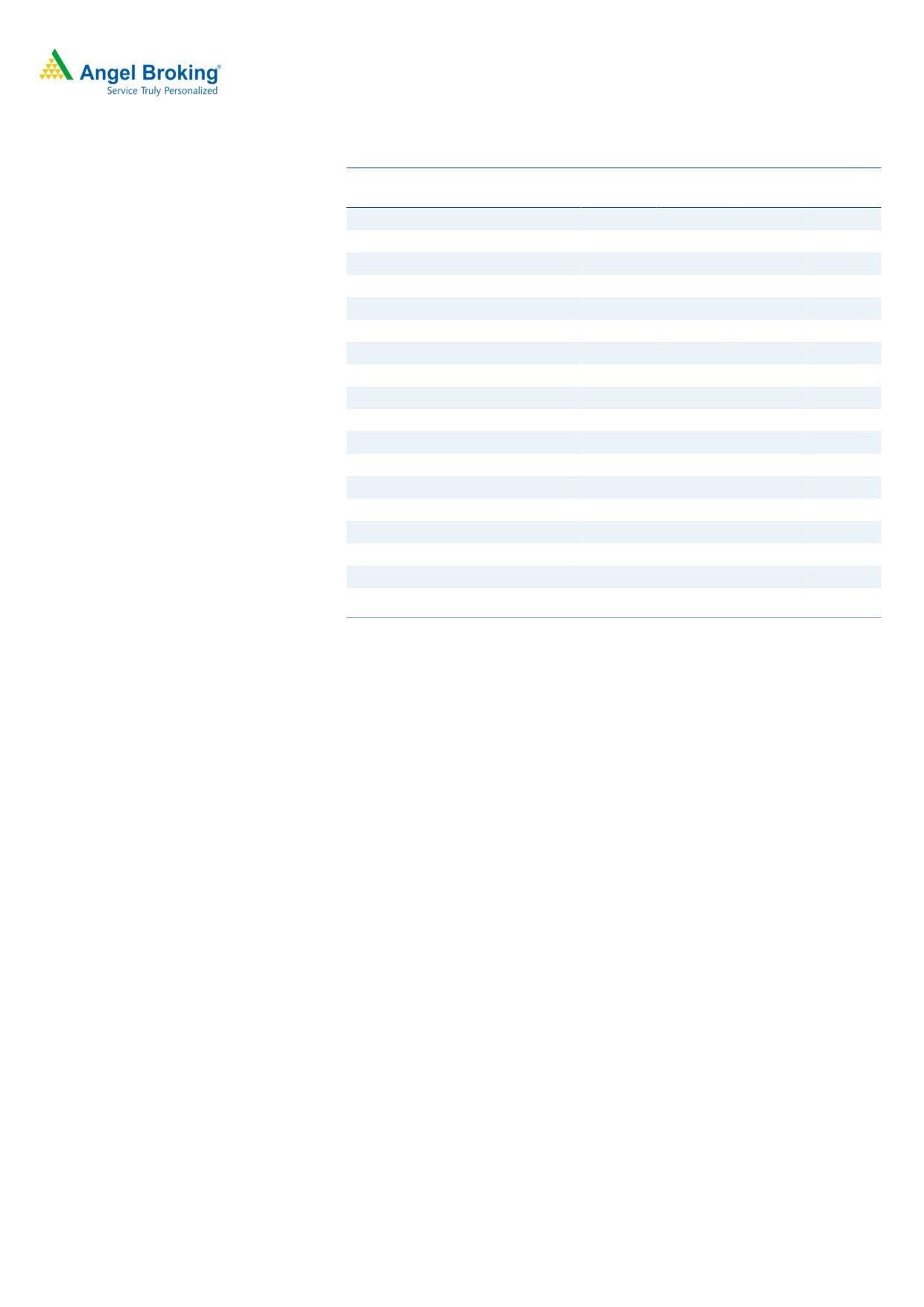

4QFY2018 Result Update | Plywood

May 31, 2018

Greenply Industries Ltd

BUY

CMP

`256

Performance Update

Target Price

`364

4QFY18

4QFY17

% chg. (yoy)

