Please refer to important disclosures at the end of this report

1

Krishna Institute of Medical Sciences Limited is one of the largest corporate healthcare

groups in South India specially in AP and Telangana. It provides multi-disciplinary

integrated healthcare services, with a focus on primary secondary, tertiary care and

quaternary healthcare. Company operates 9 multi-specialty hospitals under the “KIMS

Hospitals” brand, with an aggregate bed capacity of 3,064, including over 2,500

operational beds as of March 31, 2021.

Positives: (a) Company having a good track record of retaining high quality doctors,

consultants and medical support staff. (b) Company having negative Debt/Equity ratio,

which is one of the lowest ratios among the peers. (c) Company having very high ROCE

of 24% in FY2021 along with one of the highest EBITDA growth in the last 3 years.

Investment concerns: (a) Business highly dependent on our healthcare professionals,

including doctors that company engage on a consultancy basis, business and financial

results could be impacted if it is unable to retain healthcare professionals. (b) Company

dependence on their flagship hospital at Secunderabad in Telangana is at 33% any

geopolitical changes can impact the company business. (c) Upcoming expansion plans

in Bangalore & Chennai will require a lot of fresh capitals and both are very competitive

markets.

Outlook & Valuation: Based on FY-2021PE of 31.2x and EV/EBITDA of 17.8x at upper

band of the IPO price and are slightly better than the peers’ companies. Similarly,

company having one of the best ROE & ROCE of 23.8% and 24.8% respectively.

Company having a very healthy balance sheet with negative Net Debt/ Equity. We

expect the upcoming expansion plan in Bangalore & Chennai can be funded through

internal accruals and minimum amount of debt. We are assigning a “SUBSCRIBE”

recommendation to the issue.

