Market Outlook

July 3, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking SGX Nifty and global indices.

BSE Sensex

0.2

64

30,922

After seeing a modest strength for much of the session, the major US indices lost the

Nifty

0.2

17

9,521

ground by closing on Friday. The tech-heavy Nasdaq pulled back into negative

Mid Cap

0.6

92

14,644

territory, while the Dow and the S&P 500 remained positive. Nasdaq edged down

Small Cap

0.7

100

15,411

0.1 percent to 6,140, the Dow rose 0.3 percent to 21,350 and the S&P 500 closed

Bankex

0.0

0

26,278

up 0.2 percent to 2,423.

Stocks in the U.K. fell on Friday on a report of paltry economic growth and a rising

Global Indices

Chg (%)

(Pts)

(Close)

pound. The FTSE 100 index ended 0.5% lower at 7,313, losing grip of a small

intraday gain after the pound pulled back from a six-week high.

Dow Jones

0.3

63

21,350

Nasdaq

(0.1)

(4)

6,140

India equity markets showed some strength on the first session of the July derivatives

FTSE

(0.5)

(38)

7,313

series on Friday, with the BSE Sensex gaining about 0.21% to 30,922 and Nifty

Nikkei

(0.9)

(187)

20,033

gaining 0.18% to 9,521 ahead of GST rollout. Indian markets closed positive

despite weakness in the global markets. This positive closing reflected the optimistic

Hang Seng

(0.8)

(201)

25,765

mood on the street on the rollout of the new indirect tax regime which came into

Shanghai Com

0.1

4

3,192

reality on 1st July 2017.

Advances / Declines

BSE

NSE

News Analysis

Advances

1,321

831

GST to boost economic growth

Maruti Suzuki June-2017 Sales

Declines

1,259

827

Unchanged

186

75

Detailed analysis on Pg2

Investor’s Ready Reckoner

Volumes (` Cr)

Key Domestic & Global Indicators

BSE

3,080

Stock Watch: Latest investment recommendations on 150+ stocks

NSE

23,336

Refer Pg6 onwards

#Net Inflows (` Cr)

Net

Mtd

Ytd

Top Picks

CMP

Target

Upside

Company

Sector

Rating

FII

(732)

2,485

54,454

(`)

(`)

(%)

MFs

21

6,954

36,994

Blue Star

Capital Goods

Buy

601

760

26.5

Dewan Housing Fin. Financials

Buy

437

520

18.9

Mahindra Lifespace Real Estate

Buy

431

522

21.2

Top Gainers

Price (`)

Chg (%)

Navkar Corporation Others

Buy

202

265

31.1

Gvkpil

9

16.2

KEI Industries

Capital Goods

Accumulate

232

258

11.0

More Top Picks on Pg5

Natcopharm

1,009

7.7

Bluedart

4,713

7.1

Key Upcoming Events

Punjlloyd

20

6.1

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

Beml

1,534

5.3

Jul 3, 2017

Germany PMI Manufacturing

59.30

59.30

Jul 3, 2017

UK

PMI Manufacturing

56.70

56.30

Top Losers

Price (`)

Chg (%)

Jul 5, 2017

US

Initial Jobless claims

244.00

243.00

Ibrealest

200

(4.3)

Jul 6, 2017

Germany PMI Services

53.70

53.70

Jul 7, 2017

UK

Industrial Production (YoY)

(0.80)

0.20

Jpassociat

22

(3.7)

More Events on Pg5

Navkarcorp

205

(2.9)

Escorts

645

(2.9)

Sintex

24

(2.8)

#as on 30t June, 2017

Market Outlook

July 3, 2017

News Analysis

GST to boost economic growth

The most awaited tax reform i.e. Goods and Service Tax (GST) became a reality on

1st July 2017. GST, with the five different tax slabs (i.e. 0%, 5%, 12%, 18% and

28%) has overhauled the indirect tax regime in India. With the new tax system in

place, economic growth is expected to increase by ~1-2%.

With the single tax throughout the country, there will not be differential pricing in

the different states which allows the companies to store their goods in few large

sized warehouses rather than multiple regional warehouses. This will help in

reducing the logistics costs and bringing more efficiency in operations which will

be helpful to the companies.

On the government side, GST offers less tax invasion and more tax collection

which will be positive for improving macros further. With the unified indirect tax

regime, ease of doing business ranking is also expected to improve which will help

in getting more FII inflows in the country. While there may be some teething

problems in the beginning, overall, we expect GST to be a positive step for the

country.

Maruti Suzuki June-2017 Sales

Maruti Suzuki's June sales grew by 7.6% to 1.06 lakh vehicles. The domestic PV

sales grew by 1% yoy to 93,057 units. While the entry level car segment saw a

decline of 8%, premium category sales grew by more than 40% indicating that the

company has kept trend of strong growth in the premium category vehicles i.e.

Ciaz, Vitara Brezza, S-Cross, etc. Total exports grew by 96% yoy to 13,131 units

in the month.

In June, due to the run up to the GST, customers were seen deferring the vehicle

purchases hence company had reduced the dispatches to the dealers as well as

had announced some discounts. With the GST implemented, company has now

fully passed on the GST benefit to its customers by cutting the car prices by about

3% in most categories. However the vehicle prices in hybrid vehicle categories

have seen mild increase.

Economic and Political News

GST to boost India's GDP growth, positive for rating: Moody's

RBI report warns of more NPA pain, sees bad loans topping 10% by March-18

Non-food credit grows at 4.5% in April as industries contract

GST, 7th Pay Commission allowances to bump up inflation temporarily: HSBC

Forex reserves at new life-time high of $382.53 billion

Corporate News

Aurobindo looks to push deeper into EU, US over next 3-4 years

Hero MotoCorp cuts prices to pass on GST benefits

GST ushers in price cuts from carmakers, but hits auto sales in June

UltraTech-Jaypee cement deal closed in relief to banks

Market Outlook

July 3, 2017

Top Picks HHHHH

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leadership

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

22,186

1,856

2,161

16.5

more products in USA, which bodes for its international

business.

We expect the company would report strong profitability

Asian Granito

1,296

431

447

3.8

owing to better product mix, higher B2C sales and

amalgamation synergy.

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

5,745

601

760

26.5

growth. EMPPAC division's profitability to improve once

operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

13,708

437

520

18.9

presence in tier-II & III cities where the growth opportunity

is immense.

Loan growth is likely to pick up after a sluggish FY17.

Karur Vysya Bank

8,744

145

160

10.6

Lower credit cost will help in strong bottomline growth.

Increasing share of CASA will help in NIM improvement.

Economic recovery to have favourable impact on

advertising & circulation revenue growth. Further, the

Jagran Prakashan

5,966

183

225

23.3

acquisition of a radio business (Radio City) would also

boost the company's revenue growth.

High order book execution in EPC segment, rising B2C

KEI Industries

1,808

232

258

11.0

sales and higher exports to boost the revenues and

profitability

Speedier execution and speedier sales, strong revenue

Mahindra Lifespace

2,210

431

522

21.2

visibilty in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at

Navkar Corporation

2,882

202

265

31.1

ICD as well CFS augurs well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

1,871

1,996

2,500

25.3

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

viewership ranking in English news genre, exit from the

TV Today Network

1,425

239

344

44.0

radio business, and anticipated growth in ad spends by

corporates to benefit the stock.

