IPO Note | NBFC

July 26, 2011

L&T Finance Holding

SUBSCRIBE

Issue Open: July 27, 2011

Broad horizons

Issue Close: July 29, 2011

Diversified loan mix

Issue Details

L&T Finance Holding’s (L&TFH) well diversified loan book ranging from small

Face Value: `10

ticket microfinance to big ticket infra loans, provides the company an opportunity

Present Eq. Paid-up Capital: `1,477cr

to tap into various under penetrated segments and address a broader range of

growth opportunities across cycles. In terms of reach, the L&T finance group has

Offer Size#: 21.1cr - 24.4cr Shares

presence pan India (23 states, 837 Points of presence). Also, compared to

Post Eq. Paid-up Capital#: ` 1,688 - 1,721cr

specialised lending NBFCs, L&TFH’s risk is much better spread out into the

various segments it operates, which reduces the risks associated with any

Issue size (amount): `1,245cr

particular segment or customer concentration.

Price Band: `51-59

Strong growth track record

Post-issue implied mkt cap*: ` 8,778 - 9,959r

L&TFH’s loan portfolio has grown at a CAGR of 56.6% over FY2009-FY2011,

Promoters holding Pre-Issue: 95.9%

way ahead of its peers (35.2% for IDFC, 14.5% for Shriram transport). The

Promoters holding Post-Issue*: 82.3% - 83.9%

company has its sights set on the two of the most rapid growing sectors -

Note: # At the upper and lower price bands,

Infrastructure and rural development, which gives high visibility to its loan growth

respectively, * At the lower and upper price

outlook, driven by higher government spending and substantial latent demand.

bands, respectively

The net profit of the holding company has grown by 53.4% over FY2010-11,

although on a low base.

Book Building

Strong parentage, but relatively expensive at the upper band

QIBs

Up to 50%

L&T Finance Holding looks well-positioned for growth considering its bolstered

Non-Institutional

At least 15%

capital position post-IPO, diversified loan segments and healthy track record. The

diversified loan book also reduces risk emanating from sectoral or customer

Retail

At least 35%

concentration. That said, it remains to be seen if the company can match the

ability of the niche NBFCs in profitably sourcing high-yielding loans, while

managing credit risk effectively. At present, based on FY2011 numbers, the

Post Issue Shareholding Pattern

company’s RoEs were on the lower side compared to peers. Also, there are near-

Promoters Group

82.3% - 83.9%

term macro-headwinds for NBFCs from higher interest rates, slowing credit

MF/Banks/Indian

16.1%-17.7%

demand and asset quality concerns, due to which valuations of listed NBFCs have

FIs/FIIs/Public & Others

corrected. In the context of its lower RoEs relative to peers and considering the

near-term macro-headwinds, the valuations at the upper band look a little

expensive in our view at ~2.2x post-IPO Networth (~2.0x at the lower band).

Hence, we recommend Subscribe at the lower end of the price band.

Key financials (Consolidated)

Y/E March (` cr)

FY2010

FY2011

NII (Net interest income)

726

1,039

Vaibhav Agrawal

% chg

-

43

022 - 3935 7800 Ext: 6808

Net profit

242

398

% chg

-

65

Shrinivas Bhutda

NIM (%) (Net interest margin)

7.8

7.1

022 - 3935 7800 Ext: 6845

EPS (`) (Earning per share)

1.8

2.8

P/E (x)*

26.5

18.1

P/ABV (x)*

3.6

2.6

Varun Varma

RoA (%) (Return on asset)

2.5

2.5

022 - 3935 7800 Ext: 6847

RoE (%) (Return on equity)

21.1

16.3

Source: RHP, Angel Research. Note *: Valuations at the lower price band and at pre issue earnings

and adjusted book value

Please refer to important disclosures at the end of this report

1

L&T Finance Holding | IPO Note

Company background

L&TFH offers a diverse range of financial products and services across the

corporate, retail and infrastructure finance sectors, as well as mutual fund products

and investment management services, through their direct and indirect wholly-

owned subsidiaries.

L&T Finance’s wholly owned subsidiary L&T Infrastructure Finance Company

Limited (L&T Infra), conducts infrastructure finance business which provides

financial products and services to customers engaged in infrastructure

development and construction and is registered with the RBI as an NBFC-ND-SI

and an IFC. L&T Finance Limited (L&T Finance), another wholly owned subsidiary,

conducts retail finance business and corporate finance business and is registered

with the RBI as an NBFC-ND-SI and an AFC.

