Fusion Micro Finance Limited

Please refer to important disclosures at the end of this report

1

Incorporated in 1994, Fusion Micro Finance Limited (FML) is one of the

youngest companies among the top NBFC-MFIs in India in terms of AUM. FML

is engaged in providing financial services to unserved and underserved section

of society. The company has achieved a significant footprint across India,

where they have extended reach to 2.90 million active borrowers which are

served through its network of 966 branches and 9,262 permanent employees

spread across 377 districts in 19 states and union territories in India, as of June

30, 2022. The company's business runs on a joint liability group-lending

model, wherein a small number of women form a group (typically comprising

five to seven members) and guarantee one another's loans.

Positives: (a) Well Diversified and Extensive Pan-India Presence (b) Technologically

Advanced Operating Model (c) Well-positioned to capitalize on industry tail winds

(d) Stable and Experienced Management Team Supported by Marquee Investors

Investment concerns: (a) A large portion of collections and disbursements from

customers are in cash, exposing company to operational risks (b) Any downturn in

economy can impact GNPA/NNPA ratios (c) Any disruption in sources of funding or

increase in costs of funding could adversely affect liquidity and financial condition

Outlook & Valuation: In terms of valuations, the post-issue P/B works out to 1.9x

adjusted FY22 BVPS and P/E of 168x FY22 Diluted EPS (at upper price band of

the IPO). FML has strong revenue growth (CAGR of 31%) and healthy advances

growth (CAGR of 33%) over 2 years period. Though it posted strong growth in top

lines, it recorded declining profits due to the pandemic, and expansion spending

from FY20 to FY22. Going forward, strong tailwinds in banking sector, uptick in credit

cycle and strong Q1FY23 results of FML, considering all the positive factors, we

believe this valuation is at reasonable levels. Thus, we recommend a NEUTRAL

rating on the issue. Investors may consider investment from a medium to long term

perspective.

Key Financials

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Net Interest Income

329

452

568

% chg

38%

26%

Net profit

70

44

22

% chg

-37%

-50%

NIM (%)

9.8%

10.4%

9.6%

EPS (`)

8.4

5.3

2.6

P/E (x)

43.8

69.3

140.0

P/ABV (x)

2.5

2.4

2.3

RoA (%)

1.6%

0.8%

0.3%

RoE (%)

5.8%

3.5%

1.6%

Source: Company RHP, Angel Research

NEUTRAL

Issue Open: November 02, 2022

Issue Close: November 04, 2022

Offer for Sale: ` 504cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 58.1%

Public 41.9%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 99.1cr

Issue size (amount): ₹ 1,104cr

Price Band: ₹350 - ₹368

Lot Size: 40 shares and in multiple thereafter

Post-issue mkt. cap: * `3,551cr - ** `3,703cr

Promoters holding Pre-Issue: 85.57%

Promoters holding Post-Issue: 58.10%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: ` 600cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: ` 82.76cr

IPO NOTE

Fusion Micro Finance Limited

November 1, 2022

Fusion Micro Finance Ltd | IPO Note

November 1, 2022

2

Company background

Incorporated in 1994, Fusion Micro Finance Limited (FML) is one of the youngest

companies among the top NBFC-MFIs in India in terms of AUM. FML is engaged in

providing financial services to unserved and underserved section of society. The

company has achieved a significant footprint across India, where they have

extended reach to 2.90 million active borrowers which are served through its

network of 966 branches and 9,262 permanent employees spread across 377

districts in 19 states and union territories in India, as of June 30, 2022. The

company's business runs on a joint liability group-lending model, wherein a small

number of women form a group (typically comprising five to seven members) and

guarantee one another's loans.

It benefits from a large and diversified mix of 56 lenders comprising a range of

public banks, private banks, foreign banks, and financial institutions. It has second-

highest number of lender relationships among the top 10 NBFC-MFIs in India.

Technology is an integral part of FML's overall business strategy. Through the early

adoption of cloud computing software and emphasis on best-in-class security

practices, it established a foundation in enabling automation and digitalization of

several processes across business functions including customer onboarding,

customer service, loan disbursements, internal audit, and risk management. FML

continues to invest in and upgrade technology platforms and solutions with the

goal of applying a comprehensive "Touch & Tech" model across operations that

focuses on maintaining frequent technology-based communication points that

enhance efficiency and customer experience.

