Initiating coverage | Real Estate

May 17, 2012

Mahindra Lifespaces Developers

BUY

CMP

`312

As clean as it comes

Target Price

`376

Mahindra Lifespaces Developers (MLIFE) is a mid and premium housing

Investment Period

12 Months

developer catering to strong demand in tier-1 cities and small metros in the

country. Apart from real estate development, MLIFE also operates two integrated

Stock Info

business cities - Mahindra World City (MWC) Chennai and Jaipur [special

Sector

Real Estate

economic zones (SEZ) and domestic tariff area (DTA)]. MLIFE’s strong balance

Market Cap (` cr)

1,323

sheet (FY2013E D/E ratio - 0.2x), good corporate governance, diversified land

Beta

0.9

bank and solid brand name sets it apart from many of its peers. We also prefer

52 Week High / Low

418 / 235

MLIFE’s high turnover real estate business model, which is more focused on

Avg. Daily Volume

11,326

Face Value (`)

10

development rather than land bank accumulation. We Initiate Coverage on the

BSE Sensex

17,374

stock with a Buy recommendation.

Nifty

5,291

MLIFE in the right markets: With slowing demand in super metros (Mumbai and

Reuters Code

MALD.BO

Bloomberg Code

MLIFE IN

NCR), we favor MLIFE’s exposure to tier-1 cities (Pune and Nagpur) and small

metros (Hyderabad), given their strong demand dynamics. Pune, Nagpur and

Hyderabad now form 68% of MLIFE’s exposure in terms of saleable area. With

Shareholding Pattern (%)

5.2mn sq. ft. of forthcoming projects (~4.3x its FY2012 sales), we expect strong

Promoters

51.1

sales momentum during FY2013E and FY2014E, which is our primary catalyst.

MF / Banks / Indian Fls

5.9

We also note that with the initiation of the rate cut cycle, mid-market housing will

FII / NRIs / OCBs

31.2

lead the recovery in demand, which has been a focus area for MLIFE.

Indian Public / Others

11.8

Being conservative on MWC is the key: Impact on demand due to direct tax code

has been an overhang on MWC’s portfolio. We note that ~53% of MLIFE’s

Abs. (%)

3m 1yr 3yr

invested capital is in the MWC portfolio; however, we have conservatively valued

Sensex

3.8

(10.8)

58.2

it at `97/share (contributes 20.6% to our SOTP value of `470). Moreover, MWC

MAHLIFE

26.6

(17.4)

71.2

Chennai’s current occupancy levels, at 92%, provide stable revenue visibility.

MLIFE deserves a premium to its peers: MLIFE is currently trading at 1.0x and 0.9x

on our FY2013E and FY2014E BVPS estimates. On PB basis (one-year forward),

MLIFE is trading at a 35% premium to BSE Realty Index, which we hold is justified,

given its strong balance sheet, good corporate governance, asset-light model and

solid brand name along with solid parent backing. We value MLIFE on an SOTP

basis to arrive at a value of `470, we apply a 20% discount to our SOTP value to

arrive at our target price of `376, implying a PB (FY2014E) of 1.1x.

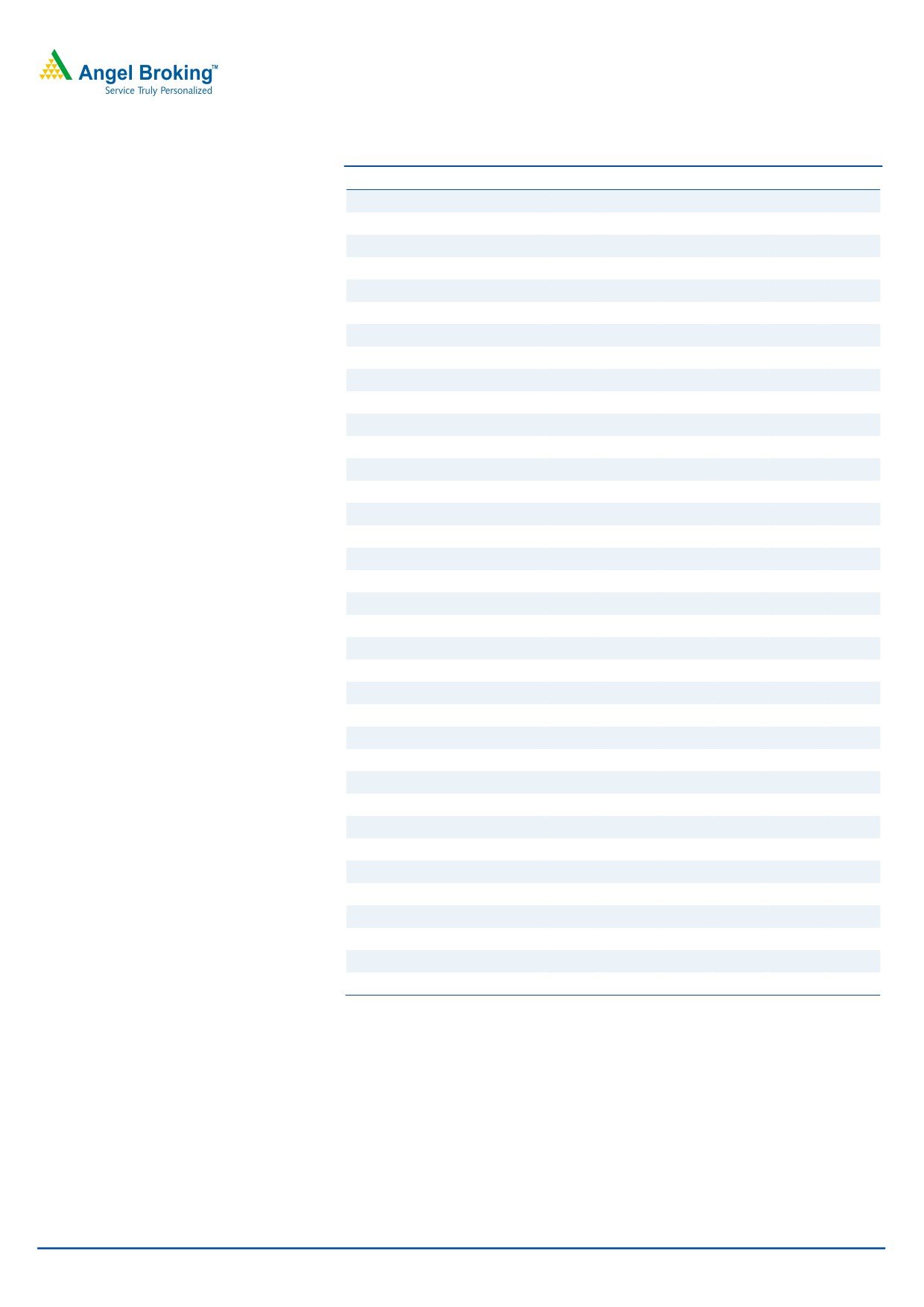

Key Financials (Consolidated)

Y/E March (` cr)

FY2011

FY2012E FY2013E

FY2014E

Net Revenue

612

701

814

897

% chg

46.4

14.6

16.1

10.2

Net Profit

108

119

128

139

% chg

37.8

10.1

7.4

8.3

EBITDA (%)

28.8

27.3

26.9

27.0

EPS (`)

26.5

29.2

31.3

33.9

P/E (x)

11.8

10.7

10.0

9.2

P/BV (x)

1.2

1.1

1.0

0.9

RoE (%)

10.2

10.3

10.2

10.1

RoCE (%)

10.5

10.4

10.6

9.8

Rahul Kaul

EV/Sales (x)

2.6

2.3

2.1

1.9

+91 22 3935 7800 Ext: 6817

EV/EBITDA (x)

8.9

8.5

8.0

7.0

Source: Company, Angel Research; Note: CMP as on May 16, 2012

Please refer to important disclosures at the end of this report

1

Mahindra Lifespaces Developers | Initiating coverage

MLIFE: In the right markets

MLIFE is a real estate developer,

MLIFE is a mid-market and premium housing developer. The company caters to

focusing on premium and mid-market

strong demand present in tier-1 cities and small metros, which are typically end-

housing and operating in two

user driven, as opposed to investor-led demand in super metros - National Capital

integrated business cities

- MWC

Region (NCR) and Mumbai.

Chennai and MWC Jaipur)

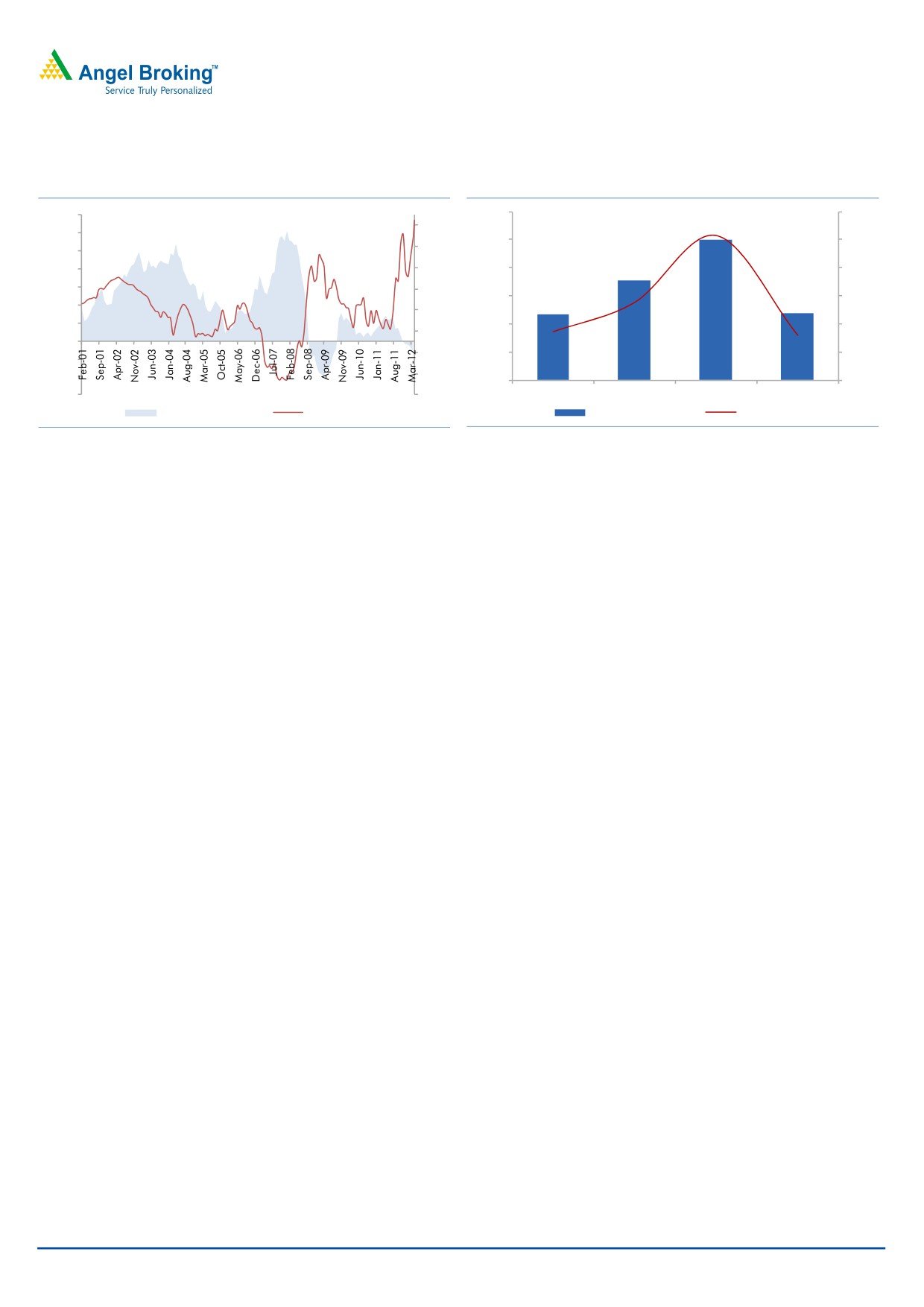

Tier-1 cities better placed than metros

Over the past few quarters, real estate in NCR (with the slight exception of

Gurgaon) and Mumbai has been marred by declining absorptions, growing

vacancy rates and falling affordability, owing to increasing prices and reluctance

on the part of developers to cut prices. Demand in small metros and tier-1 cities,

on the other hand, has been steady due to better affordability and stable end-user

demand.