Source: Company, Angel Research,

Market Outlook

July 3, 2017

Key Upcoming Events

Global economic events release calendar

Bl oomberg Data

D ate

Time

C ountry

Event Description

Unit

Period

L ast Reporte d

E stimate d

Jul 03, 2017

1:25 PMGermany PMI Manufacturing

Value

Jun F

59.30

59.30

2:00 PMUK

PMI Manufacturing

Value

Jun

56.70

56.30

Jul 05, 2017

6:00 PMUS

Initial Jobless claims

Thousands

Jul 1

244.00

243.00

Jul 06, 2017

1:25 PMGermany PMI Services

Value

Jun F

53.70

53.70

Jul 07, 2017

2:00 PMUK

Industrial Production (YoY)

% Change

May

(0.80)

0.20

India

Imports YoY%

% Change

Jun

33.10

6:00 PMUS

Change in Nonfarm payrolls

Thousands

Jun

138.00

177.00

Jul 10, 2017

6:00 PMUS

Unnemployment rate

%

Jun

4.30

4.30

India

Exports YoY%

% Change

Jun

8.30

7:00 AMChina

Consumer Price Index (YoY)

% Change

Jun

1.50

1.50

Jul 12, 2017

2:00 PMUK

Jobless claims change

% Change

Jun

7.30

5:30 PMIndia

Industrial Production YoY

% Change

May

3.10

Jul 13, 2017

US

Producer Price Index (mom)

% Change

Jun

(0.70)

China

Exports YoY%

% Change

Jun

8.70

8.40

Jul 14, 2017

6:45 PMUS

Industrial Production

%

Jun

-

0.30

6:00 PMUS

Consumer price index (mom)

% Change

Jun

(0.10)

-

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Jun

2.17

Jul 17, 2017

7:30 AMChina

Real GDP (YoY)

% Change

2Q

6.90

7:30 AMChina

Industrial Production (YoY)

% Change

Jun

6.50

Jul 18, 2017

2:30 PMEuro Zone Euro-Zone CPI (YoY)

%

Jun F

1.30

2:00 PMUK

CPI (YoY)