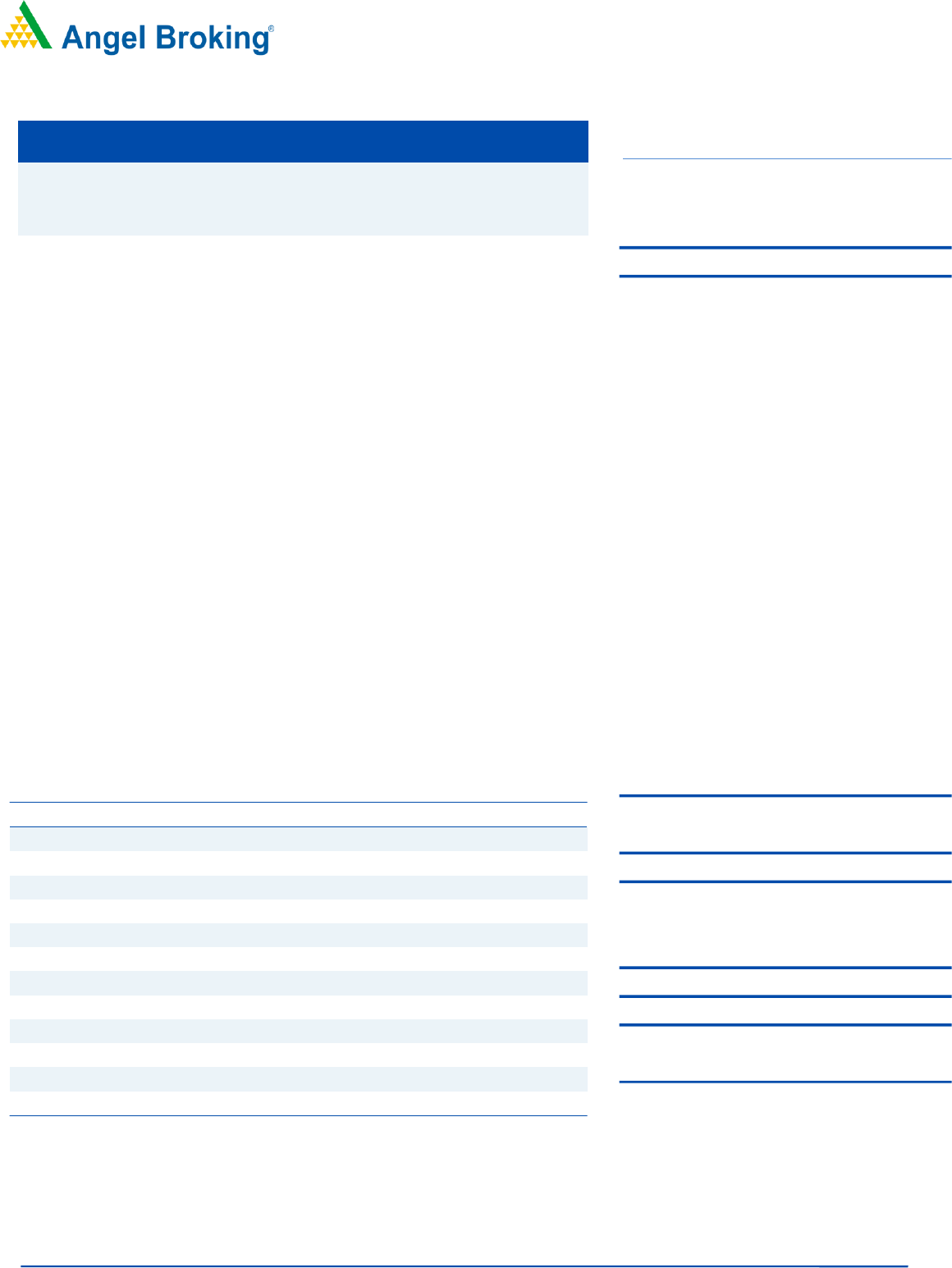

Key Finance

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

918.0

1,122.6

1,329.9

% chg

-

22.3

18.5

Net Profit

(48.8)

115.1

205.5

% chg

-

-

78.6

EBITDA (%)

8.8

21.8

27.9

EPS (Rs)

(6.6)

15.4

26.5

P/E (x)

(125.9)

53.4

31.2

P/BV (x)

11.4

10.3

7.4

ROE (%)

(9.0)

19.2

23.8

ROCE (%)

2.6

17.7

24.8

EV/EBITDA

79.3

26.1

17.8

EV/Sales

7.0

5.7

5.0

Source: Company, Angel Research

SUBSCRIBE

Issue Open: June 16, 2021

Issue Close: June 18, 2021

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 38.8%

Others 61.2%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ₹ 80 cr

Issue size (amount): ₹2143.74 cr**

Price Band: ₹ 815-825

Lot Size: 18 shares and in multiple thereafter

Post-issue mkt. cap: *₹ 6522 cr - **₹ 6602 cr

Promoters holding Pre-Issue: 46.8%

Promoters holding Post-Issue: 38.8%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: ₹ 200 cr.

Issue Details

Face Value: ₹ 10

Present Eq. Paid up Capital: ₹ 77.59 cr

Offer for Sale: ₹ 1943.7Cr

Yash Gupta,

+022 39357600, Extn: 6872

Research Analyst

Yash.gupta@angelbroking.com

IPO Note

June 15, 2021

Krishna Institute of Medical Sciences Limited

KIMS Ltd | IPO Note

June15, 2021

2

Company background

Company first hospital was established in Nellore (AP) in 2000 by Dr. Bhaskara Rao

Bollineni, a renowned cardiothoracic surgeon in India and started with a capacity of

approximately 200 beds. Then it significantly expanded hospital network in recent

years through acquisitions of hospitals in Ongole (AP) in Fiscal Year 2017, Vizag

(AP) and Anantapur (AP) in Fiscal Year 2019 and Kurnool (AP) in Fiscal Year 2020.

Approximately one-third of 3,064 beds were launched in the last four years and also

improved on overall bed occupancy rate.