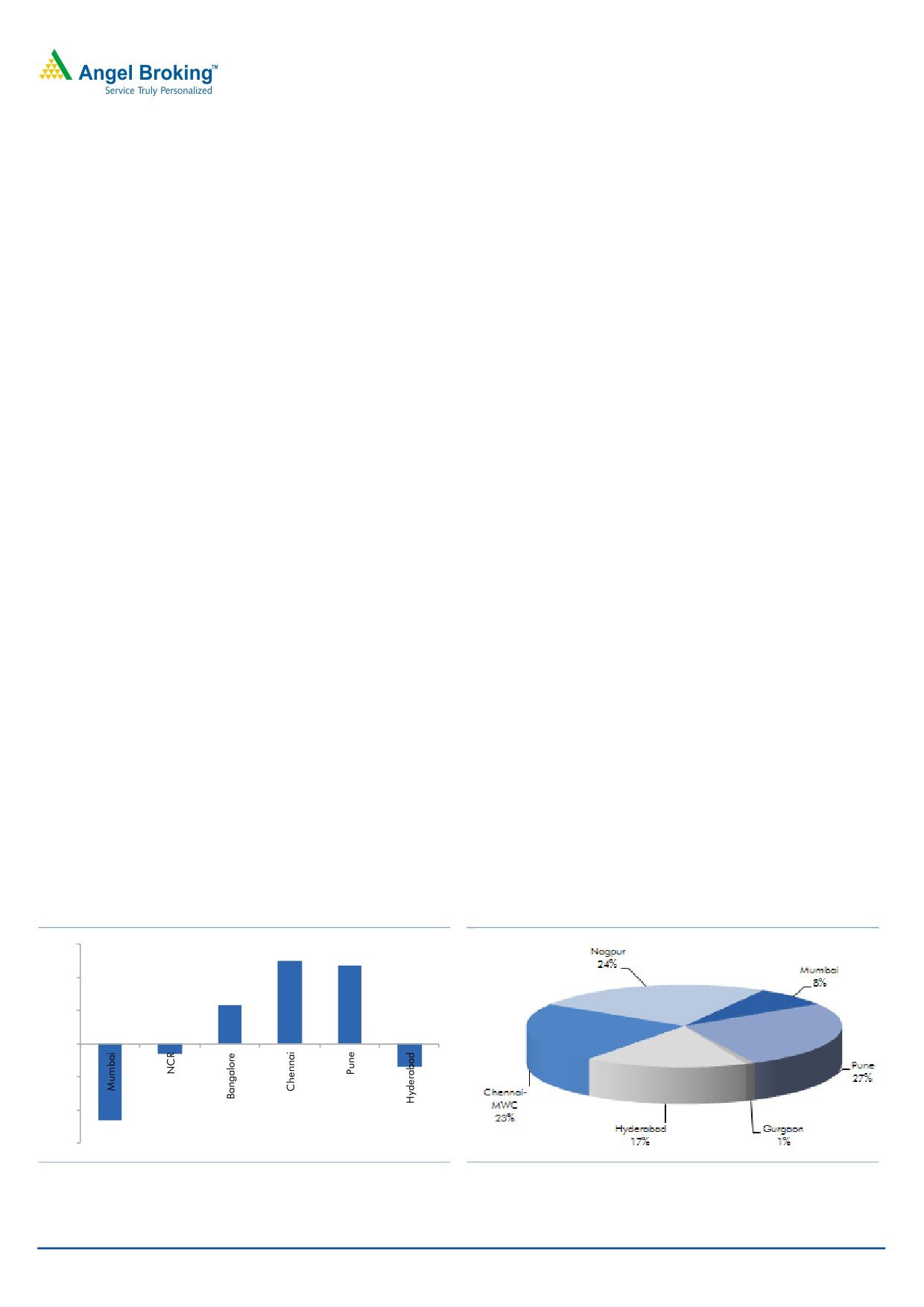

Pune, Hyderabad and Chennai have

According to data provided by Liasas Foras, inventory months as of March 2012

seen stable inventory levels, with

(Exhibit 3-8), have been stable for Pune (6 months vs. 6 months yoy), Hyderabad

inventory months as of March 2012 at

(7 months vs. 10 months yoy) and Chennai (8 months vs. 8 months yoy) over the

6 months, 7 months and 8 months,

past few quarters along with strong absorptions observed in Pune and Chennai.

respectively

Hyderabad absorption has decreased during the year due to fewer launches in

4QFY2012. On the other hand, falling absorptions in Mumbai and NCR have led

to rising inventory levels, with inventory months touching 15 months vs. 11 months

yoy and 11 months vs. 9 months yoy, respectively.

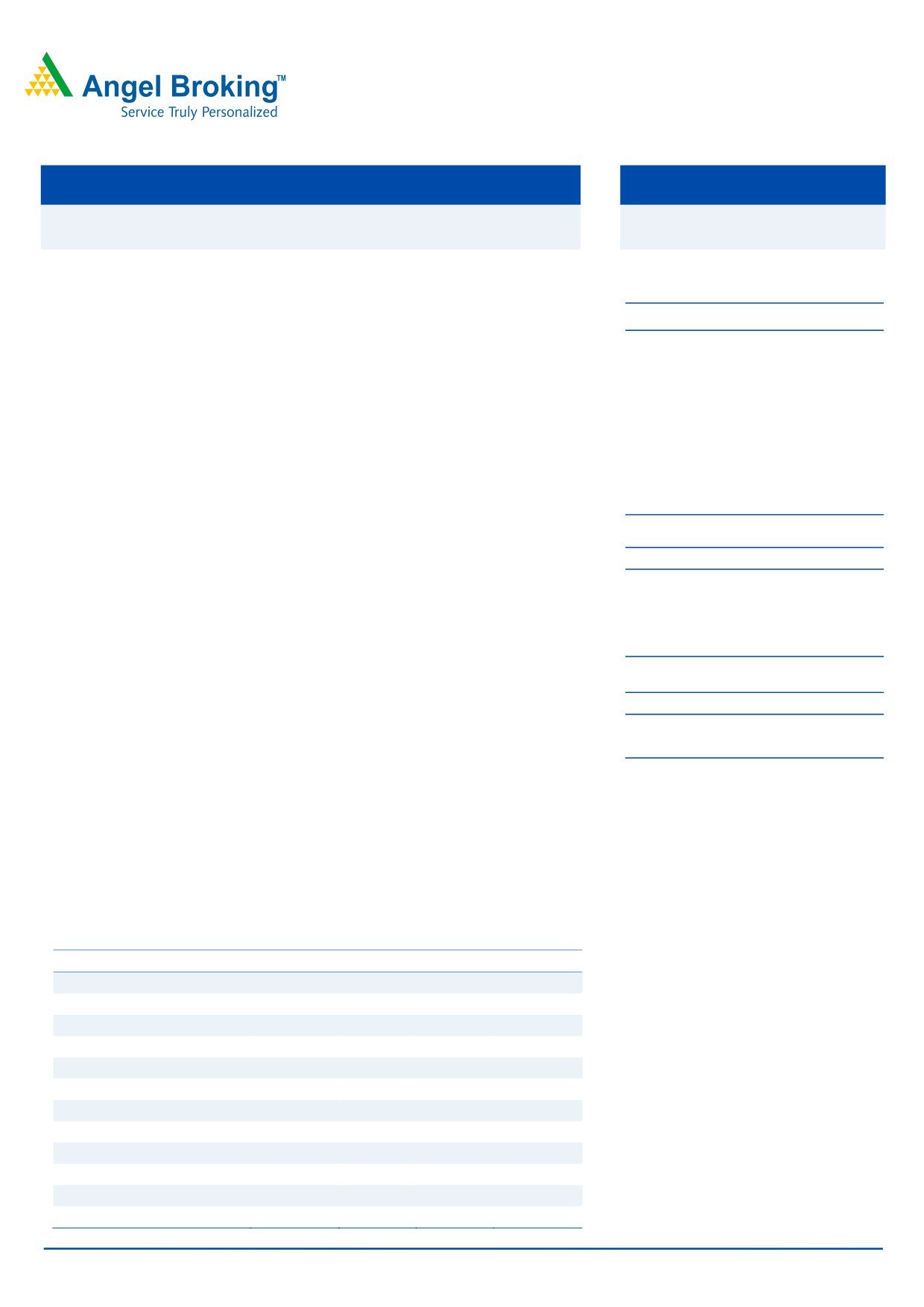

Well-diversified projects, with a focus on tier-1 cities

Pune, Hyderabad and Nagpur together form 68% of MLIFE’s exposure, in terms

Pune, Hyderabad and Nagpur together

of saleable floor area (ongoing and forthcoming projects), which is expected

form 68% of MLIFE’s exposure in terms

to be launched/sold over the coming years, with the remaining share contributed

of area yet to be sold

by NCR (Gurgaon) - 1%; Mumbai - 8%; and New Chennai - 23% (projects linked

to MWC - New Chennai). We believe MLIFE is well placed to benefit from the

relatively stable housing demand in small metros and tier-1 markets, given its

strong brand name, on-time execution track record and lesser competition from

organized players. MLIFE also recently announced that it plans to enter the

affordable housing space (`5lakh-15lakh category) in tier-2 cities.

Exhibit 1: India city residential sales trend: FY2012 vs.

Exhibit 2: MLIFE: City wise project exposure-

FY2011 (yoy %)

Forthcoming and ongoing projects

30

20

10

0

(10)

(20)

(30)

