Please refer to important disclosures at the end of this report

1

India Pesticides Limited (IPL) was incorporated on December 13, 1984. IPL is an

R&D driven agro-chemical manufacturer of Technicals with a growing

Formulations business. IPL is the fastest growing agro-chemical companies in

India in terms of volume of Technicals manufactured. In Technicals company

manufacture Fungicide Technicals, Herbicides Technicals for the export

market and on Formulation side company manufacture insecticides, fungicide

and herbicides, growth regulators and Acaricides for domestic market. IPL has

also diversified itself in APIs manufacturing in recent times.

Positives: (a) Company has done capacity expansion of 62.5% in the last three

years, in which Technical capacity has almost doubled and formulation

capacity has increased by 8.3%. (b) Diversified portfolio of niche and quality

specialized agro chemical products. (c) Company having very high ROCE &

ROE of 45% & 34% in FY2021 along with very high EBITDA margins of 29.2%.

Investment concerns: (a) Indian agro-chemicals industry is fragmented in

nature and faces competition from different domestic and global

manufacturers for different products that we manufacture. (b) Top-10

customers contribute 57% of companies overall revenue, largest customer

represent 30% of revenue to maintain relations will be challenging for the

company. (c) Any change in categorization of key technical in thr red triangle

will affect the company performance.

Outlook & Valuation: Based on FY-2021 PE of 24.5x and EV/EBITDA of 18.2x at

upper band of the IPO price, which is slightly better than the peers companies.

Similarly company having one of the best ROE & ROCE of 34% and 45%

respectively. Company having a very healthy balance sheet with negative

Net Debt to Equity. We expect the upcoming expansion plan and higher

capacity utilisation will be the growth drivers for the company in future. We

are assigning a “Subscribe” recommendation to the issue.