Company strategically focuses on the southern India healthcare market where it has

a strong understanding of regional nuances, customer culture and the mindset of

medical professionals and where there is significant and growing need for quality

and affordable healthcare services. Dr. Abhinay assumed as CEO position in 2019

and played a leadership role in expanding the KIMS’ network over the last 5 years,

including in the launch of KIMS Kondapur and the acquisitions of our hospitals in

Ongole (AP), Vizag (AP), Anantapur (AP) and Kurnool (AP). Currently company

aggregate beds are 3064 out of which 2500 are operational beds.

KIMS Ltd | IPO Note

June15, 2021

3

In Fiscal Year 2021, its nine hospitals recorded ARPOB (Average Revenue Per

Operating Bed) of 20,609, a bed occupancy rate of 78.60%, and an ALOS (Average

of length of stay) of 5.53 days, on an aggregate basis. In Fiscal Year 2021, ARPOB

for the hospitals situated in Tier 1 cities was 39,571 and ARPOB for the hospitals

situated in Tier 2-3 cities was 11,187.

Issue details

The issue size is ` 2143.74Cr, which comprises of fresh issues of up to `200 crore

& offer for sale of ` 1943.74Cr in the price band of `815-`825 per share.

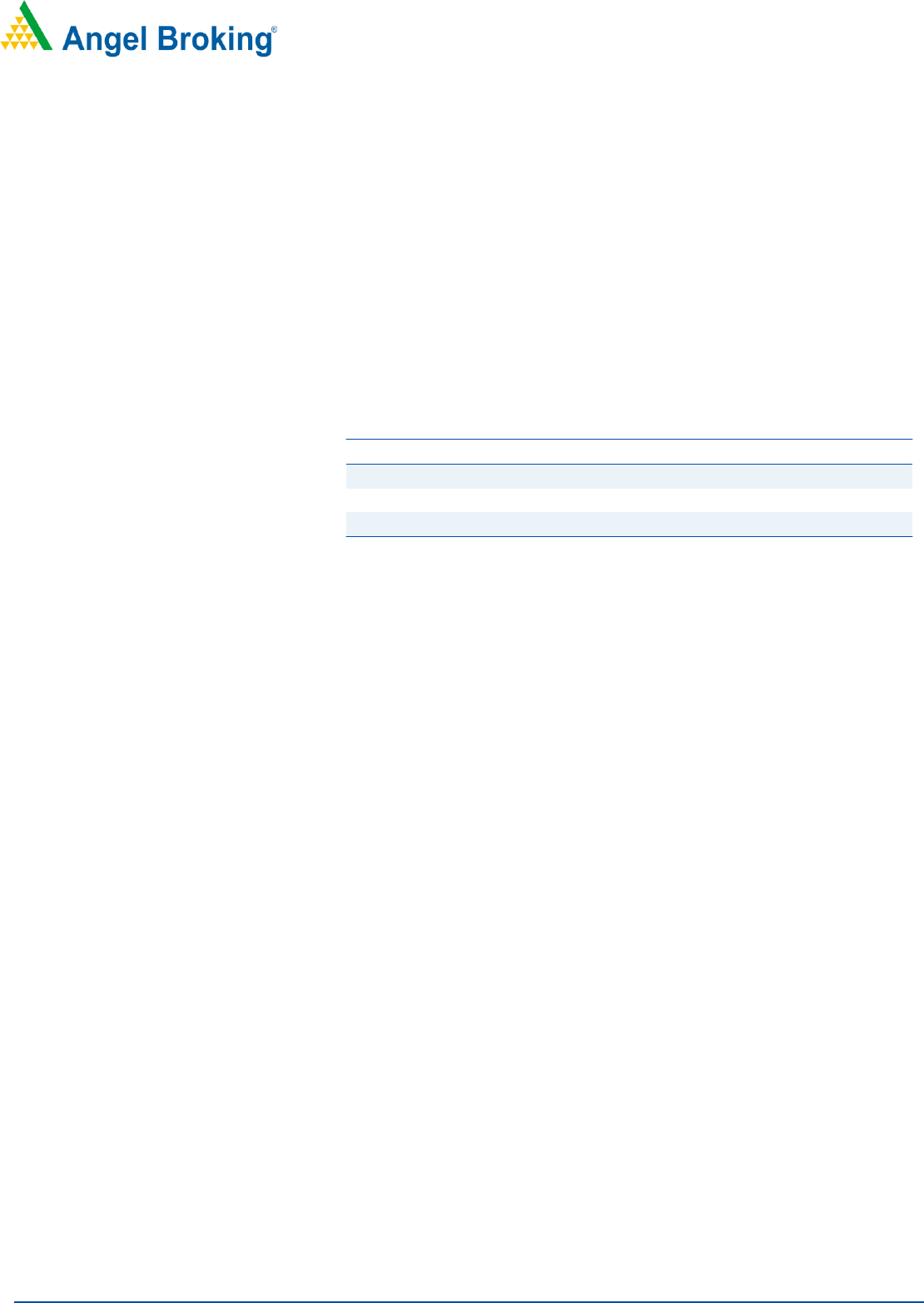

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

36,323,850

46.8

31,086,304

38.8

Public

41,269,433

53.2

48,943,574

61.2

Total

77,593,283

100.0

80,029,878

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Repayment/pre-payment, in full or part, of certain borrowings availed by

Company and by Subsidiaries viz KHKPL, SIMSPL and KHEPL; and

General corporate purposes

Key Management Personnel

Dr. Bhaskara Rao Bollineni is the Managing Director of the Company. He holds a

bachelor’s degree in medicine and surgery from Andhra University and a master’s

degree in general surgery from Madras Medical College, Chennai, Tamil Nadu. He

has also been admitted as a Diplomate of the National Board of Examinations, New

