1

Please refer to important disclosures at the end of this report

1

1

Incorporated in 1986, Indian Railway Finance Corporation Limited (IRFC) is a

dedicated market borrowing arm of Indian Railways. Their primary business is

financing the acquisition of rolling stock assets, which includes both powered and

unpowered vehicles, for example locomotives, coaches, wagons, trucks, flats,

electric multiple units, containers, cranes, trollies of all kinds and other items of

rolling stock components, leasing of railway infrastructure assets and national

projects of the Government of India (GoI) and lending to other entities under the

Ministry of Railways, GoI.

Positives: (a) Strategic role in financing growth of Indian Railways (b) Competitive

cost of borrowings based on strong credit ratings in India and diversified sources of

funding (c) Consistent financial performance and cost plus model (d) Low risk

business model along with strong asset-liability management.

Investment concerns: (a) Company derives a significant amount of their revenue

from operations from the Indian Railways. A loss of or reduction in business from

the Indian Railways, any direct borrowing by the Indian Railways or introduction of

any new avenues of funding by the Ministry of Railways, Government of India could

have an adverse effect on their business. (b) Their business is dependent on the

continued growth of the Indian railway sector, making them susceptible to the GoI

initiatives to modernize the railways and other policies. (c) Disruption in their

funding sources or any inability to raise funds at a low cost.

Outlook & Valuation: IRFC has posted strong growth in operating income of

20.7% CAGR between FY18-20 while net profits have grown at a CAGR of

26.3% during the same period. Company is unlikely to face any asset quality

issues given the fact that the company caters to the Government of India. At the

higher end of the price band the stock would be trading at P/BV of 1.0x fully

diluted post issue book value of `26.6 per share. We expect the company to

post strong growth driven by capex by Indian railways along with stable

margins due to cost plus model. Given the growth prospects, we recommend a

SUBSCRIBE rating on the issue.