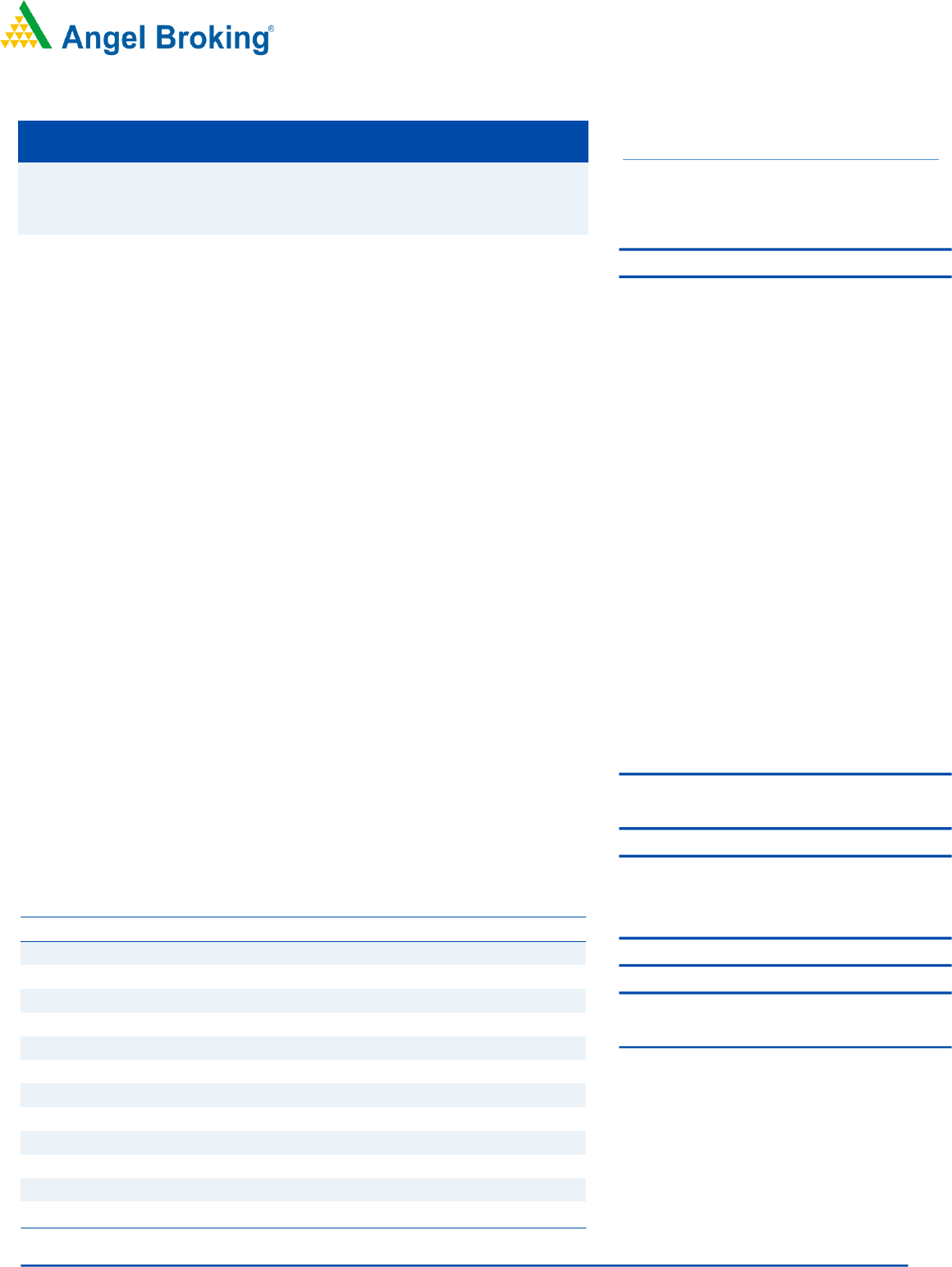

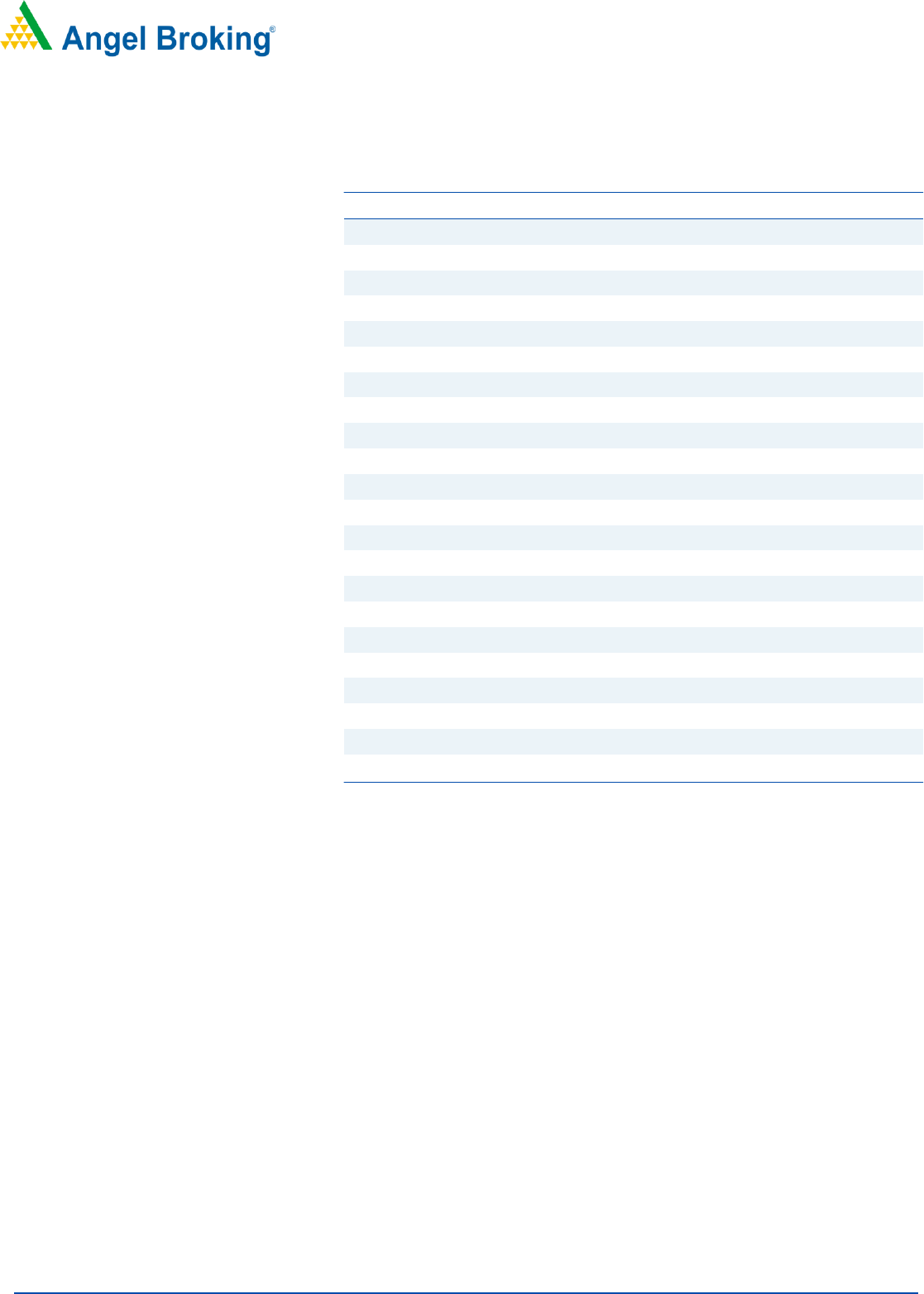

Key Financials

Y/E March (₹ cr)

