Please refer to important disclosures at the end of this report

1

Indian Railway Catering and Tourism Corporation Limited (IRCTC)

is a

Central Public Sector Enterprise wholly owned by the Government of India

and under the administrative control of the Ministry of Railways.

It

operates in four business segments, namely, internet ticketing, catering,

packaged drinking water under the “Rail Neer”

brand, and travel and

tourism.

Positives: (1)

It is the only entity authorized by Indian Railways to provide

catering services

, online railway tickets and packaged drinking water at railway

stations and trains in India. 2) From September 01, 2019 Ministry

of railways have

permitted Company to charge `15 for Non- AC & `

30 for AC ticket booked

online. If tickets are booked through BHIM or UPI charges are `10 & `

20 for

Non-AC and AC respectively. 3)

Market share of packaged drinking water at

railway premised and trains will

increase to ~80% from ~45% as the number of

plants will increase from 10 to 20 by CY21. 4) High dividend payout ratio

(44.89%

in F.Y.19).

Investment concerns: (1) B

usiness and revenues are substantially dependent on

Indian Railways. 2) Withdrawal of exclusivity of the Company for catering,

online

railway ticket and packaged drinking water at railway stations and trains in India

by the Ministry of Railways. 3) Adverse claims,

media speculation and other

public statements relating to the food quality, catering facilities and service. 4)

Removal or reduction of Service

Charge by Ministry of Railways or instructing

IRCTC to share part of revenue with them.

Outlook & Valuation: At the upper end of the price band, IRCTC demands

PE

multiple of 18.8x of FY19 EPS. R

ecent tax reduction by Government to 25.2% and

increase in revenue from service charge for online ticketing will improve

profitability substantially going forward. There is also significant opportunity

for

the Company to ramp up the catering business

given a very large captive

audience which is currently being underserved.

Increasing business volumes

from catering and Packaged drinking water businesses,

along with service charge

for online ticket booking will

drive earnings growth for the company between

FY19-21. We would therefore recommend to Subscribe to the issue.

