Please refer to important disclosures at the end of this report

1

Medplus Health Services Limited

IPO NOTE

Medplus Health Services Limited

December 10, 2021

Medplus Health Services Limited was incorporated in November 2006 by Gangadi

Madhukar Reddy with other promoters. Medplus is the second largest pharmacy

retailer in India, in terms of the number of stores as of March 31, 2021, and in

terms of revenue from the operation. Medplus offers a wide range of

pharmaceutical products and fast-moving consumer goods (FMGC), such as

medicines, vitamins, medical devices, home, and personal care products, etc.

Positives

(a) Medplus is the second largest pharmacy retailer in India, in terms

of the number of stores as of March 31, 2021, and in terms of revenue from

the operation. (b) Adding value proposition to the customer in terms of 2-hour

delivery, competitive pricing and a wide range of Pharmaceutical and FMCG

products. (c) Medplus is the first pharmacy retailer in India to offer an

omnichannel platform i.e. customers can visit the stores or place the order

online by mobile application or website. (d) Strong execution track record of

stores expansion, from 48 stores in 2006 to more than 2300 stores in 2021.

Investment concerns: (a) Increase in competition, from offline as well as online

companies like Apollo Pharmacy, Tata 1mg, Netmeds etc. (b) The company has

got some benefit of Covid related revenue in 2021 and in H1FY2022, once Covid

revenue normalizes it may be difficult for the company to have double-digit

revenue growth. (c) Company may face certain challenges to expand its retail

chain in other geographies.

Outlook & Valuation: Based on H1FY2022 numbers, the IPO is priced at a

EV/EBITDA of 27.5 times and price to sales at 2.5 times at the upper price band

of the IPO. Medplus is the second largest pharmacy retailer in India, company

offer a good value proposition to its customer in terms of discount, wide range of

product and fast delivery. We believe that the company omnichannel platform will

help to deliver strong growth in future. Hence, we are assigning a

“SUBSCRIBE” recommendation to the Medplus Health Services Limited IPO.

Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY21

H1FY22

Net Sales

2,272

2,871

3,069

1,463

1,880

% chg

-

26

6.9

-

28.5

Net Profit

12.1

2.2

63.4

22.4

66.6

% chg

-

(81.8)

2,782

-

197.3

EBITDA (%)

5.8

5.3

7.8

7.3

9.0

EPS (as stated)

1.3

0.2

5.7

2.1

6.0

P/E (x)

627

3,980

140

190

66.4

P/BV (x)

30.5

16.8

12.2

15.0

11.1

EV/EBITDA

69.7

60.2

38.6

43.1

27.5

EV/Sales

4.0

3.2

3.0

3.1

2.5

Source: Company, Angel Research

SUBSCRIBE

Issue Open: December 13, 2021

Issue Close: December 15, 2021

Medplus Health Services Limited | IPO Note

December 10, 2021

2

Company Background

Medplus Health Services Limited was incorporated in November, 2006 by

Gangadi Madhukar Reddy with other promoters. Medplus is the second largest

pharmacy retailer in India, in terms of number of stores as of March 31, 2021

and in terms of revenue from operation. Medplus offers a wide range of

products, including pharmaceutical and wellness products, including

medicines, vitamins, medical devices and test kits, and fast-moving consumer

goods (FMCG), such as home and personal care products, including toiletries,

baby care products, soaps and detergents, and sanitizers.

Company having more than 2300 offline retail network stores in 261 cities

across the states of Tamil Nadu, Andhra Pradesh, Telangana, Karnataka,

Odisha, West Bengal and Maharashtra. In 2020 company started focusing on

online sales, now company able to deliver their online purchases customers

within 2 hours of purchase in select cities of Hyderabad, Bangalore, Kolkata,

Pune and Nagpur. Medplus employs a data analytics driven cluster-based

approach to their store network expansion.

Medplus has 3 manufacturing plants in Telangana, company manufacture

range of plastic products, optical frames, spectacles and liquid disinfectants

etc.