Details of the issue

The IPO comprises an issue of `1,245cr, (21.1cr shares at upper band - 24.4cr

shares at lower price band) equity shares of face value of `10 each, in the price

band of `51-59 per share. The primary issue of shares would result in a dilution of

the promoter’s holding by 12.0% to 83.9% at the upper price band and by 13.6%

to 82.3% at the lower price band.

The objects of the Issue are to repay the intercorporate deposit issued by Promoters

to the Company, to augment the capital base of L&T Finance and L&T Infra to

meet the capital requirements arising out of expected growth in their assets,

primarily the loan portfolio, compliance with regulatory requirements and for other

general corporate purposes including meeting the expenses of the Issue.

For the use of L&T brand and monogram, L&TFH will have to pay a consideration

amounting to 0.15% of the assets, or 5% of the PAT, whichever is lower plus,

service tax. The payment will commence from FY2012 onwards.

July 26, 2011

2

L&T Finance Holding | IPO Note

Investment arguments

Highly diversified business model with pan India presence

L&TFH’s well diversified loan book ranging from small ticket microfinance to big

ticket infra loans, provides the company an opportunity to tap into various under

penetrated segments and address a broader range of growth opportunities across

cycles. Compared to specialised lending NBFCs, L&TFH’s risk is much better

spread out into the various segments it operates, which reduces the risks

associated with any particular segment or customer concentration.

The strong parentage and brand equity of L&T has facilitated L&TFH’s entry into

various segments, allowed it to gain operational skills in a short frame of time and

is likely to be an advantage with regards to attracting professional talent. Also, in

terms of reach, the L&T finance group has presence pan India (23 states, 837

Points of presence).

Exhibit 1: L&TFH’s loan structure - FY2011

Exhibit 2: L&T Infra loan break up - FY2011

L&T finance

(Corporate)

21%

Power

L&T Infra

27.7

28.7

Roads

L&T Infra

Telecommunications..

41%

L&T finance (Retail)

Oil and GaS

L&T finance

6.2

(Retail)

Urban Infrastructure

L&T finance (Corporate)

17.3

38%

Other

6.4

13.8

Source: RHP, Angel Research

Source: RHP, Angel Research

As of FY2011, the L&T finance’s loan book comprised 58.6% of the L&TFH’s loan

portfolio. The retail segment of L&T finance, which is mostly into construction

equipment finance, transport finance and rural based lending, comprises 37.9% of

the overall holding company’s loan portfolio (64.8% of L&T Finance’s loan book).

The corporate segment which provides financial products and services to corporate

customers comprises 20.6% of the overall holding company’s loan portfolio

(35.2% of L&T Finance’s loan book).

L&T Infra offers loans to customers engaged in infrastructure development and

construction. Conferred upon an IFC status by the RBI, the company’s operations

majorly comprises of lending to power and road projects. The exposure to power

sector is ~ 2,060cr (11.9% of the holding company’s loan book) with no exposure

to any state electricity board.