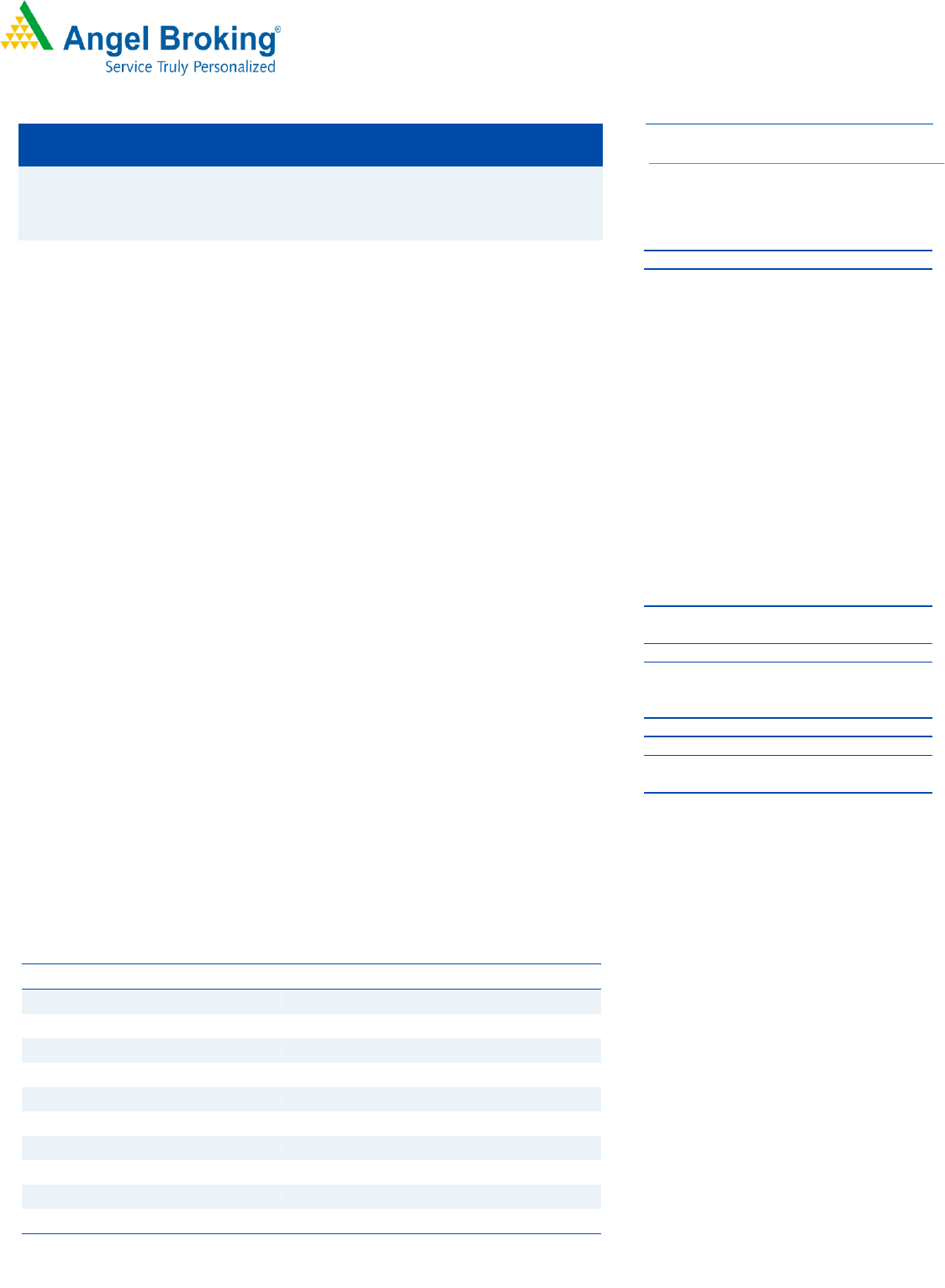

Key Financials

Y/E March (` Cr)

2018

2019

2020

Operating Income

9,206

10,987

13,420

% chg

-

9%

16%

Net Profit

2,001

2,140

3,192

% chg

-

7%

49%

NIM (%)

1.7%

1.6%

1.4%

EPS (`)

3.1

2.3

2.7

P/E (x)

8.5

11.4

9.7

P/BV (x)

0.8

1.0

1.0

RoA (%)

1.2%

1.2%

1.3%

RoE (%)

9.8%

9.5%

11.6%

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of

the price band

Subscribe

Issue Open: January 18, 2021

Issue Close: January 20, 2021

Offer for Sale: 59.4 cr

share

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 86.4%

Others 13.6%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 13,069 cr

Issue size (amount): *`4,455cr - **`4,633cr

Price Band: ` 25-26

Lot Size: 575 shares and in multiple thereafter

Post-issue implied mkt. cap: * ` 32,671cr - **`

33,978cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 86.4%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: 118.8 cr share

Iss ue Details

Face Value: ` 10

Present Eq. Paid up Capital: ` 11,880cr

Indian Railway Finance Corporation Ltd

IPO Note | NBFC

January 15, 2021

2

Janu

ary

15,

20

INDIAN RAIWAY FINANCE CORPORATION Ltd | IPO Note

January 15, 2021

2

Company background

Indian Railway Finance Corporation Limited is a dedicated market borrowing arm

of Indian Railways founded on 12

th

December 1986 as a public limited company.

Company received a certificate of commencement of business from the RoC on

23

rd

December 1986. RBI on November 22, 2010 classified the company as

NBFC-ND-Infrastructure Finance Corporation.

The company is primarily engaged in the business of financing acquisition of

rolling stock assets, leasing of project assets loans and lending to other entities

under administrative control of Ministry of Railways.

The MoR is responsible for the procurement of rolling stock assets and for the

improvement, expansion and maintenance of project assets. The company is

responsible for raising the finance necessary for such activities.

