Please refer to important disclosures at the end of this report

1

Easemytrip.com ranked second among the Key Online Travel Agencies

in India in terms of booking volume in the nine months ended December

31, 2020, and third among the Key Online Travel Agencies in India in

terms of gross booking revenues in Fiscal 2020. It offers a

comprehensive range of travel-related products and services for end-to-

end travel solutions, including airline tickets, hotels, and holiday

packages, rail tickets, bus tickets, and taxis as well as ancillary value-

added services.

Key Positives: (a) One of the leading online travel agencies in India with a

customer-focused approach, including the option of a no-convenience fee.

(b) Good track record of financial and operational performance, even in the

time of lockdown the company demonstrated its strength and was able to

report revenue of 50 crores in 9MFY2021. (c) Company business has shown

robust recovery in Q3FY21 and reaches normalcy of 70%. (d) A very strong

balance sheet with cash & bank balance of 140 Crores along with zero debt.

Investment concerns: (a) Competition will always remain a concern for this

industry as well as companies need to compete with Paytm in Air tickets

booking and aggregators like OYO in hotel business etc. (b) COVID-19

pandemic has had and is expected to have, a material adverse effect on the

travel industry along fear of the second wave of covid cases in India may

adversely affect the company performance. (c) Any reduction in commissions

or fees by our travel suppliers may adversely affect the business operations.

(d) Company revenue majorly depends on the Air tickets business as 94% of

revenue comes from it in FY2020.

Outlook & Valuation: based on FY2020 the IPO is priced at a PE of 58x at

the upper end of the price band along with a very good ROE of 34% and

ROCE of 35%. The company has the potential to grow exponentially in near

future. Looking at the company performance in FY 2020 and strong balance

sheet is given that we have certain concerns regarding competition in this

business we are assigning a “SUBSCRIBE” recommendation to the

issue.

