Quick take

HSIL Ltd

BUY

CMP

`433

Operating into the most growing segments

Target Price

`510

HSIL Limited (HSIL) is an Indian company, which offers sanitaryware products, faucets

and glass bottles. The company's segments include building products division,

Investment Period

12 Months

packaging products division and others division (retail, consumer, pipes, caps and

closures, etc.) The company’s ~46% revenue comes from building products division,

Stock Info

~43% from Packaging products division and balance from others division.

Sector

Sanitaryware

Market Cap (` cr)

2,840

Strong demand for sanitaryware to benefit HSIL: The current market size of sanitaryware

Net Debt (` cr)

782

is around `4,000-4,200cr. The market is expected to grow at ~10% CAGR going

Beta

1.1

forward on the back of increasing disposable income, urbanization, evolving

52 Week High / Low

564/ 278

preferences and government initiatives (Swachh Bharat, Housing for All, Smart cities,

Avg. Daily Volume

19,199

etc). Going forward, we estimate that HSIL would benefit from the expanding

Face Value (`)

2

sanitaryware industry backed by strong distribution network, good brand recall and

BSE Sensex

34,297

introduction of new products.

Nifty

10,546

Container glass business to be driven by demand revival: Indian market for container

Reuters Code

HSNT.BO

glass is estimated at ~`7,000cr, which is expected to grow at 4-5% CAGR going

Bloomberg Code

HSI.IN

forward. HSIL manufactures container glass for packaging needs of the companies in

the user industry (beverages, liquor, pharma, food industry, etc). HSIL is prominent

Shareholding Pattern (%)

player in the container glass segment in India. In our view, strong growth of companies

Promoters

48.4

in the user industry will lead to higher growth for HSIL.

MF / Banks / Indian Fls

26.2

Forayed into newer segments to boost additional growth: During FY16, the company

FII / NRIs / OCBs

7.8

has forayed into consumer segment, from which the company is expecting sales turnover

Indian Public / Others

17.6

of `500cr over the next 2 years with 10% of EBIT margin. Further, HSIL has expected to

launch security caps and closures in 1QFY19, which would be able to generate revenue

Abs. (%)

3m

1yr

3yr

around `130cr on full operating basis (EBIT is around 20-25%). Moreover, HSIL is also

Sensex

4.7

21.8

17.7

entering the PVC Pipe segment, which is expected to start commercial production around

Nikamal

(5.3)

(5.3)

4.5

in FY19 (will be able to generate revenue ~`400cr on peak utilization).

De-merger of building materials and consumer segment to unlock the valu e: HSIL is

demerging its consumer and building materials business, which is expected to be

completed by July 2018. Consumer and building material businesses contribute more

than 50% to the revenues of HSIL.

