Market Outlook

May 02, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat and may remain in green tracking the SGX

BSE Sensex

(0.4)

(111)

29,918

Nifty & global cues.

Nifty

(0.4)

(38)

9,304

US markets turned in a relatively lackluster performance during trading on Monday

Mid Cap

0.2

26

14,798

before ending the session mixed. Despite the choppy trading, the tech-heavy

Small Cap

0.6

193

15,373

Nasdaq ended the session at a new record closing high. Traders seemed somewhat

reluctant to make any significant moves ahead of the Federal Reserve's monetary

Bankex

0.3

74

25,325

policy announcement on Wednesday.

The European markets endured a choppy day of trade Friday, fluctuating between

Global Indices

Chg (%)

(Pts)

(Close)

small gains and losses throughout the session. The markets ended with mixed results

Dow Jones

(0.1)

(27)

20,913

after snapping a 6-session winning streak on Thursday. Investors seemed reluctant

Nasdaq

0.7

44

6,092

to make any major moves ahead of Monday's holiday.

FTSE

(0.5)

(33)

7,204

The Indian markets were closed on Monday for a public holiday. Markets fell

Nikkei

(0.3)

(55)

19,197

modestly on Friday as investors continued to book profits in recent outperformers

Hang Seng

(0.3)

(83)

24,615

ahead of a long weekend and next week's FOMC meeting, although no change in

Shanghai Com

0.1

2

3,155

rates is expected at the meeting.

News Analysis

Advances / Declines

BSE

NSE

Real estate buyers set to become king as RERA comes into force today

Advances

1,386

1,811

Detailed analysis on Pg2

Declines

1,509

854

Unchanged

125

85

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg6 onwards

BSE

4,336

NSE

26,537

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

#Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Accumulate

695

760

9.4

FII

( (23)

(1,095)

43,125

Dewan Housing Fin. Financials

Accumulate

427

460

7.8

MFs

258

9,918

19,355

Mahindra Lifespace

Real Estate

Buy

442

522

18.1

Navkar Corporation Others

Buy

208

265

27.6

Top Gainers

Price (`)

Chg (%)

KEI Industries

Capital Goods

Accumulate

217

239

10.0

More Top Picks on Pg4

Amtekauto

139

18.4

Federalbnk

107

13.6

Key Upcoming Events

Previous

Consensus

Denabank

44

9.7

Date

Region

Event Description

Reading

Expectations

Ifci

32

8.9

May 02, 2017 Germany PMI Manufacturing

58.20

58.20

Syndibank

83

8.5

May 02, 2017 Germany Unemployment change (000's)

-30.00

-10.50

May 03, 2017 UK

PMI Manufacturing

54.20

54.00

May 03, 2017 US

FOMC rate decision

1.00

1.00

Top Losers

Price (`)

Chg (%)

May 03, 2017 Germany PMI Services

54.70

54.70

Adanient

109

(4.6)

May 04, 2017 Euro Zone Euro-Zone GDP s.a. (QoQ)

0.50

0.50

Ibrealest

150

(4.3)

More Events on Pg5

Prestige

236

(4.3)

Deltacorp

159

(4.1)

Coromandel

348

(4.0)

#As on April 28, 2017

Market Outlook

May 02, 2017

News Analysis

Real estate buyers set to become king as RERA comes into force

today

The much-awaited Real Estate Act comes into force on Monday with a promise

of protecting the right of consumers and ushering in transparency but only 13

states and union territories (UTs) have so far notified rules. The government

has described the implementation of the consumer-centric Act as the

beginning of an era where the consumer is king.

Real estate players have also welcomed the implementation of the Act, saying

it will bring a paradigm change in the way the Indian real estate sector

functions. The government has brought in the legislation to protect home

buyers and encourage genuine private players.

Economic and Political News

Penalty on telcos: Trai reply to DoT this month in Jio case

March core sector output rises to 5%, fastest in 3 months

Govt to ensure power price at `3/unit: Piyush Goyal

Forex reserves shy of record high at $371.14 bn

Corporate News

BS-III ban: Two-wheeler industry incurs `600Cr loss

Bharat Financial posts `235Cr loss for Q4, weighs merger

Ambuja Cements: Higher costs offset gains from rising volumes

Walmart to open 50 new stores in India soon; 10 of them in Telangana

MCA asks 200,000 companies to stop operations, get de-registered

Market Outlook

May 02, 2017

Quarterly Bloomberg Brokers Consensus Estimate

Marico Consol - May 2, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

1,363

1,303

4.6

1,414

(3.6)

EBITDA

225

217

4.0

272

(17.3)

EBITDA margin (%)

16.5

16.6

19.3

Net profit

153

138

10.6

189

(18.9)

ICICI Bank Ltd - May 3, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net profit

2,293

3,056

(25.0)

2,442

6.1

Exide Industries Ltd - May 4, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

1,969

1,756

12.1

1,725

14.1

EBITDA

287

267

7.2

230

24.9

EBITDA margin (%)

14.6

15.2

13.3

Net profit

178

178

0.4

151

17.6

Housing Development Finance Corp - May 4, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net profit

2,020

2,607

(22.5)

1,701

18.7

Bharti Infratel Consol - May 8, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

3,486

3,162

10.3

1,530

127.8

EBITDA

1,540

1,425

8.1

706

118.3

EBITDA margin (%)

44.2

45.1

46.1

Net profit

700

662

5.8

620

12.9

ABB India Ltd - May 8, 2017

Particulars ( ` cr)

1QCY17E

1QCY16

y-o-y (%)

4QCY16

q-o-q (%)

Net sales

2,224

1,976

12.5

2,441

(8.9)

EBITDA

195

149

30.5

282

(31.0)

EBITDA margin (%)

8.7

7.5

11.5

Net profit

92

71

29.8

147

(37.3)

Market Outlook

May 02, 2017

Top Picks ★★★★★

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leadership in

Alkem Laboratories

23,571

1,971

2,257

14.5

acute therapeutic segment. Alkem expects to launch more

products in USA, which bodes for its international business.

We expect the company would report strong profitability

Asian Granito

1,151

383

405

5.8

owing to better product mix, higher B2C sales and

amalgamation synergy..

Among the top 4 players in the consumer durables segment.

Bajaj Electricals

3,560

352

395

12.4

Improved profitability backed by turn around in E&P segment.

Strong order book lends earnings visibility.

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

6,641

695

760

9.4

growth. EMPPAC division's profitability to improve once

operating environment turns around..

With a focus on the low and medium income (LMI) consumer

Dewan Housing Finance

13,364

427

460

7.8

segment, the company has increased its presence in tier-II &

III cities where the growth opportunity is immense.

Strong loan growth backed by diversified loan portfolio and

Equitas Holdings

5,613

166

235

41.4

adequate CAR. ROE & ROA likely to remain decent as risk of

dilution remains low. Attractive valuations considering growth.

Economic recovery to have favourable impact on advertising

& circulation revenue growth. Further, the acquisition of a

Jagran Prakashan

6,381

195

225

15.3

radio business (Radio City) would also boost the company's

revenue growth.

