Please refer to important disclosures at the end of this report

1

Latent View Analytics Ltd is a pure play analytics company that provides services

ranging from data & analytics consulting, business analytics & insights, advanced

predictive analytics, data engineering and digital solutions. It caters to blue chip

clients in Technology (63% of FY21 revenue), BFSI (10%), CPG & Retail (10%) and,

Industrial (18%) verticals and has 30+ Fortune 500 companies in the last three

fiscals. Some of the key clients include Adobe, Uber Technology, and 7-Eleven. It

has relationship with top-5 clients for an average of six years which contributed to

~54% to total revenues in FY21. Geographically, United States accounted for 93%

of the FY21 revenues while balance is split between UK & Netherlands and RoW.

Its employee count as on Q1FY22 was 859 and attrition rate stood at 21.5%.

Positives: (a) Leading analytics technology companies. (b) Extensive experience

across a range of data and analytics capabilities. (c) Blue-chip clients across

industries and geographies. (d) Scalable and attractive financial profile.

Investment concerns: (a) High dependence on few clients for a large portion of

revenue. (b) Derives more than 90% of revenues from clients in the US. (c) Inability

to derive benefits from investment in few of its’ Subsidiaries. (d) Forex fluctuations.

Outlook & Valuation: Latent View provides niche solutions in Descriptive and

Diagnostic solutions and Predictive analytics segments and most of its work

pertains to customer analytics. Although global customer analytics market currently

is ~9% of overall analytics application spends it was/is expected to post CAGR of

~26% over 2020-24. Its association and length of relationship with some of the

top technology companies point to its capabilities. The growth has come off in

FY21 due to non-renewal of certain existing client assignments and fewer client

additions and mandates from clients, but the same is likely to improve on focused

go-to-market strategy. Margins improved strongly in FY21 due to lower on-site

employees and lower travel & promoted spends but may contract with resumption

of spends. At `197, the company is seeking ~43x FY21/TTM its earnings which

seems reasonable compared to a high growth digital services company like

Happiest Minds trading at ~115x (comparison owing to absence of like-to-like

listed peer). The IPO provides an opportunity to invest in a pure-play analytics

company which is has tailwinds from investments on Data & Analytics and is

raising fresh funds to chase growth. We have SUBSCRIBE rating on the issue.