Source: Liasas Foras, Bloomberg, Angel Research

Source: Company, Angel Research

May 17, 2012

2

Mahindra Lifespaces Developers | Initiating coverage

Inventory months: Chennai, Pune and Hyderabad remain

stable, with Mumbai and NCR under pressure

Exhibit 3: Chennai: Stable inventory levels

Exhibit 4: Pune: Stable inventory levels

25

25

20

20

15

15

10

10

9

9

10

8

8

8

8

8

8

8

10

8

8

6

6

5

6

6

6

5

5

5

5

5

5

4

-

-

Q2

Q3

Q4

Q1

Q2 Q3 Q4

Q1

Q2

Q3

Q4

Q1

Q1

Q2 Q3 Q4 Q1 Q2 Q3

Q4

Q1

Q2

Q3

Q4

Q1

09

09

09

10

10

10

10

11

11

11

11

12

09

09

09

09

10

10

10

10

11

11

11

11

12

Source: Liasas Foras, Angel Research

Source: Liasas Foras, Angel Research

Exhibit 5: Hyderabad inventory levels stable due to

Exhibit 6: Declining sales in Mumbai leading to high

slow additions

inventory levels

25

25

20

20

17

14

15

15

14

15

12

12

11

11

10

10

10

10

10

9

9

8

10

9

10

8

8

7

7

7

7

5

6

5

5

5

-

-

Q1

Q2 Q3

Q4

Q1

Q2

Q3 Q4 Q1

Q2

Q3

Q4

Q1

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

09

09

09

09

10

10

10

10

11

11

11

11

12

09

09

09

09

10

10

10

10

11

11

11

11

12

Source: Liasas Foras, Angel Research

Source: Liasas Foras, Angel Research

Exhibit 7: NCR: Strong additions impacting inventory

Exhibit 8: Bangalore inventory months

25

25

24

20

20

15

15

15

15

13

13

12

11

11

10

11

10

11

10

9

10

9

8

10

8

7

8

8

7

7

7

7

7

7

5

5

-

-

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

Q1

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

09

09

09

09

10

10

10

10

11

11

11

11

12

09

09

09

09

10

10

10

10

11

11

11

11

12

Source: Liasas Foras, Angel Research

Source: Liasas Foras, Angel Research

May 17, 2012

3

Mahindra Lifespaces Developers | Initiating coverage

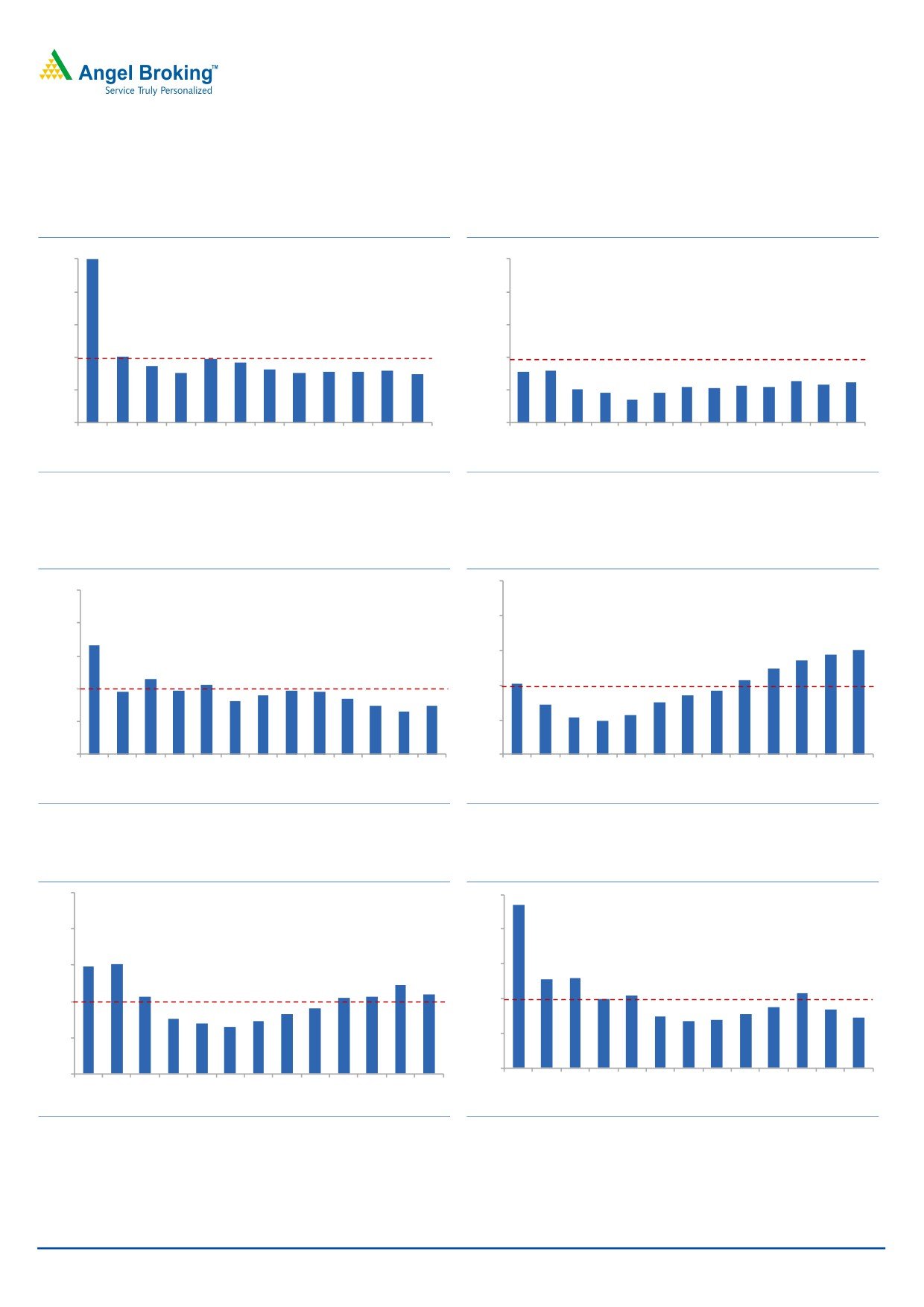

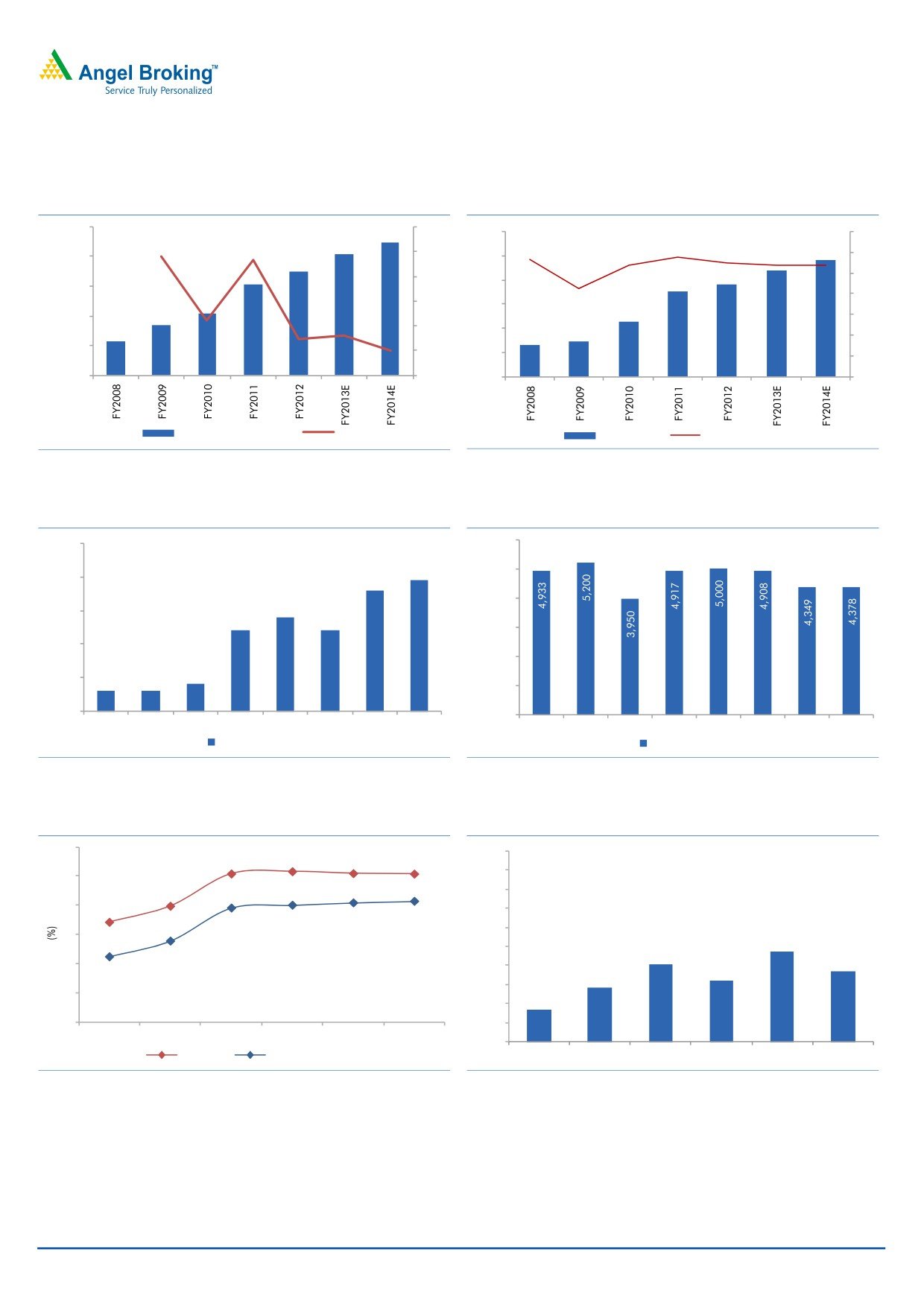

The right time to launch new projects

With 5.2mn sq. ft. of forthcoming projects, MLIFE enjoys a sales coverage of

~4.3x its FY2012 sales, thus providing a strong sales outlook for FY2013 and

FY2014E. MLIFE’s forthcoming projects are spread across Nagpur (25% of total

upcoming area), New Chennai (18%), Hyderabad (19%), Pune (31%) and Mumbai

(7%). We highlight that MLIFE’s residential projects in New Chennai (outside the

main Chennai city) are linked to its MWC Chennai portfolio, which should be the

main demand driver for the residential project. Given the high occupancy (~92%)

being observed in MWC Chennai currently, we expect strong demand for its projects.

We expect strong sales from new residential launches during FY2013E and 2014E

owing to MLIFE’s focus on small metros and tier-1 cities and a possible demand revival

due to lower interest rates. Strong sales (volume and value) during FY2013E will be a

key catalyst, in our view. We forecast sales volume of 1.6mn sq. ft. and 1.8mn sq. ft.

and sales value of `765cr and `834cr for FY2013E and FY2014E, respectively.

With most Mumbai projects close to completion and only one project left to be sold

(GE Garden - only 7% sold till March 2012), revenue and profit contribution from

Mumbai projects is set to decline, thus pulling down the company’s profit margins

going forward. We forecast EBITDA margin at 26.9% and 27.0% for FY2013E and

FY2014E, down from 27.3% in FY2012.

Exhibit 9: Strong sales expected during FY2013E and

Exhibit 10: Demand for new launches to remain

FY2014E

strong - Ongoing vs. Forthcoming projects

1,000

2.4

6.0

5.2

2.0

1.8

2.0

5.0

800

1.4

1.6

4.0

600

1.2

1.2

1.2

3.0

400

0.8

0.4

2.0

0.3

200

0.4

0.8

1.0

0

0.0

FY08

FY09

FY10

FY11

FY12E FY13E FY14E

-

Sales Value (LHS)

Sales Volume (RHS)

Ongoing Projects

Forthcoming Projects

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 11: MLIFE’s forthcoming projects breakdown

City

Forthcoming Projects

Area (mn sq. Ft.)

Mumbai

Ghatkopar

0.2

Mumbai

GE Garden

0.1

Pune

Pimpri Residential Project

1.6

Hyderabad

Kukatapally Project

1.0

Chennai

Aqua Lily

0.6

Chennai

Iris Court phase 3

0.3

Nagpur

Bloomdale

1.3

Total

5.2

Source: Company, Angel Research

May 17, 2012

4

Mahindra Lifespaces Developers | Initiating coverage

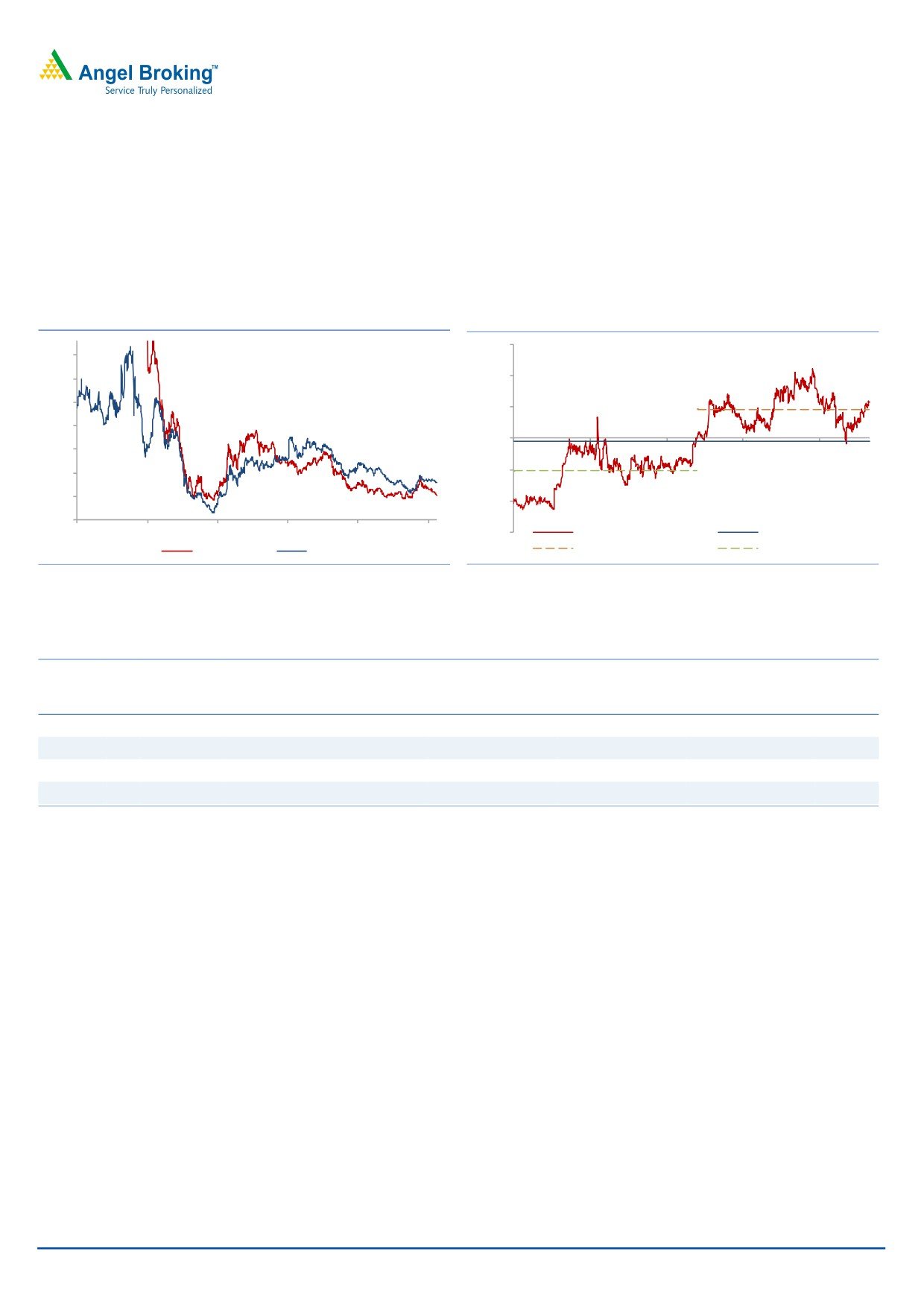

Rate cut cycle initiated, mid market to lead demand revival

Housing demand revival to be led by mid-market housing, with the initiation of the rate

cut cycle: The middle and upper-middle class segments are more dependent on housing

loans and, thus, are more sensitive to rate cuts than premium housing, in our view.

MLIFE, with its focus on upper-middle and middle class housing and its plans to

enter affordable housing, should see strong pent-up demand over the next few

quarters, especially in light of the fact that housing loan growth has been lagging

total credit growth, which can see a possible reversion due to the recent 50bp rate

cut, which should reflect in mortgage rates. Housing loans as a percentage of total

non-food credit outstanding have reduced to 9% as of March 2012 compared to

11.8% in April 2008. Further rate cuts by housing finance companies (HFCs)

would act as a near-term catalyst for MLIFE’s share price.

