IPO Note | FMCG

June 22, 2015

Manpasand Beverages

NEUTRAL

Issue Open: June 24, 2015

IPO Note - Valuation expensive

Issue Close: June 26, 2015

Investment rationale:

Issue Details

Capacity expansion to trigger growth: Currently the company has three

manufacturing plants having a total capacity of around 9 lakh litres per day. The

Face Value: `10

company is now setting up a new manufacturing facility in Haryana/Punjab, at a

Present Eq. Paid up Capital: `37.6cr

capex of around `152cr, which will increase the total capacity by around 50%. Going

Fresh Issue**: 1.25cr Shares

forward, we believe this new plant will drive additional growth for the company.

Post Eq. Paid up Capital: `50cr

A strong regional brand supported by a wide distribution network: The company

has a strong brand - Mango Sip, having presence in rural and semi urban

Market Lot: 45 Shares

regions, ie mainly in Punjab, Bihar, Maharashtra, Gujarat, and Uttar Pradesh.

Fresh Issue (amount): `400cr

Also, the company has a wide distribution network including 73 consignee agents

and 654 distributors spread across 24 states in India to whom it sells directly. The

Price Band: `290-320

company’s sales and distribution network is strategically spread across different regions

Post-issue implied mkt. cap `1,452cr*-

in India, and has an especially strong outreach in certain semi urban and rural markets.

1,602cr**

Note:*at Lower price band and **Upper price band

Investment concern:

Overall slowdown in rural markets could impact discretionary spending: A major

portion of the company’s revenue comes from rural markets owing to the

Book Building

company’s strong presence in these areas, backed by a wide distribution network.

The Indian rural story is currently going through an adverse phase due to

QIBs

75%

unseasonal rains in the recent past which impacted crops extensively, and due to

Non-Institutional

15%

lower hike in minimum support prices (MSPs), thus curtailing rural incomes. Thus,

Retail

10%

going forward, any further slowdown in rural markets could likely result in lower

spending on discretionary products.

High dependency on a single brand: The company started operations with its

Post Issue Shareholding Pattern(%)

flagship brand ’Mango Sip’ in the year 1997; since then, the brand has been the

Promoters Group

50.4

largest contributor to the company’s revenues. In the last three years, more than

97% of the company’s revenue has been contributed by ’Mango Sip’ alone.

MF/Banks/Indian

FIs/FIIs/Public & Others

49.6

Outlook and Valuation: MBL is highly dependent on a single brand (Mango Sip)

which currently has rural and semi urban focus. Going forward, for penetrating

the brand in urban markets, MBL would face stiff competition from strong existing

brands like Frooti, Slice, Mangola, Pepsi, Coca cola etc.

On the price to earnings per share (EPS; post-IPO) front, the company is valued at

95x 9MFY2015 annualized numbers, while its close peer - Dabur is trading at

44x FY2015 numbers. Further, other FMCG companies like ITC and HUL are also

trading at a lower multiple than MBL inspite of bigger brands in their portfolios, wide

pan India distribution networks, and higher ROEs, coupled with their proven track

records. Hence, we recommend NEUTRAL on the issue due to expensive valuation.

Key Financials

Y/E March (` cr)

FY2013

FY2014

9MFY15

Net Sales

240

294

239

Net Profit

22

20

13

OPM (%)

16.1

15.5

15.2

EPS (`)

