

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time Country

Event Description

Unit

Period

Last Reported

Estimated

Sep 28, 2018

1:25 PMGermany Unemployment change (000's)

Thousands

Sep

(8.00)

2:00 PMUK

GDP (YoY)

% Change

2Q F

1.30

Sep 30, 2018

6:30 AMChina

PMI Manufacturing

Value

Sep

51.30

Oct 01, 2018

2:00 PMUK

PMI Manufacturing

Value

Sep

52.80

Oct 05, 2018

6:00 PMUS

Change in Nonfarm payrolls

Thousands

Sep

201.00

6:00 PMUS

Unnemployment rate

%

Sep

3.90

2:30 PMIndia

RBI Reverse Repo rate

%

Oct 5

6.25

2:30 PMIndia

RBI Repo rate

%

Oct 5

6.50

US

Producer Price Index (mom)

% Change

Sep

-

Oct 10, 2018

2:00 PMUK

Industrial Production (YoY)

% Change

Aug

0.90

6:00 PMUS

Consumer price index (mom)

% Change

Sep

0.20

Oct 11, 2018

2:30 PMIndia

RBI Cash Reserve ratio

%

Oct 5

4.00

Oct 12, 2018

5:30 PMIndia

Industrial Production YoY

% Change

Aug

6.60

China

Exports YoY%

% Change

Sep

9.80

Oct 16, 2018

0-Jan-00UK

Jobless claims change

Thousands

Sep

8.70

0-Jan-00China

Consumer Price Index (YoY)

% Change

Sep

2.30

Oct 19, 2018

0-Jan-00China

Real GDP (YoY)

% Change

3Q

6.70

Oct 25, 2018

0-Jan-00Euro Zone ECB announces interest rates

%

Oct 25

-

Sep 28, 2018

1:25 PMGermany Unemployment change (000's)

Thousands

Sep

(8.00)