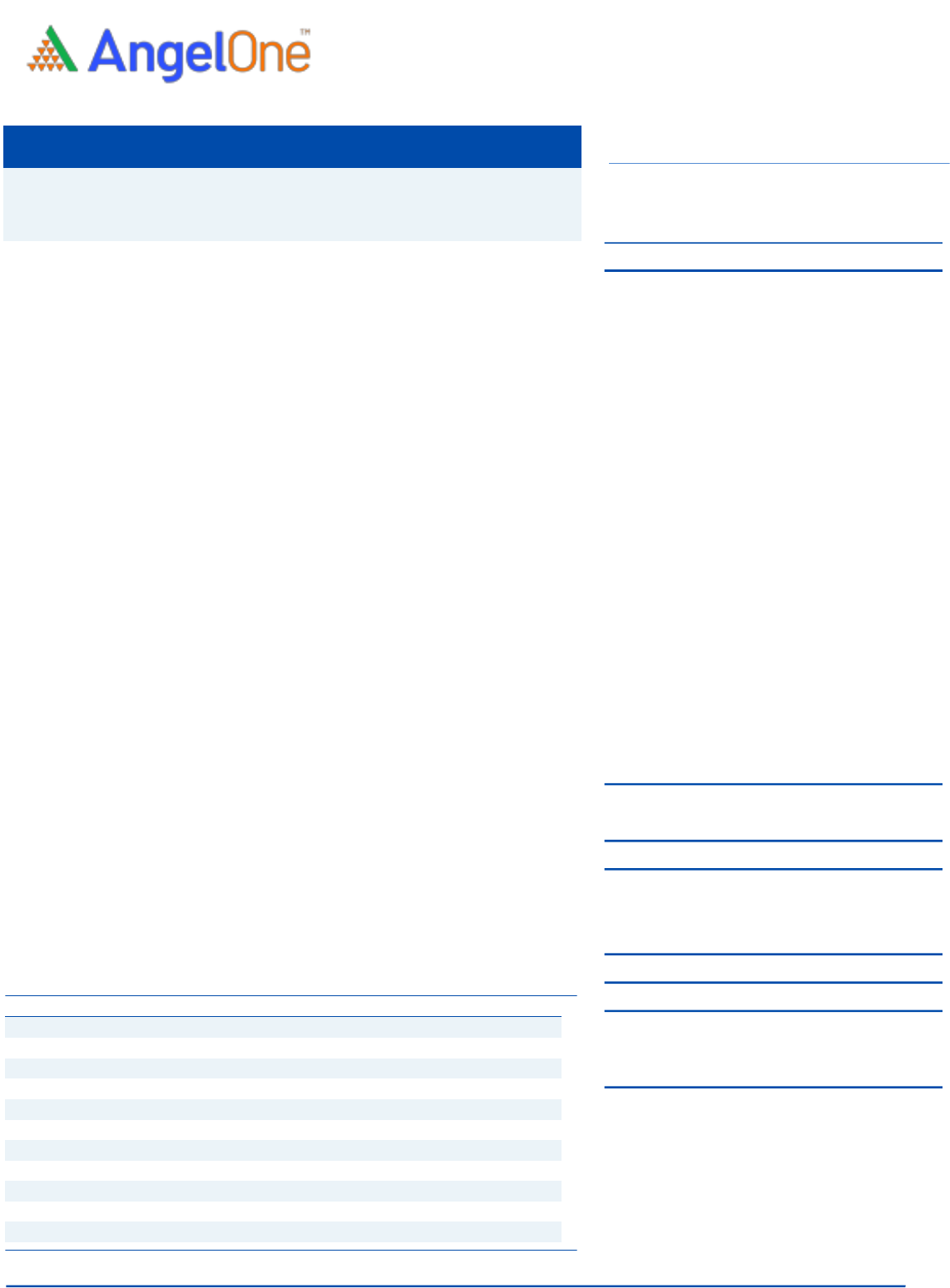

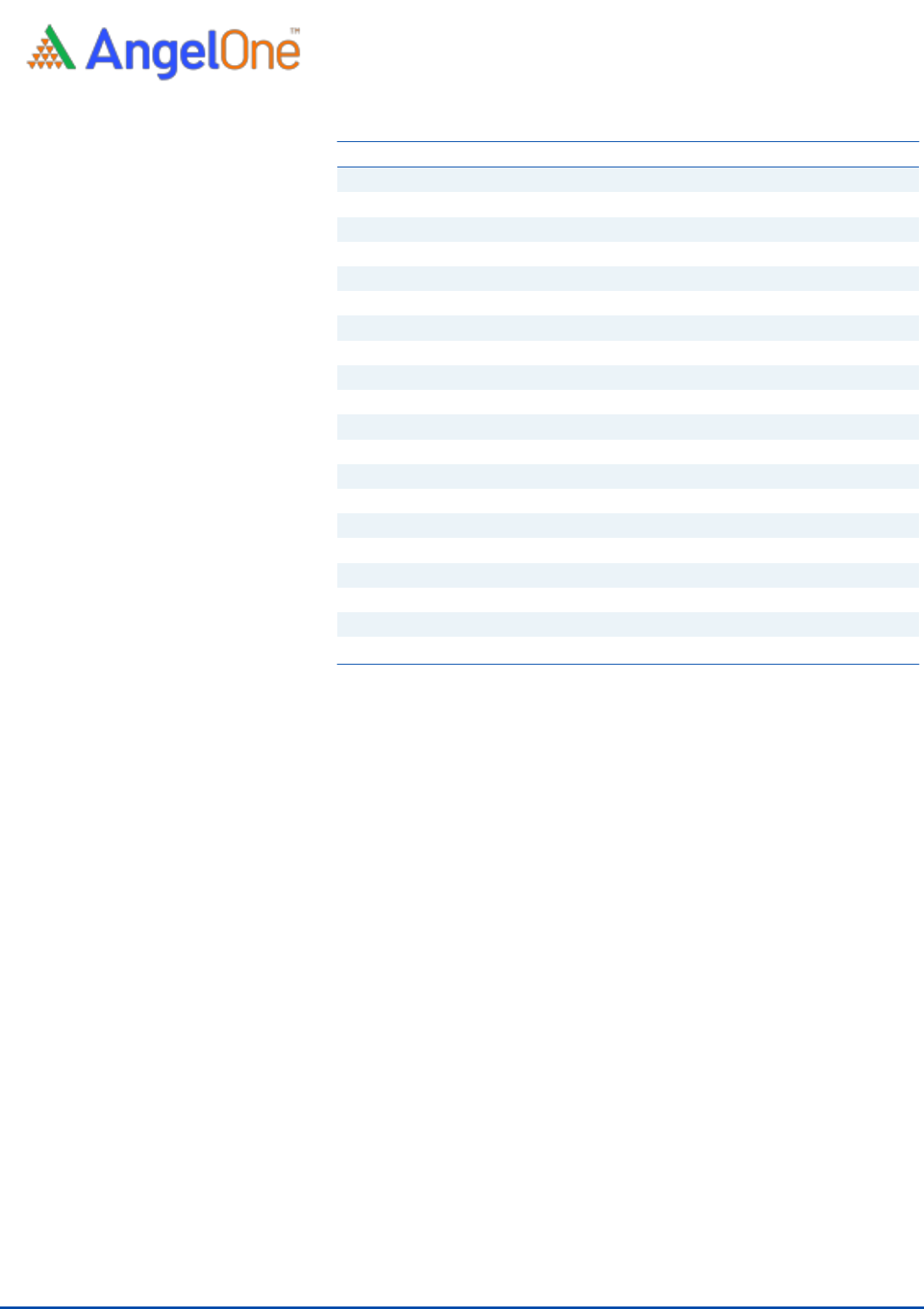

Key Finances

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Net Sales

288

310

306

73

88

% chg

--

7.8

-1.4

--

20.3

Net Profit

60

73

91

23

22

% chg

--

22.1

25.6

--

-2.1

EBIT (%)

22.8

23.8

31.9

27.4

28.8

EPS (Rs)

3.0

3.7

4.6

1.2

1.1

P/E (x)

65.3

53.5

42.6

--

--

P/BV (x)

14.6

11.2

8.9

--

--

ROE (%)

44.7

23.7

23.3

--

--

ROCE (%)

41.2

22.0

21.5

--

--

EV/Sales

13.0

11.9

12.0

--

--

Source: Company, Angel Research

SUBSCRIBE

Issue Open: Nov 10, 2021

Issue Close: Nov 12, 2021

Offer for Sale: `126 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoter & Promoter

Group

68.1%

Public 31.9%

Fresh issue: `474 cr

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `60.9 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `3.2 cr

Issue size (amount): `600 cr

Price Band: `190-197

Lot Size: 76 shares and in multiple thereafter

Post-issue mkt. cap: * `3,775 cr - ** `3,896 cr

Public (Founder, Investor & other Sh) Pre-Issue: 79.3%

Public (Founder, Investor & other Sh) Post-Issue: 20.7%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Latent View Analytics Limited

Latent View Analytics Limited |IPO Note

November 09, 2021

Latent View Analytics Limited | IPO Note

Nov 09, 2021

2

Company background

Company was incorporated as Latent View Analytics Private Limited on January 3,

2006, at Chennai, Tamil Nadu. It is among the leading pure-play data analytics

services companies in India. Company expertise in entire value chain of data

analytics from data and analytics consulting to business analytics and insights,

advanced predictive analytics, data engineering and digital solutions. Some of the

key clients that it works include Adobe, Uber Technology and 7-Eleven. It serves

clients across countries in the United States, Europe, and Asia.

Issue details

The issue comprises of offer for sale of upto `126 Cr and Fresh issue of `474 Cr in

the price band of `190-197.