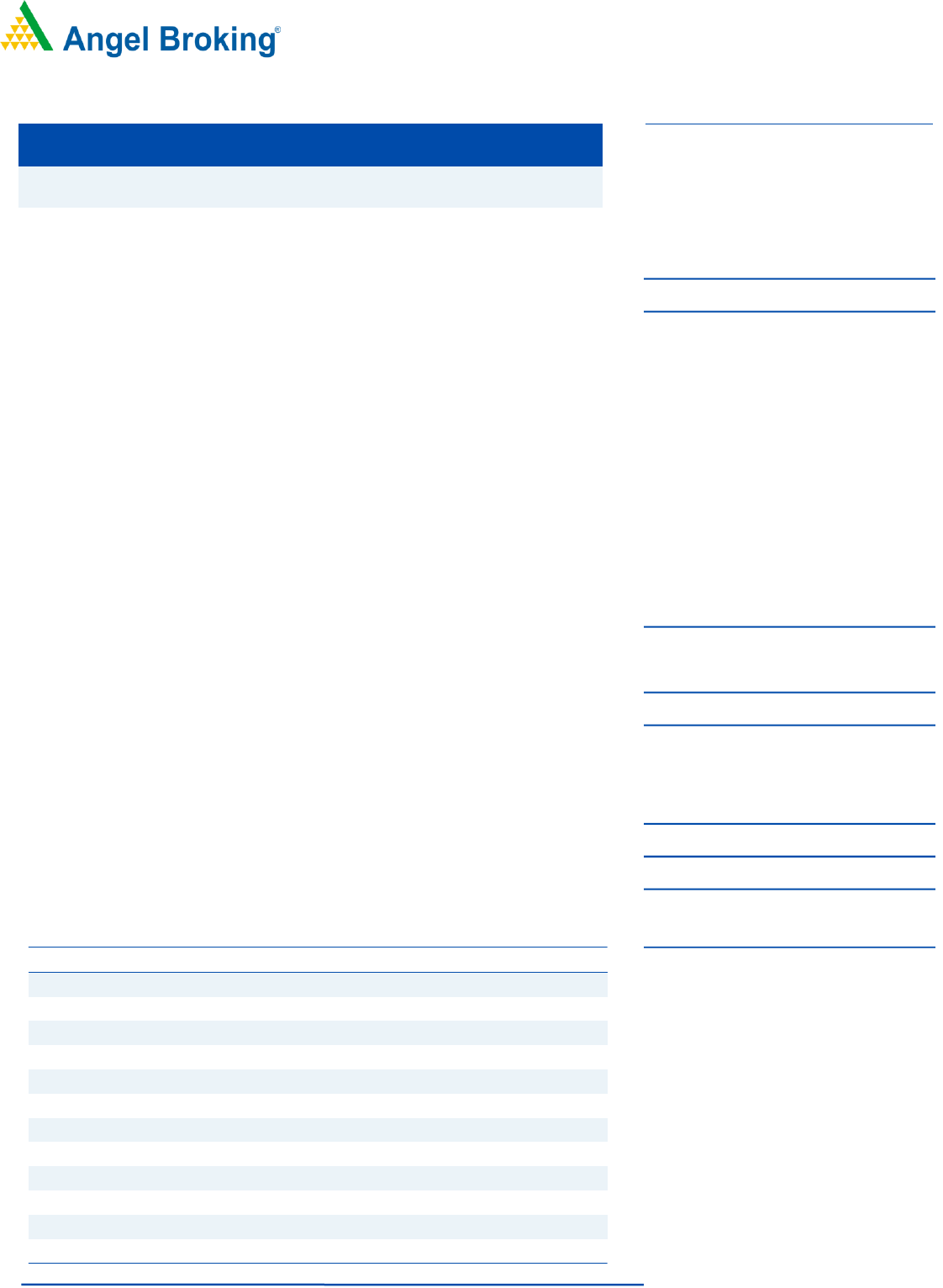

Key Financials

Y/E March (₹cr)

FY2018

FY2019

FY2020

Net Sales

113.6

151.1

179.7

% chg

-

33.1

18.9

Net Profit

0.0

24.0

34.6

% chg

-

-

44.4

EBITDA (%)

10.8

29.7

28.6

EPS (Rs)

0.0

2.2

3.2

P/E (x)

-

84.6

58.6

P/BV (x)

46.2

29.9

19.8

ROE (%)

0.1

35.3

33.7

ROCE (%)

26.8

43.2

35.3

EV/EBITDA

54.4

43.4

37.0

EV/Sales

5.9

12.9

10.6

Source: Company, Angel Research

SUBSCRIBE

Issue Open: March 08, 2021

Issue Close: March 10, 2021

Offer for sale: `510cr**

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 75.0%

Others 25.0%

Trading commences - 19th March 2021

Issue Details

Face Value: `2

Post Issue Shareholding Pattern

Issue size (amount): `510cr**

Price Band: `186-187

Lot Size: 80 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`2,021cr -

**`2,032cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 75%

*Calculated on lower price band

** Calculated on upper price band

Book Building

EASY TRIP PLANNERS LIMITED

Ltd

IPO Note

March 06, 2021

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

2

Company Background

Company commenced operations in 2008 by focusing on the B2B2C

(business to business to customer) distribution channel and providing travel

agents access to their website to book domestic travel airline tickets in order

to cater to the offline travel market in India. Subsequently, by leveraging on

B2B2C channel, it commenced operations in the B2C (business to customer)

distribution channel in 2011 by primarily focusing on the growing Indian

middle class population’s travel requirements. Consequently, due to

increased presence in the B2B2C and B2C channels, it commenced

operations in the B2E (business to enterprise) distribution channel in 2013

with end-to-end travel solutions to corporates. With presence in three distinct

distribution channels provide a diversified customer base and wide

distribution network.

Key Highlights of Easy Trip Planner

Second largest and only profitable OTA player in India in in terms of

positive return of equity in FY2019.

In FY2020 reported profit after tax of 35 crores along with this company

net cash flow of 48 crores in FY2020 from operation activity.