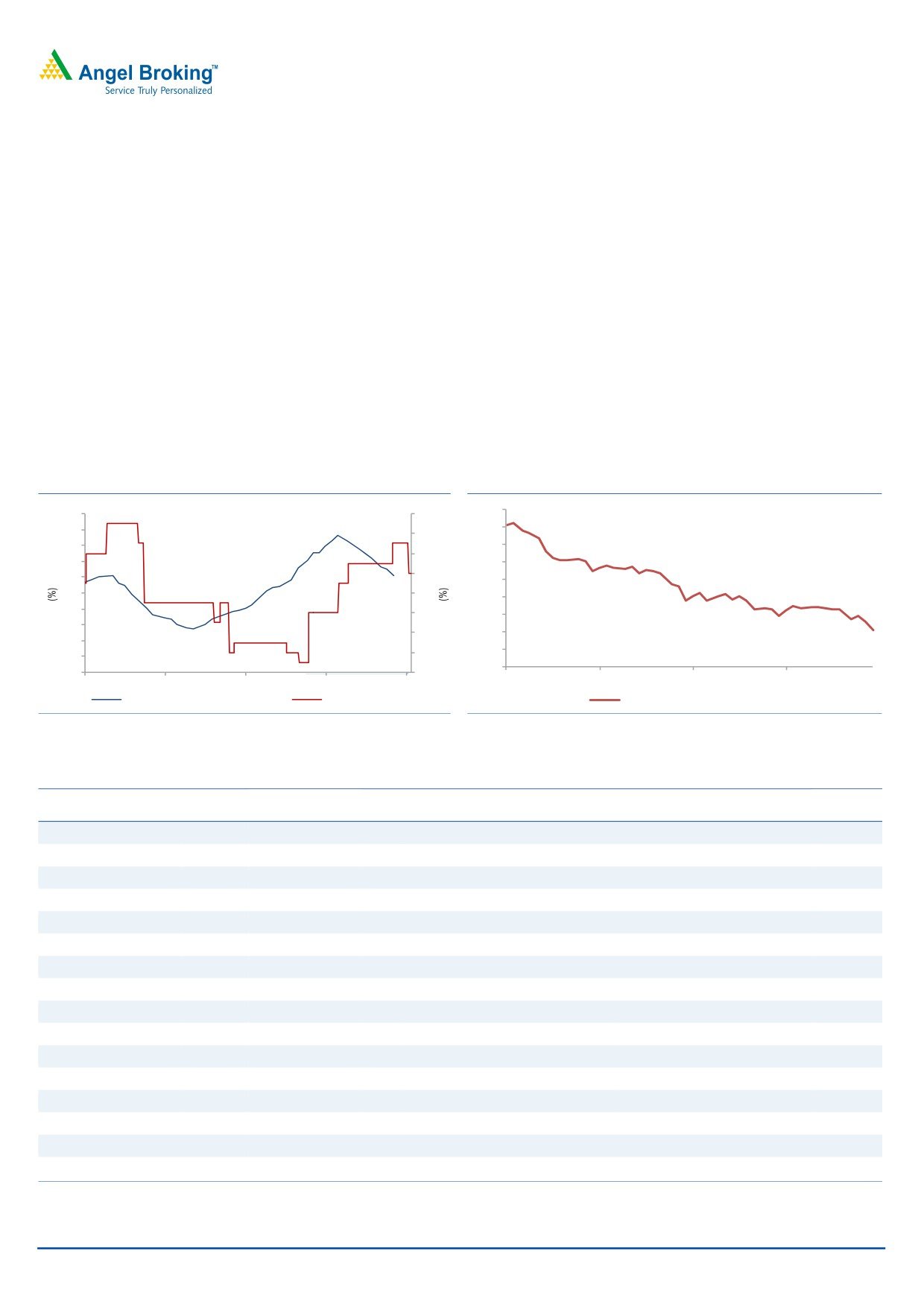

Exhibit 12: Housing loan growth* has remained

Exhibit 13: Housing loans has been decreasing as a %

subdued due to increasing mortgage rates

of total non-food credit

13%

20

12

18

12%

11.5

16

12%

11

14

11%

10.5

12

11%

10

10

10%

8

9.5

10%

6

9

9%

4

8.5

9%

2

8%

0

8

Apr-08

Apr-09

Apr-10

Apr-11

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Housing yoy% 3mma(LHS)

Mortgage Rates

Housing as % of non food credit

Source: RBI, Bloomberg, Angel Research *3-month moving average

Source: RBI, Angel Research

Exhibit 14: MLIFE focussed on the mid-market and premium segments (Ongoing projects)

Area launched

Variation

Project name

City

Units

Base selling price (`/ sq. ft.)

City Average Selling Price

(mn sq. ft.)

(%)

Eminente Aspen

Mumbai

0.15

68

10,350

10,833

(4.5)

Eminente Angelica

Mumbai

0.15

67

9,650

10,833

(10.9)

Splendour -II

Mumbai

0.36

246

8,200

10,833

(24.3)

GE Garden

Mumbai

0.12

60

10,747

10,833

(0.8)

Aura- I

NCR

0.27

231

2,450

3,570

(31.4)

Aura- II

NCR

0.24

166

3,175

3,570

(11.1)

Aura- III

NCR

0.21

110

4,100

3,570

14.9

Aura- IV

NCR

0.28

141

4,375

3,570

22.6

Aura- V

NCR

0.25

110

4,375

3,570

22.6

Aqua Lily Villas B

Chennai

0.11

33

4,350

4,035

7.8

Aqua Lily Villas C

Chennai

0.11

40

4,550

4,035

12.8

Aqua Lily Villas D

Chennai

0.12

37

4,550

4,035

12.8

Aqua Lily Apts A

Chennai

0.14

80

3,230

4,035

(20.0)

Aqua Lily Apts B

Chennai

0.32

178

3,230

4,035

(20.0)

Iris Court Ph I

Chennai

0.27

244

2,850

4,035

(29.4)

Iris Court Ph II*

Chennai

0.3

229

2,950

4,035

(26.9)

Source: Company, Industry Data, Angel Research

May 17, 2012

5

Mahindra Lifespaces Developers | Initiating coverage

Impact of tax code has been an overhang on MWC’s

portfolio

Direct tax code, which is proposed to be implemented by March 2013 and seeks to

replace profit-based tax benefit with investment-linked incentives along with

gradual removal of other existing incentives benefiting SEZ occupants, remains the

main drag on SEZ demand in India. The proposed tax code along with the

implementation of minimum alternative tax (MAT) and dividend distribution tax

(DDT) has led to slowdown in demand for SEZ units. So far, out of the total 582

SEZs being approved, only 130 have become operational with a number of them

already cancelled or stalled.

According to JLL, considerable IT SEZ supply (Exhibit 15) is expected to become

operational over

2012-15E, thus keeping office vacancy rates elevated at

15-20% for India and around 20-30% for Chennai. However, we note that IT SEZ

supply, expected to hit markets during 2012-15E, is at a risk of getting delayed or

de-notified, which would help reduce the vacancy rates faster than expected.

Office vacancy rates are expected to peak by 2012-13E.

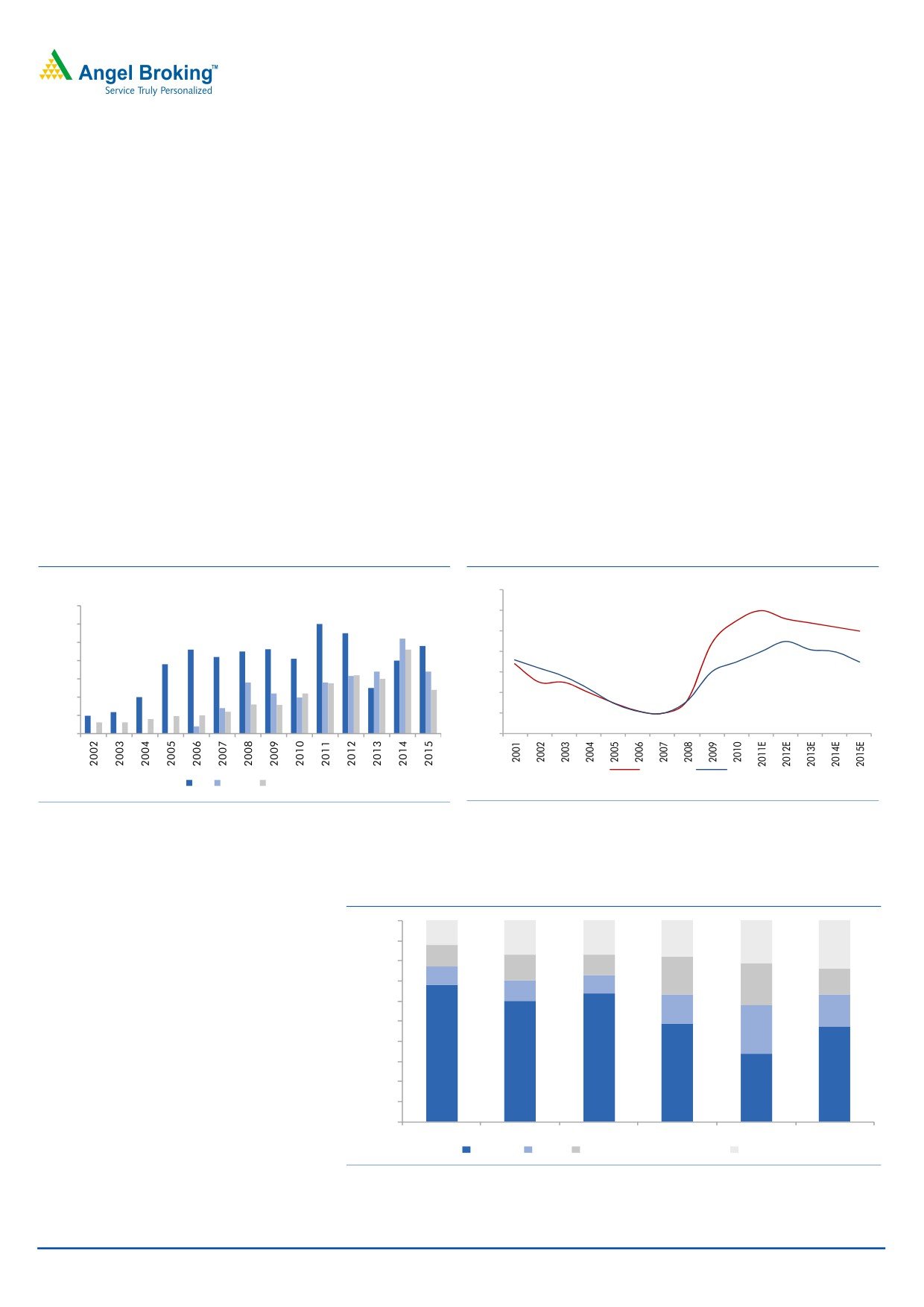

Exhibit 15: Strong office supply expected in India

Exhibit 16: High vacancy can pressurize rentals

(mn sqft.)

35

35

30

30

25

25

20

20

15

15

10

10

5

5

0

0

Chennai

India

IT

IT SEZ Non IT

Source: JLL

Source: JLL

Exhibit 17: Historically, IT/ITES has been the major source of demand

for office space in India, however its share has been falling

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2005

2006

2007

2008

2009

2010

IT/ITES

BFSI

Manufacturing/Industrial

Others

Source: JLL

May 17, 2012

6

Mahindra Lifespaces Developers | Initiating coverage

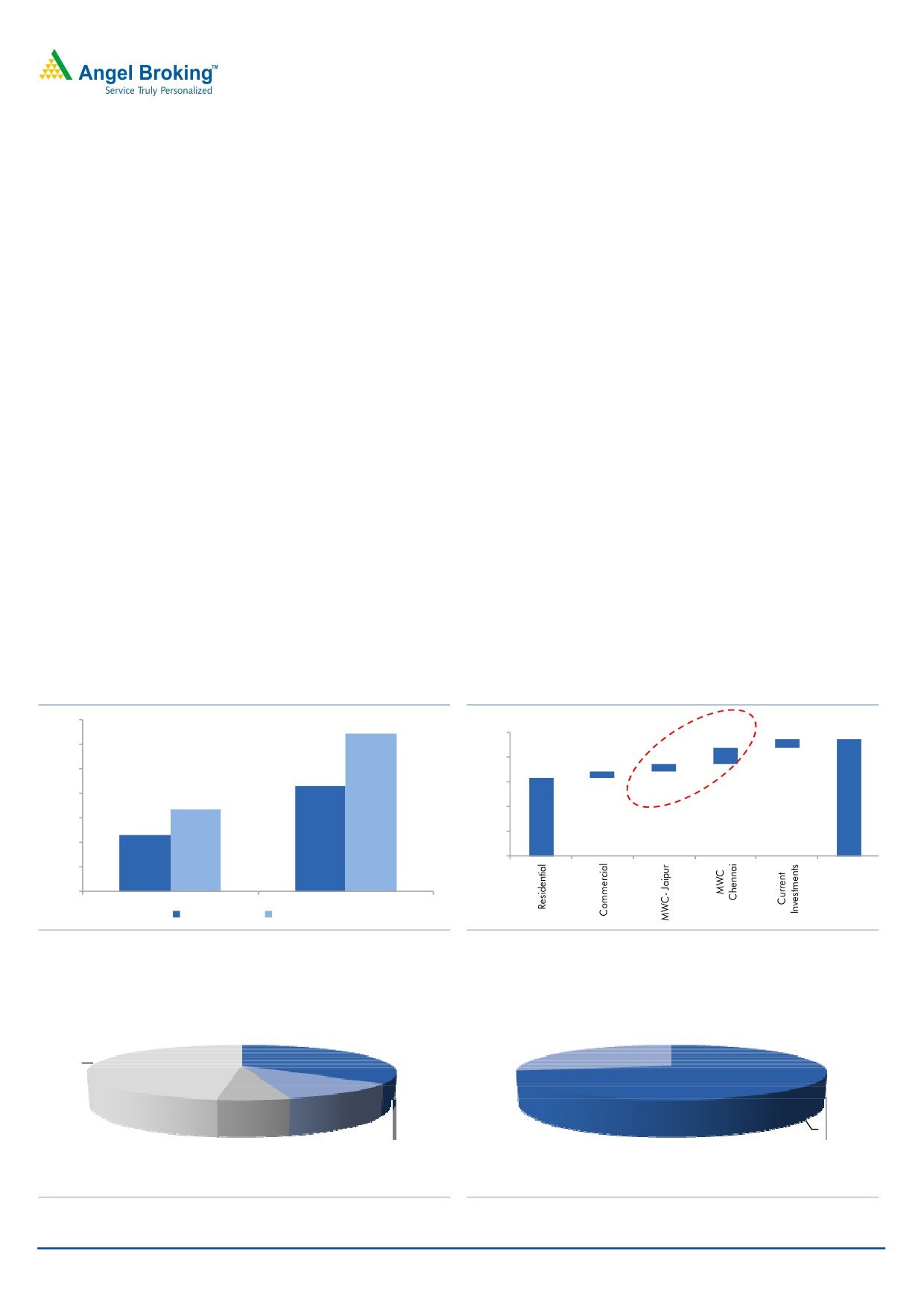

Being conservative in our outlook for MWC is the key

The MWC portfolio is more critical to MLIFE’s stock than its financials suggest. The

MWC portfolio (Jaipur and Chennai) formed only ~29% of total consolidated

book value as of FY2011; but when we consider the invested capital, it forms

~53% of total capital, which is because a major portion of debt is tied to the MWC

portfolio. However, MWC contributes only `97 (20.6%) to our SOTP value of `470.