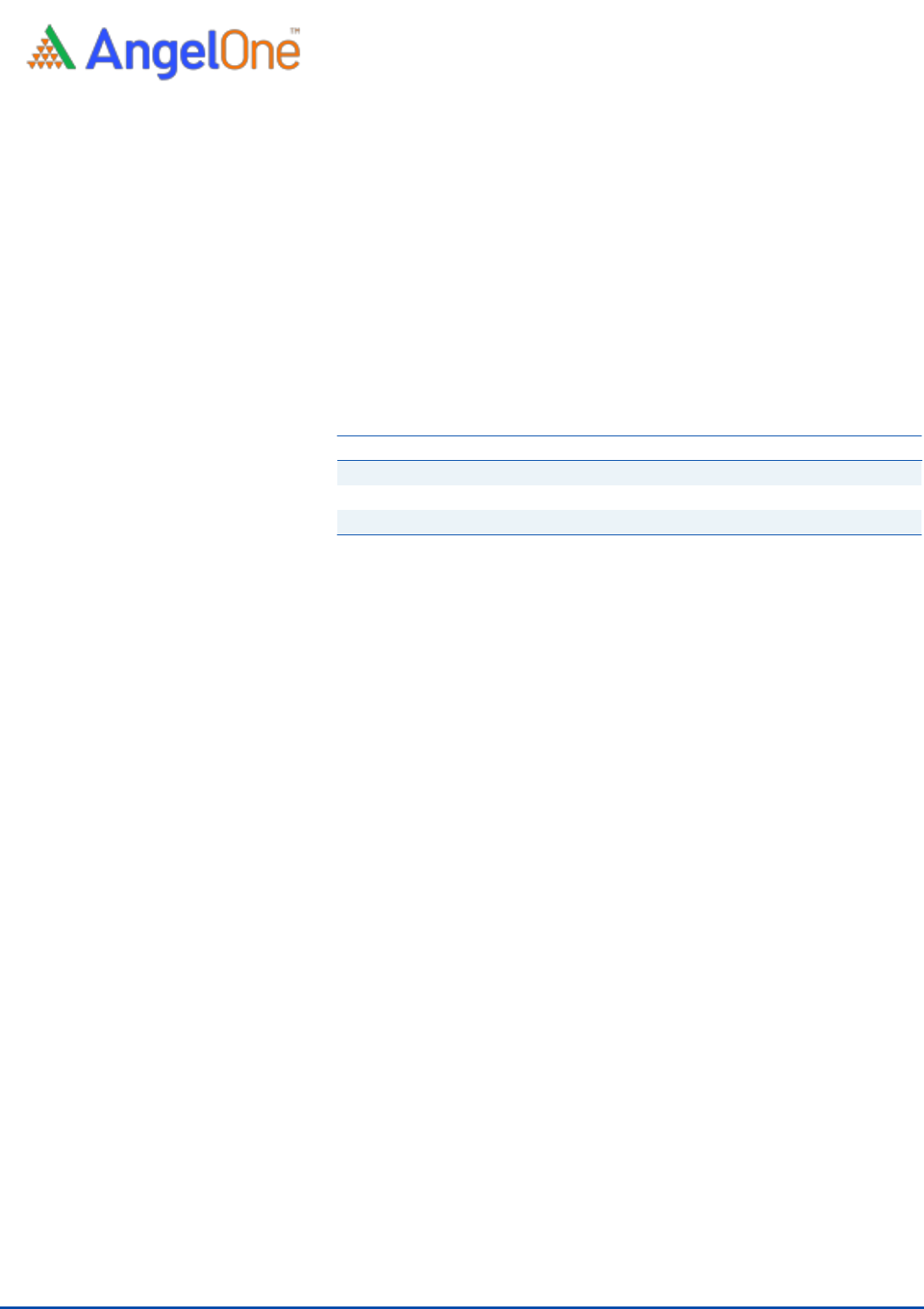

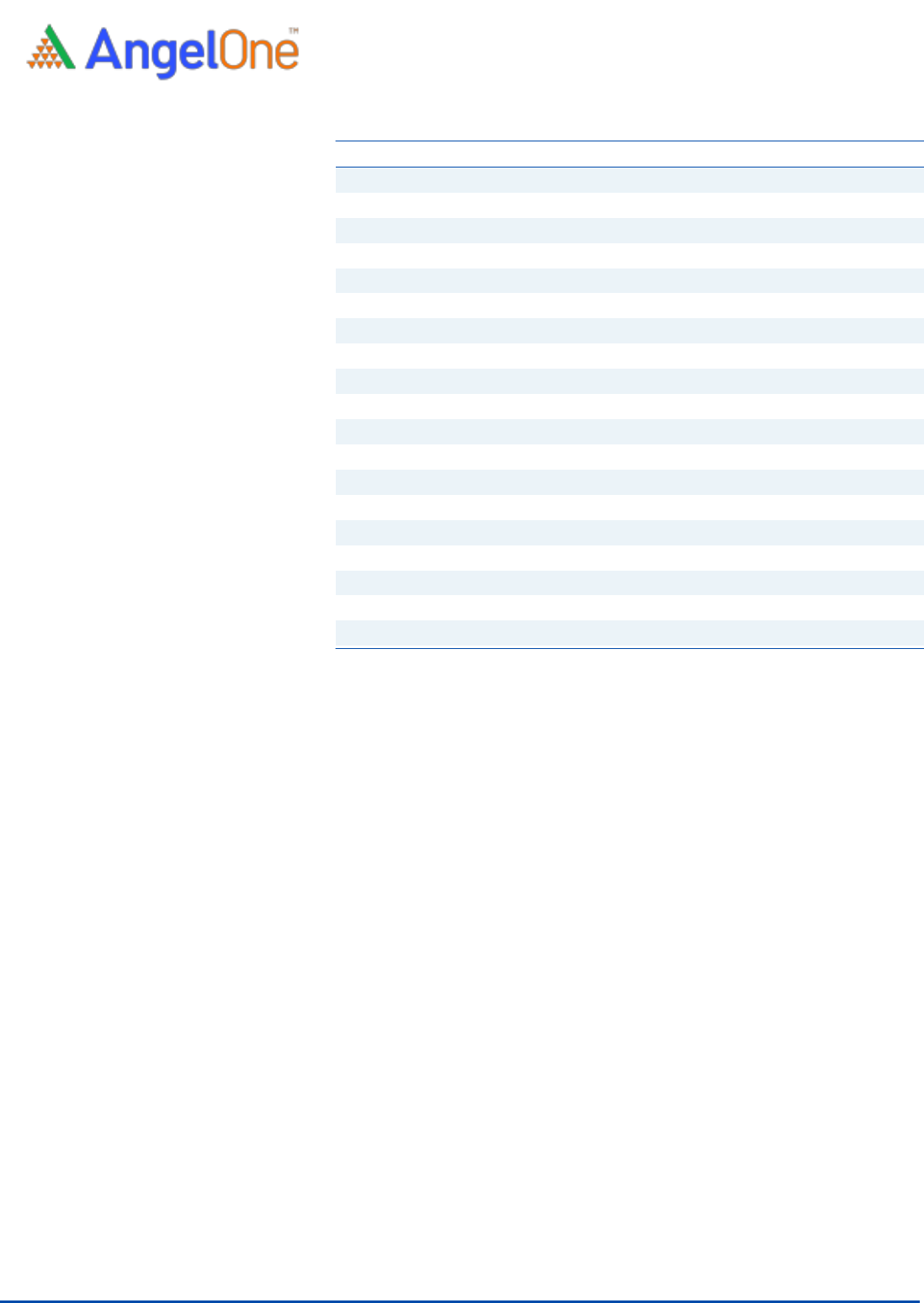

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter & Promoter Group

137,760,000

79.3

134,706,955

68.1

Public

175,157,906

20.7

63,074,883

31.9

Total

173,720,925

100.0

197,781,838

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

~`148 CR for funding inorganic growth initiatives.

~`82 Cr for funding working capital requirements of Latent View Analytics

Corporation, company’s material subsidiary.

`130 Cr for investment in subsidiaries to augment their capital base for

future growth.

General corporate purposes.

Key Management Personnel

Adugudi Viswanathan Venkatraman, is the Founder & Chairman of the company.

He holds a postgraduate diploma in management from IIM Calcutta, and a

Bachelor of Technology in Civil Engineering from IIT Madras. He has several

years of experience across IT services, credit analysis & business consulting.

Pramadwathi Jandhyala is the Co-Founder of the company. She has several years

of experience in corporate finance, and credit ratings. She graduated with a B.E.

in Computer Science from BITS Pilani and a postgraduate diploma in

management from IIM, Calcutta.

Rajan Sethuraman, is the Chief Executive Officer of the Company. He holds a

Bachelor's degree in Engineering from the BITS, Pilani and a Post Graduate

Diploma in Management from the IIM Calcutta. He has more than 13 years of

consulting experience, working with the Accenture and KPMG.

Rajan Bala Venkatesan, is the Chief Financial Officer is a Chartered

Accountant. He has previously been associated with Financial Software and

Systems, Ashok Leyland, Deloitte, Lovelock & Lewes and Mphasis.

