Derivative Report

July 25, 2014

Comments

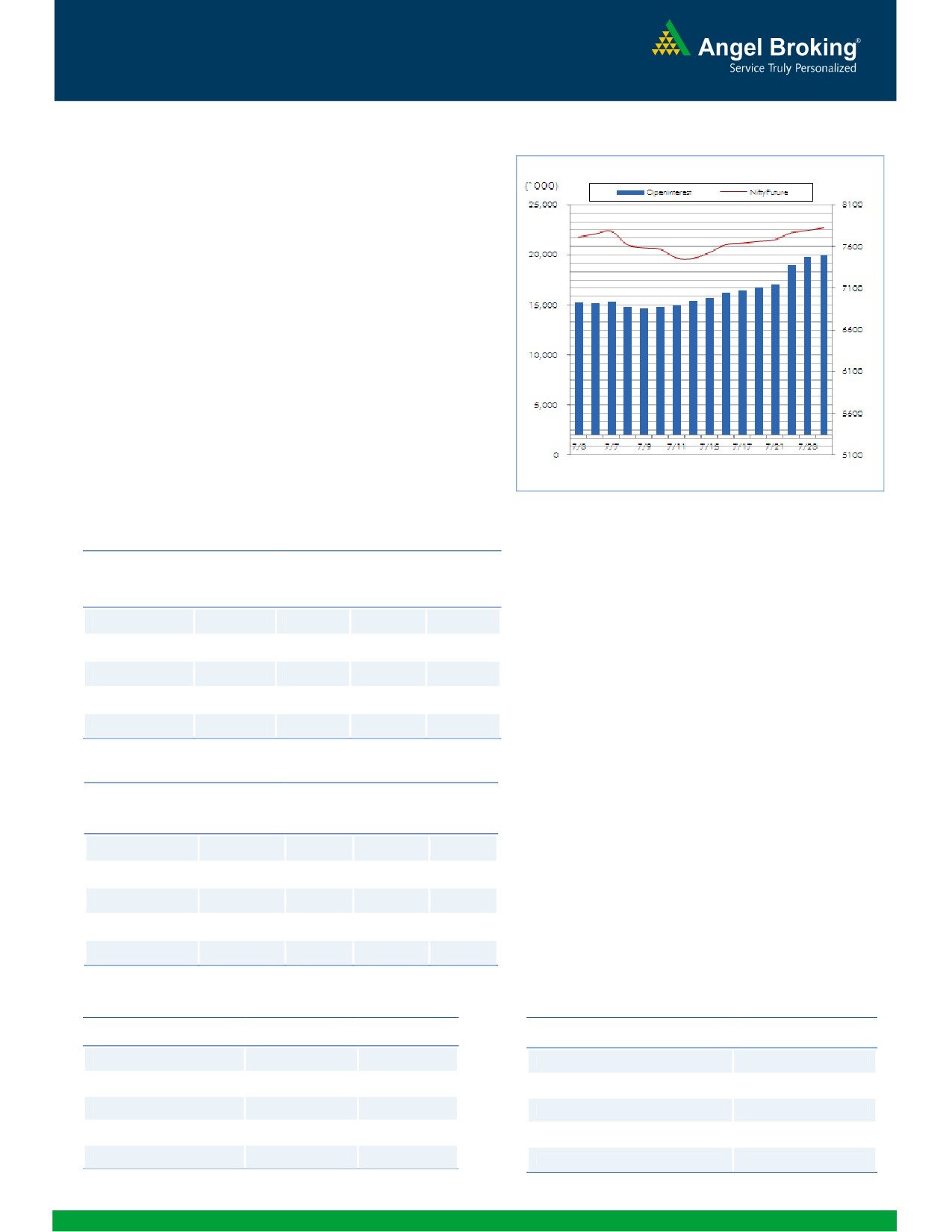

Nifty Vs OI

The Nifty futures open interest increased by 0.72% while

BankNifty futures open interest has decreased by 3.24%

as market closed at 7830.60 levels.

The Nifty July future closed at premium of 3.15 point

against a discount of 4.20 points. The August series

closed at a premium of 35.90 points.

The Implied Volatility of at the money options has

increased from 11.24% to 11.87%.

Nifty PCR-OI has increased from 0.95 to 0.97 levels.

The total OI of the market is Rs. 2,06,431/- cr. and the

stock futures OI is Rs. 56,964/- cr.

Few of the liquid counters stocks where we have seen

high cost of carry are GMRINFRA, HDIL, OFSS,

UCOBANK and INDIACEM.

OI Gainers

View

OI

PRICE

FIIs continue buying in cash market segment, they

SCRIP

OI

CHANGE

PRICE

CHANGE

bought of worth Rs. 282 crores. In F&O segment

(%)

(%)

some long unwinding was seen in Index Futures.

SUNTV

1607000

35.84

407.05

-4.69

Interesting FIIs are quite active in Stock Futures from

last two trading sessions, yesterday they were net

CAIRN

17229000

26.04

322.50

-6.38

buyer with fall in open interest which indicates

UCOBANK

24576000

15.45

107.90

6.02

covering of short positions formed earlier.