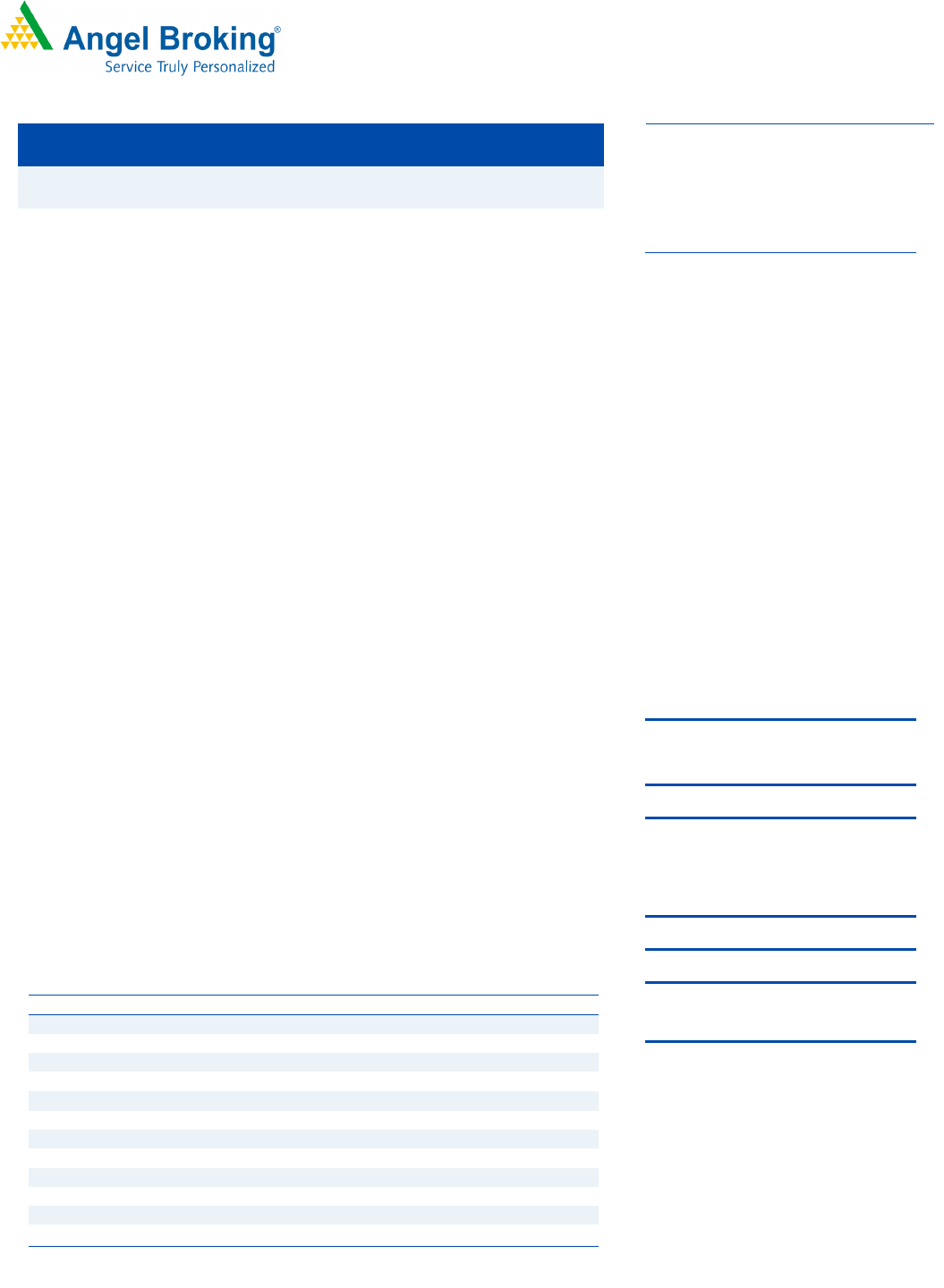

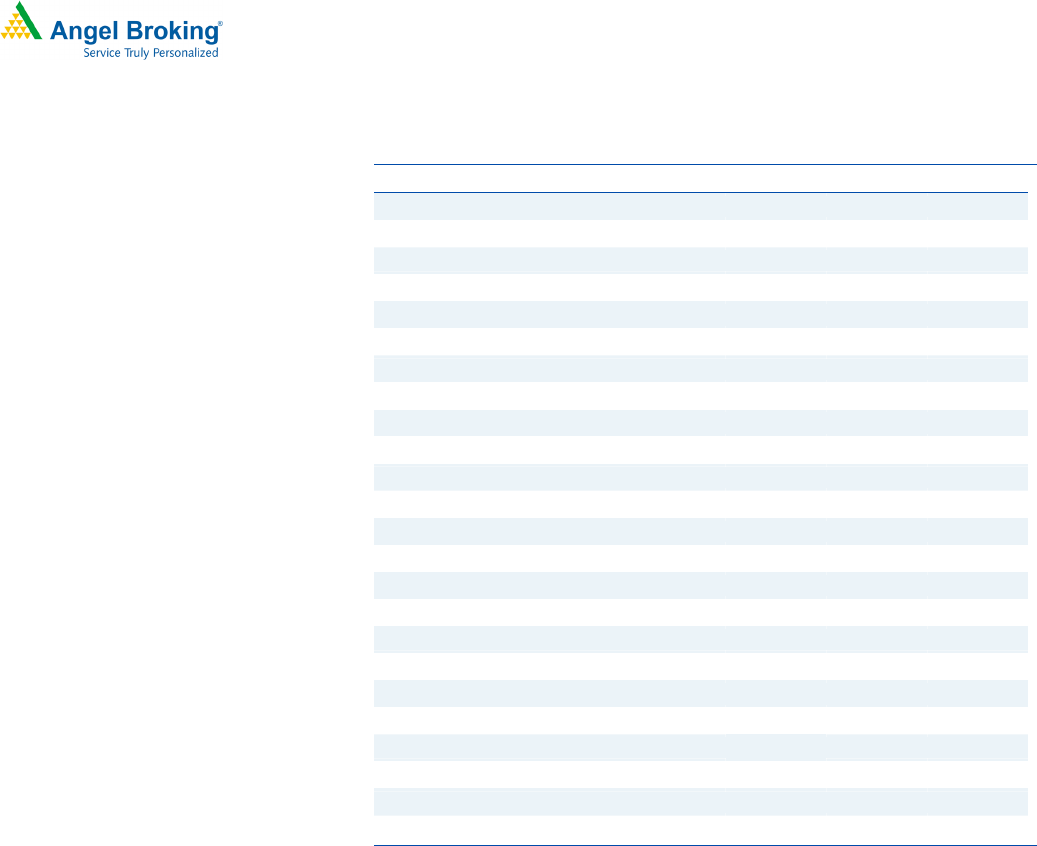

Key Financials

Y/E March (

`

cr)

FY17

FY18

FY19

Net Sales

1,535.4

1,470.5

1,867.9

% chg

-

4.2

27.0

Net Profit

229.1

220.6

272.6

% chg

-

3.7

23.5

EBITDA (%)

20.4

18.6

19.9

EPS (Rs)

14.3

13.8

17.0

P/E (x)

22.3

23.2

18.8

P/BV (x)

6.5

5.4

4.9

RoE (%)

29

.1

23.1

26.1

RoCE (%)

3

6.8

26.1

32.9

EV/EBITDA 13.7

15.7

10.7

EV/Sales

2.8

2.9

2.1

Company Source: RHP, Angel Research; Note: Valuation ratios based at upper price band.

SUBSCRIBE

Issue Open: September 30, 2019

Issue Close: October 03, 2019

Discount:

`

10 to Retail

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 87%

Others 13%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital:

`160

cr

Issue size (amt): *

`635

-**

`

645 cr

Price Band:

`315-320

Lot Size: 40 shares and in multiple

thereafter

Post-issue implied mkt. cap: *

`5040

cr -

**

`5120

cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 87.4%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: NIL

Face Value:

`10

Present Eq. Paid up Capital:

`160

cr

Offer for Sale: **2.016 cr Shares

Keshav Lahoti

+022 39357600, Extn: 6363

keshav.lahoti@angelbroking.com

IRCTC

IPO Note |

Railways

September 27

, 2019

IRCTC | IPO Note

September 27, 2019

2

Company background

IRCTC was incorporated with the objective to upgrade, modernize and

professionalize catering and hospitality services, managing hospitality services at

railway stations, on trains and other locations and to promote international and

domestic tourism in India through public-private participation. IRCTC was

conferred the status of Mini – ratna (Category-I Public Sector Enterprise) by the

Government of India, on May 1, 2008. Company have also diversified into other

businesses, including non-railway catering and services such as e-catering,

executive lounges and budget hotels, which are in line with the company’s

objective to build a “one stop solution” for customers.

