Life Insurance Corporation of India

Please refer to important disclosures at the end of this report

1

The Life Insurance Corporation of India (LIC) is the country's largest insurance

provider with a market share of 66.2%/61.4% in terms of new business premium

for FY2021/9MFY2022. LIC is the largest asset manager in India with AUM of

₹40.1 trillion, as on 31

st

December, 2021, on a standalone basis. LIC offers a wide

variety of participating and non participating products to its customers including

ULIP’s, saving insurance products, term insurance products, health insurance, and

annuity & pension products. LIC has the largest individual agent network among

life insurance entities in India, comprising approximately 1.33 million individual

agents as on 31st Dec’21, which was 6.8 times the number of individual agents of

the 2nd largest life insurer.

Positives: (a) The largest player in the fast growing and underpenetrated Indian life

insurance sector, 5th largest life insurer globally by GWP. (b) Cross-cyclical product

mix that caters to diverse consumer needs. (c) Presence across India through an

omni-channel distribution network with an unparalleled agency force. (d) Trusted

brand and a customer-centric business model. (e) Robust risk management

framework.

Investment concerns: (a) Continued market share loss to private players (b) Adverse

persistency metrics (e.g, volatility in market, regulatory change, losing faith etc)

could have a material adverse effect on company’s financial condition. (c) Adverse

impact due to COVID-19 type pandemic. (d) Difficult to value the company given

complex methodology involved in calculating embedded value.

Outlook & Valuation: At the upper end of the price band the LIC IPO is offered at

P/EV (embedded value) of 1.1x as compared to other large listed private life

insurance companies which are trading at multiples of 2.5-4.3x Sep’21 EV. Though

there are concerns over LIC regarding market share loss in individual insurance

business and historically lower margins, we believe that valuations factor in most of

the negatives. Expected improvements in product mix and greater transfer of

surplus to shareholders account over the coming years are expected to drive profits

from current low levels, which along with cheap valuations provide comfort.

Moreover, discount of ₹45 and ₹60 for retail investors & LIC policyholders makes

the issue more attractive for them. Hence, we are assigning a “SUBSCRIBE”

recommendation to the issue.

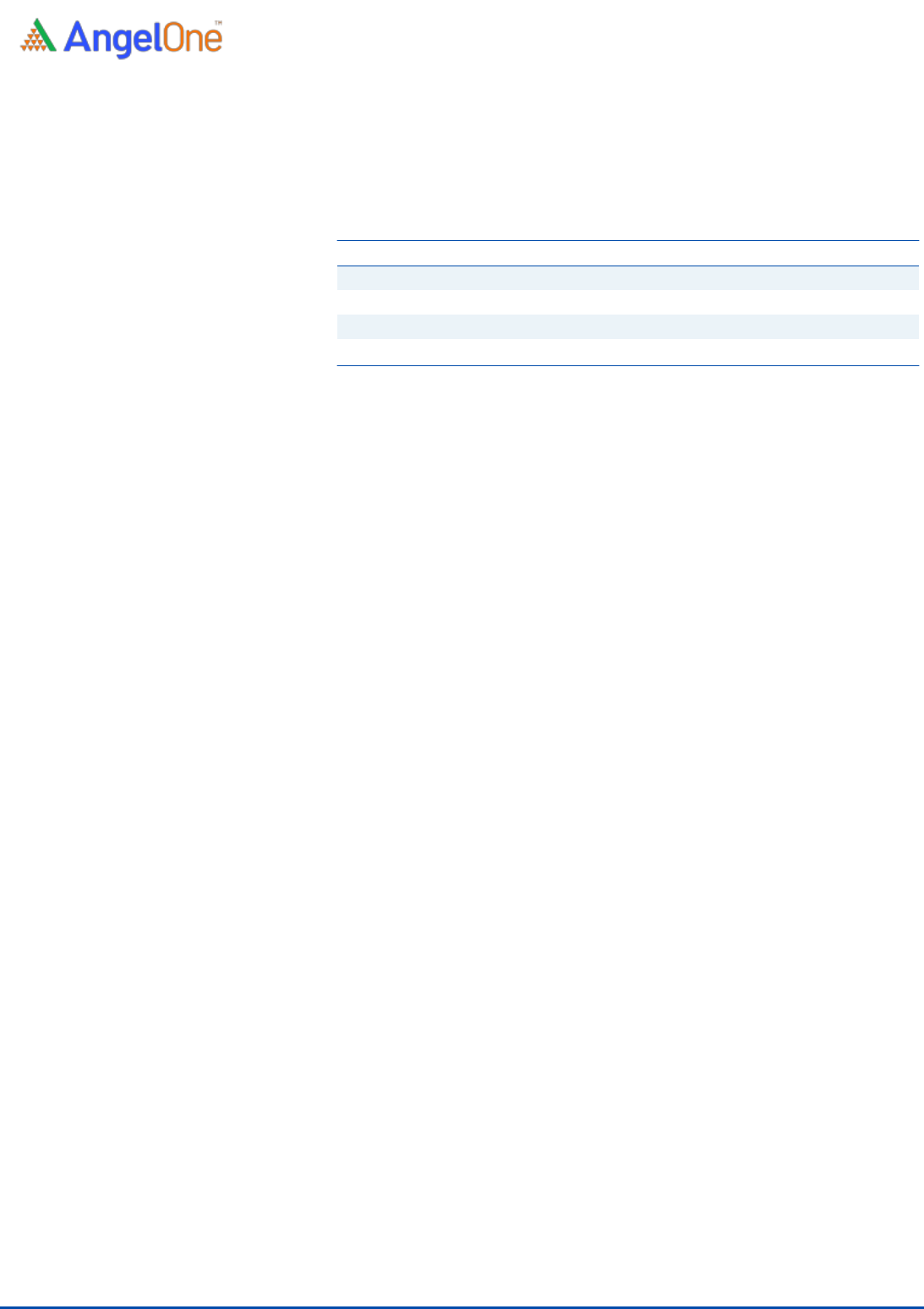

Key Financials

Y/E March (₹ cr)