3QFY18

% chg. (qoq)

Investment Period

12 Months

Net Sales

437

478

(8.6)

399

9.5

Stock Info

Operating profit

57

73

(22.2)

63

(8.9)

Sector

Plywood

Market Cap (` cr)

4,155

OPM (%)

13.1

15.3

(228)

15.7

(263)

Net Debt (` cr)

413

Adj. PAT

33

42

(22)

36

(10)

Beta

1.0

52 Week High / Low

845/587

Source: Company, Angel Research

Avg. Daily Volume

57,987

Face Value (`)

1

For 4QFY2018, Greenply Industries disappointed both on the top-line as well as

BSE Sensex

33,812

Nifty

10,442

on the bottom-line front. Revenue de-grew by ~8.6% yoy to `437cr on an

Reuters Code

GRPL.BO

Bloomberg Code

MTLM.IN

account of poor performance in Plywood segment as well as in MDF segment. On

Shareholding Pattern (%)

the operating front, margins contracted by

228bps due to due to lower

Promoters

51.0

MF / Banks / Indian Fls

20.6

realisations in Plywood and losses in Wallpaper and others category. During the

FII / NRIs / OCBs

14.9

Indian Public / Others

13.5

quarter, PAT de-grew by ~22% yoy to `33cr on account of lower revenue and

Abs.(%)

3m

1yr

3yr

Sensex

7.4

27.1

22.9

poor operating margin.

Blue Star

(23.8)

(0.2)

33.9

Overall top-line subdued: The Company’s top-line de-grew by ~8.6% yoy to

`437cr on an account of poor performance in Plywood segment as well as in

MDF segment. Plywood segment de-grew by ~9.1% yoy during the quarter,

whereas MDF segment reported a decline of ~12.4% yoy. The Company’s other

segment also de-grew by ~63.4% yoy.