FY2019

FY2020

FY2021

Net Sales

340.7

479.6

649.0

% chg

-

40.8

35.3

Net Profit

43.9

70.8

134.5

% chg

-

61.2

90.0

EBITDA (%)

19.2

19.5

28.2

EPS (Rs)

3.9

6.4

12.0

P/E (x)

75.1

46.6

24.6

P/BV (x)

5.0

12.8

8.5

ROE (%)

23.5

27.6

34.5

ROCE (%)

32.3

35.8

45.2

EV/EBITDA

48.9

33.7

18.2

EV/Sales

9.4

6.6

5.1

Source: Company, Angel Research

SUBSCRIBE

Issue Open: June 23, 2021

Issue Close: June 25, 2021

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 72.0%

Others 28.0%

Fresh issue: ₹ 100 Cr.

Issue Details

Face Value: ₹ 1

Present Eq. Paid up Capital: ₹ 11.18 Cr

Offer for Sale: ₹ 700 Cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ₹ 11.5 Cr

Issue size (amount): ₹800 Cr**

Price Band: ₹ 290- 296

Lot Size: 50 shares and in multiple thereafter

Post-issue mkt. cap: *₹ 3342 cr - **₹ 3409 cr

Promoters holding Pre-Issue: 82.68%

Promoters holding Post-Issue: 72%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Yash Gupta,

+022 39357600, Extn: 6872

Research Analyst

Yash.gupta@angelbroking.com

IPO Note

June 22, 2021

INDIA PESTICIDES LIMITED

IPL Ltd | IPO Note

June 22, 2021

2

Company background

IPL was originally incorporated as ‘India Pesticides Private Limited’, on

December 13, 1984 at Bareilly, Uttar Pradesh. Anand Swarup Agarwal and

the ASA Family Trust are the Promoters of the company. Anand Swarup

Agarwal is the Chairman and non-executive Director of the company. He

has over 35 years of experience in agrochemical manufacturing. Company

has have two distinct operating verticals, namely, (i) Technicals; and (ii)

Formulations.

Technicals: Company manufacture generic Technicals that are used in

the manufacture of fungicides and herbicides as well as APIs with

applications in dermatological products. Technical contributes 78.8% of

companies revenue for the year 2021.

Formulations: Company manufacture and sell various formulations of

insecticides, fungicide and herbicides, growth regulators and Acaricides,

which are ready-to-use products. Company manufacture over 30

Formulations that include Takatvar, IPL Ziram-27, IPL Dollar etc. Formulation

contributes 21.2% of companies revenue for the year 2021.

Key Details about the company

IPL is one of the fastest growing agro-chemicals company

in terms of volume of Technicals manufacturing.

Company are the sole Indian manufacturer of five Technicals

and among the leading manufacturers globally for Captan,

Folpet and Thiocarbamate Herbicide, in terms of production

capacity

Company have a strategic focus on R&D and our R&D capabilities

include two well-equipped in-house laboratories registered with the

DSIR.

Technicals are primarily exported and revenue generated from

exports contributed to 56.71% of revenue from operations in Fiscal

2021. Technicals are exported to over 25 countries including

Australia and other countries in North and South America, Europe,

Asia and Africa.

Formulations products are primarily sold domestically through our

extensive network of dealers and distributors. Company has a

diverse customer base that includes crop protection product

manufacturing companies, such as, Syngenta Asia Pacific Pte. Ltd,

UPL Limited.

Company currently have two manufacturing facilities located at

UPSIDC Industrial Area at Dewa Road, Lucknow and Sandila, Hardoi

in Uttar Pradesh, India that are spread across over 25 acres.