5.9

5.5

3.4

P/E (x)*

53.8

58.7

-

P/BV (x)*

14.4

11.4

-

Amarjeet S Maurya

EV/Sales (x)*

4.7

3.9

-

+91 22 3935 7800 Ext: 6831

EV/EBITDA (x)*

29.2

25.1

-

Source: Company, Angel Research; Note: *The above numbers are considering subscription at the

upper end of the price band

Please refer to important disclosures at the end of this report

1

Manpasand Beverages | IPO Note

Company background

Manpasand Beverages was incorporated in 1997 and is based in Vadodara,

Gujrat. It operates as a fruit drink manufacturing company in India. The company

offers a mango based fruit drink under the ‘Mango Sip’ brand, fruit drinks and

carbonated fruit drinks under the ‘Fruits Up’ brand, and fruit drinks with energy

replenishing qualities under the ‘Manpasand ORS’ brand. It also offers an apple

flavoured fruit drink under the ‘Apple Sip’ brand, and bottled water under the

‘Pure Sip’ brand. All of the company’s brands have a distribution focus towards

semi urban and rural markets. The company has two manufacturing facilities in

Vadodara (Gujrat) and one in Varanasi (Uttar Pradesh). Of the two facilities in

Gujrat, one has just commenced commercial production, ie from April 2015. As of

March 2015, MBL has a wide distribution network including 73 consignee agents

and 654 distributors spread across 24 states in India to whom it sell directly. The

company also sells directly to Indian Railway Catering and Tourism Organization

(“IRCTC”) approved vendors.