Medplus hold strong market share in Chennai, Bangalore, Hyderabad and

Kolkata, company has market share of approximately 30%, 29%, 30% and

22%, respectively in organized pharmacy retail market. Companies number of

stores has grown significantly, as of September 30, 2021, company operate

546 stores in Karnataka, 475 stores in Tamil Nadu, 474 stores in Telangana,

297 stores in Andhra Pradesh, 224 stores in West Bengal, 221 stores in

Maharashtra and 89 stores in Odisha.

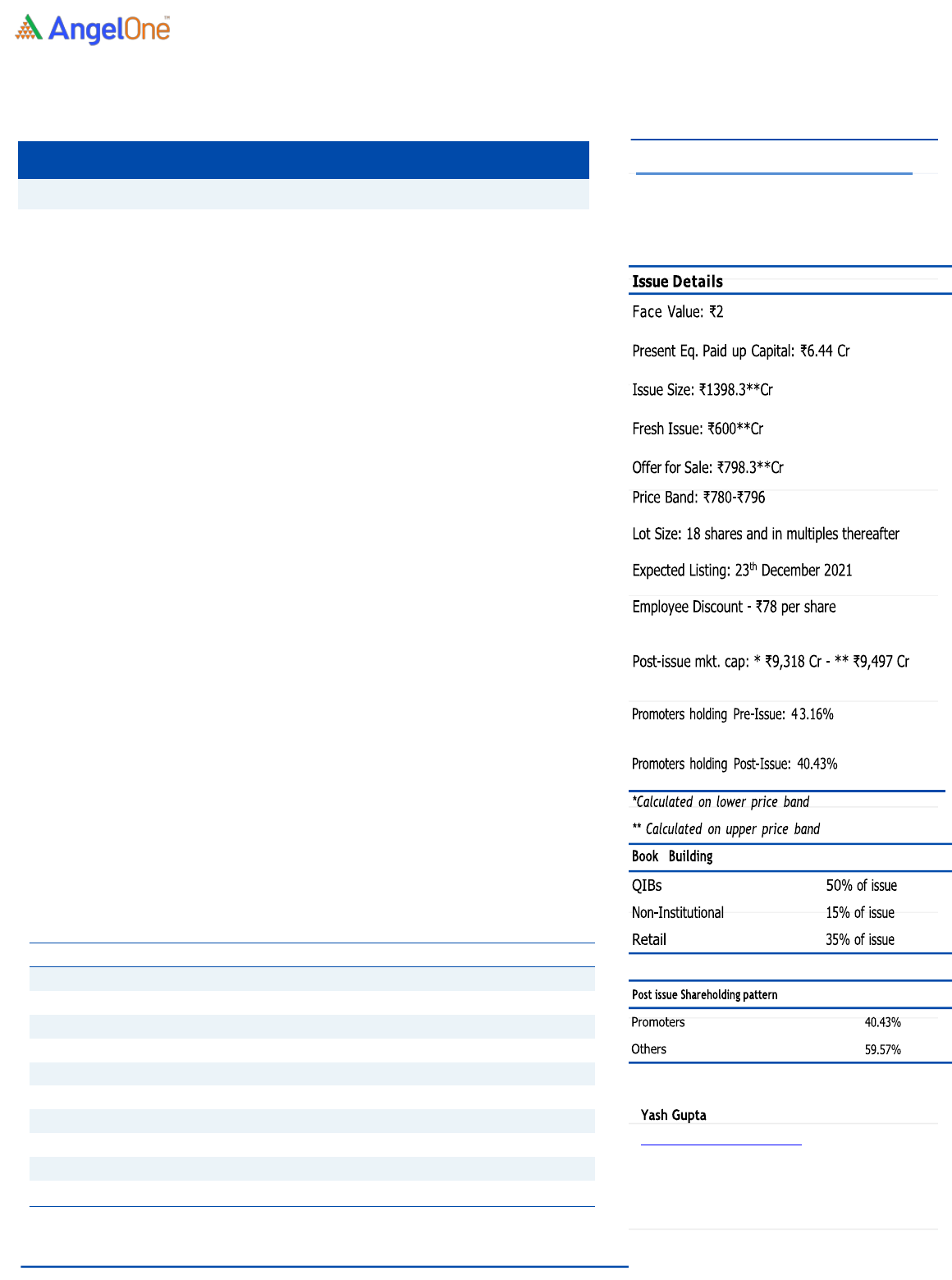

Issue Details –

The issue comprises of new issue of ₹600 crores and offer for sale of ₹798.3

crores. With the IPO, price band of ₹780-₹796.