IPL Ltd | IPO Note

June 22, 2021

3

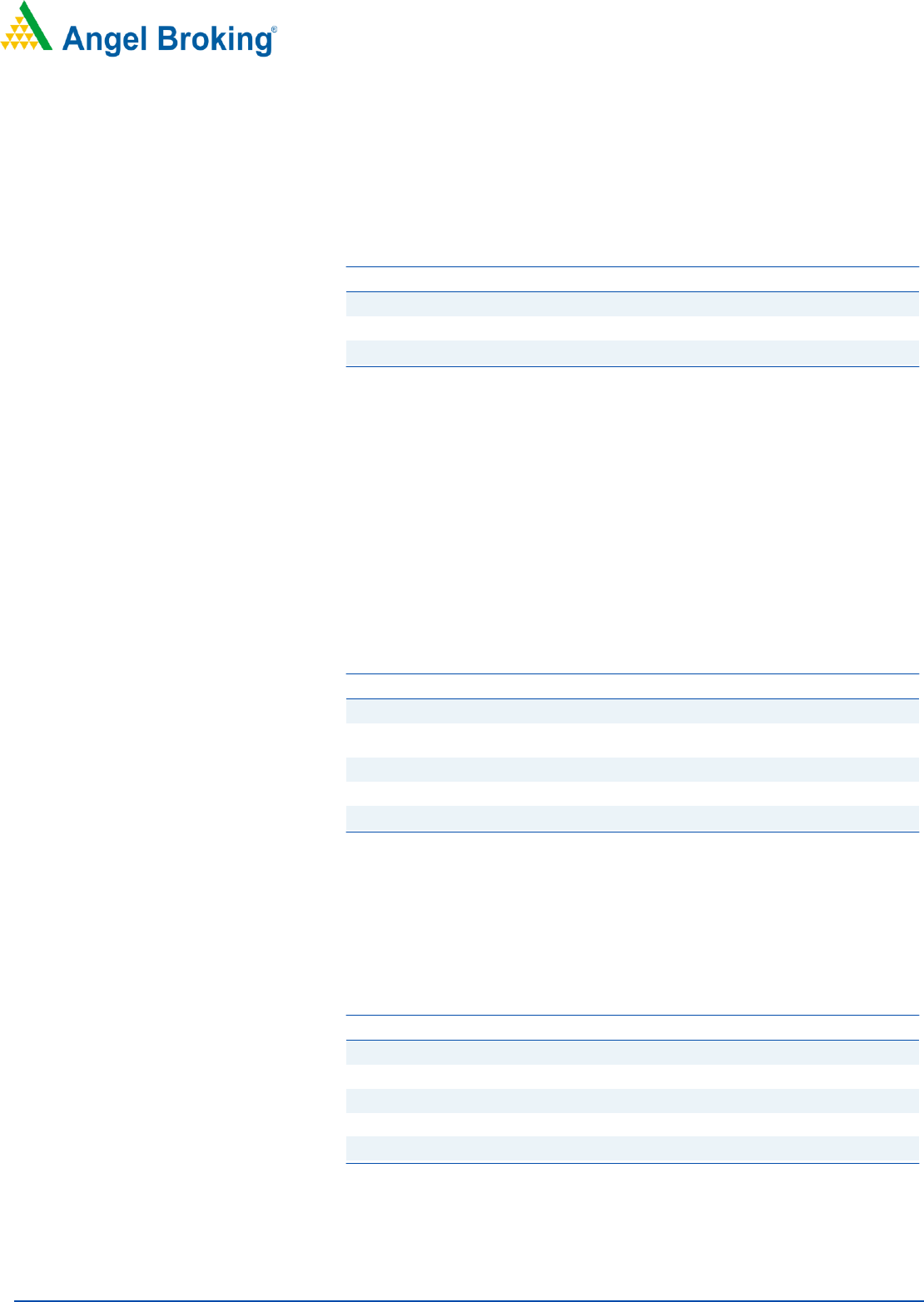

Issue details

The issue size is ₹ 800 Cr, which comprises of fresh issues of ₹ 100 crore &

offer for sale of ₹ 700 Cr in the price band of ₹290-₹296 per share.