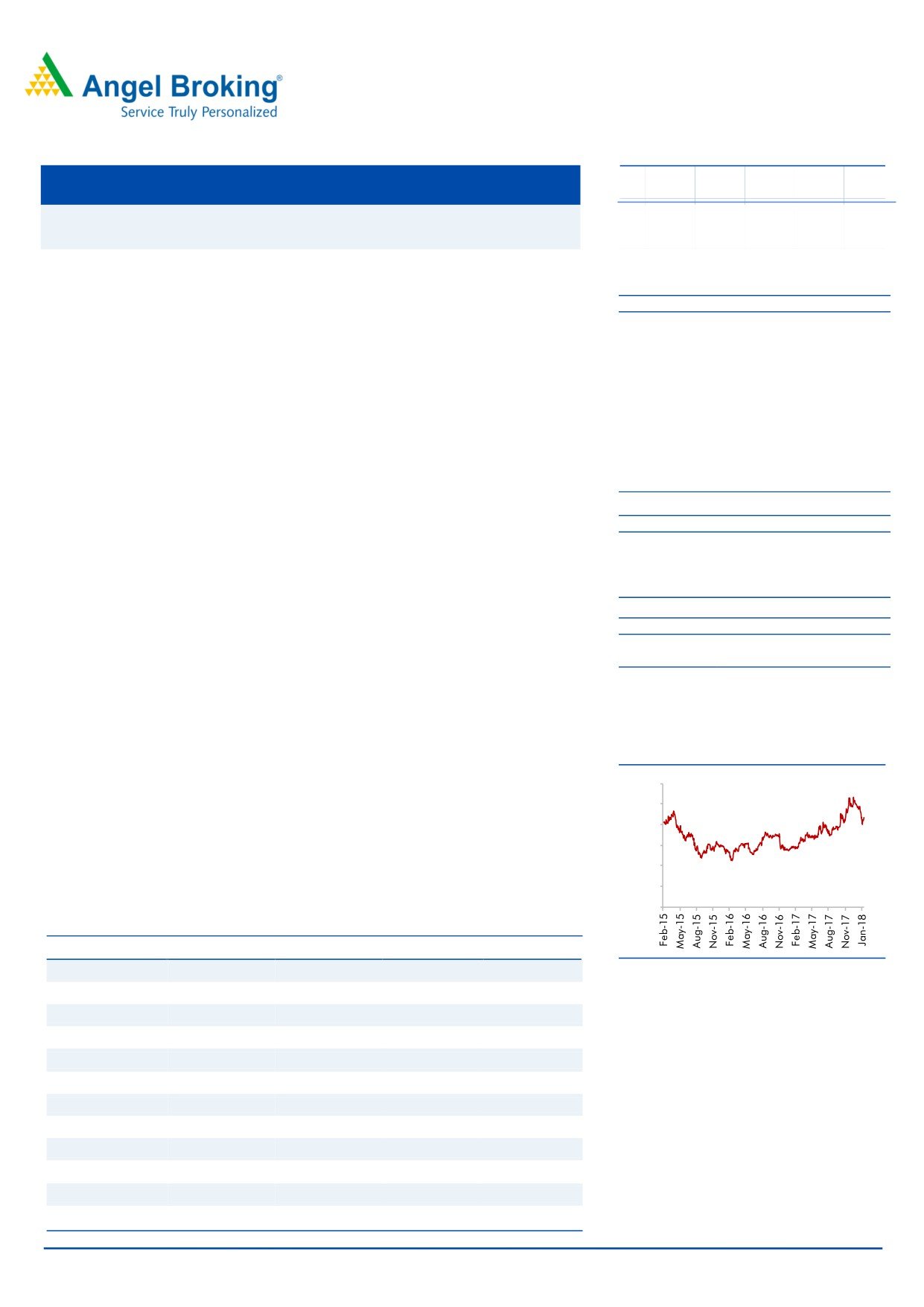

3 year daily price chart

Outlook and Valuation: Considering the various initiatives taken by the government like

smart cities, housing for all by 2022, Swachh Bharat Abhiyan and push towards

600

providing sanitation, would create new demand avenues for the sanitaryware segment.

500

Further, the company has entered into new segments like consumer, pipes and caps

and closures which will drive the further growth. We expect HSIL to report net revenue

400

CAGR of ~12% to ~`2,905cr over FY2017-20E. On bottom-line front, we expect

300

CAGR of ~15% to `154cr over FY2017-20E owing to improvement in operating

200

margins. We initiate coverage on HSIL with a Buy recommendation and target price of

100

`510, indicating an upside of ~18% from the current levels.