Therefore, we hold that any positive surprises in leasing activity (acquisition of a

major client) can lead to significant rerating of the stock.

Expecting slow pick-up in leasing as our base case

Given the uncertainty related with SEZs, we expect MWC Jaipur to increase its

leasing occupancy rate to 51% by FY2014E from 41% currently, which is prudent

in our view. We also expect a 10% decline in FY2013E and nil growth in FY2014E

lease rentals. During FY2012, MWC Jaipur added five customers and signed

MoUs with a manufacturing company (DTA) and a large multinational OEM for

engineering SEZ space.

For MWC Chennai, which is relatively a mature investment with 92% of industrial

area already leased out as of FY2012, we expect occupancy to remain constant at

92% going forward, with nil rental rate growth during FY2013E and FY2014E.

During FY2012, MWC Chennai added four new customers and signed MoUs with

five more customers.

Exhibit 18: MWC portfolio forms ~53% of MLIFE’s

Exhibit 19: ...but contributes only `97 to our SOTP

invested capital*...

value of `470

35%

32%

31

500

68

470

30%

29

400

27

25%

315

21%

300

20%

17%

200

15%

12%

100

10%

-

5%

0%

Book Value

Invested Capital

MWC Chennai

MWC Jaipur

Source: Company, Angel Research *FY2011 book value

Source: Company, Angel Research

Exhibit 20: MWC Chennai - Area statement (822 acres)

Exhibit 21: MWC Jaipur - Area statement (1,350acres)

IT SEZ

DTA

DTA

35%

28%

48%

Apparel

Auto

SEZ

and

Ancillary

72%

Fashion

SEZ

SEZ

11%

6%

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2012

7

Mahindra Lifespaces Developers | Initiating coverage

Can we expect a policy reversal?

SEZ’s contribution to exports has been a crucial source of exports

growth and FDI

We take slow demand pick-up and minor downward pressure on rentals during

FY2013 and FY2014E as our base case scenario and assume tax code will impact

demand for SEZs going forward. However, we do not completely rule out the

possibility of some sort of deferment/modification of the tax code or some other

form of sops to encourage SEZ investments, even though the probability remains

quite low currently. In spite of the controversies surrounding SEZ’s land acquisition

and tax revenue loss to the government, it is very hard to ignore the benefits of

SEZs, especially given:

SEZs quickly started contributing to India’s total exports since the act was passed,

touching a high of 28% as of FY2011, but dropped to 25% in FY2012.

Apart from exports contribution and net foreign exchange that SEZs have been

earning in the past, it has also been a major source of FDIs, touching a high

of 26% of total FDI in FY2011, but later crashing to only 8% in FY2012.

Although we take implementation of direct tax code and sluggish demand for SEZs

as our base case scenario and see any changes or reversal in the policy towards

SEZs as highly unlikely as of now, we highlight that a policy reversal (though the

chances are low) will act as a major upside risk to our forecast and can lead to

significant rerating, especially given the contribution of MWC’s portfolio (Exhibit 18

and 19) to MLIFE and its levered nature.

Exhibit 22: SEZs contributed swiftly to total export

Exhibit 23: However, export contribution has decreased

growth as soon as the SEZ act was passed

lately owing to uncertain tax environment

16,000

100%

14,000

90%

80%

12,000

70%

10,000

60%

8,000

50%

6,000

40%

30%

4,000

20%

2,000

10%

-

0%

Exports

Exports from SEZ

Exports

Exports from SEZ

Source: RBI, Angel Research

Source: RBI, Angel Research

May 17, 2012

8

Mahindra Lifespaces Developers | Initiating coverage

Exhibit 24: SEZs have been a major source of forex

Exhibit 25: FDI in SEZs has taken a beating in FY2012

reserves in the past through exports and FDI

70

6.0

30%

54

60

5.0

25%

50

52

40

50

4.0

20%

30

48

3.0

15%

20

46

10

2.0

10%

44

-

42

1.0

5%

(10)

(20)

40

-

0%

(30)

38

2009

2010

2011

2012

Forex Reserves yoy

` Spot

FDI from SEZs ($ Bn)

% of total FDI

Source: Bloomberg ,RBI Angel Research

Source: Ministry of Commerce, RBI, Angel Research

*Upward movement denotes ` depreciation

May 17, 2012

9

Mahindra Lifespaces Developers | Initiating coverage

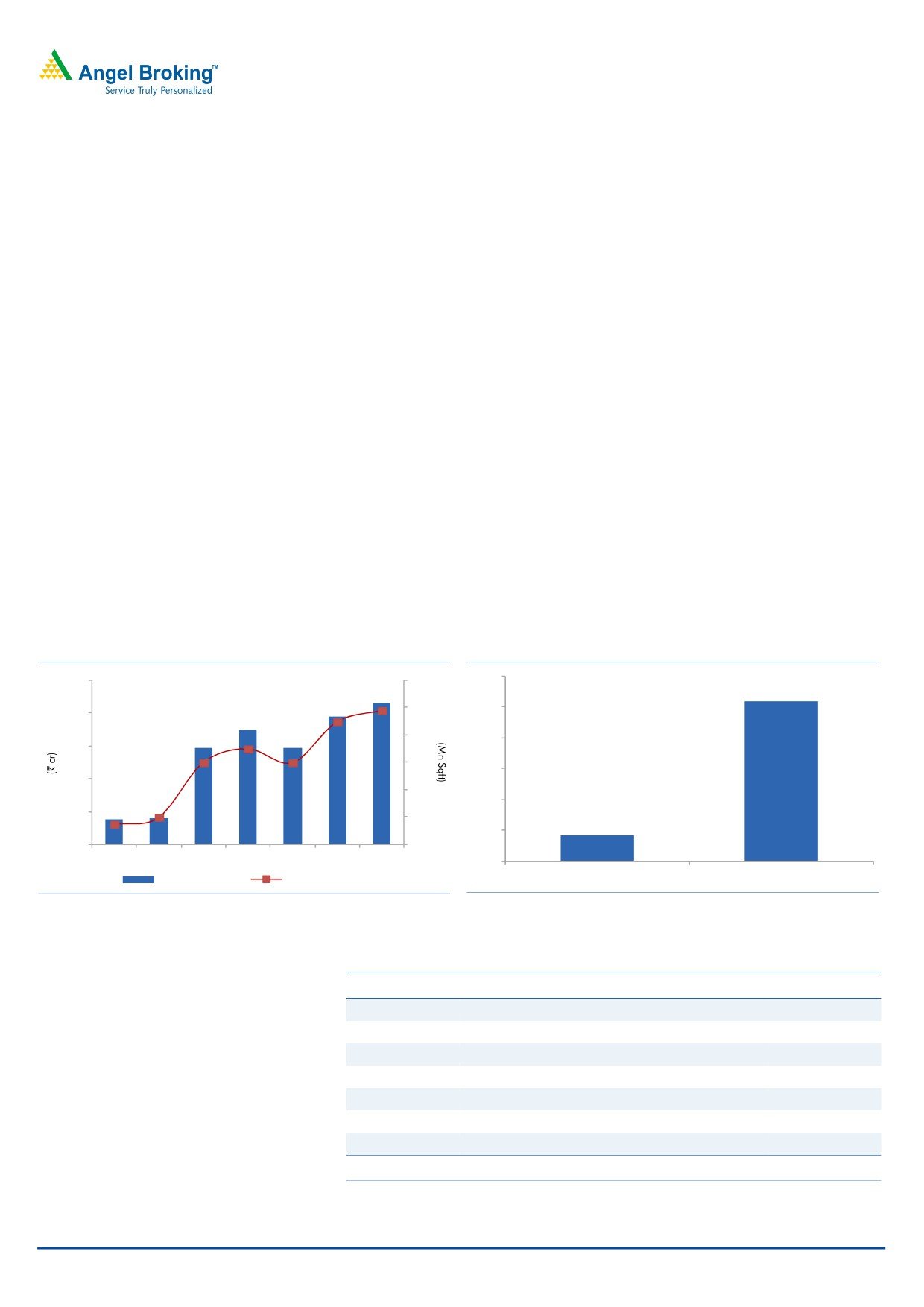

MLIFE: Expectations in brief

Exhibit 26: Revenue and revenue growth

Exhibit 27: MLIFE: EBITDA and EBITDA margin

1,000

60.0

300

35

50.0

30

800

250

40.0

25

200

600

20

30.0

150

400

15

20.0

100

10

200

10.0

50

5

-

0.0

0

0

Operating income

% chg

EBITDA

EBITDA Margin %

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 28: MLIFE: Sales volume (mn sq. ft.)

Exhibit 29: MLIFE: Average price realizations

2.5

6,000

2.0

5,000

2.0

1.8

4,000

1.4

1.5

1.2

1.2

3,000

1.0

2,000

0.4

0.5

0.3

0.3

1,000

-

-

2007

2008

2009

2010

2011

2012

2013E

2014E

2007

2008

2009

2010

2011

2012

2013E

2014E

Sales Volume (Mn Sqft)

Price (per Sqft)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 30: MLIFE: RoE and RoIC

Exhibit 31: MLIFE: Net debt to equity

12

0.5

10

10.2

10.3

10.2

10.1

0.5

0.4

8.2

8

8.0

8.3

7.9

7.8

0.4

6.8

0.3

6

5.6

0.2

0.3

0.2

4.5

0.2

4

0.2

0.2

0.1

0.2

2

0.1

0.1

0

0.1

FY09

FY10

FY11

FY12E

FY13E

FY14E

0.0

ROE

ROIC (post tax)

FY2009

FY2010

FY2011

FY2012

FY2013E FY2014E

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2012

10

Mahindra Lifespaces Developers | Initiating coverage

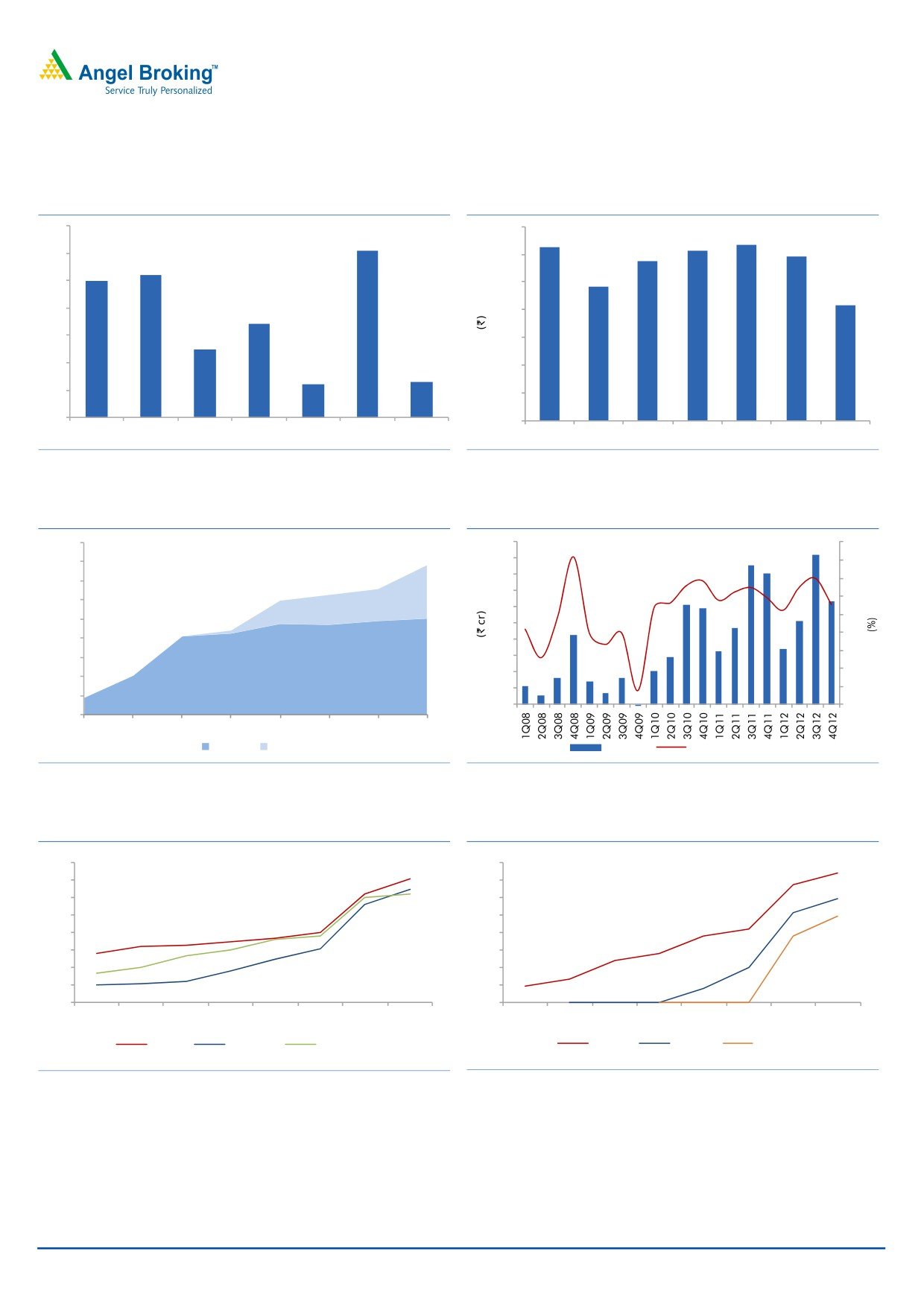

MLIFE: Operational snapshot

Exhibit 32: MLIFE: Area sold (mn sq. ft.)