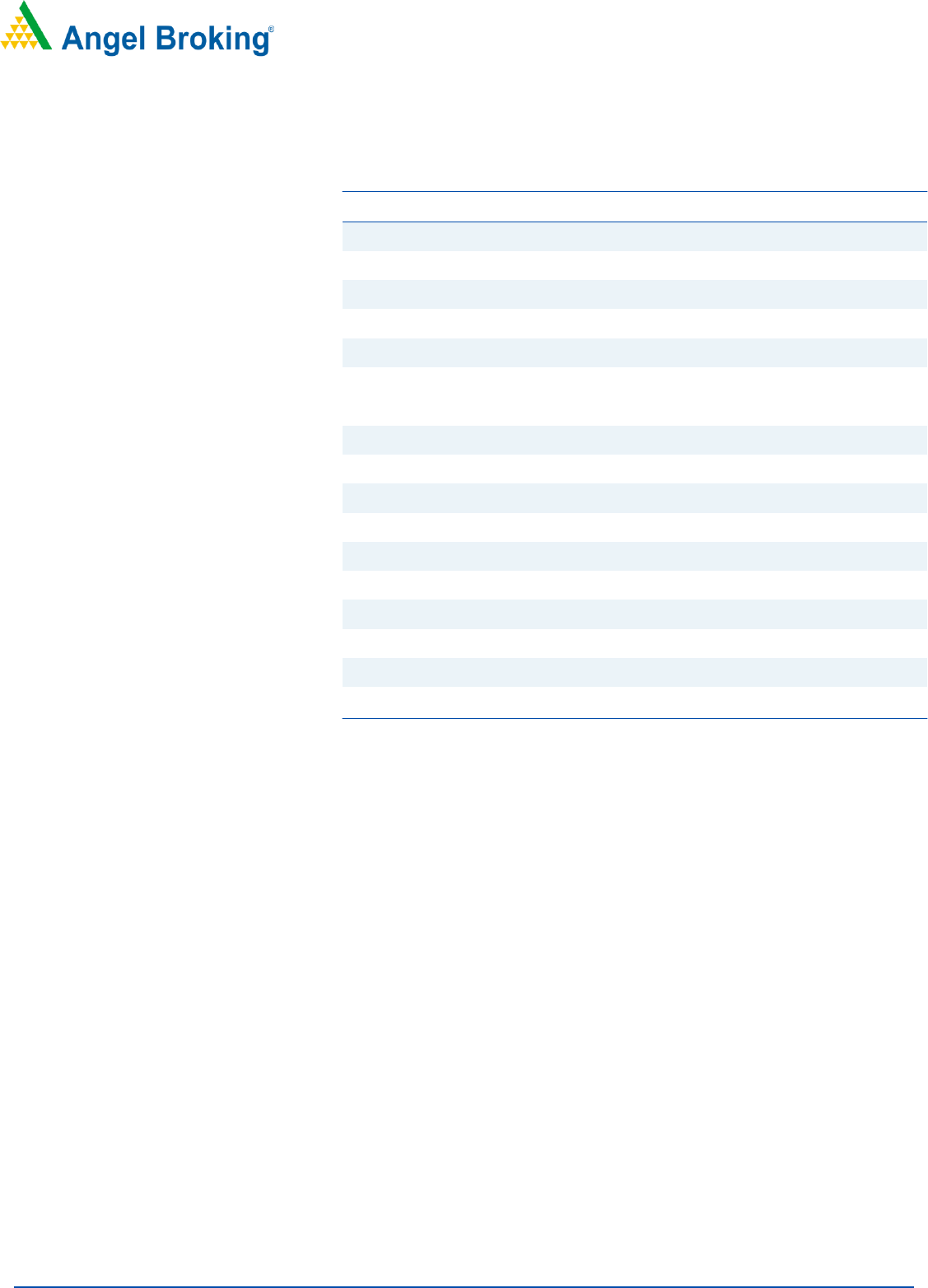

Pre & Post Shareholding

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

9,24,23,945

82.68%

8,29,17,726

72.00%

Public

1,93,61,185

17.32%

3,22,45,782

28.00%

Total

11,17,85,130

100.00%

11,51,63,508

100.00%

Source: Company, Angel Research

Objectives of the Offer

80 Crores out of 100 crores will be used to fund working capital

requirements of the company.

General corporate purposes.

Revenue Mix – Companies revenue mix has changed from 75.4% to

78.9% for Technicals, this also helps the company in increasing the

margins as majority of technicals are exported to Australia, Europe etc.

Revenue Mix

FY 2020-21

FY 2019-20

FY 2018-19

Product

Revenue

(Cr)

% of

Revenue

Revenue

(Cr)

% of

Revenue

Revenue

(Cr)

% of

Revenue

Technicals

506.8

78.9%

383.2

80.2%

256.6

75.4%

Formulations

135.7

21.1%

94.6

19.8%

83.6

24.6%

Total

642.5

100%

477.8

100%

340.2

100%

Source: Company, Angel Research

Capacity Utilisation – Company has increase its overall capacity

from 16000 Mt to 26000 Mt in last 3 years, as of now capacity utilisations are

at 75.9%.