Latent View Analytics Limited | IPO Note

Nov 09, 2021

3

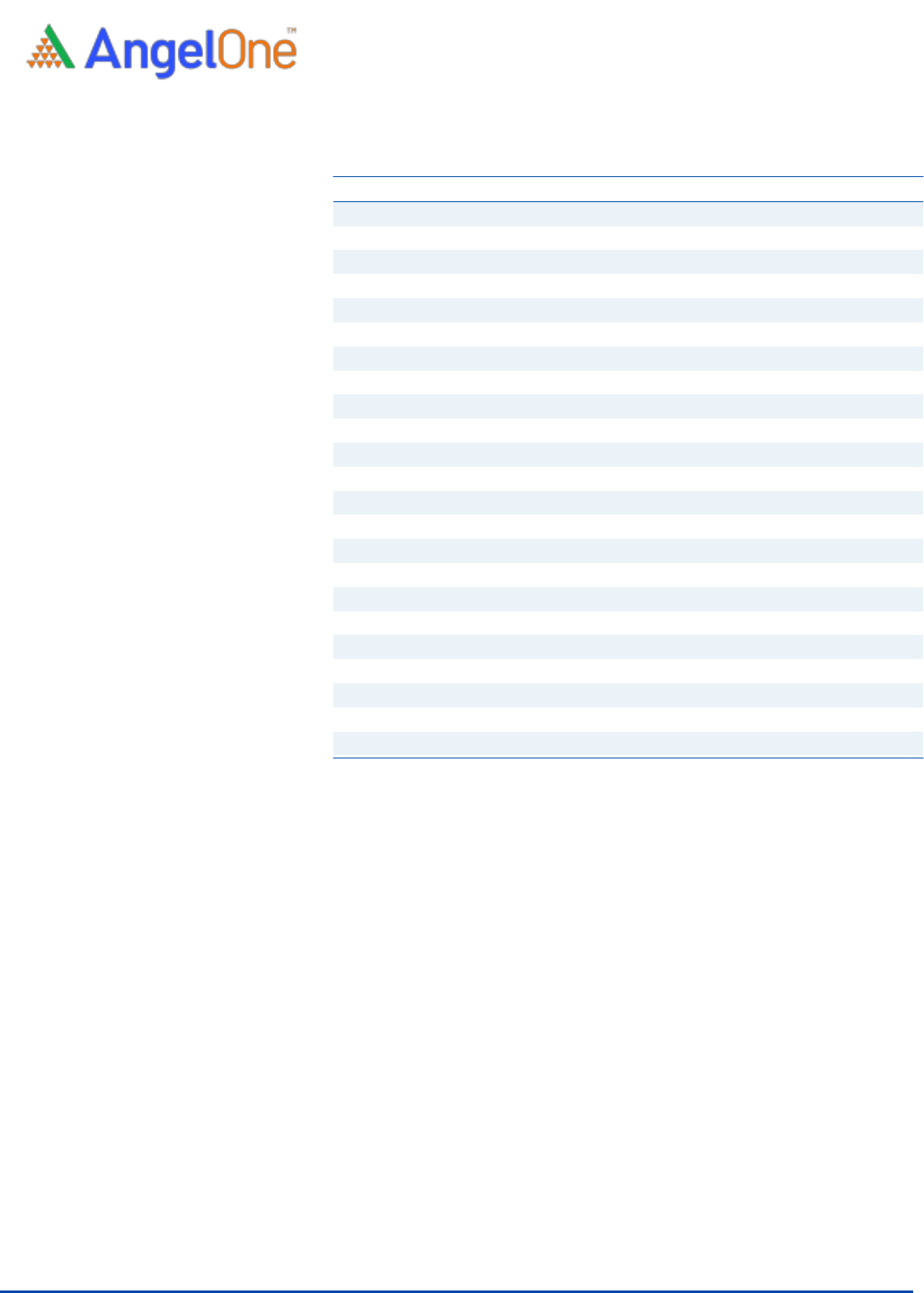

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Total operating income

288

310

306

73

88

% chg

--

7.8

-1.4

--

20.3

Total Expenditure

215

230

201

51

61

Employee benefits expense

174

198

177

47

50

Other expenses

41

32

24

5

10

EBITDA

73

80

105

22

27

% chg

--

10.7

30.0

--

24.7

(% of Net Sales)

