IPO Note | NBFC

May 04, 2017

HUDCO Limited

SUBSCRIBE

Issue Open: May 08, 2017

Issue Close: May 11, 2017

HUDCO is a wholly owned Government company with focus on Housing and

Urban Infrastructure Finance in India. The Government is divesting its 10% stake

Issue Details

in the company as part of its disinvestment programs.

Face Value: `10

Unique portfolio focusing on urban infrastructure and housing: HUDCO primarily

lends to urban infrastructure projects relating to water supply, roads & transport,

Present Eq. Paid up Capital: `2002cr

and power accounting for 69% of the loan book. It also lends towards Housing

Offer for Sale: **20.4cr Shares

Finance, which forms the balance 31% of the loan book. Both the segments have

vast untapped opportunity in India, which would provide potential growth

Fresh issue: Nil

opportunity for HUDCO to scale up its operations.

Unleveraged balance sheet to boost growth without raising capital, making it ROE

Post Eq. Paid up Capital: `2001 cr

accretive: On a net worth of `8,968cr, HUDCO has a loan book of `34,288cr,

implying a leverage of 3.8x. Further, the CAR of 68% at the end of 9MFY2017

Issue size (amount): *`1,128cr -**1,210cr

leaves enough scope for leveraging balance sheet without having to raise capital

for next 4-5 years. HUDCO reported ROE of 9.5% for FY2016, which is lower

Price Band: `56-60

than the large NBFCs in India. However, ability to grow its balance sheet without

Lot Size: 200 shares and in multiple

dilution in the medium term would prove to be ROE accretive for HUDCO, and it

thereafter

can reach mid teens over the next few years.

Post-issue implied mkt. cap: *`11,211cr -

Higher reported GNPAs is due to past NPAs from Private Sector: The reported

**`12,011cr

GNPAs & NNPAs of HUDCO were 6.80% and 1.51% respectively at the end of

Promoters holding Pre-Issue: 100%

9MFY2017. HUDCO’s high NPA was due to large defaults from some of the

Private Sector Corporates in which it had exposure to earlier. However, it’s NPA

Promoters holding Post-Issue: 89.81%

from Government sector is only 0.75%. It has already done substantial provisions

on the Private sector NPAs and stopped lending to them from FY2013 onwards,

*Calculated on lower price band

and hence, we don’t expect material change in NPAs in the near term. Further, a

** Calculated on upper price band

provisioning coverage ratio of 72% lends enough comfort on the loan book.

Book Building

Ability to raise funds at competitive rates has enabled in high NIM: HUDCO has

AAA rating on its long term borrowings from ICRA & CARE, which has helped it in

QIBs

50% of issue

borrowing at very competitive rates from the market. Despite funding to large and

Non-Institutional

15% of issue

long gestation projects HUDCO has been able to maintain NIM in the range of

4.6-4.3% over the last three years.

Retail

35% of issue

Outlook Valuation: HUDCO has a unique blend of business with focus on

financing both housing and urban infrastructure, which has vast untapped

Post Issue Shareholding Pattern

opportunity in India. Focus on Govt. sponsored projects and ability to raise funds

at a competitive price provides earnings visibility for many years. At the issue price

Promoters

90%

band of `56-60, the stock is offered at 1.25x-1.35x its 9MFY2017 BV, which we

believe is reasonably priced, and hence, recommend SUBSCRIBE to the issue.

Others

10%

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

9mFY2017

NII

1,296

1,249

1,571

1,345

1,104

% chg

17.0

(3.6)

25.8

(14.4)

Net profit

700

734

768

811

496

% chg

12.6

4.9

4.7

5.5

EPS

3.5

3.7

3.8

4.0

3.3

Book Value (`)

32.5

35.6

38.9

42.3

44.8

P/E

17.2

16.4

15.6

14.8

18.2

P/BV (x)

1.8

1.7

1.5

1.4

1.3

Siddhart Purohit

RoE (%)

10.7

10.3

9.9

9.6

7.4

+022 39357600, Extn: 6872

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at

upper end of the price band

Please refer to important disclosures at the end of this report

1

HUDCO | IPO Note

Company background

HUDCO is a wholly-owned Government company with more than 46 years

experience in providing loans for housing and urban infrastructure projects in

India. The corporation has been playing a key role in various Govt. schemes to

develop the Indian housing and urban infrastructure sector. At the end of

9MFY2017, HUDCO had total outstanding loan portfolio of `36,385cr, of which

31% was towards Housing Finance and balance 69% was towards the Urban

Infrastructure Finance segment. Of the total portfolio ~90% of the loans were

given to various State Governments and their agencies.

The two segments which are served by HUDCO are Urban Infrastructure and

Housing Finance. In the Urban infrastructure finance segment, HUDCO gives

loans for projects relating to water supply, roads & transport and power. While the

Housing Finance Loans are classified into Social Housing, Residential real estate,

and Retail Finance, which is branded as HUDCO Niwas.

