Please refer to important disclosures at the end of this report

1

Fino payment Bank Ltd was incorporated in 2017 and offers a wide portfolio of

digital financial products and services in India. It offers such products and services

to target market via a Pan-India distribution network and proprietary technologies,

and since 2017, it has grown its’ operational presence to cover over 90% of

districts as of September 30, 2021. The bank’s products and services includes

various current accounts and savings accounts (“CASA”), issuance of debit card

and related transactions, facilitating domestic remittances, open banking

functionality via their Application Programming Interface, withdrawing and

depositing cash (via micro-ATM or Aadhaar Enabled Payment System “AePS”) and

Cash Management Services (“CMS”). It operates an asset light business model

that principally relies on fee and commission based income generated from

merchant network and strategic commercial relationships.

Positives: (a) Unique DTP (Distribution, Technology, Partnership) network helps in

better customer servicing (b) Focus on technology development and in-house

technological expertise (c) Customer centric and innovative business model (d)

Highly experienced management team.

Investment concerns: (a) Inability to generate income from fee and commission-

based activities. (b) Rely extensively on IT systems, success depends on ability to

innovate, upgrade and respond to new technological advances. (c) Subject to

stringent regulatory requirements and prudential norms. (d) Cyber threats

attempting to exploit network may cause damage to reputation.

Outlook & Valuation: Fino payments bank has posted strong a 46.0% CAGR in

total revenues between FY2019-21 and has also turned around its operations and

reported profits of `20 crore for the first time in FY2021. At the higher end of the

price band the stock would be trading at P/E of 220x FY2021 fully diluted EPS of

`2.6 which is expensive. Despite strong growth prospects, we believe that

valuations do not justify the premium and hence we have a NEUTRAL

recommendation to the IPO.