Issue details

IPO is a mix of offer for sale & issue of fresh equity shares. 118.8 crore new shares

would be issued and 59.4 crore shares will be sold by promoter in the offer for

sale in the price band of ` 25-26.

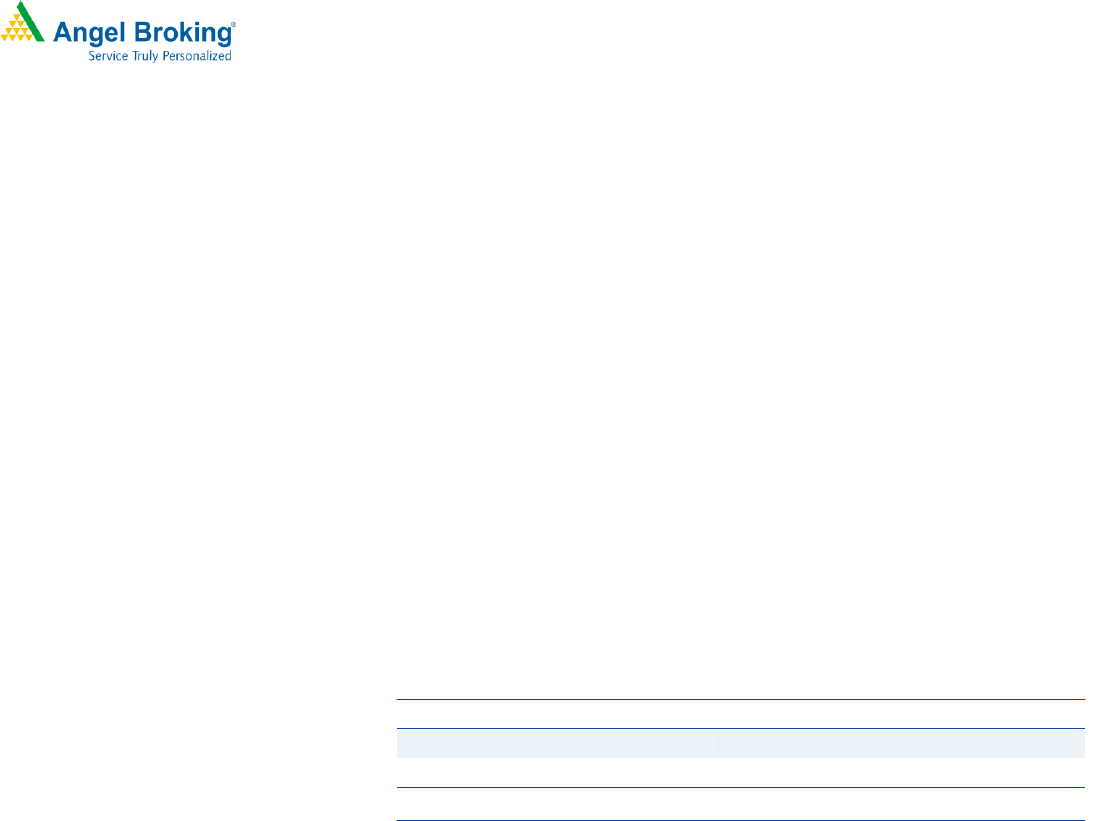

Pre and post IPO shareholding pattern

No of shares (Pre-issue)

%

No of shares (Post-issue)

%

Promoter

11,880,460,000

100

11,286,437,000

86.4

Public

-

-

1,782,069,000

13.6

Total

11,880,460,000

100

13,068,506,000

100

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Augmenting company equity capital base to meet their future capital

requirements arising out of growth in their business

General corporate purposes, subject to the applicable laws.

