Please refer to important disclosures at the end of this report

1

Glenmark Life Sciences Limited (“GLS”) was incorporated on 23rd June, 2011.

GLS is a wholly-owned subsidiary of the Promoter, Glenmark Pharmaceuticals

Ltd. GLS operates two business lines – Generic APIs (generics and complex

APIs) and CDMO (including specialty). GLS is a leading developer and

manufacturer of select high value, non-commoditized active pharmaceutical

ingredients (“APIs”) in chronic therapeutic areas, including cardiovascular

disease (“CVS”), central nervous system disease (“CNS”), pain management

and diabetes.

Positives: (a) Good track record of regulatory compliance, company has not

received any warning letter since 2015. (b) Leading manufacturer of selected

specialized APIs for chronic therapeutic areas like CVS, CNS, diabetes, and

pain management. (c) 16 of the 20 largest generic companies globally were

customers, maintains a strong relationship with leading global generic

companies.

Investment concerns: a) Dependence on Repetitive orders- approximately

69% of their customers were repeat customers. (b) Company will be increasing

its capacity by 25% in FY2022 and underutilization will impact the return ratio.

(c) Company will require new working capital for the growth as company

having a high working capital cycle of 238 days.

Outlook & Valuation: Based on FY-2021 PE of 22x and EV/EBITDA of 12.9x at the

upper price band of the IPO price, valuations are slightly better than the peer

companies. Similarly, the company has one of the best ROCE of 32.7%.

Company has a healthy balance sheet and will be Net Debt free after the IPO.

We expect the upcoming expansion plan in Ankleshwar & Dahej will be the

next growth driver for the company. We are assigning a “Subscribe”

recommendation to the issue.