0

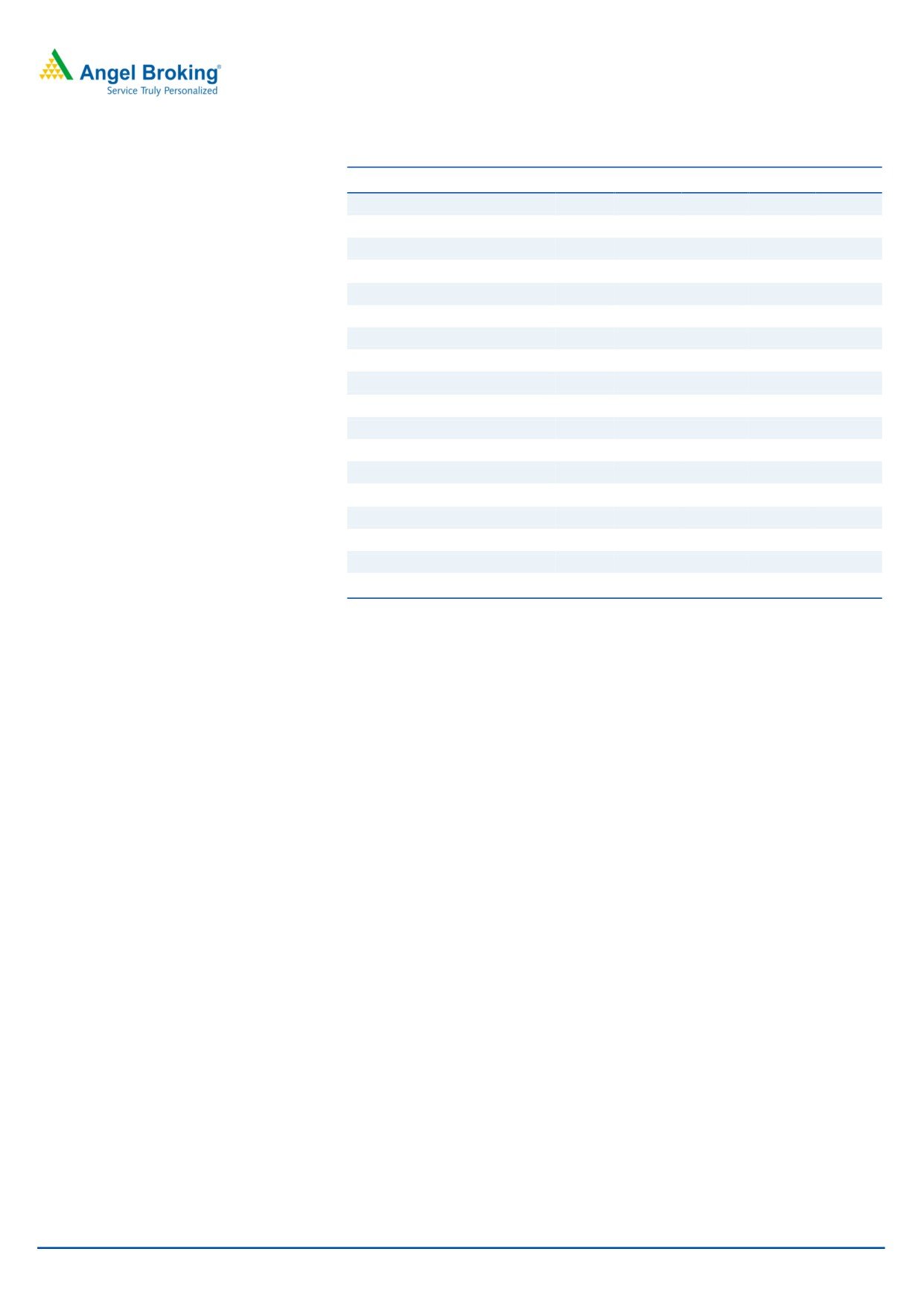

Key financials

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

Net Sales

2,078

2,204

2,506

2,905

Source: Company, Angel Research

% chg

5.0

6.0

13.7

15.9

Net Profit

100

81

114

154

% chg

(7.6)

(19.1)

40.5

34.7

Amarjeet S Maurya

OPM (%)

13.8

12.5

13.3

13.9

022-39357800 Ext: 6831

EPS (`)

13.9

11.2

15.8

21.2

P/E (x)

31.2

38.6

27.5

20.4

P/BV (x)

2.2

2.1

2.0

1.8

RoE (%)

6.9

5.4

7.2

9.0

RoCE (%)

7.4

6.6

8.4

10.1

EV/Sales (x)

1.8

1.7

1.5

1.4

EV/EBITDA (x)

13.2

14.0

11.6

9.8

Source: Company, Angel Research, Note: CMP as of February 15, 2018

Please refer to important disclosures at the end of this report

1

Quick take

HSIL

Investment rational

Strong demand for sanitaryware to benefit HSIL: The current market size of

sanitaryware is around `4,000-4,200cr. The market is expected to grow at ~10%

CAGR going forward on the back of increasing disposable income, urbanization,

evolving preferences and government initiatives (Swachh Bharat, Housing for All, Smart

cities, etc). Going forward, we estimate that HSIL would benefit from the expanding

sanitaryware industry backed by strong distribution network, good brand recall and

introduction of new products, which will aid in gaining market share and increase

revenues.

Container glass business to be driven by demand revival: Indian market for container

glass is estimated at ~`7,000cr, which is expected to grow at 4-5% CAGR going

forward. HSIL manufactures container glass for packaging needs of the companies in

the user industry (beverages, liquor, pharma, food industry, etc). HSIL is prominent

player in the container glass segment in India. In our view, strong growth of companies

in the user industry will lead to higher growth for HSIL.

Forayed into newer segments to boost additional growth: During FY16, the company

has forayed into consumer segment, from which the company is expecting sales

turnover of `500cr over the next 2 years with 10% of EBIT margin. Further, HSIL has

expected to launch security caps and closures in 1QFY19, which would be able to

generate revenue around `130cr on full operating basis (EBIT is around 20-25%).

Moreover, HSIL is also entering the PVC Pipe segment, which is expected to start

commercial production around in FY19 (will be able to generate revenue ~`400cr on

peak utilization).

De-merger of Building material and consumer segment to unlock the value: HSIL is

demerging its consumer and building materials business, which is expected to be

completed by July 2018. In this demerger, branding, marketing, sales, distribution, etc.

of consumer products and that of furniture, furnishings, home décor (Retail

Undertaking) will be demerged into an entity named Somany Home Innovation Limited

(SHIL). Moreover, branding, marketing, sales, distribution, etc. of building products

(BPDM) will be transferred to Brilloca Limited, which will be a wholly owned step down

subsidiary of SHIL. Post sanction of this scheme, SHIL will apply for listing on respective

stock exchanges. HSIL will retain the manufacturing of all the building & consumer

products in addition to manufacturing and sales of packaging products (Glassware).