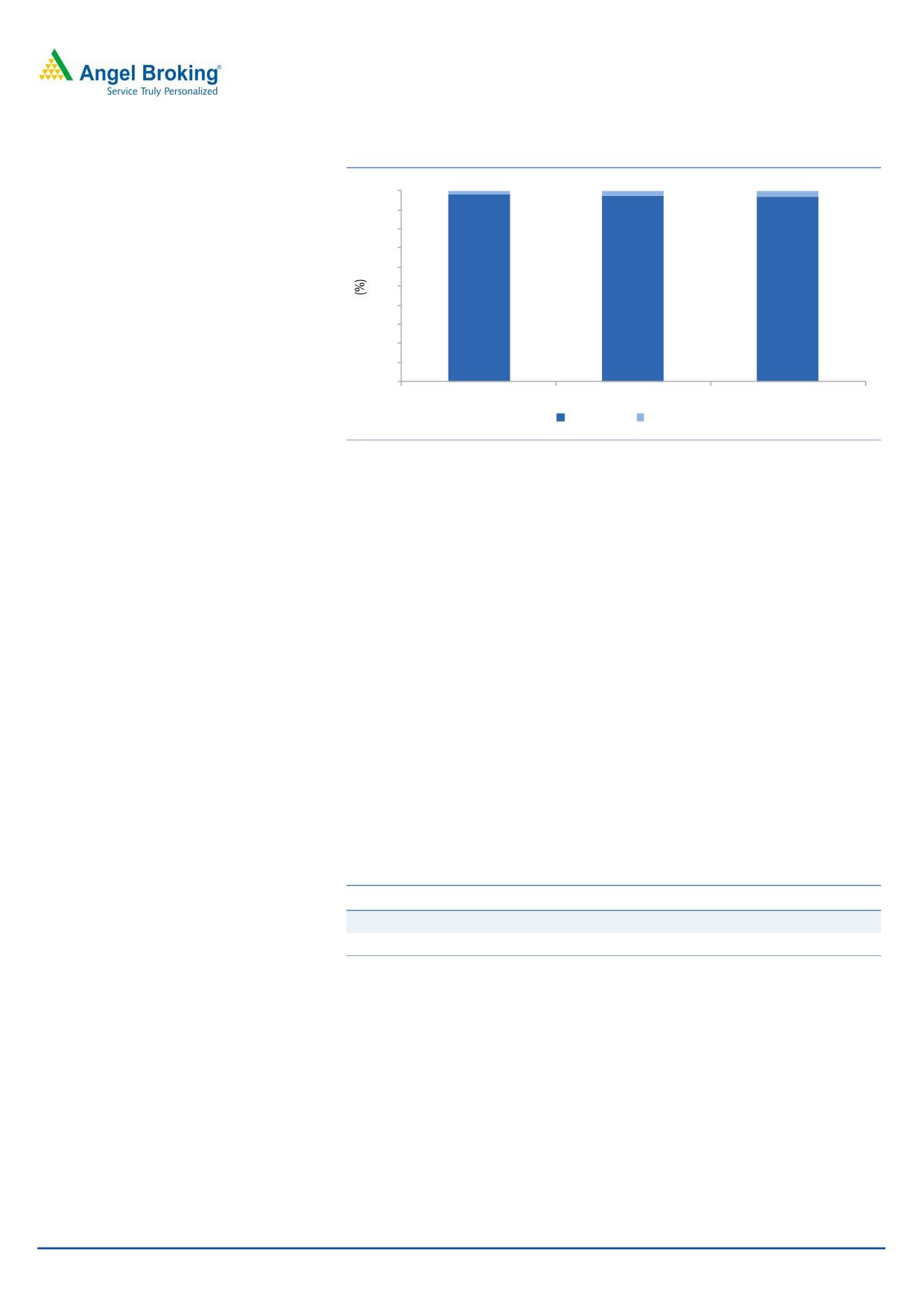

Exhibit 1: Sales mix -Tetra pack vs Bottle

100%

90%

20%

80%

70%

60%

60%

50%

40%

80%

30%

20%

40%

10%

0%

Historically

Current

Tetra pack

Bottle

Source: Company, Angel Research

Exhibit 2: Tetra pack

Source: Company, Angel Research

June 22, 2015

2

Manpasand Beverages | IPO Note

Exhibit 3: Bottle

Source: Company, Angel Research

Issue details

MBL is backed by venture capital fund SAIF Partners (which holds ~30%), private

equity firm Aditya Birla Private Equity (which holds ~3%) while promoters hold

~67% in the company. The company is raising money through an IPO (fresh issue)

via the book building process aggregating to `400cr. Shares could be subscribed

to in the price band of `290-320 (face value of shares: `10/- each). The fresh

issue of shares will constitute ~27% of the post-issue paid-up equity share capital

of the company.

Exhibit 4: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

2,52,40,500

67.2

2,52,40,500

50.4

Others

1,23,13,500

32.8

2,48,13,500

49.6

Total

3,75,54,000

100.0

5,00,54,000

100.0

Source: Company, Angel Research

Objects of the offer

Setting-up of a new manufacturing facility in the state of Haryana/Punjab

which would cost around `152cr.

Modernization of manufacturing facilities, ie Vadodara 1 Facility and Varanasi

Facility, which would cost around `39cr.

Setting-up of a new corporate office at Vadodara, which would cost around

`22cr.

Repayment/prepayment of certain borrowings availed by the company to the