Issue details

The IPO is made up of Fresh issue of ₹600cr and offer for sale of ₹504cr making

the total Issue size of ₹1,104cr.

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

7,21,61,216

85.6%

5,84,65,750

58.1%

Public

1,14,54,800

13.6%

4,14,54,614

41.2%

Others

7,10,372

0.8%

7,10,372

0.7%

Total

8,43,26,388

100.0%

10,06,30,736

100.0%

Source: Company, Angel Research

Objectives of the Offer

Rs 600cr proceeds from the fresh issue would be utilized for strengthening the

Capital Adequacy position of the company

Fusion Micro Finance Ltd | IPO Note

November 1, 2022

3

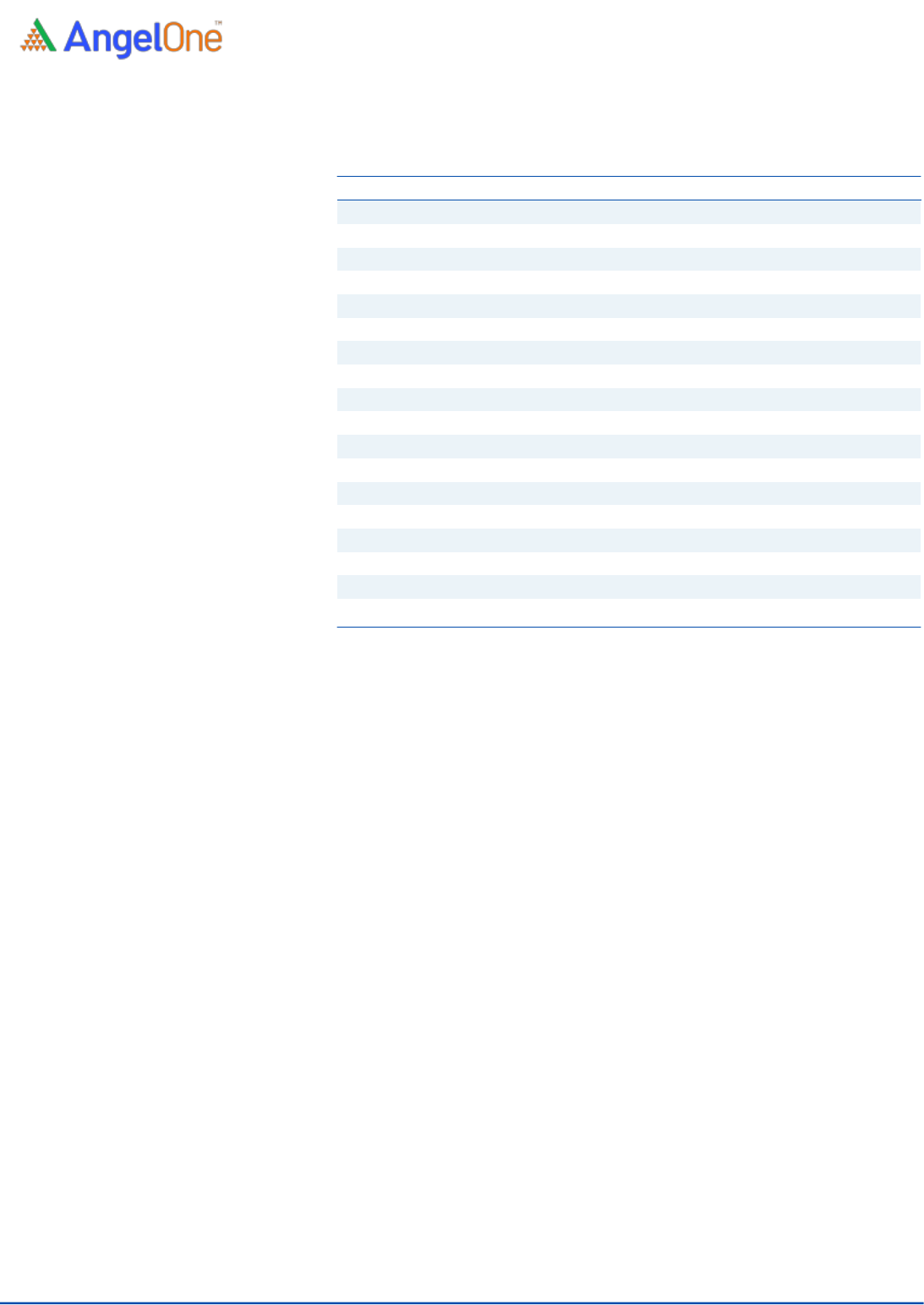

Financial Summary

Income Statement

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Net Interest Income

329

452

568

- YoY Growth (%)

38%

26%

Other Income

64

46

137

- YoY Growth (%)

-29%

201%

Operating Income

393

498

705

- YoY Growth (%)

27%

42%

Operating Expenses

200

220

312

- YoY Growth (%)

10%

42%

Pre - Provision Profit

193

278

393

- YoY Growth (%)

44%

42%

Prov. & Cont.

93

221

369

- YoY Growth (%)

138%

67%

Profit Before Tax

100

57

24

- YoY Growth (%)

-43%

-57%

Provision for Taxes

30

13

3

- as a % of PBT

30%

23%

11%

PAT

70

44

22

- YoY Growth (%)

-37%

-50%

Source: Company, Angel Research

Fusion Micro Finance Ltd | IPO Note

November 1, 2022

4

Balance Sheet (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Equity

79

79

83

Reserve & Surplus

1,120

1,167

1,255

Total Net worth

1,199

1,246

1,338

- Growth (%)

4%

7%

Financial Liabilities

Debt Securities

400

990

784

Borrowings

2,457

3,325

4,829

Subordinated liabilities

117

117

163

Other Financial Liabilities

55

138

159

Non-Financial Liabilities

Provisions

6

8

7

Other Liabilities

6

13

11

Total Liabilities

4,240

5,838

7,290

Financial Assets

Cash Balances

540

1,215

1,011

Bank Balances

278

120

142

Advances

3,343

4,361

5,918

- Growth (%)

30%

36%

Other Financial Assets

27

33

71

Non-Financial Assets

Fixed Assets

6

18

19

Other Assets

46

91

128

Total Assets

4,240

5,838

7,291

- Growth (%)