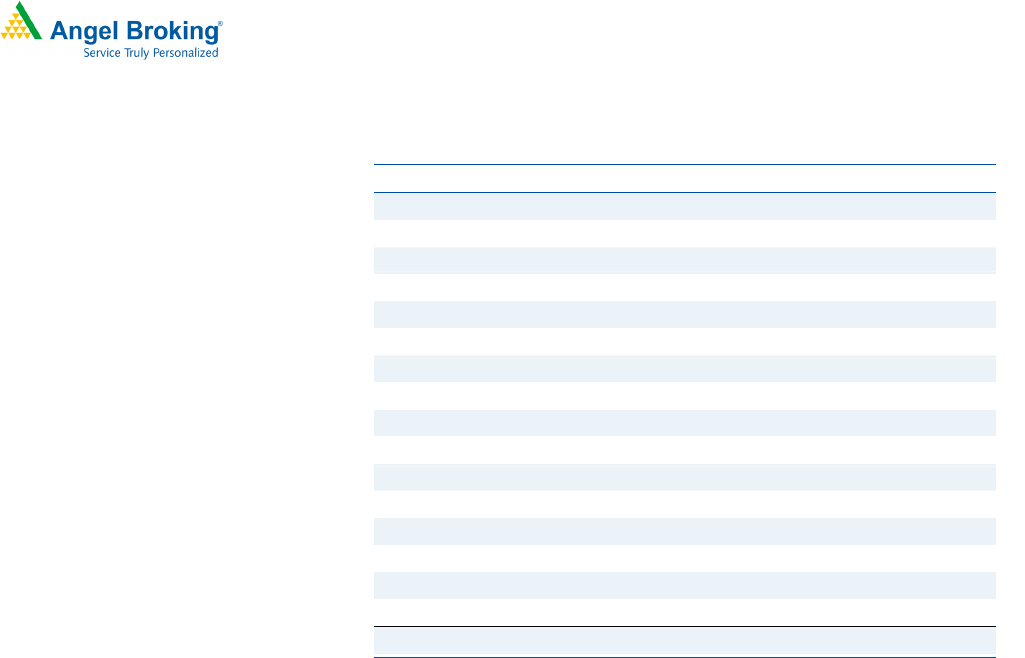

Exhibit 1: Segment Result (` in Cr)

P

articular

(FY19)

Revenue % of revenue

Segment

results

% of segment

result

Catering 1044.5 55

119

31.9

Internet Ticketing 234.5

12.3

156.6

42

Tourism 253.1

13.3

22.7

6.2

State Teertha 190.8

10.1

45.3

12.1

Rail neer (drinking water) 176.2 9.3

29.3

7.8

Total 1899.1 100

372.9

100

Source: Company, Angel Research

Internet Ticketing: As of August 31, 2019, more than 1.40 million passengers

travelled on Indian Railways on a daily basis, which consisted of approximately

72.6% of Indian Railways tickets booked online. As a result, there are more than

0.84 million tickets booked through www.irctc.co.in and “Rail Connect” on a

daily basis. Due to service charge on train booking from September 01, 2019

IRCTC is expected to clock in more than `400 revenue on full year basis. However

due to implementation of service charge, IRCTC won’t be compensated from

Government. IRCTC received compensation of `80cr and `88cr from Government

in FY18 & FY19 respectively.

Catering: Company provides food catering services to Indian Railway passengers

on trains and at stations. Company provides catering services for approximately

350 pre-paid and post-paid trains and 530 static units. Company provide catering

services through mobile catering units, base kitchens, cell kitchens, refreshment

rooms, food plazas, food courts, train side vending, and Jan Ahaars.

Travel and Tourism: Company has footprints in across all major tourism segments

such as hotel bookings, land, cruise, air tour packages, air ticket bookings and

specialization in rail tourism.

Packaged Drinking Water (Rail Neer): IRCTC operates ten Rail Neer Plants with an

installed production capacity of approximately 1.09 million litres per day, which

caters to approximately 45% of the current demand of packaged drinking water

at railway premises and in trains. To increase their presence in the packaged

drinking water market at railway stations, and to meet the growing demand,

Company is commissioning six new Rail Neer plants. Further four new Rail Neer

plants have been approved by the Company’s Board of Directors and will be

commissioned by 2021.

IRCTC | IPO Note

September 27, 2019

3

Issue Details

IRCTC is selling 2.016cr equity shares through offer for sale in the price band of

`315-320. Retail & eligible employees are also eligible for `10 discount.

Narendra, aged 50 years, is the Director (Finance) of our Company since August

19, 2019. He holds a bachelor’s degree in Arts and a master’s degree in History

from University of Delhi. He is an officer of Indian Railway Accounts Service and

presently holding Director (Finance) of the Company in addition to his present

position of executive director – finance (Public Private Partnership), Railway Board.