High order book execution in EPC segment, rising B2C sales

KEI Industries

1,687

217

239

10.0

and higher exports to boost the revenues and profitability

Speedier execution and speedier sales, strong revenue visibilty

Mahindra Lifespace

1,814

442

522

18.1

in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,963

208

265

27.6

as well CFS augurs well for the company

Strong brands and distribution network would boost growth

Siyaram Silk Mills

1,583

1,689

1,872

10.8

going ahead. Stock currently trades at an inexpensive

valuation.

Market leadership in Hindi news genre and no. 2 viewership

ranking in English news genre, exit from the radio business,

TV Today Network

1,597

268

344

28.5

and anticipated growth in ad spends by corporates to benefit

the stock.

Source: Company, Angel Research

Market Outlook

May 02, 2017

Key Upcoming Events

Result Calendar

Date

Company

May 2, 2017

Marico

May 3, 2017

ICICI Bank, Alembic Pharma

May 4, 2017

Exide Industries, Bank of Maharashtra, MRF

May 5, 2017

Apollo Tyres, Visaka Industries, Aventis

May 6, 2017

L G Balakrishnan & Bros

Source: Bloomberg, Angel Research

Global economic events release calendar

Date

Time

Country

Event Description

Unit

Period

Bloomberg Data

Last Reported Estimated

May 2,, 2017 1:25PM

Germany

PMI Manufacturing

Value

Apr F

58.20

58.20

1:25PM

Germany

Unemployment change (000's)

Thousands

Apr

(30.00)

(10.50)

May 3,, 2017 2:00PM

UK

PMI Manufacturing

Value

Apr

54.20

54.00

11:30PM

US

FOMC rate decision

%

May 3

1.00

1.00

1:25PM

Germany

PMI Services

Value

Apr F

54.70

54.70

May 4,, 2017 2:30PM

Euro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

1Q A

0.50

0.50

6:00PM

US

Initial Jobless claims

Thousands

Apr 29

257.00

249.50

May 5,, 2017 6:00PM

US

Change in Nonfarm payrolls

Thousands

Apr

98.00

190.00

6:00PM

US

Unnemployment rate

%

Apr

4.50

4.60

May 8,, 2017

China

Exports YoY%

% Change

Apr

16.40

--

May 10, 2017 7:00AM

China

Consumer Price Index (YoY)

% Change

Apr

0.90

--

India

Imports YoY%

% Change

Apr

45.30

--

India

Exports YoY%

% Change

Apr

27.60

--

May 11, 2017

US

Producer Price Index (mom)

% Change

Apr

(0.20)

--

2:00PM

UK

Industrial Production (YoY)

% Change

Mar

2.80

--

4:30PM

UK

BOE Announces rates

% Ratio

May 11

0.25

--

May 12, 2017 6:00PM

US

Consumer price index (mom)

% Change

Apr

(0.30)

0.30

5:30PM

India

Industrial Production YoY

% Change

Mar

(1.20)

--

11:30AM

Germany

GDP nsa (YoY)

% Change

1Q P

1.20

--

May 15, 201712:00PM

India

Monthly Wholesale Prices YoY%

% Change

Apr

5.70

--

7:30AM

China

Industrial Production (YoY)

% Change

Apr

7.60

--

May 16, 2017 6:00PM

US

Housing Starts

Thousands

Apr

1,215.00

--

6:00PM

US

Building permits

Thousands

Apr

1,267.00

--

6:45PM

US

Industrial Production

%

Apr

0.55

--

2:00PM

UK

CPI (YoY)

% Change

Apr

2.30

--

May 17, 2017 2:30PM

Euro Zone

Euro-Zone CPI (YoY)

%

Apr F

1.90

--

7:30PM

Euro Zone

Euro-Zone Consumer Confidence

Value

May A

(3.60)