February 16, 2018

2

Quick take

HSIL

Company Background

HSIL Limited is an Indian company, which offers sanitaryware, faucets and glass

bottles. The company's segments include building products division and packaging

products division. The building products division's products include sanitaryware, such

as water closets, wash basins, pedestals, squatting pans, urinals, cisterns and bidets;

wellness, such as bath tubs, shower panels, shower enclosures and whirlpools;

faucets/showers, such as showers, bathroom faucets and kitchen faucets; allied

products, such as seat covers and concealed cisterns; and consumer products, such as

kitchen appliances (vents, chimneys, waste crusher system, hobs and cooktops), water

heaters/geysers, air purifier and kitchen sink. The packaging products division's

products include glass containers, polyethylene terephthalate (PET) bottles, security caps

and closures. The company's brands include QUEO, Amore, Hindware Italian

Collection/Hindware Art, Benelave, Raasi, Moonbow, EVOK, AGI and Garden

Polymers.

Outlook and Valuation

Considering the various initiatives taken by the government like smart cities, housing for

all by 2022, Swachh Bharat Abhiyan and push towards providing sanitation, would

create new demand avenues for the sanitaryware segment. Further, the company has

entered into new segments like consumer, pipes and caps and closures which will drive

the further growth. We expect HSIL to report net revenue CAGR of ~12% to ~`2,905cr

over FY2017-20E. On bottom-line front, we expect CAGR of ~15% to `154cr over

FY2017-20E owing to improvement in operating margins. We initiate coverage on HSIL

with a Buy recommendation and target price of `510, indicating an upside of ~18%

from the current levels.