As of Dec 31, 2020, company has an access to more than 400

international and domestic airlines for booking.

Company has more than 1,096,400 hotels in India and international

jurisdictions for booking on its platform.

Company covers almost all the railway stations in India as well as bus

tickets and taxi rentals for major cities in India.

Company provides the option of no-convenience fee option to their

customers, which is a big mote for the company as compared to its

competitors.

Registered Customers base in the B2C channel increased at a CAGR of

28.24% from 5.87 million FY’18 to 9.66 million FY’20. In Fiscal 2019,

GoAir, and SpiceJet, recognized as amongst the top travel partners in

terms of revenue and passenger count.

It offers a comprehensive range of travel-related products and services

for end-to-end travel solutions, including airline tickets, hotels and holiday

packages, rail tickets, bus tickets and taxis as well as ancillary value-

added services such as travel insurance, visa processing and tickets for

activities and attractions.

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

3

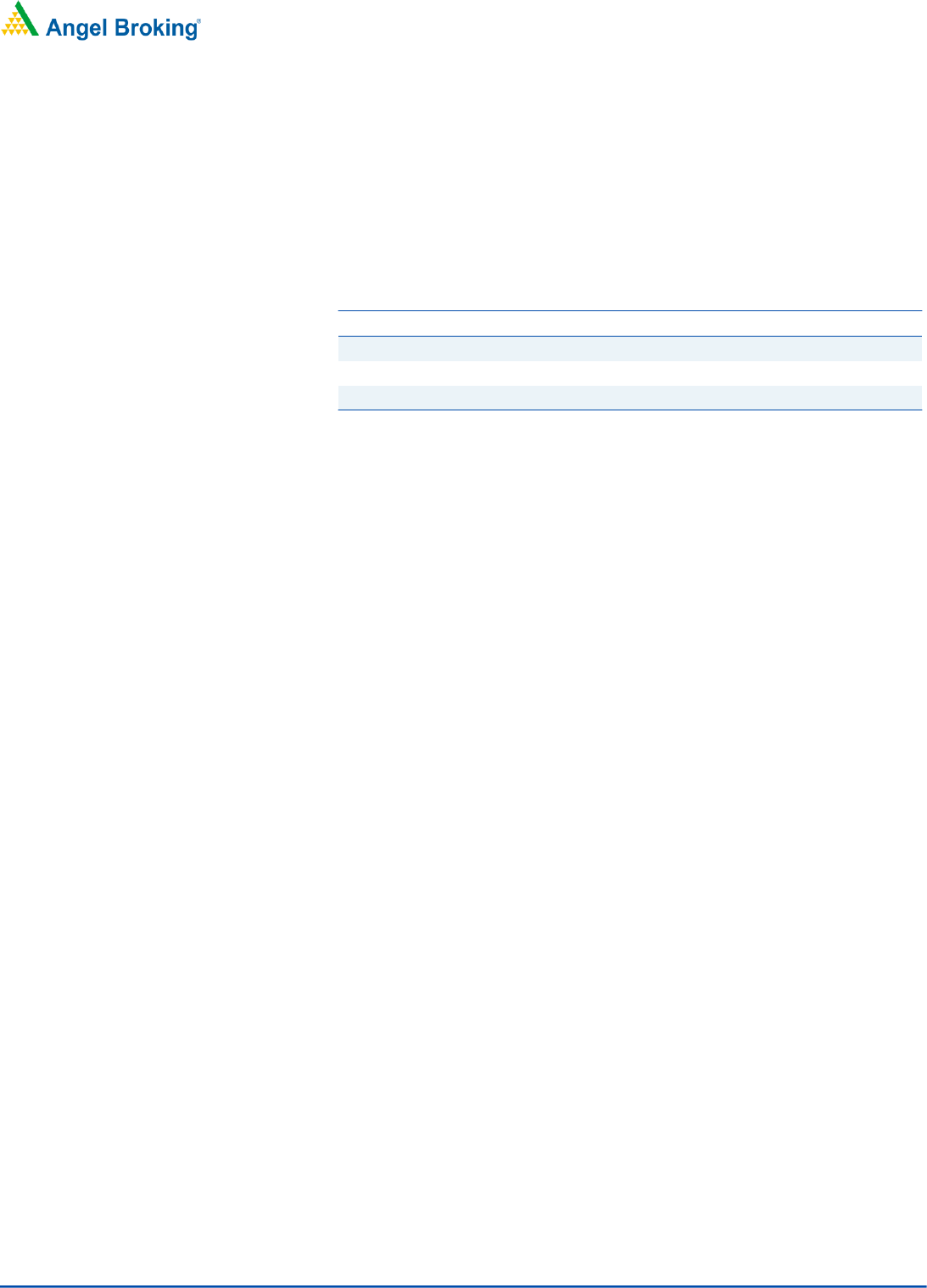

Issue Details

Easy trip planner is raising `510 Cr through Offer For Sale (2,72,72,727 shares),

price band of `186-187.

Exhibit 1: Pre & Post issue Shareholding

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

10,86,45,000

100

8,14,83,750

75

Public

-

0

2,71,61,250

25

Total

10,86,45,000

100

10,86,45,000