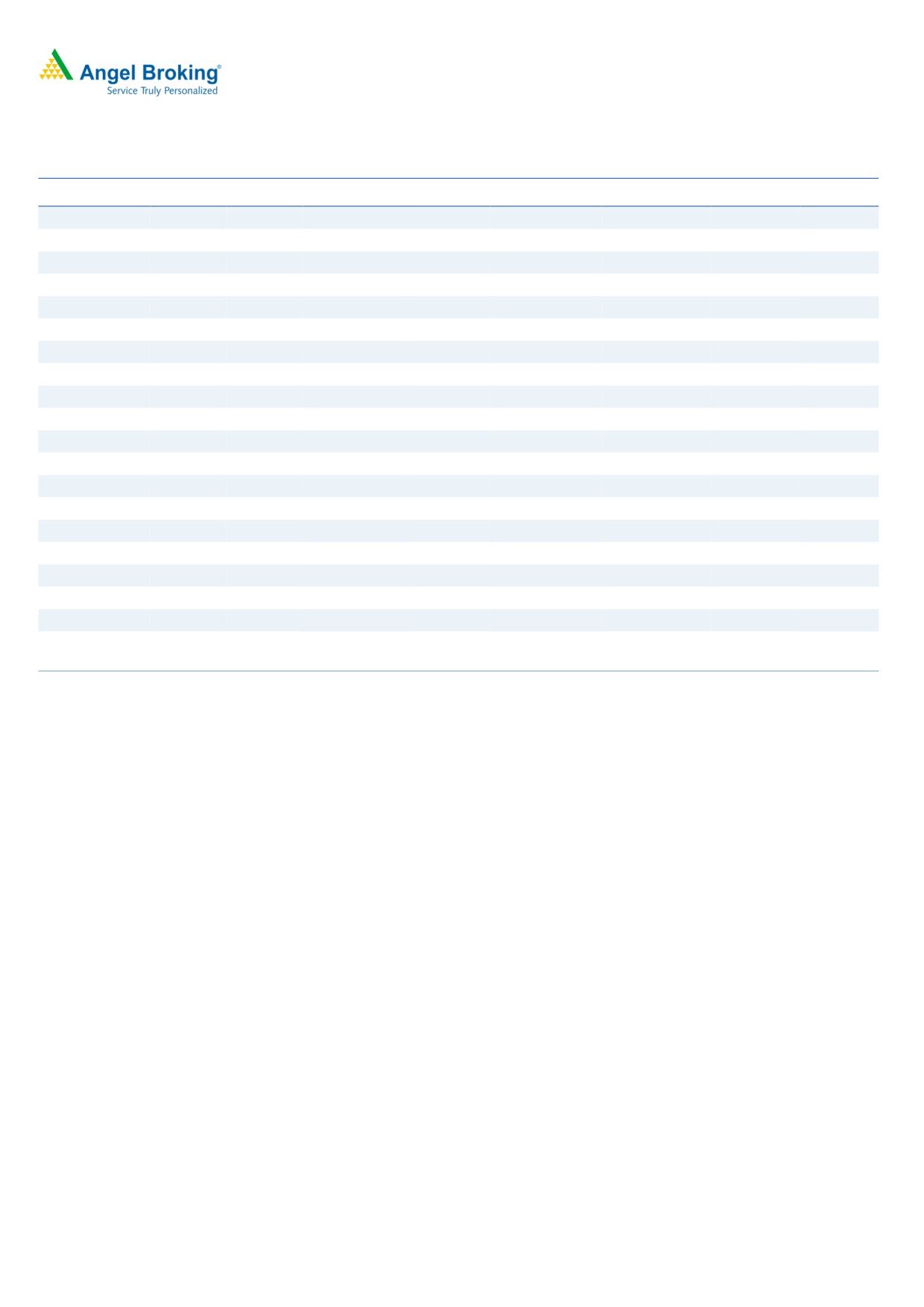

3-year price chart

Lower revenue and poor operating performance drag the overall profitability: On

the operating front, the company’s margin contracted by 228bps yoy due to lower

450

realisations in Plywood and losses in Wallpaper and others category. On the

400

bottom-line front, PAT de-grew by ~22% yoy to `33cr on an account of lower

350

revenue and poor operating margin.

300

250

Outlook & Valuation: We forecast GIL to report top-line CAGR of ~15% to

200

`2,256cr over FY18-20E on the back of strong brand and distribution network. On

150

the bottom-line front, we estimate ~12% CAGR to `139cr owing to improvement

100

in volumes. We recommend Buy with a revised target price of `364.

50

Key Financials

0

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Net Sales

1,664

1,713

1,938

2,256

% chg

1.0

3.0

13.1

16.4

Source: Company, Angel Research

Net Profit

125

111

120

140

% chg

(1.9)

(11.8)

8.8

16.0

OPM (%)

14.5

13.5

13.6

13.8

EPS (Rs)

10.2

9.0

9.8

11.4

P/E (x)

33.2

37.7

34.6

29.9

P/BV (x)

5.4

4.7

4.2

3.6

Amarjeet S Maurya

RoE (%)

16.2

12.5

12.0

12.2

022-39357800 Ext: 6831

RoCE (%)

16.3

11.6

11.5

11.8

EV/Sales (x)

2.7

2.8

2.5

2.1

EV/EBITDA (x)