Exhibit 33: MLIFE: Average sales realization

0.7

5500

0.6

5000

0.5

4500

0.4

4000

0.3

3500

0.2

3000

0.1

2500

0

2000

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Source: Company, Angel Research

Source: Company, Angel Research

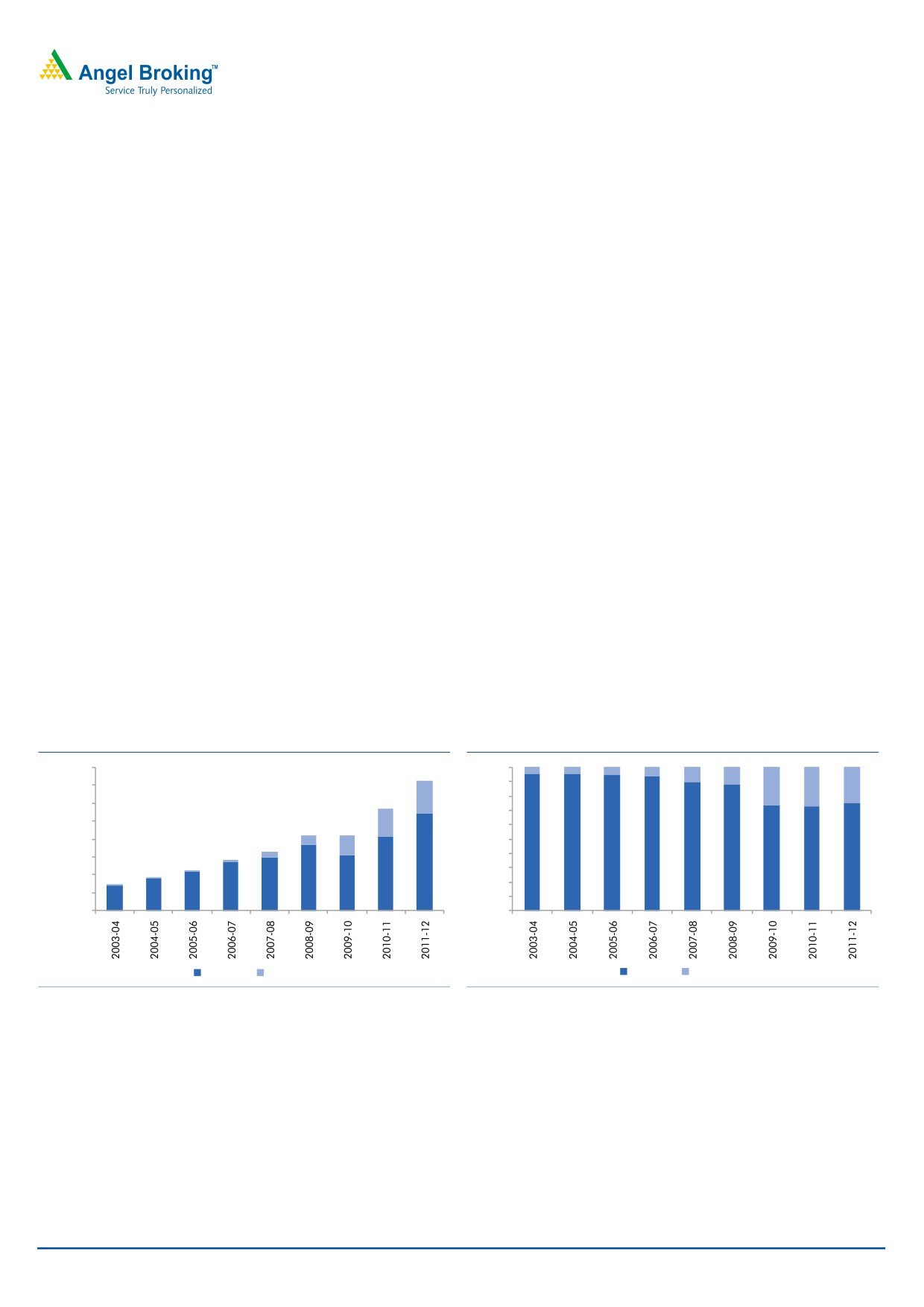

Exhibit 34: MWC: Area leased (acres)

Exhibit 35: MLIFE: Quarterly EBITDA margin

1800

50

40

1600

45

35

40

1400

30

35

1200

25

30

20

1000

25

15

800

20

10

600

15

10

5

400

5

0

200

0

(5)

0

2005

2006

2007

2008

2009

2010

2011

2012

Chennai Jaipur

EBIDTA

EBITDA margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 36: Execution schedule of Mumbai projects

Exhibit 37: Execution schedule of NCR projects

80

80

70

70

60

60

50

50

40

40

30

30

20

20

10

10

0

0

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Aspen

Angelica

Splendour -II

Aura- I

Aura- II

Aura- III

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2012

11

Mahindra Lifespaces Developers | Initiating coverage

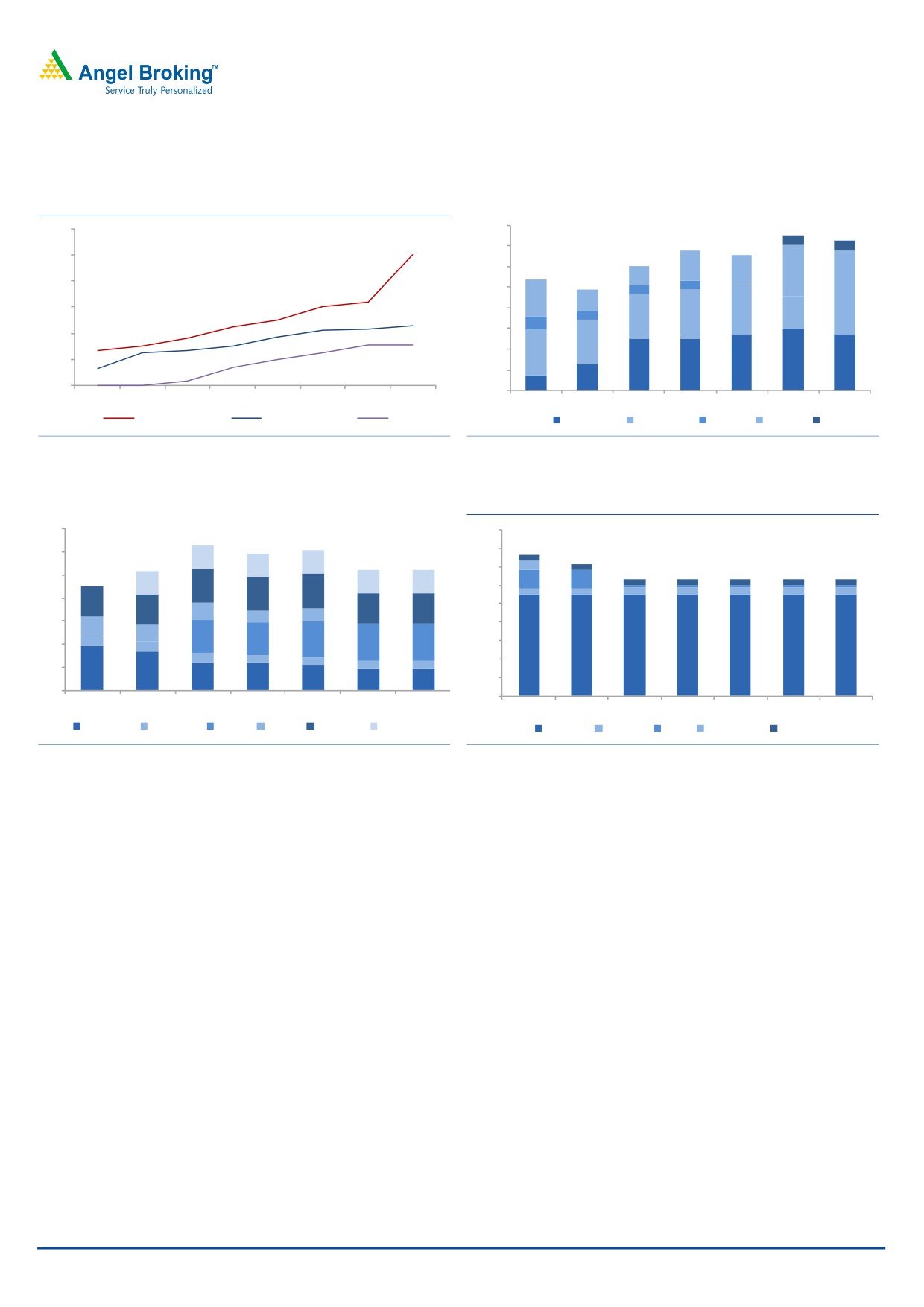

MLIFE: Operational snapshot

Exhibit 38: New Chennai: Project execution schedule

Exhibit 39: Ongoing projects evolution by city (mn sqft)

4.00

120

3.50

100

3.00

80

2.50

60

2.00

1.50

40

1.00

20

0.50

0

-

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Aqualily Villas A

Aqualily Villas B

Iris Ph I

Chennai

Mumbai

Pune

NCR

Nagpur

Source: Company, Angel Research

Source: Company, Angel Research *represents total area of ongoing project

Exhibit 40: Forthcoming projects evolution (mn sq. ft.)

Exhibit 41: Land bank evolution by city (mn sq. ft.)

7

18

16

6

14

5

12

4

10

3

8

2

6

4

1

2

0

0

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Chennai

Mumbai

Pune

NCR

Nagpur

Hyderabad

Chennai

Mumbai Pune Hyderabad

Nasik

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2012

12

Mahindra Lifespaces Developers | Initiating coverage

Valuation

We value MLIFE on SOTP basis using NAV approach for its standalone business

and value its subsidiaries on NAV/Cap Rate/BV basis and arrive at an SOTP value

of `470. We apply a 20% discount to our SOTP value to arrive at our target price

of `376, suggesting an upside of 21% from current levels. MLIFE is currently

trading at PB (FY2014E) of 0.9x, with our target price of `376, suggesting a PB

(FY2014E) of 1.1x.

Real estate development business contributes `315/share

We have valued MLIFE’s real estate business using the NAV approach, where we

value the company’s standalone as well as subsidiary residential projects

individually. We have assumed cost of equity of 16.9% (Beta - 1.2; risk-free rate -

8.5%; and risk premium - 7.0%), cost of debt of 12% and arrive at a WACC of

13.3%.

MWC (Chennai and Jaipur) contributes `97/share

MWC Chennai is relatively at a more mature stage than MWC Jaipur, with ~92%

of industrial area leased. We value MWC by applying a capitalization rate of 8%

on its FY2014E operating income and discounting it back. Similarly, for MWC

Jaipur, we apply a capitalization rate of 8% on its FY2016E operating income and

then discount it back. Despite valuing the MWC portfolio cautiously, we have

arrived at a potential upside of 21%, which suggests that the stock might already

have priced in an adverse impact of removal of tax benefits.

We initiate coverage of MLIFE with a Buy rating and a target price of `392.

Exhibit 42: MLIFE: SOTP breakdown

Valuation method

MLIFE value

Value/share

Residential

NAV

1,286

315

Commercial

Cap rate of 8%

109

27

MWC- Jaipur

Cap rate of 8%

119

29

MWC Chennai

Cap rate of 8%

278

68

Current Investments

Book Value

128

31

SOTP

470

Target price (20% Disc. to NAV)

376

CMP

312

Upside

21%

Source: Angel Research, Company

May 17, 2012

13

Mahindra Lifespaces Developers | Initiating coverage

MLIFE deserves a premium to BSE Realty, in our view

Given MLIFE’s strong balance sheet, good corporate governance and brand name

along with strong parent backing, we are of the opinion that MLIFE deserves to

trade at a premium to sector average, especially given the corporate governance

concerns regarding the real estate sector.

Exhibit 43: One-year forward PB

- MLIFE vs. BSE

Exhibit 44: MLIFE deserves a premium to BSE Realty -

Realty Index

Currently trading at 35% premium

90

3.7

3.2

60

2.7

30

2.2

-

1.7

Sep

-07

Sep-08

Sep-09

Sep-10

Sep-11

1.2

(30)

0.7

(60)

0.2

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

(90)

Prem.

