Dreamfolks Services Limited IPO

Please refer to important disclosures at the end of this report

1

Dreamfolks Services Limited (DFSL) is a dominant player and India's largest

airport service aggregator platform facilitating an enhanced airport

experience to passengers leveraging a technology driven platform. Company

follows an asset light business model that integrates global card networks in

India, card issuers and other corporate clients in India, including airline

companies with various airport lounge operators and other airport related

service providers on a unified technology platform. DFSL facilitates the

customers of its clients to access the airport related services such as Lounge,

Food & beverages, Spa, pick up and drop service amongst others. Company

has 100% market share in facilitating 54 lounges currently operational in India

and it also has over 95% market share of all India issued credit and debit cards

access to the airport lounges.

Positives: (a) Dominant player in the airport lounge aggregation industry in India

with strong tailwinds (b) Strong relationships with clients in card network and card

issuer space (c) Evolving services portfolio leading to increased cross selling benefits

for clients and indirectly increasing client stickiness for the company (d) Asset and

human resource light business model providing ability to scale business with less

incremental cash deployment.

Investment concerns: (a) Business possesses high key man risk (b) Slowdown in

Travel Industry (c) High Client and Revenue Concentration (d) Threat of airport

lounge operators forward integrating and tying up directly with card networks and

card issuers.

Outlook & Valuation: In terms of valuations, the post-issue P/E works out to

104.8x FY22 EPS (at the upper end of the issue price band). However, the multiple

looks higher mainly due to lower profitability caused by pandemic led industry wide

issues. DFSL enjoys a 95% market share and enjoys early mover advantage in the

segment. It has been an asset-light business model gaining the preference of air

travelers. Further, DFSL has focused on diversifying and increasing its services

portfolio. Thus, we have a SUBSCRIBE rating on the issue from a medium to long-

term perspective.