18.5

20.8

18.2

15.3

Source: Company, Angel Research Note: CMP as of May 31,2018

Please refer to important disclosures at the end of this report

1

Greenply Industries Ltd | 4QFY2018 Result Update

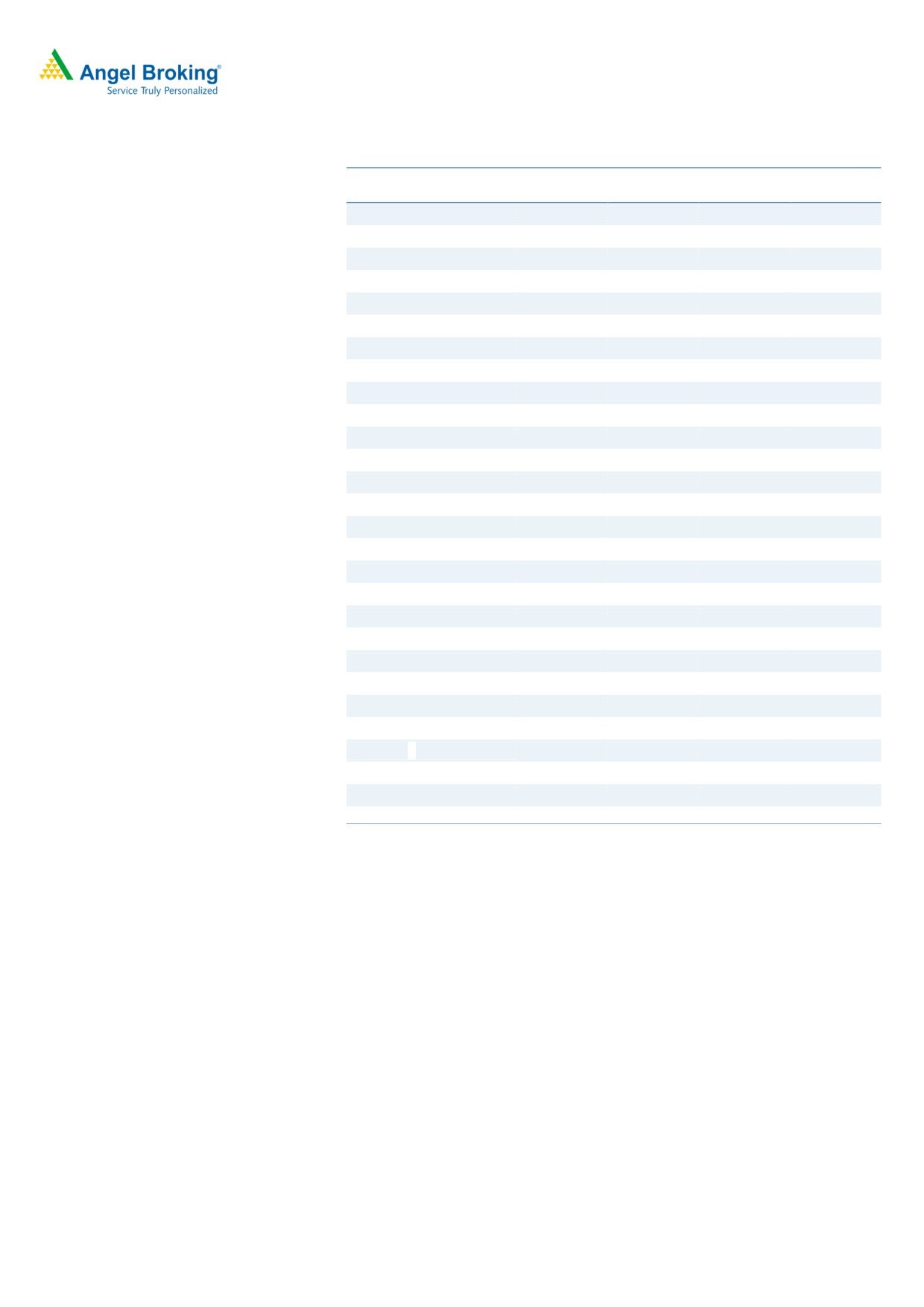

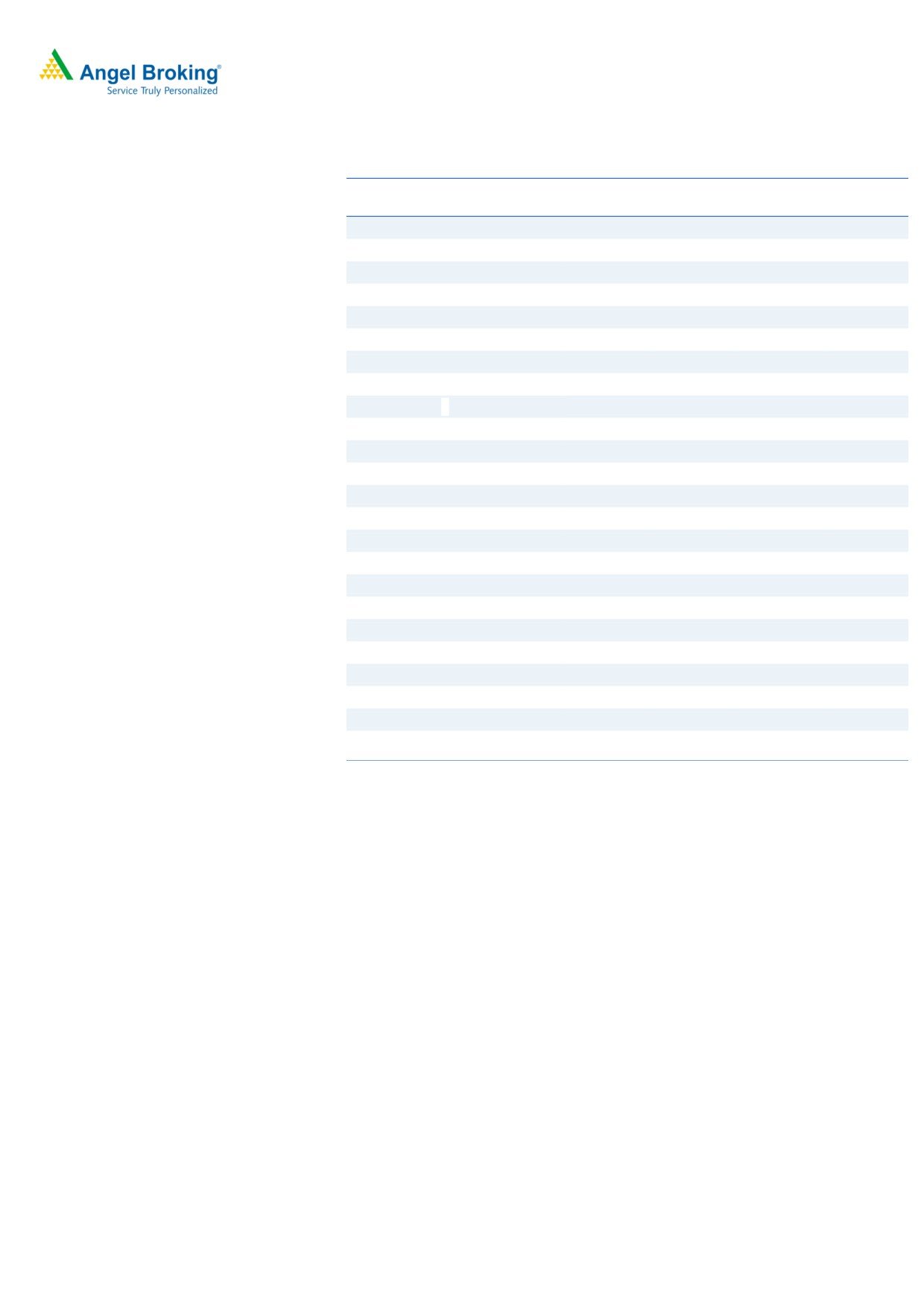

Exhibit 1: 4QFY2018 Performance

Y/E March (` cr)

4QFY18

4QFY17

% chg. (yoy)

3QFY18

% chg. (qoq)

FY2018

FY2017

% chg

Net Sales

437

478

(8.6)

399

9.5

1,704

1,777

(4.1)

Net raw material

232.0

232

(0.2)

213

9.1

884.1

879.7168

0.5

(% of Sales)

53.1

48.6

448

53.3

(19)

51.9

49.5

Employee Cost

42

43

(1.8)

49

(14.9)

185

171

8.5

(% of Sales)

9.6

8.9

67

12.3

(274)

10.9

9.6

Other Expenses

106

130

(18.3)

75

41.9

395

473

(16.5)

(% of Sales)

24.3

27.2

(287)