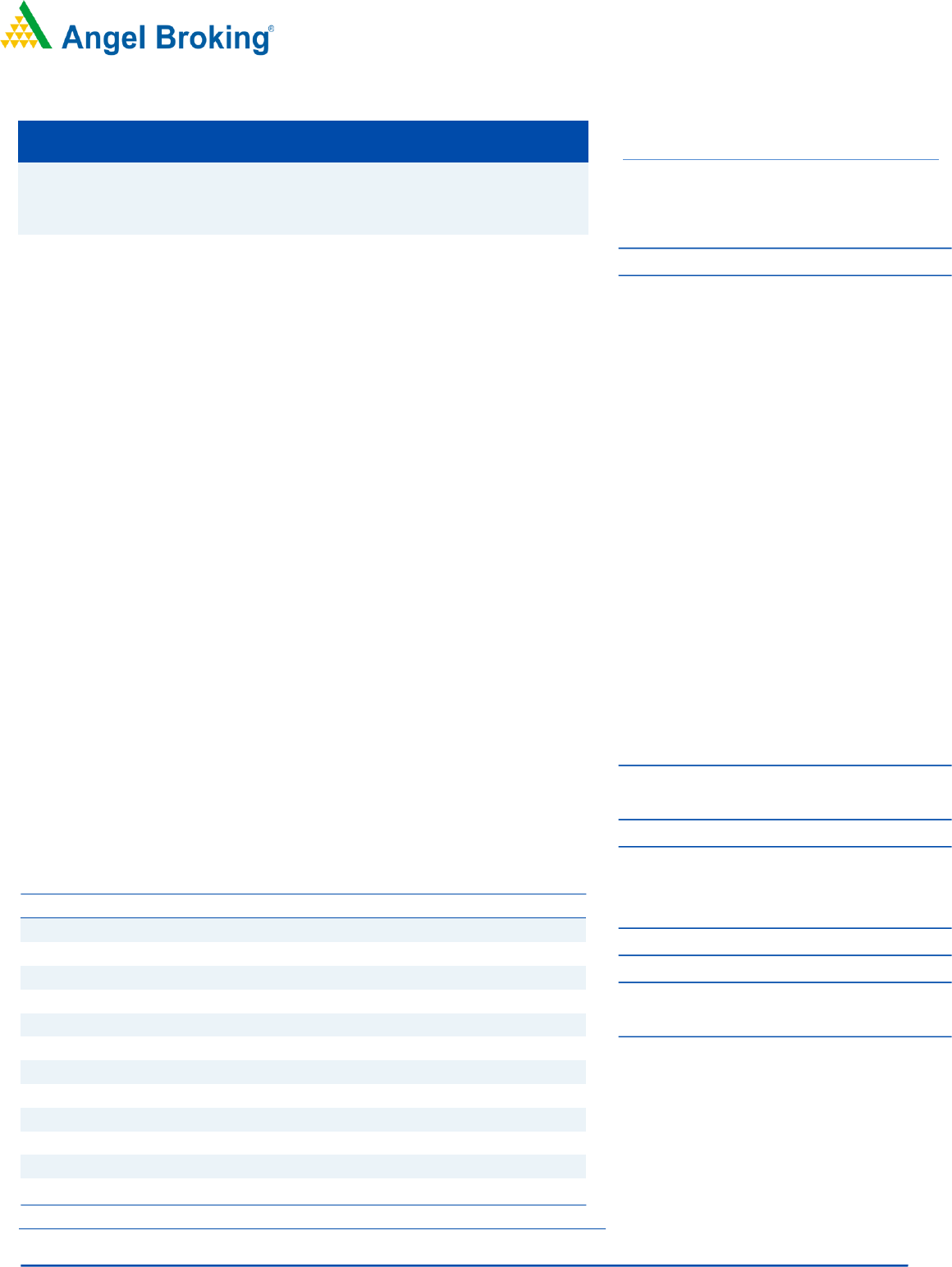

Key Ratio

Y/E March (₹ Cr)

FY19

FY20

FY21

Net Sales

886.4

1,537.3

1,885.1

% chg

-

73.4

22.6

Net Profit

195.8

313.3

351.9

% chg

-

60.0

12.3

EBITDA (%)

28.0

31.5

31.4

EPS (as stated)

24.6

29.0

32.8

P/E (x)

29.2

24.8

22.0

P/BV (x)

88.1

19.3

10.3

Ronw (%)

99.3

77.9

46.7

RoCE (%)

18.2

30.8

32.7

EV/EBITDA

31.3

16.0

12.9

EV/Sales

8.8

5.0

4.1

Source: Company, Angel Research

SUBSCRIBE

Issue Open: July 27, 2021

Issue Close: July 29, 2021

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 82.8%

Others 17.2%

Fresh issue: ₹ 1060 Cr.

Issue Details

Face Value: ₹ 2

Present Eq. Paid up Capital: ₹ 1.96 Cr

Offer for Sale: ₹ 454 Cr

Post Issue Shareholding Pattern

Issue size (amount): ₹1514 Cr**

Price Band: ₹ 695-720

Lot Size: 20 shares and in multiple thereafter

Post-issue mkt. cap: *₹ 8552 cr - **₹ 8822 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 82.84%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Expected Listing date - 06/08/2021