% Change

Jun

2.90

Source: Bloomberg, Angel Research

Market Outlook

July 3, 2017

Macro watch

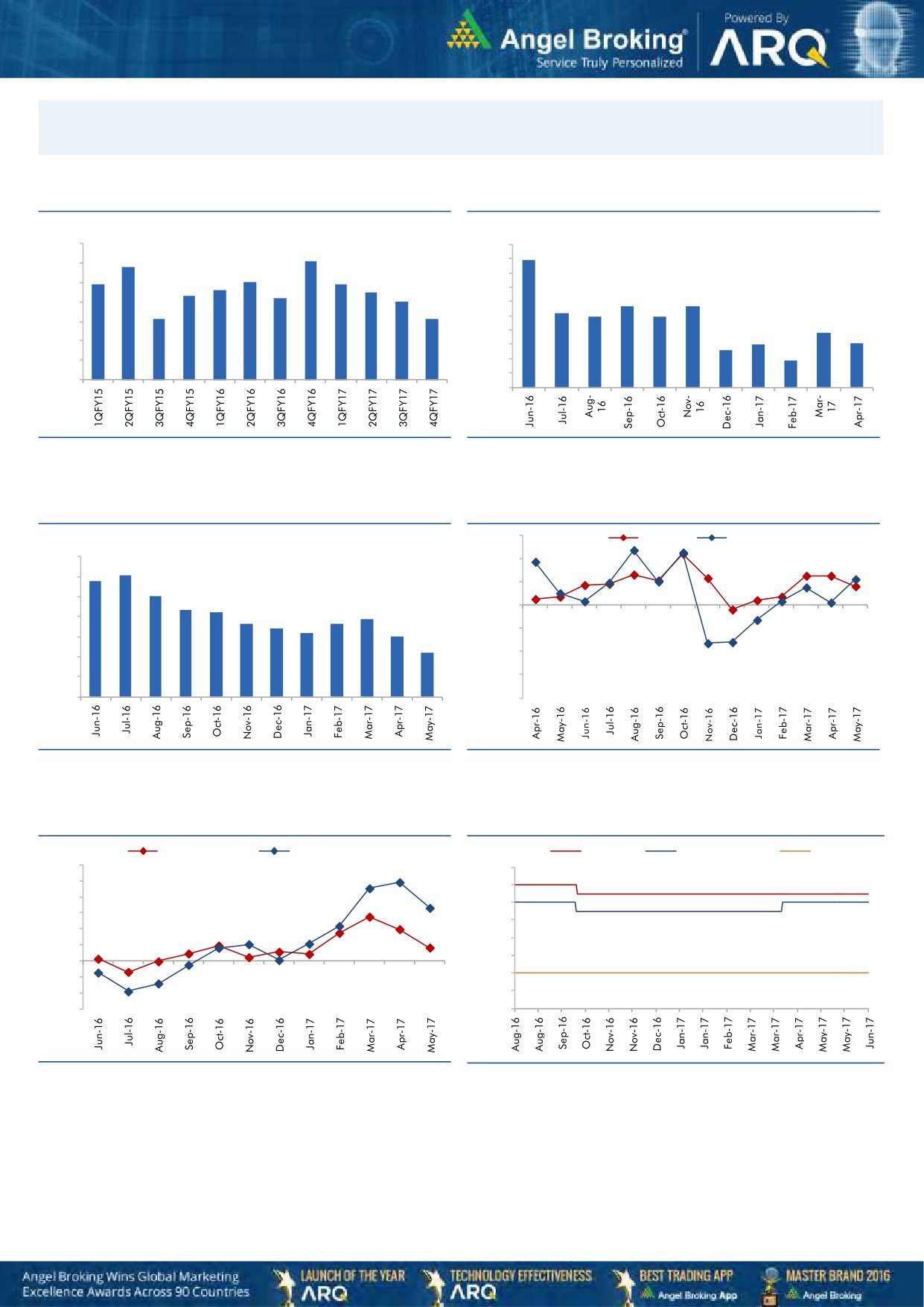

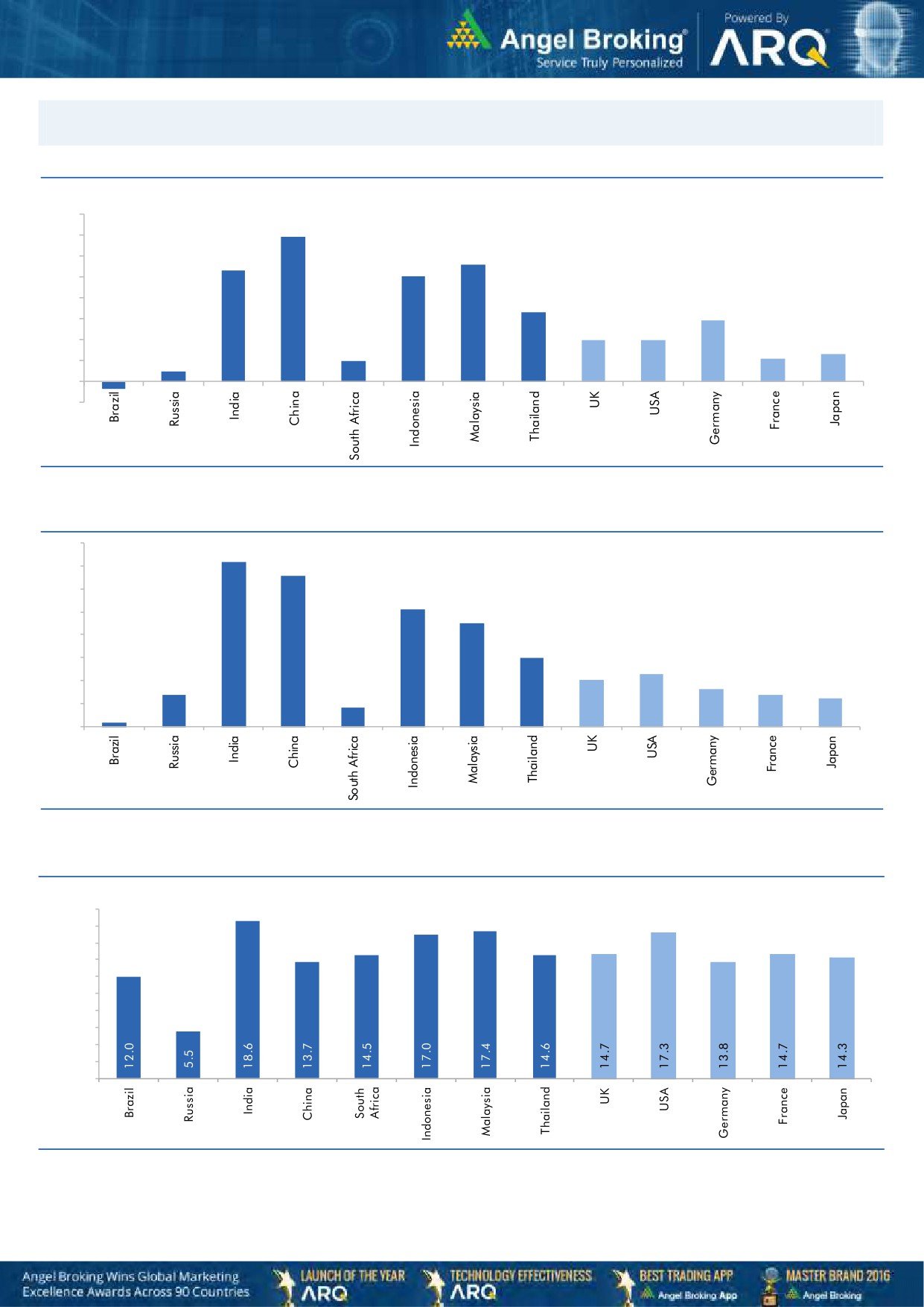

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

10.0

9.1

8.9

8.8

9.0

9.0

7.9

8.0

7.9

8.0

7.6

7.5

8.0

7.3

7.2

7.0

7.0

5.7

5.7

7.0

6.0

5.2

6.1

6.1

4.9

4.9

6.0

5.0

3.8

4.0

3.0

3.1

2.6

5.0

3.0

1.9

4.0

2.0

1.0

3.0

-

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

7.0

54.0

6.1

5.8

6.0

5.1

52.0

5.0

4.3

4.2

3.9

50.0

3.6

3.7

4.0

3.4

3.2

3.0

48.0

3.0

2.2

46.0

2.0

1.0

44.0

-

42.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

7.00

50.0

6.50

40.0

6.00

30.0

5.50

20.0

5.00

10.0

4.50

0.0

4.00

(10.0)

(20.0)

3.50

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

July 3, 2017

Global watch

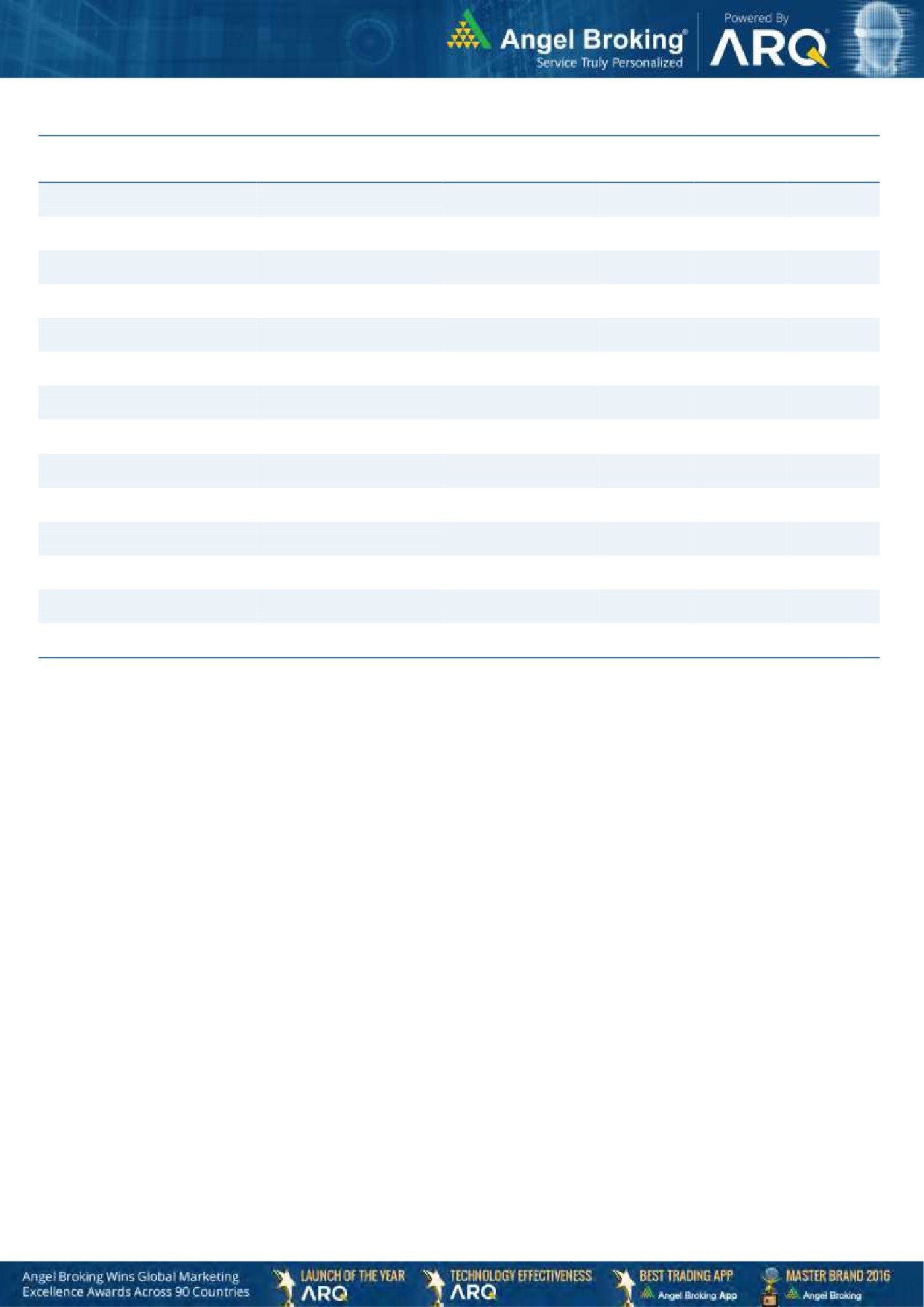

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.6

6.0

5.3

5.0

1.0

5.0

4.0

3.3

2.9

3.0

2.0

2.0

0.5

2.0

1.1

1.3

1.0

-

(1.0)