Capacity Utilisation

FY 2020-21

FY 2019-20

FY 2018-19

Products

Capacity

Utilisation

Capacity

Utilisation

Capacity

Utilisation

Technicals

19500

76.9%

14500

76.1%

10000

79.7%

Formulations

6500

72.7%

6500

58.2%

6000

58.9%

Total

26000

75.9%

21000

70.5%

16000

71.9%

Source: Company, Angel Research

IPL Ltd | IPO Note

June 22, 2021

4

Key Management Personnel

Anand Swarup Agarwal is the Chairman and non-executive Director of the

company. He has over 35 years of experience in agrochemical

manufacturing. He is one of the Promoters and one of the founders of the

company. In the past he was the part time non-official director on the

board of directors of Punjab National Bank.

Rajendra Singh Sharma is the whole-time Director of the company. He has

been associated with the company since last 22 years and has experience

in agro-chemical manufacturing.

Rahul Arun Bagaria is the Non-Executive Director of the company. He has

more than 5 years of professional experience and expertise in corporate

law and taxation.

Adesh Kumar Gupta is the Independent Director of the company. He

previously held the position of whole time director and chief financial officer

at Grasim Industries Ltd. and has also been a director at Ultra Tech Cement

Ltd.

Mohan Vasant Tanksale is the Independent Director of the company. He

was previously the chairman and managing director of Central Bank of

India and was an executive director on the board of Punjab National Bank

till June 2011.

Madhu Dikshit is the Independent Director of the company. In the past, she

has been associated with the CSIR – Central Drug Research Institute,

Lucknow as a director.