Key Management Personnel

Ravi Kanth Medithi - Chairman & MD- He is an IAS officer with 29+ years of

experience in public administration. Prior to this he has held various positions with

Government of India, Government of Kerala and Joint Secretary, Ministry of

Power, Government of India.

Issue details

Issuance of 20.4cr Equity shares of face value via IPO at an offer price band of

`56-60. The issue size is `1,128cr - `1210cr at the price band and there is a

discount of `2/ share for retail category and for employees.

Objects of the offer

To achieve the benefit of listing the stock on the exchanges.

May 04, 2017

2

HUDCO | IPO Note

Investment rationale

Unique portfolio focusing on urban infrastructure and housing - which has huge

potential in India: HUDCO primarily lends to Urban infrastructure projects relating

to water supply, roads & transport and power, which accounts for 69% of the loan

book. It also lends towards Housing Finance, which forms the balance 31% of the

loan book. Both the segments have vast untapped opportunity in India, which

would provide potential growth opportunity for HUDCO to scale up its operations.

The Government’s ambitious projects of upgrading urban infrastructure like

transport is a positive trigger for HUDCO, as opportunities to finance large scale

projects could be expected.

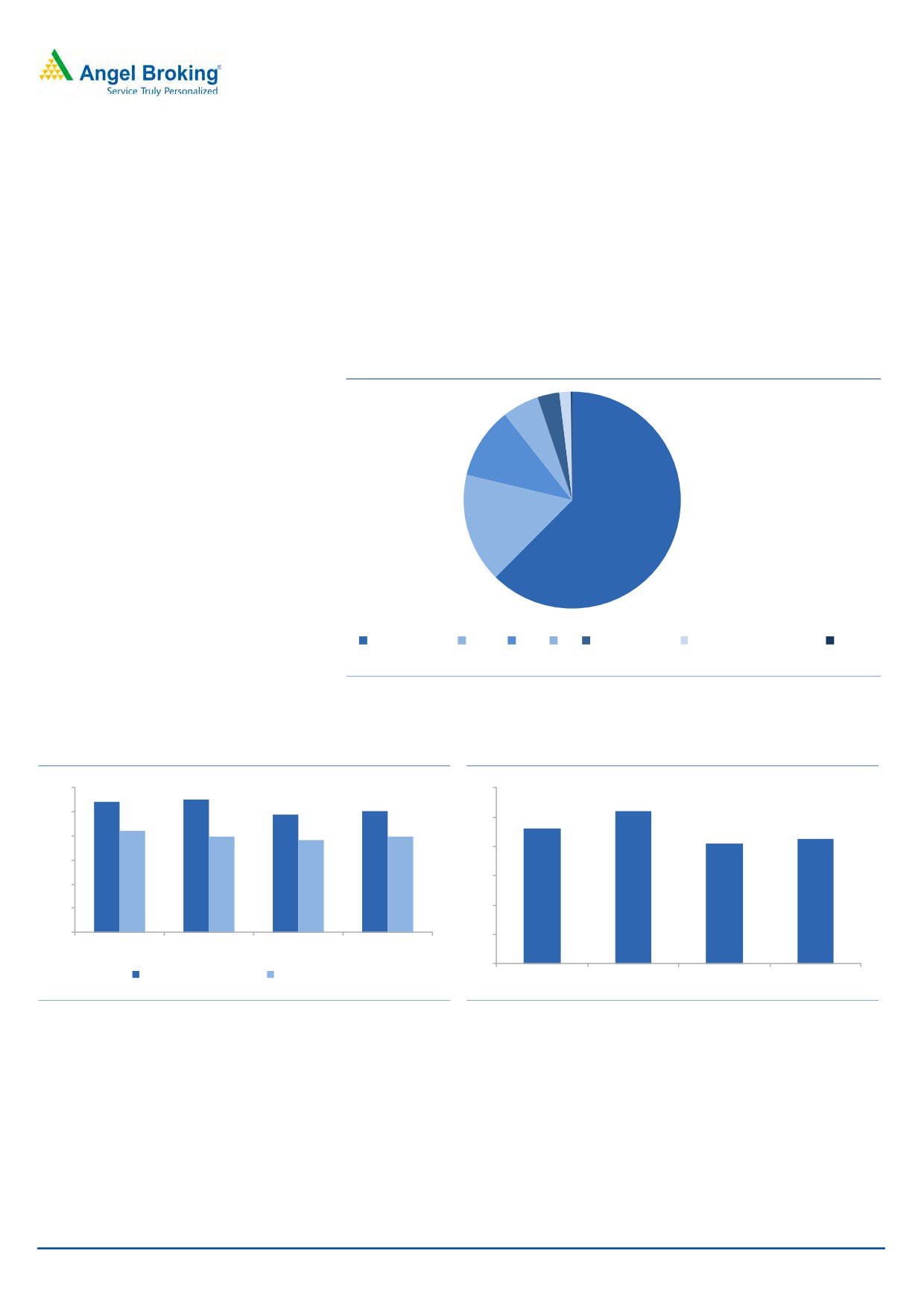

Exhibit 1: Loan bifurcation

( ` Cr )