tune of `100cr; while the balance would be utilized towards general corporate

purposes.

June 22, 2015

3

Manpasand Beverages | IPO Note

Key investment rational

Capacity expansion to trigger growth

Currently the company has three manufacturing plants (two plants in Vadodara

and one in Varanasi) which have a total capacity of around 9 lakh litres per day.

The company is now setting up a new manufacturing plant in Haryana/Punjab, at

a capex of around ~`152cr, which will likely increase total capacity by 50%. The

company is also modernizing its existing facilities at Vadodara and Varanasi at an

estimated cost of ~`39cr. Going forward, we believe the new plant will drive

additional growth for the company.

A strong regional brand with a wide distribution network

The company has a strong brand - Mango Sip which has presence in rural and

semi urban markets, mainly Punjab, Bihar, Maharashtra, Gujarat and Uttar

Pradesh. Mango Sip contributed by more than 97% to the company’s total revenue

in FY2014. The brand is supported by a wide distribution network including 73

consignee agents and 654 distributors spread across 24 states in India to whom

the company sells directly. In addition, the company’s consignee agents and

distributors also engage a number of super stockists, other distributors and sub

distributors who distribute the company’s products to a number of retail outlets.

The company’s sales and distribution network is strategically spread across

different regions in India, and has an especially strong outreach in certain semi

urban and rural markets.