18.7

556

23.2

26.6

Total Expenditure

380

405

(6.2)

337

12.9

1,464

1,524

(3.9)

Operating Profit

57

73

(22.2)

63

(8.9)

240

253

(5)

OPM (%)

13.1

15.3

(228)

15.7

(263)

14.07

14.25

(18)

Interest

1

2

(37.1)

3

(47.9)

9

18

(47.7)

Depreciation

11

12

(7.6)

10

6.7

45

49

(7.7)

Other Income

1

1

(14.3)

1

24.3

4

4

(13.5)

PBT

46

61

(24.4)

51

(9.4)

189

191

(0.9)

(% of Sales)

10.5

12.7

12.7

11.1

10.7

Tax

13

19

(29.5)

15

(9.2)

54

56

(4.2)

(% of PBT)

28.9

31.0

28.8

28.3

29.3

Reported PAT

33

42

(22.1)

36

(9.5)

136

135

0.5

PATM

7.5

8.8

9.0

8.0

7.6

Adj PAT

33

42

(22.1)

36

(9.5)

136

135

0.5

Source: Company, Angel Research

May 31, 2018

2

Greenply Industries Ltd | 4QFY2018 Result Update

Outlook & Valuation: We forecast GIL to report top-line CAGR of ~15% to

`2,256cr over FY18-20E on the back of strong brand and distribution network. On

the bottom-line front, we estimate ~12% CAGR to `139cr owing to improvement

in volumes. We maintain our Buy recommendation with a target price of `364.

Downside risks to our estimates

Most of the company’s raw material is imported from other countries. The

company also has ECB loan, hence any unfavorable change in currency may

pose forex risks, which could significantly impact GIL’s margins.

The company is expanding the MDF plant with capex of ~`700cr, any

slowdown in MDF market can impact the company’s earnings due higher fixed

cost overheads.

Company Background

Greenply Industries Limited is engaged in the business of manufacturing plywood

& allied products and medium density fibreboards (MDF) through its factories at

various locations. The company's segments include Plywood & Allied Products and

Medium Density Fibre Boards & Allied Products. The Plywood & Allied Products

segment is engaged in the business of manufacturing and trading of Plywood,

block boards, veneer, doors and other wood panel products through its wholesale

and retail network. The Medium Density Fibre Boards & Allied Products segment is

engaged in the business of manufacturing of Medium Density Fibreboards and

other allied products through its wholesale and retail network. The company offers

a portfolio of residential and commercial products comprising plywood and block

boards, MDF, wood floors, flush doors and decorative veneers. The company

offers wood floors under the brand name Green Floormax.Electronics.

May 31, 2018

3

Greenply Industries Ltd | 4QFY2018 Result Update

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

Total operating income

1,664

1,713

1,938

2,256

% chg

1.0

3.0

13.1

16.4

Total Expenditure

1,423

1,482

1,674

1,945

Raw Material

883

895

1,013

1,180

Personnel

177

197

225

264

Others Expenses

362

390

436

501

EBITDA

241

231

264

311

% chg

0.9

(4.2)

14.2

18.2

(% of Net Sales)

14.5

13.5

13.6

13.8

Depreciation& Amortisation

51

50

64

83

EBIT

190

181

200

228

% chg

0.6

(4.9)

10.4

14.2

(% of Net Sales)

11.4

10.6

10.3

10.1

Interest & other Charges

19

11

35

38

Other Income

10

2

10

12

(% of PBT)

5.5

1.3

5.7

5.9

Share in profit of Associates

-

-

-

-

Recurring PBT

181

172

174

202

% chg

6.9

(5.3)

1.6

16.0

Tax

56

54

54

63

(% of PBT)

30.8

31.2

31.0

31.0

PAT (reported)

125

118

120

140

% chg

(1.9)

(11.8)

8.8

16.0

(% of Net Sales)

7.5

6.5

6.2

6.2

Basic EPS (`)

10.2

9.0

9.8

11.4

Fully Diluted EPS (Rs)

10.2

9.0

9.8

11.4

% chg

(1.9)

(11.8)