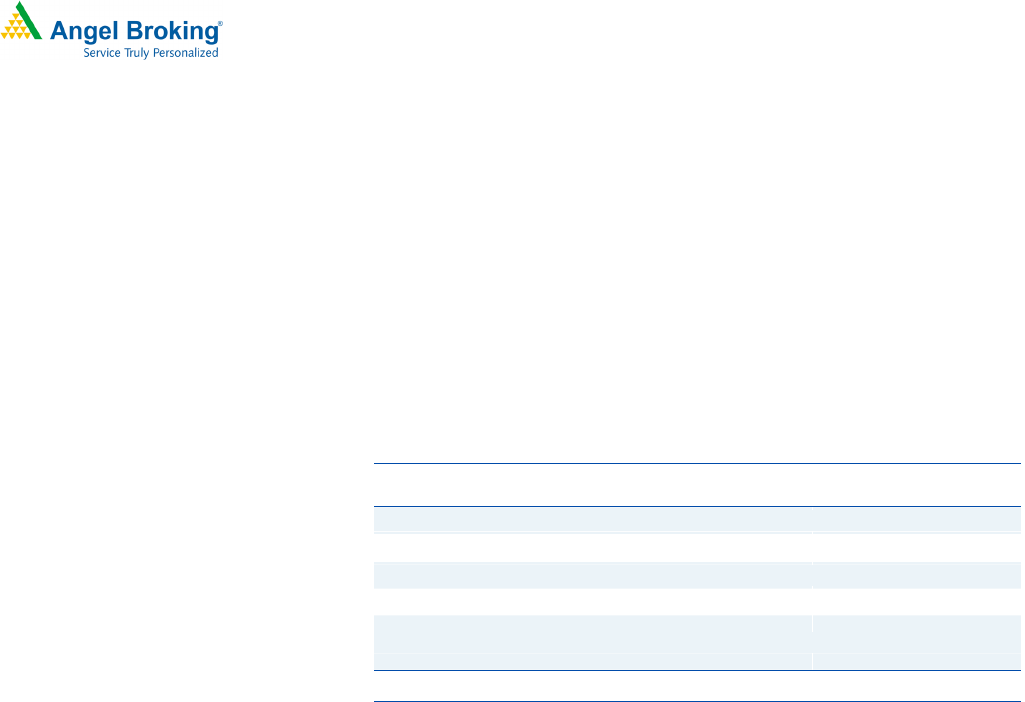

Exhibit 2: Pre & Post IPO Shareholding pattern

No of shares (Pre-issue)

%

(Post-issue)

%

Promoter 160,000,000 100 139,840,000 87.4

%

Public 0 0 20,160,000 12.6

%

160,000,000 100 160,000,000 100

Source: RHP, Angel Research. Note: Calculated on upper price band.

Objects of the offer

The purpose of the offer is to carry out the disinvestment and to achieve

the benefits of listing the Equity Shares on the Stock Exchanges. Company will not

receive any proceeds from the Offer and all proceeds shall go to the Selling

Shareholder.

Key Management Personnel:

Mahendra Pratap Mall, aged 58 years is the chairman & Managing Director of the

Company. He has experience of over four decades in the agriculture business. He

holds a bachelor’s degree in Science and a master’s degree in Arts (political

science) from University of Allahabad. He also holds a diploma in national

management programme from Management Development Institute, Gurgaon

and was an officer of Indian Railway Accounts Service. He was awarded “most

influential CFOs of India” by Chartered Institute of Management Accounts on

July, 2015.

Rajni Hasija, aged 56 years, is the Whole-time Director (Tourism & Marketing) of

the Company since May 18, 2018. She holds a bachelor’s and master’s degree in

Science from University of Delhi. She was an officer of Indian Railway Traffic

Service and has 30 years of experience in commercial and operation of railways.