(0.4)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.2

7.0

6.6

6.0

5.1

5.0

4.5

4.0

3.0

3.0

2.3

2.0

1.4

1.6

2.0

1.4

1.2

0.2

0.8

1.0

-

Source: IMF, Angel Research

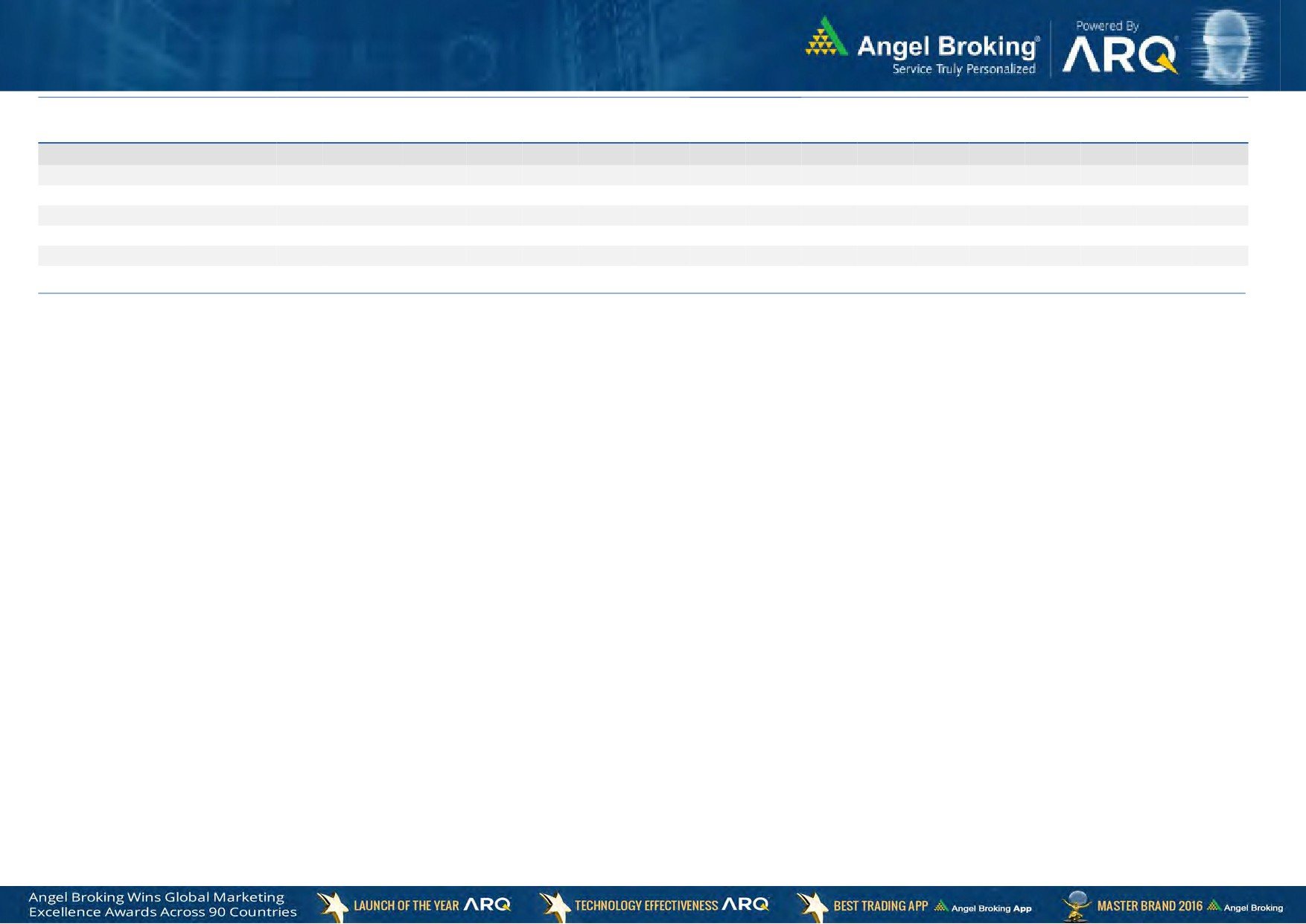

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

July 3, 2017

Exhibit 4: Relative performance of indices across globe

Returns (%)

C ountry

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

62,900

(1.7)

(2.7)

25.8

Russia

Micex

1,880

(2.8)

(7.5)

(1.5)

India

Nifty

9,521

(1.1)

4.6

17.7

China

Shanghai Composite

3,192

2.4

(2.3)

10.5

South Africa

Top 40

45,422

(4.8)

1.7

0.7

Mexico

Mexbol

49,857

2.2

1.7

7.9

Indonesia

LQ45

978

0.7

8.6

17.1

Malaysia

KLCI

1,764

(0.5)

1.1

7.9

Thailand

SET 50

994

0.8

(0.1)

8.9

USA

Dow Jones

21,350

1.6

3.0

18.9

UK

FTSE

7,313

(2.8)

(0.4)

12.1

Japan

Nikkei

20,033

1.9

4.2

23.4

Germany

DAX

12,325

(2.2)

1.4

31.5

France

CAC

5,121

(3.1)