100

Source: Company, Angel Research

Objects of the offer

Fresh Listing of the Equity Shares to enhance visibility/brand and provide

liquidity to its existing Shareholders

Leveraging on arrangement of partnership with international airlines and

corporate customers to further boost international air travel

Key Management Personnel

Mr. Nishant Pitti is a Whole-time Director and CEO of our Company. He is one

of the Promoters and has been associated with our Company since inception. Mr.

Nishant Pitti holds a bachelor’s degree in commerce from the University of Delhi

and has approximately 12 years of experience in the travel and tourism sector.

He has been awarded the ‘Doctor of Excellence’ for excellence in the field of

travel management by the Confederation of International Accreditation

Commission – (CIAC), Global at the 6th International Education Forum, 2019 and

‘TnH Face of the Future’ at the Travel and Hospitality (TnH) Awards, 2016. He

was also awarded ‘Entrepreneur of the Year in Service Business – Travel’ at the

Entrepreneur Awards, 2019.

Mr. Rikant Pittie is a Whole-time Director of our Company and has been on

Board since August 8, 2011. He is also one of our Promoters and has been

responsible for operations, sales, marketing, human resources and technology in

the Company. He has attended the course for a bachelor’s degree in technology

at Kurukshetra University, Ambala and has approximately nine years of

experience in the travel and tourism sector.