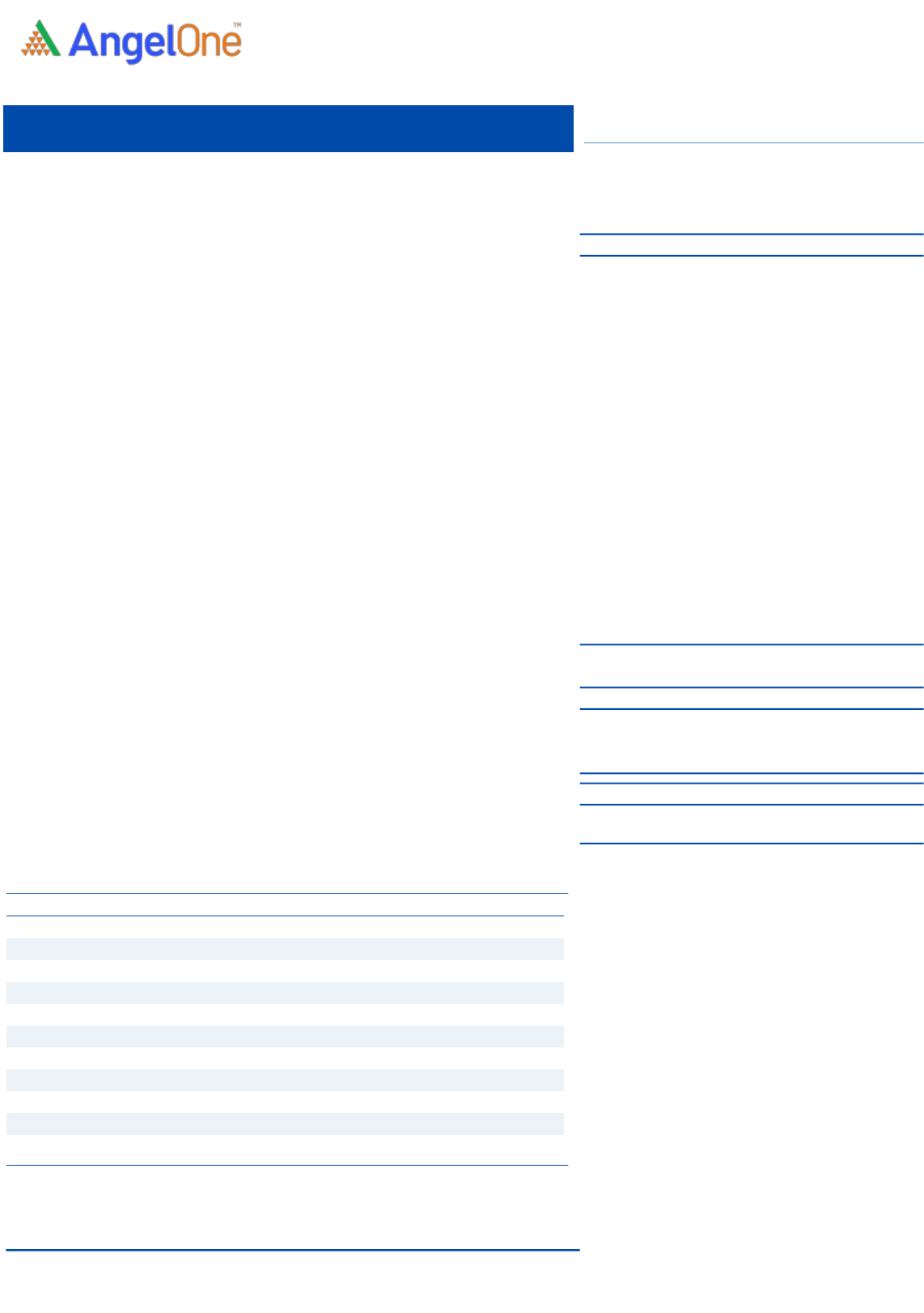

Key Financials

Y/E March (₹ cr)

FY'20

FY'21

FY’22

Net Sales

367

106

282

% chg

-71%

167%

PAT

32

(1)

16

% chg

-105%

1221%

EBITDA (%)

12.3

(0.4)

8.0

EPS (Rs)

6.1

(0.3)

3.1

P/E (x)

53.8

(1,174.7)

104.8

P/BV (x)

26.0

26.5

20.7

ROE (%)

48.4

(2.3)

19.8

ROCE (%)

63.4

(2.6)

22.6

EV/Sales

4.6

16.1

6.0

Source: Company RHP, Angel Research

SUBSCRIBE

Issue Open: August 24, 2022

Issue Close: August 26, 2022

Offer for Sale: ` 562cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 67.0%

Public 33.0%

Fresh issue: ` 0cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: ` 10.45cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 10.45cr

Issue size (amount): ₹ 562cr

Price Band: ₹308- ₹326

Lot Size: 46 shares and in multiple thereafter

Post-issue mkt. cap: * `1,609cr - ** `1,703cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 67%

*Calculated on lower price band

** Calculated on upper price band

Book Building

IPO NOTE

Dreamfolks Services Limited

August 23, 2022

Dreamfolks Services Limited | IPO Note

August 23, 2022

2

Company background

DFSL is a dominant player and India's largest airport service aggregator

platform facilitating an enhanced airport experience to passengers leveraging

a technology driven platform. Company follows an asset light business model

that primarily integrates global card networks in India, card issuers and other

corporate clients in India including airline companies with various airport

lounge operators and other airport related service providers on a unified