1.0

22.2

Source: Bloomberg, Angel Research,

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Agri / Agri Chemical

Rallis

Reduce

242

209

4,713

1,937

2,164

13.3

14.3

9.0

11.0

26.9

22.0

4.7

4.1

18.4

19.8

2.5

2.2

United Phosphorus

Neutral

840

-

42,693

15,176

17,604

18.5

18.5

37.4

44.6

22.5

18.8

4.4

3.7

21.4

21.2

2.9

2.5

Auto & Auto Ancillary

Ashok Leyland

Buy

94

111

27,466

20,021

21,915

11.6

11.9

4.5

5.3

20.9

17.6

4.3

3.8

20.6

21.5

1.3

1.2

Bajaj Auto

Neutral

2,791

-

80,748

25,093

27,891

19.5

19.2

143.9

162.5

19.4

17.2

5.4

4.7

30.3

29.4

2.9

2.6

Bharat Forge

Neutral

1,092

-

25,416

7,726

8,713

20.5

21.2

35.3

42.7

30.9

25.6

5.7

5.2

18.9

20.1

3.4

2.9

Eicher Motors

Neutral

27,039

-

73,607

16,583

20,447

17.5

18.0

598.0

745.2

45.2

36.3

15.5

11.8

41.2

38.3

4.3

3.4

Gabriel India

Neutral

151

-

2,166

1,544

1,715

9.0

9.3

5.4

6.3

27.9

23.9

5.3

4.7

18.9

19.5

1.4

1.2

Hero Motocorp

Neutral

3,697

-

73,822

28,083

30,096

15.3

15.7

171.8

187.0

21.5

19.8

7.5

6.3

30.1

27.9

2.5

2.2

Jamna Auto Industries Neutral

249

-

1,987

1,486

1,620

9.8

9.9

15.0

17.2

16.6

14.5

3.6

3.1

21.8

21.3

1.4

1.3

L G Balakrishnan & Bros Neutral

748

-

1,174

1,302

1,432

11.6

11.9

43.7

53.0

17.1

14.1

2.4

2.2

13.8

14.2

1.0

0.9

Mahindra and Mahindra Neutral

1,348

-

83,702

46,534

53,077

11.6

11.7

67.3

78.1

20.0

17.3

3.3

2.8

15.4

15.8

1.8

1.5

Maruti

Neutral

7,218

-

218,038

67,822

83,288

16.0

16.4

253.8

312.4

28.4

23.1

6.5

5.3

23.0

22.9

2.9

2.3

Minda Industries

Neutral

640

-

5,534

2,728

3,042

9.0

9.1

68.2

86.2

9.4

7.4

2.1

1.7

23.8

24.3

2.1

1.8

Motherson Sumi

Neutral

460

-

64,543

45,896

53,687

7.8

8.3

13.0

16.1

35.3

28.6

11.4

9.1

34.7

35.4

1.5

1.2

Rane Brake Lining

Neutral

1,318

-

1,043

511

562

11.3

11.5

28.1

30.9

46.9

42.6

7.2

6.5

15.3

15.0

2.2

2.0

Setco Automotive

Neutral

37

-

491

741

837

13.0

13.0

15.2

17.0

2.4

2.2

0.4

0.4

15.8

16.3

1.0

1.0

Tata Motors

Neutral

433

-

124,878

300,209

338,549

8.9

8.4

42.7

54.3

10.1

8.0

1.6

1.4

15.6

17.2

0.5

0.5

TVS Motor

Neutral

549

-

26,104

13,390

15,948

6.9

7.1

12.8

16.5

43.1

33.2

10.7

8.5

26.3

27.2

2.0

1.6

Amara Raja Batteries

Buy

838

1,009

14,315

5,305

6,100

16.0

16.3

28.4

34.0

29.5

24.7

5.7

4.8

19.3

19.3

2.7

2.3

Exide Industries

Neutral

220

-

18,696

7,439

8,307

15.0

15.0

8.1

9.3

27.2

23.7

3.8

3.4

14.3

16.7

2.1

1.9

Apollo Tyres

Neutral

241

-

12,268

12,877

14,504

14.3

13.9

21.4

23.0

11.2

10.5

1.8

1.5

16.4

15.2

1.1

1.0

Ceat

Neutral

1,796

-

7,265

7,524

8,624

13.0

12.7

131.1

144.3

13.7

12.5

2.5

2.1

19.8

18.6

1.0

0.9

JK Tyres

Neutral

160

-

3,639

7,455

8,056

15.0

15.0

21.8

24.5

7.4

6.6

1.5

1.3

22.8

21.3

0.6

0.5

Swaraj Engines

Neutral

2,346

-

2,914

660

810

15.2

16.4

54.5

72.8

43.0

32.2

13.4

12.2

31.5

39.2

4.2

3.4

Subros

Neutral

241

-

1,447

1,488

1,681

11.7

11.9

6.4

7.2

37.7

33.7

4.0

3.6

10.8

11.4

1.2

1.0

Indag Rubber

Neutral

208

-

546

286

326

19.8

16.8

11.7

13.3

17.8

15.6

3.0

2.8

17.8

17.1

1.6

1.4

Capital Goods

ACE

Neutral

68

-

672

709

814

4.1

4.6

1.4

2.1

48.5

32.4

2.0

1.9

4.4

6.0

1.1

1.0

BEML

Neutral

1,534

-

6,390

3,451

4,055

6.3

9.2

31.4

57.9

48.9

26.5

2.9

2.7

6.3

10.9

2.0

1.7

Bharat Electronics

Neutral

162

-

36,084

8,137

9,169

16.8

17.2

58.7

62.5

2.8

2.6

0.4

0.4

44.6

46.3

3.4

3.1

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Capital Goods

Voltas

Neutral

458

-

15,150

6,511

7,514

7.9

8.7

12.9

16.3

35.5

28.1

6.4

5.6

16.7

18.5

2.1

1.8

BGR Energy

Neutral

142

-

1,024

16,567

33,848

6.0

5.6

7.8

5.9

18.2

24.0

1.0

1.0

4.7

4.2

0.2

0.1

BHEL

Neutral

135

-

33,128

28,797

34,742

-

2.8

2.3

6.9

58.9

19.6

1.0

1.0

1.3

4.8

0.8

0.6

Blue Star

Buy

601

760

5,745

4,283

5,077

5.9

7.3

14.9

22.1

40.4

27.1

7.8

6.6

20.4

26.4

1.4

1.2

CG Power and Industrial

Neutral

82

-

5,146

5,777

6,120

5.9

7.0

3.3

4.5

24.9

18.2

1.1

1.0

4.4

5.9

0.8

0.7

Solutions

Greaves Cotton

Neutral

162

-

3,962

1,755

1,881

16.8

16.9

7.8

8.5

20.8

19.1

4.2

3.9

20.6

20.9

2.0

1.8

Inox Wind

Neutral

142

-

3,157

5,605

6,267

15.7

16.4

24.8

30.0

5.7

4.7

1.6

1.2

25.9

24.4

0.6

0.5

KEC International

Neutral

257

-

6,610

9,294

10,186

7.9

8.1

9.9

11.9

26.0

21.6

3.8

3.3

15.6

16.3

0.9

0.9

KEI Industries

Accumulate

232

258

1,808

2,633

3,001

10.4

10.0

12.7

13.0

18.3

17.9

3.9

3.3

21.4

18.2

0.9

0.8

Thermax

Neutral

939

-

11,193

5,421

5,940

7.3

7.3

25.7

30.2

36.6

31.1

4.4

4.0

12.2

13.1

1.9

1.8

VATech Wabag

Neutral

689

-

3,759

3,136

3,845

8.9

9.1

26.0

35.9

26.5

19.2

3.3

2.8

13.4

15.9

1.1

0.9

Cement

ACC

Neutral

1,568

-

29,444

11,225

13,172

13.2

16.9

44.5

75.5

35.2

20.8

3.3

3.1

11.2

14.2

2.6

2.2

Ambuja Cements

Neutral

246

-

48,817

9,350

10,979

18.2

22.5

5.8

9.5

42.4

25.9

3.6

3.2

10.2

12.5

5.2

4.5

India Cements

Neutral

197

-

6,081

4,364

4,997

18.5

19.2

7.9

11.3

25.0

17.5

1.8

1.8

8.0

8.5

2.2

1.9

JK Cement

Neutral

940

-

6,568

4,398

5,173

15.5

17.5

31.2

55.5

30.1

16.9

3.6

3.1

12.0

15.5

2.0

1.7

J K Lakshmi Cement

Neutral

484

-

5,693

2,913

3,412

14.5

19.5

7.5

22.5

64.5

21.5

4.0

3.3

12.5

18.0

2.5

2.1

Orient Cement

Neutral

141

-

2,891

2,114

2,558

18.5

20.5

8.1

11.3

17.4

12.5

2.6

2.2

9.0

14.0

2.0

1.6

UltraTech Cement

Neutral

3,963

-

108,800

25,768

30,385

21.0

23.5

111.0

160.0

35.7

24.8

4.6

4.0

13.5

15.8

4.3

3.6

Construction

ITNL

Neutral

95

-

3,132

8,946

10,017

31.0

31.6

8.1

9.1

11.8

10.5

0.4

0.4

4.2

5.0

3.7

3.4

KNR Constructions

Neutral

208

-

2,923

1,385

1,673

14.7

14.0

41.2

48.5

5.0

4.3

0.9

0.8

14.9

15.2

2.2

1.8

Larsen & Toubro

Neutral

1,688

-

157,542

111,017

124,908

11.0

11.0

61.1

66.7

27.6

25.3

3.3

3.1

13.1

12.9

2.5

2.3

Gujarat Pipavav Port

Neutral

150

-

7,227

705

788

52.2

51.7

5.0

5.6

29.9

26.7

3.0

2.7

11.2

11.2

9.9

8.4

Nagarjuna Const.

Neutral

88

-

4,864

8,842

9,775

9.1

8.8

5.3

6.4

16.5

13.7

1.3

1.2

8.2

9.1

0.7

0.6

PNC Infratech

Neutral

143

-

3,663

2,350

2,904

13.1

13.2

9.0

8.8

15.9

16.2

0.6

0.5

15.9

13.9

1.7

1.4

Simplex Infra

Neutral

510

-

2,522

6,829

7,954

10.5

10.5

31.4

37.4

16.2

13.6

1.7

1.5

9.9

13.4

0.8

0.7

Power Mech Projects

Neutral

585

-

861

1,801

2,219

12.7

14.6

72.1

113.9

8.1

5.1

1.5

1.3

16.8

11.9

0.5

0.4

Sadbhav Engineering

Neutral

312

-

5,354

3,598

4,140

10.3

10.6

9.0

11.9

34.7

26.2

3.6

3.2

9.9

11.9

1.8

1.5

NBCC

Neutral

203

-

18,225

7,428

9,549

7.9

8.6

8.2

11.0

24.7

18.4

1.2

1.0

28.2

28.7

2.2

1.6

MEP Infra

Neutral

111

-

1,800

1,877

1,943

30.6

29.8

3.0

4.2

36.9

26.4

17.9

12.0

0.6

0.6

2.3

2.2

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Construction

SIPL

Neutral

109

-

3,827

1,036

1,252

65.5

66.2

(8.4)

(5.6)

4.1

4.6

(22.8)

(15.9)

11.9

9.9

Engineers India

Neutral

154

-

10,357

1,725

1,935

16.0

19.1

11.4

13.9

13.5

11.1

1.9

1.8

13.4

15.3

4.9

4.4

Financials

Axis Bank

Accumulate

516

580

123,706

46,932

53,575

3.5

3.4

32.4

44.6

16.0

11.6

2.1

1.8

13.6

16.5

-

-

Bank of Baroda

Neutral

161

-

37,120

19,980

23,178

1.8

1.8

11.5

17.3

14.0

9.3

1.6

1.3

8.3

10.1

-

-

Canara Bank

Neutral

329

-

19,651

15,225

16,836

1.8

1.8

14.5

28.0

22.7

11.8

1.6

1.3

5.8

8.5

-

-

Can Fin Homes

Neutral

3,233

-

8,605

420

526

3.5

3.5

86.5

107.8

37.4

30.0

8.0

6.6

23.6

24.1

-

-

Cholamandalam Inv. &

Accumulate

1,124

1,230

17,570

2,012

2,317

6.3

6.3

42.7

53.6

26.3

21.0

4.2

3.6

16.9

18.3

-

-

Fin. Co.