Pre & Post issue share holding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Promoter

4,82,33,135

43.2%

4,82,33,135

28.4%

Public

6,31,00,810

56.5%

7,06,45,321

41.6%

Employee Trust

4,27,220

0.4%

4,27,220

0.3%

Total

11,17,61,165

100.0%

16,96,24,024

100.0%

Source: Company, Angel Research

Medplus Health Services Limited | IPO Note

December 10, 2021

3

Objectives of the Offer

The IPO aims to utilize the net proceed for working capital requirement.

General Corporate Purposes.

Key Management Personnel

Gangadi Madhukar Reddy is the Managing Director and Chief Executive Officer

of the company. He is one of the Promoters of the company and has been a

Director of the company since incorporation on November 30, 2006.

Anish Kumar Saraf is the Non-Executive Director of the company. He is the

managing director of Warburg Pincus India Pvt Ltd and has been in the

employment of the company for 15 years.

Cherukupalli Bhaskar Reddy is the Chief Operating Officer – outlet operations

of the company. He joined the company on March 1, 2007. He has over 14

years of experience in the pharmaceutical industry.

Hemanth Kundavaram is the CFO of the company. He joined the company on

January 2, 2021. He has over 15 years of experience in corporate finance and

accounting in various industries.

Madhavan Ganesan is the Non-Executive Independent Director of the

company. He has over 34 years of experience in various companies in the

retail, technology and the industrial sectors.

Hiroo Mirchandani is the Non-Executive Independent Director of the company.

Her business career has primarily been in the healthcare and consumer goods

sectors.

Medplus Health Services Limited | IPO Note

December 10, 2021

4

Consolidated Profit & Loss account

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY21

H1FY22

Total operating income

2,272

2,871

3,069

1,463

1,880

% chg

-

26

6.9

-

28.5

Total Expenditure

2,153

2,737

2,852

1,364

1,721

Raw material

1844

2337

2424

1144

1479

Employee Benefit Expense

211

272

339

180

180

Other Expenses

98

128

90

40

62

EBITDA

119

134

217

98

159

% chg

-

12

62

-

62

(% of Net Sales)

5.2

4.7

7.1

6.7

8.4

Depreciation& Amortization

58.5

74.8

88.2

42.2

54.7

EBIT

60.7

59.2

128.6

56.0

104.1

% chg

-

-2

117

-

86

(% of Net Sales)

2.7

2.1

4.2

3.8

5.5

Interest & other Charges

50

47

55

27

31

Other Income

12.2

17.2

21.5

8.4

10.9

(% of Sales)

0.5

0.6

0.7

0.6

0.6

PBT

22.9

29.7

95.3

37.4

83.7

(% of Net Sales)

1.0

1.0

3.1

2.6

4.5

Tax

10.8

27.5

31.9

15.0

17.1

PAT (reported)

12.1

2.2

63.4

22.4

66.6

% chg

-

(82)

2,782

-

197.3

(% of Net Sales)

0.5

0.1

2.1

1.5

3.5

EPS (as stated)

1.27

0.2

5.7

2.1

6.0

% chg

-

(84)