--

Source: Bloomberg, Angel Research

Market Outlook

May 02, 2017

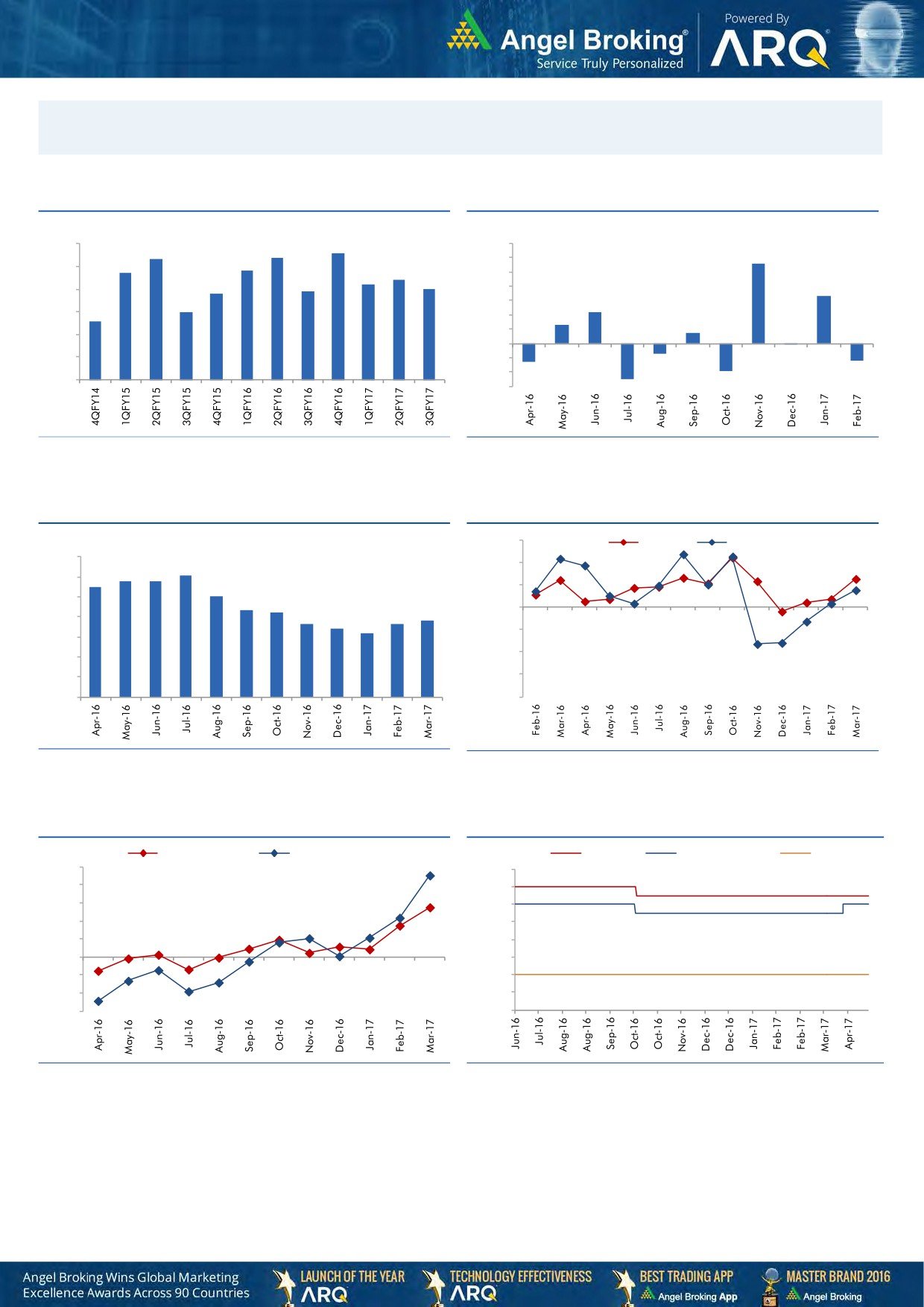

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.6

9.0

8.3

8.4

7.0

5.6

7.7

7.8

6.0

8.0

7.4

7.2

5.0

6.9

7.0

6.8

3.3

7.0

4.0

6.0

3.0

2.2

5.6

6.0

2.0

1.3

0.7

1.0

5.0

-

4.0

(1.0)

(0.1)

(0.7)

(2.0)

(1.3)

(1.2)

3.0

(3.0)

(1.9)

(2.5)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

7.0

6.1

54.0

5.8

5.8

6.0

5.5

5.1

52.0

5.0

4.3

4.2

3.7

3.8

50.0

4.0

3.6

3.4

3.2

48.0

3.0

46.0

2.0

1.0

44.0

-

42.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

50.0

7.00

40.0

6.50

30.0

6.00

20.0

5.50

10.0

5.00

0.0

4.50

(10.0)

4.00

(20.0)

3.50

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 02, 2017

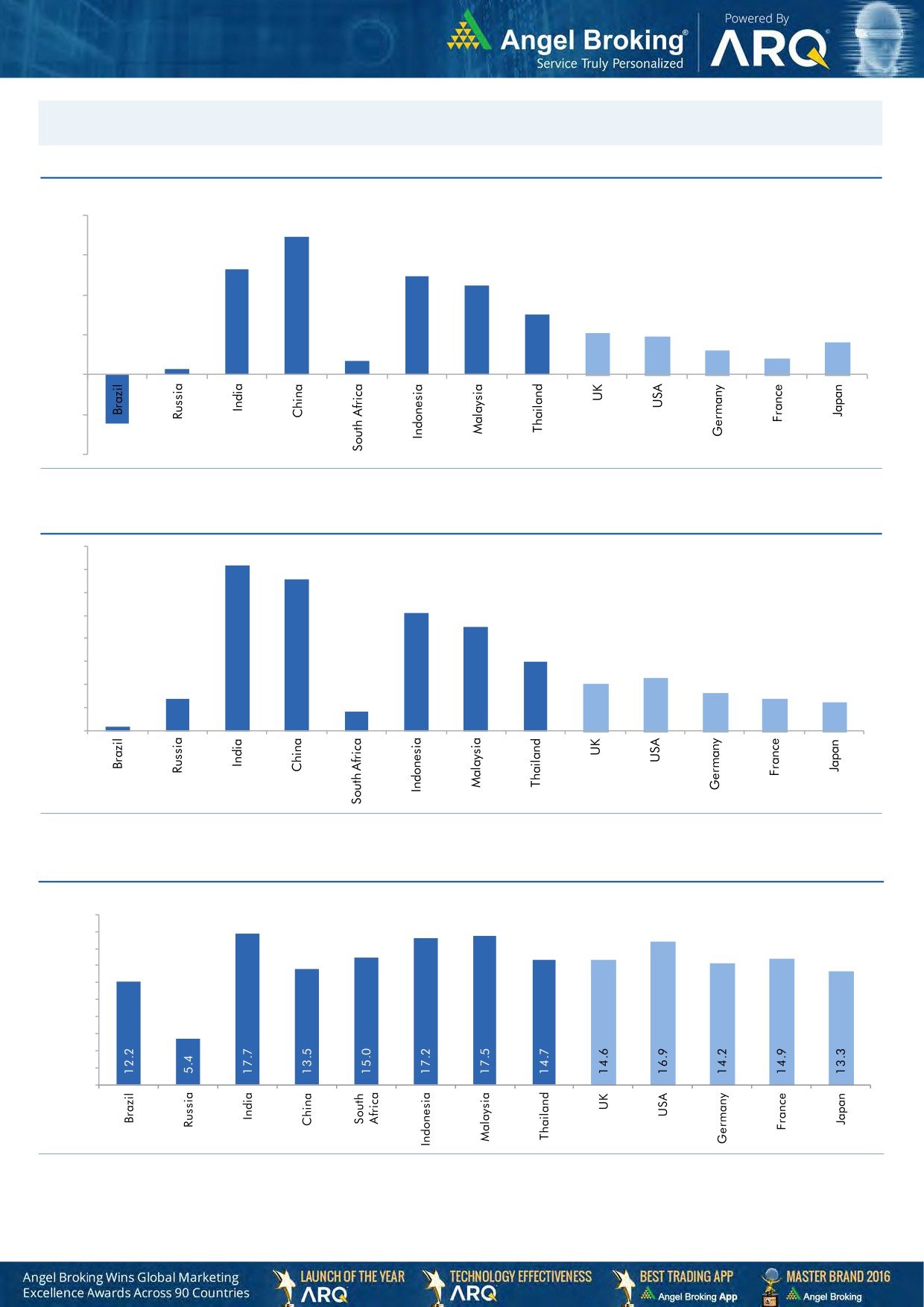

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

6.0

5.3

4.9

0.7

4.5

4.0

3.0

2.1

1.9

2.0

0.3

1.6

1.2

0.8

-

(2.0)

(2.5)

(4.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.2

6.6

7.0

6.0

5.1

5.0

4.5

4.0

3.0

3.0

2.3

2.0

1.4

1.6

2.0

1.4

1.2

0.2

0.8

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

May 02, 2017

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

65,403

1.7

(0.5)

20.1

Russia

Micex

2,017

(0.3)

(9.5)

4.7

India

Nifty

9,304

2.9

10.9

16.8

China

Shanghai Composite

3,155

(3.3)

0.7

3.4

South Africa

Top 40

47,072

5.4

1.3

1.0

Mexico

Mexbol

49,261

(0.1)

2.3

7.8

Indonesia

LQ45

941

2.1

6.9

11.8

Malaysia

KLCI

1,768

1.0

5.0

2.9

Thailand

SET 50

994

(0.4)

1.0

9.9

USA

Dow Jones

20,913

1.2

4.1

16.9

UK

FTSE

7,204

(1.2)

0.6

16.5

Japan

Nikkei

19,311

(0.1)

(1.4)