Delhi for the practice of cardio-thoracic surgery. He has over 27 years of experience

in cardiothoracic surgery and has in the past held various positions with Apollo

Hospitals, Austin Hospital, University of Melbourne and Mahavir Hospital and

Research Centre.

Anitha Dandamudi is a Whole-time Director of the Company. She holds a diploma

in business management from the ICFAI University and a certification for the six-

sigma green belt. She also holds certifications for the auditing of quality systems as

per ISO 9001-2000 and ISO 9004-2000, and has completed a training program

on internal quality audit for the NABH. She has over 16 years of experience in the

hospital industry, having held various positions with our Company, and has also

served as vice president of administration at e-Talent Software Limited.

KIMS Ltd | IPO Note

June15, 2021

4

Dr. Abhinay Bollineni is an Executive Director of the Company. He holds a bachelor’s

degree in medicine and a bachelor’s degree in surgery from Dr. NTR University of

Health Sciences, Andhra Pradesh (Faculty of Modern Medicine) through Deccan

College of Medical Sciences. He also participated in the ‘International Visitor

Leadership Program on Oncology: Research, Prevention and Treatment’ held by the

U.S. Department of State where he undertook training in diagnosis, treatment

methods, alternative therapies, support groups and follow-up care for cancer

patients and their families.

Sandeep Naik is a Non-Executive Director of the Company. He holds a bachelor’s

degree in engineering from the University of Bombay, and has completed his

master’s degree in science from the Virginia Commonwealth University and a

master’s in business administration from Wharton School of Business at University

of Pennsylvania. He is a Managing Director and head of General Atlantic’s business

in India and Asia-Pacific and a member of the management committee at General

Atlantic.

