Please refer to important disclosures at the end of this report

1

Incorporated in 2010, Go Fashion (India) Limited is one of the largest women's

bottom-

wear brands in India. The company is engaged in the development,

design, sourcing, marketing, and retailing of a range of women's bottom-

wear

products under the brand, 'G

o Colors'. The company offers one of the widest

portfolios of bottom-

wear products among women's apparel retailers in terms of

colors and styles. Go Fashion serves their customers primarily through their

extensive network of 459 exclusive brand outlets (“E

BOs”) (including 12 kiosks

operated on a “company owned and company operated” (“COCO”) model and

11 franchise stores) that are spread across 23 states and union territories in

India, as of September 30, 2021.

Positives: (a) One of the largest women's bottom-wear brands in India (b)

Wide,

well-diversified, product portfolio and first-mover advantage (c)

the company has

459 exclusive brand outlets (EBOs) that are spread across 23 state

s and union

territories in India (d) Strong financial performance record.

Investment concerns: (a) Increase in competition (b)

Slowdown in the economy

could impact the overall revenue of the company.

Outlook & Valuation:

In terms of valuations, the post-issue FY20 EV/EBITDA works out -

30.2x to (at

the upper end of the issue price band), which is almost in similar

range

compared to its peers TCNS Clothing Co. (FY20 EV/EBITDA -

29.3x). Further, Go

Fashion India has better track record of

revenue growth, higher operating

margin & high Return on equity compared to TCNS Clothing Co.

Considering

all the positive factors, we believe this valuation is at reasonable levels.

Thus, we

recommend a subscribe rating on the issue.