FY'19

FY'20

FY'21

9M FY'22

New business premium

144,038

180,274

185,523

126,778

Growth (%)

25.2%

2.9%

-

APE

40,566

47,972

45,588

29,923

Growth (%)

18.3%

-5.0%

-

VNB margin (%)

-

-

9.9%

9.3%

IEV*

NA

46,497

95,605

539,686

PAT

2,627

2,710

2,974

1,715

P/IEV

NA

12.9

6.3

1.1

EPS

4.2

4.3

4.7

2.7

P/E

228.7

221.2

201.9

-

ROE

293%

247%

43%

19%

Source: Company RHP, Angel Research

SUBSCRIBE

Issue Open: May 04, 2022

Issue Close: May 09, 2022

Offer for Sale: ` 19,517 cr - `20,557 cr

QIBs 45% of issue

Non-Institutional 13% of issue

Retail 35% of issue

Policyholders 10% of issue

Promoters 96.5%

Others 3.5%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 6,325 cr

Issue size (amount): ₹ 19,517 cr - ₹ 20,557

Price Band: ₹902 - ₹949

Lot Size: 15 shares and in multiple thereafter

Post-issue mkt. cap: * `5,70,515 cr - ** `6,00,242 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 96.5%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `0 cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: ` 6,325 cr

IPO NOTE

Life Insurance Corporation of India

April 30, 2022

LIC | IPO Note

April 30, 2022

2

Company background

LIC is India's only government-owned insurance provider company. Life Insurance

Corporation of India (“LIC”) was established on September1, 1956, under the LIC

Act by merging and nationalizing 245 private life insurance companies in India. It

is providing life insurance in India for more than 65 years and is the largest life

insurer in India. It is a part insurance and part investment products company. Their

plans are a combination of insurance and investment with a guaranteed return.

LIC has over 13.5 lakh agents who help bring most of the new business.

Largest Insurance Company in India with significant market share

LIC is the largest life insurer in India, with a 61.6% market share in terms of

total/gross written premiums (GWP) and a 61.4% market share in terms of New

Business Premium (“NBP”) for 9MFY2022. Moreover LIC has a 71.8% market

share in terms of number of individual policies issued and 88.8% market share in

terms of number of group policies issued for the 9 months ended December 31,

2021.

LIC’s market share in the Indian life insurance industry for Fiscal 2021 was 64.1%

in terms of GWP, 66.2% in terms of NBP, 74.6% in terms of number of individual

policies issued, and 81.1% in terms of number of group policies issued.

Wide product basket catering to all segments

LIC has a broad, diversified product portfolio covering various segments across

individual products and group products. Their individual products comprise (i)

participating insurance products and (ii) non-participating products, which include

(a) savings insurance products; (b) term insurance products; (c) health insurance

products; (d) annuity and pension products; and (e) unit linked insurance products.

LIC’s individual product portfolio in India comprised 33 individual products (17

participating products and 16 non-participating products) and 7 individual riders.

LIC’s group products comprise (i) group term insurance products, (ii) group savings

insurance products; (iii) group savings pension products; and (iv) group annuity

products. LIC’s group product portfolio in India comprised 11 group products

Robust pan India distribution network driven by individual agents

LIC has a robust pan India omni-channel distribution platform for individual

products which comprises of (i) individual agents, (ii) bancassurance partners, (iii)

alternate channels (iv) digital sales (v) Micro Insurance agents and (vi) Point of

Sales Persons-Life Insurance scheme.

LIC has the largest individual agent network among life insurance entities in India,

comprising approximately 1.33 million individual agents as on 31

st

Dec’21, which

was 6.8 times the number of individual agents of the 2nd largest life insurer. As on

31st Dec’21, LIC had 2,048 branch offices and 1,559 satellite offices in India,

covering 91% of all districts in India.

LIC’s individual policies are primarily distributed by their individual agents who

were responsible for sourcing 94.8%/96.2% of LIC’s NBP for their individual

products in India, for FY2021/9MFY2022 respectively.