2,750

-

187

Source: Company, Angel Research

Medplus Health Services Limited | IPO Note

December 10, 2021

5

Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY21

H1FY22

SOURCES OF FUNDS

Equity Share Capital

0.2

0.2

0.4

0.2

6.4

Other equity

291

529

731

591

795

Shareholders Funds

291

529

731

591

801

Total Loans

287

321

401

344

464

Other liabities

8.1

17.7

18.3

18.7

17.6

Total Liabilities

586

867

1,151

954

1,282

APPLICATION OF FUNDS

Net Block

47

60

87

61

108

Current Assets

469

816

923

828

987

Sundry Debtors

9

6

5

4

7

Cash &Bank Balance

25

114

107

42

26

Other Assets

17

25

49

67

74

Current liabilities

372

481

415

431

464

Net Current Assets

97

335

508

397

524

Other Non Current Asset

442

473

555

496

651

Total Assets

586

867

1151

954

1282

Source: Company, Angel Research

Medplus Health Services Limited | IPO Note

December 10, 2021

6

Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY21

H1FY22

Profit before tax

22.7

29.3

95.0

37.2

83.5

Depreciation

58.5

74.8

88.3

42.2

54.7

Change in Working Capital

(33.1)

(251.4)

(130.6)

(76.4)

(69.0)

Interest Expense

14.1

6.5

8.3

4.7

2.6

Direct Tax Paid

(12.5)

(14.8)

(28.7)

(8.9)

(16.3)

Others

16.8

20.9

30.5

42.2

1.8

Cash Flow from Operations

146.4

(6.6)

2.9

5.7

156.3

(Inc.)/ Dec. in Fixed Assets

(21.6)

(30.1)

(54.0)

(9.5)

(41.6)

Investment

(1.3)

(1.9)

14.9

(3.7)

(58.6)

Interest received

3.6

5.3

4.2

1.7

1.6

Other

0

(0.9)

0.2

0.2

-

Cash Flow from Investing

(19.3)

(27.6)

(34.7)

(11.3)

(98.6)

Proceeds Convertible Preference Sh.

-

203.8

98.0

-

-

Dividend paid on equity shares

(14.1)

(6.5)

(8.3)

(4.7)

(2.6)

Others

-

0.6

-

-

0.4

Cash Flow from Financing

(82.8)

89.8

(5.6)

(47.6)

(60.6)

Inc./(Dec.) in Cash

44.5

55.6

(37.2)

(53.4)

(2.6)

Opening Cash balances

(91.3)

(46.8)

8.8

8.8

(28.4)

Closing Cash balances

(46.8)

8.8

(28.4)

(44.6)

(31.0)

Source: Company, Angel Research

Key Ratios

Y/E March

FY19

FY20

FY21

H1FY21

H1FY22

Valuation Ratio (x)

P/E (on FDEPS)

627

3,980

140

190.4

66.4

P/CEPS

126.0

115.5

58.7

68.9

36.7

P/BV

30.5

16.8

12.2

15.0

11.1

EV/Sales

4.0

3.2

3.0

3.1

2.5

EV/EBITDA

69.7

60.2

38.6

43.1

27.5

Per Share Data (Rs)

EPS (fully diluted )

1.27

0.20

5.70

2.09

5.99

Cash EPS

6.3

6.9

13.6

5.8

10.9

Book Value

26.1

47.3

65.4

52.9

71.7

DPS

-

-

-

-

-

Number of share

11.18

11.18

11.18

11.18

11.18

Returns (%)

RONW

4.1

0.4

8.7

3.8

8.4

Turnover ratios (x)

Asset Turnover (net)

25.4

27.3

23.2

27.5

24.4

Receivables (days)

1.4

0.8

0.6

0.5

0.7

Inventory Days

63.3

81.8

89.2

85.5

78.6

Payables (days)

31.3

36.6

22.3

28.9

27.6

Working capital cycle (days)

33.4

46.1

67.5

57.1

51.8

Source: Company, Angel Research

Medplus Health Services Limited | IPO Note

December 10, 2021

7

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst)

Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI

or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment

in the securities of the companies referred to in this document (including the merits and risks involved), and should consult

their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities

of the subject company at the end of the month immediately preceding the date of publication of the research report.

Neither Angel or its associates nor Research Analysts or his relative has any material conflict of interest at the time of

publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings,

corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business. Angel or its associates did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with the research report. Neither Angel nor

its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as

such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not

be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. Angel Broking Limited has not independently verified all the information contained within this

document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis

the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing

so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information. Angel or its associates or Research Analyst or his relative might have

financial interest in the subject company. Research analyst has not served as an officer, director or employee of the subject

company.