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

4

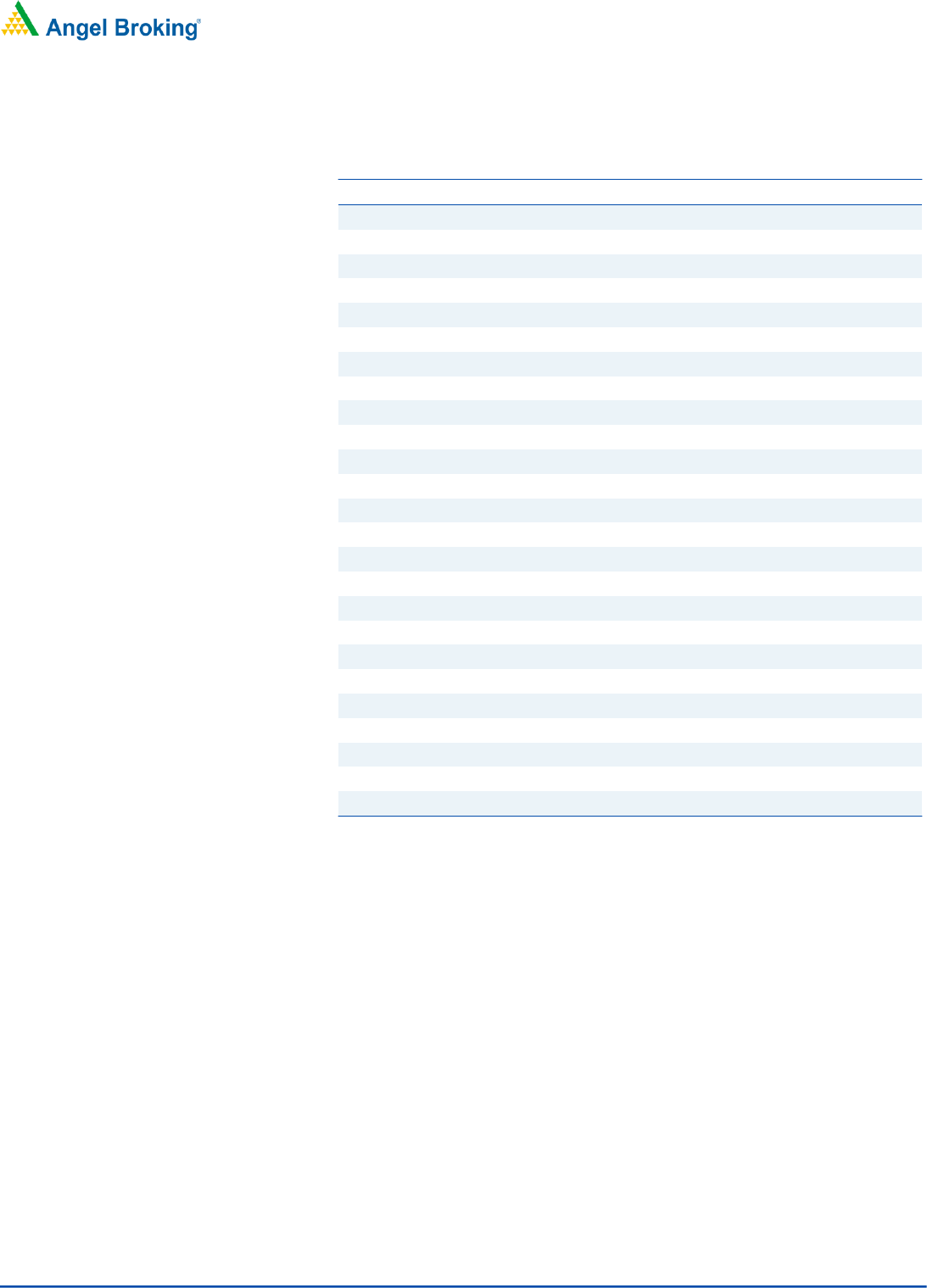

Consolidated Profit & Loss Statement

Y/E March (₹ cr)

FY2018

FY2019

FY2020

9MFY2021

Total operating income

113.6

151.1

179.7

81.6

% chg

-

33.1

18.9

Total Expenditure

101.3

106.3

128.4

37.9

Service cost

0.0

0.0

3.7

0.0

Employee benefits expense

15.9

22.0

29.9

14.7

Other expenses

85.4

84.3

94.7

23.2

EBITDA

12.3

44.8

51.3

43.6

% chg

-

265

15

(% of Net Sales)

10.8

29.7

28.6

53.5

Depreciation& Amortisation

0.2

0.5

0.7

0.5

EBIT

12.0

44.3

50.6

43.2

% chg

-

268.3

14.1

(% of Net Sales)

10.6

29.3

28.2

52.9

Finance costs

1.5

3.2

3.1

1.3

Other income

-6.6

-5.3

-

-

(% of Sales)

-5.8

-3.5

-

-

Recurring PBT

3.9

35.8

47.5

41.8

% chg

-

809

32.6

Exceptional item

-

-

-

-

Tax

3.9

11.8

12.9

10.7

PAT (reported)

0.0

24.0

34.6

31.1

% chg

-

-

44.4

(% of Net Sales)

0.0

15.9

19.3

38.1

Basic & Fully Diluted EPS (Rs)