Yash Gupta,

+022 39357600, Extn: 6872

Research Analyst

Yash.gupta@angelbroking.com

IPO Note

July 26, 2021

GLENMARK LIFE SCIENCES LIMITED

GLS | IPO Note

July 26, 2021

2

Company background

The company was incorporated in June, 2011 at Pune. The company was

acquired by Glenmark Pharmaceuticals Ltd pursuant to the Share Purchase

Agreement dated July 4, 2018. The Promoter - Glenmark Pharmaceuticals

Ltd currently holds 100% of the pre- Offer issued Equity Share capital. GLS

operates two business lines – Generic APIs (90.6% of total revenue) and

CDMO (8.1% of total revenue). Company’s API business comprises of the

development, manufacture and sale of select high value, non-

commoditized APIs in chronic therapeutic areas, including CVS, CNS, pain

management and diabetes. The CDMO business currently comprises of

applying for and procuring permission to market products in regulated

markets as well as contract manufacturing of APIs for utilization by

pharmaceutical companies to make formulations

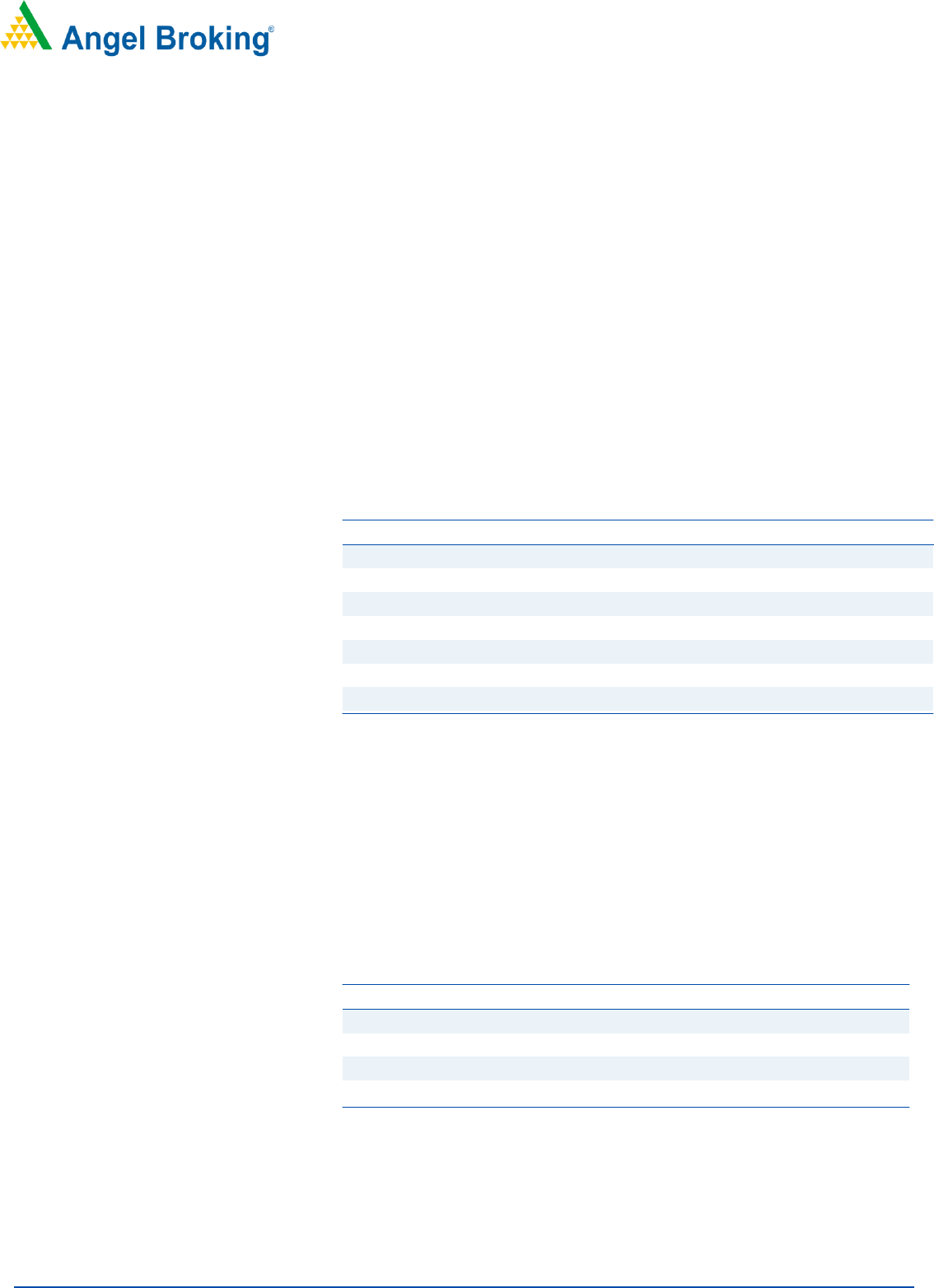

Exhibit 1Company Revenue Break-up

2021

2020

2019

Revenue

%to Sales

Revenue

%to Sales

Revenue

%to Sales

CVS Therapeutic Area

776.3

45.4%

668.2

51.6%

543.9

43.1%

CNS Therapeutic Area

167.7

9.8%

128.0

9.9%

122.0

9.7%

Diabetes Therapeutic Area

61.9

3.6%

57.1

4.4%

79.5

6.3%

Pain Management

70.6

4.1%

72.7

5.6%

68.5

5.4%

APIs in Other Therapeutic

631.9

37.0%

367.9

28.4%

448.9

35.6%

Total

1708.4

100.0%

1293.9

100.0%

1262.7

100.0%

Source: Company, Angel Research

Issue details

The issue size is ` 1541 Cr, which comprises of fresh issues of `1060 crore &

offer for sale of ` 454 Cr in the price band of `695-720 per share

Pre & Post Shareholding

Pre-issue

Post-issue

Particular

No of shares

%

No of shares

%

Promoter

10,78,04,950

100.%

10,15,04,950

82.8%

Other

0

0.%

2,10,22,222

17.2%

Total

10,78,04,950

100%

12,25,27,172

100%

Source: Company, Angel Research

GLS | IPO Note