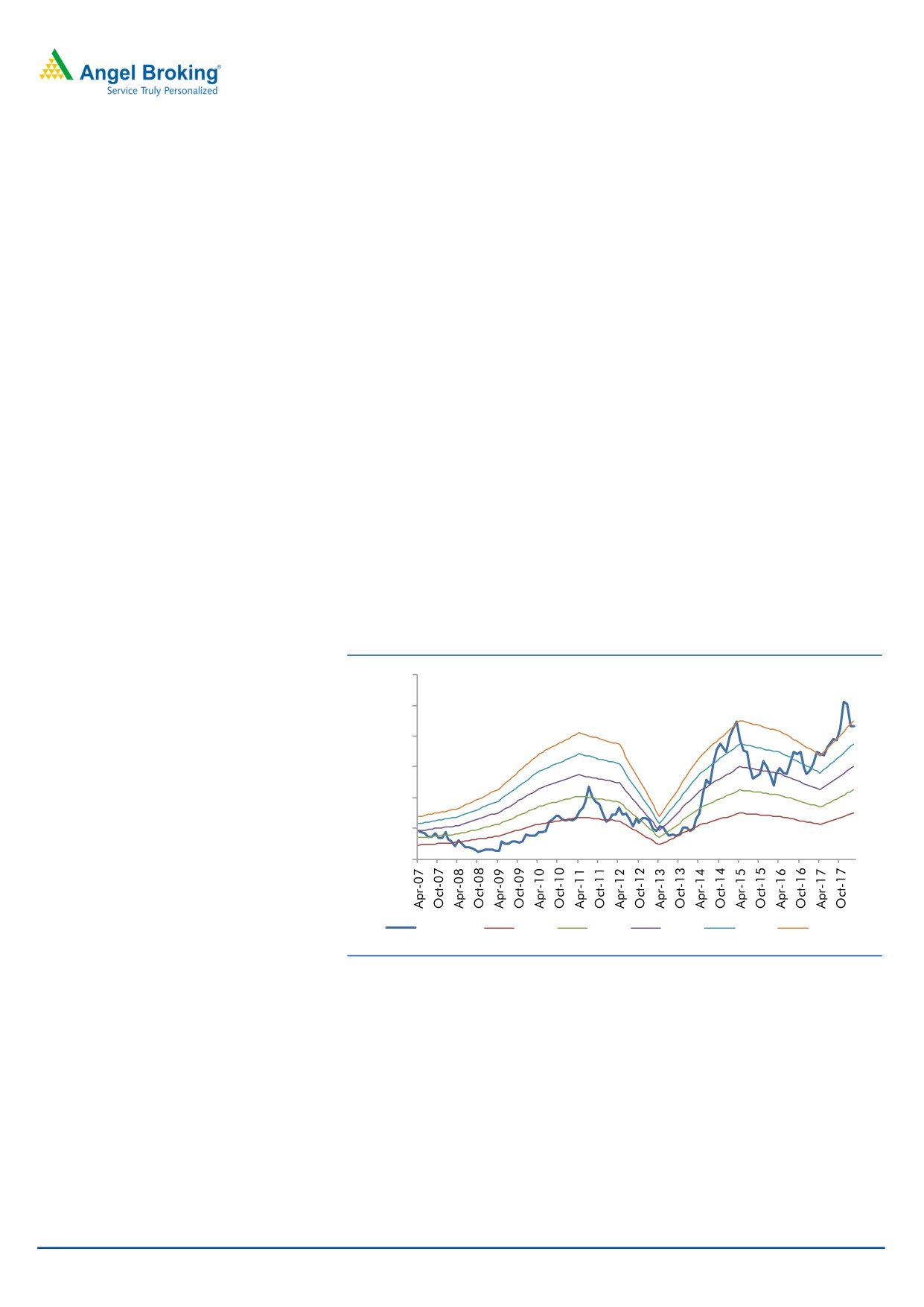

Exhibit 1: One year forward PE chart

600.00

500.00

400.00

300.00

200.00

100.00

0.00

Share Price

10.0 X

15.0 X

20.0 X

25.0 X

30.0 X

Source: Company, Angel Research

Risks to our estimates

Increase in input costs (sand, sandstone, clays, chemical fitting &

accessories purchased) could negatively impact profitability of

sanitaryware business and any increase in the price of soda ash (important

for the container glass business) would impact it negatively.

HSIL faces competition from domestic as well as international companies

(Chinese sanitaryware), which is a major threat for the company.

Any slowdown in Real estate sector could negatively impact the demand

for Sanitaryware products.