25.2

25.9

34.2

29.7

30.8

Depreciation& Amortization

7

7

7

2

2

EBIT

66

74

98

20

25

% chg

--

12.5

32.4

--

26.4

(% of Net Sales)

22.8

23.8

31.9

27.4

28.8

Finance costs

3

3

3

1

1

Other income

8

19

21

9

4

(% of Sales)

2.8

6.2

6.8

12.8

4.5

Recurring PBT

63

71

95

19

25

% chg

--

13.3

34.2

--

27.5

Exceptional item

-

-

-

-

-

Tax

11

17

24

6

6

PAT (reported)

60

73

91

23

22

% chg

--

22.1

25.6

--

-2.1

(% of Net Sales)

20.7

23.5

29.9

31.2

25.4

Basic & Fully Diluted EPS (Rs)

3.0

3.7

4.6

1.2

1.1

Source: Company, Angel Research

Latent View Analytics Limited | IPO Note

Nov 09, 2021

4

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

SOURCES OF FUNDS

Equity Share Capital

1

1

1

1

1

Other equity

266

347

437

370

461

Shareholders’ Funds

267

348

438

371

462

Total Loans

36

33

52

55

96

Other liabilities

(30)

(29)

(26)

(27)

(26)

Total Liabilities

272

352

463

399

531

APPLICATION OF FUNDS

Property, Plant and Equipment

4

5

5

5

6

Right-of-use assets

33

30

25

29

24

Capital work-in-progress

-

-

-

-

-

Intangible assets

0

0

0

0

0

Non-Current Investments

-

-

91

34

91

Other Non-Current Asset

3

27

3

3

14

Current Assets

252

303

365

347

424

Inventories

-

-

-

-

-

Investments

99

72

48

44

48

Trade receivables

51

53

61

38

64

Cash and Cash equivalents

79

150

221

213

279

Loans & Other Financial Assets

20

21

26

48

21

Other current assets

3

7

8

5

12

Current Liability

19

14

26

19

27

Net Current Assets

232

289

338

329

397

Total Assets

272

352

463

399

531

Source: Company, Angel Research

Latent View Analytics Limited | IPO Note

Nov 09, 2021

5

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Operating profit

71

90

116

29

29

Net changes in working capital

5

(2)

(5)

23

(8)

Cash generated from operations

8

(4)

(6)

(3)

(0)

Direct taxes paid (net of refunds)

(19)

(21)

(16)

(4)

(4)

Net cash flow from operating activities

64

63

90

44

16

Purchase of Assets

(2)

(3)

(2)

(0)

(1)

Interest received

1

4

8

3

2

Others

(47)

(34)

(52)

(17)

(19)

Cash Flow from Investing

(47)

(34)

(45)

(15)

(17)

Repayment (long term borrowings)

(1)

-

23

23

36

Repayment (short term borrowings)

-

-

-

-

-

Proceeds from issue/repayment debentures

-

-

-

-

-

Interest paid

(0)

(0)

(0)

(0)

(0)

Payment of Lease liabilities

(5)

(6)

(6)

(1)

(1)

Dividend Paid

0

0

0

0

0

Cash Flow from Financing

(6)

(5)