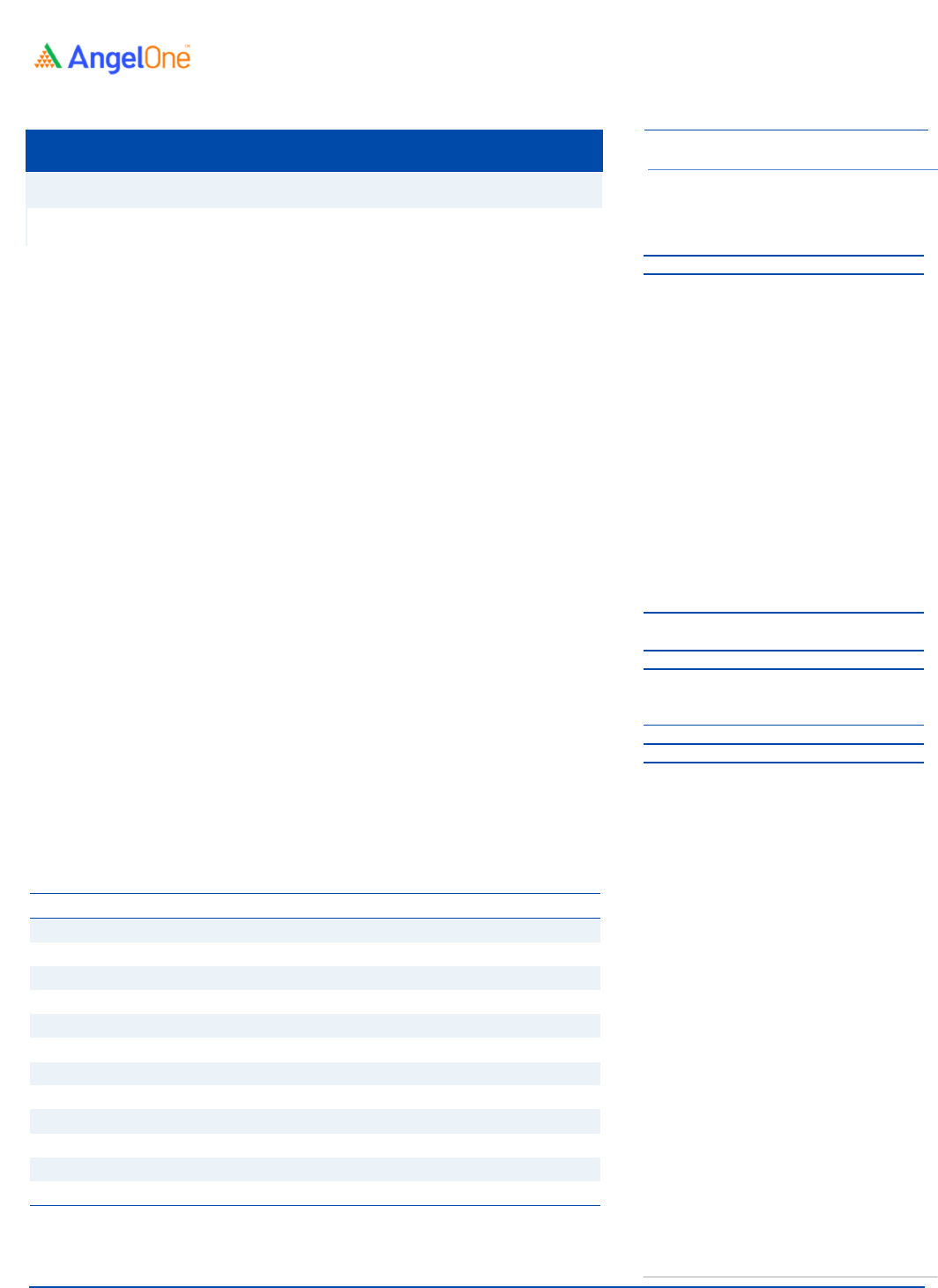

Key Financials

Y/E March (Rs cr)

FY2019

FY2020

FY2021

1QFY21

1QFY22

Net Sales

293

406

268

10

31

% chg

-

38.7

(34.0)

-

200.8

Net Profit

31

53

(4)

9

(19)

% chg

-

130.0

92.2

-

-

OPM (%)

27.7

31.5

17.7

(147.6)

(19.1)

EPS (Rs)

5.9

10.1

(0.7)

-

-

P/E (x)

116.4

68.4

-

-

P/BV (x)

15.8

12.6

12.7

-

RoE (%)

13.5

18.4

(1.3)

-

RoCE (%)

12.8

16.4

(2.5)

-

EV/Sales (x)

12.6

9.3

14.0

-

EV/EBITDA (x)

45.6

29.4

79.0

-

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

Subscribe

Issue Open: Nov 17, 2021

Issue Close: Nov 22, 2021

Offer for Sale: `888.6cr

QIBs 75%

Non-Institutional 15%

Retail 10%

Promoters 52.8%

Public 47.2%

Fresh issue: `125cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `52.2cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `54.0cr

Issue size (amount): `1,014cr

Price Band: `655-690

Lot Size: 21 shares

Post-issue mkt.cap: ` 3,544*– 3,727cr**

Promoter holding Pre-Issue: 57.5%

Promoter holding Post-Issue: 52.8%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Amarjeet S Maurya

+022 40003600, Extn: 6831

amarjeet.maurya@angelbroking.com

Go Fashion (India) Limited

IPO Note |

Retail

November, 16

, 2021

Go Fashion (India) Ltd | IPO Note

November 16, 2021

2

Company background

Go Fashion (India) Limited (“Go Fashion”) was incorporated on September 9, 2010.

Go Fashion is among the largest women’s bottom-wear brands in India, with a

market share of approximately 8% in the branded women’s bottom-wear market in

Fiscal 2020. They are engaged in the development, design, sourcing, marketing

and retailing a range of women’s bottom-wear products under the brand, ‘Go

Colors’.

The company offers one of the widest portfolios of bottom-wear products among

women’s apparel retailers in India in terms of colours and styles. As of September

30, 2021, they sold bottom-wear in over 50 styles in more than 120 colours.

Go Fashion serves their customers primarily through their extensive network of 459

exclusive brand outlets (“EBOs”) (including 12 kiosks operated on a “company

owned and company operated” (“COCO”) model and 11 franchise stores) that are

spread across 23 states and union territories in India, as of September 30, 2021.

In addition, their distribution channels include large format stores (“LFSs”) including

Reliance Retail Ltd, Central, Unlimited, Globus Stores Pvt Ltd and Spencer's Retail

among others. As of September 30, 2021, they have 1,270 LFSs. In addition, they

sell their products through their own website and online marketplaces and through

multi-brand outlets (“MBOs”).