LIC | IPO Note

April 30, 2022

3

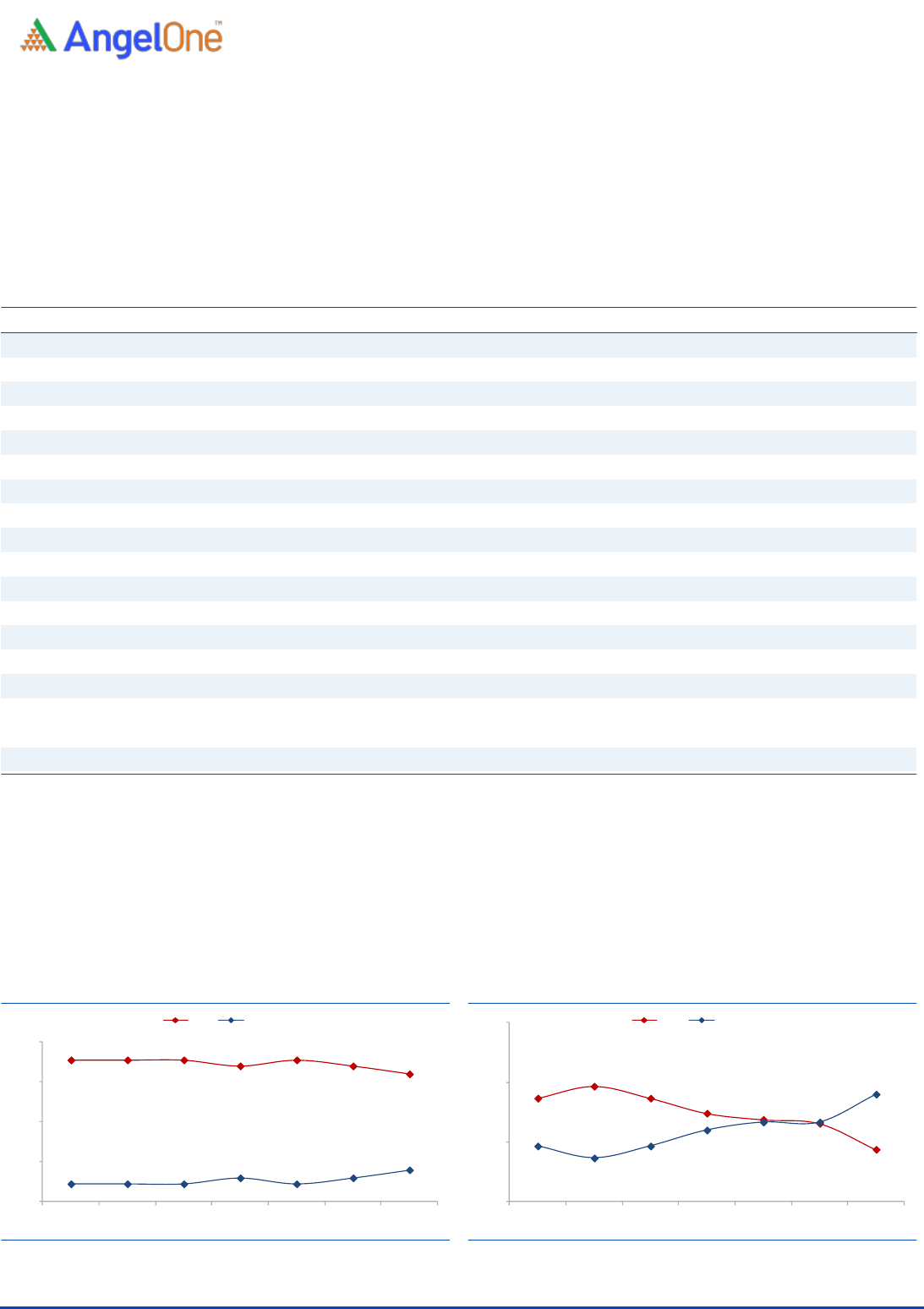

Continued dominant position in group insurance driving NBP growth

In terms of business parameters LIC’s new business premium (NBP) has grown at a

CAGR of 13.5% between FY2019-FY2021 while total premium has grown at a

CAGR of 9.2% during the same period. Total premium in India has grown at a

CAGR of 9.3% while annualized premium equivalent (APE) has grown at a CAGR

of 6.0% CAGR during the same period.

