Derivative Report

Aug 22, 2014

Comments

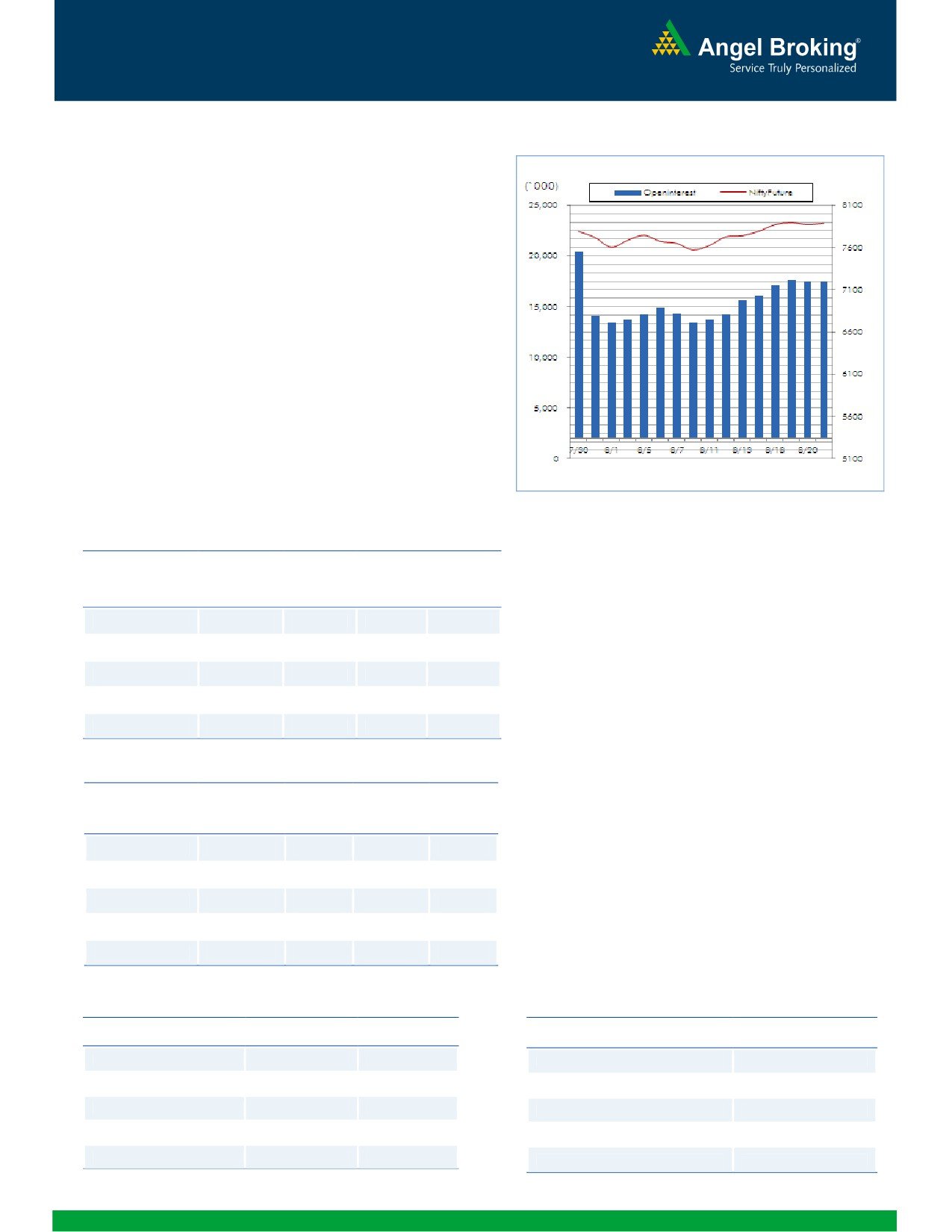

Nifty Vs OI

The Nifty futures open interest decreased by 0.29% while

BankNifty futures open interest has increased by 10.96%

as market closed at 7891.10 levels.

The Nifty August future closed at premium of 12.05 point

against a premium of 15.40 points. The September

series closed at a premium of 45.40 points.

The Implied Volatility of at the money options has

decreased from 11.48% to 11.07%.

Nifty PCR-OI has decreased from 1.03 to 1.01 levels.

The total OI of the market is Rs. 1,90,957/- cr. and the

stock futures OI is Rs. 53,384/- cr.

Few of the liquid counters stocks where we have seen

high cost of carry are SUNTV, BPCL, RCOM, ALBK and

JUSTDIAL.

View

OI Gainers

Yesterday Nifty moved in a range of 20-30 points

and closed on a positive note. FIIs were net buyer in

OI

PRICE

SCRIP

OI

CHANGE

PRICE

CHANGE

cash market segment of worth Rs. 412 crores, while

(%)

(%)

in F&O segment they were net seller in Index Futures

with some rise in open interest indicating very mirror

BPCL

4556000

17.51

685.40

2.89

short positions in yesterday’s trading session. They

TITAN

7034000

16.94

366.95

5.75

were also quite active in Stock Futures yesterday,

wherein they bought of worth Rs. 674 crores with

HDFC

7334000

14.16

1064.40

-0.76

marginal change in open interest which is mix of

SUNTV

2839000

11.12

368.60

-1.12

both long & short positions.

