Please refer to important disclosures at the end of this report

1

Laxmi Organic Industries Ltd. is a leading manufacturer of Acetyl

Intermediates and Specialty Intermediates with almost three decades of

experience in large scale manufacturing of chemicals. Company started

its business in 1989, with initially manufacturing acetaldehyde and acetic

acid in 1992, and soon thereafter moved on to manufacturing of ethyl

acetate in 1996; currently among the largest manufacturers of ethyl

acetate in India with a market share of approximately 30% of the Indian

ethyl acetate market.

Positives: (a) Leading manufacturer of ethyl acetate with significant

market share (b) Only Indian manufacturer of diketene derivatives with a

significant market share and one of the largest portfolios of diketene

products (c) Diversified customer base across high growth industries and

long-standing relationships with marquee customers (d) Strategically

located manufacturing facilities, vertical integration and supply chain

efficiencies.

Investment concerns: (a) The continuing impact of the outbreak of the

COVID-19 could have a significant effect on operations, and could

negatively impact business, revenues, financial condition and results of

operations. (b) A large part of the manufacturing facilities is located in one

geographic, and therefore, any localized social unrest, natural disaster or

breakdown of services could have material adverse effect on operations.

(c) Due to foreign client base, it is exposed to foreign currency exchange

risks which may adversely impact our results of operations.

Outlook & Valuation: Based on FY2020 earnings the IPO is priced at a PE of

42x at the upper end of the price band along with a good ROE of 16.4%.

The company is the largest manufacturer of ethyl acetate with over 30%

market share in the Indian ethyl acetate market and the only

manufacturer of diketene derivatives in India with a diversified customer

base. Looking at the competitive advantage and strong growth potential

we are assigning a “SUBSCRIBE” recommendation to the issue.

