JSPL | Quick Take

July 05, 2018

Jindal steel & Power

BUY

CMP

`212

Target Price

`327

JSPL is part of OP Jindal Group with presence in steel, power and mining

sectors. JSPL has capacity of 10.6 MTPA crude steel and 3,400MW of power

Investment Period

12 Months

generation capacity through its subsidiary Jindal Power Limited (JPL).

Capacity expansion done; EBIDTA/Tonne likely to improve: The company has

Stock Info

increased its crude steel capacity more than double in last five years from 3.6 MTPA

Sector

Steel & Pow er

to 8.6 MTPA and currently running at ~50% utilization, However given the current

Market Cap (` cr)

20,520

market scenario of steel demand we expect utilization level to improve to 80-85% in

Beta

2.8

next 7-8 months.

52 Week High / Low

294/112

Further, Jindal Shadeed (OMAN subsidiary) with a crude steel capacity of 2MTPA

Avg. Daily Volume

630,702

has ram up significantly in last three years and running at ~ 80% utilization we

Face Value (`)

1

expect the plant to reach to further utilization level of

85-90% going ahead. On

BSE Sensex

35,574

account of this we expect a combined output of crude steel to reach to 8.5-9 MTPA

by FY19.

Nifty

10,750

Improvement in PLF and PPA going ahead: In FY18 JPL has signed a additional

Reuters Code

JNSP.BO

250MW of PPA which makes it ~30% of installed capacity and it is in further

Bloomberg Code

JNSP IN

discussions with various utilities for signing of another 300MW PPA. Management

expects to generate ~1,700 MW units by FY19 owing to GOI’s effort to improve coal

Shareholding Pattern (%)

availability with implementation of SHAKTI scheme.

Outlook & Valuation: JSPL is currently placed at an inflection point where it is

Promoters

58.7

witnessing positive changes like (a) end of capex cycle and equipped with fully

MF / Banks / Indian Fls

6.9

operational Angul plant with 5 MTPA capacity, (b) increasing demand of power

FII / NRIs / OCBs

19.2

going forward with expectation of signing new PPA at JPL, (c) monetization of few

Indian Public / Others

15.3

assets like disinvestment of Tamnar- (EUP-I) 1,000 MW power plant and planning

for IPO of OMAN plant. Considering the company’s recent developments and

favorable business environment, we believe JSPL is trading at attractive valuation to

Abs.(%)

3m 1yr

3yr

its peer, hence we recommend ACCUMULATE on the stock with Target Price of

Sensex

6.0

12.9

26.2

`327 based on asset based approach of Steel segment on EV/Tonne basis and

JSPL

(7.0)

63.0

156.0

Power segment on EV/MW basis.

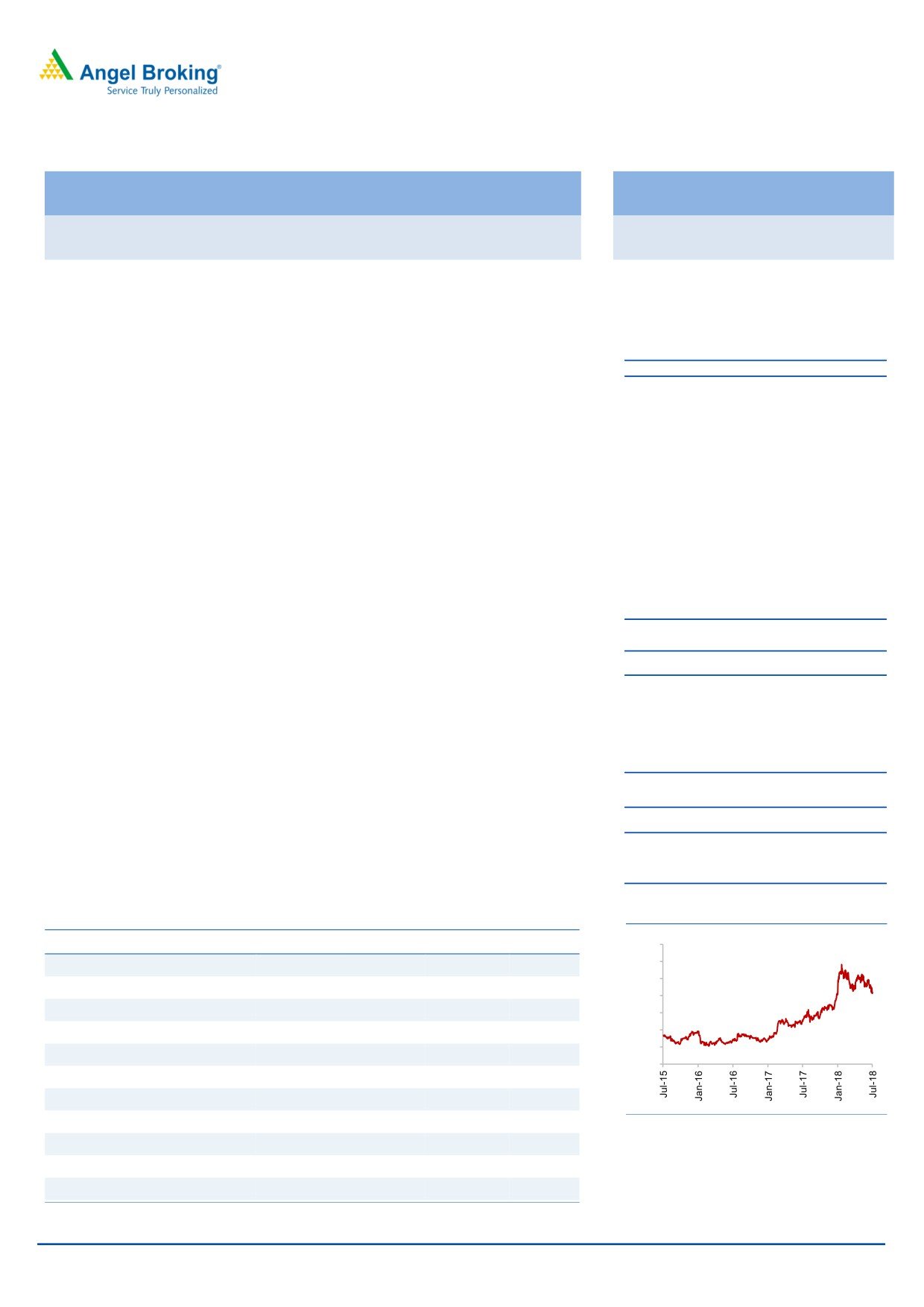

3 years price performance

Exhibit 1: Key Financials

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

350

300

Net Sales

17,948

20,409

27,069

35,918

44,048

250

% chg

(6)