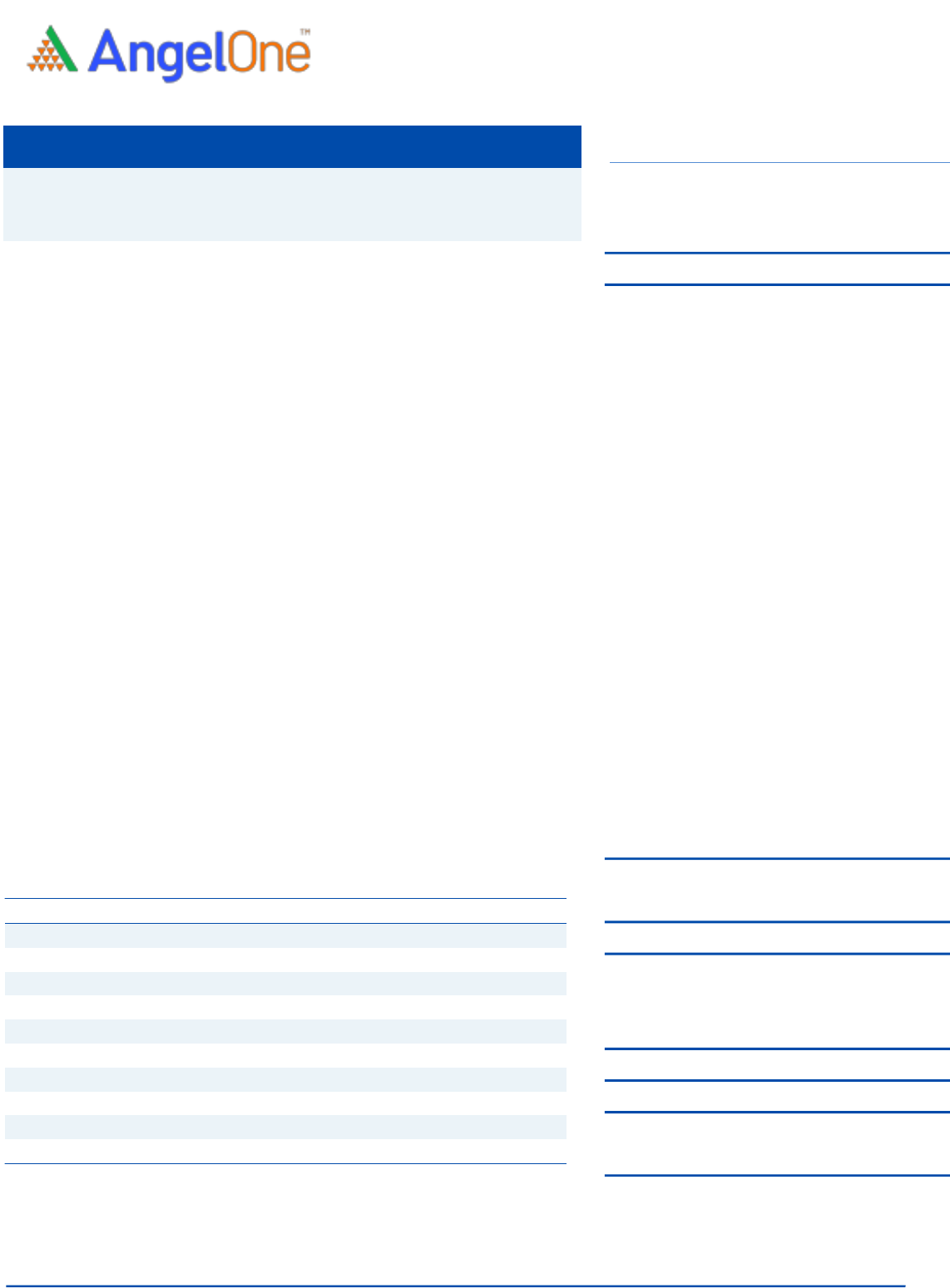

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Total Revenues

371.1

691.4

791.0

% chg

-

86.3

14.4

Net Profit

-62.4

-32.0

20.5

% chg

-

-48.6

-163.9

EPS (`)

(8.0)

(4.1)

2.6

P/E (x)

(72.2)

(140.5)

219.9

P/BV (x)

27.8

34.6

29.9

ROE (%)

(38.5)

(24.6)

13.6

ROA (%)

(9.1)

(5.1)

2.0

Mkt cap/Total Revenue

12.1

6.5

5.7

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

NEUTRAL

Issue Open: Oct 29, 2021

Issue Close: Nov 02, 2021

Offer for Sale: `900 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 75.0%

Others 25.0%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `83.2cr

Issue size (amount): `1,200 cr

Price Band: `560-577

Lot Size: 25 shares and in multiple thereafter

Post-issue mkt. cap: * `4,660 cr - ** `4,801 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 75%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `300 cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `78.0 cr

Jyoti Roy

+022 39357600, Extn: 6842

jyoti.roy@angelbroking.com

Fino Payments Bank Limited

Fino Payments Bank |IPO Note

October 28, 2021

Fino Payments Bank | IPO Note

Oct 28, 2021

2

Company background

Fino payments Bank was incorporated as ‘Fino Fintech Foundation’ dated June 23,

2007. The company operates an asset-light business model that is underpinned by

the "phygital" model and relies on merchant networks and other participants. It has

built a Pan-India presence with 724,671 merchants (own and API) as of June 30,

2021, which are typically located in Tier-2 and Tier-3 towns (based on

population). Additionally, FPBL 54 branches and 130 Customer Service Points

("CSPs") as of June 30, 2021.

Issue details

The issue comprises of Fresh Issue upto `300 Cr and OFS of 15,602,999 Eq

Shares amounting upto ` 900.29 Cr only.