February 16, 2018

3

Quick take

HSIL

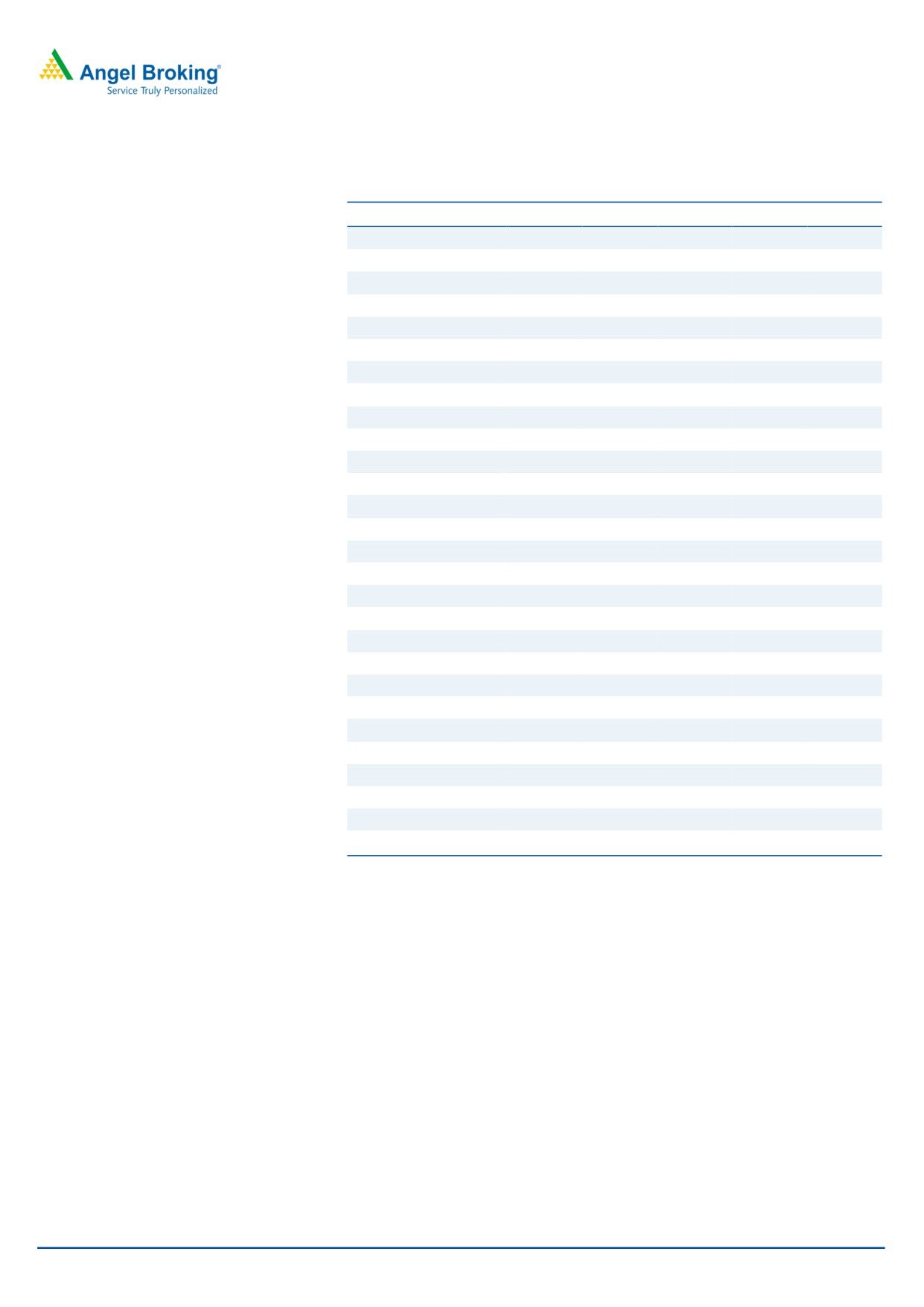

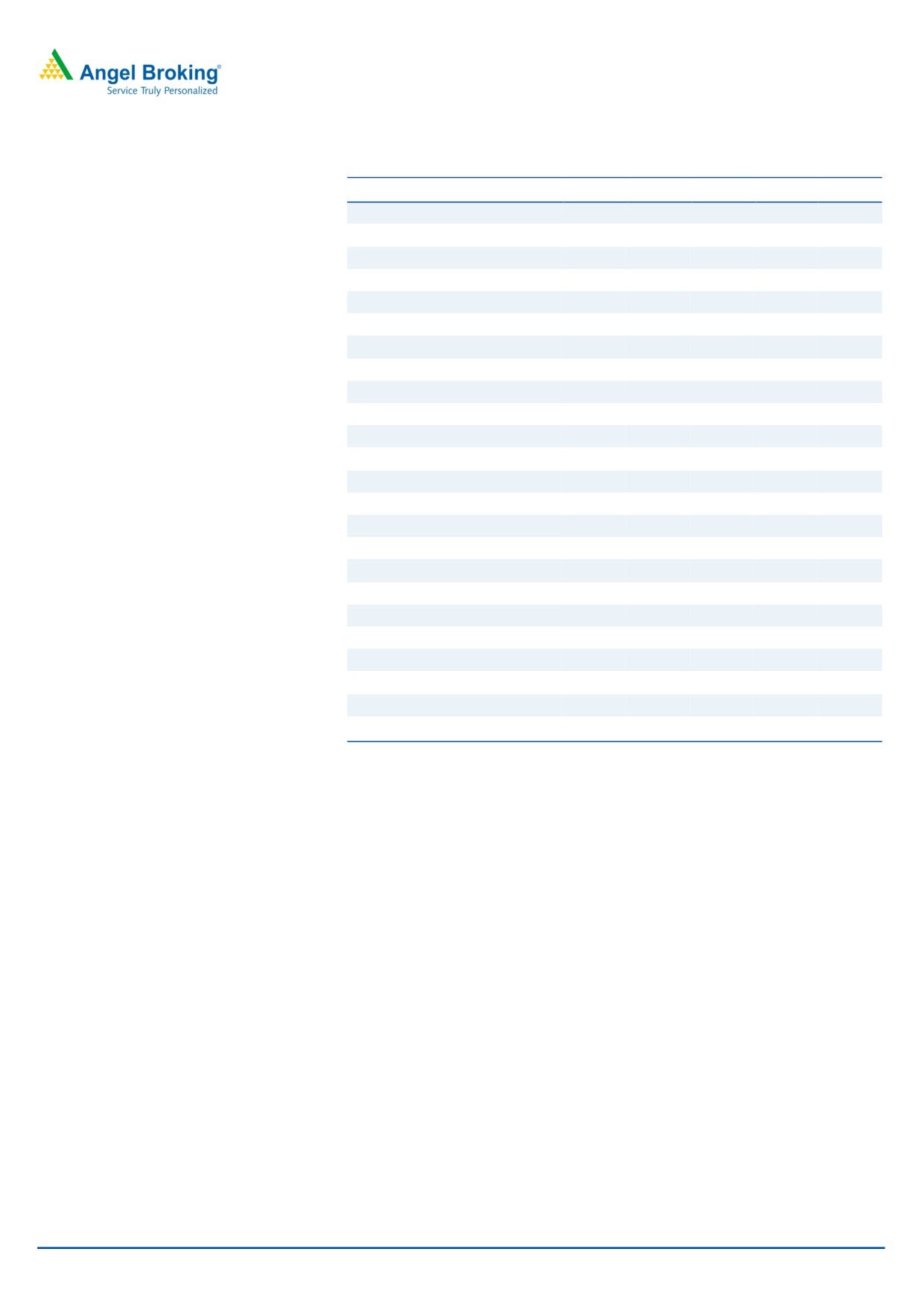

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Net Sales

1,979

2,078

2,204

2,506

2,905

% chg

(0.1)