IRCTC | IPO Note

September 27, 2019

4

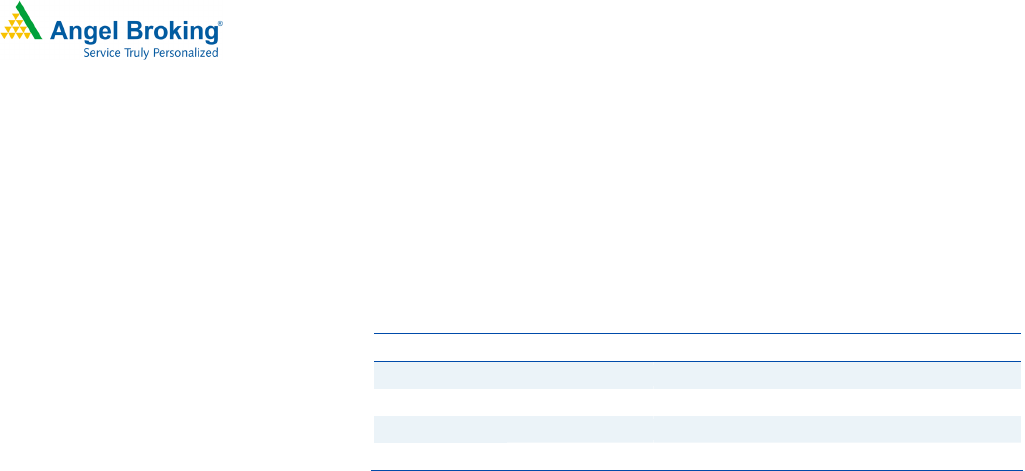

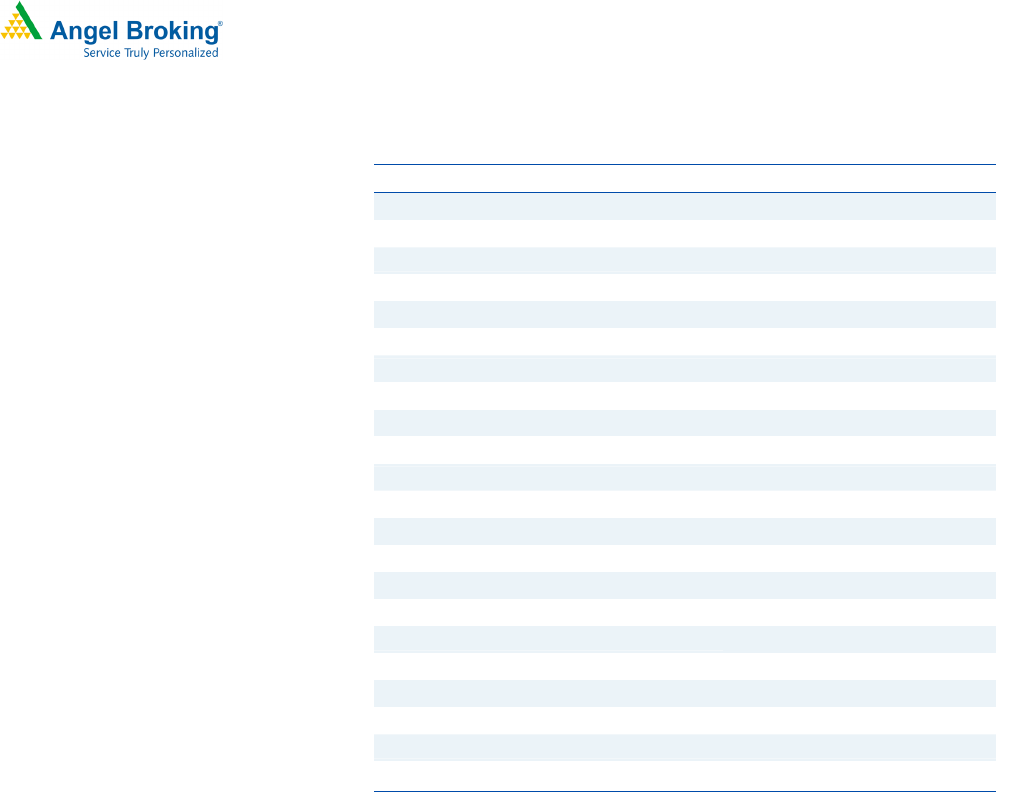

Consolidated Balance Sheet

Y/E March (` cr) FY17

FY18

FY19

SOURCES OF FUNDS

Equity Share Capital 40.0

40.0

160.0

Reserves& Surplus 746.6

914.5 882.8

Shareholders Funds 786.6

954.5

1,042.8

Other liabilities 14.2

31.2

20.5

Provisions 78.0

58.5

46.2

Total Liabilities 878.7

1,044.2 1,109.5

APPLICATION OF FUNDS

Net Block 170.4

162.2 154.6

Capital Work-in-Progress 16.8

7.7

40.4

Investment property -

27.6

27.7

Current Assets 1,566.7

2,060.2

2,258.7

Inventories 6.6

7.4

7.9

Sundry Debtors 289.4

550.9 581.7

Cash & Bank 853.0

833.9

1,140.0

Loans & Advances 9.6

9.0

8.4

Other Assets 408.2

659.0 520.7

Current liabilities 947.7

1,274.9

1,474.2

Net Current Assets 619.0

785.3 784.5

Other Non Current Asset 72.5

61.4

102.4

Total Assets 878.7

1044.2

1109.5

Source: Company, Angel Research

IRCTC | IPO Note

September 27, 2019

5

Consolidated Income Statement

Y/E March (` cr)

FY17

FY18

FY19

Total operating income

1,535.4

1,470.5

1,867.9

% chg -

4.2

27.0

Total Expenditure

1,222.8

1,197.3

1,495.7

Direct Expense

958.7

875.3

1,133.5

Personnel

163.8

192.2

195.1

Others Expenses

100.3

129.8

167.2

EBITDA

312.6

273.1