Dewan Housing Finance Buy

437

520

13,708

2,225

2,688

2.9

2.9

29.7

34.6

14.7

12.6

2.4

1.6

16.1

14.8

-

-

Equitas Holdings

Buy

150

235

5,074

939

1,281

11.7

11.5

5.8

8.2

25.9

18.3

2.2

2.0

10.9

11.5

-

-

Federal Bank

Accumulate

113

125

19,466

8,259

8,995

3.0

3.0

4.3

5.6

26.2

20.1

2.2

2.1

8.5

10.1

-

-

HDFC

Neutral

1,616

-

257,467

11,475

13,450

3.4

3.4

45.3

52.5

35.7

30.8

6.9

6.1

20.2

20.5

-

-

HDFC Bank

Neutral

1,652

-

425,270

46,097

55,433

4.5

4.5

58.4

68.0

28.3

24.3

5.0

4.2

18.8

18.6

-

-

ICICI Bank

Accumulate

290

315

186,036

42,800

44,686

3.1

3.3

18.0

21.9

16.1

13.3

2.2

2.0

11.1

12.3

-

-

Karur Vysya Bank

Accumulate

145

160

8,744

5,640

6,030

3.3

3.2

8.9

10.0

16.3

14.5

1.7

1.6

11.2

11.4

-

-

Lakshmi Vilas Bank

Neutral

200

-

3,827

3,339

3,799

2.7

2.8

11.0

14.0

18.1

14.3

1.9

1.7

11.2

12.7

-

-

LIC Housing Finance

Neutral

744

-

37,524

3,712

4,293

2.6

2.5

39.0

46.0

19.1

16.2

3.6

3.1

19.9

20.1

-

-

Punjab Natl.Bank

Neutral

137

-

29,185

23,532

23,595

2.3

2.4

6.8

12.6

20.2

10.9

3.1

2.2

3.3

6.5

-

-

RBL Bank

Neutral

508

-

19,123

1,783

2,309

2.6

2.6

12.7

16.4

40.0

31.0

4.4

3.9

12.8

13.3

-

-

Repco Home Finance

Neutral

825

-

5,161

388

457

4.5

4.2

30.0

38.0

27.5

21.7

4.6

3.8

18.0

19.2

-

-

South Ind.Bank

Neutral

28

-

5,014

6,435

7,578

2.5

2.5

2.7

3.1

10.3

9.0

1.3

1.1

10.1

11.2

-

-

St Bk of India

Neutral

274

-

236,173

88,650

98,335

2.6

2.6

13.5

18.8

20.3

14.6

1.9

1.7

7.0

8.5

-

-

Union Bank

Neutral

147

-

10,126

13,450

14,925

2.3

2.3

25.5

34.5

5.8

4.3

0.8

0.7

7.5

10.2

-

-

Yes Bank

Neutral

1,462

-

66,874

8,978

11,281

3.3

3.4

74.0

90.0

19.8

16.2

3.8

3.2

17.0

17.2

-

-

FMCG

Akzo Nobel India

Neutral

1,833

-

8,790

2,955

3,309

13.3

13.7

57.2

69.3

32.1

26.4

10.5

8.8

32.7

33.3

2.8

2.4

Asian Paints

Neutral

1,104

-

105,910

17,128

18,978

16.8

16.4

19.1

20.7

57.8

53.3

20.1

19.0

34.8

35.5

6.1

5.5

Britannia

Neutral

3,695

-

44,345

9,594

11,011

14.6

14.9

80.3

94.0

46.0

39.3

18.9

14.6

41.2

-

4.5

3.9

Colgate

Neutral

1,112

-

30,234

4,605

5,149

23.4

23.4

23.8

26.9

46.7

41.3

25.9

20.2

64.8

66.8

6.5

5.8

Dabur India

Neutral

292

-

51,463

8,315

9,405

19.8

20.7

8.1

9.2

36.1

31.8

10.0

8.3

31.6

31.0

5.8

5.1

GlaxoSmith Con*

Neutral

5,350

-

22,500

4,350

4,823

21.2

21.4

179.2

196.5

29.9

27.2

7.9

6.7

27.1

26.8

4.6

4.0

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FMCG

Godrej Consumer

Neutral

965

-

65,750

10,235

11,428

18.4

18.6

41.1

44.2

23.5

21.8

5.2

4.4

24.9

24.8

6.5

5.8

HUL

Neutral

1,082

-

234,108

35,252

38,495

17.8

17.8

20.7

22.4

52.4

48.3

50.1

42.9

95.6

88.9

6.5

5.9

ITC

Neutral

324

-

393,393

40,059

44,439

38.3

39.2

9.0

10.1

36.1

32.0

10.1

8.8

27.8

27.5

9.3

8.4

Marico

Neutral

314

-

40,514

6,430

7,349

18.8

19.5

6.4

7.7

49.1

40.8

14.8

12.5

33.2

32.5

6.1

5.3

Nestle*

Neutral

6,723

-

64,821

10,073

11,807

20.7

21.5

124.8

154.2

53.9

43.6

22.1

19.9

34.8

36.7

6.2

5.3

Tata Global

Neutral

151

-

9,508

8,675

9,088

9.8

9.8

7.4

8.2

20.4

18.4

1.6

1.5

7.9

8.1

1.0

1.0

Procter & Gamble

Neutral

8,023

-

26,044

2,939

3,342

23.2

23.0

146.2

163.7

54.9

49.0

13.9

11.5

25.3

23.5

8.4

7.3

Hygiene

IT

HCL Tech^

Buy

851

1,014

121,380

46,723

52,342

22.1

20.9

60.0

62.8

14.2

13.5

3.6

3.0

25.3

22.4

2.3

2.0

Infosys

Buy

936

1,179

214,914

68,484

73,963

26.0

26.0

63.0

64.0

14.9

14.6

3.1

2.9

20.8

19.7

2.8

2.5

TCS

Accumulate

2,364

2,651

465,878

117,966

127,403

27.5

27.6

134.3

144.5

17.6

16.4

5.2

4.9

29.8

29.7

3.6

3.4

Tech Mahindra

Buy

381

533

37,199

29,141

31,051

14.4

15.0

32.3

35.6

11.8

10.7

2.0

1.8

17.1

17.0

1.1

1.0

Wipro

Accumulate

259

280

125,912

55,421

58,536

20.3

20.3

35.1

36.5

7.4

7.1

1.3

1.1

19.2

14.6

1.7

1.5

Media

D B Corp

Neutral

380

-

6,994

2,297

2,590

27.4

28.2

21.0

23.4

18.1

16.3

4.2

3.7

23.7

23.1

2.8

2.5

HT Media

Neutral

81

-

1,882

2,693

2,991

12.6

12.9

7.9

9.0

10.2

9.0

0.9

0.8

7.8

8.3

0.3

0.2

Jagran Prakashan

Buy

183

225

5,966

2,283

2,555

28.0

28.0

10.6

12.3

17.2

14.9

3.7

3.2

21.4

21.4

2.6

2.3

Sun TV Network

Neutral

814

-

32,071

2,850

3,265

70.1

71.0

26.2

30.4

31.1

26.8

8.0

7.0

24.3

25.6

10.8

9.3

Hindustan Media

Neutral

270

-

1,983

1,016

1,138