Key Management Personnel:

Amitabh Banerjee is the Chairman and Managing Director of the company. He

holds a bachelor’s degree honours) in commerce from the Shri Ram College of

Commerce, University of Delhi and a master’s degree in commerce from

University of Delhi and is also a fellow member of the Institute of Cost Accountants

of India. He is an officer of the Indian Railways Accounts Service (1988 batch).

Prior to his current position, he was associated with Konkan Railway Corporation

Limited as well as the Hindustan Paper Corporation Limited in the capacity of

director (finance).

Shelly Verma is the Director (Finance) and Chief Financial Officer of the company.

She holds a bachelor’s degree in commerce from the University of Delhi and is

also a fellow member of the Institute of Chartered Accountants of India. She has

more than 30 years of experience in power sector financing. Prior to her

appointment to the Board, she has served in various capacities, including, most

recently, as an executive director with Power Finance Corporation Limited.

3

Janu

ary

15,

20

INDIAN RAIWAY FINANCE CORPORATION Ltd | IPO Note

January 15, 2021

3

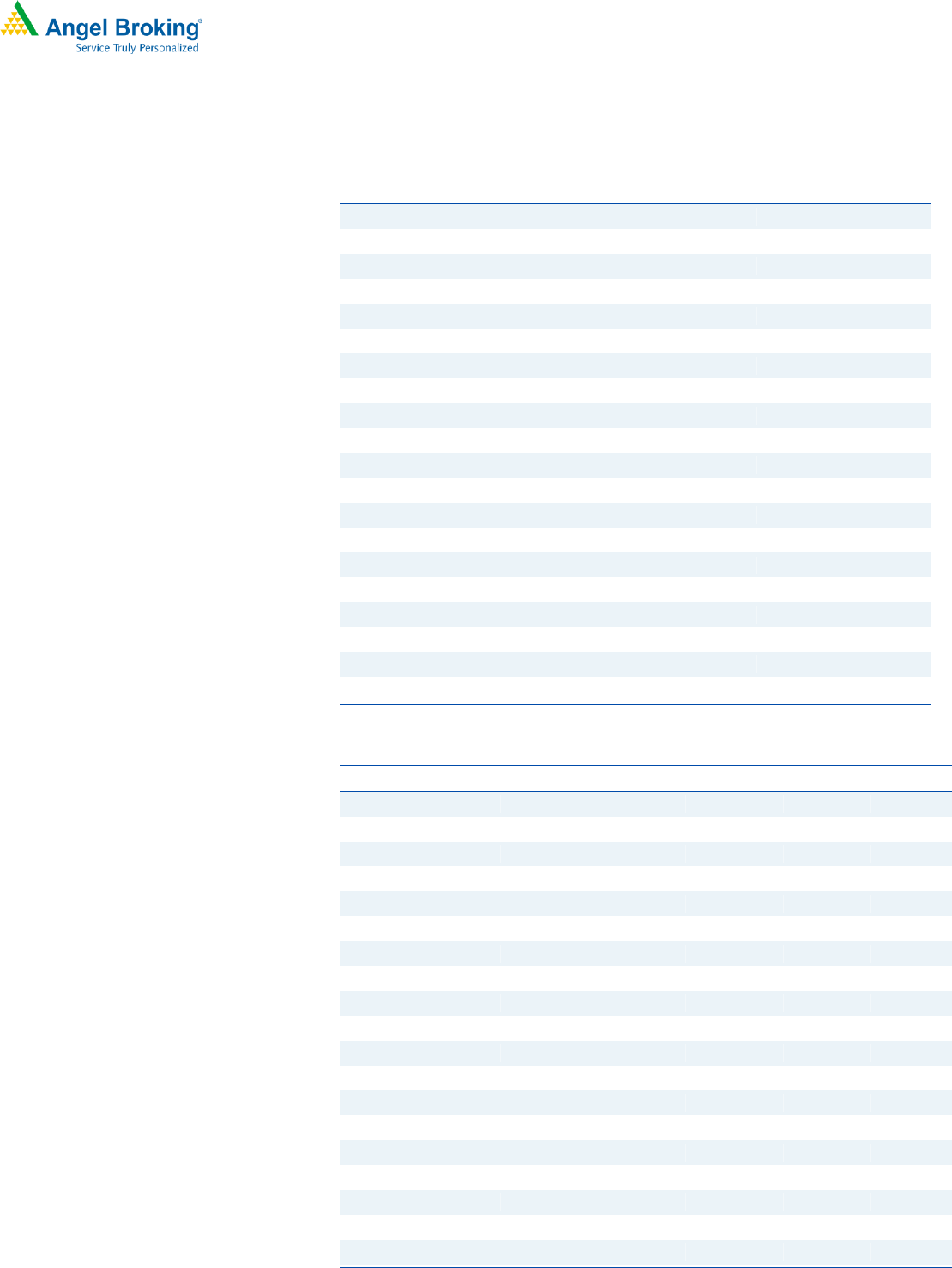

Income Statement

Y/E March (` Cr)

FY18

FY19

FY20

H1FY20

H1FY21

Operating Income

9,206

10,987

13,420

6,575

7,383

Interest Expended

6,638

8,183

10,163

4,937

5,441

Net Operating Income

2,569

2,804

3,258

1,637

1,942

- YoY Growth (%)

9%

16%

-

19%

Other Income

1.4

0.5

0.7

2.7

1.9

- YoY Growth (%)