372.2

% chg -

12.6

36.3

(% of Net Sales)

20.4

18.6

19.9

Depreciation& Amortisation

22.4

23.7

28.6

EBIT

290.1

249.5

343.5

% chg -

14.0

37.7

(% of Net Sales)

18.9

17.0

18.4

Interest & other Charges

2.5

2.9

2.3

Other Income

67.5

99.1

88.8

(% of Sales)

4.4

6.7

4.8

Recurring PBT

355.1

345.7

430.0

% chg -

2.7

24.4

Tax

126.0

125.0

157.4

PAT (reported)

229.1

220.6

272.6

% chg -

3.7

23.5

(% of Net Sales)

14.9

15.0

14.6

Basic & Fully Diluted EPS (Rs)

14.3

13.8

17.0

% chg -

3.7

23.6

Source: Company, Angel Research

IRCTC | IPO Note

September 27, 2019

6

Consolidated Cash Flow Statement

Y/E March (` cr)

FY17

FY18

FY19

Profit before tax

355.1

345.6

430.0

Depreciation

22.4

23.7

28.6

Change in Working Capital

142.3

(176.9)

259.9

Interest

(44.4)

(3.9) (57.3)

Direct taxes paid

(138.1)

(125.9)

(162.8)

Others

0.9

(38.9) (5.8)

Cash Flow from Operations

338.2

23.6

492.7

(Inc.)/ Dec. in Fixed Assets

(32.0)

(34.3) (53.9)

Dividend

-

3.9

6.4

Interest Income

64.8

44.5

40.5

Changes in Bank Balance

60.8

26.1

(339.3)

Cash Flow from Investing

93.6

40.2

(346.4)

Dividend Paid (including DDT)

(135.9)

(56.8)

(179.4)

Cash Flow from Financing

(135.9)

(56.8)

(179.4)

Inc./(Dec.) in Cash

295.9

7.0

(33.1)