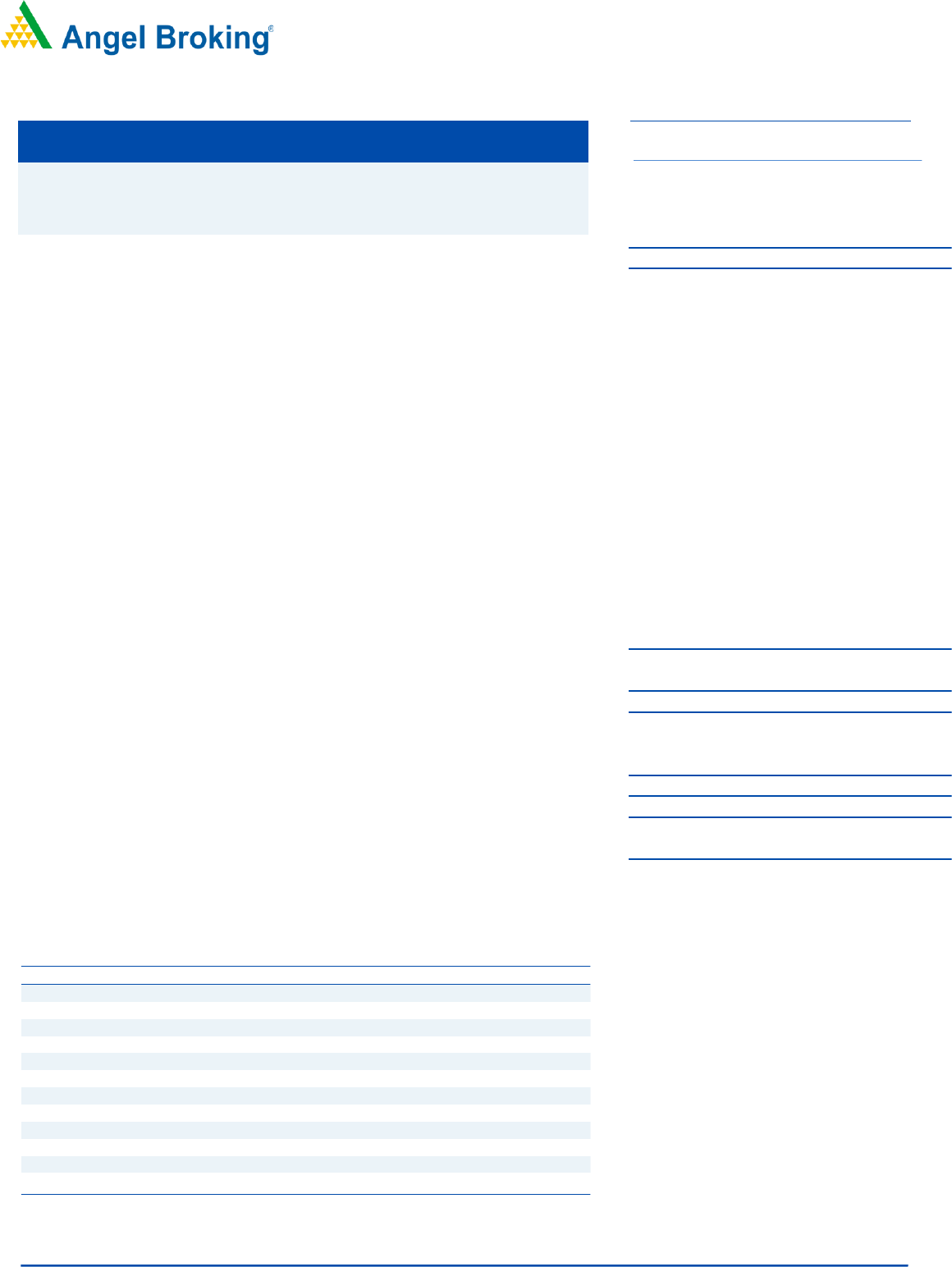

Key Financials

Y/E March (` cr)

FY2018

FY2019

FY2020

Net Sales

1,393

1,569

1,534

% chg

-

12.6

-2.2

Net Profit

76

72

70

% chg

-

-4.4

-3.0

EBITDA (%)

10.9

9.8

7.4

EPS (Rs)*

3.0

2.9

3.1

P/E (x)

43.0

44.9

41.7

P/BV (x)

8.6

7.2

6.9

ROE (%)

20.0

16.1

16.4

ROCE (%)

19.9

17.6

11.2

EV/EBITDA

20.6

20.0

26.7

EV/Sales

2.2

2.0

2.0

Source: Company, Angel Research.

Note: Valuation ratios at upper price band., * FY2018 EPS is adjusted for bonus issue

SUBSCRIBE

Issue Open: March 15, 2021

Issue Close: March 17, 2021

Offer for Sale: Rs. 300cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 72.9%

Others 27.1%

Fresh issue: Rs. 300 cr.

Issue Details

Face Value: Rs 2

Present Eq. Paid up Capital: Rs 240.6 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: Rs 263.7cr

Issue size (amount): Rs 600 cr

Price Band: Rs 129-130

Lot Size: 115 shares and in multiple thereafter

Post-issue mkt. cap: *Rs 3401 cr - **Rs 3428 cr

Promoters holding Pre-Issue: 89.5%

Promoters holding Post-Issue: 72.9%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Laxmi Organic Industries Limited

f

IPO Note

March 12, 2021

Laxmi Organics Industry Ltd | IPO Note

March12, 2021

2

Company background

Company was incorporated as Laxmi Organic Industries Limited at

Mumbai, Maharashtra on dated May 15, 1989. Its business includes

manufacturers and dealing in chemicals, chemical compounds organic

and inorganic) in all forms, and chemical products. In Fiscal 2010, it

commenced manufacturing the Specialty Intermediates by acquiring

Clariant’s diketene business. Company is the only manufacturer of

diketene derivatives in India with a market share of approximately 55 % of

the Indian diketene derivatives market in terms of revenue in Fiscal 2020

and one of the largest portfolios of diketene products.