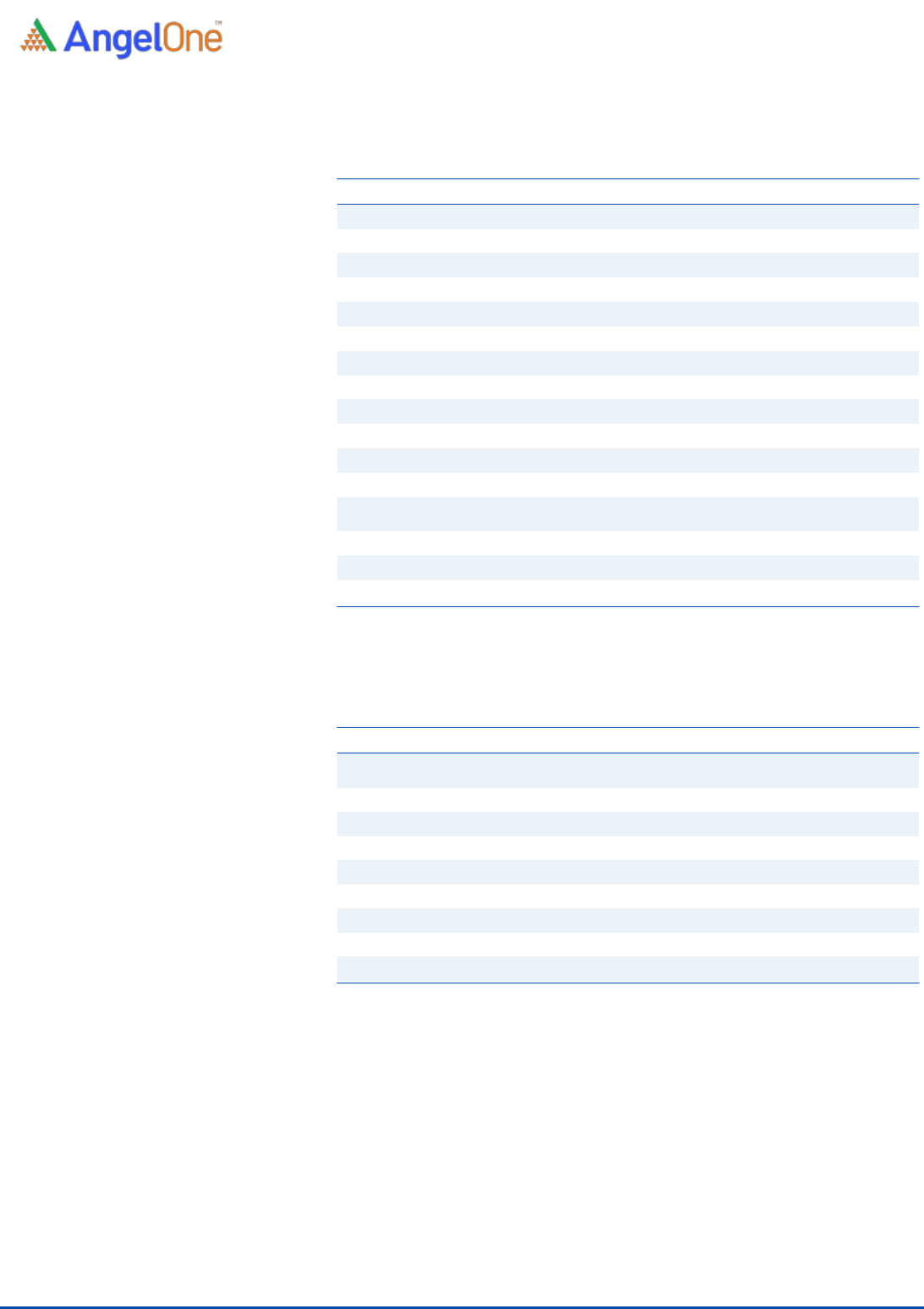

Exhibit 1: Key Operating & financial parameters

Particulars (₹ cr)

FY2019

FY2020

FY2021

9MFY22

Premium (consolidated)

340,295

382,811

405,851

285,730

Of which:

(i) First year premiums

31,677

58,446

34,341

22,215

(ii) Single premiums & consideration for annuities granted

112,361

121,828

151,182

104,562

(iii) NBP ((i)+(ii))

144,038

180,274

185,523

126,778

(iv) Renewable premiums

196,257

202,537

220,328

158,952

Premium (in India)

337,130

379,014

402,888

283,753

Individual APE (in India)

31,448

35,297

32,271

20,904

Group APE

9,118

12,675

13,317

9,019

Total annualized premium equivalent (“APE”) (in India)

40,566

47,972

45,588

29,923

AUM (Consolidated)

3,271,033

3,338,108

3,692,967

4,032,170

IEV

-

46,497

95,605

539,686 *

VNB Margin (%)

-

-

9.9%

9.3%

Operating expenses related to insurance business to premium ratio (as a % of premium)

8.3%

9.0%

8.7%

9.5%

Conservation Ratio

92.2%

88.8%

84.5%

93.7%

Source: Company RHP, Angel Research; * IEV as of 30

th

Sep’21

LIC continues to be an overall market leader in the insurance space with a

66.2%/61.4% market share in new business premium for FY2021/9MFY2022.

LIC’s dominant position in the life insurance business is largely driven by its 75%+

market share in the group insurance business. However over the past few years

LIC has lost significant market share in the high margin individual insurance

business.