5.0

6.0

13.7

15.9

Total Expenditure

1,663

1,791

1,928

2,173

2,502

Raw Material

763

805

855

975

1,133

Personnel

251

287

309

353

412

Power, Oil & Fuel

232

244

304

356

415

Others Expenses

418

456

461

489

541

EBITDA

315

287

275

333

403

% chg

(5.2)

(9.1)

(3.9)

21.0

20.8

(% of Net Sales)

15.9

13.8

12.5

13.3

13.9

Depreciation& Amortization

115

111

112

118

126

EBIT

201

176

164

216

277

% chg

(3.3)

(12.4)

(7.0)

31.8

28.4

(% of Net Sales)

10.1

8.5

7.4

8.6

9.5

Interest & other Charges

41

33

47

51

53

Other Income

15

5

5

6

6

(% of PBT)

8.5

3.1

4.1

3.2

2.6

Share in profit of Associ ates

-

-

-

-

-

Recurring PBT

174

147

121

170

229

% chg

30.4

(15.6)

(17.6)

40.5

34.7

Tax

66

47

40

56

76

(% of PBT)

37.7

31.7

33.0

33.0

33.0

PAT (reported)

109

100

81

114

154

% chg

27.0

(7.6)

(19.1)

40.5

34.7

(% of Net Sales)

5.5

4.8

3.7

4.5

5.3

Basic EPS (`)

15.0

13.9

11.2

15.8

21.2

Fully Diluted EPS (`)

15.0

13.9

11.2

15.8

21.2

% chg

27.0

(7.6)

(19.1)