FY14

FY15

FY16

9mFY17

Segmental Loan Portfolio

Housing Finance Loan Portfolio

7,875

9,661

11,696

11,228

Urban Infrastructure Finance Loan Portfolio

22,137

23,473

23,969

25,158

Total Loans

30,012

33,135

35,665

36,386

Segmental Loan Portfolio %

Housing Finance Loan Portfolio

26.2%

29.2%

32.8%

30.9%

Urban Infrastructure Finance Loan Portfolio

73.8%

70.8%

67.2%

69.1%

Source: RHP, Angel Research

Exhibit 2: Break up of Urban Infrastructure

Loan Portfolio ( ` Cr )

FY14

FY15

FY16

9mFY17

Water Supply

3,752

5,638

7,284

8,485

Roads & Transport

6,074

6,041

6,041

6,142

Power

7,626

7,138

5,380

5,226

Emerging Sector

1,636

1,932

1,814

2,127

Commercial Infrastructure

1,224

1,135

1,662

1,411

Social Infrastructure

1,233

943

1,033

1,045

Sewerage and Drainage

591

647

755

722

Total

22,137

23,473

23,969

25,158

% of Portfolio

Water Supply

17%

24%

30%

34%

Roads & Transport

27%

26%

25%

24%

Power

34%

30%

22%

21%

Emerging Sector

7%

8%

8%

8%

Commercial Infrastructure

6%

5%

7%

6%

Social Infrastructure

6%

4%

4%

4%

Sewerage and Drainage