14

33

33

23

200

EBIDTA

3,201

4,337

5,882

8,097

10,580

150

100

% chg

(7)

35

36

38

31

50

EBITDA (%)

18%

21%

22%

23%

24%

0

EPS (Rs)

(32)

(26)

(17)

1

20

P/E (x)

-

-

-

216

10

P/BV (x)

0.6

0.7

0.7

0.7

0.6

Source: C-line, Angel Research

RoE (%)

-

-

-

0.3

5.9

RoCE (%)

-

0.6

2.9

5.7

9.5

Kripashankar Maurya

EV/EBITDA

19.9

13.8

10.1

7.3

5.2

022 39357600, Extn: 6004

Source: Company, Angel Research; Note: CMP as of July 05, 2018

July 05, 2018

1

JSPL | Quick Take

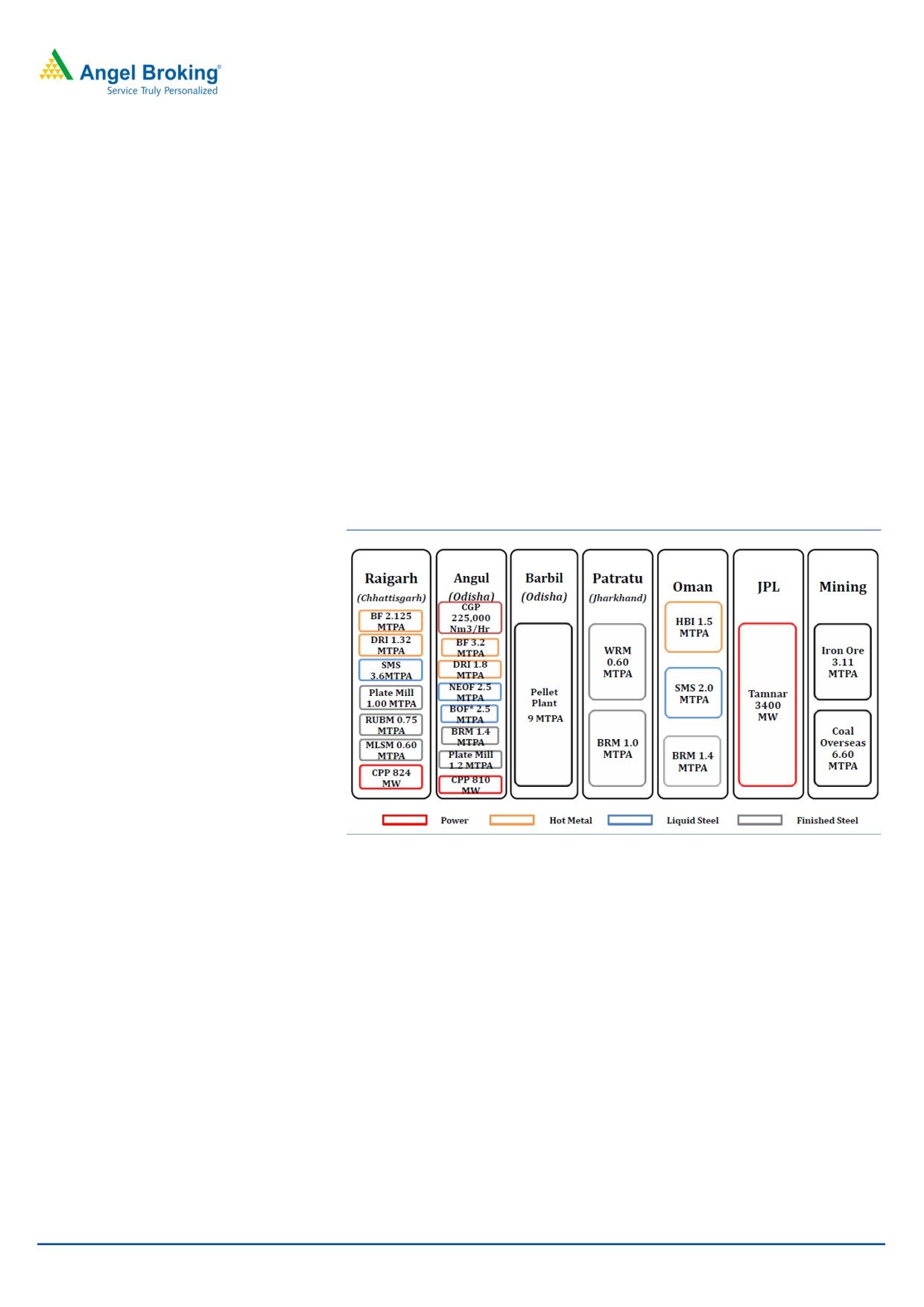

Company background

JSPL is part OP Jindal Group with presence in steel, power and mining sectors.

JSPL has capacity of 10.6 MTPA crude steel and 3,400MW of power generation

capacity through its subsidiary Jindal Power Limited (JPL).

JSPL operates the largest coal-based sponge iron plant in the world and has an

installed capacity of 3 MTPA (million tonnes per annum) of steel at Raigarh in

Chhattisgarh. Moreover, it has set up a 0.6 MTPA wire rod mill and a 1 MTPA

capacity bar mill at Patratu, Jharkhand, a medium and light structural mill at

Raigarh, Chhattisgarh and a 2.5 MTPA steel melting shop and a plate mill to

produce up to 5 -meter-wide plates at Angul, Odisha. In Oman (Middle East), the

company has a 2 MTPA integrated steel plant with a 1.5 MTPA gas-based Hot

Briquetted Iron (HBI) plant.

JSPL has installed power capacity of

3,400MW through its wholly owned

subsidiary Jindal Power Limited (JPL). In FY18, JPL had Power Purchase Agreement

(PPA) of 1,350MW and it operates at 35-37% utilization.