KIMS Ltd | IPO Note

June15, 2021

5

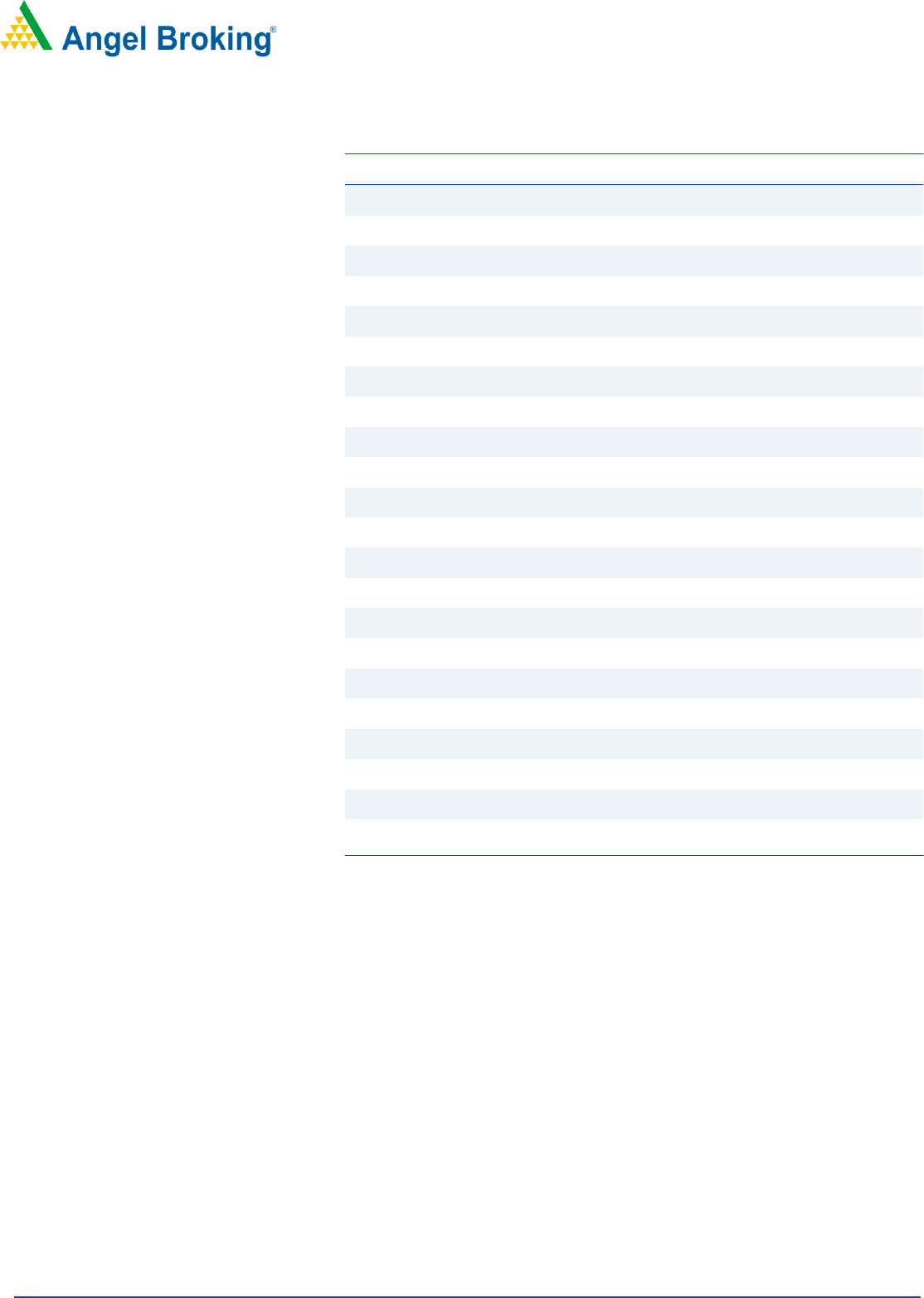

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Total operating income

918

1,123

1,330

% chg

-

22.3

18.5

Total Expenditure

837

878

959

Purchase of medical consumables

210

254

289

Employee benefits expense

163

198

220

Other expenses

464

425

450

EBITDA

81

245

371

% chg

-

202.6

51.4

(% of Net Sales)