technology platform. Company has tie up with all the 5 card networks in India

including Visa, Mastercard, Diners/Discovery and RuPay, also the company has

tie-ups with India’s largest card issuers such as HDFC Bank, Kotak Mahindra

Bank amongst others.

DFSL facilitates the customers of its clients to access the airport related services

such as Lounge, Food & beverages, Spa, pick up and drop service amongst

others. Company currently has 1,416 total touchpoints of which 244

touchpoints are in India and 1,172 are outside India. Through these touchpoints

company facilitates its services to the customers of its clients.

Diverse range of Services:

1) Lounge Access: DFSL has 100% coverage of operational lounges in Indian

airports, and it offers a unique value proposition to its clients by enabling

access to the Consumers to a network of all operational airport lounges in

India. As of March 31, 2022, company had exclusivity to provide access to

12 domestic lounges across 11 airports in India constituting around 22.22%

of the total access of the domestic lounges for India issued credit cards and

debit cards. Revenue from lounge access services contributed on an

average 98.55% over FY20 to FY22 to the top line.

2) Food and beverage offerings: DFSL had tied up with various entities to

facilitate access to around 57 restaurants / F&B outlets at 18 airports across

India.

3) Spa Services: Consumers can avail of specified massage therapies such as

head, neck and shoulder massage, and foot reflexology. DFSL facilitates

access to this service in tie-up with O2 Spa Salon Private Limited.