40.5

34.7

February 16, 2018

4

Quick take

HSIL

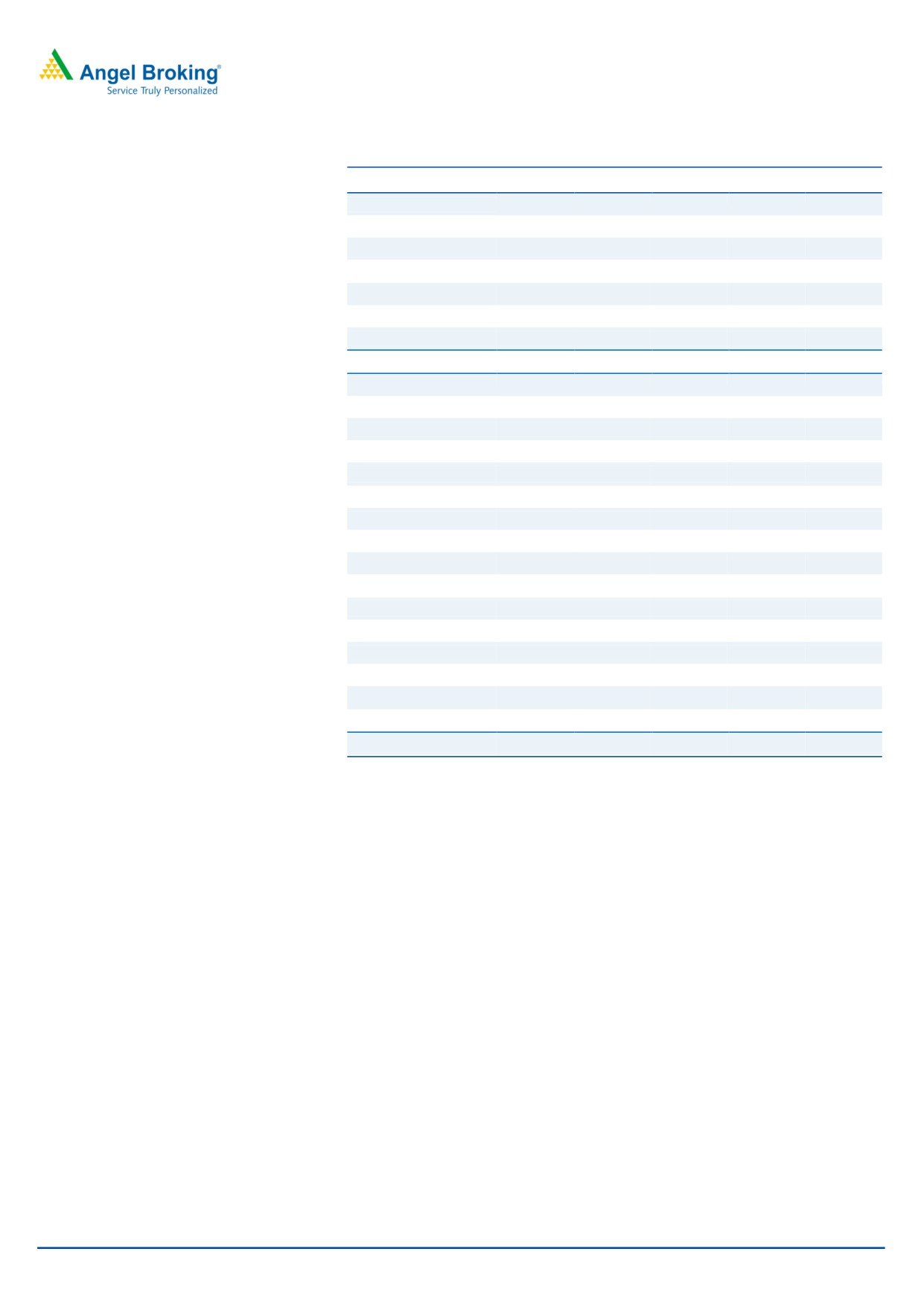

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

14

14

15

15

15

Reserves& Surplus

1,372

1,432

1,484

1,569

1,694

Shareholders Funds

1,387

1,447

1,499

1,584

1,709

Minority Interest

-

-

-

-

-

Total Loans

622

933

963

993

1,023

Deferred Tax Liability

247

242

242

242

242

Total Liabilities

2,256

2,621

2,704

2,819

2,974

APPLICATION OF FUNDS

Gross Block

1,628

1,730

1,880

1,980

2,080

Less: Acc. De preciation

113

223

335

453

579

Net Block

1,514

1,507

1,545

1,528

1,502

Capital Work-in-Progress

63

152

-

-

-

Investments

29

136

136

136

136

Current Assets

1,049

1,290

1,417

1,631

1,928

Inventories

490

493

537

625

740

Sundry De btors

390

398

435

508

605

Cash

20

144

114

110

89

Loans & Advances

51

68

88

113

145

Other Assets

97

187

242

276

349

Current liabilities

438

498

429

510

626

Net Current Assets

611

792

988

1,121

1,302

Deferred Tax Asset

40

34

34

34

34

Mis. Exp. not written off

-

-

-

-

-

Total Assets

2,256

2,621

2,704

2,819

2,974

February 16, 2018

5

Quick take

HSIL

Consolidated Cash flow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

174

147

121

170

229

Depreciation

115

111

112

118

126

Change in Working Capital

55

(16)

(226)

(137)

(202)

Interest / Dividend (Net)

39

32

0

0

0

Direct taxes paid

(71)

(73)

(40)

(56)

(76)

Others

(1)

4

0

0

0

C ash Flow from Operati ons

311

204

(33)

95

78

(Inc.)/ Dec. i n Fixed Assets

(74)

(224)

(150)

(100)

(100)

(Inc.)/ Dec. i n Inve stments

8

(104)

155

3

3

C ash Flow from Inve sting

(66)

(329)

5

(97)

(97)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

80

211

30

30

30

Dividend Paid (Incl. T ax)

(25)

(29)

(29)

(29)

(29)

Interest / Divide nd (Net)

(302)

65

2

(3)

(3)

C ash Flow from Financing

(247)

248

3

(2)

(2)

Inc./(Dec.) in Cash

(3)

123

(26)

(4)

(21)

O pening Cash balance s

19

17

140

114

110

Closing Cash balances

17

140

114

110

89

February 16, 2018

6

Quick take

HSIL

Key Ratios

Y/E March

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Valuati on Ratio (x)

P/E (on FDEPS)

28.9

31.2

38.6

27.5

20.4

P/CEPS

14.0

14.8

16.2

13.5

11.2

P/BV

2.3

2.2

2.1

2.0

1.8

Dividend yield (%)

0.9

0.9

0.9

0.9

0.9

EV/Sales

1.9

1.8

1.7

1.5

1.4

EV/EBITDA

11.8

13.2

14.0

11.6

9.8

EV / Total Assets

1.6

1.4

1.4

1.4

1.3

Per Share Data (Rs)

EPS (Basic)

15.0

13.9

11.2

15.8

21.2

EPS (fully diluted)

15.0

13.9

11.2

15.8

21.2

Cash EPS

30.9

29.2

26.7

32.1

38.7

DPS

4.0

4.0

4.0

4.0

4.0

Book Value

191.8

200.1

207.4

219.1

236.4

Returns (%)

ROCE

10.0

7.4

6.6

8.4

10.1

Angel ROIC (Pre-tax)

10.2

8.4

7.4

9.2

11.0

ROE

7.8

6.9

5.4

7.2

9.0

Turnover rati os (x)

Asset Turnover (Gross Block)

1.2

1.2

1.2

1.3

1.4

Inventory / S ales (days)

90

87

89

91

93

Receivables (days)

72

70

72

74

76

Payables (days)

31

39

39

39

40

Working capital cycle (ex-cash) (days)

131

118

122

126

129

Source: Company, Angel Research

February 16, 2018

7

Quick take

HSIL

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration numb er

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/ben eficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we canno t

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage th at may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please r efer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HSIL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 16, 2018

8