Exhibit 1: Product mix and installed capacity

Source: Company, Angel Research

Steel Sector outlook

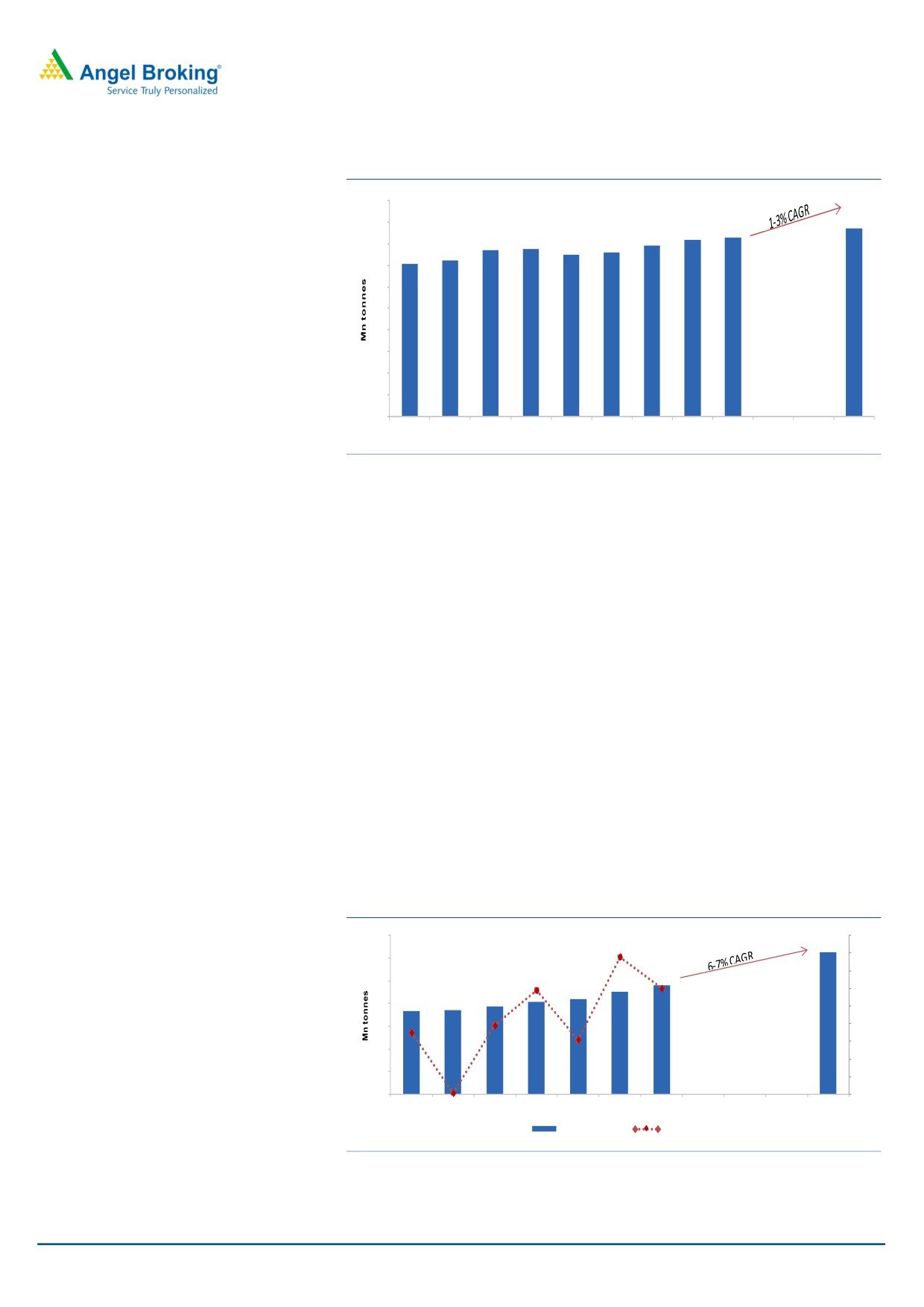

Global steel demand to grow at 1-3% through FY2022

In 2017, global steel demand grew at 4.8% yoy supported by robust growth from

China at 8.3% followed by US, Japan and EU at 6.4%, 3.5 and 3.1% respectively.

Going ahead, we expect steel demand to benefit from favorable global economic

momentum, especially in advanced economies, however, the risks arising from

global trade tensions still exist. Further, higher than expected GDP growth would

aid 2-2.5% growth in steel demand from US and EU. China’s demand growth is

expected to moderate to 2-3% yoy owing to the slack in the construction industry

and declining auto production. However, India is expected to outperform with

strong growth projection of ~6% yoy led by robust growth in infrastructure and

construction segments coupled with healthy automobile production.