Issue details

Go Fashion India

is raising

₹

1,013.6

cr through fresh issue (

`

125

cr) and

Promoter & investors are selling equity share 1.3

cr through offer for sale in the

price band of ₹655-690.

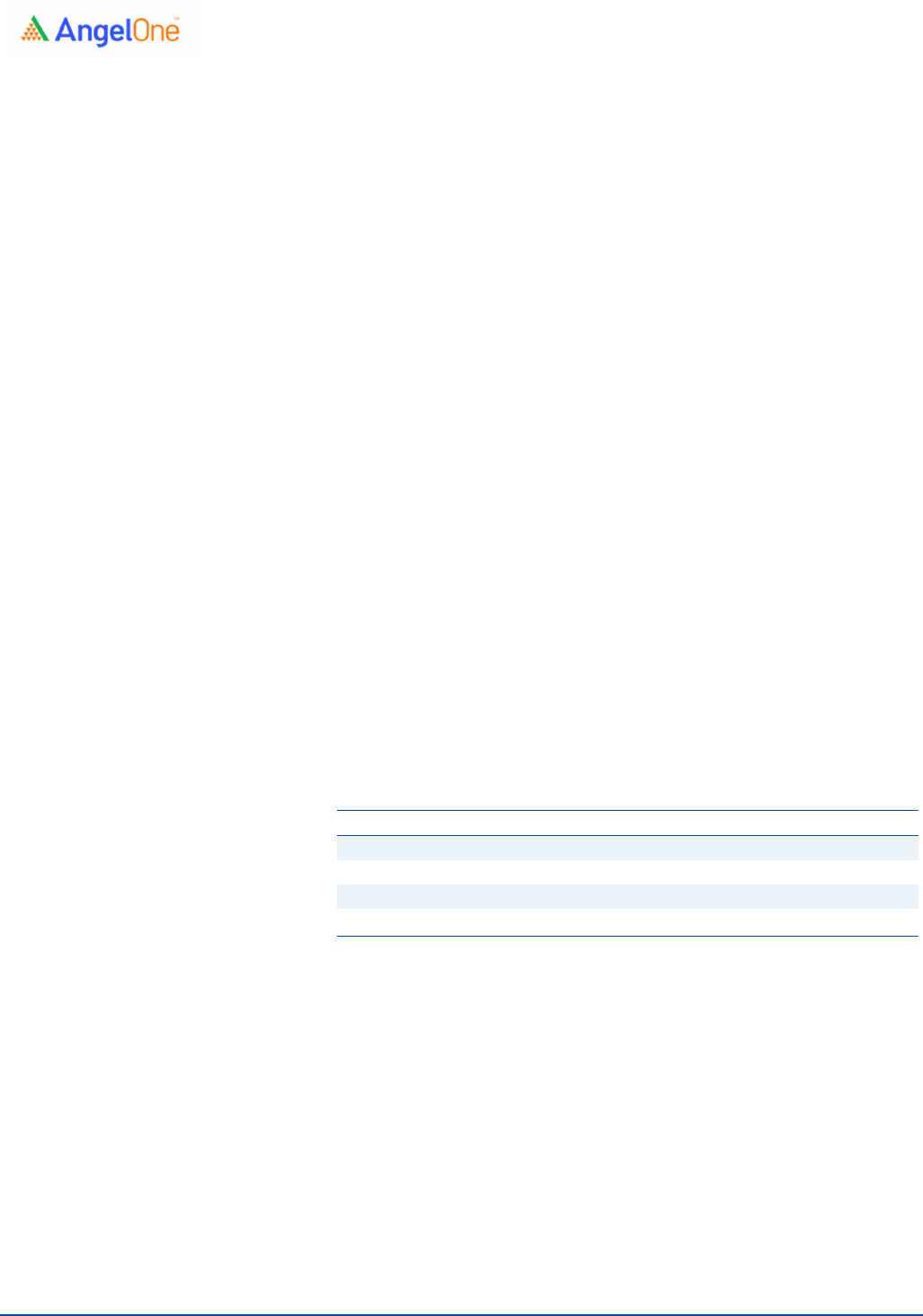

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue)

%

Promoter

30,000,000

57.5%

28,505,942

52.8%

Public

22,197,390

42.5%

25,503,042

47.2%

Total

52,197,390 100.0%

54,008,984

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Funding roll out of 120 new EBOs (Exclusive Brand Outlets) -₹33.7cr;