13.5

Germany

DAX

12,438

3.7

5.0

26.3

France

CAC

5,267

5.0

8.2

21.8

Source: Bloomberg, Angel Research

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Agri / Agri Chemical

Rallis

Neutral

242

-

4,704

1,937

2,164

13.3

14.3

9.0

11.0

26.9

22.0

4.7

4.1

18.4

19.8

2.5

2.2

United Phosphorus

Neutral

806

-

40,935

15,176

17,604

18.5

18.5

37.4

44.6

21.6

18.1

4.2

3.5

21.4

21.2

2.8

2.4

Auto & Auto Ancillary

Amara Raja Batteries

Accumulate

889

1,009

15,182

5,305

6,100

16.0

16.3

28.4

34.0

31.3

26.1

6.0

5.1

19.3

19.3

2.9

2.5

Apollo Tyres

Neutral

244

-

12,425

12,877

14,504

14.3

13.9

21.4

23.0

11.4

10.6

1.8

1.5

16.4

15.2

1.1

1.0

Ashok Leyland

Buy

85

111

24,318

20,021

21,915

11.6

11.9

4.5

5.3

19.0

16.1

3.9

3.5

20.6

21.5

1.2

1.0

Bajaj Auto

Neutral

2,868

-

83,001

25,093

27,891

19.5

19.2

143.9

162.5

19.9

17.7

5.6

4.8

30.3

29.4

3.0

2.7

Bharat Forge

Neutral

1,144

-

26,632

7,726

8,713

20.5

21.2

35.3

42.7

32.4

26.8

6.0

5.4

18.9

20.1

3.5

3.1

Ceat

Neutral

1,521

-

6,152

7,524

8,624

13.0

12.7

131.1

144.3

11.6

10.5

2.1

1.8

19.8

18.6

0.9

0.8

Eicher Motors

Neutral

26,068

-

70,932

16,583

20,447

17.5

18.0

598.0

745.2

43.6

35.0

14.9

11.3

41.2

38.3

4.1

3.3

Exide Industries

Neutral

230

-

19,563

7,439

8,307

15.0

15.0

8.1

9.3

28.4

24.8

4.0

3.6

14.3

16.7

2.2

2.0

Gabriel India

Neutral

124

-

1,783

1,544

1,715

9.0

9.3

5.4

6.3

23.0

19.7

4.3

3.8

18.9

19.5

1.1

1.0

Hero Motocorp

Neutral

3,311

-

66,114

28,083

30,096

15.3

15.7

171.8

187.0

19.3

17.7

6.7

5.7

30.1

27.9

2.2

2.0

Indag Rubber

Neutral

213

-

558

286

326

19.8

16.8

11.7

13.3

18.2

16.0

3.1

2.9

17.8

17.1

1.6

1.4

Jamna Auto Industries

Neutral

241

-

1,920

1,486

1,620

9.8

9.9

15.0

17.2

16.1

14.0

3.5

3.0

21.8

21.3

1.4

1.2

JK Tyres

Neutral

166

-

3,757

7,455

8,056

15.0

15.0

21.8

24.5

7.6

6.8

1.6

1.3

22.8

21.3

0.6

0.5

L G Balakrishnan & Bros Neutral

626

-

983

1,302

1,432

11.6

11.9

43.7

53.0

14.3

11.8

2.0

1.8

13.8

14.2

0.8

0.8

Mahindra and Mahindra Neutral

1,335

-

82,888

46,534

53,077

11.6

11.7

67.3

78.1

19.8

17.1

3.2

2.8

15.4

15.8

1.8

1.5

Maruti

Neutral

6,526

-

197,122

67,822

83,288

16.0

16.4

253.8

312.4

25.7

20.9

5.9

4.8

23.0

22.9

2.6

2.0

Minda Industries

Neutral

481

-

4,153

2,728

3,042

9.0

9.1

68.2

86.2

7.1

5.6

1.6

1.3

23.8

24.3

1.6

1.4

Motherson Sumi

Neutral

401

-

56,241

45,896

53,687

7.8

8.3

13.0

16.1

30.7

24.9

9.9

7.9

34.7

35.4

1.3

1.1

Rane Brake Lining

Neutral

1,006

-

796

511

562

11.3

11.5

28.1

30.9

35.8

32.5

5.5

5.0

15.3

15.0

1.7

1.6

Setco Automotive

Neutral

43

-

572

741

837

13.0

13.0

15.2

17.0

2.8

2.5

0.5

0.4

15.8

16.3

1.2

1.0

Subros

Neutral

230

-

1,382

1,488

1,681

11.7

11.9

6.4

7.2

36.0

32.2

3.8

3.5

10.8

11.4

1.2

1.0

Swaraj Engines

Neutral

1,818

-

2,258

660

810

15.2

16.4

54.5

72.8

33.4

25.0

10.4

9.4

31.5

39.2

3.2

2.6

Tata Motors

Neutral

458

-

132,183

300,209

338,549

8.9

8.4

42.7

54.3

10.7

8.4

1.7

1.5

15.6

17.2

0.6

0.5

TVS Motor

Neutral

496

-

23,545

13,390

15,948

6.9

7.1

12.8

16.5

38.8

30.0

9.7

7.7

26.3

27.2

1.8

1.5

Capital Goods

ACE

Neutral

62

-

617

709

814

4.1

4.6

1.4

2.1

44.6

29.7

1.8

1.7

4.4

6.0

1.0

0.9

BEML

Neutral

1,406

-

5,855

3,451

4,055

6.3

9.2

31.4

57.9

44.8

24.3

2.7

2.4

6.3

10.9

1.8

1.5

BGR Energy

Neutral

164

-

1,181

16,567

33,848

6.0

5.6

7.8

5.9

21.0

27.7

1.2

1.2

4.7

4.2

0.2

0.1

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Capital Goods

Bharat Electronics

Neutral

183

-

40,864

8,137

9,169

16.8

17.2

58.7

62.5

3.1

2.9

0.5

0.4

44.6

46.3

4.0

3.6

BHEL

Neutral

176

-

43,004

28,797

34,742

-

2.8

2.3

6.9

76.4

25.5

1.3

1.3

1.3

4.8

1.1

0.8

Blue Star

Accumulate

695

760

6,641

4,283

5,077

5.9

7.3

14.9

22.1

46.7