July 05, 2018

2

JSPL | Quick Take

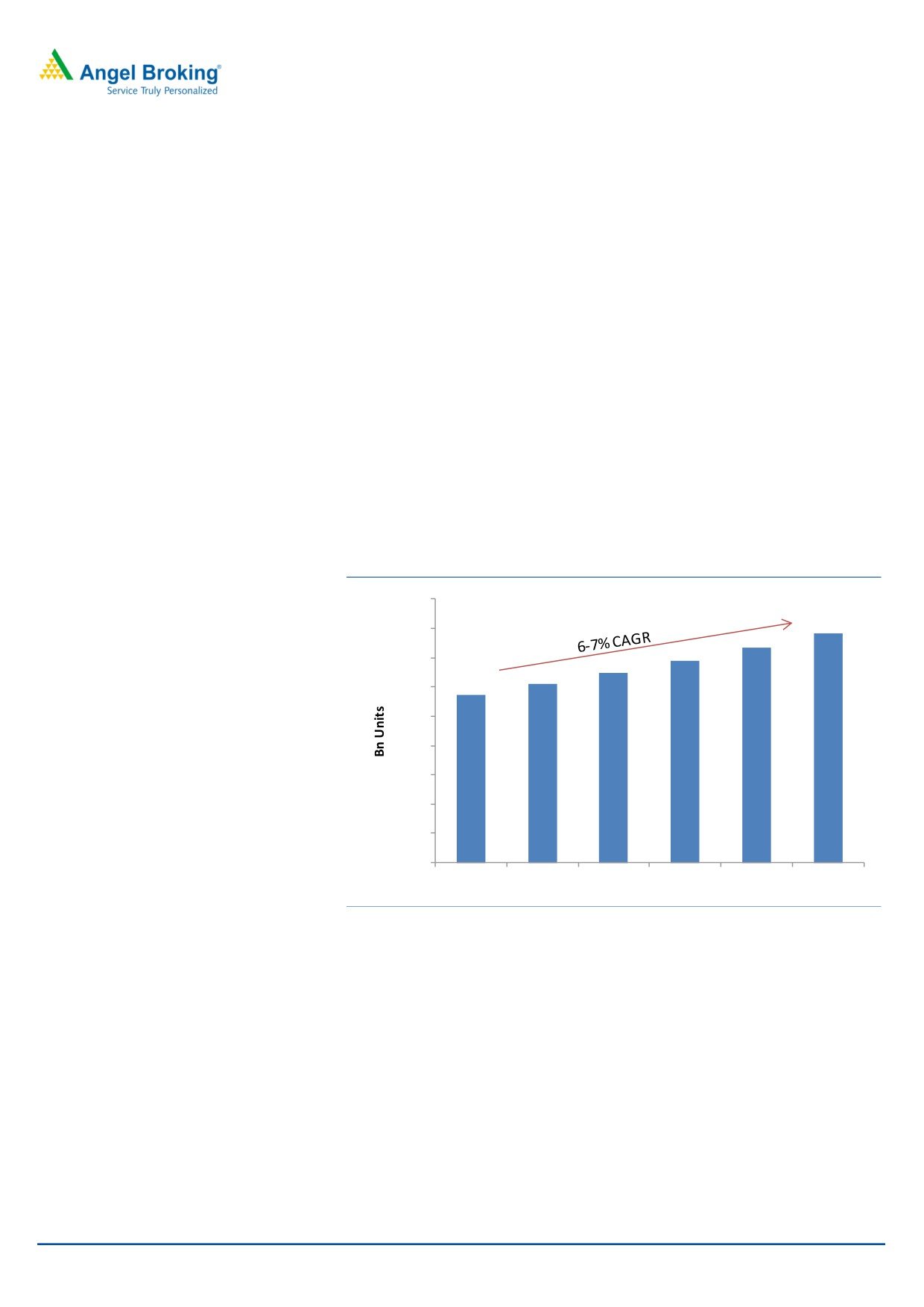

Exhibit 2: Global steel demand

2000

1742

1800

1660

1631

1587

1535

1546

1600

1501

1515

1414

1443

1400

1200

1000

800

600

400

200

0

2011

2012

2013

2014

2015

2016

2017

2018P

2019P

2022P

Source: CRISIL, Angel Research

Domestic steel demand to grow at 6-7% through FY2022

Post witnessing moderate growth period since 2012, India's steel demand is

exhibiting swift comeback with vigorous growth of 7.8% yoy in FY2018. Pent-up

demand from low base of last year (affected due to demonetization), pick up in

infra projects, robust growth in auto (automobile production was up 14%) has

provided the required thrust to the sector's growth.

Going ahead, we foresee steel demand to continue its strong stride at 6-7%

through FY2022E supported by government led initiatives, especially affordable

housing and infrastructure projects in metro, road and urban infra space (which

are more steel intensive). Government’s focus is expected to rise towards

execution of affordable housing, with 2019 being a pre-election year.

This is evident from the recent rise in houses sanctioned for construction tripling

to 4 million in March 2018 as against 1.3 million in January 2017. Additionally,

awarding of infrastructure projects is also estimated to pick-up going ahead.

Moreover, automotive production is also expected to witness a robust growth of

7-9% through FY2022.