Issue details

The issue comprises of fresh issues of up to Rs. 600 crore in the price band

of `129-`130 per share.

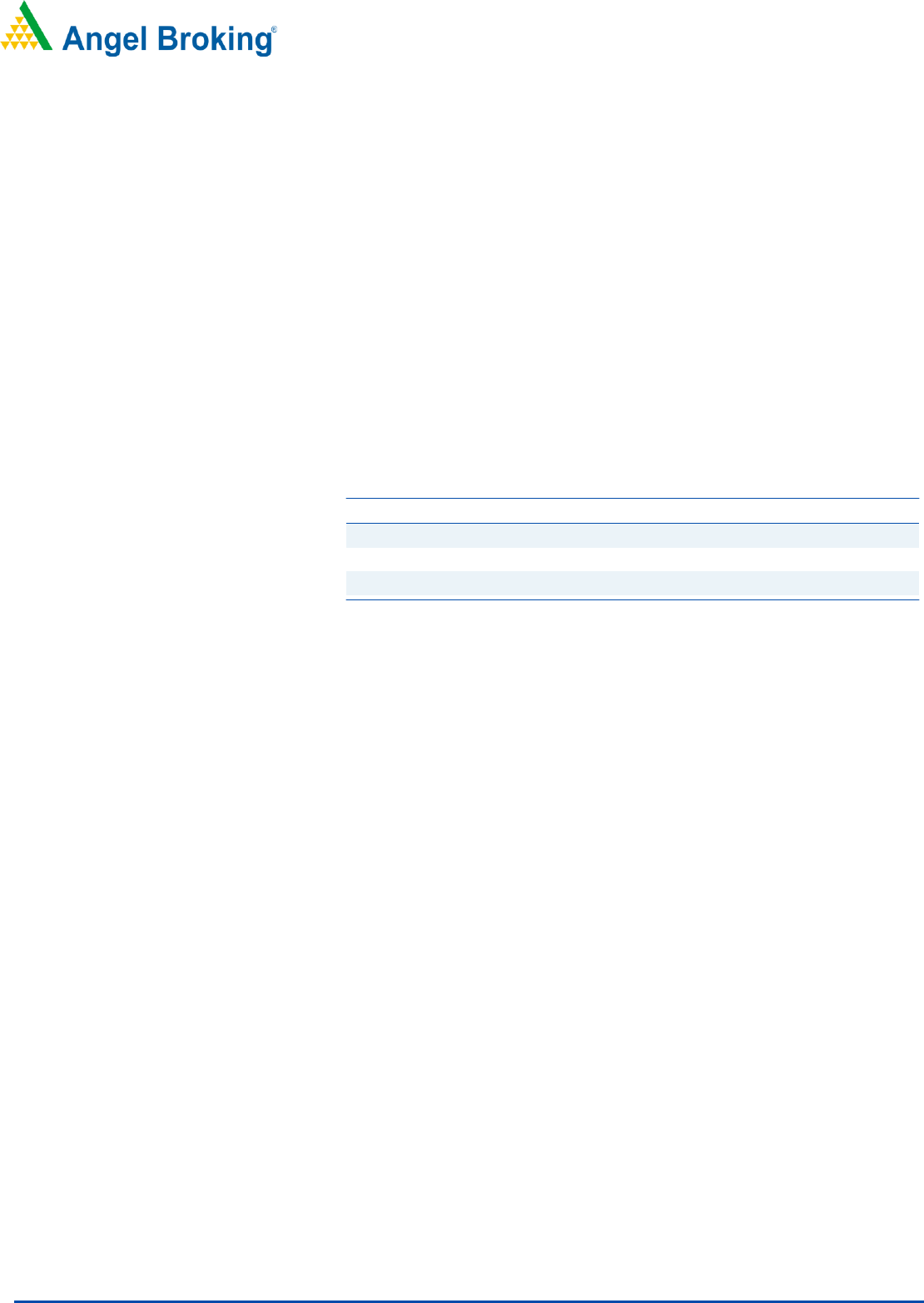

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

215,339,729

89.5

192,262,806

72.9

Public

25,246,121

10.5

71,399,967

27.1

Total

240,585,850

100.0

263,662,773

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

◼ The proceeds of the Offer for Sale shall be received by the

Promoter Selling Shareholder.