IPL Ltd | IPO Note

June 22, 2021

5

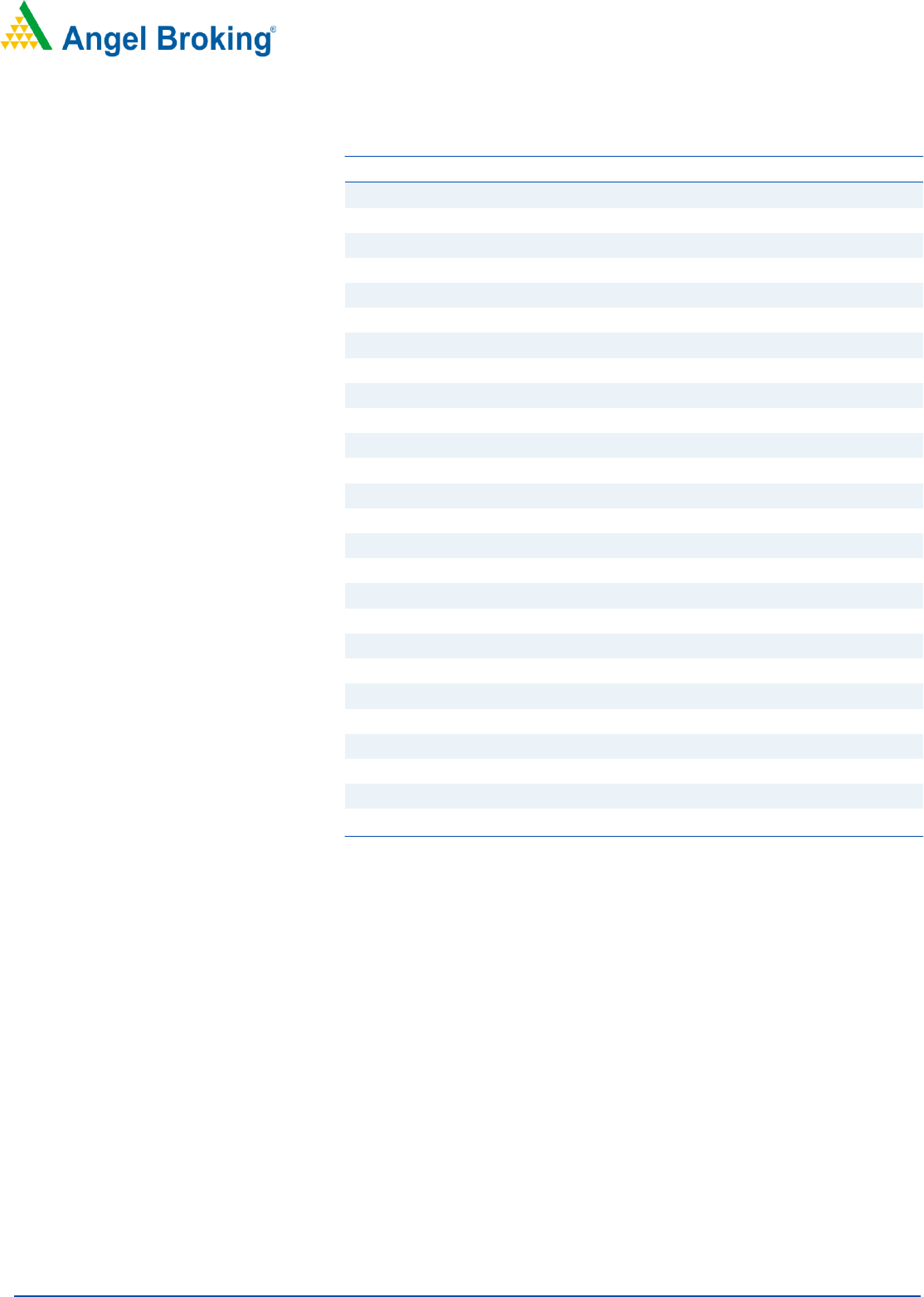

Consolidated Profit & Loss Account

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

Total operating income

341

480

649

% chg

-

40.8

35.3

Total Expenditure

275

386

466

Cost of Materials Consumed

195

257

330

Changes in inventories

-7

-4

-20

Employee Benefits Expense

13

16

23

Other Expenses

75

117

133

EBITDA

65

94

183

% chg

-

43.3

95.7

(% of Net Sales)

19.2

19.5

28.2

Depreciation& Amortisation

4.0

5.1

6.1

EBIT

61

88

177

% chg

-

44

100

(% of Net Sales)

18.0

18.4

27.3

Finance costs

5.6

5.2

3.4

Other income

5.4

10.1

6.4

(% of Sales)

1.6

2.1

1.0

Recurring PBT

61

93

180

% chg

-

53

93

Exceptional item

-

-

-

Tax

17

23

45

PAT (reported)

44

71

135

% chg

-

61

90

(% of Net Sales)

12.9

14.8

20.7

Basic & Fully Diluted EPS (Rs)

3.9

6.4

12.0

% chg

-

61.2

89.5

Source: Company, Angel Research

IPL Ltd | IPO Note

June 22, 2021

6

Consolidated Balance Sheet

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

3.2

3.2

11.2

Other equity (Retained Earning)

184

254

378

Shareholders Funds

187

257

389

Total Loans

55

24

30

Other liabilities

8

8

9

Total Liabilities

250

289

428

APPLICATION OF FUNDS

Property, Plant and Equipment

70

95

120

Right of Use Assets

-

4

4

Capital work-in-progress

5

1

12

Current Assets

233

255

367

Inventories

36

39

70

Trade Receivables

178

183

214

Cash and Cash Equivalents

2

7

2

Other Balances with Banks

1

1

41

Other Financial Assets

1

1

0

Other Current Assets

16

25

39

Current Liability

67

77

89

Net Current Assets

166

178

278

Other Non Current Asset

9

10

14

Total Assets

250

289

428

Source: Company, Angel Research

IPL Ltd | IPO Note

June 22, 2021

7

Consolidated Cash Flow Statement

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

Operating profit before working capital changes

68

101

190

Net changes in working capital

-54

-3

-62

Cash generated from operations

14

97

128

Direct taxes paid (net of refunds)

-17

-22

-45

Net cash flow (used in)/from operating activities (A)

-3

75

83

Purchase of property

-7

-31

-42

Others

1

0

-42

Cash Flow from Investing

-7

-31

-84

Proceeds from term Borrowings

13

0

1

Repayment of term Borrowings

-9

-3

-7

Proceeds from short-term borrowings (net)

11

-30

9

Dividend (including dividend tax)

-1

-1

-4

Interest paid (net)