Opening Cash balances

190.3

486.1

493.2

Closing Cash balances

486.1

493.2

460.1

Source: Company, Angel Research

IRCTC | IPO Note

September 27, 2019

7

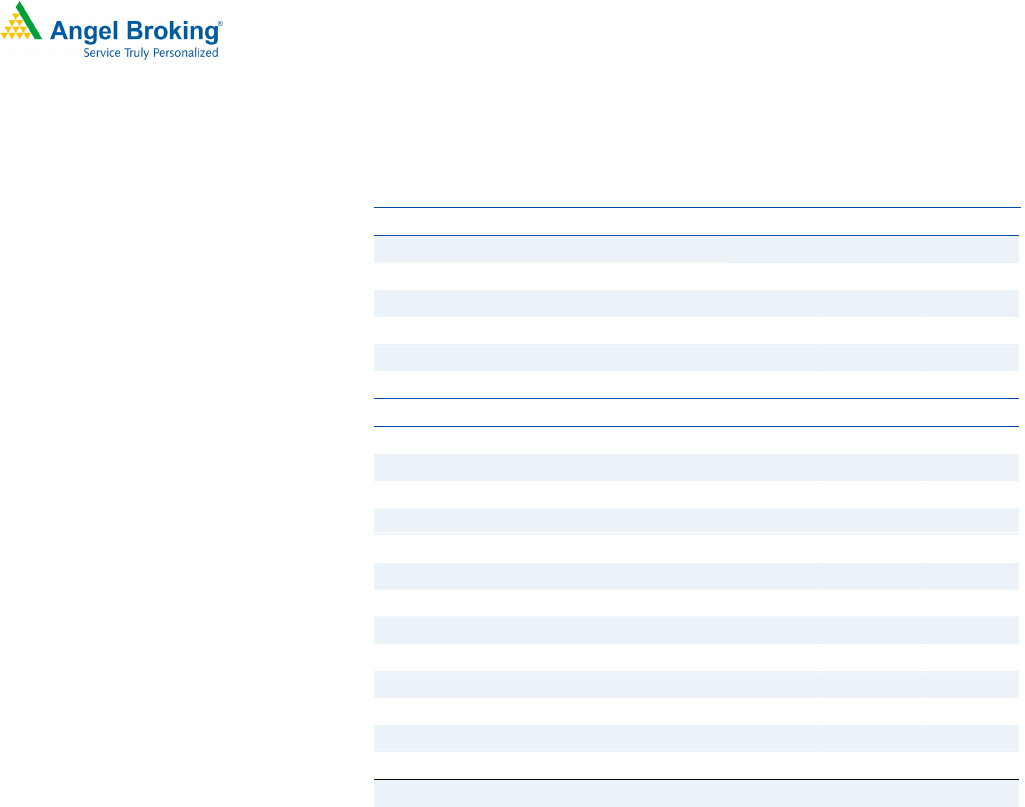

Key Ratios

Y/E March

FY17

FY18

FY19

Valuation Ratio (x)

P/E (on FDEPS)

22.3

23.2

18.8

P/CEPS

19.7

20.2

18.9

P/BV

6.5

5.4

4.9

EV/Sales

2.8

2.9

2.1

EV/EBITDA

13.7

15.7

10.7

EV / Total Assets

2.3

1.8

1.5

Per Share Data (Rs)

EPS (Basic)

14.3

13.8

17.0

EPS (fully diluted)

14.3

13.8

17.0

Cash EPS

16.2

15.8

16.9

Book Value

49.2

59.7

65.2

Returns (%)

ROCE

36.9

26.1

32.9

Angel ROIC (Pre tax)

40.6

28.8

37.1

ROE

29.1

23.1

26.1

Turnover ratios (x)

Fixed Asset Turnover

9.0

9.1

12.1

Inventory / Sales (days)

35.8

42.1

35.3

Receivables (days)

68.8

136.8 113.7

Payables (days)

32.7

37.4

37.5

Working capital cycle (ex-cash) (days)

71.9

141.4 111.5

Source: Company, Angel Research

IRCTC | IPO Note

September 27, 2019

8

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in

securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of

securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

Research Team Tel: 022

-

39357800

E

-

mail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.