July 26, 2021

3

Objectives of the Offer

Payment of outstanding purchase consideration to the Promoter for

the spin-off of the API business from the Promoter into the company

pursuant to the Business Purchase Agreement.

Funding the capital expenditure requirements.

General corporate purposes.

Key Management Personnel

Glenn Saldanha is the Chairman and non-executive director of the

company. He is also the chairman and managing director of the Promoter,

Glenmark Pharmaceuticals Ltd.

V.S Mani is the non-executive director of the company. He is also an

executive director and global chief financial officer of the Promoter,

Glenmark Pharmaceuticals Ltd.

Yasir Rawjee is the Managing Director and Chief Executive Officer of the

company. He leads the overall operations of the company and is

responsible for the overall business strategy of the company.

Sumantra Mitra is the executive director and vice president – human

resources department of the company and has been associated with the

company since October 11, 2018. He is responsible for talent acquisition,

talent management, capability development, organizational development

and industrial relations, besides other aspects of the human resources

agendas for the company.

Sridhar Gorthi is the independent director of the company. He is a

partner at Trilegal. His areas of expertise at Trilegal include mergers and

acquisitions, joint ventures, private equity and venture capital.

Manju Agarwal is the independent director of the company. She has

approximately 34 years of experience in State Bank of India.

Taruvai Laxminarayanan Easwar is the independent director of the

company. He is currently engaged as an advisor to the Boston Consulting

Group (BCG) and is also a consultant with pharmaceutical companies.

Gita Nayyar is the independent director of the company. She is also serving

as an independent director on the board of Taj-SATS Air Catering Ltd,

Transport Corporation of India and Oriental Hotels Ltd.