31.4

9.1

7.6

20.4

26.4

1.6

1.3

CG Power and Industrial

Neutral

79

-

4,926

5,777

6,120

5.9

7.0

3.3

4.5

23.8

17.5

1.1

1.0

4.4

5.9

0.8

0.7

Solutions

Greaves Cotton

Neutral

171

-

4,180

1,755

1,881

16.8

16.9

7.8

8.5

21.9

20.1

4.4

4.1

20.6

20.9

2.1

1.9

Inox Wind

Neutral

196

-

4,357

5,605

6,267

15.7

16.4

24.8

30.0

7.9

6.5

2.2

1.6

25.9

24.4

0.8

0.7

KEC International

Neutral

219

-

5,626

9,294

10,186

7.9

8.1

9.9

11.9

22.1

18.4

3.2

2.8

15.6

16.3

0.8

0.8

KEI Industries

Accumulate

217

239

1,687

2,682

3,058

10.4

10.0

11.7

12.8

18.5

16.9

3.7

3.1

20.1

18.2

0.8

0.7

Thermax

Neutral

1,018

-

12,134

5,421

5,940

7.3

7.3

25.7

30.2

39.6

33.7

4.8

4.4

12.2

13.1

2.1

1.9

VATech Wabag

Neutral

673

-

3,671

3,136

3,845

8.9

9.1

26.0

35.9

25.9

18.7

3.2

2.8

13.4

15.9

1.1

0.9

Voltas

Neutral

410

-

13,581

6,511

7,514

7.9

8.7

12.9

16.3

31.8

25.2

5.7

5.0

16.7

18.5

1.8

1.6

Cement

ACC

Neutral

1,625

-

30,515

11,225

13,172

13.2

16.9

44.5

75.5

36.5

21.5

3.5

3.2

11.2

14.2

2.7

2.3

Ambuja Cements

Neutral

246

-

48,837

9,350

10,979

18.2

22.5

5.8

9.5

42.4

25.9

3.6

3.2

10.2

12.5

5.2

4.5

India Cements

Neutral

216

-

6,638

4,364

4,997

18.5

19.2

7.9

11.3

27.4

19.1

2.0

1.9

8.0

8.5

2.3

2.0

J K Lakshmi Cement

Neutral

463

-

5,445

2,913

3,412

14.5

19.5

7.5

22.5

61.7

20.6

3.8

3.2

12.5

18.0

2.5

2.1

JK Cement

Neutral

967

-

6,759

4,398

5,173

15.5

17.5

31.2

55.5

31.0

17.4

3.7

3.2

12.0

15.5

2.1

1.7

Orient Cement

Neutral

170

-

3,491

2,114

2,558

18.5

20.5

8.1

11.3

21.0

15.1

3.1

2.6

9.0

14.0

2.3

1.8

UltraTech Cement

Neutral

4,239

-

116,369

25,768

30,385

21.0

23.5

111.0

160.0

38.2

26.5

4.9

4.3

13.5

15.8

4.6

3.8

Construction

Engineers India

Neutral

166

-

11,213

1,725

1,935

16.0

19.1

11.4

13.9

14.6

12.0

2.0

2.0

13.4

15.3

5.4

4.9

Gujarat Pipavav Port

Neutral

160

-

7,733

705

788

52.2

51.7

5.0

5.6

32.0

28.6

3.2

2.8

11.2

11.2

10.6

9.0

ITNL

Neutral

115

-

3,770

8,946

10,017

31.0

31.6

8.1

9.1

14.2

12.6

0.5

0.5

4.2

5.0

3.8

3.5

KNR Constructions

Neutral

199

-

2,794

1,385

1,673

14.7

14.0

41.2

48.5

4.8

4.1

0.9

0.8

14.9

15.2

2.1

1.7

Larsen & Toubro

Neutral

1,748

-

163,140

111,017

124,908

11.0

11.0

61.1

66.7

28.6

26.2

3.4

3.2

13.1

12.9

2.5

2.3

MEP Infra

Neutral

66

-

1,076

1,877

1,943

30.6

29.8

3.0

4.2

22.1

15.8

10.7

7.2

0.6

0.6

2.0

1.8

Nagarjuna Const.

Neutral

95

-

5,304

8,842

9,775

9.1

8.8

5.3

6.4

18.0

14.9

1.4

1.3

8.2

9.1

0.8

0.7

NBCC

Neutral

200

-

17,978

7,428

9,549

7.9

8.6

8.2

11.0

24.4

18.2

1.2

1.0

28.2

28.7

2.1

1.6

PNC Infratech

Neutral

158

-

4,055

2,350

2,904

13.1

13.2

9.0

8.8

17.6

18.0

0.6

0.6

15.9

13.9

1.8

1.5

Power Mech Projects

Neutral

558

-

821

1,801

2,219

12.7

14.6

72.1

113.9

7.7

4.9

1.4

1.2

16.8

11.9

0.5

0.3

Sadbhav Engineering

Neutral

334

-

5,732

3,598

4,140

10.3

10.6

9.0

11.9

37.1

28.1

3.9

3.4

9.9

11.9

1.9

1.6

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Construction

Simplex Infra

Neutral

404

-

1,996

6,829

7,954

10.5

10.5

31.4

37.4

12.9

10.8

1.3

1.2

9.9

13.4

0.7

0.6

SIPL

Neutral

102

-

3,582

1,036

1,252

65.5

66.2

(8.4)

(5.6)

3.8

4.4

(22.8)

(15.9)

11.7

9.7

Financials

Axis Bank

Accumulate

510

580

122,089

46,932

53,575

3.5

3.4

32.4

44.6

15.8

11.4

2.0

1.8

13.6

16.5

-

-

Bank of Baroda

Neutral

188

-

43,203

19,980

23,178

1.8

1.8

11.5

17.3

16.3

10.8

1.9

1.5

8.3

10.1

-

-

Can Fin Homes

Neutral

2,617

-

6,967

420

526

3.5

3.5

86.5

107.8

30.3

24.3

6.5

5.3

23.6

24.1

-

-

Canara Bank

Neutral

355

-

21,189

15,225

16,836

1.8

1.8

14.5

28.0

24.5

12.7

1.7

1.4

5.8

8.5

-

-

Cholamandalam Inv. &

Accumulate

1,112

1,230

17,375

2,012

2,317

6.3

6.3

42.7

53.6

26.0

20.7

4.1

3.5

16.9

18.3

-

-

Fin. Co.