8.8

16.0

May 31, 2018

4

Greenply Industries Ltd | 4QFY2018 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

12

12

12

12

Reserves& Surplus

760

871

991

1,131

Shareholders Funds

773

883

1,004

1,143

Minority Interest

-

-

-

-

Total Loans

397

682

732

782

Deferred Tax Liability

49

49

49

49

Total Liabilities

1,218

1,614

1,785

1,974

APPLICATION OF FUNDS

Gross Block

797

807

1,507

1,517

Less: Acc. Depreciation

272

321

385

468

Net Block

526

486

1,122

1,049

Capital Work-in-Progress

269

620

-

-

Investments

26

26

26

26

Current Assets

757

865

1,071

1,385

Inventories

158

215

255

297

Sundry Debtors

302

319

372

451

Cash

78

33

77

163

Loans & Advances

66

127

155

203

Other Assets

153

171

213

271

Current liabilities

395

410

462

513

Net Current Assets

363

455

609

872

Deferred Tax Asset

35

35

35

35

Mis. Exp. not written off

-

-

-

-

Total Assets

1,218

1,614

1,785

1,974

May 31, 2018

5

Greenply Industries Ltd | 4QFY2018 Result Update

Consolidated Cash flow Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E FY2020E

Profit before tax

181

172

174

202

Depreciation

51

50

64

83

Change in Working Capital

(25)

(137)

(110)

(177)

Interest / Dividend (Net)

18

11

35

38

Direct taxes paid

(42)

(54)

(54)

(63)

Others

(0)

0

0

0

Cash Flow from Operations

183

42

109

84

(Inc.)/ Dec. in Fixed Assets

(295)

(10)

0

(10)

(Inc.)/ Dec. in Investments

2

(345)

(80)

0

Cash Flow from Investing

(293)

(355)

(80)

(10)

Issue of Equity

50

0

0

0

Inc./(Dec.) in loans

129

285

50

50

Dividend Paid (Incl. Tax)

(7)

0

0

0

Interest / Dividend (Net)

(22)

(11)

(35)

(38)

Cash Flow from Financing

150

274

15

12

Inc./(Dec.) in Cash

40

(38)