July 26, 2011

3

L&T Finance Holding | IPO Note

Exhibit 3: Product mix for L&TFH

L&TFH - Well diversified product mix

Corporate Finance

Retail Finance Group

Infra Group

Asset-backed loans

Construction equipment finance

Power

Term loans

Transportation equipment finance

Roads

Receivables discounting

Rural products finance

Telecommunications

Short-term working capital facilities

Microfinance

Oil and GaS

Operating and finance leases

Distribution of 3rd party fin. products

Urban Infrastructure

Supply chain finance

Capital markets products

Competitors

Competitors

Competitors

Shriram Transport, SKS Microfinance, Magma Fincorp,

PSU and Pvt. Banks

IDFC, PFC, REC

M&M Fin Services

Source: Company, Angel Research

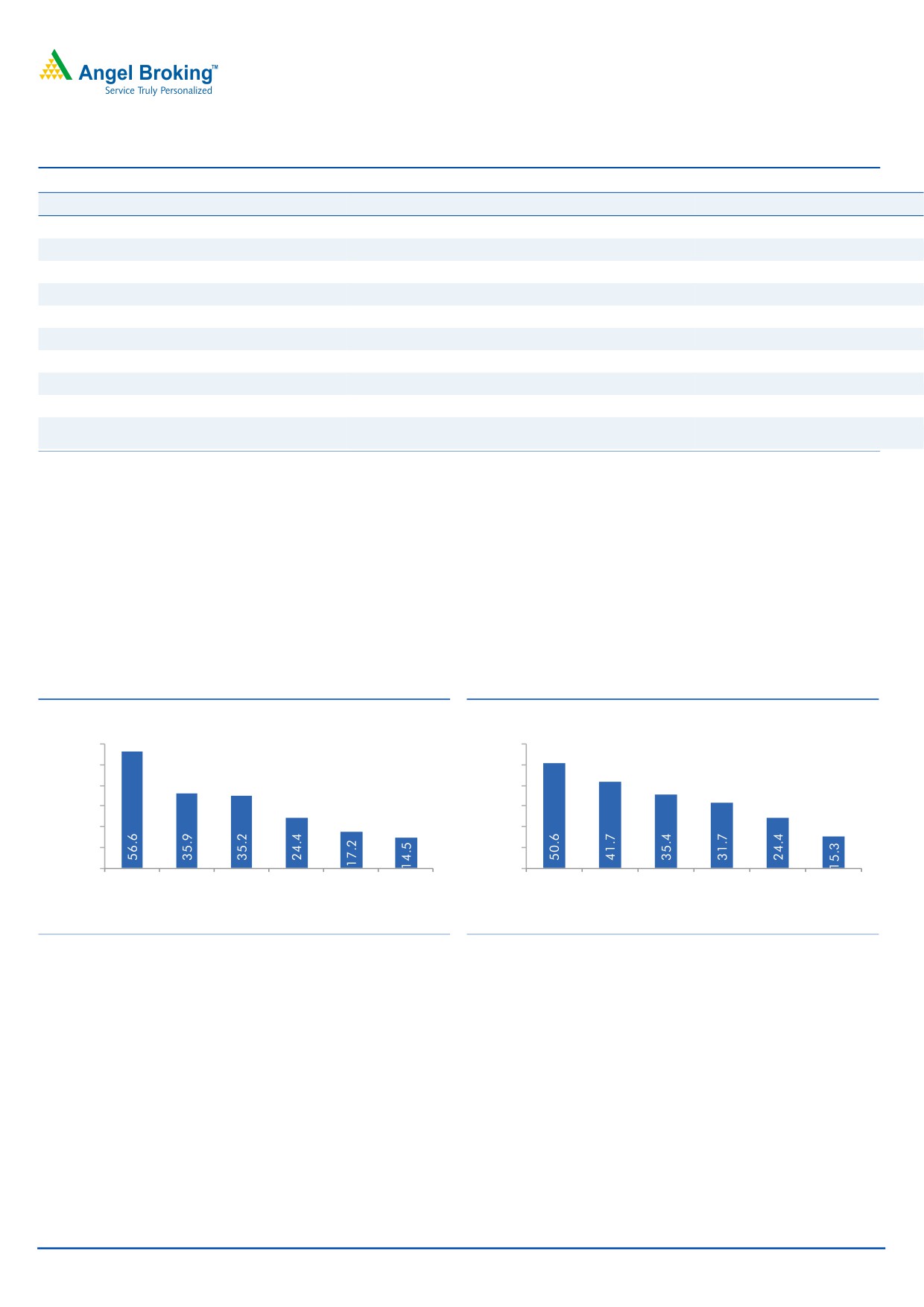

Strong growth track record

L&TFH’s loan portfolio has grown at a CAGR of 56.6% over FY2009-FY2011, way

ahead of its peers (35.2% for IDFC, 14.5% for Shriram transport). The company

has its sights set on the two of the most rapid growing sectors - Infrastructure and

rural development, which gives high visibility to its loan growth outlook, driven by

higher government spending and substantial latent demand. The net profit of the

holding company has grown by 53.4% over FY2010-11, although on low base.

Exhibit 4: Loan growth CAGR FY2009-11

Exhibit 5: PAT growth CAGR FY2009-11*

(%)

(%)

60.0

60.0

50.0

50.0

40.0

40.0

30.0

30.0

20.0

20.0

10.0

10.0

0.0

0.0

L&T Fin

LICHF IDFC

PFC HDFC Shriram

L&T Fin Shriram LICHF

IDFC HDFC

PFC

Holding

Trans.

Holding Trans.

Source: RHP, Angel Research

Source: RHP, Angel Research, *note; FY10-11 growth for L&T Fin Holding

L&TFH has seen robust growth in the last 2 years, while maintaining its asset

quality. As of FY2011 the gross NPA ratios for L&T finance stood at 1.4% (2.8% in

FY2010), while for L&T infra, the gross NPA ratio stood at 0.7% (1.9% in FY2010).