◼ Investment in wholly owned Subsidiary, Yellowstone Fine Chemicals

Private Limited (“YFCPL”) for part-financing its capital expenditure

requirements.

◼ Funding capital expenditure requirements for expansion of the

company’s SI Manufacturing.

◼ Funding working capital requirements of the Company.

Key Management Personnel

Ravi Goenka, aged 59 years, is the Chairman and Managing Director of

the Company. He holds a bachelors’ degree in chemical engineering

from Bangalore University. He has been associated with the company

since inception, and has approximately 30 years of experience in the

chemicals and paper industries, 16 years of experience in the education

industry, and 21 years in the power industry.

Satej Nabar, aged 57 years, is an Executive Director and Chief Executive

Officer of our Company. He holds a bachelors’ degree in mechanical

engineering from the University of Bombay, a masters’ degree in plastic

engineering from the University of Bombay, and is a chartered engineer

registered with the Institution of Engineers (India). He has around 31 years

of experience in the chemicals industry and has handled numerous

functions including, sales and marketing, corporate strategy, innovation

and manufacturing.

Laxmi Organics Industry Ltd | IPO Note

March12, 2021

4

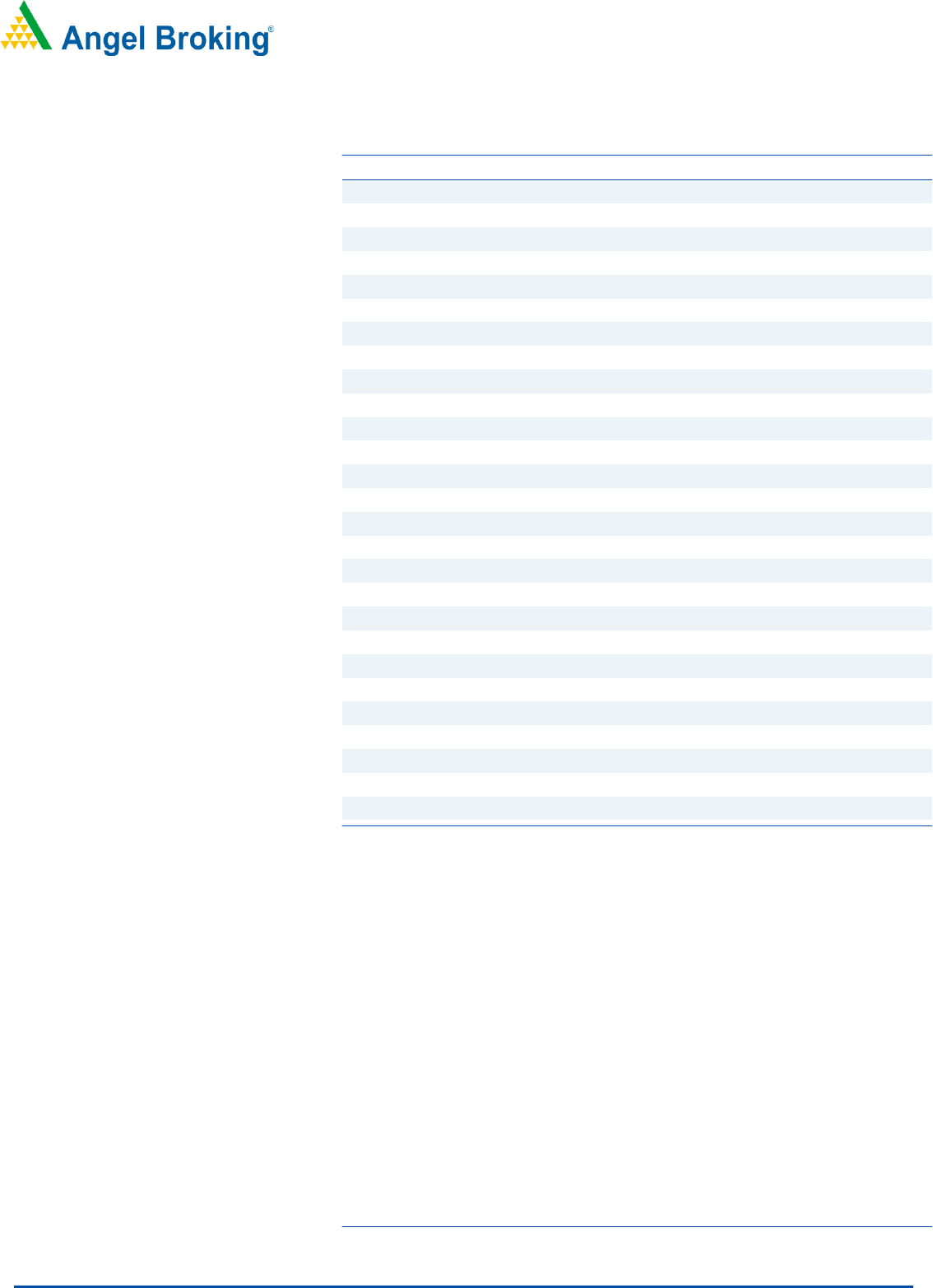

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2018

FY2019

FY2020

6MFY2021

Total operating income

1,393.1

1,568.5

1,534.1

813.4

% chg

-

12.6

-2.2

-

Total Expenditure

1,241.7

1,415.2

1,420.6

728.0

Cost of raw materials consumed

655.8

888.4

781.0

351.9

Purchase of stock in trade

321.3

249.6

287.1

209.3

Stock in Trade

-8.7

-42.4

28.5

12.5

Excise Duty

17.6

-

-

-

Employee benefits expense

52.6

64.5

68.6

35.7

Other expenses

203.1

255.1

255.4

118.6

EBITDA

151.4

153.3

113.5

85.4

% chg

-

1.3

-25.9

-24.8

(% of Net Sales)

10.9

9.8

7.4

10.5

Depreciation& Amortization

31.3

44.1

48.9

22.7

EBIT

120.1

109.2

64.7

62.7

% chg

-

-9.1

-40.8

-

(% of Net Sales)

8.6

7.0

4.2

7.7

Finance costs

9.8

17.0

14.0

7.4

Other income(with income from associate)

3.0

5.3

4.5

0.9

(% of Sales)

0.2

0.3

0.3

0.1

Recurring PBT

113.3

97.6

55.1

56.2

% chg

-

-13.9

-43.5

1.9

Exceptional item

-

-

25.7

-

Tax

37.6

25.2

10.6

10.7

PAT (reported)

75.7

72.4

70.2

45.5

% chg

-

-4.4

-3.0

-35.2

(% of Net Sales)