Exhibit 5: Distribution network

States

Distributors

Punjab

96

Bihar

75

Maharashtra

73

Gujarat

53

Delhi

47

Haryana

44

Rajasthan

38

Uttar Pradesh

38

Chhattisgarh

36

Karnataka

33

Jharkhand

21

Uttarakhand

12

Assam

10

Madhya Pradesh

9

Himachal Pradesh

8

Andhra Pradesh

7

Goa

7

Manipur

5

Orissa

5

Kerala

3

Tamil Nadu

2

Jammu & Kashmir

1

Telangana

1

Source: Company, Angel Research

June 22, 2015

4

Manpasand Beverages | IPO Note

Key investment concerns

Overall slowdown in rural markets could impact discretionary

spending

A majority of the company’s revenue comes from rural markets through sales of

discretionary products like fruit drinks. The Indian rural story, in the recent past,

has been negatively impacted due to unseasonal rain which adversely affected

crops. Further, lower hike in MSPs (in FY2015, price hike was of 4.3% compared to

last six years’ average hike of 12.5%) has also curtailed income in rural hands.

Also, for FY2016, the government has announced a hike in MSP of around 3.7%,

which is even lower than in FY2015. Considering the above factors, we see less

scope for discretionary spending to expand in rural markets in the near term.

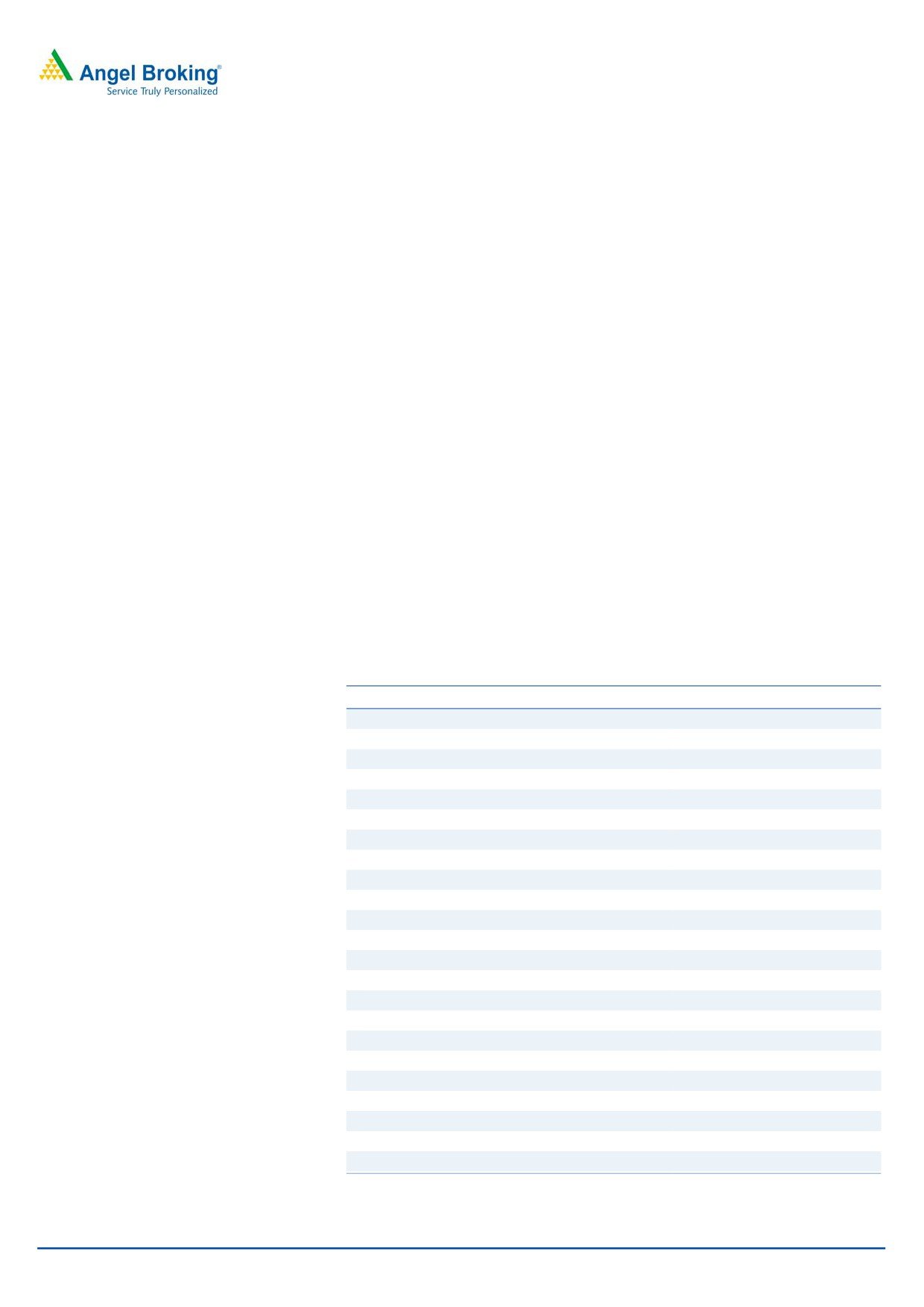

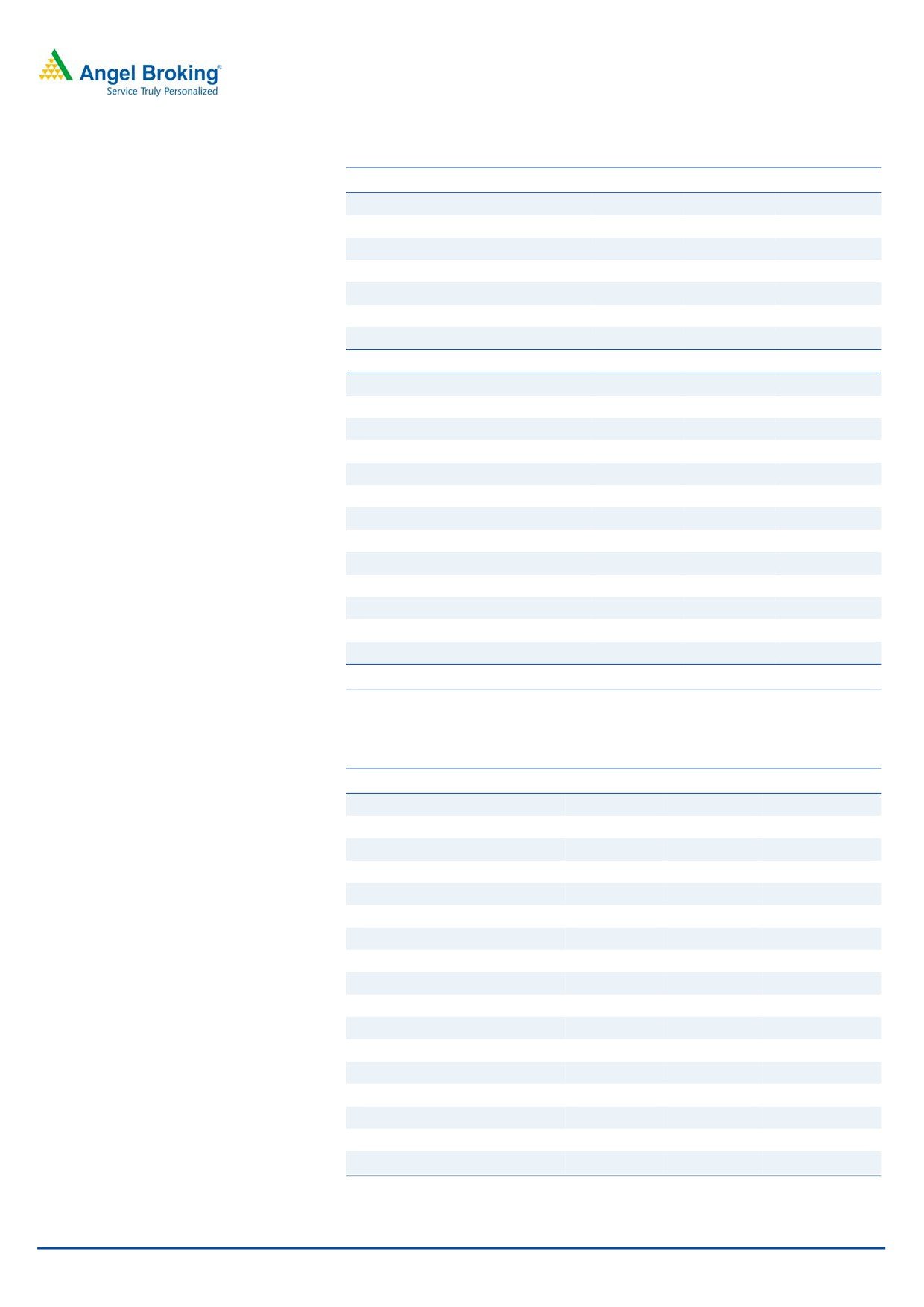

Exhibit 6: Historical average MSP Price trend growth

35

30.9

30

25

20

14.4

15

10.4

9.3

8.9

10

4.3

3.7

5

0.8

0

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

Average % increase in MSP (wheat & pady)

Source: Company, Angel Research

Higher dependency on a single brand

The company started operations with its flagship brand “Mango Sip” in the year

1997; since then, the brand has been the largest contributor to the company’s

revenues. In the last three years, more than 97% of the company’s revenue has

been contributed by “Mango Sip” alone.

As against this, other listed FMCG companies like HUL, ITC, Dabur etc have a well

diversified product portfolio, thereby not being subject to the single product

dependency risk, to a fair extent. Although MBL has launched a few brands in

FY2015 to restrain the single brand dependency risk, it will take time for these

brands to take off; as of now, the contribution of these brands is insignificant for

the company.