3%

3%

3%

3%

Total

100%

100%

100%

100%

Source: RHP, Angel Research

May 04, 2017

3

HUDCO | IPO Note

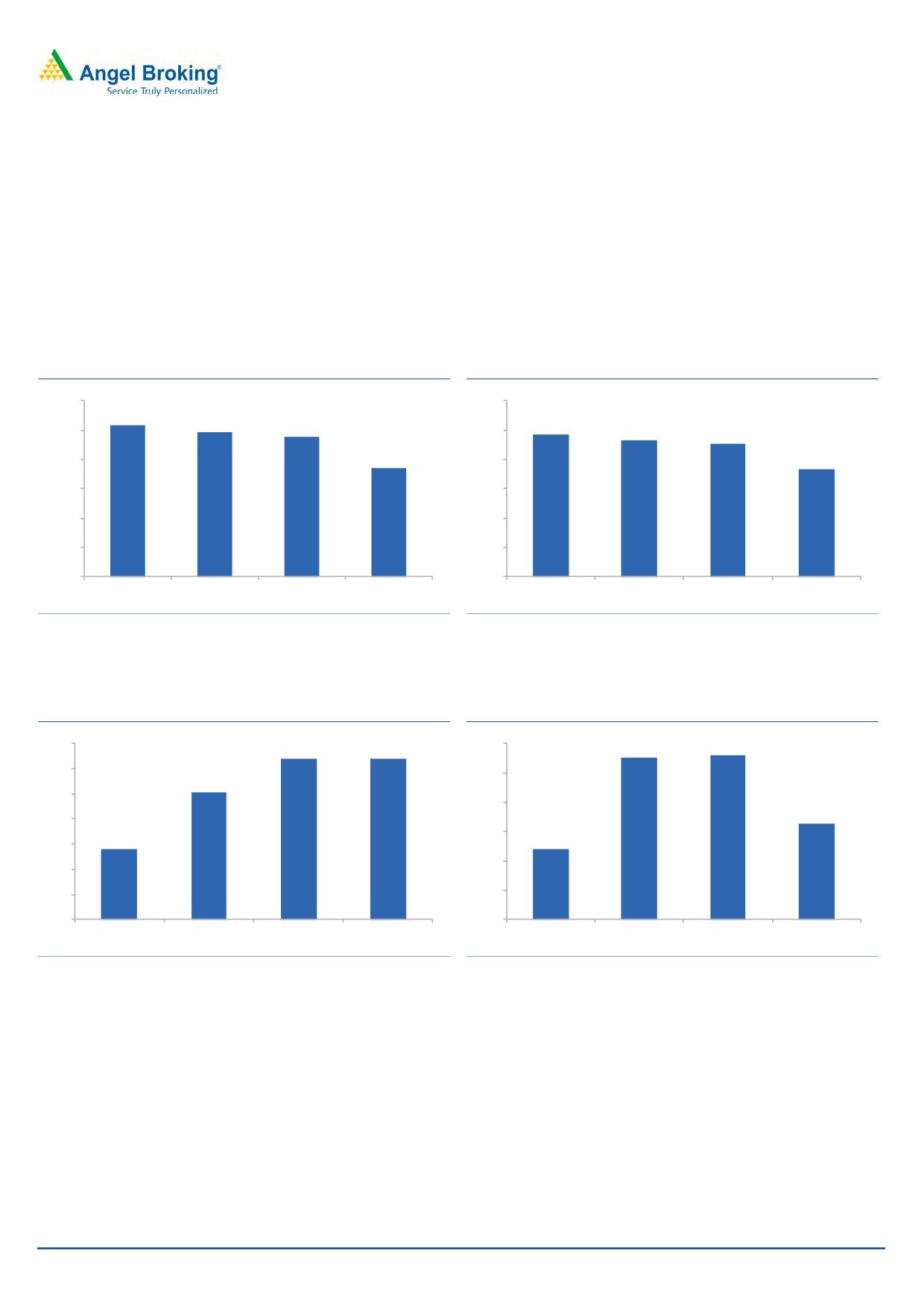

Unleveraged balance sheet to boost growth without raising capital, making it ROE

accretive: On a net worth of `8,968cr, HUDCO has a loan book of `34,288cr,

implying a leverage of 3.8x. Further, the CAR of 68% at the end of 9MFY2017

leaves enough scope for leveraging balance sheet without having to raise capital

for next 4-5 years. HUDCO reported ROE of 9.5% for FY2016, which is lower than

the large NBFCs in India. However, ability to grow its balance sheet without

dilution in the medium term would prove to be ROE accretive for HUDCO, and it

can reach mid teens over the next few years.

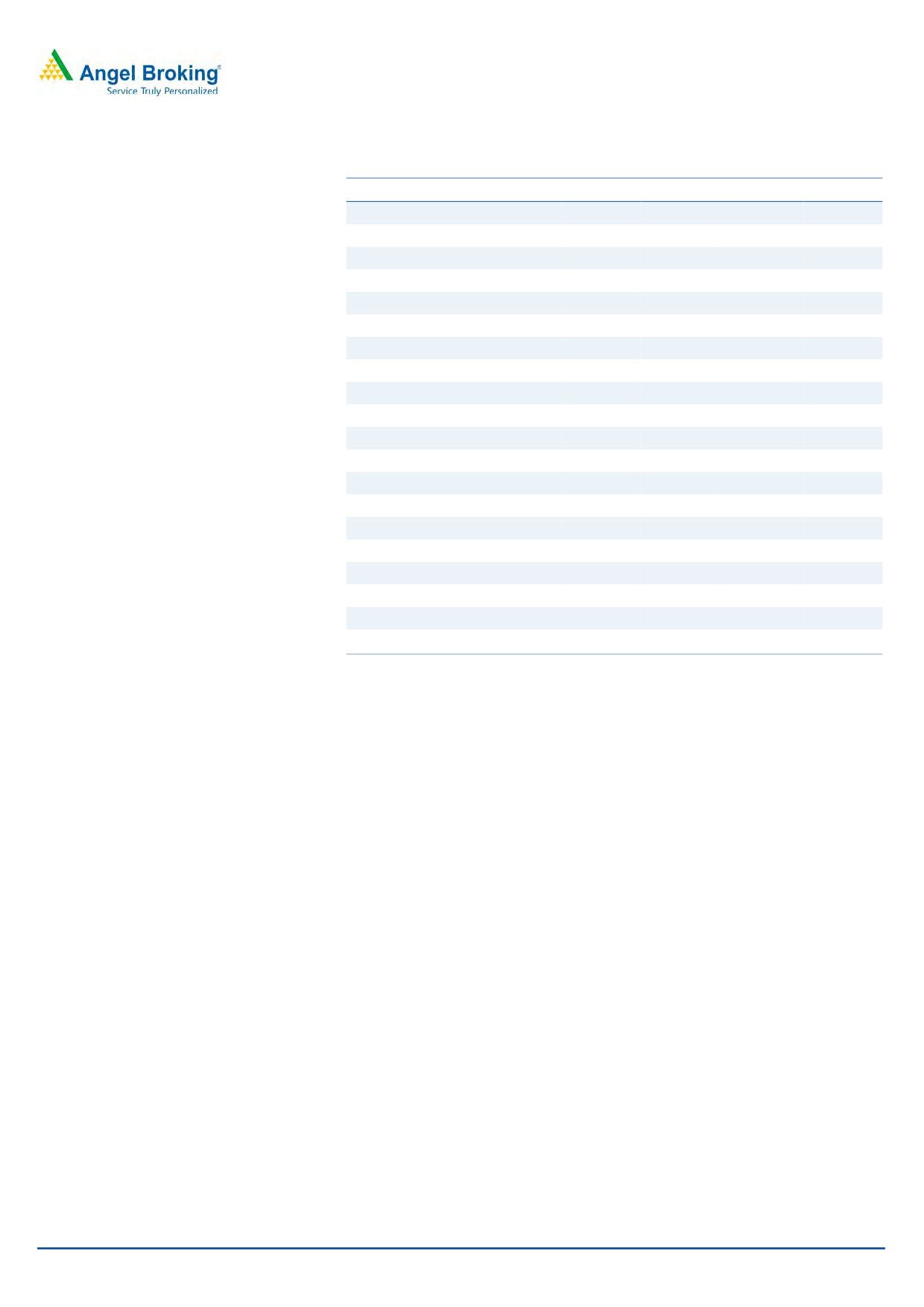

Exhibit 3: ROE (%) has been moderate

Exhibit 4: ROA (%) trend

12.0

3.0

10.3

9.9

9.6

2.4

10.0

2.5

2.3

2.3

7.4

1.8

8.0

2.0

6.0

1.5

4.0

1.0

2.0

0.5

0.0

0.0

FY14

FY15

FY16

9mFY17

FY14

FY15

FY16

9mFY17

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: CAR %- Well capitalised to grow