GLS | IPO Note

July 26, 2021

4

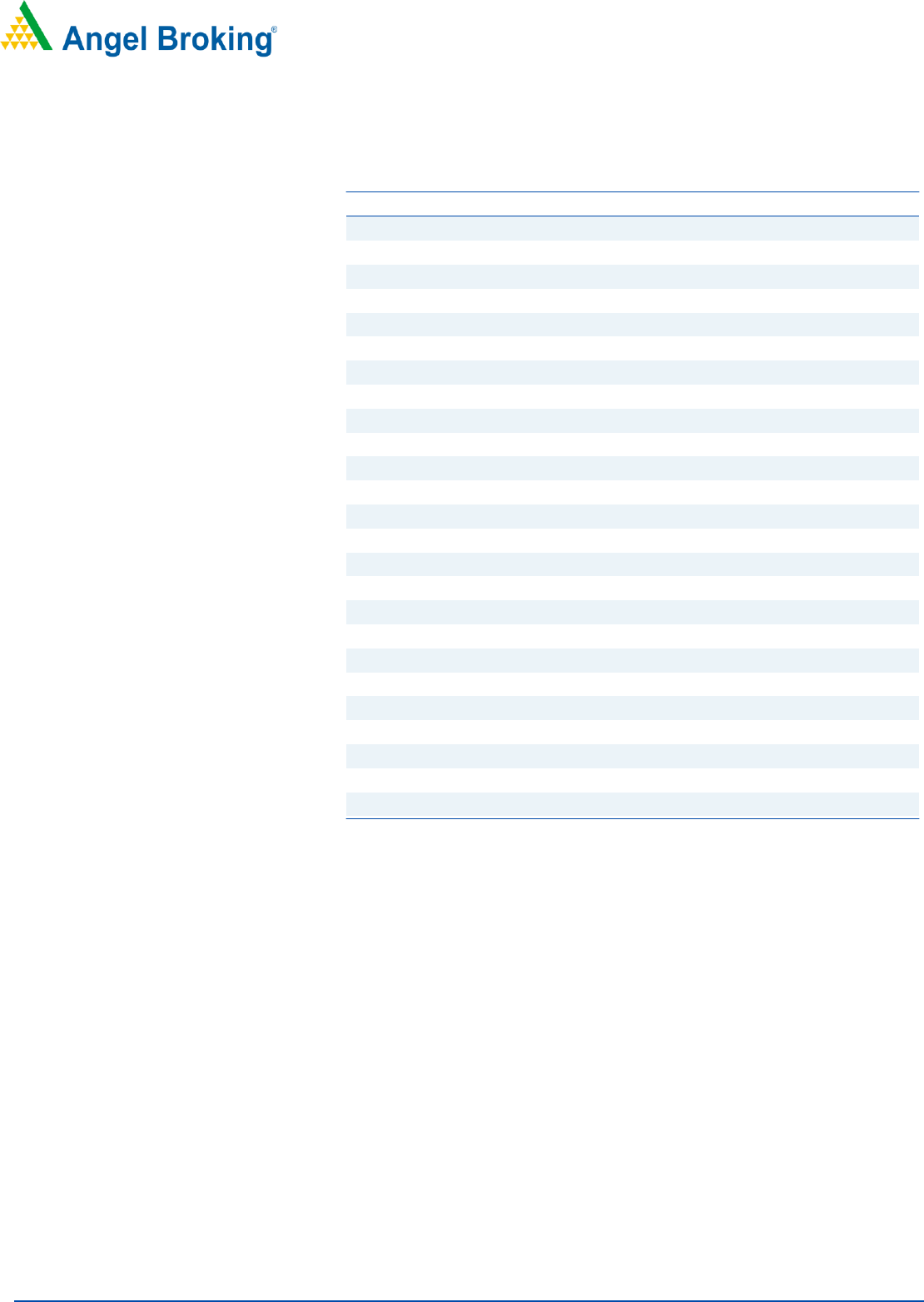

Consolidated Profit & Loss account

Y/E March (₹ Cr)

FY19

FY20

FY21

Total operating income

886.4

1,537.3

1,885.1

% chg

-

73.4

22.6

Total Expenditure

638.6

1,065.3

1,293.9

Raw Material cost

352.3

690.5

905.4

Employee Benefit Expense

106.2

142.2

149.1

Other Expenses

180.1

232.6

239.4

EBITDA

247.8

472.0

591.2

% chg

-

90.5

25.3

(% of Net Sales)

28.0

30.7

31.4

Depreciation& Amortisation

19.2

29.3

33.3

EBIT

228.6

442.7

557.9

% chg

-

93.7

26.0

(% of Net Sales)