Funding working capital requirements -₹61.45r and

General corporate purposes

Go Fashion (India) Ltd | IPO Note

November 16, 2021

3

Exhibit 2: Income Statement

Y/E March (` cr)

FY2019

FY2020 FY2021

Net Sales

293

406

268

% chg

38.7

(34.0)

Total Expenditure

212

278

220

Raw Material

94

130

92

Personnel

42

62

61

Others Expenses

75

86

67

EBITDA

81

128

47

% chg

58.2

(62.9)

(% of Net Sales)

27.7

31.5

17.7

Depreciation& Amortisation

32

47

61

EBIT

49

82

(13)

% chg

66.9

(116.0)

(% of Net Sales)

16.7

20.1

(4.9)

Interest & other Charges

12

18

22

Other Income

6

5

32

(% of PBT)

13.6

7.1

(1,006.1)

Share in profit of Associates

-

- -

Recurring PBT

42

68

(3)

% chg

61.8

(104.6)

Tax

11

16

0

(% of PBT)

26.7

22.9

(12.7)

PAT (reported)

31

53

(4)

Basic EPS (`)

5.9

10.1

(0.7)

% chg

70.1

(106.7)

Source: Company, Angel Research

Go Fashion (India) Ltd | IPO Note

November 16, 2021

4

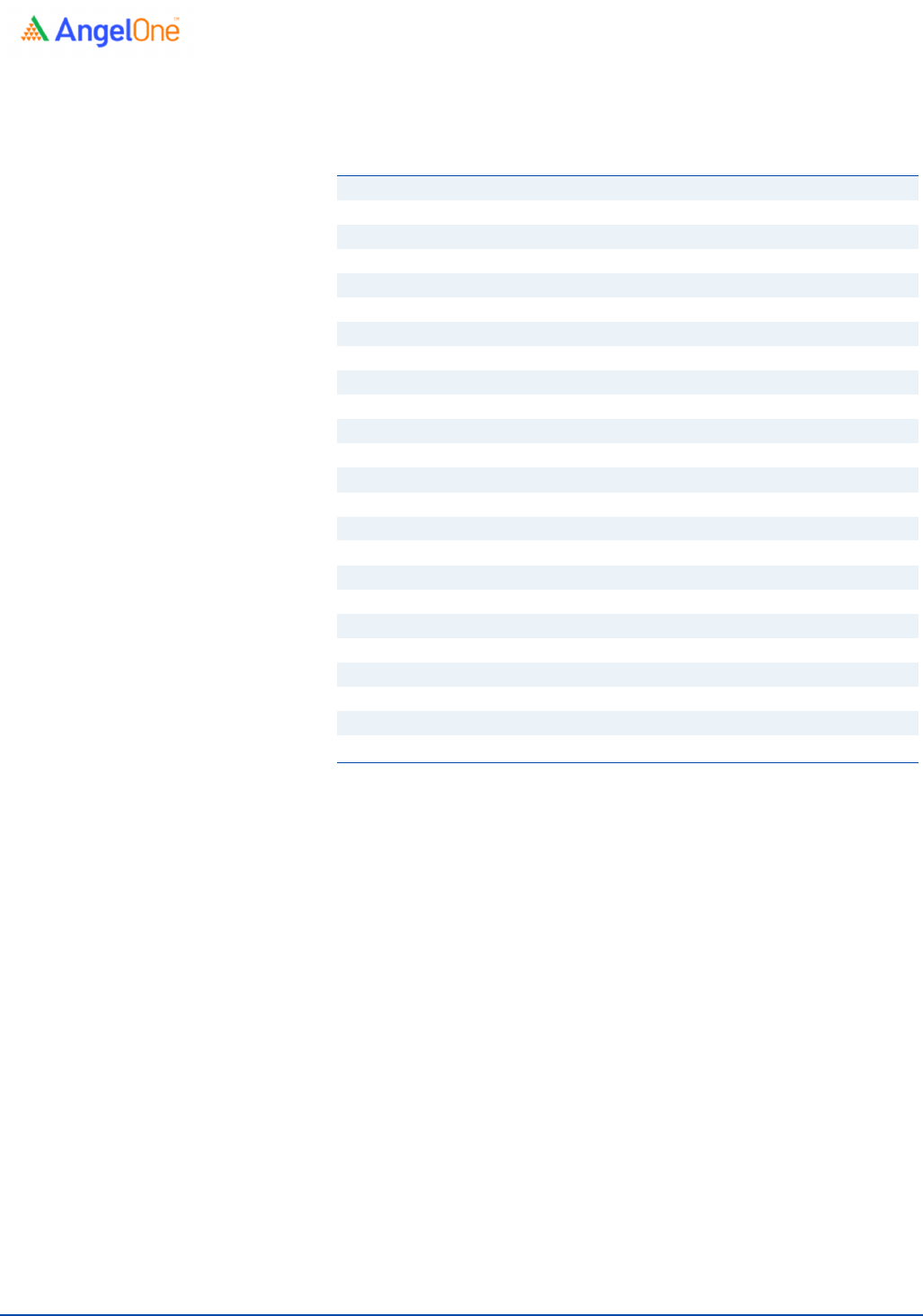

Balance Sheet

Y/E March (` cr)

FY2019

FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital

43

50

53

Reserves& Surplus

429

474

427

Shareholders Funds

472

524

480

Total Loans

96

646

645

Deferred Tax Liability

17

12

11