0.0

2.2

3.2

10.9

% chg

-

-

44.4

Source: Company, Angel Research

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

5

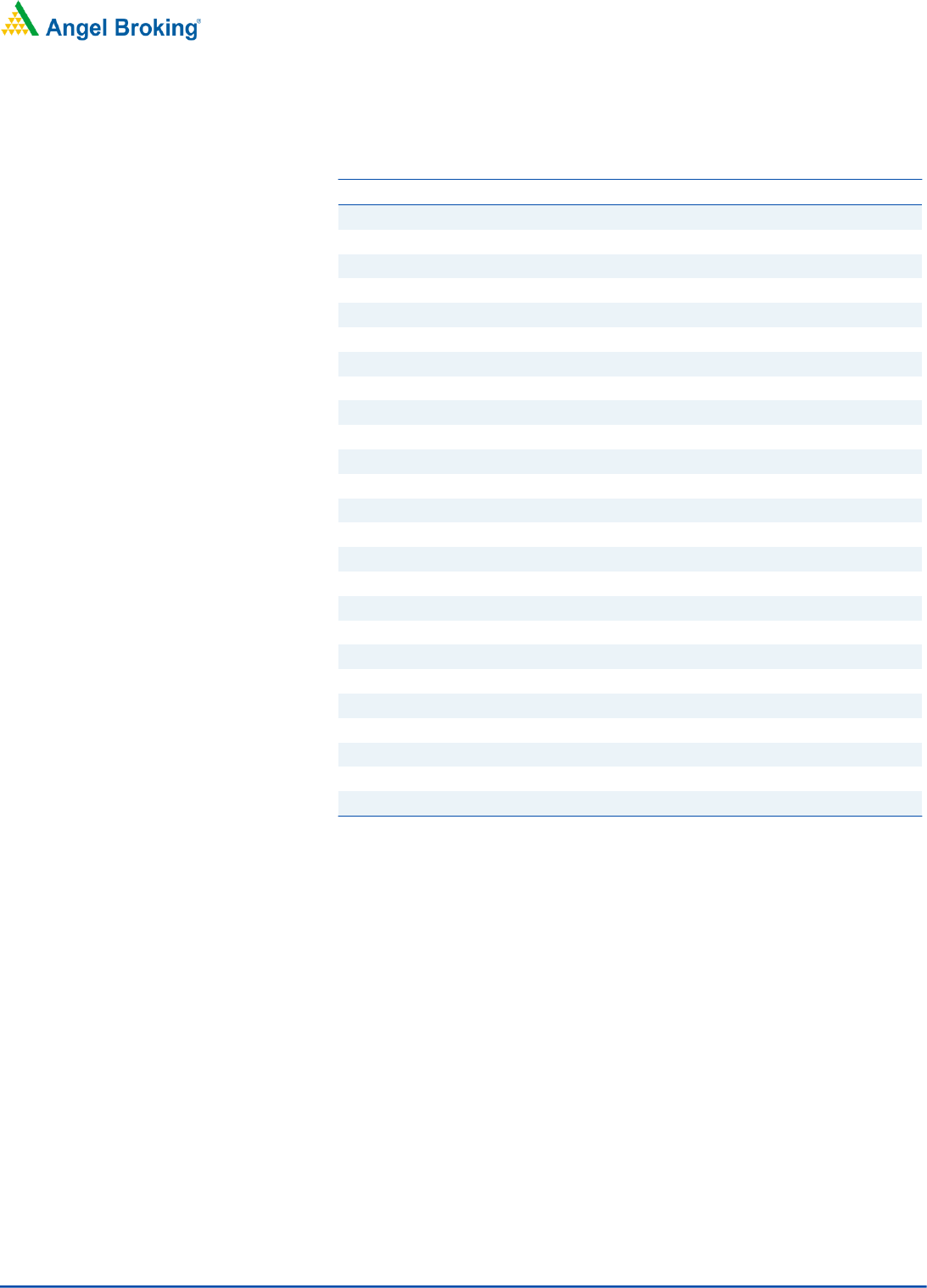

Consolidated Balance sheet

Y/E March (₹ cr)