Exhibit 6: Leverage (X)- Scope for further leveraging

70

63.85

63.7

4.1

4.1

4.1

60

4.1

50.46

50

4.0

4.0

40

4.0

27.85

4.0

30

4.0

20

4.0

10

0

4.0

FY14

FY15

FY16

9mFY17

FY14

FY15

FY16

9mFY17

Source: Company, Angel Research

Source: Company, Angel Research

May 04, 2017

4

HUDCO | IPO Note

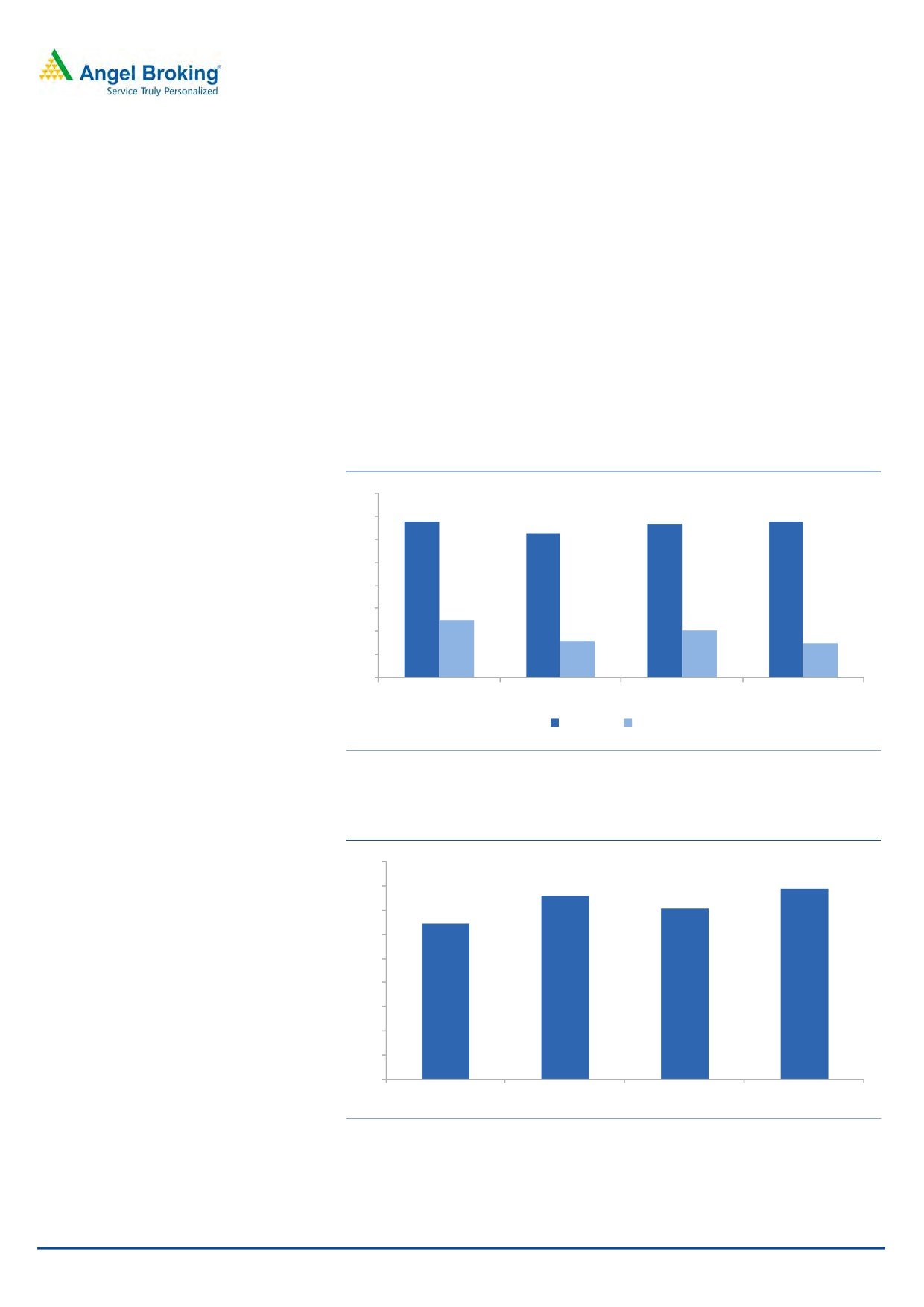

Higher reported is GNPAs due to past NPAs from Private Sector, where it has

ceased to lend: The reported GNPAs and NNPAs of HUDCO were 6.80% and

1.51% at the end of 9MFY2017. HUDCO’s high NPA was due to large defaults

from some of the Private Sector Corporates in which it had exposure to earlier.