Source: Bloomberg, Angel Research

Market Outlook

September 28, 2018

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

9.0

8.5

9.1

8.0

7.3

7.5

9.0

8.2

6.9

6.9

8.0

8.1

6.6

7.6

7.7

7.0

8.0

7.2

6.8

7.0

6.0

5.3

7.0

6.3

4.5

6.1

5.0

4.1

5.6

3.9

6.0

4.0

5.0

3.0

1.8

4.0

2.0

1.0

3.0

-

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

4.9

4.9

4.6

52.0

5.0

4.4

4.3

4.2

50.0

3.6

3.7

4.0

3.3

48.0

3.0

46.0

2.0

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

35.0

7.00

30.0

6.50

25.0

6.00

20.0

5.50

15.0

5.00

10.0

4.50

5.0

4.00

0.0

3.50

(5.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

September 28, 2018

Global watch

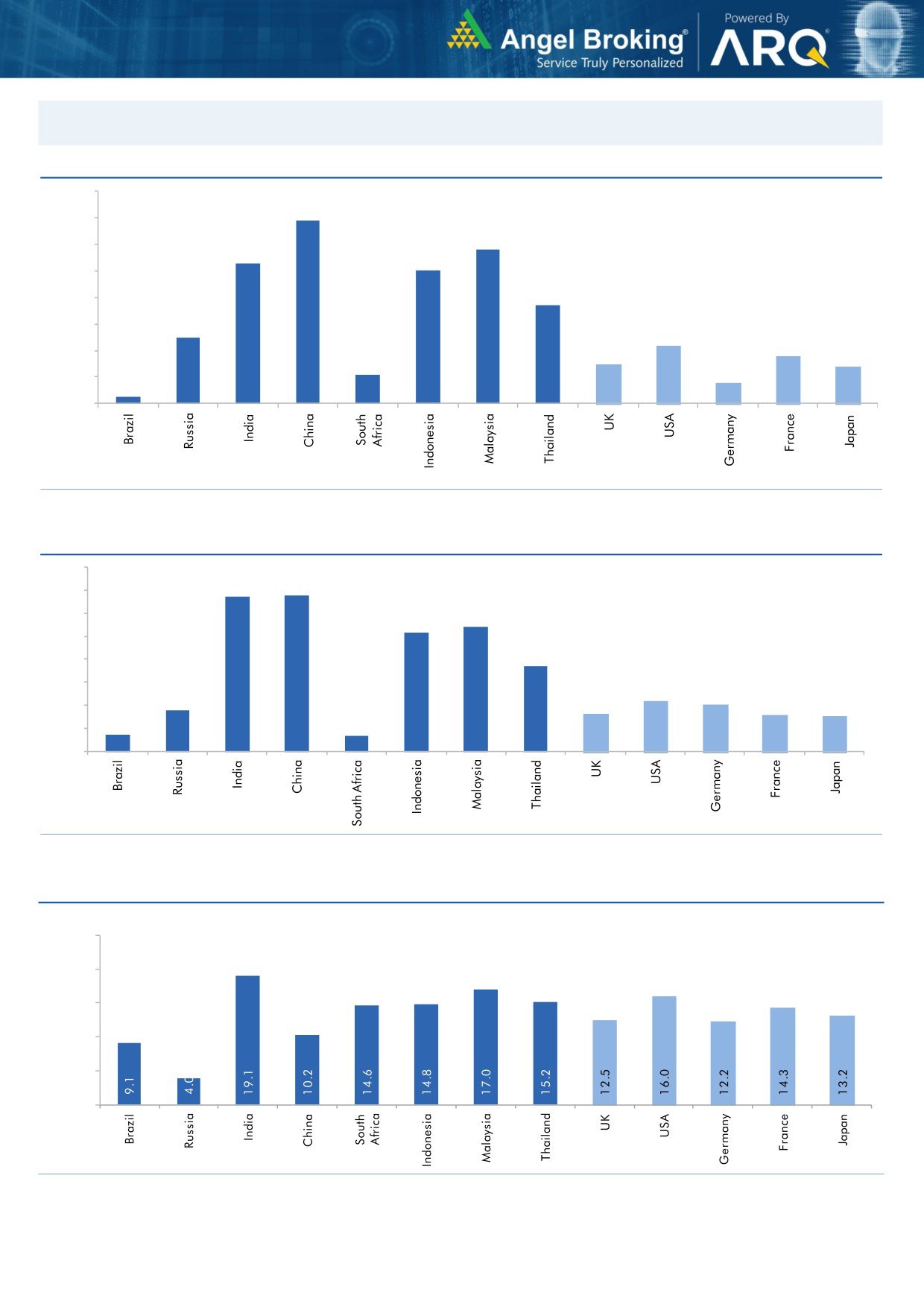

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

8.0

(%)

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

1.5

2.0

0.7

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research

Market Outlook

September 28, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

75,429

(4.0)

5.6

2.7

Russia

Micex

4,327

1.4

7.1

11.4

India

Nifty

11,515

0.7

6.1

14.1

China

Shanghai Composite

2,682

(1.5)

(11.3)

(20.8)

South Africa

Top 40

50,441

1.7

(1.7)

1.9

Mexico

Mexbol

49,612

2.2

6.3

(1.0)

Indonesia

LQ45

937

(2.7)

(2.6)

(4.7)

Malaysia

KLCI

1,804

(0.1)

1.6

1.7

Thailand

SET 50

1,136

2.5

0.7

9.9

USA

Dow Jones

26,155

3.4

3.9

17.5

UK

FTSE

7,304

(4.0)

(4.3)

0.7

Japan

Nikkei

23,095

4.0

1.1

19.8

Germany

DAX

12,124

(0.3)

(5.5)

(3.2)

France

CAC

5,353

0.9

(1.8)

2.1

Source: Bloomberg, Angel Research As of 25 Sep, 2018

Market Outlook

September 28, 2018

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

17-08-2018

Top Picks

Ashok Leyland

128

156

Open

10-08-2018

Top Picks

Inox Wind

107

127

Open

31-08-2018

Top Picks

TTK Prstige

7,235

8,200

Open

09-08-2018

Top Picks

TTK Prstige

6,206

7,500

06-07-2018

Top Picks

Aurobindo Pharma

603

780

Open

30-08-2018

Top Picks

RBL Bank

626

690

Open

06-07-2018

Top Picks

RBL Bank

565

670

06-07-2018

Top Picks

Yes Bank

348

418

Open

30-06-2018

Top Picks

Jindal Steel & Power

222

350

Open

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

30-07-2018

Top Picks

Bata India

918

1,007

Open

23-07-2018

Top Picks

Bata India

842

955

01-07-2018

Top Picks

Bata India

862

948

18-06-2018

Top Picks

Bata India

779

896

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

573

1016

Closed(17/08/2018)

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

27-08-2018

Top Picks

GMM Pfaudler Limited

1,170

1,287

Open

18-08-2018

Top Picks

GMM Pfaudler Limited

1,024

1,200

07-08-2018

Top Picks

GMM Pfaudler Limited

984

1,100

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

03-03-2018

Fundamental

Greenply Industries

340

395

Open

27-08-2018

Top Picks

Safari Industries

974

1,071

Open

14-08-2018

Top Picks

Safari Industries

868

1,000

07-08-2018

Top Picks

Safari Industries

788

870

16-07-2018

Top Picks

Safari Industries

693

800

16-04-2018

Top Picks

Safari Industries

651

750

21-02-2018

Top Picks

Safari Industries

532

650

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

Source: Company, Angel Research

Market Outlook

September 28, 2018

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

FundamentalEndurance Technologies Ltd

1111

1277

Closed (01/12/2017)

11-09-2017

Top Picks

GIC Housing

533

655

Open

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

07-07-2017

Fundamental L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

05-07-2017

Top Picks

Maruti

7371

10619

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

23-05-2018

Top Picks

KEI Industries

481

589

Open

04-01-2017

Top Picks

KEI Industries

125

485

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

08-12-2015

Top Picks

Blue Star

357

867

Open

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company

Market Outlook

September 28, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.