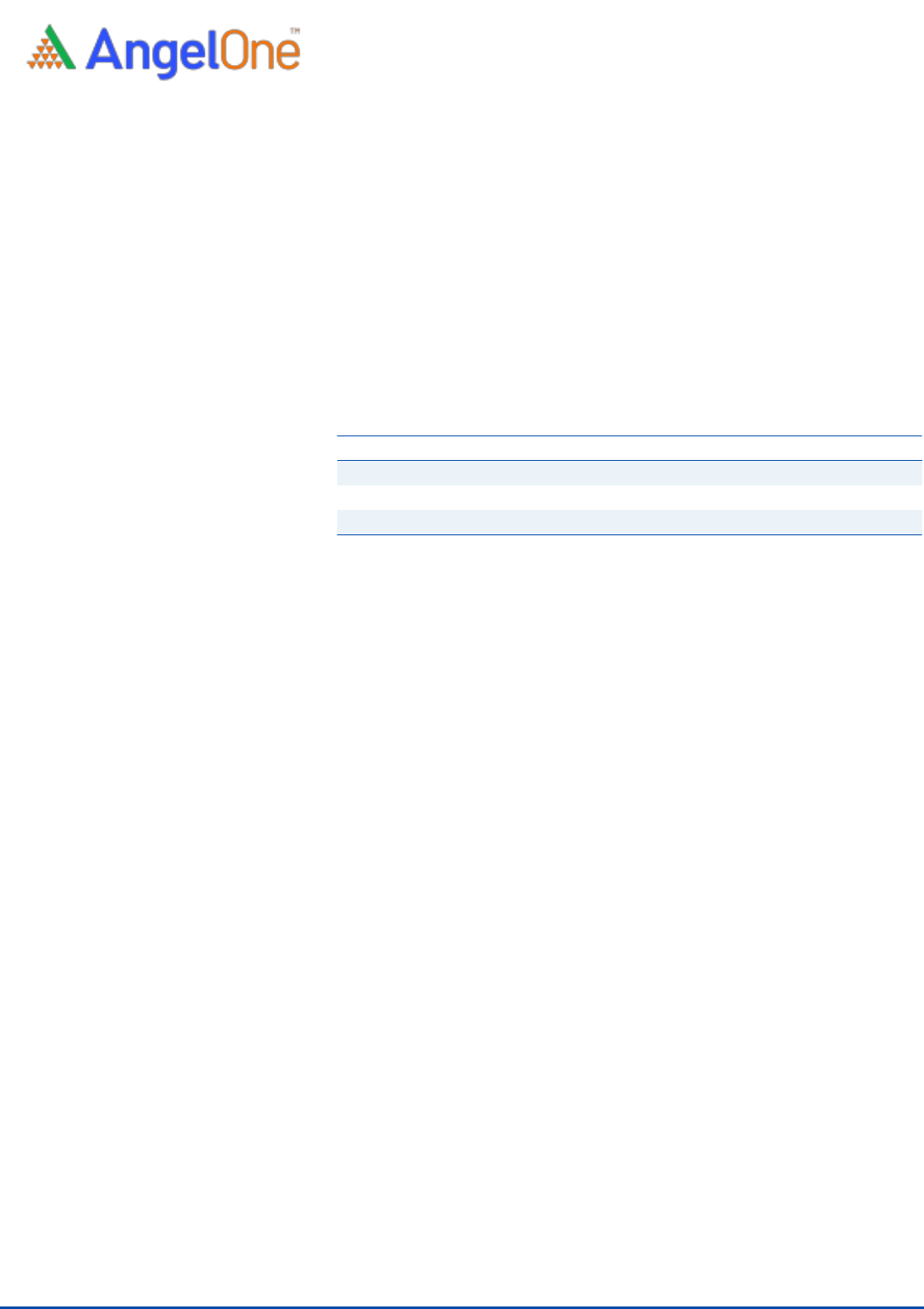

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter & Promoter Gp.

78,014,996

100.0%

62,411,997

75.0%

Public

0

0.0%

20,802,305

25.0%

Total

78,014,996

100%

83,214,303

100.0%

Source: Company, Angel Research & RHP.

Objectives of the Offer

Augmenting Bank’s Tier – 1 capital base to meet its future capital

requirements.

To meet the expenses in relation to the offer.

Key Management Personnel

Rishi Gupta is the Managing Director and CEO of the Bank. He holds a bachelor’s

degree in commerce from University of Delhi. He is also a qualified chartered

accountant and cost and works accountant and member of ICAI and ICWAI

respectively.