However, it’s NPAs from Government sector is only 0.75%. It has already done

substantial provisions on the Private sector NPAs and stopped lending to them

since FY2013, and hence, we don’t expect material change in NPAs in the near

term. Further, a PCR of 72% provides enough comfort on the loan book.

Moreover, HUDCO normally finances large projects by State Govt. entities. The

chances of defaults in these projects are negligible since they are Government

projects and carry Govt. guarantees. However, as a policy, even if the loans are

given to Govt. entities, if an interest payment is due above 90 days it is classified

as NPA. However, it has been noted by the management that subsequently it is

recovered.

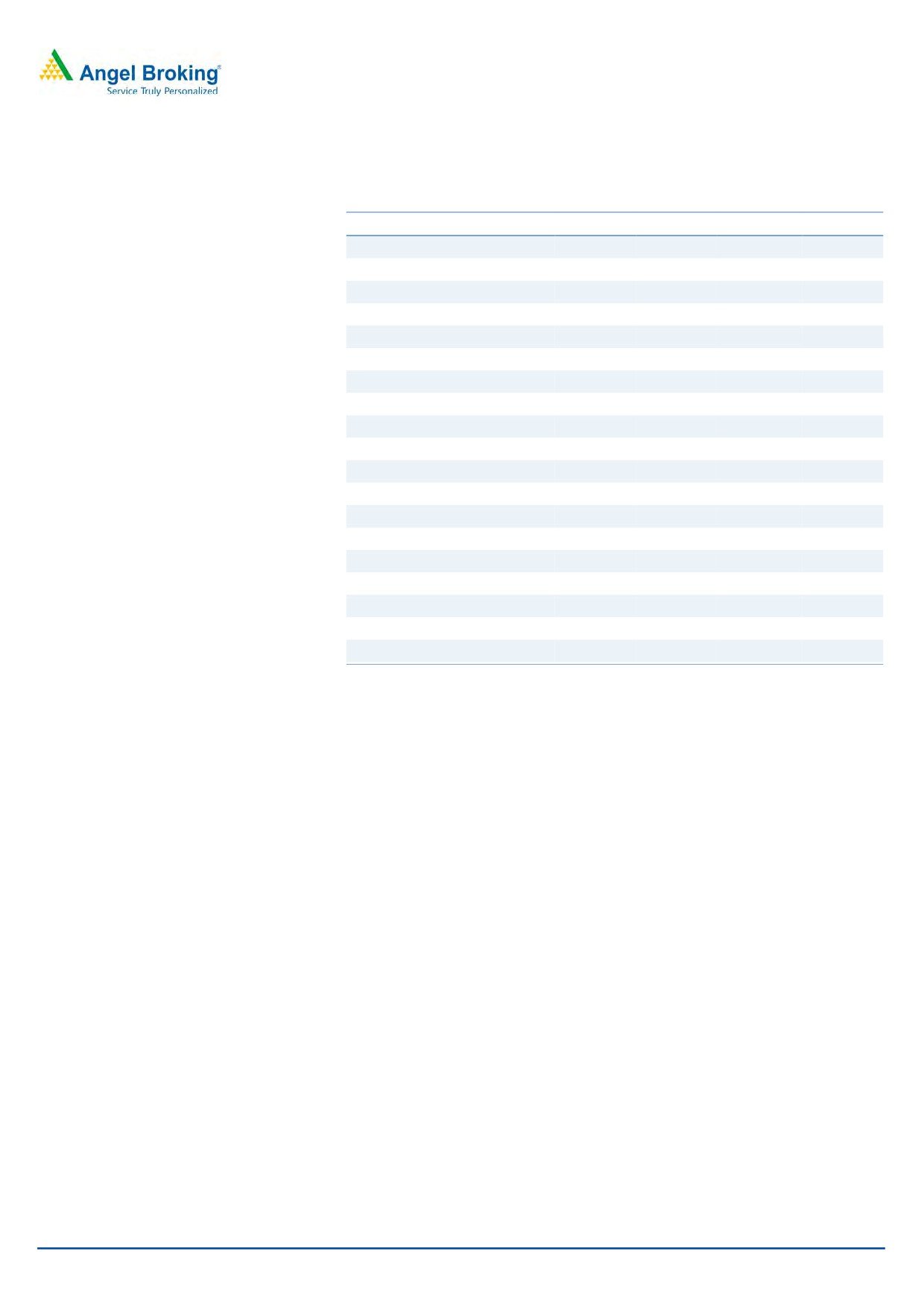

Exhibit 7: Asset Quality (%)

8

6.76

6.68

6.8

7

6.25

6

5

4

3

2.52

2.06

1.59

1.51

2

1

0

FY14

FY15

FY16

9mFY17

GNPAs % NNPAs %

Source: RHP, Angel Research

Exhibit 8: Provisioning Coverage Ratio (%)

90

79

76

80

71

70

64

60

50

40

30

20

10

0

FY14

FY15

FY16

9mFY17

Source: RHP, Angel Research

May 04, 2017

5

HUDCO | IPO Note

Ability to raise funds at competitive rates has enabled in high NIM: HUDCO has

AAA rating on its long term borrowings from ICRA & CARE, which has helped it in

borrowing at very competitive rates from the market. Despite funding to large and

long gestation projects HUDCO has been able to maintain NIM in the range of

4.6-4.3% over the last three years. In funding large scale and long gestation

projects, the sources of funds also has to be long term in nature and to meet this

HUDCO partly depends on tax free bonds, which in addition to carry lower

coupon rates are also of long tenure in nature.