44

86

Opening Cash balances

31

71

33

77

Closing Cash balances

71

33

77

163

May 31, 2018

6

Greenply Industries Ltd | 4QFY2018 Result Update

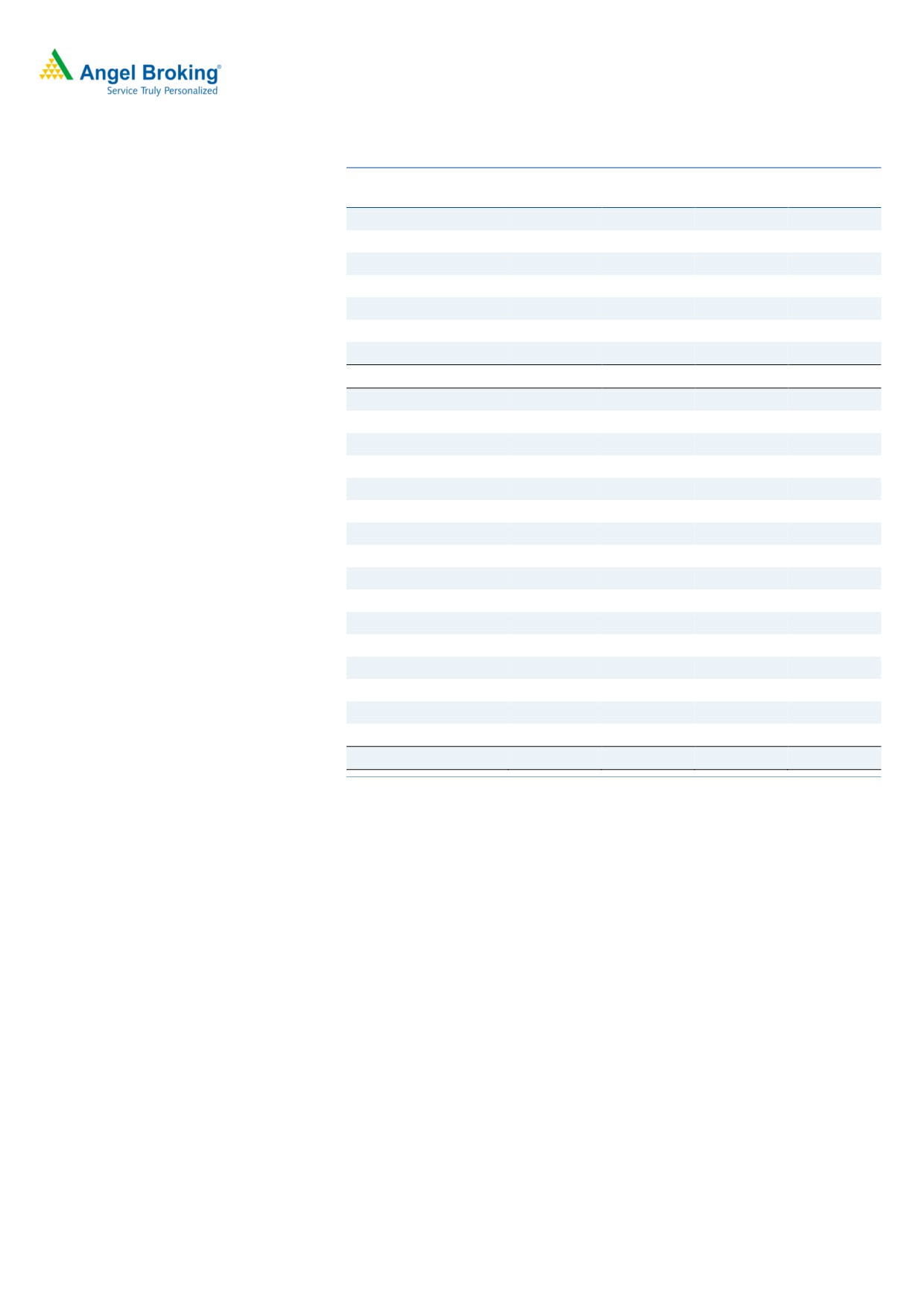

Key Ratios

Y/E March

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

33.2

37.7

34.6

29.9

P/CEPS

23.7

24.8

22.7

18.7

P/BV

5.4

4.7

4.2

3.6

Dividend yield (%)

20.6

0.0

0.0

0.0

EV/Sales

2.7

2.8

2.5

2.1

EV/EBITDA

18.5

20.8

18.2

15.3

EV / Total Assets

3.7

3.0

2.7

2.4

Per Share Data (`)

EPS (Basic)

10.2

9.0

9.8

11.4

EPS (fully diluted)

10.2

9.0

9.8

11.4

Cash EPS

14.4

13.7

15.0

18.2

DPS

70.0

0.0

0.0

0.0

Book Value

63.0

72.0

81.9

93.2

Returns (%)

ROCE

16.3

11.6

11.5

11.8

Angel ROIC (Pre-tax)

17.9

12.0

12.2

13.1

ROE

16.2

12.5

12.0

12.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.1

2.1

1.3

1.5

Inventory / Sales (days)

35

46

48

48

Receivables (days)

66

68

70

73

Payables (days)

66

66

66

64

Working capital cycle (ex-cash) (days)

35

48

52

57

Source: Company, Angel Research

May 31, 2018

7

Greenply Industries Ltd | 4QFY2018 Result Update

Research Team Tel: 022 - 39357800

Website:

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of

this document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to

time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The

views contained in this document are those of the analyst, and the company may or may not subscribe to all the views

expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group

companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent

error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty,

express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited

endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance,

investment banking or other advisory services in a merger or specific transaction to the companies referred to in this

report, as on the date of this report or in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that

may arise from or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also,

please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt.

Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement Nilkamal

1. Analyst ownership of the stock No

2. Angel and its Group companies ownership of the stock No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 31, 2018

8