The overall funding mix comprises mostly of term loans (63.0% of total borrowings

as of FY2011) and debentures (28.6% of total borrowings as of FY2011).

July 26, 2011

4

L&T Finance Holding | IPO Note

Exhibit 6: Funding Mix as of FY2011

Exhibit 7: Improvement in asset quality in FY2011

(%)

Term Loans/FIs/Promoters

Debentures

CP

(%)

FY10

FY11

100%

2.81

8.4

3.00

10.3

14.4

80%

19.1

2.50

28.6

1.85

38.0

2.00

60%

1.44

1.50

40%

1.00

0.68

70.7

63.0

47.6

0.50

20%

-

0%

L&T Infra GNPA (%)

L&T Finance GNPA (%)

2009

2010

2011

Source: Company, Angel Research

Source: Company, Angel Research

Strong credit rating with high capital adequacy

Both L&T finance and L&T Infra have strong credit ratings (AA+ from CARE and

LAA+ from ICRA) allowing them access to various sources of funds. Moreover, L&T

Infra is classified as an IFC, which allows raising low cost tax saving long term

infrastructure bonds and also lowers the risk weightage for bank loans to the

company. As of FY2011 both L&T Finance and L&T Infra had a capital adequacy

ratio comfortably above the regulatory requirements. Also, L&T Infra has till now

not raised any tier 2 capital (`75cr tier 2 capital in L&T Finance also below

regulatory limits), giving it the option of raising capital through tier 2 bonds in the

future.

Exhibit 8: Strong credit rating

CARE

ICRA

Status

CAR

L&T Infra

AA+

LAA+

IFC, PFI

16.5%

L&T Finance

AA+

LAA+

AFC

16.3%

Source: Company, Angel Research

Could be a contender for a banking license

With the RBI in the process of finalizing guidelines for issue of new banking license,

we believe the L&T group (through L&TFH) could be a strong contender for

receiving a license. In its discussion paper, the RBI had listed safeguards to address

the downside risks of industrial and business houses promoting banks. One of the

main criteria in our view was that industrial and business houses promoting banks

must have diversified ownership and no connection with real estate.

Considering that any licensee would in our view need to have deep pockets and

strong reputation, in our analysis we considered corporates with market

capitalization exceeding `10,000cr. Amongst such corporates, L&T emerges as

one of the very few where the promoter stake is less than 25% and is driven by a

strong, professional management and board. Hence, we believe amongst various

corporates who have evinced interest in a banking foray, the L&T group (through

L&TFH) could emerge as a meaningful contender for receiving a banking license.

However, it is important to note that there are several elements to this debate and

at this stage, it would not be prudent to bank on any such development while

evaluating L&TFH.

July 26, 2011

5

L&T Finance Holding | IPO Note

Investment risks

Both L&T finance and L&T infra have a wide mix of product offerings where they

compete with a host of specialized players with already established asset appraisal

skills. The product offerings by L&T finance range from working capital loans in the

corporate space to rural based lending in retail space, on the one hand making its

portfolio well diversified and shielded from slump in any particular sector i.e. it is a

positive from a sectoral risk point-of-view.

But on the other hand, a diversified loan offering, however, also implies building

asset appraisal skills (PFC in power lending, Shriram transport in vehicle loans) in

every segment. It remains to be seen if the company can match the ability of the

niche NBFCs in profitably sourcing high-yielding loans, while managing credit risk

effectively. At present, based on FY2011 numbers, even at a reasonably high

leverage, the company’s RoEs were on the lower side compared to peers.

Also considering exposure to infra (above 40% of total loans outstanding; Nil to

SEBs) and MFI (`460cr exposure, with `200cr being in Andhra Pradesh), NPA and

restructuring concerns surfacing in the short-to-medium term cannot be ruled out.

Outlook and valuation

L&TFH looks well-positioned for growth considering its bolstered capital position

post-IPO, diversified loan segments and healthy track record. The diversified loan

book also reduces risk emanating from sectoral or customer concentration. The

company is also likely to benefit from L&T’s strong corporate brand in attracting

talent and capital. That said, it remains to be seen if the company can match the

ability of the niche NBFCs in profitably sourcing high-yielding loans, while

managing credit risk effectively. At present, based on FY2011 numbers, even at a

reasonably high leverage, the company’s RoEs were on the lower side compared

to peers.