FY2018

FY2019

FY2020

Q3FY21

SOURCES OF FUNDS

Equity Share Capital

7.2

21.7

21.7

21.7

Other equity (Retained Earning)

36.7

46.2

81.0

112.4

Shareholders Funds

44.0

67.9

102.7

134.1

Total Loans

-

-

-

-

Other liabilities

1.0

34.7

40.6

28.9

Total Liabilities

45.0

102.6

143.3

163.0

APPLICATION OF FUNDS

Property, plant and equipment

6.3

7.1

7.8

7.7

Investment property

9.8

8.4

2.3

2.3

Intangible assets

0.0

0.0

0.1

0.2

Intangibles under development

-

-

0.3

0.3

Current Assets

155.8

224.8

252.6

273.9

Inventories

3.1

-

-

-

Trade receivables

43.1

41.8

58.4

19.8

Cash and cash equivalents

7.7

34.1

13.1

44.6

Other bank balances

1.3

52.0

117.8

96.5

Other financial assets

1.6

42.7

20.4

21.1

Other current assets

53.7

17.5

28.7

86.1

loan

17.2

36.8

13.2

4.8

Investment

28.0

-

1.0

1.0

Current Liability

135.3

140.4

139.0

194.0

Net Current Assets

20.5

84.4

113.6

80.0

Other Non Current Asset

8.3

2.7

19.2

72.5

Total Assets

45.0

102.6

143.3

163.0

Source: Company, Angel Research

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

6

Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY2018

FY2019

FY2020

Q3FY21

Operating profit before working capital changes

34.8

6.6

21.8

13.2

Net changes in working capital

-14.6

74.9

31.8

45.3

Cash generated from operations

20.2

81.5

53.6

58.5

Direct taxes paid (net of refunds)

-7.4

-11.3

-5.7

-2.4

Net cash flow (used in)/from operating activities

12.8

70.2

47.8

56.0

Interest received

4.8

5.0

7.8

7.2

Dividend received

0.3

0.2

0.0

0.0

Others

-0.4

-47.2

-76.4

-31.7

Cash Flow from Investing

4.7

-42.0

-68.6

-24.5

Repayment of short term borrowing

-10.4

0.0

0.0

0.0

Payment of principal portion of lease liabilities

0.0

0.0

-0.2

0.0

Payment of interest portion of lease liabilities

0.0

0.0

-0.1

0.0

Finance costs paid

-1.8

-1.7

0.0

0.0

Cash Flow from Financing

-12.2

-1.7

-0.3

0.0

Inc./(Dec.) in Cash

5.3

26.4

-21.0

31.5

Opening Cash balances

2.4

7.7

34.1

13.1

Closing Cash balances

7.7

34.1

13.1

44.6

Source: Company, Angel Research

Key Ratios

Y/E March

FY2018

FY2019

FY2020

Valuation Ratio (x)

P/E (on FDEPS)

-

84.6

58.6

P/CEPS

-

83.0

57.4

P/BV

46.2

29.9

19.8

EV/Sales

5.9

12.9

10.6

EV/EBITDA

54.4

43.4

37.0

Per Share Data (₹)

EPS (Basic)

0.0

2.2

3.2

EPS (fully diluted)

0.0

2.2

3.2

Cash EPS

0.0

2.3

3.3

Book Value

4.0

6.3

9.5

Returns (%)

ROE

0.1

35.3

33.7

ROCE

26.8

43.2

35.3

Turnover ratios (x)

Receivables (days)

138.5

101.1

118.5

Inventory (days)

11.3

-

-

Payables (days)

54.5

97.8

70.6

Working capital cycle (days)

72.7

3.2

47.9

Source: Company, Angel Research

EASY TRIP PLANNERS LIMITED | IPO Note

March 06, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information..

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.