Exhibit 3: Domestic steel consumption

140

9.00%

125

8.00%

120

7.00%

96

100

91

82

84

6.00%

77

80

74

74

5.00%

60

4.00%

3.00%

40

2.00%

20

1.00%

0

0.00%

FY13

FY14

FY15

FY16

FY17

FY18P FY19P

FY23P

Steel consumption

Y-o-Y growth

Source: CRISIL, Angel Research

July 05, 2018

3

JSPL | Quick Take

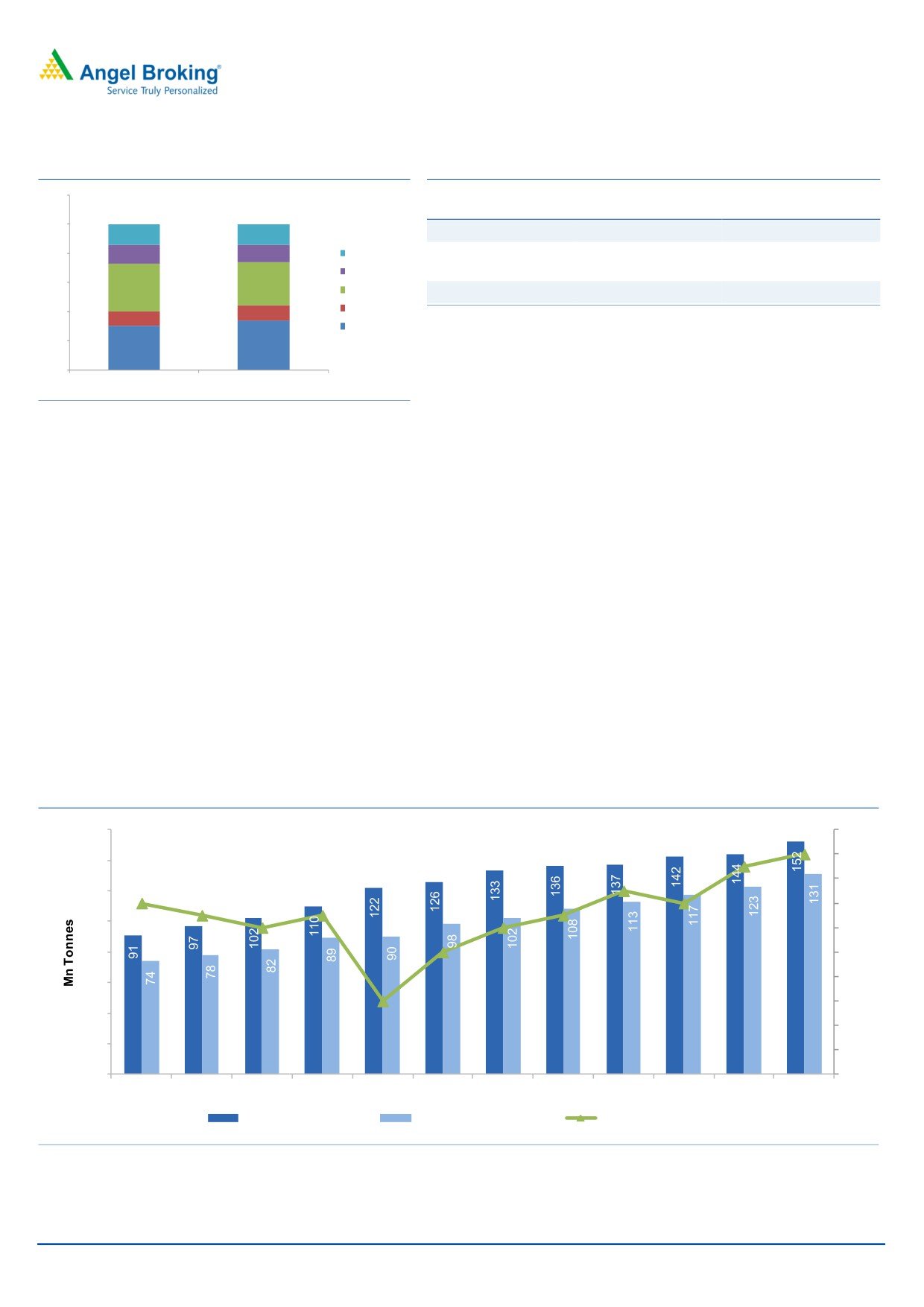

Exhibit 4: Sector wise growth

Exhibit 5: Key sectors growth rate

120%

Past 5 year growth

Next 5 years growth

Segments

(%)

(%)

100%

14%

14%

Infrastructure

6-7%

8-10%

80%

13%

12%

Others

Building &

2-3%

4.5-5.5%

Capital & Consumer g

Construction

60%

30%

33%

Building & Constructi

Automotive Vehicles

5%

7-8%

40%

Automotive Vehicles

10%

10%

Source: CRISIL, Angel Research

Infrastructure

20%

30%

34%

0%

FY18

FY23P

Source: CRISIL, Angel Research

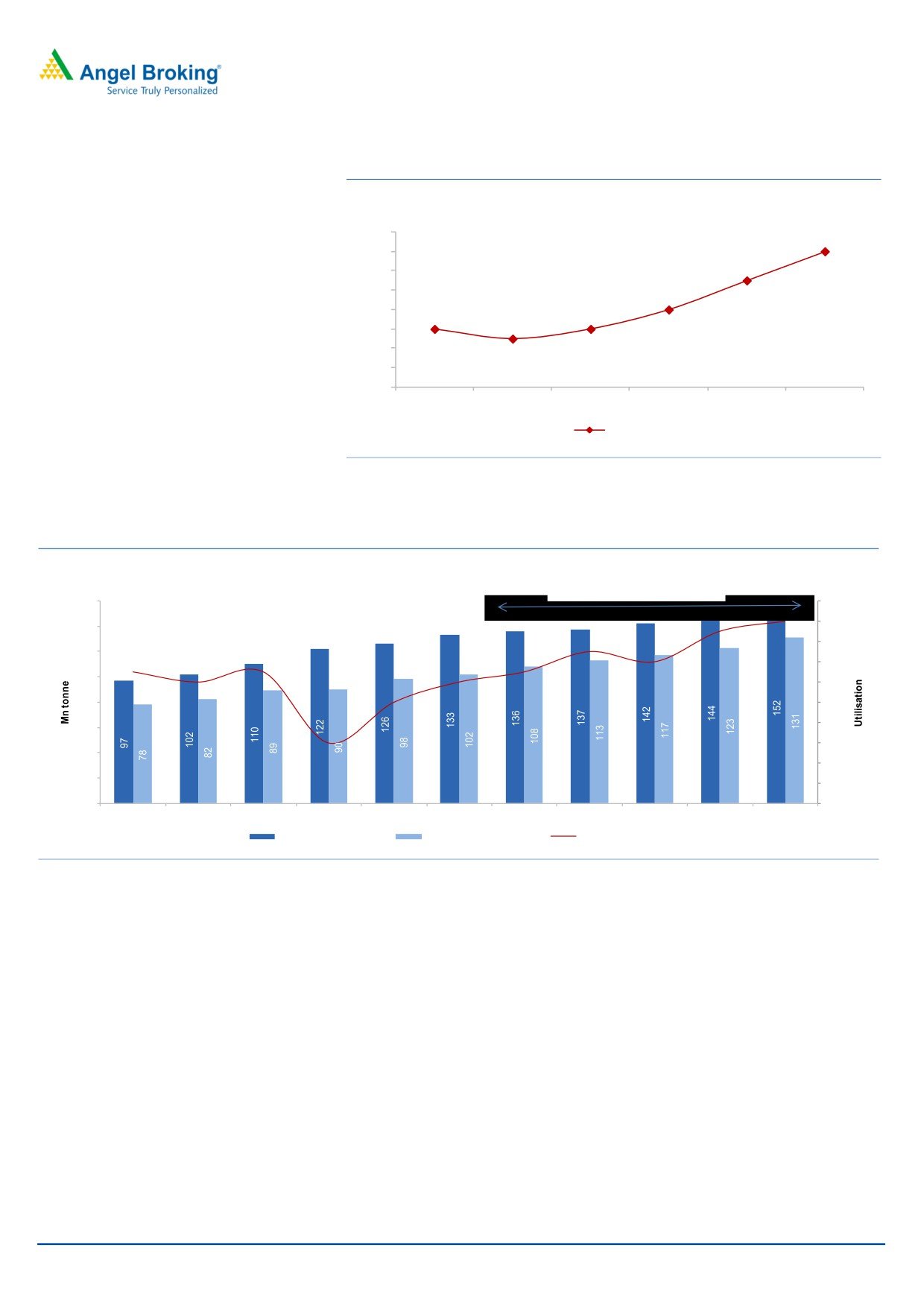

Improvement in utilization levels to continue its upward trajectory

After reaching lower utilization levels in FY2016 due to flooding imports,

utilization levels have revived to 78% in FY2017 with government intervention.

Even in FY2018, utilization levels steered upward to 80% led by 7.8% demand

growth and 17% export growth coupled with capacity additions commissioning

towards later part of the year.

With upcoming elections in 2019, progress of government-led projects under

affordable housing and infrastructure sector is estimated to expedite. Moreover,

automobile production, primarily cars and MHCVs, is expected to grow in the

range of 7-8%. This shall potentially result in uptick in the domestic steel demand

at 5.5-6.5% yoy. Healthy demand prospects and positive export outlook coupled

with minimal capacity additions to further improve utilization levels. Over the next

five years, with healthy demand growth at 6-7%, stable exports levels and limited

capacity additions would increase utilization levels to 86% by FY2022.