38%

25%

Source: Company, Angel Research

Fusion Micro Finance Ltd | IPO Note

November 1, 2022

5

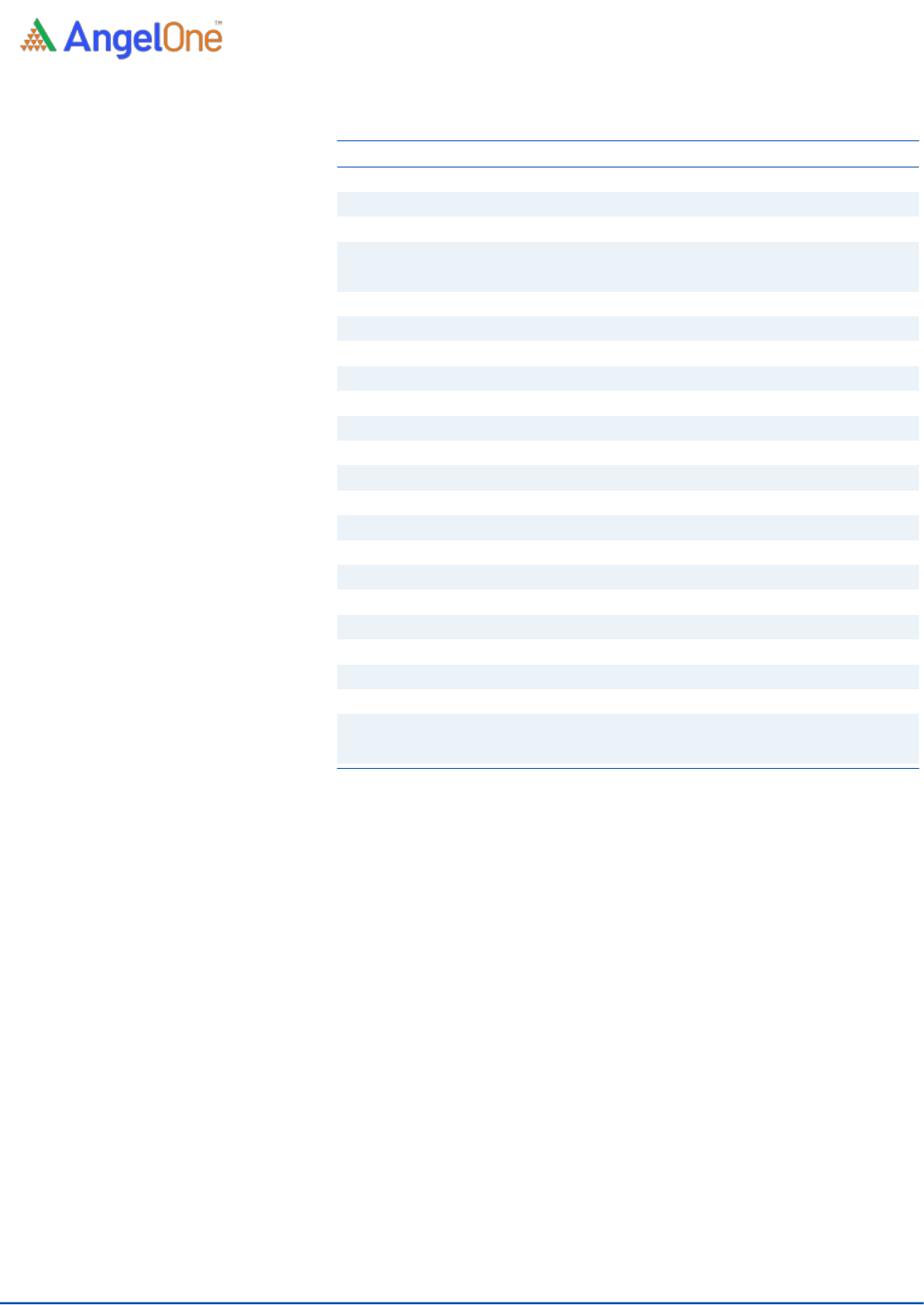

Key Ratios

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Profitability ratios (%)

NIMs

9.8%

10.4%

9.6%

Cost to Income Ratio

51%

44%

44%

RoA

1.6%

0.8%

0.3%

RoE

5.8%

3.5%

1.6%

B/S ratios (%)

CAR

36%

27%

22%

Tier I

33%

26%

20%

Asset Quality (%)

Gross NPAs

1.1%

5.5%

5.7%

Net NPAs

0.4%

2.4%

1.7%

Provision /Avg. Assets

2%

4%

6%

Provision Coverage

65%

57%

69%

Per Share Data (`)

EPS

8.41

5.31

2.63

Diluted EPS

7.03

4.44

2.20

BVPS

144.9

150.6

161.7

ABVPS

144.6

150.4

158.6

Profitability ratios (%)

NIMs

9.8%

10.4%

9.6%

Cost to Income Ratio

51%

44%

44%

Source: Company, Angel Research;

ROA TREE

Y/E March

FY’20

FY'21

FY'22

Interest Income

15.7%

14.2%

14.6%

Interest Expense

8.0%

6.4%

6.8%

Net Interest Income

7.8%

7.7%

7.8%

Other Income

1.5%

0.8%

1.9%

Total Income

9.3%

8.5%

9.7%

Operating Expenses

4.7%

3.8%

4.3%

PPoP

4.5%

4.8%

5.4%

Provisions

2.2%

3.8%

5.1%

Profit Before Tax

2.4%

1.0%

0.3%

Provision for Taxes

0.7%

0.2%

0.0%

ROA

1.6%

0.8%

0.3%

Leverage

3.5

4.7

5.4

ROE

5.8%

3.5%

1.6%

Source: Company, Angel Research;

Fusion Micro Finance Ltd | IPO Note

November 1, 2022

6

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity

with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred

to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of

such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject

company. Research analyst has not served as an officer, director or employee of the subject company.