17

22

36

Inc./(Dec.) in Cash

11

24

62

51

34

Acquisition

-

-

-

-

-

Opening Cash balances

35

47

75

75

135

Closing Cash balances

47

75

135

127

171

Source: Company, Angel Research

Latent View Analytics Limited | IPO Note

Nov 09, 2021

6

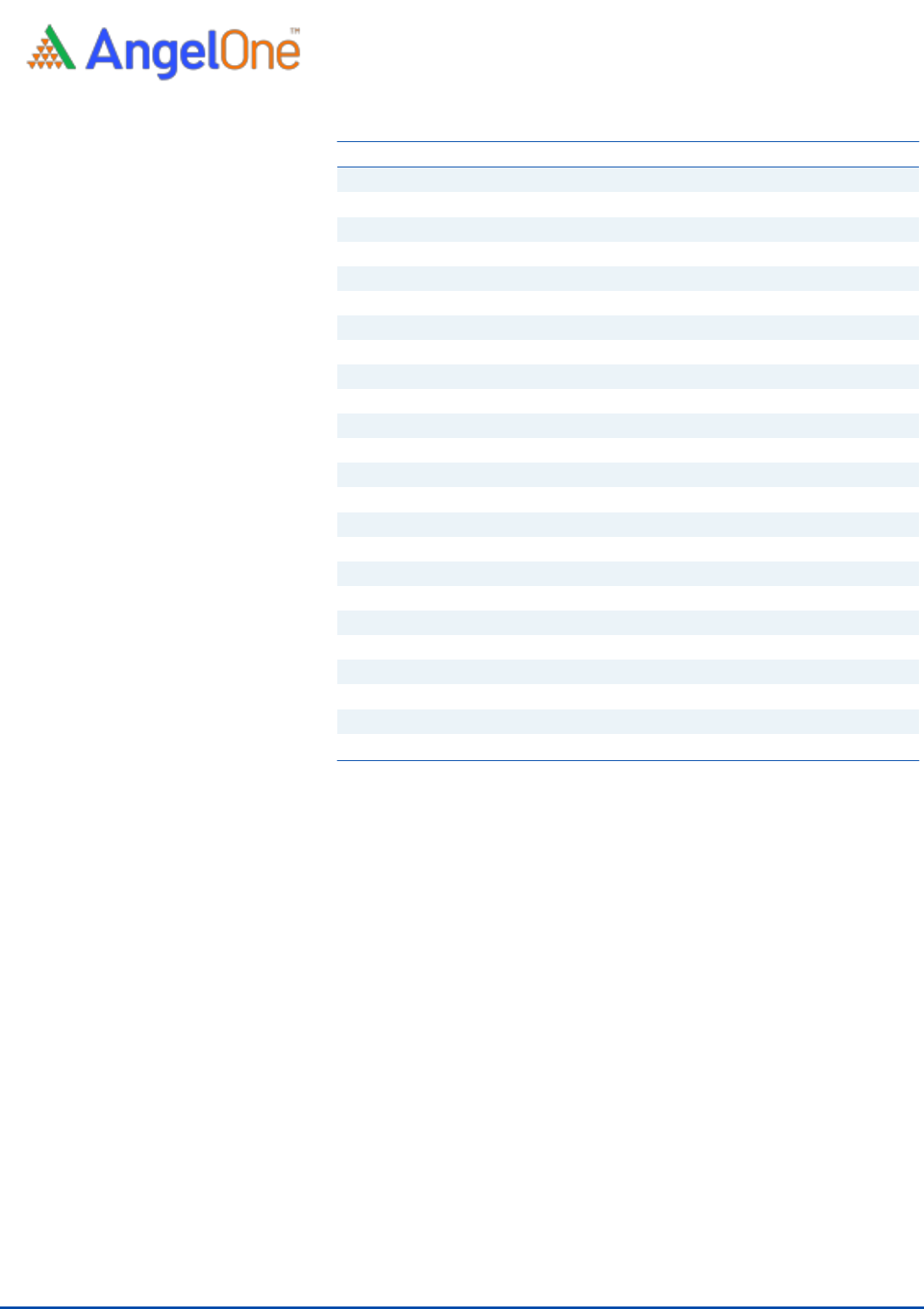

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Valuation Ratio (x)

P/E (on FDEPS)

65.3

53.5

42.6

-

-

P/CEPS

58.4

49.0

39.6

-

-

P/BV

14.6

11.2

8.9

-

-

EV/Sales

13.0

11.9

12.0

-

-

EV/EBITDA

51.7

46.1

35.2

-

-

Per Share Data (Rs)

EPS (Basic)

3.0

3.7

4.6

1.2

1.1

EPS (fully diluted)

3.0

3.7

4.6

1.2

1.1

Cash EPS

3

4

5

1

1

Book Value

13

18

22

19

23

Returns (%)

ROE

44.7

23.7

23.3

-

-

ROCE

41.2

22.0

21.5

-

-

Turnover ratios (x)

Receivables (days)

64

62

73

-

-

Inventory (days)

0

0

0

-

-

Payables (days)

11

5

6

-

-

Working capital cycle (days)

53

57

67

-

-

Source: Company, Angel Research

Latent View Analytics Limited | IPO Note

Nov 09, 2021

7

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity

& Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has

not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

1.Financial interest of research analyst or Angel or his Associate or his relative No

2.Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3.Served as an officer, director or employee of the company covered under Research No

4.Broking relationship with company covered under Research No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

Hold (Fresh purchase not recommended)