Exhibit 2: Market share (NBP) – Group insurance

Source: Company RHP, Angel Research

Exhibit 3: Market share (NBP) – Individual insurance

Source: Company RHP, Angel Research

81%

81%

81%

78%

81%

78%

74%

19%

19%

19%

22%

19%

22%

26%

10%

30%

50%

70%

90%

FY16

FY17

FY18

FY19

FY20

FY21

9MFY22

LIC

Private players

56%

59%

56%

52%

51%

50%

43%

44%

41%

44%

48%

50%

50%

57%

30%

45%

60%

75%

FY16

FY17

FY18

FY19

FY20

FY21

9MFY22

LIC

Private players

LIC | IPO Note

April 30, 2022

4

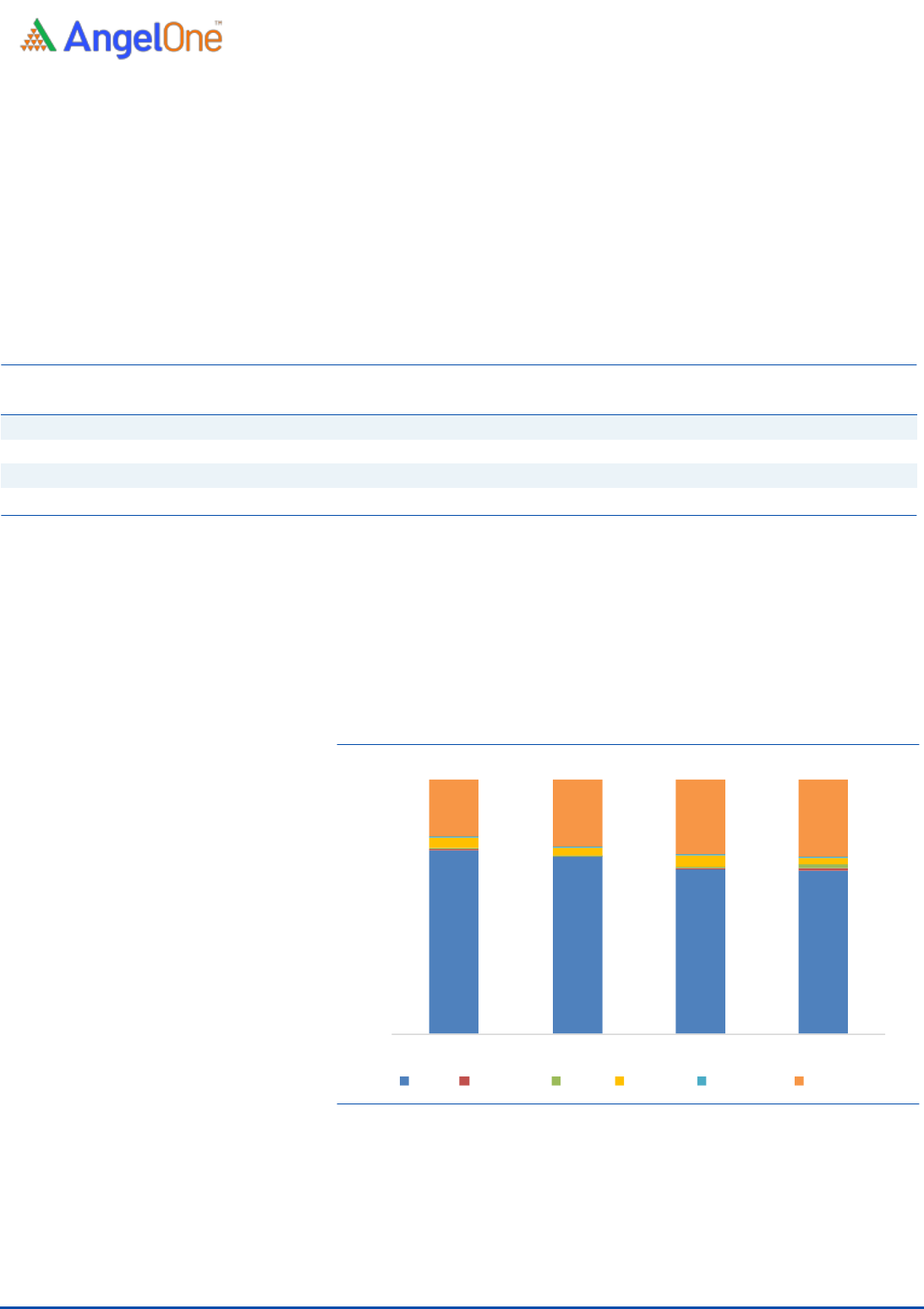

High proportion of Group & Participating businesses have been a drag on margins

In terms of annual premium equivalent (APE) LIC derives a significant portion of

their business from group and participating businesses which are by nature low

margin business as compared to individual and non-participating and protection

business. Higher contribution from group insurance and participating business has

been a drag on LIC’s NBP margins at 9.3% for 9MFY2022 which is significantly

lower than the listed life insurance players despite its size and scale.