5.4

4.6

4.6

5.6

Basic & Fully Diluted EPS (Rs)*

3.0

2.9

3.1

2.0

Source: Company, Angel Research, * FY2018 EPS is adjusted for bonus issue

Laxmi Organics Industry Ltd | IPO Note

March12, 2021

5

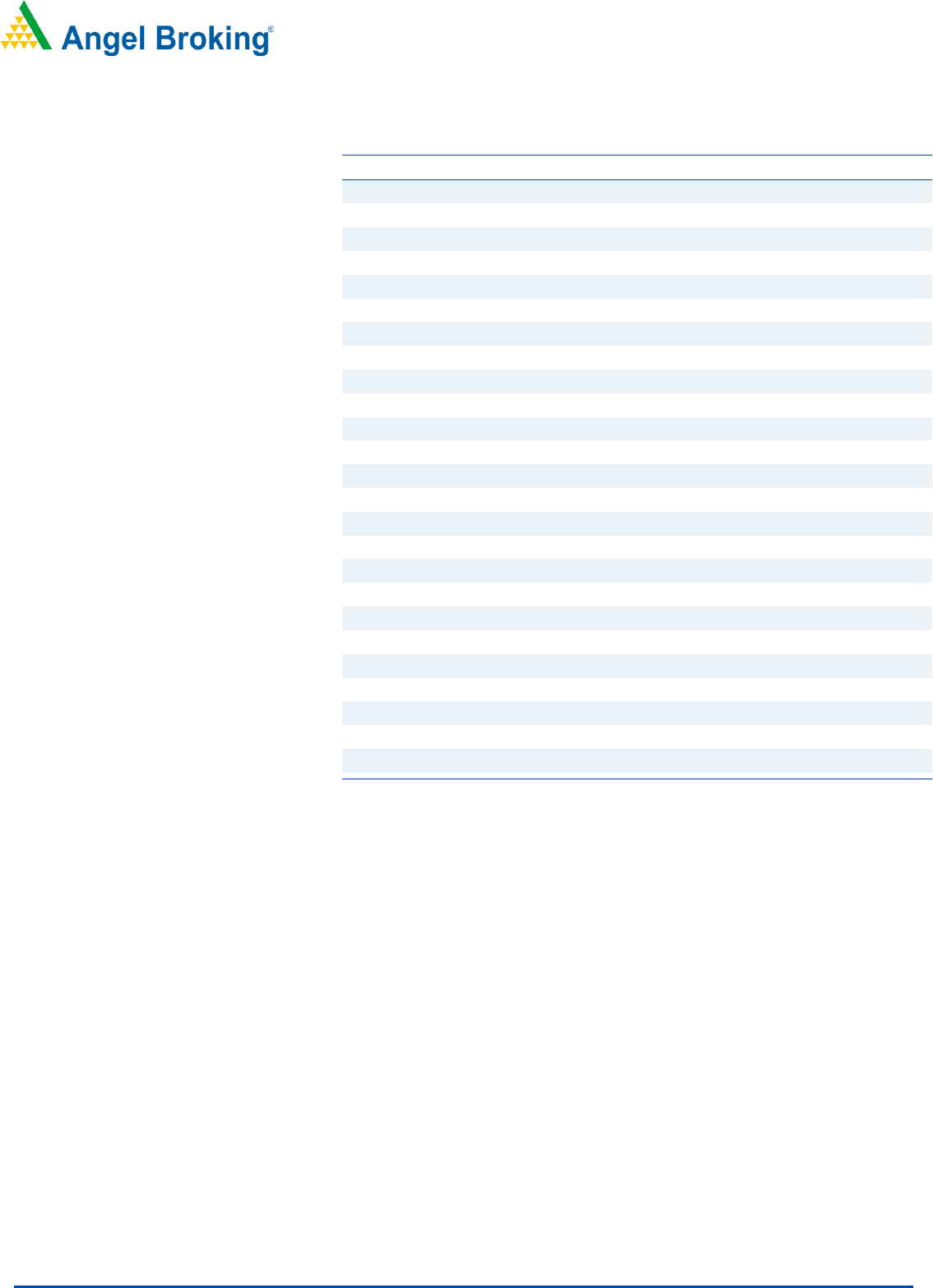

Consolidated Balance Sheet

Y/E March (` cr)

FY2018

FY2019

FY2020

6MFY2021

SOURCES OF FUNDS

Equity Share Capital

10.0

50.0

45.0

45.0

Other equity (Retained Earning)