-62%

29%

-

-28%

Total Income

2,570

2,804

3,258

1,640

1,944

- YoY Growth (%)

9%

16%

-

19%

Operating Expenses

38

21

64

9

57

- YoY Growth (%)

-44%

200%

-

521%

Pre - Provision Profit

2,532

2,783

3,194

1,631

1,887

- YoY Growth (%)

10%

15%

-

16%

Prov. & Cont.

-

28

2

-

-

- YoY Growth (%)

-

-92%

-

-

Profit Before Tax

2,532

2,755

3,192

1,631

1,887

- YoY Growth (%)

9%

16%

-

16%

Prov. for Taxation

530

615

-

-

-

- as a % of PBT

16%

-100%

-

-

PAT

2,001

2,140

3,192

1,631

1,887

- YoY Growth (%)

7%

49%

-

16%

Source: Company, Angel Research

Balance Sheet

Y/E March (` Cr)

FY18

FY19

FY20

H1FY20

H1FY21

Equity

6,526

9,380

11,880

9,380

11,880

Reserve & Surplus

13,798

15,486

18,419

16,865

19,807

Networth

20,324

24,866

30,300

26,245

31,687

Debt Securities

110,844

123,598

155,290

135,190

161,259

- Growth (%)

12%

26%

-

19%

Borrowings

23,161

50,335

79,086

49,442

84,091

Other Liab. & Prov.

7,121

7,639

10,828

27,401

14,950

Total Liabilities

161,451

206,438

275,504

238,278

291,987

Cash Balances

1

4

1

1

2

Bank Balances

99

77

99

9,618

94

Investments

14

13

12

12

11

Lease Receivables

149,297

195,018

259,688

216,238

271,739

- Growth (%)

31%

33%

-

26%

Advances

5,238

5,895

6,423

5,650

6,243

- Growth (%)

13%

9%

-

11%

Fixed Assets

11

11

11

11

11

Other Assets

6,791

5,419

9,270

6,749

13,886

Total Assets

161,451

206,438

275,504

238,278

291,987

- Growth (%)