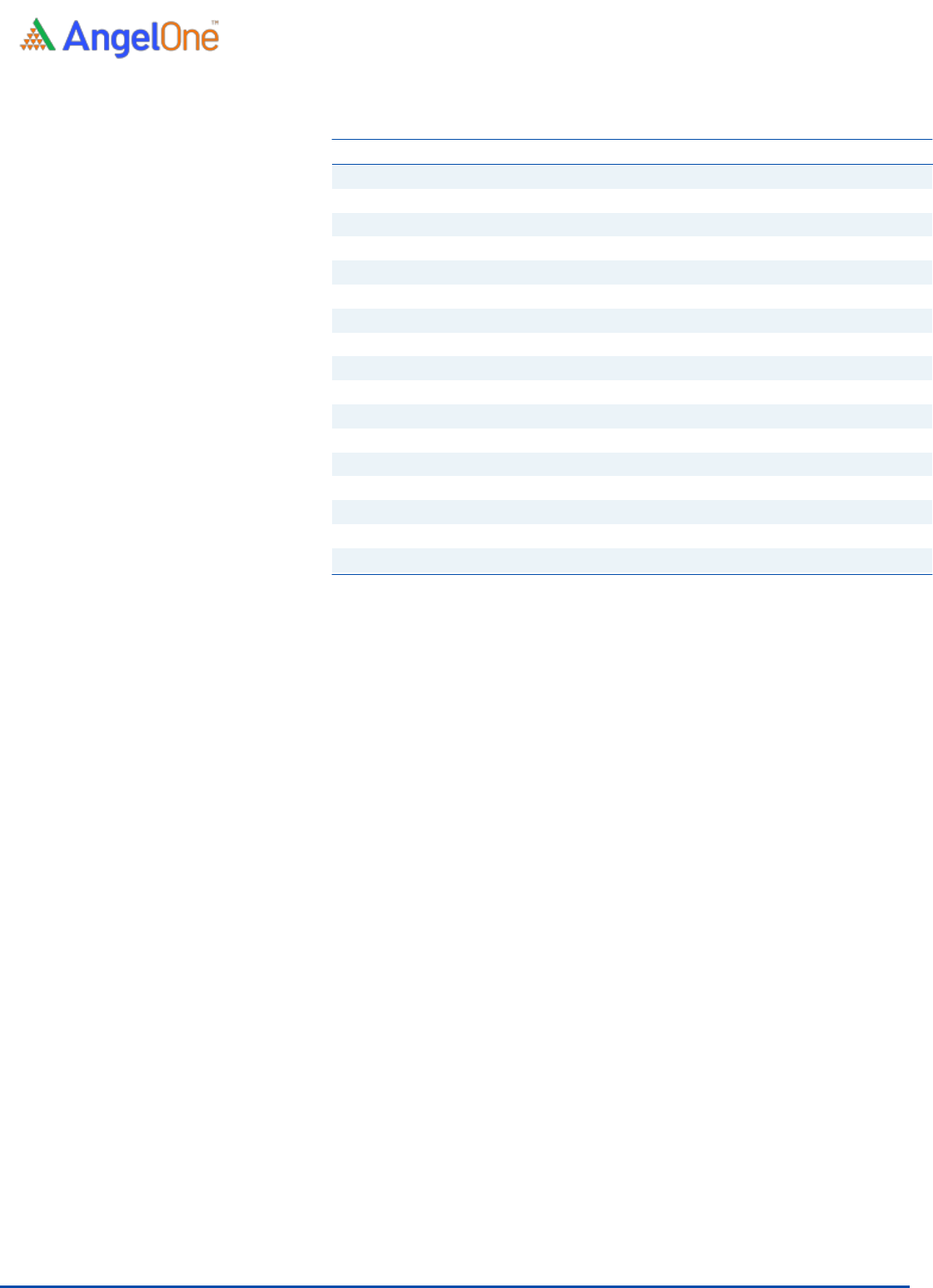

Exhibit 4: The IPO is priced at a significant discount to listed life insurance companies

Company Name

CMP

(Rs.)**

Market cap

(Rs. Cr)**

Total premium

(Rs Cr)#

NBP

(Rs. Cr)#

PAT

(Rs. Cr)#

VNB Margin

(%)#

P/EV

(X)*

LIC

949

600,242

284,050

126,020

1,715

9.3%

1.1

HDFC Life

583

123,060

31,540

17,190

821

26.5%

4.3

ICICI Pru Life

526

75,646

25,750

10,250

572

27.1%

2.5

SBI Life

1,108

110,831

41,250

18,790

834

25.5%

3.1

Source: Company, BSE, Angel Research; * EV/IEV as of 30

th

Sep’21; ** CMP, M Cap. as of closing 29

th

Apr’22 for listed companies; # 9MFY22 figures

Over the last few years there has been a shift from participating to non

participating policies in the product mix. However participating policies still

accounted for 64.4% of LIC’s total APE in 9MFY2022 which is significantly higher

than private life insurance companies like HDFC Life, ICICI Prudential and SBI Life

where participating business account for less than 30% of total APE.

Exhibit 5: Product mix skewed towards PAR products

Source: Company RHP, Angel Research

Moreover, LIC’s PAT margins are also significantly lower than listed private players

due to 1. Greater share of participating product in the mix and 2. Transfer of 5%

of surplus in participation policies from policyholder’s a/c to shareholder’s account

as compared to 10% by private players.

72.5%

69.5%

64.8%

64.4%

4.1%

3.2%

4.4%

2.9%

22.5%

26.4%

29.2%

30.1%

0%

25%

50%

75%

100%

FY2019

FY2020

FY2021

9MFY2022

PAR

Non PAR

ULIP

Annuity

Protection

Group

LIC | IPO Note

April 30, 2022

5

Shift towards non PAR products and increased transfer to shareholders a/c to drive

profit growth

There has been more than an 800bps shift in product mix away from PAR products

as a % of APE between FY2019 to 9MFY2022, which is expected to continue over

the next few years. LIC still has significant scope in terms of achieving a more

balanced product mix relative to private players.

Against the current policy of transferring 5% of surplus in participating products to

shareholders’ account, the company will start transferring 7.5% and 10.0% of

surplus to shareholders account from FY2023 and FY2025, which will bring LIC in

line with other private players. For Non PAR products, LIC has already stated

transferring 100% of surplus to shareholders account from FY2022 (as compared

to 5% earlier), which is in line with other private players.

Exhibit 6: Surplus transfer to shareholders a/c for LIC

Product Type

FY2021

FY2022

FY2023

FY2024

Post FY2025

Participating

5.0%

5.0%

7.5%

7.5%

10.0%

Others

5.0%

100.0%

100.0%

100.0%

100.0%

Source: Company RHP, Angel Research

We believe that shift in product mix towards non PAR products will drive

improvement in VNB margins from current low levels to mid teens figure over the

next few years. Greater transfer of surplus from policyholders account along with

improvement in VNB margins will drive profits from current low levels.

Discounted valuations to listed peers provide comfort

At the upper end of the price band the LIC IPO is offered at P/EV (embedded

value) of 1.1x as compared to other listed players which are trading at multiples of

2.5-4.3x Sep’21 EV. Though there are concerns over LIC regarding market share

loss in the individual product business and low margins, we believe that valuations

factor in most of the negatives.