369.3

399.8

381.9

427.4

Shareholders’ Funds

379.3

449.8

426.9

472.4

Total Loans

192.1

141.6

124.2

153.9

Other liabilities

30.7

30.0

24.5

22.2

Total Liabilities

602.2

621.5

575.6

648.5

APPLICATION OF FUNDS

Property, plant and equipment

277.1

330.6

325.5

320.9

Capital work-in-progress

30.0

31.5

67.5

74.4

Intangible assets

0.3

1.0

0.8

0.6

Right of use assets

16.0

14.1

11.4

10.0

Current Assets

543.9

624.9

646.9

612.0

Inventories

145.8

170.7

151.9

126.2

Trade receivables

324.2

326.2

359.4

334.3

Cash and cash equivalents

5.2

7.6

24.1

26.6

Other Bank Balance

-

39.1

20.6

55.0

Loans and Advances

1.0

0.2

0.2

0.2

Others

0.8

0.9

40.3

33.1

Other current assets

59.6

80.1

50.5

36.6

Assets held-for-sale

7.2

-

-

-

Current Liability

292.6

393.0

495.1

388.6

Net Current Assets

251.4

231.8

151.9

223.4

Other Non Current Asset

27.5

12.5

18.6

19.1

Total Assets

602.2

621.5

575.6

648.5

Source: Company, Angel Research

Laxmi Organics Industry Ltd | IPO Note

March12, 2021

6

Consolidated Cash flow

Y/E March (‘cr)

FY18

FY19

FY20

6MFY21

Operating profit before working capital changes

153.5

158.6

110.9

86.4

Net changes in working capital

-132.9

56.7

100.6

-40.1

Cash generated from operations

20.6

215.2

211.5

46.3

Direct taxes paid (net of refunds)

-27.4

-27.6

-15.5

-10.8

Net cash flow (used in)/from operating activities (A)

-6.7

187.7

196.0

35.5

Capital expenditure on Property Plant and Equipment

-88.5

-97.5

-77.1

-23.6

Movement in Other Bank Balances

5.1

-33.8

18.0

-35.1

Others

-1.6

8.7

3.4

0.9

Cash Flow from Investing (B)

-85.0

-122.5

-55.8

-57.8

Proceeds from Long term borrowings

40.0

56.4

50.0

25.0

Repayment of Long term borrowings

-29.0

-26.5

-34.1

-21.3

Net Proceeds from Short term borrowings

86.3

-72.2

-33.0

29.7

Non Controlling interest

0.1

0.1

-0.1

-0.1

Interest paid

-9.0

-15.9

-11.4

-7.0

Others

-3.6

-4.7

-95.2

-1.5

Cash Flow from Financing

84.7

-62.7

-123.8

24.8

Inc./(Dec.) in Cash

-7.1

2.4

16.5

2.5

Opening Cash balances

12.3

5.2

7.6

24.1

Closing Cash balances

5.2

7.6

24.1

26.6

Source: Company, Angel Research

Key Ratios

Y/E March

FY2018

FY2019

FY2020

Valuation Ratio (x)

P/E (on FDEPS)

43.0

44.9

41.7

P/CEPS

6.1

27.9

24.6

P/BV

8.6

7.2

6.9

EV/Sales

20.6

20.0

26.7

EV/EBITDA

2.2

2.0

2.0

Per Share Data (Rs)

EPS (Basic)*

3.0

2.9

3.1

EPS (fully diluted)*

3.0

2.9

3.1

Cash EPS

4.3

4.7

5.3

Book Value

15.2

18.0

19.0

Returns (%)

ROE

20.0

16.1

16.4

ROCE

19.9

17.6

11.2

Turnover ratios (x)

Receivables (days)

84.9

75.9

85.5

Inventory (days)

38.2

39.7

36.1

Payables (days)

76.7

91.5

117.8

Working capital cycle (days)

46.5

24.2

3.9

Source: Company, Angel Research,* FY2018 EPS is adjusted for bonus issue

Laxmi Organics Industry Ltd | IPO Note

March12, 2021

7

www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a

Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI

(Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the

company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of

this document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied

on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies

shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report. Angel Broking Limited has not independently verified all the information contained

within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.