Exhibit 6: Improving Utilization level

160

88%

86%

86%

140

85%

84%

120

83%

82%

82%

82%

81%

81%

81%

100

80%

80%

80%

80

78%

78%

76%

60

74%

74%

40

72%

20

70%

0

68%

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19P FY20P FY21P FY22P FY23P

Crude steel capacity

Crude steel production

Crude steel Utilization

Source: CRISIL, Angel Research

July 05, 2018

4

JSPL | Quick Take

Power Sector Outlook

Indian power sector is undergoing a significant change that has redefined the

industry’s outlook. Sustained economic growth continues to drive electricity

demand in India. The Government of India’s focus on attaining ‘Power for all’ has

accelerated capacity addition in the country. At the same time, the competitive

intensity is increasing at both the market and supply sides (fuel, logistics, finances,

and manpower). Total installed capacity of power stations in India stood at 344

Gigawatt (GW) as on April, 2018.

Power demand to grow at 6-6.5 % CAGR over FY2019-22

Power demand is expected to register a healthy growth of 6-6.5% CAGR over the

next 5 years (FY2018-22). Industrial demand is expected to grow at a moderate

pace, in-line with GDP growth and gradual pick-up in economic activity. However,

residential demand is expected to witness stronger growth on account of higher

latent demand and rapid urbanization coupled with impetus from government for

rural electrification. Electricity consumption in domestic segment is estimated to

increase at a rapid pace of around 8.5-9.0% over FY2018-22 and its share in total

electricity consumption is expected to increase to 25% in FY2021 from 23% in

FY2016

Exhibit 7: Power sector requirement

1800

1566

1600

1400

1143

1200

1000

800

600

400

200

0

FY17P

FY18P

FY19P

FY20P

FY21P

FY22P

Source: CRISIL, Angel Research

Higher PLF on the back of demand growth

Power supply deficit is expected to narrow down to zero as oversupply situation is

going to persist owing to ~29 GW of coal based capacity additions over FY2019-

23. However, retirement of ~9.5 GW of old capacities over the same period and

higher growth in demand at ~6.8% CAGR would support PLFs. The PLFs are

expected to steadily rise to 67-68% by FY2022 with higher off-take from existing

tied up capacities, thereby benefitting generators. Coal based PLFs are estimated

to remain low at about 62% till FY2020. However, from FY2020 onwards, with an

improvement in power demand and retirement of old plants coupled with

slowdown in capacity additions owing to stretched financials of developers, we

expect an improvement in coal based PLFs to about 67-68% by FY2021-22.

July 05, 2018

5

JSPL | Quick Take

Exhibit 8: Coal based utilisation to improve

Utilisation

70%

68%

68%

66%

65%

64%

62%

62%

60%

60%

60%

59%

58%

56%

54%

FY17

FY18P

FY19P

FY20P

FY21P

FY22P

Utilisation

Source: CRISIL, Angel Research

Exhibit 9: Limited Capacity addition with improving utilisation

Capacity addition 18-20 MT

160

88%

86%

140

85%

84%

120

83%

82%

82%

81%

81%

81%

100

80%

80%

80%

80

78%

78%

76%

60

74%

74%

40

72%

20

70%

0

68%

FY13

FY14

FY15

FY16

FY17

FY18

FY19P

FY20P

FY21P

FY22P

FY23P

Crude steel Capacity

Crude steel Production

Crude steel utilisation

Source: CRISIL, Angel Research

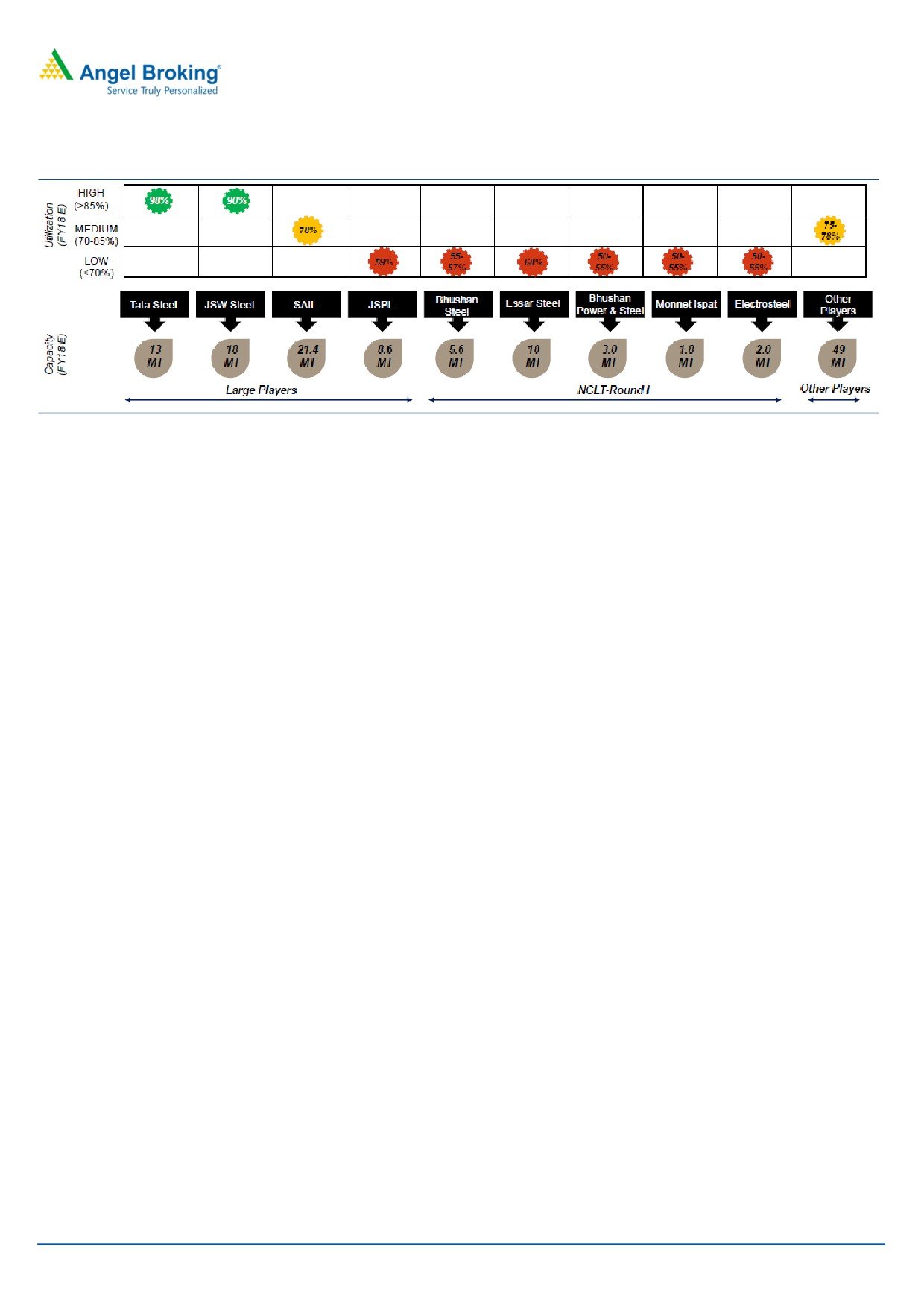

Limited capacity addition leads to improving utilization

Steel capacity expansion is expected to increase moderately due to fewer

additions i.e. from 133 MT in FY18 to 152 MT in FY23E, with net addition of ~18-

20 MT against 36 MT in last five years. Apart from this, India’s nearly one-fifth of

steel capacity is referred to NCLT, hence consolidation in industry is expected and