Expected improvements in product mix and greater transfer of surplus over the

coming years are expected to drive profits from current low levels which along with

cheap valuations provide comfort. Key risk to the thesis is continued market share

loss in the high margin individual business and continued high contribution from

low margin PAR and group insurance business.

LIC | IPO Note

April 30, 2022

6

Issue details

The IPO is entirely made up of offer for sale of 221,374,920 equity shares by

the Government of India.

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

6,324,997,701

100%

6,103,622,781

96.5%

Public

0

0%

221,374,920

3.5%

Total

6,324,997,701

100%

6,324,997,701

100%

Source: Company, Angel Research

Objectives of the Offer

To achieve the benefits of listing the equity shares on the stock exchange.

To carry out an offer for sale of 221,374,920 shares by selling

shareholders.

Key Management Personnel

Mangalam Ramasubramanian Kumar is the Whole-time Chairperson of LIC. He

joined LIC in the year 1983 and has experience in the insurance sector. Previously,

he was the zonal manager of South, North-Central and North zones of LIC and

has also headed the personnel and pension & group schemes department.

Pankaj Jain is a Government Nominee Director of the Corporation and is an

officer at the Indian Administrative Service from the 1990 batch. He is presently

serving as a secretary in the Ministry of Petroleum, Government of India. He is a

qualified cost accountant from the Institute of Cost Accountants of India and a

member of the International Financial Services Centres Authority.

Raj Kumar is the Managing Director of the Corporation. He joined the Corporation

in the year 1984 as an apprentice officer and has experience in the insurance

sector. He has also served as the chief executive officer of LIC Mutual Fund Asset

Management Limited.

Siddhartha Mohanty is the Managing Director of the Corporation. He holds

bachelor’s degree in law and a master’s degree of arts (political science) from

Utkal University, Bhubaneswar, Odisha. He previously served as COO and CEO

of LIC Housing Finance Limited and has held various other key positions.

Ipe Mini is the Managing Director of the Corporation. She holds master’s degree

of commerce from the Faculty of Commerce and Management Studies, Andhra

University. Previously, she was also the shareholder director of Central Bank of

India.

Bishnu Charan Patnaik is the Managing Director of LIC. He joined LIC in the year

1985 and has experience in the insurance sector and has handled several

positions in LIC.

Dr Ranjan Sharma is the Independent Director of LIC. He is experienced in the

field of academics.