Also, there are near-term macro-headwinds for NBFCs from higher interest rates,

slowing credit demand and asset quality concerns, due to which valuations of listed

NBFCs have corrected. In the context of its lower RoEs relative to peers and

considering the near-term macro-headwinds, the valuations at the upper band

look a little expensive in our view at ~2.2x post-IPO Networth (~2.0x at the lower

band). Hence, we recommend Subscribe at the lower end of the price band.

July 26, 2011

6

L&T Finance Holding | IPO Note

Exhibit 9: DuPont Analysis L&TFH and competitors

FY11

IDFC

Bajaj Finance

M&M Finance

Shriram Transport

SKS Micro Finance

L&T FH*

Interest earned

10.5

22.0

19.9

22.9

30.6

13.4

Less: Prov

0.6

3.3

1.5

2.4

6.2

0.7

Adj interest earned

9.9

18.7

18.3

20.6

24.4

12.6

Int expense

5.9

6.1

6.5

9.6

9.1

6.6

Adj NII

4.0

12.7

11.9

10.9

15.3

6.0

Other income

1.7

0.6

0.3

0.1

2.5

0.3

Staff expenses

0.7

2.3

2.2

1.5

8.5

0.6

Other opex

0.6

5.0

2.7

1.7

4.9

1.8

PBT

4.4

5.9

7.3

7.9

4.5

4.0

Tax

1.2

2.0

2.5

2.6

1.6

1.4

ROA

3.2

4.0

4.8

5.2

2.9

2.6

PAT Equity

3.2

4.0

4.8

5.2

2.9

2.5

Leverage

4.4

5.0

4.8

5.4

2.8

5.9

ROE

14.0

19.7

22.9

28.1

8.1

15.0

Market Cap

20,709

2,670

7,428

15,800

3,859

8,778

P/BV

1.8

2.0

2.9

3.2

2.2

2.0

P/E

16.2

10.8

15.1

12.8

34.6

13.1

Source: Company, Angel Research, Note*: Post issue valuations

July 26, 2011

7

L&T Finance Holding | IPO Note

Income statement

Y/E March (` cr)

FY10

FY11

Net Interest Income

726

1,039

- YoY Growth (%)

NA

43.1

Other Income

23

56

- YoY Growth (%)

NA

137

Operating Income

749

1,094

- YoY Growth (%)

NA

46

Operating Expenses

260

372

- YoY Growth (%)

NA

43

Pre - Provision Profit

489

723

- YoY Growth (%)

NA

48

Prov. and Cont.

113

111

- YoY Growth (%)

NA

(2)

Profit Before Tax

376

612

- YoY Growth (%)

NA

63

Provision for Taxation

134

213

- as a % of PBT

36

35

PAT

242

398

- YoY Growth (%)

NA

65

Balance sheet

Y/E March (` cr)

FY10

FY11

Share Capital

1,354

1,417

Reserve & Surplus

672

1,431

Borrowings

9,727

15,916

- Growth (%)

56.4

63.6

Other Liabilities & Provisions

667

928

Total Liabilities

12,419

19,693

Investments

309

732

Advances

10,949

17,411

- Growth (%)

54.2

59.0

Fixed Assets

398

453

Other Assets

763

1,096

Total Assets

12,419

19,693

July 26, 2011

8

L&T Finance Holding | IPO Note

Ratio Analysis

Year end March

FY2010

FY2011

Per Share Data (`)

EPS

1.9

2.8

ABVPS ( 75% Coverage for NPAs)

14.1

19.6

Profitability ratios (%)

NIMs

7.8

7.1

ROA

2.5

2.5

ROE

21.1

16.3

Asset Quality (%)

Gross NPAs

2.49

1.10

Net NPAs

1.73

0.67

Valuation Ratios $

PER (x)

26.5

18.1

P/ABVPS (x)

3.6

2.6

DuPont Analysis (%)

NII

7.1

6.5

(-) Prov. Exp.

0.9

0.7

Adj NII

6.2

5.8

Other Inc.

0.2

0.3

Op. Inc.

6.4

6.1

Opex

2.6

2.3

PBT

3.9

3.8

Taxes

1.3

1.3

ROA

2.5

2.5

Leverage

8.3

6.6

ROE

21.1

16.3

Note: $ Valuations at the lower price band and pre issue earnings and adjusted book value

July 26, 2011

9

L&T Finance Holding | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

July 26, 2011

10