24.3

25.2

27.3

30.1

9.9

9.0

1.9

1.7

16.2

15.8

1.3

1.1

Ventures

TV Today Network

Buy

239

344

1,425

608

667

21.5

22.3

15.7

19.2

15.2

12.4

2.3

2.0

16.1

16.0

1.9

1.7

Metals & Mining

Coal India

Neutral

244

-

151,585

84,638

94,297

21.4

22.3

24.5

27.1

10.0

9.0

4.2

4.0

42.6

46.0

1.3

1.2

Hind. Zinc

Neutral

263

-

111,063

14,252

18,465

55.9

48.3

15.8

21.5

16.6

12.2

2.7

2.4

17.0

20.7

7.8

6.0

Hindalco

Neutral

191

-

42,748

107,899

112,095

7.4

8.2

9.2

13.0

20.7

14.7

1.0

0.9

4.8

6.6

0.9

0.9

JSW Steel

Neutral

203

-

49,130

53,201

58,779

16.1

16.2

130.6

153.7

1.6

1.3

0.2

0.2

14.0

14.4

1.7

1.5

NMDC

Neutral

108

-

34,265

6,643

7,284

44.4

47.7

7.1

7.7

15.3

14.1

1.3

1.3

8.8

9.2

2.9

2.6

SAIL

Neutral

58

-

24,099

47,528

53,738

(0.7)

2.1

(1.9)

2.6

22.4

0.6

0.6

(1.6)

3.9

1.4

1.2

Vedanta

Neutral

249

-

92,577

71,744

81,944

19.2

21.7

13.4

20.1

18.6

12.4

1.6

1.4

8.4

11.3

1.7

1.3

Tata Steel

Neutral

544

-

52,868

121,374

121,856

7.2

8.4

18.6

34.3

29.3

15.9

1.8

1.7

6.1

10.1

1.1

1.1

Oil & Gas

GAIL

Neutral

361

-

61,056

56,220

65,198

9.3

10.1

27.1

33.3

13.3

10.8

1.2

1.1

9.3

10.7

1.3

1.1

ONGC

Neutral

157

-

201,867

137,222

152,563

15.0

21.8

19.5

24.1

8.1

6.5

0.7

0.7

8.5

10.1

1.8

1.6

Indian Oil Corp

Neutral

385

-

187,049

373,359

428,656

5.9

5.5

54.0

59.3

7.1

6.5

1.1

1.0

16.0

15.6

0.7

0.6

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Oil & Gas

Reliance Industries

Neutral

1,380

-

448,797

301,963

358,039

12.1

12.6

87.7

101.7

15.7

13.6

1.6

1.5

10.7

11.3

2.0

1.6

Pharmaceuticals

Alembic Pharma

Buy

503

648

9,476

3,101

3,966

19.7

20.5

21.4

25.5

23.5

19.7

5.0

4.1

23.0

22.8

3.0

2.2

Alkem Laboratories Ltd

Buy

1,856

2,161

22,186

5,853

6,901

17.1

18.4

74.6

85.0

24.9

21.8

5.3

4.4

21.1

20.2

3.8

3.2

Aurobindo Pharma

Buy

683

823

40,042

14,845

17,086

21.5

22.1

39.4

44.7

17.4

15.3

4.3

3.4

27.6

24.7

2.9

2.5

Aventis*

Neutral

4,162

-

9,584

2,206

2,508

16.6

16.8

128.9

139.9

32.3

29.8

5.5

4.3

21.6

23.5

4.1

3.4

Cadila Healthcare

Reduce

526

450

53,808

9,220

11,584

18.4

20.3

14.5

18.7

36.3

28.1

7.7

6.3

23.5

24.6

6.2

4.7

Cipla

Sell

554

461

44,601

14,281

16,619

15.4

16.2

12.5

19.7

44.4

28.1

3.6

3.2

8.4

12.0

3.3

2.8

Dr Reddy's

Neutral

2,683

-

44,458

14,081

15,937

16.1

18.6

72.6

105.9

37.0

25.3

3.6

3.3

9.6

13.6

3.4

3.0

Dishman Pharma

Sell

143

1,718

1,890

22.7

22.8

9.5

11.3

10.1

10.9

3.3

2.9

GSK Pharma*

Neutral

2,499

-

21,164

2,927

3,290

11.8

16.2

34.4

49.6

72.6

50.4

10.6

11.0

13.9

21.3

7.0

6.3

Indoco Remedies

Sell

202

153

1,864

1,067

1,154

12.1

14.9

8.4

11.3

24.1

17.9

2.9

2.5

12.6

15.0

1.9

1.8

Ipca labs

Buy

491

620

6,198

3,211

3,593

13.9

14.5

15.4

19.4

31.9

25.3

2.5

2.3

8.2

9.5

2.1

1.8

Lupin

Buy

1,060

1,526

47,901

17,120

18,657

24.1

24.1

56.9

61.1

18.6

17.4

3.5

3.0

20.7

18.6

3.1

2.5

Natco Pharma

Accumulate

1,002

1,060

17,460

2,065

1,988

33.1

33.7

27.9

25.7

35.9

39.0

10.5

8.9

29.2

22.9

8.6

8.6

Sun Pharma

Buy

555

712

133,038

30,264

32,899

29.0

26.9

32.7

31.6

17.0

17.6

3.6

3.1

22.2

18.7

4.1

3.7

Power

Tata Power

Neutral

81

-

21,787

36,916

39,557

17.4

27.1

5.1

6.3

15.8

12.8

1.4

1.3

9.0

10.3

1.6

1.4

NTPC

Neutral

158

-

130,649

86,605

95,545

17.5

20.8

11.8

13.4

13.4

11.8

1.4

1.3

10.5

11.1

2.9

2.8

Power Grid

Accumulate

211

223

110,151

25,315

29,193

88.2

88.7

14.2

17.2

14.9

12.3

2.3

2.0

15.2

16.1

9.0

8.1

Real Estate

Prestige Estate

Neutral

251

-

9,429

4,707

5,105

25.2

26.0

10.3

13.0

24.4

19.3

2.0

1.8

10.3

10.2

3.2

2.8

MLIFE

Buy

431

522

2,210

1,152

1,300

22.7

24.6

29.9

35.8

14.4

12.0

1.1

1.0

7.6

8.6

2.6

2.2

Telecom

Bharti Airtel

Neutral

379

-

151,561

105,086

114,808

34.5

34.7

12.2

16.4

31.1

23.1

2.1

2.0

6.8

8.4

2.4

2.1

Idea Cellular

Neutral

85

-

30,670

40,133

43,731

37.2

37.1

6.4

6.5

13.3

13.1

1.1

1.0

8.2

7.6

1.8

1.5

zOthers

Abbott India

Neutral

4,210

-

8,945

3,153

3,583

14.1

14.4

152.2

182.7

27.7

23.0

135.8

116.0

25.6

26.1

2.5

2.2

Asian Granito

Neutral

431

-

1,296

1,066

1,169

11.6

12.5

13.0

16.0

33.1

27.0

3.2

2.9

9.5

10.7

1.5

1.3

Bajaj Electricals

Buy

327

395

3,319

4,801

5,351

5.7

6.2

10.4

13.7

31.4

23.9

3.9

3.5

12.4

14.5

0.7

0.6

Banco Products (India)