Total Liabilities

587

1,182

1,134

APPLICATION OF FUNDS

Net Block

719

1,161

1,084

Capital Work-in-Progress

21

21

30

Investments

-

16

27

Current Assets

355

186

208

Inventories

38

47

48

Sundry Debtors

22

5 8

Cash

186

39

50

Loans & Advances

16

74

75

Other Assets

92

20

28

Current liabilities

508

202

215

Net Current Assets

(153)

(16) (7)

Deferred Tax Asset

-

-

-

Total Assets

587

1,182

1,134

Source: Company, Angel Research

Go Fashion (India) Ltd | IPO Note

November 16, 2021

5

Cash Flow Statement

Y/E March (` cr)

FY2019 FY2020 FY2021

Profit before tax

42

68

(3)

Depreciation

32

47

61

Change in Working Capital

(42)

(53)

63

Interest / Dividend (Net)

9

13

(10)

Direct taxes paid

(17)

(20)

(0)

Others

8

3

(20)

Cash Flow from Operations

33

57

90

(Inc.)/ Dec. in Fixed Assets

(26)

(28)

(10)

(Inc.)/ Dec. in Investments

21

10

(37)

Cash Flow from Investing

(5)

(18)

(47)

Issue of Equity

0

0

0

Inc./(Dec.) in loans

(20)

(27)

(17)

Dividend Paid (Incl. Tax)

0

0

(0)

Interest / Dividend (Net)

(11)

(16)

(20)

Cash Flow from Financing

(31)

(44)

(37)

Inc./(Dec.) in Cash

(3) (5)

5

Opening Cash balances

5

2

(3)

Closing Cash balances

2

(3)