-5

-5

-3

Cash Flow from Financing

9

-39

-4

Inc./(Dec.) in Cash

-1

5

-5

Opening Cash balances

2.4

1.6

6.7

Closing Cash balances

1.6

6.7

1.9

Source: Company, Angel Research

IPL Ltd | IPO Note

June 22, 2021

8

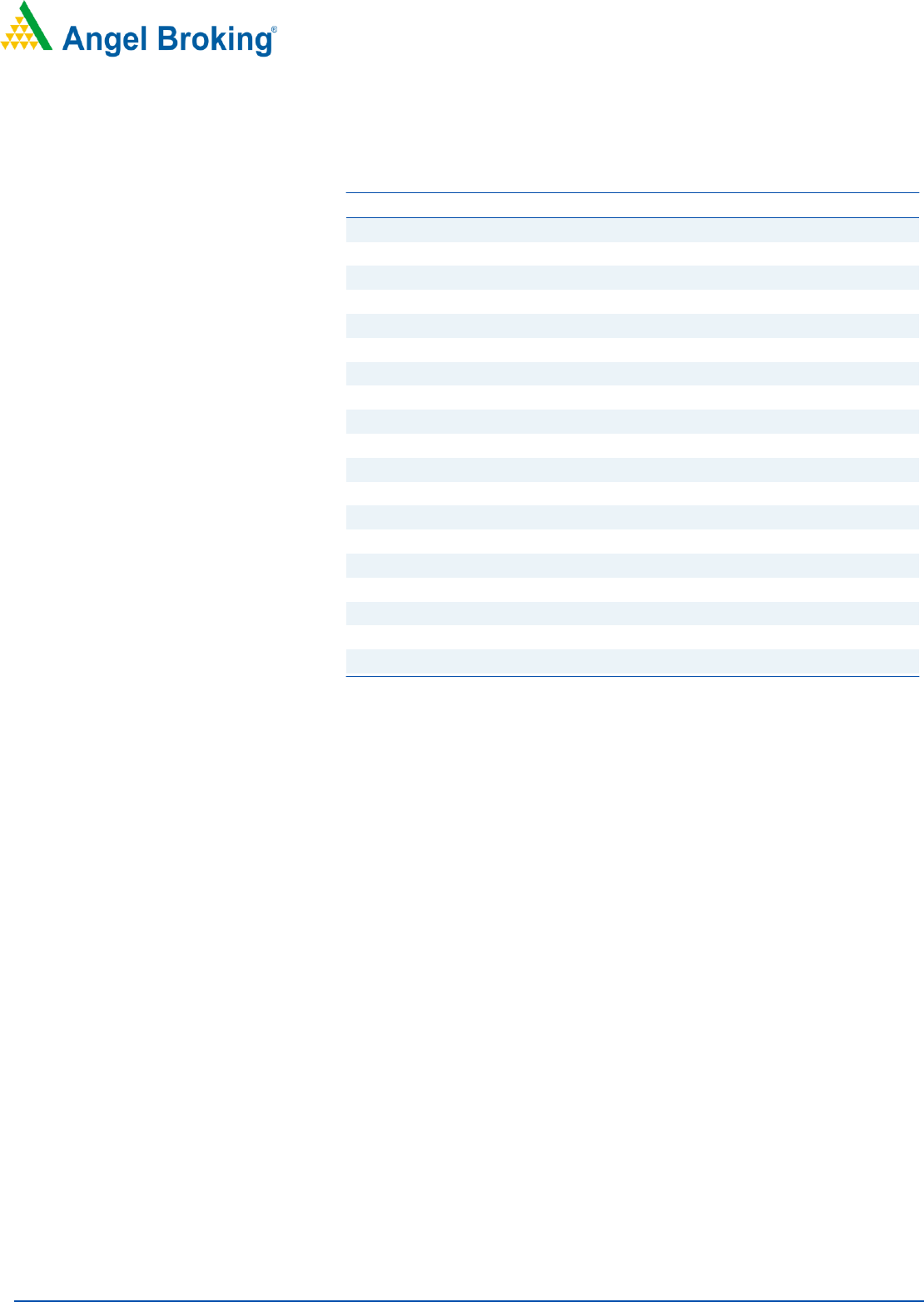

Financial Ratio

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

75.1

46.6

24.6

P/CEPS

64.9

41.4

23.5

P/BV

5.0

12.8

8.5

EV/Sales

9.4

6.6

5.1

EV/EBITDA

48.9

33.7

18.2

Per Share Data (₹)

EPS (Basic)

3.9

6.4

12.0

EPS (fully diluted)

3.9

6.4

12.0

Cash EPS

4.6

7.2

12.6

Book Value

58.8

23.1

34.9

Returns (%)

ROE

23.5

27.6

34.5

ROCE

32.3

35.8

45.2

Turnover ratios (x)

Receivables (days)

191.0

139.4

120.5

Inventory (days)

38.1

29.4

39.4

Payables (days)

-

-

-

Working capital cycle (days)

229.1

168.8

159.9

Source: Company, Angel Research

IPL Ltd | IPO Note

June 22, 2021

9

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual

Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst)

Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst

during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall

not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report. Angel Broking Limited has not independently verified all the information contained

within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.