8.8

21.8

27.9

Depreciation& Amortization

56

71

70

EBIT

25

174

301

% chg

-

612

72.8

(% of Net Sales)

2.7

15.5

22.7

Finance costs

46

40

32

Other income

6

6

10

Recurring PBT

-15.4

140.5

279.0

% chg

-

-

98.6

Tax

33.4

25.5

73.5

PAT (reported)

-48.8

115.1

205.5

% chg

-

-

78.6

(% of Net Sales)

-5.3

10.3

15.5

Basic & Fully Diluted EPS (`)

-6.6

15.4

26.5

Source: Company, Angel Research

KIMS Ltd | IPO Note

June15, 2021

6

Consolidated Balance Sheet Statement

Y/E March (`cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

74.5

74.5

77.6

Other equity (Retained Earning)

466

524

786

Shareholders’ Funds

541

598

864

Total Loans

287

292

252

Other liabilities

109

97

97

Total Liabilities

936

987

1,213

APPLICATION OF FUNDS

Property, plant and equipment

708

749

771

Capital work-in-progress

0

2

9

Goodwill

75

85

85

Other intangible assets

26

26

25

Right-of-use assets

56

56

51

Current Assets

174

220

451

Inventories

27

30

24

Trade receivables

123

132

110

Cash and cash equivalents

8

41

52

Bank balances other than (ii) above

2

5

232

Loans

2

2

2

Other financial assets

9

5

23

Other current assets

3

4

7

Current Liability

183

209

223

Net Current Assets

-9

11

228

Other Non-Current Asset

80

58

45

Total Assets

936

987

1,213

Source: Company, Angel Research

KIMS Ltd | IPO Note

June15, 2021

7

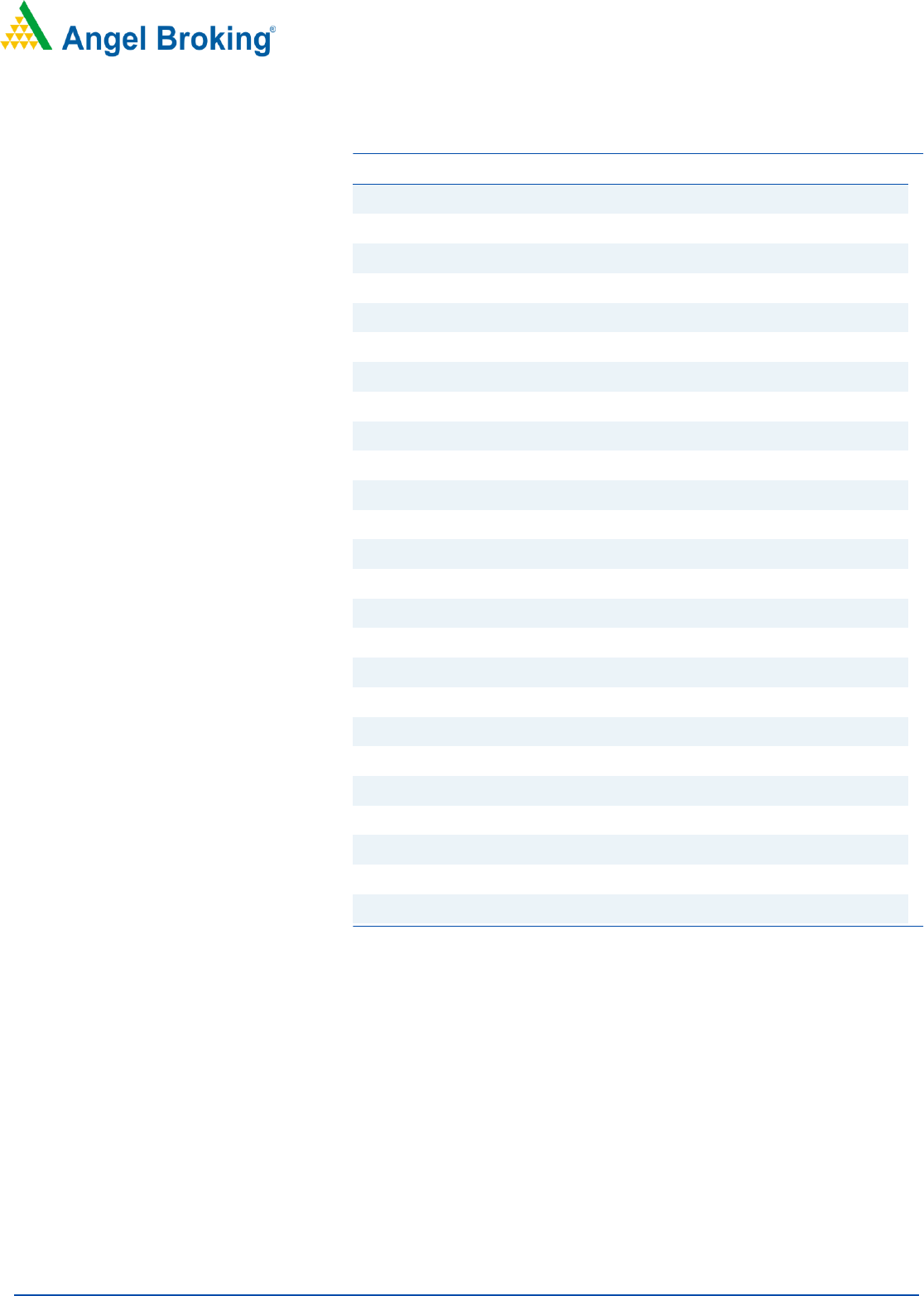

Consolidated Cash flow

Y/E March (`cr)

FY2019

FY2020