Dewan Housing Finance Accumulate

427

460

13,364

2,225

2,688

2.9

2.9

29.7

34.6

14.4

12.3

2.3

1.5

16.1

14.8

-

-

Equitas Holdings

Buy

166

235

5,613

939

1,281

11.7

11.5

5.8

8.2

28.7

20.3

2.5

2.2

10.9

11.5

-

-

Federal Bank

Buy

107

125

18,514

8,259

8,995

3.0

3.0

4.3

5.6

25.0

19.2

2.1

2.0

8.5

10.1

-

-

HDFC

Neutral

1,537

-

244,186

11,475

13,450

3.4

3.4

45.3

52.5

33.9

29.3

6.5

5.8

20.2

20.5

-

-

HDFC Bank

Accumulate

1,542

1,650

395,547

46,097

55,433

4.5

4.5

58.4

68.0

26.4

22.7

4.6

3.9

18.8

18.6

-

-

ICICI Bank

Accumulate

279

315

162,239

42,800

44,686

3.1

3.3

18.0

21.9

15.5

12.7

2.1

2.0

11.1

12.3

-

-

Karur Vysya Bank

Buy

120

140

7,222

5,640

6,030

3.3

3.2

8.9

10.0

13.4

12.0

1.4

1.3

11.2

11.4

-

-

Lakshmi Vilas Bank

Neutral

185

-

3,542

3,339

3,799

2.7

2.8

11.0

14.0

16.8

13.2

1.8

1.6

11.2

12.7

-

-

LIC Housing Finance

Neutral

668

-

33,732

3,712

4,293

2.6

2.5

39.0

46.0

17.1

14.5

3.2

2.8

19.9

20.1

-

-

Punjab Natl.Bank

Neutral

169

-

35,941

23,532

23,595

2.3

2.4

6.8

12.6

24.8

13.4

3.8

2.7

3.3

6.5

-

-

RBL Bank

Neutral

564

-

21,178

1,783

2,309

2.6

2.6

12.7

16.4

44.4

34.4

4.9

4.3

12.8

13.3

-

-

Repco Home Finance

Accumulate

769

825

4,809

388

457

4.5

4.2

30.0

38.0

25.6

20.2

4.3

3.6

18.0

19.2

-

-

South Ind.Bank

Neutral

26

-

4,633

6,435

7,578

2.5

2.5

2.7

3.1

9.5

8.3

1.2

1.0

10.1

11.2

-

-

St Bk of India

Neutral

289

-

234,740

88,650

98,335

2.6

2.6

13.5

18.8

21.4

15.4

2.0

1.8

7.0

8.5

-

-

Union Bank

Neutral

171

-

11,748

13,450

14,925

2.3

2.3

25.5

34.5

6.7

5.0

1.0

0.8

7.5

10.2

-

-

Yes Bank

Neutral

1,631

-

74,469

8,978

11,281

3.3

3.4

74.0

90.0

22.0

18.1

4.2

3.5

17.0

17.2

-

-

FMCG

Akzo Nobel India

Neutral

1,963

-

9,416

2,955

3,309

13.3

13.7

57.2

69.3

34.4

28.3

11.2

9.4

32.7

33.3

3.0

2.6

Asian Paints

Neutral

1,120

-

107,392

17,128

18,978

16.8

16.4

19.1

20.7

58.6

54.1

20.4

19.2

34.8

35.5

6.2

5.6

Britannia

Neutral

3,627

-

43,529

9,594

11,011

14.6

14.9

80.3

94.0

45.2

38.6

18.6

14.3

41.2

-

4.4

3.8

Colgate

Neutral

1,038

-

28,239

4,605

5,149

23.4

23.4

23.8

26.9

43.6

38.6

24.2

18.9

64.8

66.8

6.1

5.4

Dabur India

Accumulate

287

304

50,476

8,315

9,405

19.8

20.7

8.1

9.2

35.4

31.2

9.9

8.2

31.6

31.0

5.7

5.0

GlaxoSmith Con*

Neutral

5,128

-

21,565

4,350

4,823

21.2

21.4

179.2

196.5

28.6

26.1

7.6

6.4

27.1

26.8

4.3

3.8

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FMCG

Godrej Consumer

Neutral

1,743

-

59,358

10,235

11,428

18.4

18.6

41.1

44.2

42.4

39.4

9.4

7.9

24.9

24.8

5.9

5.2

HUL

Neutral

935

-

202,302

35,252

38,495

17.8

17.8

20.7

22.4

45.3

41.8

43.3

37.1

95.6

88.9

5.6

5.1

ITC

Neutral

279

-

338,426

40,059

44,439

38.3

39.2

9.0

10.1

31.0

27.5

8.7

7.6

27.8

27.5

8.0

7.2

Marico

Neutral

315

-

40,637

6,430

7,349

18.8

19.5

6.4

7.7

49.2

40.9

14.9

12.5

33.2

32.5

6.1

5.3

Nestle*

Neutral

6,702

-

64,622

10,073

11,807

20.7

21.5

124.8

154.2

53.7

43.5

22.1

19.8

34.8

36.7

6.2

5.3

Procter & Gamble

Neutral

7,369

-

23,920

2,939

3,342

23.2

23.0

146.2

163.7

50.4

45.0

12.8

10.6

25.3

23.5

7.7

6.7

Hygiene

Tata Global

Neutral

153

-

9,663

8,675

9,088

9.8

9.8

7.4

8.2

20.7

18.7

1.6

1.6

7.9

8.1

1.0

1.0

IT

HCL Tech^

Buy

812

1,000

115,927

49,242

57,168

20.5

20.5

55.7

64.1

14.6

12.7

3.0

2.3

20.3

17.9

2.2

1.8

Infosys

Buy

919

1,179

211,181

68,484

73,963

26.0

26.0

63.0

64.0

14.6

14.4

3.1

2.8

20.8

19.7

2.8

2.4

TCS

Buy

2,272

2,651

447,701

117,966

127,403

27.5

27.6

134.3

144.5

16.9

15.7

5.0

4.7

29.8

29.7

3.4

3.2

Tech Mahindra

Buy

417

600

40,620

29,673

32,937

15.5

17.0

32.8

39.9

12.7

10.5

2.5

2.2

19.6

20.7

1.1

0.9

Wipro

Buy

494

570

120,171

55,421

58,536

20.3

20.3

35.1

36.5

14.1

13.5

2.4

2.1

19.2

14.6

1.6

1.4

Media

D B Corp

Neutral

381

-

6,998

2,297

2,590

27.4

28.2

21.0

23.4

18.1

16.3

4.2

3.7

23.7

23.1

2.8

2.5

Hindustan Media

Neutral

289

-

2,124

1,016

1,138

24.3

25.2

27.3

30.1

10.6

9.6

2.0

1.8

16.2

15.8

1.4

1.2

Ventures

HT Media

Neutral

82

-

1,910

2,693

2,991

12.6

12.9

7.9

9.0

10.4

9.1

0.9

0.8

7.8

8.3

0.3

0.2

Jagran Prakashan

Buy

195

225

6,381

2,355

2,635

28.0

28.0

10.8

12.5

18.1

15.6

3.9

3.4

21.7

21.7

2.7

2.4

Sun TV Network

Neutral

921

-

36,307

2,850

3,265

70.1

71.0

26.2

30.4

35.2

30.3

9.0

7.9

24.3

25.6

12.3

10.6

TV Today Network

Buy

268

344

1,597

567

645

26.7

27.0

15.4

18.1

17.4

14.8

2.6

2.3

14.9

15.2

2.4

2.0

Metals & Mining

Coal India

Neutral

277

-

171,852

84,638

94,297

21.4

22.3

24.5

27.1

11.3

10.2

4.7

4.5

42.6

46.0

1.5

1.4

Hind. Zinc

Neutral

269

-

113,598

14,252

18,465

55.9

48.3

15.8

21.5

17.0

12.5

2.8

2.4

17.0

20.7

8.0

6.2

Hindalco

Neutral

199

-

44,664

107,899

112,095

7.4

8.2

9.2

13.0

21.6

15.3

1.0

1.0

4.8

6.6

0.9

0.9

JSW Steel

Neutral

199

-

48,103

53,201

58,779

16.1

16.2

130.6

153.7

1.5

1.3

0.2

0.2

14.0

14.4

1.7

1.4

NMDC

Neutral

127

-

40,229

6,643

7,284

44.4

47.7

7.1

7.7

17.9

16.5

1.6

1.5

8.8

9.2

3.8

3.4

SAIL

Neutral

60

-

24,946

47,528

53,738

(0.7)

2.1

(1.9)

2.6

23.2

0.7

0.6

(1.6)

3.9

1.4

1.2

Tata Steel

Neutral

449

-

43,593

121,374

121,856

7.2

8.4

18.6

34.3

24.1

13.1

1.5

1.4

6.1

10.1

1.0

1.0

Vedanta

Neutral

244

-

72,205

71,744

81,944

19.2

21.7

13.4

20.1

18.2

12.1

1.6

1.4

8.4

11.3

1.4

1.1

Oil & Gas

Cairn India

#VALUE!