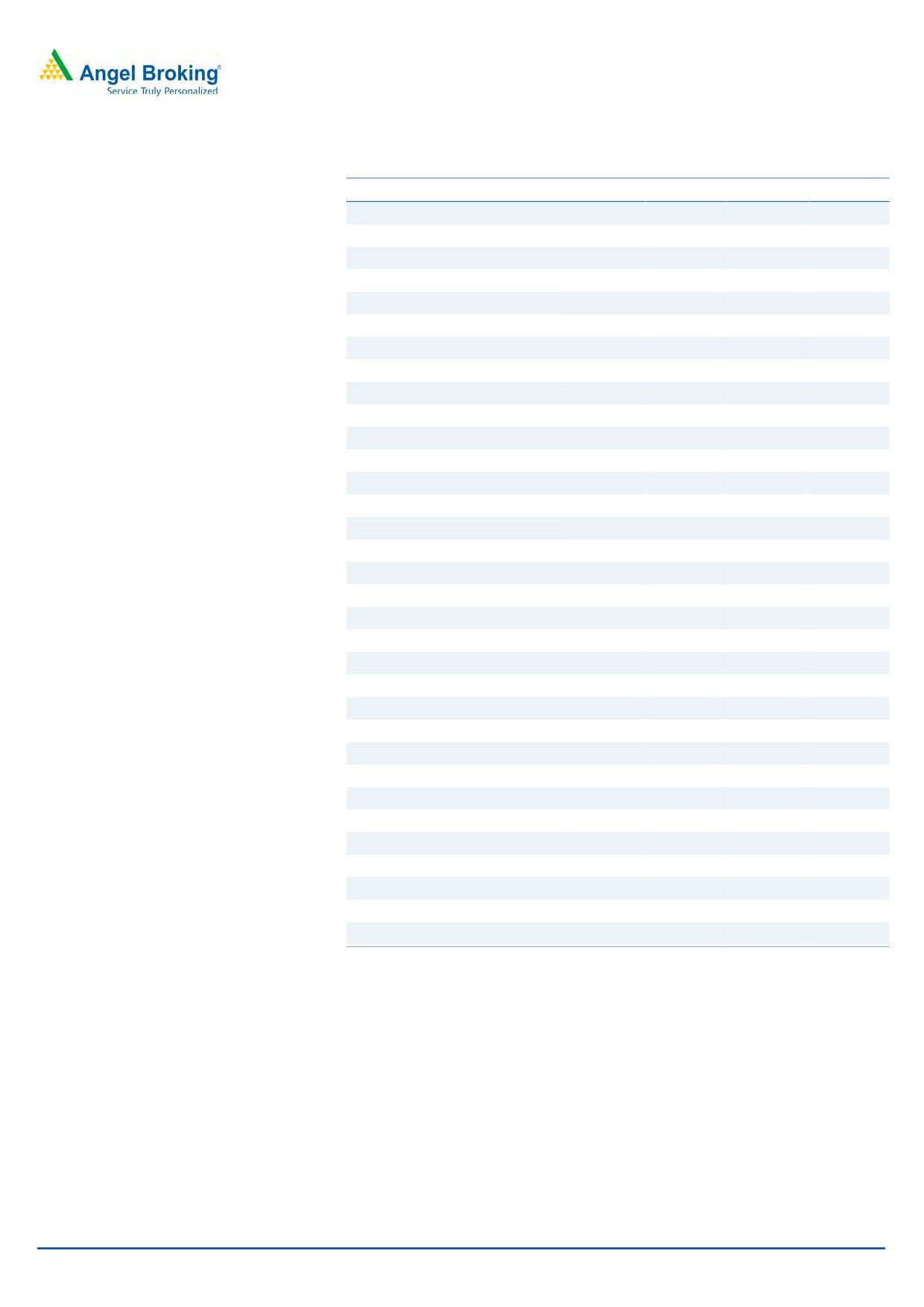

Exhibit 9: Wide source of Funding (%)