post acquisition (if any), the potential ramping up of the stressed asset (refer

Exhibit 10) by around 3-4 MTPA is estimated. We expect this scenario to create a

significant opportunity for JSPL to tap the upcoming steel demand and deliver

better performance.

July 05, 2018

6

JSPL | Quick Take

Exhibit 10: Steel player’s capacity and Utilisation

Source: CRISIL, Angel Research

Investment Argument

Capacity expansion done; EBIDTA/Tonne likely to improve:

The company has more than doubled its crude steel capacity in last five years

from 3.6 MTPA to 8.6 MTPA and is currently running at ~50% utilization. However,

given the current market scenario of steel demand, we expect utilization level to

improve to 80-85% over the next 7-8 months. Further, Jindal Shadeed (OMAN

subsidiary), with a crude steel capacity of 2MTPA, has ramped up significantly in

the last three years and is running at ~ 80% utilization. We expect the plant to

reach to further utilization level of 85-90% going ahead. On account of this, we

expect a combined output of crude steel to reach to 8.5-9 MTPA by FY19E.

Moreover, higher utilization of current capacity would lead to an improvement in

the company’s steel production and enhance operating margins. Over FY19-20E,

we expect JSPL to report EBITDA/tonne in the range of `10,500-12,000 (`12,500

EBIDTA/tonne in Q4FY18) owing to continuous demand of steel from

infrastructure, housing and auto sectors

Improvement in PLF and PPA going ahead

JPL currently has PPA arrangement of 30% of total installed capacity of 3400 MW

power plant and running at 37% utilization level. During the year JPL has signed a

250MW PPA and it is in discussions with various utilities for another 300MW PPA

and management expects to generate ~ 1,700 MW units by FY19. We expect the

plant’s utilization to improve further owing to increasing power demand and

GOI’s effort to improve coal availability with implementation of SHAKTI scheme.

July 05, 2018

7

JSPL | Quick Take

Exhibit 11: PPA arrangements

Project

Buyer

Type

From

ToQuantum MW

Tamnar II (Phase 1)

Long term Feb-14 Sep-18

400

Tamilnadu

Tamnar

Medium TermSep-17Aug-19

200

Tamnar II (Phase 1)

Long Term Jun-18May-41

200

KSEB

Tamnar II (Phase 1)

Oct-18 Sep-42

150

Tamnar II

After

60

(Phase 1)

commercial

operation of

Chhattisgarh

Long Term

Tamnar II

Unit and for

60

(Phase 2)

complete life

of plant

Source: Company, Angel Research

Exhibit 12: Coal arrangements

Arrangements

Tamnar-I (EUPI)*Tamnar-II (EUPII)Tamnar-II-(EUP III)

Coal sourced through market

linkages with

FSA

purchase and e-auction

MGL and SECL

TNEB-400MW

CSEB-60MW

PPA

TNEB-200 MW

CSEB-60MW

KSEB-200MW

KSEB-150 MW

Source: Company, Angel Research

*Disinvestment announced

Valuation Assumption

We value the stock on Asset based approach, valuing each segment’s assets at

discount to its peer companies, while applying multiple to respective asset. We

arrive at the SOTP based target price of ` 327.

July 05, 2018

8

JSPL | Quick Take

Exhibit 13: Asset based SOTP Valuation

Segments

Capacity

Multiple (X) ` Cr.

Total `Cr.

Power- (EV/MW)*

3,400

4

13,600

Steel- (EV/Tonne)#

10.6

5,400

57,240

Consol Enterprise Value (A)

70,840

Add

CWIP (B)

3,877

Cash(C)

468

Subtotal (D )= (A)+(B)+(C)

75,185

Less

Debt FY18 (E)

42,000

Equity Value ( F)= (D)-(E)

33,185

No of share (G)^

102

Value per share INR (F)/(G)

327

CMP

212

Upside

54%

Source: Company, Angel Research

Note:

*Disinvestment announced in May 2016 by JSW Energy to acquire 1,000 MW (4X250)

Tamnar Thermal Power Plant from JSPL.

Valuing Power segment by applying multiple of `4Cr./MW at 16% discount to JSW

Energy’s EV `4.75Cr./MW.

# Valuing the steel segment by applying multiple of `5,400Cr. /MTPA at 12% discount

to JSW Steel’s EV/Tonne `6,100Cr. /MTPA.

^ Factoring issuance of warrant shares.

Exhibit 14: Peer Asset Valuation

Particular

JSW steel

Tata Steel JSW Energy Tata power

NTPC

EV/Tonne

6,103

5,393

EV/MW

4.8

5.5

4.6

Crude steel Capacity (MTPA)

18

28

Power Generation Capacity (MW)

4,437

10,757

53,651

Source: Company, Angel Research

Outlook & Valuation

JSPL is currently placed at an inflection point where it is witnessing positive

changes like (a) end of capex cycle and equipped with fully operational Angul

plant with 5 MTPA capacity, (b) increasing demand of power going forward with

expectation of signing new PPA at JPL, (c) monetization of few assets like

disinvestment of Tamnar- (EUP-I) 1,000 MW power plant and planning for IPO of

OMAN plant. Considering the company’s recent developments and favorable

business environment, we believe JSPL is trading at attractive valuation to its peer,

hence we recommend ACCUMULATE on the stock with Target Price of `327

based on asset based approach of Steel segment on EV/Tonne basis and Power

segment on EV/MW basis.

July 05, 2018

9

JSPL | Quick Take

Key risks

Shortage of coal

The major threat for the company is the shortage and higher coal prices going

forward, which may affect the power segment adversely.