9,127

10,632

4.3

20.6

8.8

11.7

3.3

4.2

GAIL

Neutral

424

-

71,669

56,220

65,198

9.3

10.1

27.1

33.3

15.6

12.7

1.4

1.3

9.3

10.7

1.5

1.2

Indian Oil Corp

Neutral

440

-

213,684

373,359

428,656

5.9

5.5

54.0

59.3

8.2

7.4

1.3

1.1

16.0

15.6

0.7

0.6

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Oil & Gas

ONGC

Neutral

186

-

239,083

137,222

152,563

15.0

21.8

19.5

24.1

9.6

7.7

0.8

0.8

8.5

10.1

2.0

1.8

Reliance Industries

Neutral

1,395

-

453,496

301,963

358,039

12.1

12.6

87.7

101.7

15.9

13.7

1.6

1.5

10.7

11.3

2.0

1.6

Pharmaceuticals

Alembic Pharma

Accumulate

611

689

11,525

3,483

4,244

20.2

21.4

24.3

33.6

25.2

18.2

5.7

4.6

25.5

25.3

3.2

2.6

Alkem Laboratories Ltd

Accumulate

1,971

2,257

23,571

6,065

7,009

18.7

20.0

80.2

92.0

24.6

21.4

5.5

4.6

22.5

21.6

3.8

3.3

Aurobindo Pharma

Buy

606

877

35,507

15,720

18,078

23.7

23.7

41.4

47.3

14.6

12.8

3.8

3.0

29.6

26.1

2.5

2.1

Aventis*

Neutral

4,203

-

9,680

2,277

2,597

16.6

17.4

128.9

157.0

32.6

26.8

5.6

4.3

21.6

26.4

4.0

3.3

Cadila Healthcare

Neutral

440

-

45,034

10,429

12,318

17.7

21.6

13.1

19.2

33.6

22.9

7.0

5.6

22.8

27.1

4.4

3.6

Cipla

Sell

557

465

44,795

15,378

18,089

15.7

16.8

19.3

24.5

28.9

22.7

3.4

3.0

12.3

13.9

3.1

2.6

Dishman Pharma

Sell

311

143

5,014

1,718

1,890

22.7

22.8

9.5

11.3

32.7

27.5

3.2

2.9

10.1

10.9

3.4

3.0

Dr Reddy's

Neutral

2,599

-

43,062

16,043

18,119

18.0

23.0

78.6

130.9

33.1

19.9

3.2

2.8

10.1

15.2

2.5

2.4

GSK Pharma*

Neutral

2,500

-

21,180

2,800

3,290

10.2

20.6

32.2

60.3

77.7

41.5

14.4

14.2

17.2

34.5

7.3

6.3

Indoco Remedies

Accumulate

227

240

2,090

1,112

1,289

16.2

18.2

11.6

16.0

19.6

14.2

3.1

2.6

17.0

20.1

2.0

1.7

Ipca labs

Neutral

598

-

7,548

3,258

3,747

12.8

15.3

12.1

19.2

49.4

31.2

3.1

2.8

6.4

9.5

2.4

2.1

Lupin

Buy

1,338

1,809

60,420

15,912

18,644

26.4

26.7

58.1

69.3

23.0

19.3

4.5

3.7

21.4

20.9

3.9

3.2

Natco Pharma

Accumulate

924

974

16,105

2,090

2,335

32.1

26.6

26.8

23.2

34.4

39.9

9.8

8.4

28.4

21.1

7.8

95.4

Sun Pharma

Buy

643

847

154,163

31,129

35,258

32.0

32.9

30.2

35.3

21.3

18.2

3.5

2.9

20.0

20.1

4.5

3.8

Power

NTPC

Neutral

164

-

135,555

86,605

95,545

17.5

20.8

11.8

13.4

13.9

12.3

1.4

1.3

10.5

11.1

2.9

2.9

Power Grid

Accumulate

208

223

108,608

25,315

29,193

88.2

88.7

14.2

17.2

14.7

12.1

2.2

1.9

15.2

16.1

8.9

8.0

Tata Power

Neutral

84

-

22,801

36,916

39,557

17.4

27.1

5.1

6.3

16.5

13.4

1.5

1.3

9.0

10.3

1.6

1.5

Real Estate

MLIFE

Buy

442

522

1,814

1,152

1,300

22.7

24.6

29.9

35.8

14.8

12.3

1.1

1.0

7.6

8.6

2.3

1.9

Prestige Estate

Neutral

236

-

8,837

4,707

5,105

25.2

26.0

10.3

13.0

22.9

18.1

1.8

1.7

10.3

10.2

3.0

2.7

Telecom

Bharti Airtel

Neutral

355

-

141,748

105,086

114,808

34.5

34.7

12.2

16.4

29.1

21.6

2.0

1.8

6.8

8.4

2.3

2.0

Idea Cellular

Neutral

86

-

30,880

40,133

43,731

37.2

37.1

6.4

6.5

13.4

13.2

1.1

1.0

8.2

7.6

1.8

1.5

zOthers

Abbott India

Neutral

4,419

-

9,390

3,153

3,583

14.1

14.4

152.2

182.7

29.0

24.2

142.6

121.7

25.6

26.1

2.7

2.3

Asian Granito

Accumulate

383

405

1,151

1,060

1,169

12.2

12.5

12.7

15.9

30.2

24.1

2.9

2.6

9.5

10.7

1.4

1.2

Bajaj Electricals

Accumulate

352

395

3,560

4,801

5,351

5.7

6.2

10.4

13.7

33.7

25.7

4.2

3.7

12.4

14.5

0.7

0.7

Banco Products (India)