Neutral

218

-

1,560

1,353

1,471

12.3

12.4

14.5

16.3

15.0

13.4

20.8

18.7

14.5

14.6

1.1

117.4

Coffee Day Enterprises

Neutral

247

-

5,082

2,964

3,260

20.5

21.2

4.7

8.0

-

30.8

2.9

2.6

5.5

8.5

2.1

1.9

Ltd

Competent Automobiles Neutral

187

-

120

1,137

1,256

3.1

2.7

28.0

23.6

6.7

7.9

36.1

32.6

14.3

11.5

0.1

0.1

Elecon Engineering

Neutral

57

-

640

1,482

1,660

13.7

14.5

3.9

5.8

14.6

9.8

3.4

3.2

7.8

10.9

0.8

0.7

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

zOthers

Finolex Cables

Neutral

458

-

7,009

2,883

3,115

12.0

12.1

14.2

18.6

32.3

24.6

17.2

15.0

15.8

14.6

2.1

1.9

Garware Wall Ropes

Neutral

816

-

1,785

863

928

15.1

15.2

36.4

39.4

22.4

20.7

4.1

3.5

17.5

15.9

2.0

1.8

Goodyear India*

Neutral

886

-

2,043

1,598

1,704

10.4

10.2

49.4

52.6

17.9

16.8

82.8

72.6

18.2

17.0

1.0

137.5

Hitachi

Neutral

2,003

-

5,445

2,081

2,433

8.8

8.9

33.4

39.9

60.0

50.2

48.4

40.3

22.1

21.4

2.6

2.2

HSIL

Neutral

365

-

2,639

2,384

2,515

15.8

16.3

15.3

19.4

23.9

18.8

23.7

20.4

7.8

9.3

1.3

1.2

Interglobe Aviation

Neutral

1,167

-

42,182

21,122

26,005

14.5

27.6

110.7

132.1

10.5

8.8

63.1

45.0

168.5

201.1

2.0

1.6

Jyothy Laboratories

Neutral

356

-

6,467

1,440

2,052

11.5

13.0

8.5

10.0

41.9

35.6

10.1

9.4

18.6

19.3

4.8

3.3

Kirloskar Engines India

Neutral

400

-

5,785

2,554

2,800

9.9

10.0

10.5

12.1

38.1

33.1

15.9

15.0

10.7

11.7

1.9

1.7

Ltd

Linc Pen & Plastics

Neutral

273

-

403

382

420

9.3

9.5

13.5

15.7

20.2

17.4

3.5

3.0

17.1

17.3

1.1

1.0

M M Forgings

Neutral

613

-

740

546

608

20.4

20.7

41.3

48.7

14.9

12.6

84.0

74.3

16.6

17.0

1.2

1.1

Manpasand Bever.

Neutral

787

-

4,505

836

1,087

19.6

19.4

16.9

23.8

46.6

33.1

5.6

4.9

12.0

14.8

5.1

3.9

Mirza International

Neutral

153

-

1,845

963

1,069

17.2

18.0

6.1

7.5

25.0

20.4

3.8

3.3

15.0

15.7

2.1

1.9

MT Educare

Neutral

63

-

250

366

417

17.7

18.2

9.4

10.8

6.7

5.8

1.5

1.3

22.2

22.3

0.6

0.5

Narayana Hrudaya

Neutral

314

-

6,422

1,873

2,166

11.5

11.7

2.6

4.0

118.8

79.3

7.3

6.6

6.1

8.3

3.5

3.0

Navkar Corporation

Buy

202

265

2,882

347

371

43.2

37.3

6.7

6.0

30.3

33.7

2.1

1.9

6.2

10.6

9.4

8.8

Navneet Education

Neutral

179

-

4,187

1,062

1,147

24.0

24.0

6.1

6.6

29.4

27.1

6.1

5.4

20.6

19.8

4.0

3.7

Nilkamal

Neutral

1,884

-

2,812

1,995

2,165

10.7

10.4

69.8

80.6

27.0

23.4

107.7

93.5

16.6

16.5

1.4

1.3

Page Industries

Neutral

16,678

-

18,603

2,450

3,124

20.1

17.6

299.0

310.0

55.8

53.8

371.5

283.6

47.1

87.5

7.6

6.0

Parag Milk Foods

Neutral

216

-

1,818

1,919

2,231

9.3

9.6

9.5

12.9

22.9

16.7

3.6

2.9

15.5

17.5

1.1

0.9

Quick Heal

Neutral

206

-

1,449

408

495

27.3

27.0

7.7

8.8

26.7

23.5

2.5

2.5

9.3

10.6

2.7

2.2

Radico Khaitan

Buy

121

147

1,616

1,667

1,824

13.0

13.2

6.7

8.2

18.3

14.8

1.7

1.5

9.0

10.2

1.4

1.2

Relaxo Footwears

Neutral

482

-

5,788

2,085

2,469

9.2

8.2

7.6

8.0

63.7

60.6

24.7

21.1

17.9

18.8

2.9

2.4

S H Kelkar & Co.

Neutral

264

-

3,814

1,036

1,160

15.1

15.0

6.1

7.2

43.2

36.7

4.6

4.2

10.7

11.5

3.6

3.1

Siyaram Silk Mills

Buy

1,996

2,500

1,871

1,574

1,769

12.5

12.7

97.1

113.1

20.6

17.6

3.2

2.7

15.4

15.5

1.4

1.2

Styrolution ABS India*

Neutral

832

-

1,464

1,440

1,537

9.2

9.0

40.6

42.6

20.5

19.5

52.4

47.6

12.3

11.6

1.0

0.9

Surya Roshni

Neutral

282

-

1,238

3,342

3,625

7.8

7.5

17.3

19.8

16.3

14.3

31.0

24.9

10.5

10.8

0.6

0.6

Team Lease Serv.

Neutral

1,344

-

2,298

3,229

4,001

1.5

1.8

22.8

32.8

59.0

40.9

6.3

5.5

10.7

13.4

0.6

0.5

The Byke Hospitality

Neutral

187

-

751

287

384

20.5

20.5

7.6

10.7

24.6

17.5

5.1

4.2

20.7

23.5

2.6

2.0

Transport Corporation of

Neutral

330

-

2,526

2,671

2,911

8.5

8.8

13.9

15.7

23.8

21.1

3.3

2.9

13.7

13.8

1.1

1.0

India

Stock Watch

July 03, 2017

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E

zOthers

TVS Srichakra

Neutral

3,771

-

2,888

2,304

2,614

13.7

13.8

231.1

266.6

16.3

14.2

423.8

333.7

33.9

29.3

1.3

1.1

UFO Moviez

Neutral

395

-

1,090

619

685

33.2

33.4

30.0

34.9

13.2

11.3

1.8

1.6

13.8

13.9

1.5

1.1

Visaka Industries

Neutral

506

-

803

1,051

1,138

10.3

10.4

21.0

23.1

24.1

21.9

64.8

60.7

9.0

9.2

1.0

1.0

VRL Logistics

Neutral

335

-

3,058

1,902

2,119

16.7

16.6

14.6

16.8

23.0

19.9

5.0

4.4

21.9

22.2

1.7

1.5

VIP Industries

Buy

182

218

2,573

1,270

1,450

10.4

10.4

5.6

6.5

32.5

28.0

6.7

5.9

20.7

21.1

2.0

1.8

Navin Fluorine

Buy

3,035

3,650

2,988

789

945

21.1

22.4

120.1

143.4

25.3

21.2

4.1

3.5

17.8

18.5

3.7

3.0

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on June 30, 2017

Market Outlook

July 03, 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.