28%

33%

-

23%

Source: Company, Angel Research

4

Janu

ary

15,

20

INDIAN RAIWAY FINANCE CORPORATION Ltd | IPO Note

January 15, 2021

4

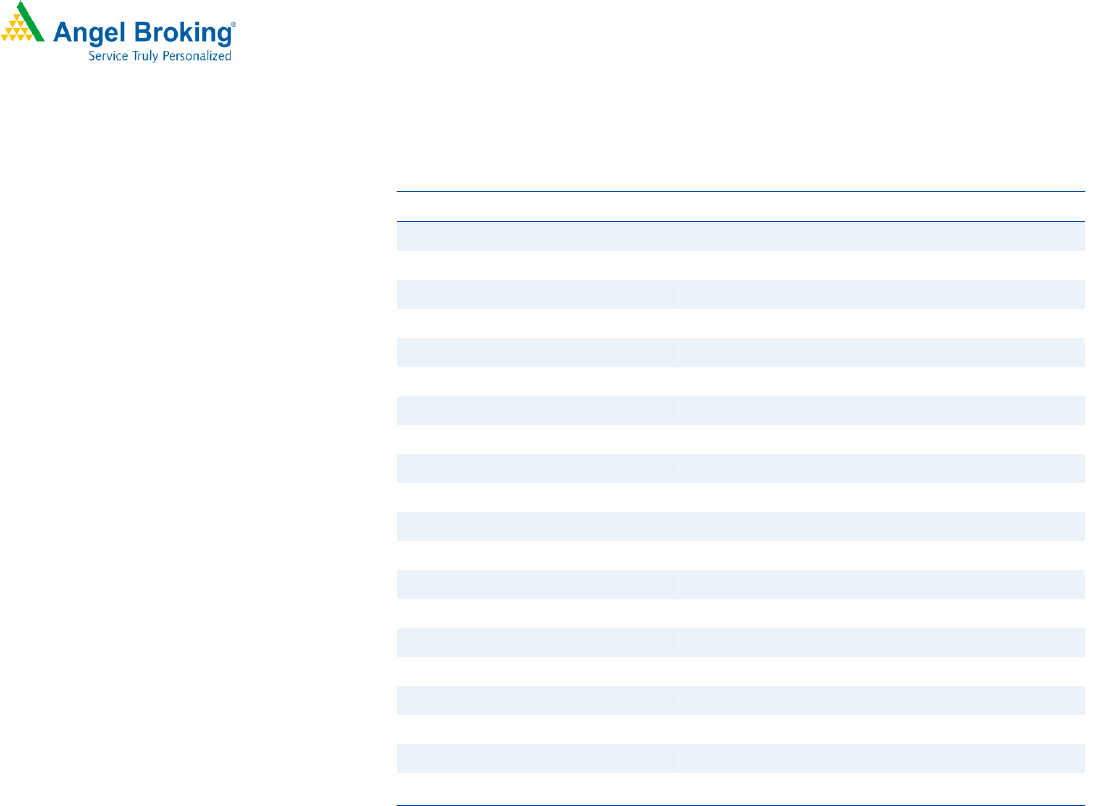

Key Ratios

Y/E March

FY18

FY19

FY20

Profitability ratios (%)

NIMs

1.7%

1.6%

1.4%

Cost to Income Ratio

1.5%

0.8%

2.0%

RoA

1.2%

1.2%

1.3%

RoE

9.8%

9.5%

11.6%

B/S ratios (%)

Debt/Equity

6.6

7.0

7.7

Financial Leverage

7.9

8.3

9.1

CAR

320.6%

347.1%

395.4%

Tier I

320.6%

347.1%

395.4%

Asset Quality (%)

Gross NPAs

-

-

-

Net NPAs

-

-

-

Per Share Data (Rs)

EPS

3.1

2.3

2.7

BVPS

31.1

26.5

25.5

DPS

0.36

0.48

0.21

Valuation Ratios

PER (x)

8.5

11.4

9.7

P/BVPS (x)

0.8

1.0

1.0

Source: Company, Angel Research (Valuation at the upper price band)

5

Janu

ary

15,

20

INDIAN RAIWAY FINANCE CORPORATION Ltd | IPO Note

January 15, 2021

5

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.