Average

BSE Realty*

MLIFE

Average since Feb'10

Average till feb'10

Source: Company, Angel Research, Bloomberg *Bloomberg Consensus

Source: Company, Angel Research, Bloomberg

numbers

Exhibit 45: MLIFE vs. peers

Market Net Debt to EBITDA Net Debt to Equity

ROE

P/Book

P/Earnings

Cap

Price

FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E

(` cr)

MLIFE

312

1,266

1.4

1.0

0.2

0.2

10.2

10.1

1.0

0.9

10.0

9.2

DLF

182

31,216

5.6

4.4

1.0

0.9

6.3

8.4

1.2

1.1

19.0

13.5

HDIL

62

2,581

3.5

3.1

0.4

0.4

8.0

8.7

0.2

0.2

2.9

2.5

Anant Raj

51

1,505

2.4

1.7

0.2

0.2

6.1

8.5

0.4

0.3

6.1

4.0

Source: Company, Angel Research

May 17, 2012

14

Mahindra Lifespaces Developers | Initiating coverage

Key risks

MLIFE’s projects in Chennai are based in MWC - Chennai. Therefore, their

performance is linked to MWC Chennai’s leasing activity. Any decline/slow

growth in MWC Chennai leasing will adversely impact its Chennai projects

and value of its 11 mn sq. ft. land bank.

Delays in getting project and land approvals will lead to slowdown in future

launches, which would impact sales.

Slower-than-expected execution will delay MLIFE’s revenue recognition and

negatively impact its brand name.

Failure of any meaningful rate cuts by HFCs and banks will lead to muted

housing demand for MLIFE.

Better-than-expected leasing in MWC brands, especially MWC Jaipur, poses

an upside risk to the target price, as we have conservatively valued MWC’s

portfolio.

May 17, 2012

15

Mahindra Lifespaces Developers | Initiating coverage

Company overview

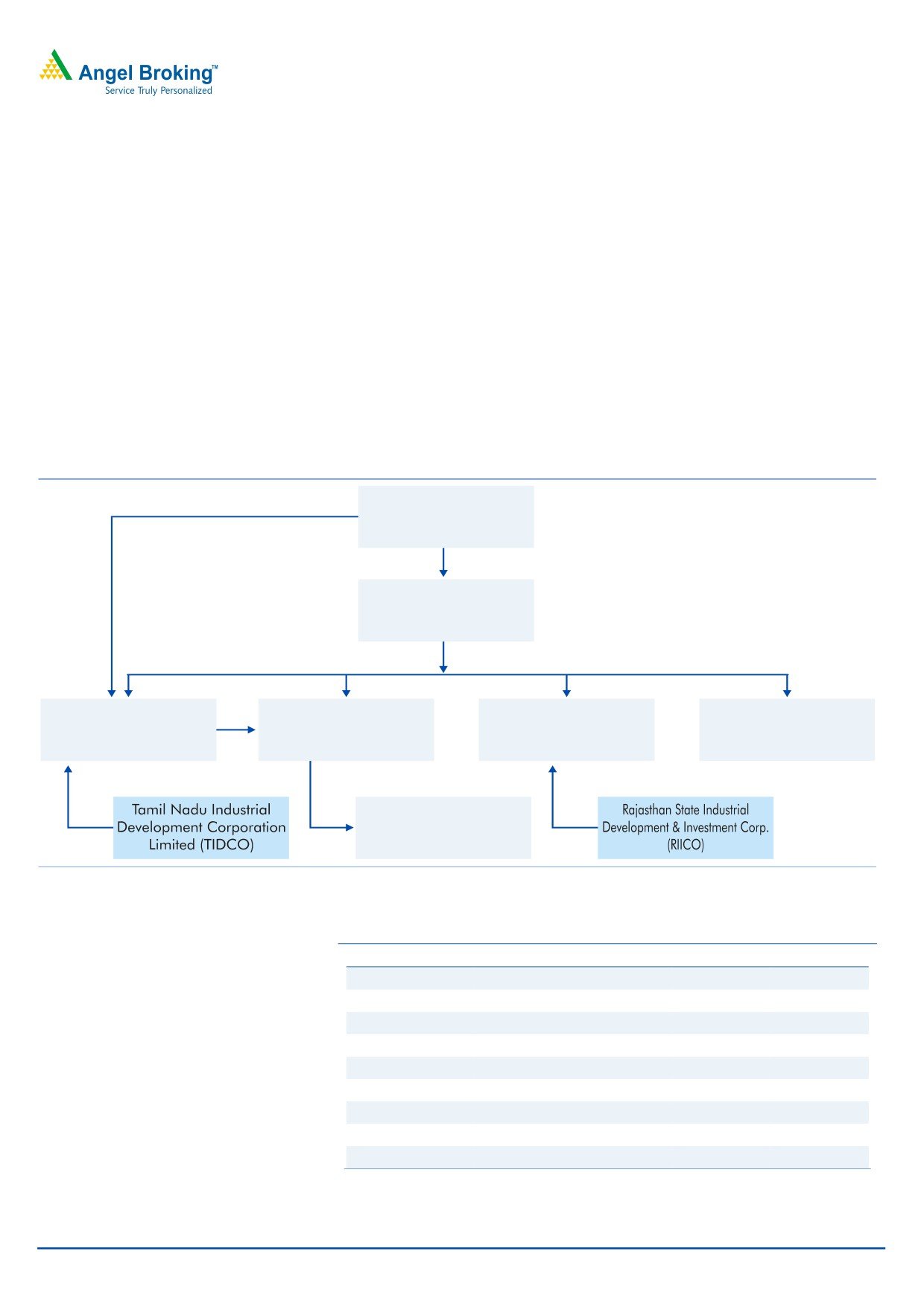

Mahindra Lifespaces Developers (MLDL), a 51% owned subsidiary of Mahindra

and Mahindra Group, is in the business of real estate development, with a focus

on residential projects and integrated infrastructure developments such as business

cities, industrial parks and SEZs. MLDL has till date developed ~7mn sq. ft. of

residential projects in cities like Mumbai, Pune, NCR, Chennai and is expanding its

presence to cities like Hyderabad, Nagpur and Nasik by increasing its focus on the

premium and mid-market segments. The company has also announced its plans to

enter the affordable housing segment in tier-2 cities.

MLDL is also present in integrated development space, with two operational

projects through its subsidiaries - MWC Jaipur and MWC Chennai. These are

spread over an area of ~4,200 acres with presence of SEZs and DTAs.

Exhibit 46: Corporate structure

Mahindra and

6%

Mahindra Group

51%

Mahindra Lifespace

Developers

(MLDL)

83%

74%

74%

70%

Mahindra World City

Mahindra Integrated

Mahindra World City

Mahindra Bebanco

26%

Developers Ltd.

Township Ltd.

(Jaipur)

Developers Ltd

(MWCDL)

(MITL)

(MWCJL)

(MBDL)

Mahindra Residential

26%

51%

11%

Developers Ltd

(MRDL)

Source: Company

Exhibit 47: MLIFE: Project snapshot

Location (mn sq. ft.)

Completed

Ongoing

Forthcoming

Land bank

Chennai

0.6

1.5

1.0

11.0

Mumbai

3.1

0.8

0.4

0.7

Pune

1.6

-

1.6

0.3

NCR

1.7

1.2

-

-

Nagpur

-

0.2

1.3

-

Hyderabad

-

-

1.0

-

Nasik

-

-

-

0.6

Bangalore

0.1

-

-

-

Total

7.0

3.8

5.2

12.6

Source: Company

May 17, 2012

16

Mahindra Lifespaces Developers | Initiating coverage

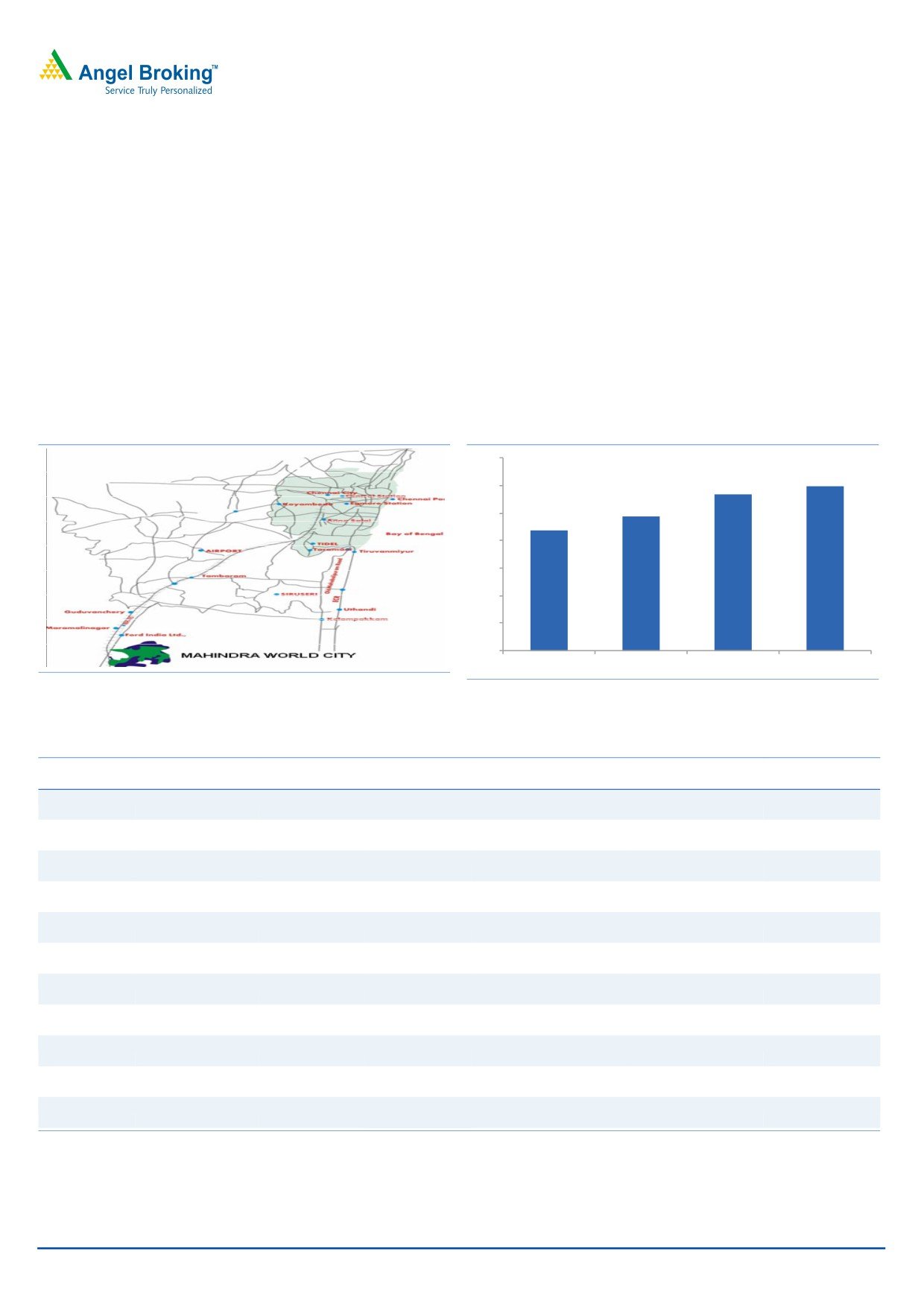

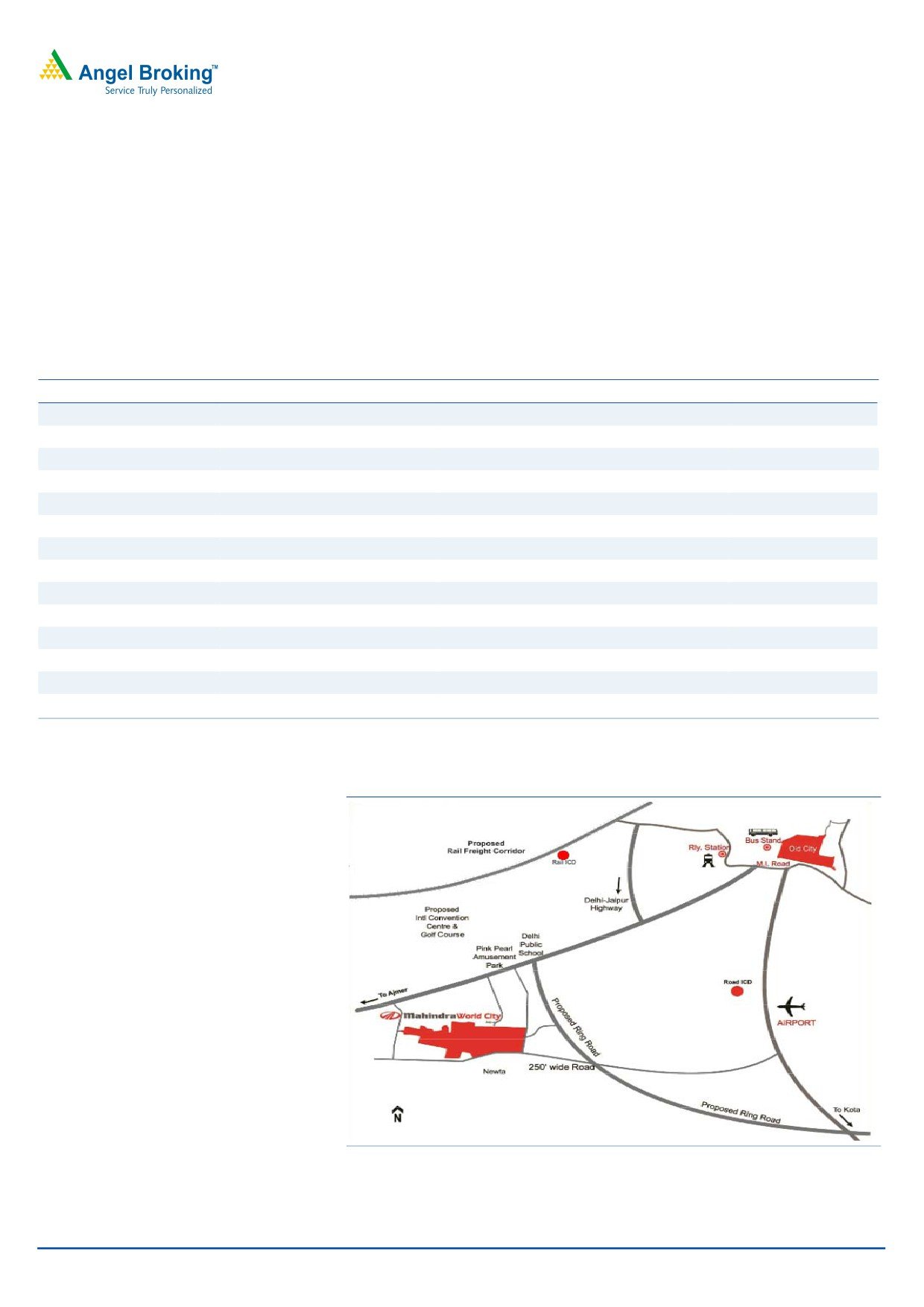

Mahindra World City (MWC) - Chennai

MWC Chennai is jointly promoted by Mahindra World City Developers Ltd.