4) Airport transfer services: DFSL facilitates airport transfer, i.e., airport ‘pick-

up and drop’ facilities in 47 cities across India and in 145 cities outside

India, as of March 31, 2022

5) Baggage Transfer: DFSL has tied up with a service provider to provide

baggage pick-up and drop-off facility to and from airports across

Bengaluru, Hyderabad, Mumbai, and New Delhi

6) Other: In addition to providing Services at airports, DFSL has also, in the

current Fiscal, forayed into the railways sector and, company has entered

contracts to provide lounge access at 8 railway stations in India.

Dreamfolks Services Limited | IPO Note

August 23, 2022

3

Issue details

The IPO is made up entirely of Offer for sale ₹562cr.

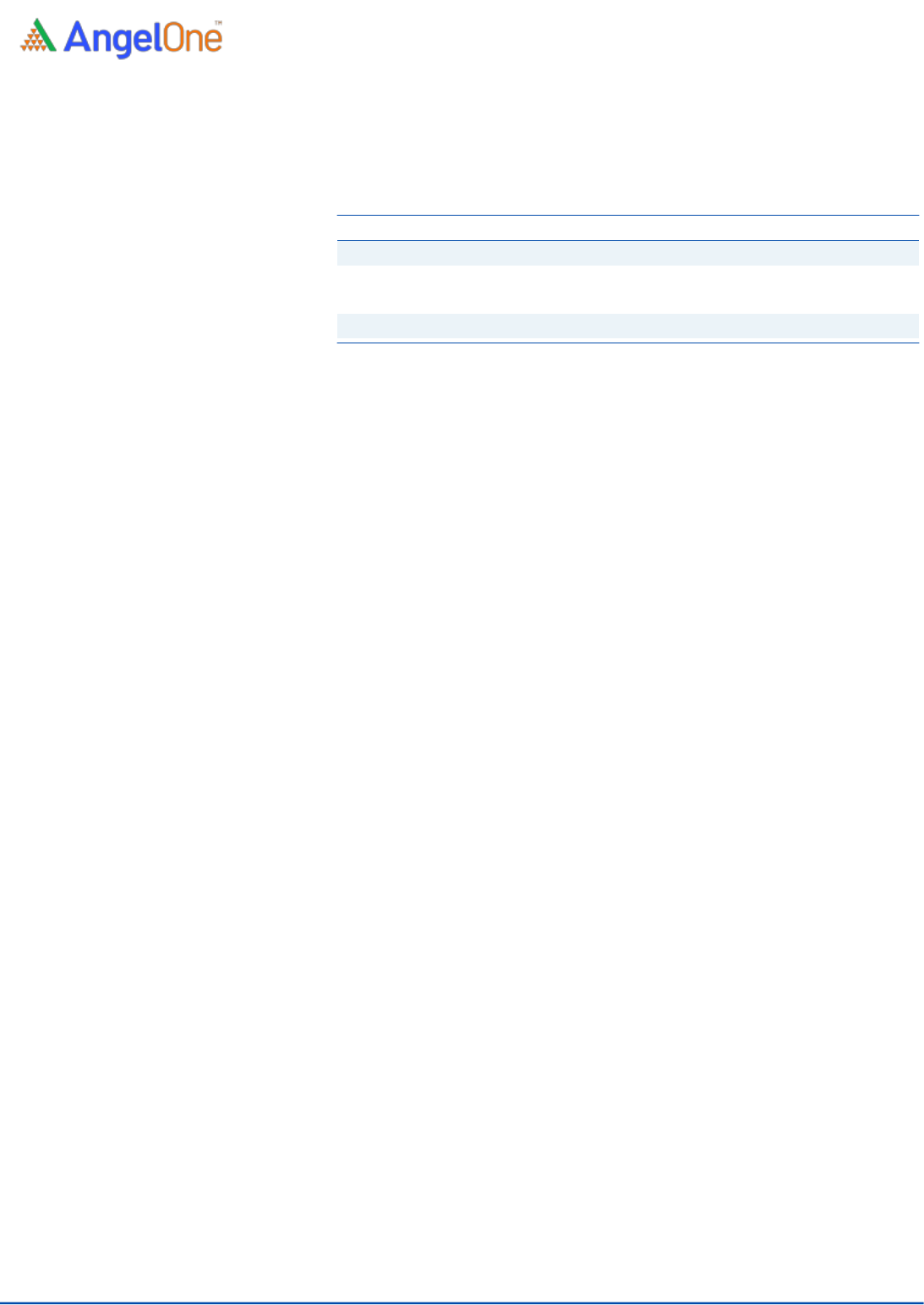

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

5,22,49,900

100.0%

3,50,07,532

67.0%

Public

100

0.0%

1,72,42,468

33.0%

Total

5,22,50,000

100.0%

5,22,50,000

100.0%

Source: Company, Angel Research

Objectives of the Offer

◼ To carry out the Offer for Sale of 17,242,368 equity shares aggregate upto

₹562cr.