Mahendra Kumar Chouhan is a part time chairman and an independent

director in the Bank. He has previously served on policy making and

regulatory committees such as SEBI Committee on Corporate Governance as

well as the Ministry of Corporate Affairs Committee for the National Policy on

Corporate Governance.

Suresh Kumar Jain is an independent director in the Bank. He has been a

banker for over 36 years and was a General Manager on Bank of India, He

was selected by Government of India as Executive Director of Union Bank of

India and retired in May 2014.

Punita Kumar Sinha is an independent director in the Bank. She holds a

bachelor’s degree in chemical engineering from IIT Delhi, MBA (Finance) from

Drexel University and Ph.D. from University of Pennsylvania. She is also a

qualified CFA. She has experience in investment management and financial

markets. Previously she has worked as a senior managing director of

Blackstone – Asia Advisory Group.

Fino Payments Bank | IPO Note

Oct 28, 2021

3

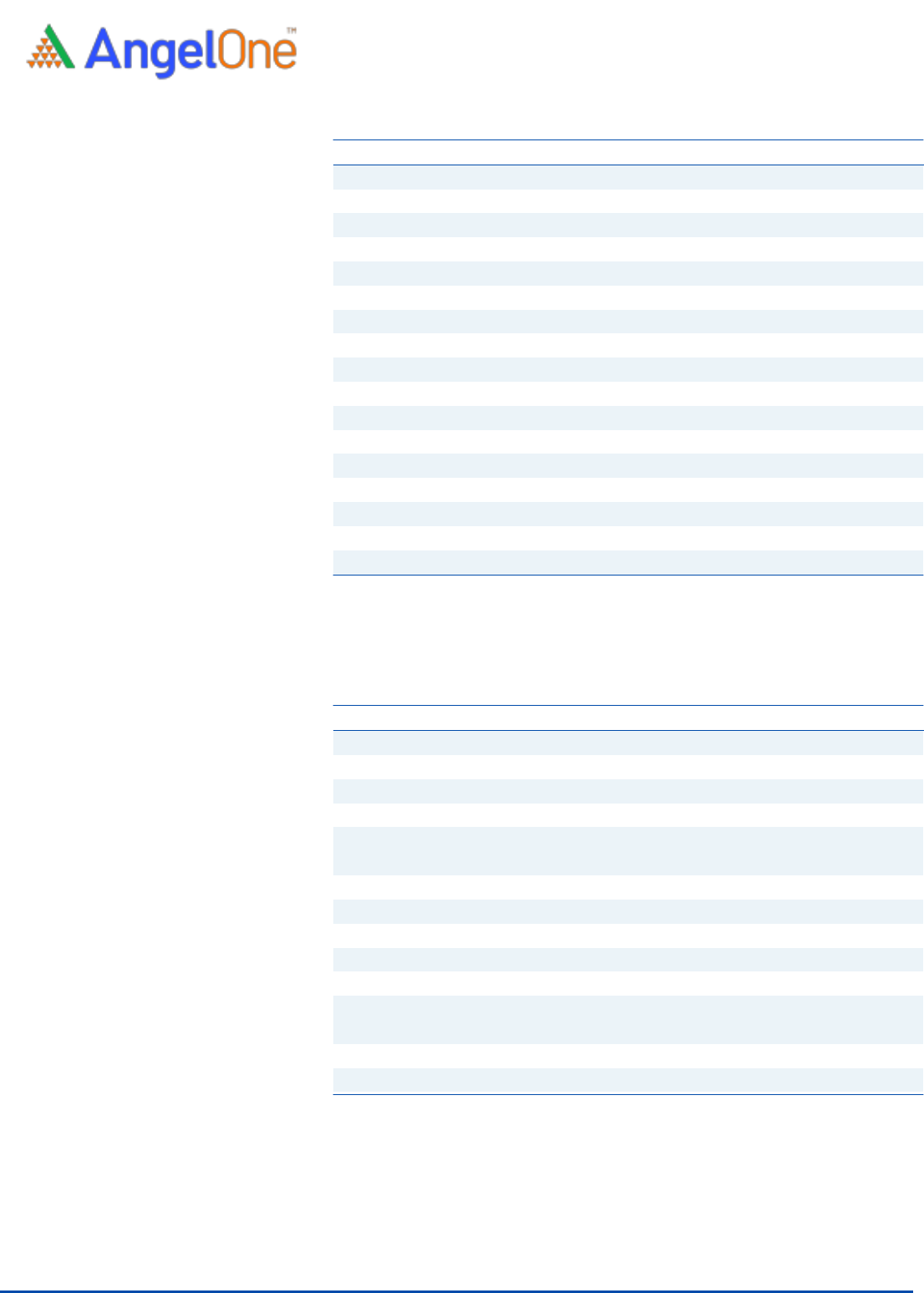

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Total operating income

371.1

691.4

791.0

206.2

% chg

-

86.3

14.4

36.3

Total Expenditure

428.0

713.6

761.0

200.1

Operating expenses

427.0

712.5

757.0

200.1

Provisions and contingencies

0.9

1.0

4.0

-

Operating Profit

-56.9

-22.2

30.0

6.2

% chg

-

-61.0

-

29.7

(% of Net Sales)

-15.3

-3.2

3.8

3.0

Interest expended

5.5

9.9

9.5

3.1

Recurring PBT

-62.4

-32.0

20.5

3.1

% chg

-

-48.6

-

69.0

Exceptional item

-

-

-

Tax

-

-

-

PAT (reported)

-62.4

-32.0

20.5

3.1

% chg

-

-48.6

-

69.0

(% of Net Sales)

-16.8

-4.6

2.6

1.5

Basic & Fully Diluted EPS (Rs)

-8.0

-4.1

2.6

0.4

Source: Company, Angel Research

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

SOURCES OF FUNDS

Equity

44.6

44.6

44.6

44.6

Reserve & Surplus

117.5

85.5

106.0

109.1

Net worth

162.1

130.1

150.5

153.7

Borrowings

82.9

110.8

180.8

211.3

Deposits

47.5

117.5

242.8

251.3

Other Liab. & Prov.