Neutral

229

-

1,636

1,353

1,471

12.3

12.4

14.5

16.3

15.8

14.0

21.8

19.6

14.5

14.6

1.1

123.6

Coffee Day Enterprises

Neutral

250

-

5,153

2,964

3,260

20.5

21.2

4.7

8.0

-

31.3

2.9

2.7

5.5

8.5

2.1

1.9

Ltd

Competent Automobiles Neutral

232

-

149

1,137

1,256

3.1

2.7

28.0

23.6

8.3

9.8

44.6

40.3

14.3

11.5

0.1

0.1

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

zOthers

Elecon Engineering

Neutral

61

-

680

1,482

1,660

13.7

14.5

3.9

5.8

15.6

10.5

3.7

3.4

7.8

10.9

0.8

0.7

Finolex Cables

Neutral

525

-

8,033

2,883

3,115

12.0

12.1

14.2

18.6

37.0

28.2

19.7

17.2

15.8

14.6

2.5

2.2

Garware Wall Ropes

Neutral

753

-

1,647

863

928

15.1

15.2

36.4

39.4

20.7

19.1

3.7

3.2

17.5

15.9

1.8

1.7

Goodyear India*

Neutral

886

-

2,043

1,598

1,704

10.4

10.2

49.4

52.6

17.9

16.8

82.8

72.6

18.2

17.0

1.0

137.5

Hitachi

Neutral

1,795

-

4,882

2,081

2,433

8.8

8.9

33.4

39.9

53.8

45.0

43.4

36.1

22.1

21.4

2.3

2.0

HSIL

Neutral

342

-

2,471

2,384

2,515

15.8

16.3

15.3

19.4

22.3

17.6

22.2

19.1

7.8

9.3

1.2

1.1

Interglobe Aviation

Neutral

1,106

-

39,973

21,122

26,005

14.5

27.6

110.7

132.1

10.0

8.4

59.8

42.7

168.5

201.1

1.9

1.5

Jyothy Laboratories

Neutral

400

-

7,265

1,440

2,052

11.5

13.0

8.5

10.0

47.0

40.0

11.4

10.6

18.6

19.3

5.3

3.7

Kirloskar Engines India

Neutral

395

-

5,713

2,554

2,800

9.9

10.0

10.5

12.1

37.6

32.7

15.7

14.9

10.7

11.7

1.9

1.7

Ltd

Linc Pen & Plastics

Neutral

291

-

431

382

420

9.3

9.5

13.5

15.7

21.6

18.5

3.7

3.2

17.1

17.3

1.2

1.1

M M Forgings

Neutral

598

-

721

546

608

20.4

20.7

41.3

48.7

14.5

12.3

81.9

72.5

16.6

17.0

1.2

1.0

Manpasand Bever.

Neutral

702

-

4,017

836

1,087

19.6

19.4

16.9

23.8

41.6

29.5

5.0

4.4

12.0

14.8

4.5

3.4

Mirza International

Accumulate

107

113

1,282

963

1,069

17.2

18.0

6.1

7.5

17.4

14.2

2.7

2.3

15.0

15.7

1.5

1.4

MT Educare

Neutral

81

-

321

366

417

17.7

18.2

9.4

10.8

8.6

7.5

1.9

1.7

22.2

22.3

0.8

0.7

Narayana Hrudaya

Neutral

322

-

6,580

1,873

2,166

11.5

11.7

2.6

4.0

121.7

81.2

7.5

6.7

6.1

8.3

3.6

3.1

Navkar Corporation

Buy

208

265

2,963

369

561

42.9

42.3

6.9

11.5

30.1

18.0

2.1

1.9

7.4

10.5

9.0

5.9

Navneet Education

Neutral

169

-

3,935

1,062

1,147

24.0

24.0

6.1

6.6

27.7

25.4

5.7

5.0

20.6

19.8

3.8

3.5

Nilkamal

Neutral

2,179

-

3,251

1,995

2,165

10.7

10.4

69.8

80.6

31.2

27.0

124.5

108.2

16.6

16.5

1.6

1.5

Page Industries

Neutral

14,460

-

16,128

2,450

3,124

20.1

17.6

299.0

310.0

48.4

46.6

322.0

245.8

47.1

87.5

6.6

5.2

Parag Milk Foods

Neutral

243

-

2,048

1,919

2,231

9.3

9.6

9.5

12.9

25.8

18.8

4.0

3.3

15.5

17.5

1.2

1.0

Quick Heal

Neutral

246

-

1,722

408

495

27.3

27.0

7.7

8.8

31.7

27.9

2.9

3.0

9.3

10.6

3.4

2.8

Radico Khaitan

Buy

123

147

1,635

1,667

1,824

13.0

13.2

6.7

8.2

18.5

15.0

1.7

1.5

9.0

10.2

1.4

1.2

Relaxo Footwears

Neutral

492

-

5,915

2,085

2,469

9.2

8.2

7.6

8.0

65.1

62.0

25.3

21.6

17.9

18.8

2.9

2.5

S H Kelkar & Co.

Neutral

324

-

4,678

1,036

1,160

15.1

15.0

6.1

7.2

53.0

45.1

5.7

5.2

10.7

11.5

4.4

3.9

Siyaram Silk Mills

Accumulate

1,689

1,872

1,583

1,652

1,857

11.6

11.7

92.4

110.1

18.3

15.3

2.7

2.3

14.7

15.2

1.2

1.0

Styrolution ABS India*

Neutral

738

-

1,298

1,440

1,537

9.2

9.0

40.6

42.6

18.2

17.3

46.4

42.2

12.3

11.6

0.9

0.8

Surya Roshni

Neutral

265

-

1,160

3,342

3,625

7.8

7.5

17.3

19.8

15.3

13.4

29.1

23.3

10.5

10.8

0.6

0.5

Team Lease Serv.

Neutral

1,058

-

1,810

3,229

4,001

1.5

1.8

22.8

32.8

46.5

32.2

5.0

4.3

10.7

13.4

0.5

0.4

The Byke Hospitality

Neutral

214

-

858

287

384

20.5

20.5

7.6

10.7

28.2

20.0

5.9

4.8

20.7

23.5

3.0

2.2

Stock Watch

May 02, 2017

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E

zOthers

Transport Corporation of

Neutral

244

-

1,865

2,671

2,911

8.5

8.8

13.9

15.7

17.6

15.6

2.4

2.1

13.7

13.8

0.8

0.7

India

TVS Srichakra

Neutral

4,043

-

3,095

2,304

2,614

13.7

13.8

231.1

266.6

17.5

15.2

454.2

357.7

33.9

29.3

1.3

1.2

UFO Moviez

Neutral

467

-

1,288

619

685

33.2

33.4

30.0

34.9

15.6

13.4

2.2

1.9

13.8

13.9

1.8

1.4

Visaka Industries

Neutral

335

-

532

1,051

1,138

10.3

10.4

21.0

23.1

16.0

14.5

43.0

40.2

9.0

9.2

0.8

0.7

VRL Logistics

Neutral

332

-

3,030

1,902

2,119

16.7

16.6

14.6

16.8

22.8

19.7

5.0

4.4

21.9

22.2

1.7

1.5

Wonderla Holidays

Neutral

390

-

2,203

287

355

38.0

40.0

11.3

14.2

34.5

27.5

4.9

4.3

21.4

23.9

7.4

6.0

VIP Industries

Accumulate

199

218

2,809

1,270

1,450

10.4

10.4

5.6

6.5

35.5

30.6

7.4

6.4

20.7

21.1

2.2

1.9

Navin Fluorine

Buy

3,141

3,650

3,075

789

945

21.1

22.4

120.1

143.4

26.2

21.9

4.2

3.6

17.8

18.5

3.8

3.1

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on April 28, 2017

Market Outlook

May 02, 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.