Key Management Personnel

Liberatha Peter Kallat is the Promoter and Managing Director of the Company.

She was designated as the Chairperson on November 30, 2021. She holds a

bachelor’s degree in science from Andhra University. She has been associated with

the Company since 2014 and is responsible for the strategy and overall

management of our Company. She has experience in the hospitality sector and has,

in the past, been associated with Indian and global multinational companies such

as Taj GVK Hotels & Resorts Ltd, PepsiCo. India, Premium Port Lounge Management

Company Private Ltd, and Pernod Ricard India (P) Ltd.

Balaji Srinivasan is an Executive Director and Chief Technology Officer of the

Company. He holds a diploma in software and systems management from NIIT,

New Delhi. He has been associated with the Company since 2019. He has

experience in the technology sector. Prior to joining DFSL, he held senior

management positions at start-up ventures such as FarEye and held the position of

Vice-President at Genpact India Private Limited. He has been awarded the Smart

Innovator Award 2019 at the Enterprise Innovation Summit 2019 in recognition of

his extraordinary ability to innovate that resulted in creating business value for the

organization and the Smart Innovator Award 2021 and Enterprise Innovation

Summit 2021 in recognition of the extraordinary efforts in technology innovation

that resulted in creating business value for the organization.

Dreamfolks Services Limited | IPO Note

August 23, 2022

4

Financial Summary

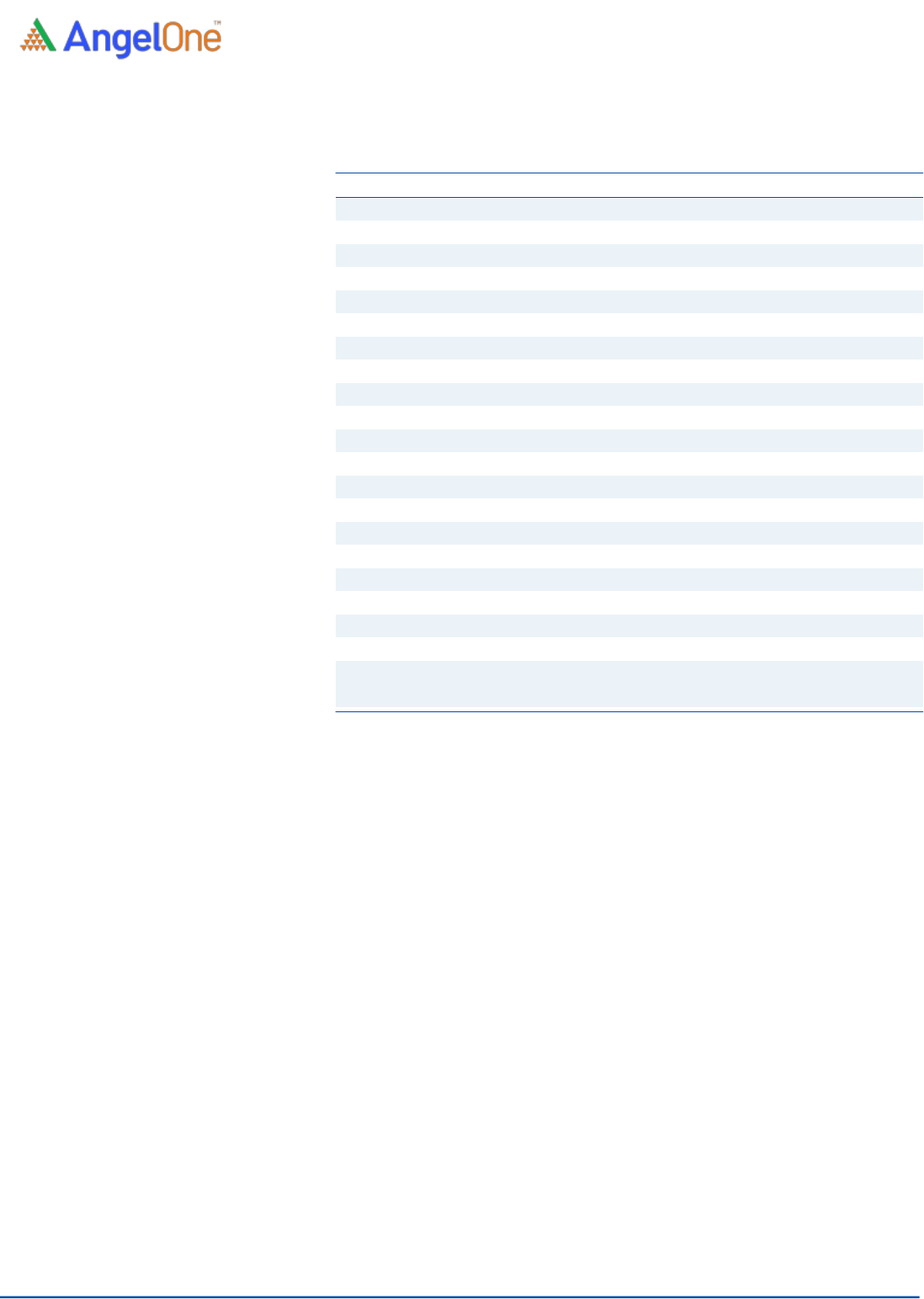

Income Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Net Sales

367

106

282

% chg

-71%

167%

Total Expenditure

322

106

260

Raw Material

300

88

237

Personnel

18

13

17

Other Expenses

4

6

6

EBITDA

45

(0)

23

% chg

-101%

6064%

(% of Net Sales)

12.3

(0.4)

8.0

Depreciation & Amortization

2

2

2

EBIT

43

(2)

20

% chg

-104%

1157%

(% of Net Sales)

11.9

(1.8)

7.2

Interest & other Charges

1

1

1

Other Income

1

2

1

PBT

44

(0)

20

% chg

-100%

10287%

Tax

12

1

4

(% of PBT)

27.3

(621.4)

20.6

PAT

32

(1)

16

% chg

-105%

1221%

Basic EPS (Rs)

6.1

(0.3)

3.1

Source: Company, Angel Research

Dreamfolks Services Limited | IPO Note

August 23, 2022

5

Balance Sheet (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Equity Share Capital

5

5

10

Reserves& Surplus

61

60

72

Shareholders’ Funds

66

64

82

Minority Interest

-

-

-

Total Loans

3

9

8

Other Liabilities

2

2

2

Total Liabilities

71

76

92

APPLICATION OF FUNDS

Net Block

5

11

14

Investment Property

-

27

2

Capital Work-in-Progress

1

0

-

Investments

-

-

-

Current Assets

116

62

128

Inventories

-

-

-

Sundry Debtors

69

40

91

Cash

32

10

15

Loans & Advances

-

-

-

Other Assets

16

12

23

Current liabilities

67

47

77

Net Current Assets

50

15

51

Deferred Tax Liabilities (net)