391.5

265.6

436.1

403.9

Total Liabilities

684.1

624.0

1010.3

1020.2

Cash Balances

157.4

130.8

88.3

47.8

Bank Balances

230.9

171.2

182.5

166.8

Investments

73.2

128.3

503.6

557.8

Advances

0.1

0.1

0.1

0.1

Fixed Assets

42.2

49.5

64.2

80.1

Other Assets

180.3

144.2

171.6

167.6

Total Assets

684.1

624.0

1010.3

1020.2

Source: Company, Angel Research

Fino Payments Bank | IPO Note

Oct 28, 2021

4

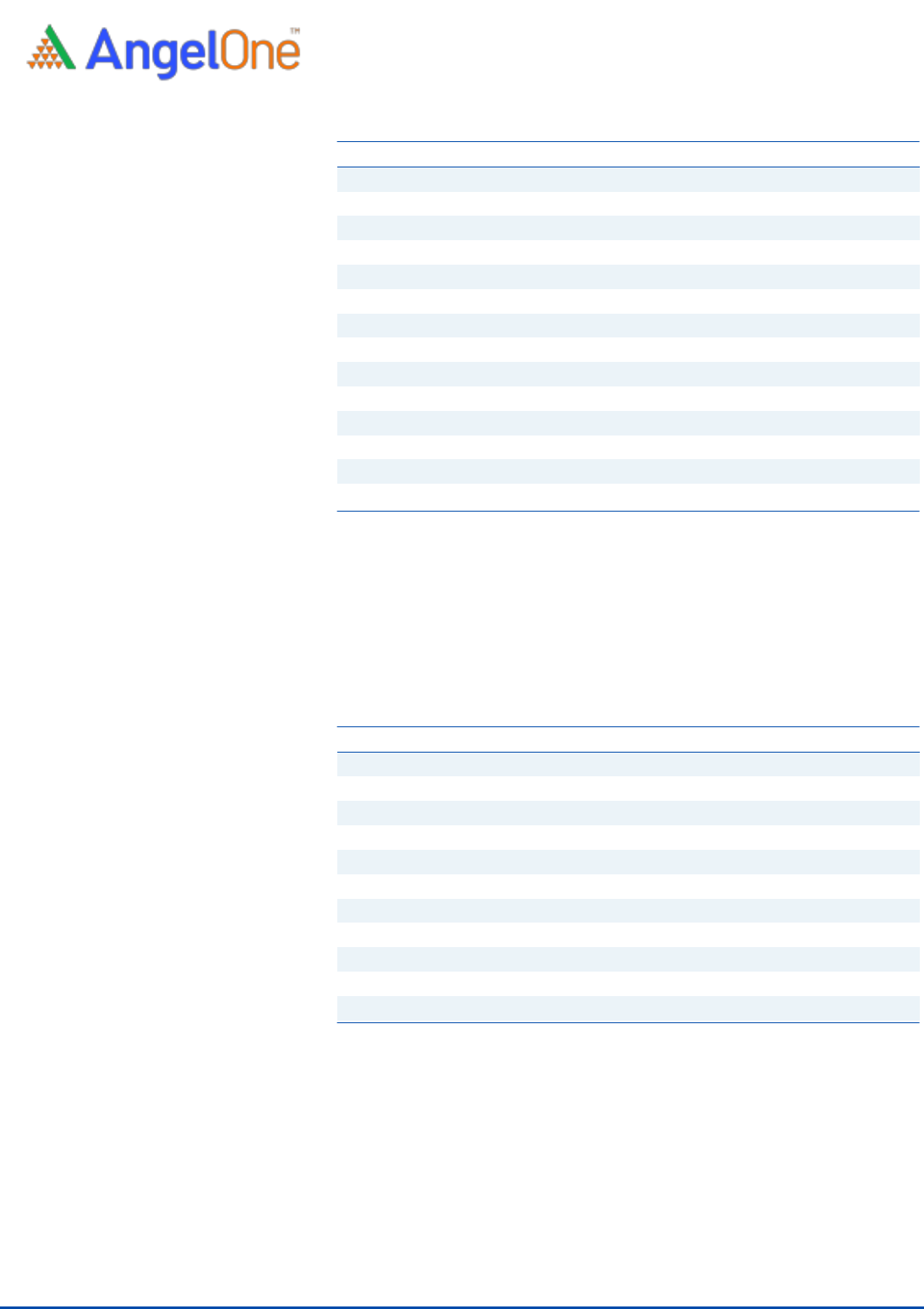

Exhibit 3: Consolidated Cash flows

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Operating profit before changes

-40.3

-4.5

81.5

10.5

Net changes in working capital

63.6

-86.0

-123.2

-72.7

Cash generated from operations

23.3

-90.5

-41.7

-62.2

Direct taxes paid (net of refunds)

5.3

6.8

9.5

-1.8

Net cash flow operating activities

28.6

-83.7

-32.2

-64.1

Addition to fixed assets

-13.8

-30.9

-69.0

-22.7

Sale of Fixed assets

0.2

0.4

0.1

-

Cash Flow from Investing

-13.6

-30.5

-68.9

-22.7

Net proceeds from borrowings

35.0

27.9

70.0

30.5

Cash Flow from Financing

35.0

27.9

70.0

30.5

Inc./(Dec.) in Cash

50.0

-86.3

-31.2

-56.3

Opening Cash balances

338.3

388.3

302.0

270.8

Exchange effect

0.0

0.0

0.0

0.0

Closing Cash balances

388.3

302.0

270.8

214.5

Source: Company, Angel Research

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

(72.2)

(140.5)

219.9

P/BV

27.8

34.6

29.9

Mkt cap/Total Revenue

12.1

6.5

5.7

Per Share Data (Rs)

EPS (Basic)

(8.0)

(4.1)

2.6

EPS (fully diluted)

(8.0)

(4.1)

2.6

Book Value

20.8

16.7

19.3

Returns (%)

ROE

(38.5)

(24.6)

13.6

ROA

(9.1)

(5.1)

2.0

Source: Company, Angel Research

Fino Payments Bank | IPO Note

Oct 28, 2021

5

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.