ALBK

21040000

12.71

117.30

-2.77

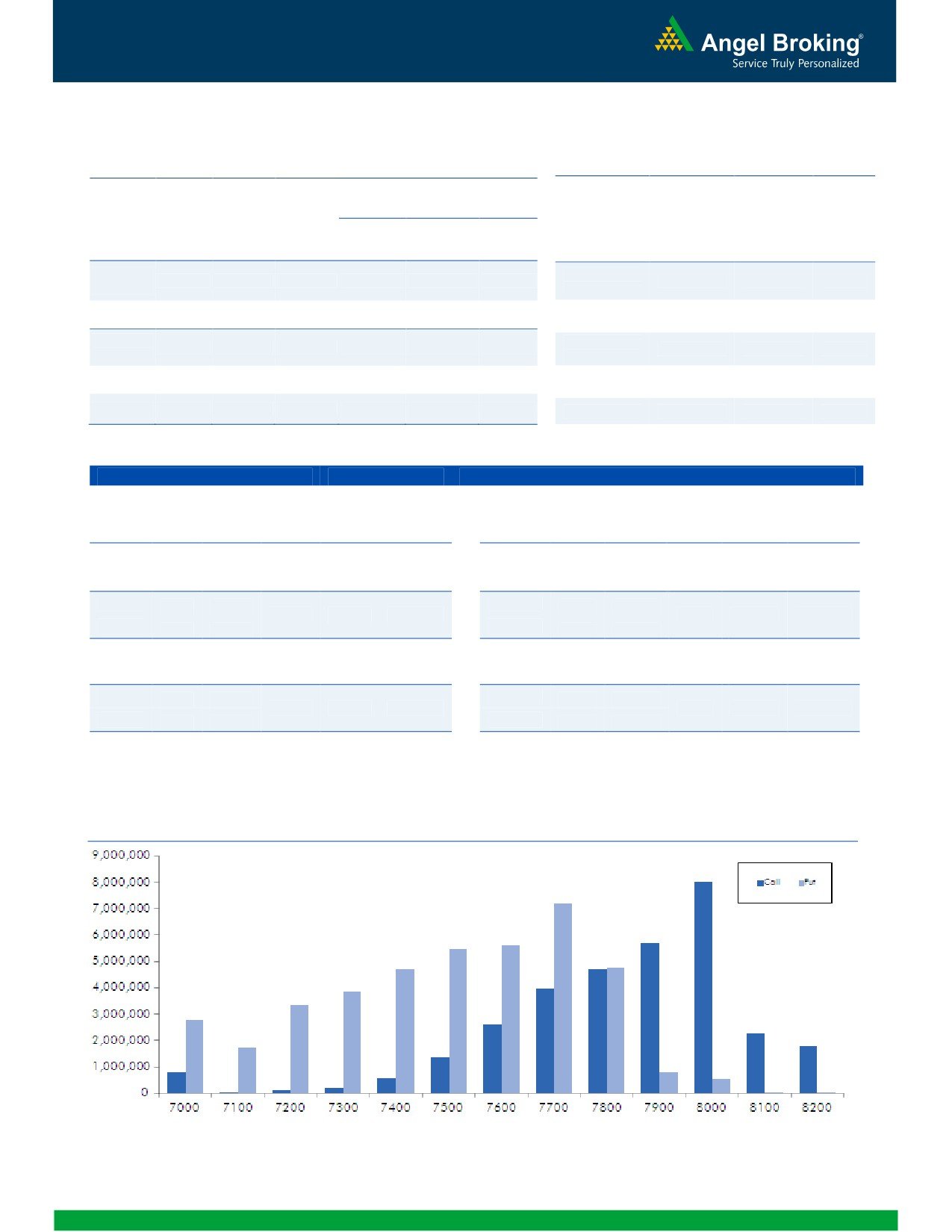

In Index options FIIs were net seller with rise in open

GAIL

3415000

12.22

430.15

-1.84

interest indicating fresh short formation. In put

options we saw huge buildup in 7800 put options,

we believe these are short positions formed by

OI Losers

FIIs. On the other hand in call options we could

OI

PRICE

hardly see any relevant buildup, majority of activity

SCRIP

OI

CHANGE

PRICE

CHANGE

was seen in 7900 strike price followed by some profit

(%)

(%)

booking in 7700 call options. Maximum buildup in

GLENMARK

748000

-19.35

596.85

0.24

current series is witnessed in 8000 call and 7700 put

options.

MRF

43250

-11.05

23858.10

-1.98

MCLEODRUSS

2701000

-9.03

283.05

1.01

CROMPGREAV

20400000

-6.97

202.50

-2.27

JSWENERGY

9264000

-6.23

81.50

-1.27

Put-Call Ratio

Historical Volatility

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

0.97

1.04

CAIRN

40.13

BANKNIFTY

1.10

0.91

JPPOWER

83.37

RELIANCE

0.42

0.45

UCOBANK

66.09

SBIN

0.61

0.63

JPASSOCIAT

68.33

INFY

0.68

0.43

ASIANPAINT

32.00

1

Derivative Report

July 25, 2014

Strategy Date

Symbol

Strategy

Status

30-06-2014

Reliance

Ratio Bull Call Spread

Open

07-07-2014

ITC

Long Put Ladder

Open

14-07-2014

DLF

Short Strangle

Open

21-07-2014

NIFTY

Ratio Bull Call Spread

Open

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in

this document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment

banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of

this report or in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to

the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates

may have investment positions in the stocks recommended in this report.

Derivative Research Team

For Private Circulation Only

SEBI Registration No: INB 010996539

3