3

Source: Company, Angel Research

Go Fashion (India) Ltd | IPO Note

November 16, 2021

6

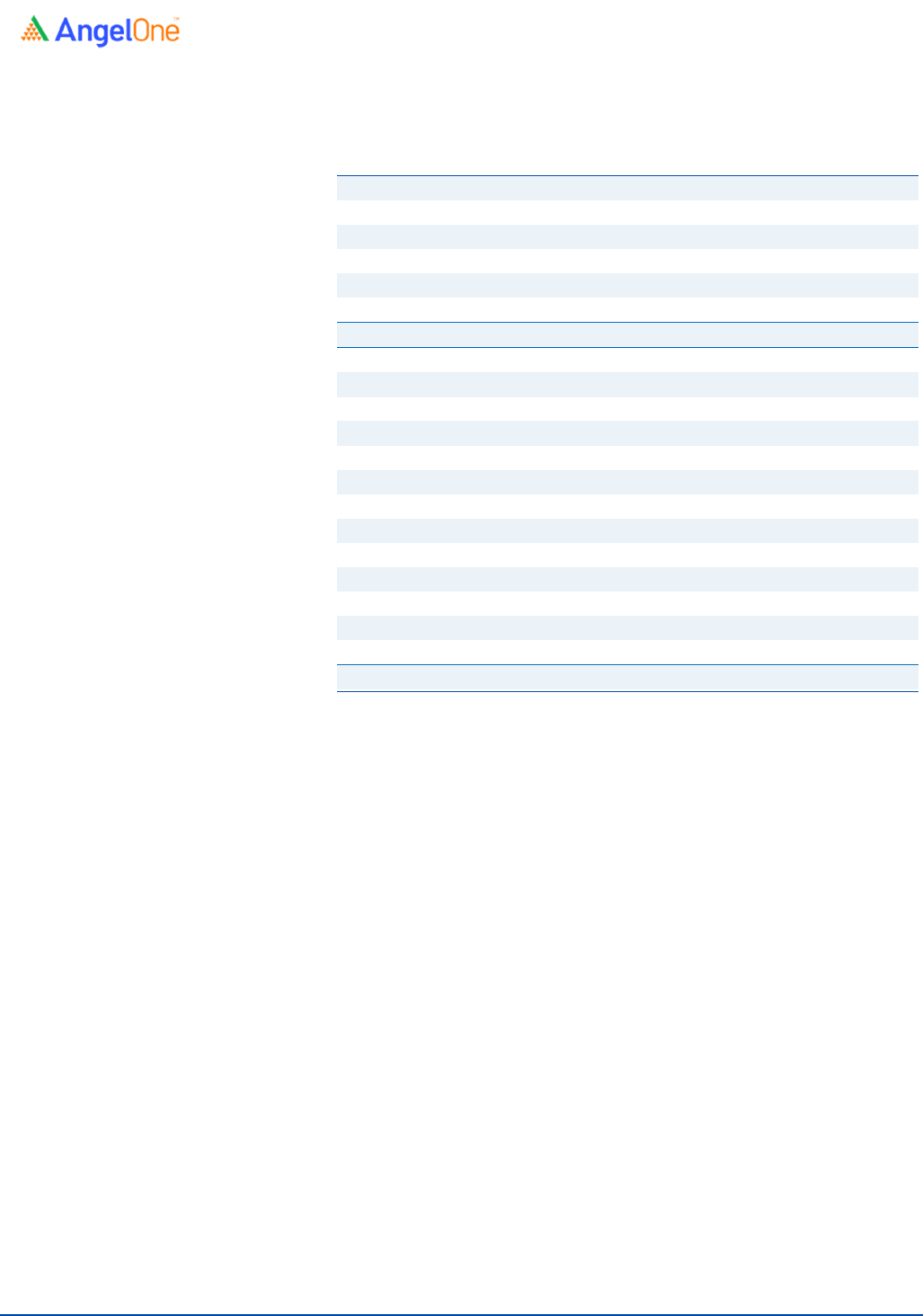

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

116.4

68.4

NA

P/CEPS

57.1

36.3

63.2

P/BV

15.8

12.6

12.7

EV/Sales

12.6

9.3

14.0

EV/EBITDA

45.6

29.4

79.0

EV / Total Assets

9.7

7.6

7.3

Per Share Data (Rs)

EPS (Basic)

5.9

10.1

(0.7)

EPS (fully diluted)

5.9

10.1

(0.7)

Cash EPS

12.1

19.0

10.9

Book Value

43.7

54.9

54.2

Returns (%)

ROCE

12.8

16.4

(2.5)

Angel ROIC (Pre-tax)

15.5

17.9

(3.0)

ROE

13.5

18.4

(1.3)

Turnover ratios (x)

Asset Turnover (Net Block)

1.6

1.6

1.0

Inventory / Sales (days)

88

97

115

Receivables (days)

50

50

64

Payables (days)

18

10

17

Working capital cycle (ex-cash) (days)

119

136

162

Source: Company, Angel Research

Go Fashion (India) Ltd | IPO Note

November 16, 2021

7

Research Team Tel: 022 - 40003600

E-mail: research@angelbroking.com

Website: www.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst

in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst

has not received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the

past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred

to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of

such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent

us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

1.Financial interest of research analyst or Angel or his Associate or his relative No

2.Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3.Served as an officer, director or employee of the company covered under Research No

4.Broking relationship with company covered under Research No

Ratings

(Based

on

expected

returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral

(

-

5

to

5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

Hold

(Fresh

purchase

not

recommended)