Excess supply of steel

Resolution in NCLT phase I is a key, any material improvement in utilization of this

group company may stabilizes or reduce steel price in future. However, this plant

is already running at 60-70% utilization level.

Softening of steel prices

Any slowdown of investments in key steel consuming sector such as

infrastructure, housing and auto may trigger lower demand of steel, which could

lead to subdued steel prices.

Income Statement

Y/E March (`cr)

FY16

FY17

FY18

FY19E FY20E

Total operating income

18,371

21,051

27,383

35,918

44,048

% chg

(6)

15

30

31

23

Total Expenditure

15,170

16,714

21,502

27,821

33,468

Raw Material

6,076

6,535

9,378

11,709

14,536

Personnel

947

914

956

1,268

1,555

Purchase of finished goods

21

265

324

359

440

Others Expenses

8,127

8,999

10,843

14,484

16,937

EBIDTA

3,201

4,337

5,882

8,097

10,580

% chg

(51)

35

36

38

31

(% of Net Sales)

17.4

20.6

21.5

22.5

24.0

Depreciation& Amortisation

4,068

3,949

3,883

4,114

4,234

EBIT

-867

388

1,999

3,983

6,346

% chg

(123)

(145)

415

99

59

(% of Net Sales)

-5

2

7

11

14

Interest & other Charges

3,254

3,441

3,866

3,866

3,866

Other Income

157

10

3

3

3

Extraordinary Items

(236)

(372)

(577)

-

-

Recurring PBT

-3,728

-2,671

-1,287

121

2,483

% chg

(220)

(28)

(52)

(109)

1,960

Tax

-877

-503

-240

28

571

PAT (reported)

-2,850

-2,168

-1,047

93

1,912

% chg

(189)

(24)

(52)

(109)

1,960

(% of Net Sales)

-15.5

-10.3

-3.8

0.3

4.3

Basic & Fully Diluted EPS (Rs)

-32

-26

-17

1

20

Source: Company, Angel Research

July 05, 2018

10

JSPL | Quick Take

Balance Sheet

Y/E March (` cr)

FY16

FY17

FY18

FY19E FY20E

SOURCES OF FUNDS

Equity Share Capital

91

92

97

97

97

Reserves& Surplus

32,345

29,959

30,283

30,376

32,288

Shareholders’ Funds

32,436

30,051

30,380

30,473

32,385

Equity Share warrant

5

5

5

Minority Interest

900

647

440

338

235

Total Loans

44,132

39,958

39,198

38,824

34,362

Other Liabilities

6,911

6,430

6,074

8,412

8,744

Total Liabilities

84378

77086

76097

78052

75731

APPLICATION OF FUNDS

Net Block

66,195

66,934

69,550

67,732

65,997

Capital Work-in-Progress

10,703

8,714

3,877

1,947

1,850

Investments

359

368

146

146

146

Long Term Loans & Advances

-

-

Current Assets

12,732

13,022

14,313

18,245

21,727

Inventories

3,254

3,599

4,960

6,396

7,241

Sundry Debtors

1,429

1,717

1,826

2,423

2,972

Cash & Cash Equivalent

620

477

468

254

344

Loans & Advances

7,354

6,841

6,589

8,743

10,722

Investments & Others

74

387

471

429

450

Current liabilities

8,815

13,489

13,133

17,488

20,765

Net Current Assets

3,917

-467

1,180

758

963

Other Non Current Asset

3,204

1,537

1,343

7,470

6,775

Total Assets

84378

77086

76097

78052

75731

Source: Company, Angel Research

July 05, 2018

11

JSPL | Quick Take

Cash Flow

Y/E March (`cr)

FY16

FY17

FY18

FY19E

FY20E

Profit before tax

(3,728)

(2,671)

(1,287)

121

2,483

Depreciation

4,068

3,949

3,883

4,114

4,234

Change in Working Capital

Interest / Dividend (Net)

3,254

3,441

3,866

3,866

3,866

Direct taxes paid

(877)

(503)

(240)

28

571

Others

1,617

2,582

(516)

(701)

(114)

Cash Flow from Operations

4,333

6,799

5,706

7,427

11,040

(Inc.)/ Dec. in Fixed Assets

(3,853)

(2,354)

(2,000)

(2,499)

(2,498)

(Inc.)/ Dec. in Investments

1,589

356

175

(46)

(45)

Cash Flow from Investing

(2,261)

(1,998)

(1,825)

(2,545)

(2,543)

Issue of Equity

-

-

1,200

-

-

Inc./(Dec.) in loans

-17085.5

-2875.18

-759.59

-374.85

-4462

Others

14,414

(2,181)

(4,306)

(4,516)

(3,946)

Cash Flow from Financing

(2,672)

(5,057)

(3,866)

(4,891)

(8,408)

Inc./(Dec.) in Cash

(600)

(256)

15

(9)

89

Opening Cash balances

1,103

503

247

262

254

Closing Cash balances

503

247

263

254

343

Source: Company, Angel Research

Key Valuation

Y/E March (X)

FY2016 FY2017

FY2018

FY2019E

FY2020E

P/E (on FDEPS)

-

-

-

215.9

10.5

P/CEPS

16.5

11.3

7.1

4.8

3.3

P/BV

0.6

0.7

0.7

0.7

0.6

EV/Sales

3.6

2.9

2.2

1.6

1.2

EV/EBITDA

19.9

13.8

10.1

7.3

5.2

EV / Total Assets

0.8

0.8

0.8

0.8

0.7

Per Share Data (`)

EPS (Basic)

-31.9

-26.2

-16.8

1.0

19.8

EPS (fully diluted)

-30.4

-25.0

-16.0

0.9

18.8

Cash EPS

12.6

18.4

29.3

43.5

63.5

DPS

0.0

0.0

0.0

0.0

0.0

Book Value

335

310

314

315

335

Returns (%)

ROCE

-1.1

0.6

2.9

5.7

9.5

Angel ROIC (Pre-tax)

-1.2

0.6

2.8

5.3

8.6

ROE

-9.5

-8.5

-5.3

0.3

5.9

Turnover ratios (x)

Inventory / Sales (days)

66

64

67

65

60

Receivables (days)

29

31

25

25

25

Payables (days)

47

52

56

56

56

Working capital cycle (ex-cash) (days)

48

43

35

33

28

Source: Company, Angel Research

July 05, 2018

12

JSPL | Quick Take

Research Team Tel: 022 - 39357800

DISCLAIMER

DISCLAIMER:

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014

vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Company Name

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

July 05, 2018

13