1.6

3.1

0.2

5.1

10.1

15.4

59.0

Tax Free Bonds NCDs NHB CP Public Deposits Foreign Currency Loans Others

Source: RHP, Angel Research

Exhibit 10: Cost of Funds has been trending down

Exhibit 11: NIM (%) has been largely stable

12

10.81

11.01

6

9.81

10.07

5.18

10

5

4.59

8.43

7.97

7.91

7.7

4.26

4.11

8

4

6

3

4

2

2

0

1

FY14

FY15

FY16

9mFY17

0

Avg Yield on Advances

Avg Cost Of Funds

FY14

FY15

FY16

9mFY17

Source: Company, Angel Research

Source: Company, Angel Research

May 04, 2017

6

HUDCO | IPO Note

Outlook & Valuation

HUDCO has a unique blend of business with focus on financing both housing and

urban infrastructure, which has vast untapped opportunity in India. Focus on Govt.

sponsored projects and ability to raise funds at a competitive price provides

earnings visibility for many years. At the issue price band of `56-60, the stock is

offered at 1.25x-1.35x its 9MFY2017 BV, which we believe is reasonably priced,

and hence, recommend SUBSCRIBE to the issue.

May 04, 2017

7

HUDCO | IPO Note

Exhibit 12: Income Statement

Y/E March (` Cr)

FY14

FY15

FY16

9mFY17

NII

1,249

1,571

1,345

1,104

- YoY Growth (%)

-3.6

25.8

-14.4

Other Income

52

81

97

65

- YoY Growth (%)

-11.1

55.7

19.9

Operating Income

1,301

1,652

1,443

1,169

- YoY Growth (%)

-3.9

27.0

-12.7

Operating Expenses

167

209

193

148

- YoY Growth (%)

-6.3

25.1

-7.5

Pre - Provision Profit

1,134

1,444

1,250

1,021

- YoY Growth (%)

-3.6

27.3

-13.4

Prov. & Cont.

9

274

129

281

- YoY Growth (%)

-93.2

2882.6

-52.8

Profit Before Tax

1,125

1,170

1,121

741

- YoY Growth (%)

8.1

4.0

-4.2

Exceptional Item

-20.3

0.0

5.2

0.3

PBT After Exceptional Item

1,105

1,170

1,126

741

Prov. for Taxation

371

402

315

245

- as a % of PBT

34

34

28

33

PAT

734

768

811

496

- YoY Growth (%)

4.9

4.7

5.5

Source: RHP, Angel Research

May 04, 2017

8

HUDCO | IPO Note

Exhibit 13: Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

9mFY17

Share Capital

2,002

2,002

2,002

2,002

Reserve & Surplus

5,130

5,779

6,470

6,966

Net Worth

7,132

7,780

8,472

8,968

Borrowings

18,888

18,315

22,732

23,470

- Growth (%)

39.4

-3.0

24.1

Other Liab. & Prov.

3,289

6,051

3,707

2,788

Total Provisions

406

451

467

408

Others

14

9

18

7

Deferred Tax

495

507

486

456

Total Liabilities

30,224

33,114

35,882

36,098

Cash and Cash equivalents

272

285

590

387

Investments

754

356

369

369

Total Loans & Advances

28,214

31,043

33,805

34,288

- Growth (%)

13.9

10.0

8.9

Fixed Assets

95

100

101

104

Current Investments

0

400

0

0

Others

10

10

2

2

Other Assets

879

920

1015

949

Total Assets

30,224

33,114

35,882

36,098

Source: RHP, Angel Research

May 04, 2017

9

HUDCO | IPO Note

Exhibit 14: Key Ratios

Y/E March

FY14

FY15

FY16

9mFY17

Profitability ratios (%)

NIMs

4.6

5.2

4.1

4.3

RoA

2.6

2.4

2.3

1.8

RoE

10.6

9.9

9.5

7.4

Asset Quality (%)

Gross NPAs %

6.8

6.3

6.7

6.8

Net NPAs %

2.5

1.6

2.1

1.5

Credit Cost

0.1

0.9

0.4

0.8

PCR %

64.4

75.8

70.6

79.0

Per Share Data (`)

EPS

3.7

3.8

4.0

3.3

BVPS

35.6

38.9

42.3

44.8

Adj BV

32.1

36.4

38.8

42.2

DPS

0.5

0.5

0.5

-

Valuation Ratios

PER (x)

16.4

15.6

14.8

18.2

P/BVPS (x)

1.7

1.5

1.4

1.3

P/ABVPS (x)

1.9

1.6

1.5

1.4

Dividend Yield (%)

0.8

0.8

0.8

0.0

DuPont Analysis

Interest Income

10.3

10.6

9.4

9.7

Interest Expenses

6.0

5.6

5.5

5.6

NII

4.4

5.0

3.9

4.1

Other Inc.

0.2

0.3

0.3

0.2

Total Income

4.6

5.2

4.2

4.3

Opex

0.6

0.7

0.6

0.5

PPP

4.0

4.6

3.6

3.8

Provision

0.0

0.9

0.4

1.0

PBT

3.9

3.7

3.2

2.7

Taxes

1.3

1.3

0.9

0.9

RoA

2.6

2.4

2.3

1.8

Leverage

4.0

4.1

4.1

4.0

RoE

10.6

9.9

9.5

7.4

Source: RHP, Angel Research

May 04, 2017

10

HUDCO | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

May 04, 2017

11