(MWCDL) and Tamil Nadu Industrial Development Corporation Ltd. (TIDCO), with

1) three sector-specific SEZs catering to industry sectors viz. IT (services and

manufacturing), apparel and fashion accessories, and auto ancillaries; 2) a DTA;

and 3) a residential and social infrastructure zone. The project is spread across an

area of 1,550 acres (includes 100 acres expansion to cater to fresh demand).

MWCDL has signed MoUs with multi-national companies from Japan, U.S. and

Ireland in the auto ancillary sector for around 50% of the proposed expansion

area. The business zone has 60 clients, of which 28 are in SEZ and 32 are in DTA.

MWC is located on National Highway 45 and is ~60km from the Chennai city.

Exhibit 48: MWC Chennai - Location

Exhibit 49: Client base of MWC Chennai

70

60

57

60

49

50

44

40

30

20

10

0

FY2009

FY2010

FY2011

FY2012

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 50: Clients of MWC Chennai

IT SEZ

Auto SEZ

Apparel SEZ

DTA

DTA

DTA

Social

Atos Origin*

Brakes India

AI Enterprises

Alpha

Guangdong Greatoo

Netafim

Duet Hotels

Packaging

Cap Gemini

Madras

Bengal Hangers

American Axle

Husky Injection

NTN Corporation

JSP Hospitals

India

Engineering

Molding Systems

Electronic

Sundaram

Capella

Armstrong

Ingersoll Rand

Parker Hannifin

Mahindra World

Recycling

Brake Linings

Fashions

School

Helios &

Sundaram Clayton Intermode

B. Braun

JCF Valves

Sakazaki Engraving

AmelioDay Care

Matheson*

Medical

Infosys

Sundram Fasteners Leather Craft

BMW India

JSP Foams

Sanwa Synergy

BP -Petrol Station

Technologies

Mastek

Timken Engineering Linea Fashions

CII

Kryolan Cosmetics

Sharda Motor

Canopy

Industries

MindTree*

UCAL Fuel Systems Rico Group

DePuy Medical

Lincoln Electric

SMC Pneumatic

Company

Renault Nissan*

Srinivasa

Federal Mogul

Mahindra & Mahindra

Tesa Tapes India

Fashions

Tech Mahindra*

Slam Apparel

Freight Systems

Milton Roy India

Tridon Automotive

VIPL

Timex Garments

Fujitec India

Musashi Paints

TTK Healthcare

Wipro

Galipoglu

Mecaplast India

Hidromas

Source: Company

May 17, 2012

17

Mahindra Lifespaces Developers | Initiating coverage

MWC Jaipur

MWC Jaipur is a 74-26 joint venture between MLIFE and Rajasthan State Industrial

Development and Investment Corporation Limited (RIICO). It is being developed as

a multi-product SEZ and DTA across 3,000 acres. The project has received

notifications for three SEZs - IT/ITeS, light engineering (including automotive and

auto components) and handicrafts; and formal approval for two more SEZs,

namely gems and jewelry (25 acres) and IT/ITeS (86 acres). MWC Jaipur also

plans to expand in segments like apparel and logistics.

Exhibit 51: Clients of MWC Jaipur

IT/ITeS SEZ

Handicrafts SEZ

Engineering & Related Industries SEZ

DTA

DBOI Global Services

GAD Industries

Dynamic Powertech

ICICI Bank

EXL Service

Jaipur Crafts

Gravita

State Bank of India

SystweakSoftware

Kirat Crafts

India Agrovision

Genpact

Laxmi Ideal Interiors

KnitproInternational

Girnar Software

OrviDesign

Marsons Industries

Infosys BPO

Rajdhani Craft

Poly Medicure

Infosys Ltd.

RatanTextiles

QH Talbros

Isys Softech

Rediprint International

Tijaria International

Nagarro Sortware

Samurai Designs & Interiors

Veto Electricals

Nucleus Software

Seesham Handicraft House

Veto Polymers & Metals

Truworth KPO Services

Rama Handicrafts

Wipro

Art Age Furnishings

ConnexxionsIT Services

Rustic Furniture

Tech Mahindra

Source: Company

Exhibit 52: MWC Jaipur - Location

Source: Company, Angel Research

May 17, 2012

18

Mahindra Lifespaces Developers | Initiating coverage

Upcoming business cities

MLIFE is planning to launch two integrated business cities, in-line with its existing

MWC portfolio. The new integrated cities will be developed in Dholera (Gujarat)

and in the Northern part of Chennai. Both the projects are expected to be

launched in March 2013.

Integrated Business City, Chennai, will be spread across 1,000 acres to cater

to mid-size ancillary industries of this segment, including auto components,

electronics, precision engineering and logistics. The company has already

acquired 50% of land requirements. The land is being acquired through

private negotiations.

Integrated Business City, Dholera, Gujarat will be spread across 2,500 acres

and will be located on the proposed Delhi Mumbai industrial corridor. Land

acquisition will be facilitated by the Gujarat government.

May 17, 2012

19

Mahindra Lifespaces Developers | Initiating coverage

Profit and Loss Account (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012E

FY2013E

FY2014E

Operating income

342

418

612

701

814

897

% chg

47.9

22.3

46.4

14.6

16.1

10.2

Operating Expenses

229

253

366

427

498

548

Personnel

14

18

23

29

34

38

Other

26

34

47

53

63

69

Total Expenditure

269

305

436

510

595

655

EBITDA

73

113

176

191

219

242

% chg

10.9

55.3

56.6

8.5

14.5

10.4

(% of Net Sales)

21.2

27.0

28.8

27.3

26.9

27.0

Depreciation

(4)

7

8

9

10

12

EBIT

76

106

168

182

209

230

% chg

24.8

38.8

58.6

8.1

15.0

10.0

(% of Net Sales)

22.4

25.4

27.5

26.0

25.7

25.7

Interest & other charges

4

9

11

21

27

36

Other Income

29

22

15

27

24

35

(% of sales)

1.1

2.2

1.9

3.0

3.4

4.1

PBT

102

119

172

188

206

229

% chg

10.2

16.4

44.7

9.3

9.8

10.8

Tax

31.3

38.3

58.7

59.3

65.1

72.1

(% of PBT)

30.7

32.3

34.1

31.5

31.5

31.5

PAT (reported)

71

81

113

129

141

157

Extraordinary (Exp)/Inc.

Minority Interest

7

2

5

10

13

18

ADJ. PAT

64

78

108

119

128

139

% chg

(3.3)

22.2

37.8

10.1

7.4

8.3

(% of Net Sales)

18.8

18.8

17.7

17.0

15.7

15.4

Basic EPS (`)

16.1

19.2

26.5

29.2

31.3

33.9

Fully Diluted EPS (`)

16.1

19.2

26.5

29.2

31.3

33.9

% chg

(1.2)

19.6

37.7

10.1

7.4

8.3

May 17, 2012

20

Mahindra Lifespaces Developers | Initiating coverage

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011 FY2012E FY2013E FY2014E

SOURCES OF FUNDS

Equity Share Capital

41

41

41

41

41

41

Preference Capital

14

10

0

0

0

0

ESOP Outstanding

0

0

1

1

1

1

Reserves& Surplus

884

938

1,024

1,114

1,215

1,324

Shareholders’ Funds

939

989

1,065

1,155

1,256

1,366

Minority Interest

86

82

83

100

114

132

Total Loans

332

421

544

509

759

1,009

Deferred Tax Liability

9

10

15

22

22

22

Total Liabilities

1,365

1,501

1,708

1,786

2,151

2,528

APPLICATION OF FUNDS

Net Block

150

163

179

195

230

260

Goodwill

29

29

29

29

29

29

Capital Work-in-Progress

46

13

17

8

8

8

Investments

108

148

87

175

175

175

Current Assets

1,214

1,394

1,705

1,852

2,215

2,649

Cash

145

133

240

150

287

581

Loans & Advances

199

207

294

367

400

440

Inventory

768

906

936

1,049

1,215

1,283

Debtors

73

121

207

198

275

303

Other current assets

29

25

28

89

38

42

Current liabilities

182

245

310

473

506

593

Net Current Assets

1,032

1,148

1,395

1,379

1,708

2,056

Mis. Exp. not written off

Total Assets

1,365

1,501

1,708

1,786

2,151

2,528

May 17, 2012

21

Mahindra Lifespaces Developers | Initiating coverage

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011 FY2012E FY2013E FY2014E

Profit before tax

102

119

172

188

206

229

Depreciation

(4)

7

8

9

10

12

Change in Working Capital

(80)

(88)

6

(33)

119

(140)

Other income

(29)

(22)

(15)

(27)

(24)

(35)

Direct taxes paid

(31)

(38)

(59)

(59)

(65)

(72)

Others

(193)

(43)

132

149

218

132

Cash Flow from Operations

(151)

(20)

20

72

(28)

138

(Inc.)/Dec. in Fixed Assets

72

4

28

32

37

41

(Inc.)/Dec. in Investments

224

(35)

62

-

-

-

Other income

29

22

15

27

24

35

Others

(133)

(19)

(64)

(78)

(86)

(104)

Cash Flow from Investing

192

(29)

41

(19)

(24)

(28)

Issue of Equity

26

-

1

-

-

-

Inc./(Dec.) in loans

47

89

123

(27)

250

250

Dividend Paid (Incl. Tax)

13

13

19

25

27

29

Others

(29)

(65)

(98)

(71)

(81)

(94)

Cash Flow from Financing

57

36

46

(73)

196

185

Inc./(Dec.) in Cash

99

(12)

107

(20)

144

295

Opening Cash balances

46

145

133

240

220

364

Closing Cash balances

145

133

240

220

364

659

May 17, 2012

22

Mahindra Lifespaces Developers | Initiating coverage

Key Ratio’s

Y/E March (` cr)

FY2009

FY2010

FY2011 FY2012E FY2013E FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

19.4

16.2

11.8

10.7

10.0

9.2

P/CEPS

21.1

15.0

10.9

9.9

9.3

8.5

P/BV

1.4

1.3

1.2

1.1

1.0

0.9

Dividend yield (%)

1.0

1.0

1.5

2.0

2.1

2.3

EV/Sales

4.3

3.7

2.6

2.3

2.1

1.9

EV/EBITDA

20.1

13.9

8.9

8.5

8.0

7.0

EV / Total Assets

1.1

1.0

0.9

0.9

0.8

0.7

Per Share Data (`)

EPS (Basic)

15.7

19.2

26.5

29.2

31.3

33.9

EPS (fully diluted)

15.7

19.2

26.5

29.2

31.3

33.9

Cash EPS

14.8

20.8

28.5

31.4

33.7

36.7

DPS

3.2

3.2

4.7

6.1

6.6

7.1

Book Value

230.1

242.3

260.8

282.9

307.6

334.4

Du pont Analysis

EBIT margin

22.4

25.4

27.5

26.0

25.7

25.7

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

0.3

0.3

0.4

0.5

0.5

0.5

ROIC (Post-tax)

4.5

5.6

7.8

8.0

8.2

8.3

Cost of Debt (Post Tax)

0.0

0.0

0.0

0.0

0.0

0.0

Leverage (x)

0.2

0.1

0.2

0.2

0.2

0.2

Operating ROE

9.0

11.1

15.6

16.1

16.4

16.6

Returns (%)

ROCE (Pre-tax)

6.0

7.4

10.5

10.4

10.6

9.8

Angel ROIC (Pre-tax)

6.5

8.2

11.9

11.7

12.0

12.1

ROE

6.8

7.9

10.2

10.3

10.2

10.1

Turnover ratios (x)

Asset Turnover

0.3

0.4

0.5

0.5

0.5

0.5

Inventory / Sales (days)

764

731

550

517

508

508

Receivables (days)

63

85

98

105

106

118

Payables (days)

236

255

233

280

301

306

WC cycle (ex-cash) (days)

837

831

647

621

594

590

Solvency ratios (x)

Net debt to equity

0.08

0.14

0.20

0.16

0.24

0.19

Net debt to EBITDA

1.1

1.2

1.2

1.0

1.4

1.0

Interest Coverage (EBIT / Interest)

20.4

11.4

14.9

8.6

7.7

6.3

May 17, 2012

23

Mahindra Lifespaces Developers | Initiating coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Mahindra Lifespaces Developers

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

May 17, 2012

24