25.8

28.8

29.6

Interest & other Charges

0.6

33.5

87.5

Other Income

0.4

12.0

0.8

(% of Sales)

0.0

0.8

0.0

Exceptional items

0

0

0

Recurring PBT

228.4

421.2

471.2

(% of Net Sales)

25.8

27.4

25.0

Tax

32.6

107.9

119.3

PAT (reported)

195.8

313.3

351.9

% chg

-

60.0

12.3

(% of Net Sales)

22.1

20.4

18.7

EPS (as stated)

24.64

29.05

32.80

% chg

-

17.9

12.9

Source: Company, Angel Research

GLS | IPO Note

July 26, 2021

5

Consolidated Balance Sheet

Y/E March (₹ Cr)

FY19

FY20

FY21

SOURCES OF FUNDS

Equity Share Capital

2

2

2

Other equity ( Includes Preference shares)

86

400

751

Shareholders Funds

88

402

753

Total Loans

7

16

23

Other liabities

-

-

-

Total Liabilities

95

418

775

APPLICATION OF FUNDS

Net Block

537

557

587

Current Assets

930

1,160

1,399

Sundry Debtors

448

639

620

Cash &Bank Balance

8

31

143

Other Assets

74

78

123

Current liabilities

1,380

1,307

1,221

Net Current Assets

(449.6)

(147.2)