FY2021

Operating profit

193

255

380

Net changes in working capital

-28

0

14

Cash generated from operations

165

255

394

Direct taxes paid

-31

-54

-38

Cash flow operating activities

134

202

356

Purchase of property, plant and equipment

-77

-52

-94

Proceeds from sale

0

1

1

Others

-33

-73

-261

Cash Flow from Investing

-110

-125

-354

Repayment of long-term borrowings

-186

-72

-141

Proceeds from long-term borrowings

130

81

46

Proceeds from short-term borrowings

-25

-12

45

Payment of lease liabilities

-8

-9

-7

Proceeds from issue of shares

88

-

95

Others

-26

-33

-27

Cash Flow from Financing

-27

-44

10

Inc./(Dec.) in Cash

-3

32

12

Opening Cash balances

11.0

8.1

40.5

Closing Cash balances

8.1

40.5

52.1

Source: Company, Angel Research

KIMS Ltd | IPO Note

June15, 2021

8

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

(125.9)

53.4

31.2

P/CEPS

803.4

33.1

23.3

P/BV

11.4

10.3

7.4

EV/Sales

7.0

5.7

5.0

EV/EBITDA

79.3

26.1

17.8

Per Share Data (`)

EPS (Basic)

(6.6)

15.4

26.5

EPS (fully diluted)

(6.6)

15.4

26.5

Cash EPS

1.0

24.9

35.4

Book Value

72.6

80.3

111.3

Returns (%)

ROE

(9.0)

19.2

23.8

ROCE

2.6

17.7

24.8

Turnover ratios (x)

Receivables (days)

49.0

43.0

30.1

Inventory (days)

10.7

9.9

6.6

Payables (days)

-

-

-

Working capital cycle (days)

59.7

52.9

36.7

Source: Company, Angel Research

KIMS Ltd | IPO Note

June15, 2021

9

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.