June 22, 2015

5

Manpasand Beverages | IPO Note

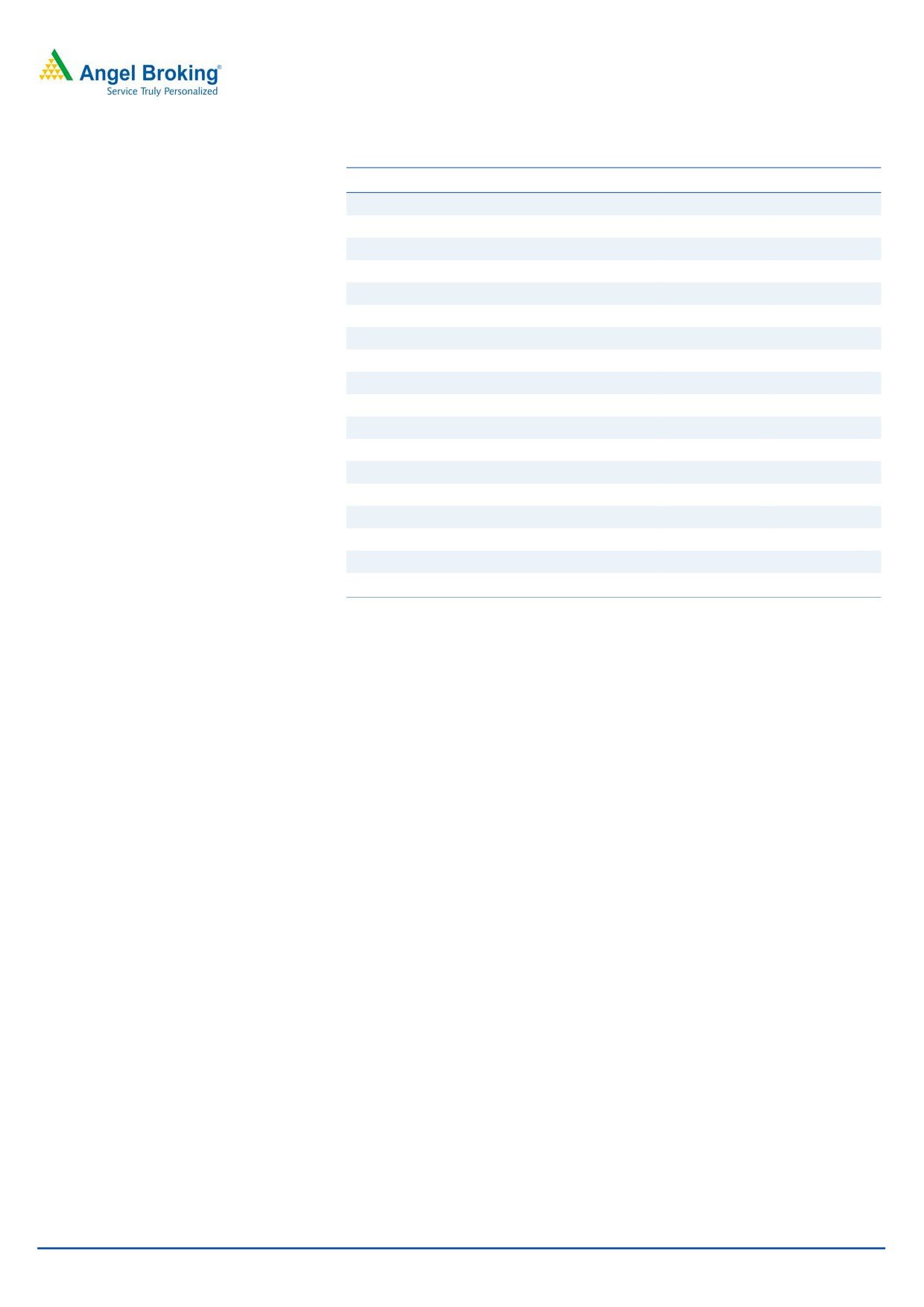

Exhibit 7: Mango Sip brand’s contribution to total revenue

100

2

2

3

90

80

70

60

50

98

98

97

40

30

20

10

0

FY2012

FY2013

FY2014

Mango Sip Others

Source: Company, Angel Research

Expensive Valuation

During FY2014, MBL reported a top-line of ~`294cr and a bottom-line of

~`20cr. For 9HFY2015, the company has reported a top-line of `239cr and a net

profit of `13cr.

MBL is highly dependent on a single brand (Mango Sip) which currently has rural

and semi urban focus. Going forward, for penetrating the brand in urban markets,

MBL would face stiff competition from strong existing brands like Frooti, Slice,

Mangola, Pepsi, Coca cola etc.

On the price to earnings per share (EPS; post-IPO) front, the company is valued at

95x 9MFY2015 annualized numbers, while its close peer - Dabur is trading at 44x

FY2015 numbers. Further, other FMCG companies like ITC and HUL are also

trading at a lower multiple than MBL inspite of bigger brands in their portfolios,

wide pan India distribution networks, and higher ROEs, coupled with their proven

track records. Hence, we recommend NEUTRAL on the issue due to expensive

valuation.

Exhibit 8: Valuation table

MBL

Dabur

ITC

HUL

PE

95

44

25

43

ROE (%)

9

32

30

108

Source: Company, Angel Research; Note: MBL’s 9MFY15 numbers are annualised for comparison;

other peers FY15 numbers have been taken. Valuation Ratio at the upper price band

Risks to upside

(a) Improvement in economic growth and better than expected monsoon would

likely increase crop produce, which would lead to higher disposable incomes

in the hands of the rural consumer. This would be a risk to our

recommendation.