2

1

1

Other Assets

13

21

24

Total Assets

71

76

92

Source: Company, Angel Research

Dreamfolks Services Limited | IPO Note

August 23, 2022

6

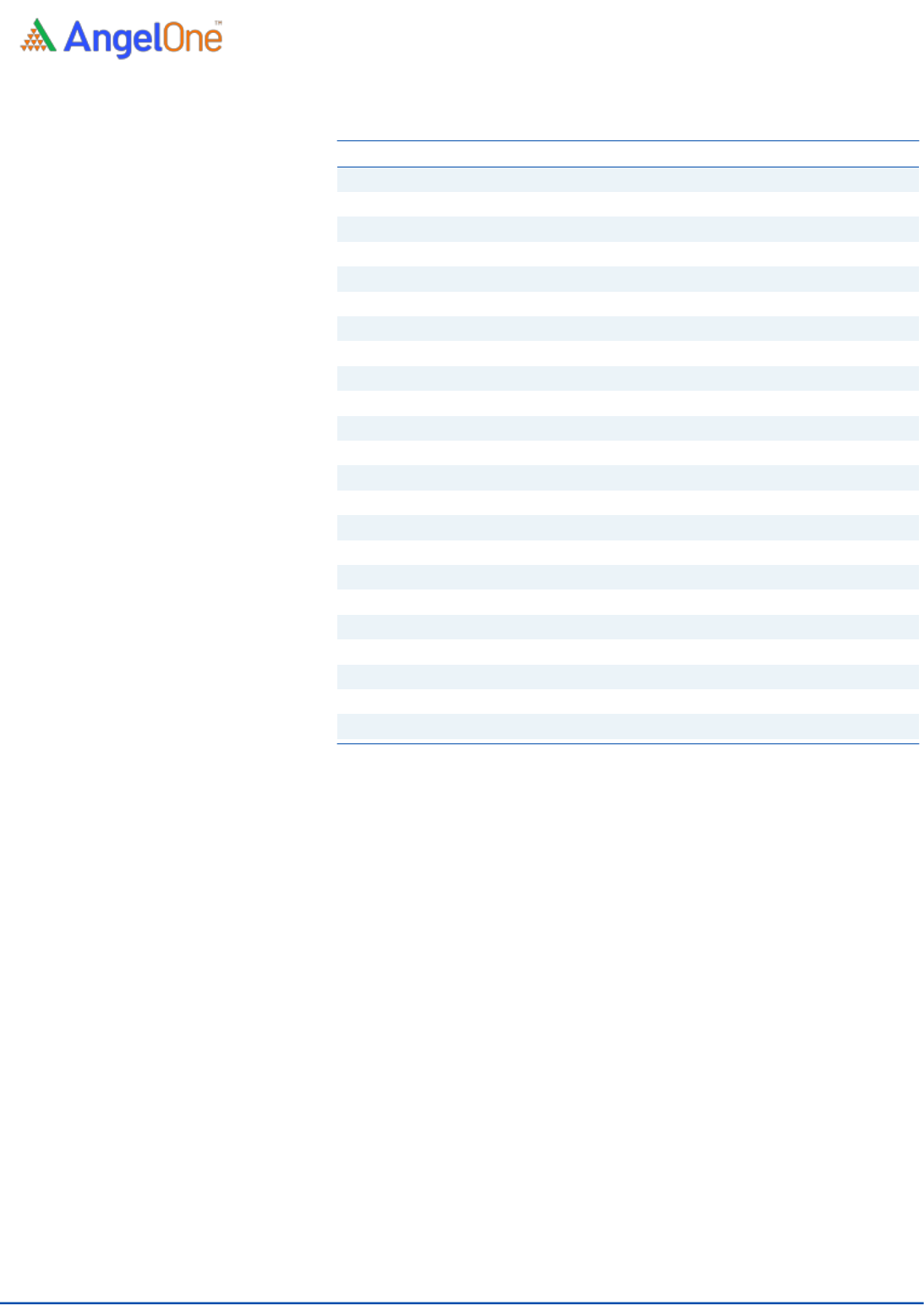

Cashflow Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Profit before tax

44

0

20

Depreciation

2

2

2

Change in Working Capital

(7)

5

-29

Interest / Dividend (Net)

0

-2

0

Direct taxes paid

(16)

2

-8

Others

(0)

0

1

Cash Flow from Operations

22

6

-12

(Inc.)/ Dec. in Fixed Assets

(7)

-36

-7

(Inc.)/ Dec. in Investments

0

9

27

Interest Received

7

0

-13

Cash Flow from Investing

0

-27

6

Proceeds / (Repayment) of borrowings

1

-1

-1

Proceeds / (repayment) of Other Financial liabilities

0

0

-1

Interest paid

(0)

0

-1

Cash Flow from Financing

1

-2

-3

Inc./(Dec.) in Cash

23

-22

-9

Opening Cash balances

9

32

10

Closing Cash balances

32

10

1

Source: Company, Angel Research

Key Ratios

Y/E March (₹ cr)

FY'20

FY'21

FY’22

Valuation Ratio (x)

P/E (on FDEPS)

53.8

(1,174.7)

104.8

P/CEPS

51.2

16,378.4

92.7

P/BV

26.0

26.5

20.7

EV/Sales

4.6

16.1

6.0

Per Share Data (Rs)

EPS (Basic)

6.1

-0.3

3.1

EPS (fully diluted)

6.1

(0.3)

3.1

Cash EPS

6.4

0.0

3.5

Book Value

12.5

12.3

15.7

Returns (%)

ROE

48.4

(2.3)

19.8

ROCE

63.4

(2.6)

22.6

Source: Company, Angel Research;

Dreamfolks Services Limited | IPO Note

August 23, 2022

7

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity

with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred

to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of

such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject

company. Research analyst has not served as an officer, director or employee of the subject company.