178

Other Non Current Asset

14

16

19

Total Assets

95

418

775

Source: Company, Angel Research

GLS | IPO Note

July 26, 2021

6

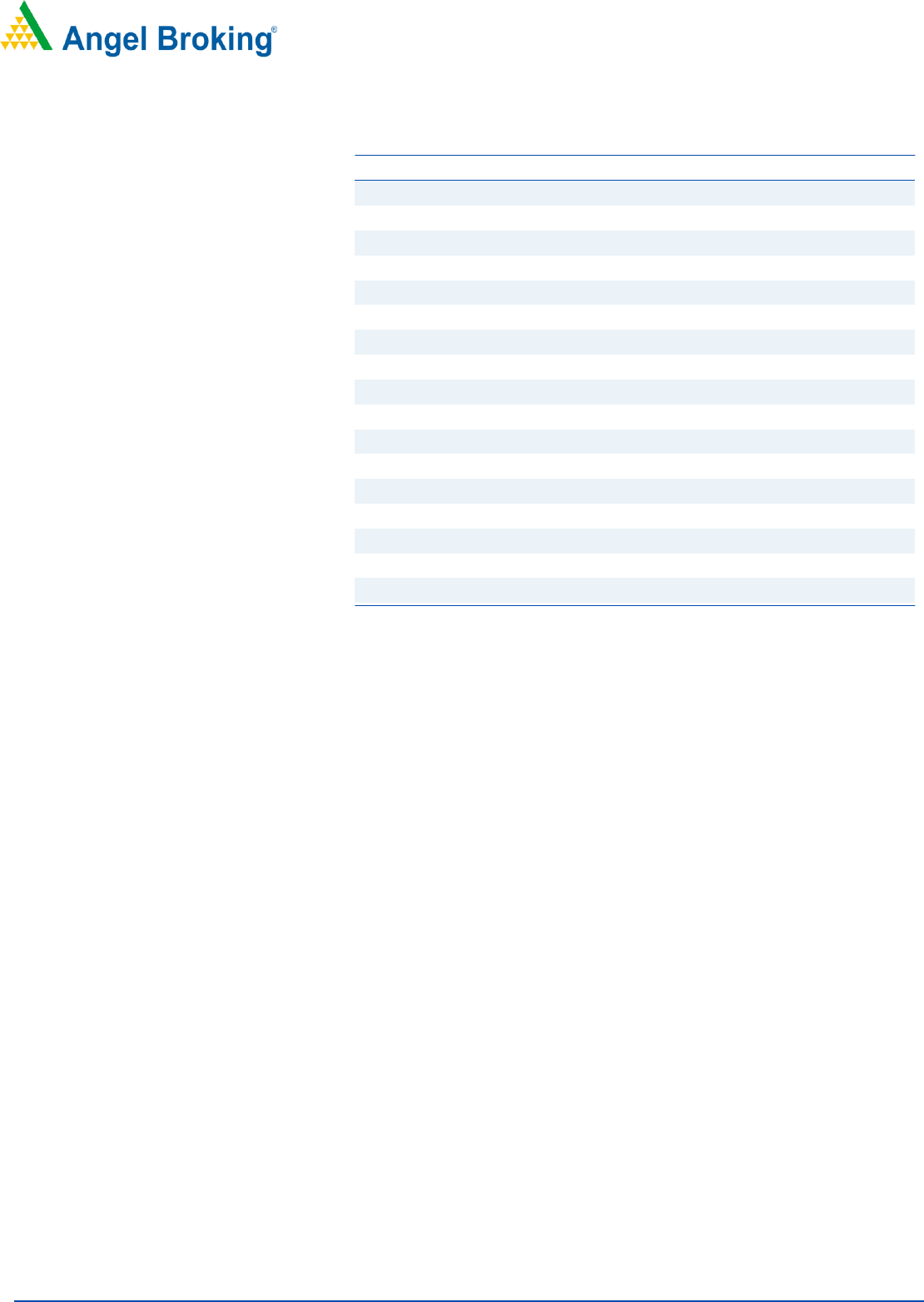

Consolidated Cash Flow Statement

Y/E March (₹cr)

FY19

FY20

FY21

Restated Profit before tax

228.2

421

470.9

Depreciation

19.2

29.3

33.3

Change in Working Capital

(93.2)

(190.2)

(107.6)

Interest Expense

0.6

33.5

87.4

Direct Tax Paid

(23.5)

(92.5)

(108.5)

Others

(119.9)

26.5

99.5

Cash Flow from Operations

10.4

195.0

387.7

(Inc.)/ Dec. in Fixed Assets

(9.3)

(50.9)

(66.3)

Investment in bank deposits (net)

-

-

(2.8)

Interest received

0.4

0.3

0.4

Cash Flow from Investing

(8.9)

(50.6)

(68.7)

Proceeds from fresh issue

1.5

-

-

Dividend paid on equity shares

0.9

(136.5)

(213.7)

Others

-

-

-

Cash Flow from Financing

2.4

(136.5)

(213.7)

Inc./(Dec.) in Cash

1.9

7.9

105.3

Opening Cash balances

-

2.0

10.0

Closing Cash balances

1.9

9.9

115.3

Source: Company, Angel Research

GLS | IPO Note

July 26, 2021

7

Key Financial Ratio

Y/E March

FY19

FY20

FY21

Valuation Ratio (x)

P/E (on FDEPS)

29.2

24.8

22.0

P/CEPS

35.0

22.1

19.8

P/BV

88.1

19.3

10.3

EV/Sales

8.8

5.0

4.1

EV/EBITDA

31.3

16.0

12.9

Per Share Data (Rs)

EPS (fully diluted )

24.64

29.05

32.80

Cash EPS

20.6

32.7

36.3

Book Value

8.2

37.3

69.8

DPS

-

-

-

Number of share

10.78

10.78

10.78

Returns (%)

RONW

99.3

77.9

46.7

ROCE

18.2

30.8

32.7

Turnover ratios (x)

Asset Turnover (net)

1.9

2.8

3.3

Receivables (days)

184.5

151.6

119.9

Inventory Days

415.2

218.2

207.0

Payables (days)

189.3

106.2

89.2

Working capital cycle (days)

410.4

263.5

237.7

Source: Company, Angel Research

GLS | IPO Note

July 26, 2021

8

Research Team Tel: 022 - 39357800 E-mail: r[email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual

Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst)

Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst

during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall

not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report. Angel Broking Limited has not independently verified all the information contained

within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.