Vinod Kumar Verma is the Independent Director of LIC. He is experienced in

electronics business. He is an Independent Director of LIC from October 29, 2021

LIC | IPO Note

April 30, 2022

7

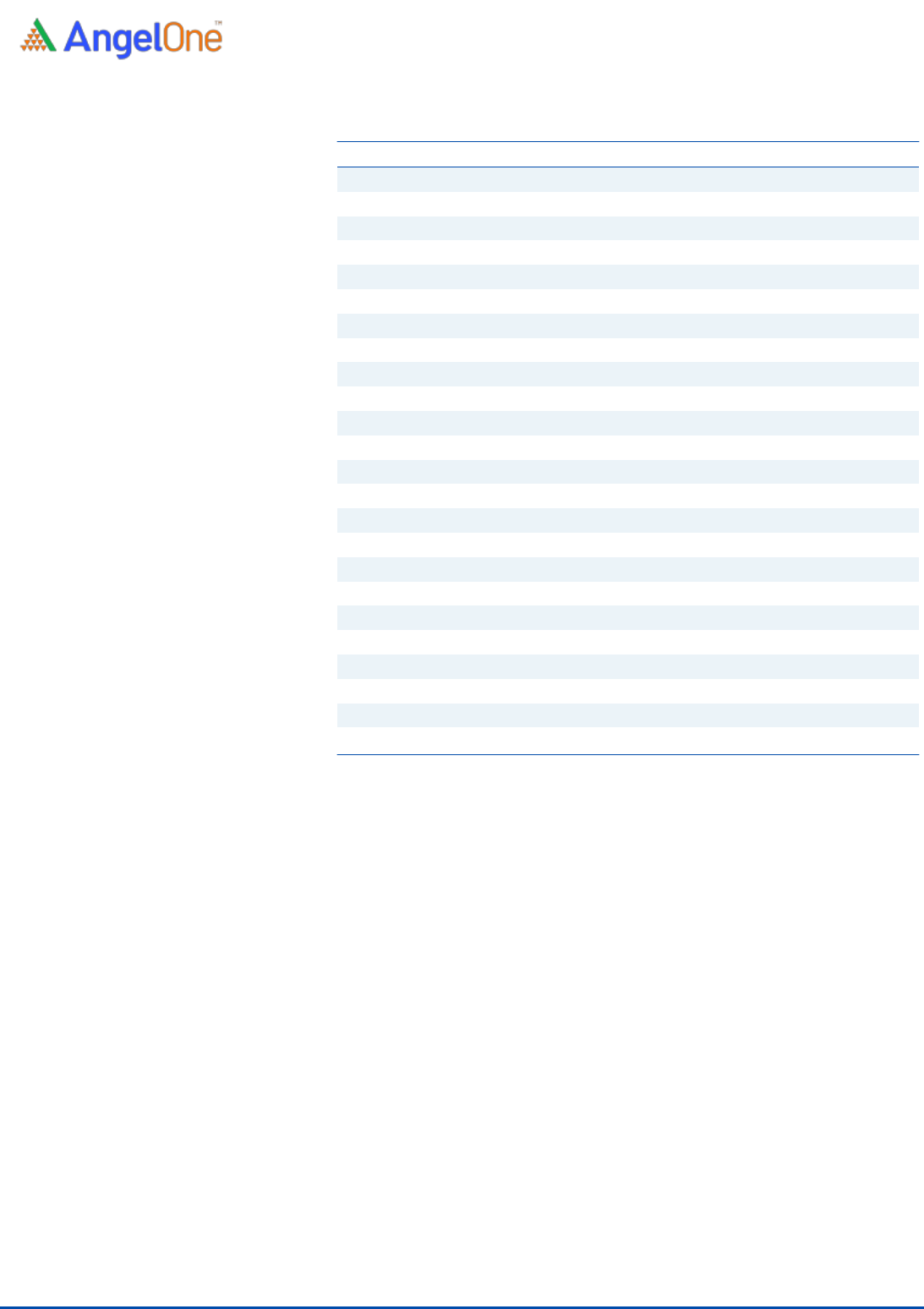

Financial Summary Policyholders Account (technical)

Y/E March (₹ cr)

FY’19

FY’20

FY’21

9M FY’22

Premiums earned - Net

339,972

382,476

405,398

285,342

Income from Investments

225,044

242,836

285,520

226,254

Other income

5,794

20,294

12,791

684

Total

570,810

645,605

703,709

512,279

Commission

20,483

21,548

22,358

15,538

Operating expenses

28,332

34,426

35,162

27,267

Other exp

4,832

19,732

13,456

0

GST & other charges

110

98

93

56

Provisions

21,158

35,276

16,483

-273

Benefits paid (Net)

252,381

255,479

288,489

234,620

Interim Bonuses Paid

1,651

1,673

2,229

2,470

Change in valuation of policy liabilities

253,585

296,628

321,134

239,357

Transfer to/ (from) Provision

for Linked Liabilities

-9,312

-9,110

434

-9,528

Transfer (others)

6

4

9

1,129

Share of Profit (Associates/Minority Interest)

3,185

6,947

717

2,225

Surplus/(deficit) net

769

-3,202

4,579

3,868

Source: Company, Angel Research

Financial Summary Shareholders Account (Non-technical)

Y/E March (₹ cr)

FY’19

FY’20

FY’21

9M FY’22

Amounts transferred

from Policyholders' account

2,599

2,696

2,963

1,638

Income from investments & others

46

35

23

120

Total

2,645

2,731

2,986

1,757

Expenses other than insurance

0

0

0

0

Contribution to Policyholders' account

2

6

5

0

Others

0

6

0

0

Profit before Tax

2,642

2,719

2,980

1,757

Provision for tax

15

8

6

42

PAT

2,627

2,710

2,974

1,715

Source: Company, Angel Research

LIC | IPO Note

April 30, 2022

8

Balance Sheet

Y/E March (₹ cr)

FY’19

FY’20

FY’21

9M FY’22

Sources of Funds

Share capital

100

100

100

6,325

Reserve and surplus

798

892

6,705

2,499

Credit/[debit] fair value change account

(89)

10

78

141

Minority Interest (Shareholders)

88

96

99

102

Borrowings

269,401

253,414

4

4

Policyholders' funds

3,096,023

3,159,634

3,739,414

4,080,610

Funds For Future Appropriations

13

29

3

1,107

Total Liabilities

3,366,335

3,414,175

3,746,404

4,090,787

Applications of Funds

Shareholders’ investments

369

401

426

5,187

Policyholders’ investments

2,877,687

2,957,908

3,498,441

3,843,617

Asset held to cover linked liabilities

33,567

32,170

32,975

23,467

Loans

249,880

237,435

108,764

111,141

Fixed assets

14,568

14,572

3,474

3,463

Net current assets

190,264

171,690

102,325

103,912

Total Assets

3,366,335

3,414,175

3,746,404

4,090,787

Source: Company, Angel Research

LIC | IPO Note

April 30, 2022

9

Key Ratios

Y/E March (₹ cr)

FY'19

FY'20

FY'21

9M FY'22

Growth

New Business Premium

144,038

180,274

185,523

126,778

Net Premium Earned

339,972

382,476

405,398

285,342

APE

40,566

47,972

45,588

29,923

AUM

3,271,033

3,338,108

3,692,967

4,032,170

PAT

2,627

2,710

2,974

1,715

Growth (%)

-

-

-

-

New Business Premium

-

25%

3%

-

Net Premium Earned

-

13%

6%

-

APE

-

18%

-5%

-

AUM

-

2%

11%

-

PAT

-

3%

10%

-

Valuations

EPS (Rs)

4.2

4.3

4.7

2.7

BV (Rs)

1.4

1.7

11.0

14.3

IEV (per share)

-

74

151

853*

P/IEV

-

12.9

6.3

1.1

P/E

228.7

221.2

201.9

-

Capital & Efficiency

VNB Margin

-

-

9.9%

9.3%

ROE (%)

293%

247%

43%

19%

Commission ratio (%)

6.0%

5.6%

5.5%

5.4%

Insurance expense (%)

8.3%

9.0%

8.7%

9.6%

Expense ratio (%)

14.4%

14.6%

14.2%

15.0%

Source: Company, Angel Research; * As of 30

th

Sep’21

LIC | IPO Note

April 30, 2022

10

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing

in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent

us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the

subject company. Research analyst has not served as an officer, director or employee of the subject company.