(b) Success of recently launched brands and their higher contribution to overall

revenue of the company would be a risk to our recommendation.

June 22, 2015

6

Manpasand Beverages | IPO Note

Profit & Loss

Y/E March (` cr)

FY2013

FY2014

9MFY2015

Total operating income

240

294

239

Total Expenditure

202

249

203

Cost of Materials

148

172

143

Personnel Expenses

7

8

7

Others Expenses

46

68

53

EBITDA

39

46

36

(% of Net Sales)

16.1

15.5

15.2

Depreciation& Amortisation

10

15

15

EBIT

29

31

21

(% of Net Sales)

11.9

10.5

9.0

Interest & other Charges

4

8

8

Other Income

0

0

0

(% of PBT)

1.3

0.2

2.6

Share in profit of Associates

-

-

-

Recurring PBT

25

23

14

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

PBT (reported)

25

23

14

Tax

2

3

1

(% of PBT)

9.1

11.5

10.2

PAT (reported)

22

20

13

Restatement Adjustments

(0)

(0)

0

PAT after MI (reported)

22

20

13

ADJ. PAT

22

20

13

(% of Net Sales)

9.3

7.0

5.3

Basic EPS (`)

6.6

6.0

3.4

June 22, 2015

7

Manpasand Beverages | IPO Note

Balance Sheet

Y/E March (` cr)

FY2013

FY2014

9MFY2015

SOURCES OF FUNDS

Equity Share Capital

3

3

38

Reserves& Surplus

72

92

147

Shareholders Funds

76

96

185

Minority Interest

-

-

-

Total Loans

47

65

89

Deferred Tax Liability

-

0

-

Total Liabilities

123

161

273

APPLICATION OF FUNDS

Fixed Assets

93

92

80

Capital Work-in-Progress

-

-

105

Investments

0

0

0

Current Assets

71

106

144

Inventories

21

42

41

Sundry Debtors

33

48

43

Cash

6

5

10

Loans & Advances

10

11

45

Other Assets

2

1

5

Current liabilities

41

38

55

Net Current Assets

30

69

88

Deferred Tax Asset

0

-

0

Total Assets

123

161

273

Cash flow statement

Y/E March (` cr)

FY2013

FY2014

9MFY2015

Profit before tax

25

23

14

Depreciation

10

15

15

Change in Working Capital

(1)

(41)

18

Interest / Dividend (Net)

(0)

0

0

Others

(1)

5

4

Cash Flow from Operations

32

2

51

(Inc.)/ Dec. in Fixed Assets

(48)

(15)

(138)

(Inc.)/ Dec. in Investments

(0)

-

(0)

Cash Flow from Investing

(48)

(15)

(138)

Issue of Equity

-

-

-

Inc./(Dec.) in loans

16

(3)

89

Dividend Paid (Incl. Tax)

7

22

11

Interest / Dividend (Net)

(4)

(8)

(8)

Cash Flow from Financing

19

11

92

Inc./(Dec.) in Cash

3

(1)

5

Opening Cash balances

2

5

4

Closing Cash balances

5

4

9

June 22, 2015

8

Manpasand Beverages | IPO Note

Key Ratios

Y/E March

FY2013

FY2014

Valuation Ratio (x)

P/E (on FDEPS)

53.8

58.7

P/CEPS

36.9

34.0

P/BV

14.4

11.4

EV/Sales

4.7

3.9

EV/EBITDA

29.2

25.1

EV / Total Assets

0.7

0.6

Per Share Data (`)

EPS (Basic)

5.9

5.5

EPS (fully diluted)

5.9

5.5

Cash EPS

8.7

9.4

Book Value

22.2

28.1

Turnover ratios (x)

Asset Turnover

2.6

3.2

Inventory / Sales (days)

32

52

Receivables (days)

49

59

Payables (days)

28

22

Working capital cycle (days)

53

89

June 22, 2015

9

Manpasand Beverages | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

June 22, 2015

10