HINDPETRO

9159000

10.54

467.45

4.31

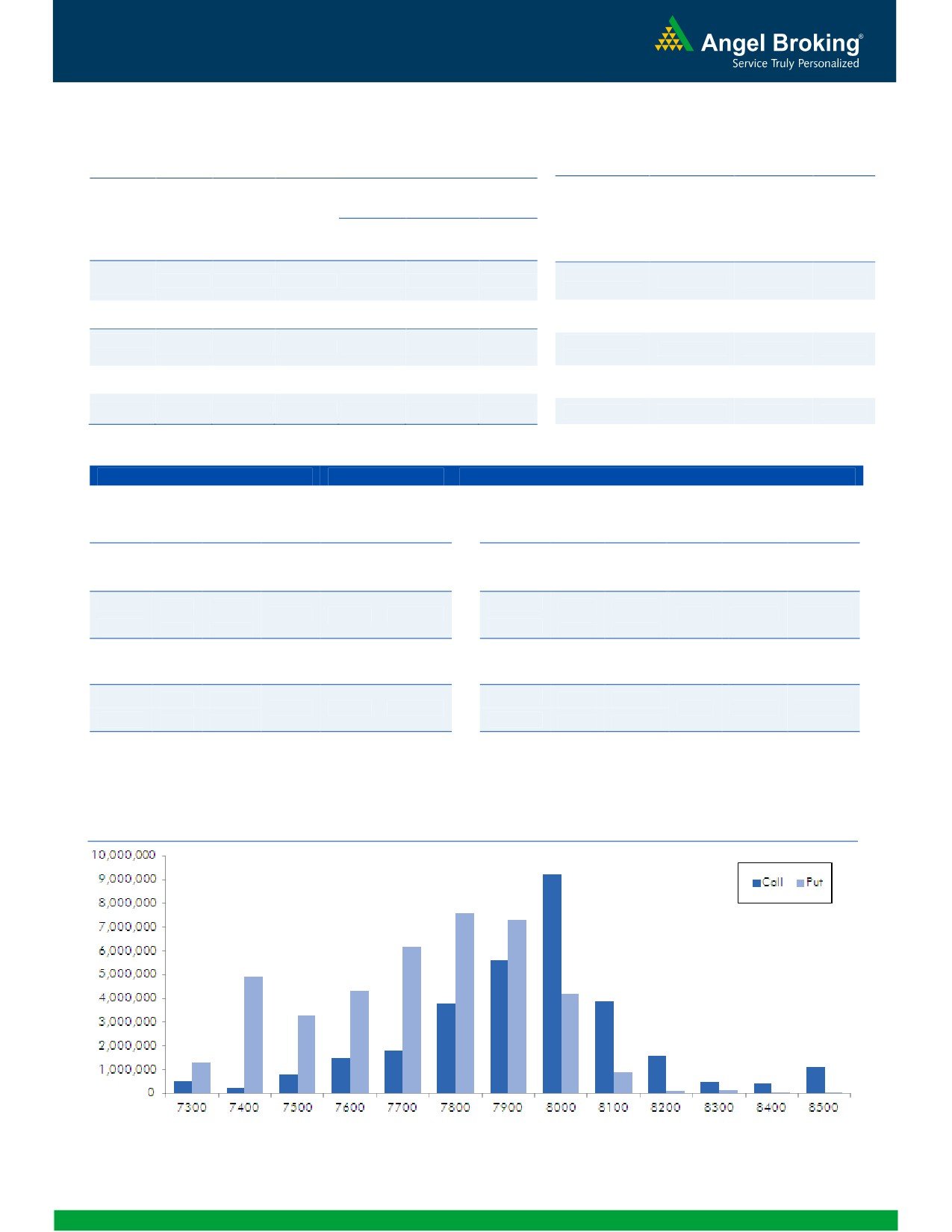

In Index options FIIs were net buyer with rise in open

interest indicating good amount of long formation. In

yesterday’s trading session we hardly saw any

OI Losers

reasonable activity in call options, majority of open

OI

PRICE

interest addition was seen in 8000 call options. In put

SCRIP

OI

CHANGE

PRICE

CHANGE

options decent amount of buildup in

7800 was

(%)

(%)

witnessed and we believe these are FIIs long positions

IGL

1247000

-29.19

374.05

1.14

formed in last trading session. Maximum open

interest in current series is seen in 8000 call & 7700

MCDOWELL-N

3865625

-9.06

2402.10

-2.16

put options.

SRTRANSFIN

979500

-8.76

933.05

-0.71

Large caps counters where we have seen good

BAJAJ-AUTO

992625

-6.74

2268.05

2.59

amount of addition in open interest are HDFC,

DIVISLAB

522250

-5.30

1542.70

1.38

KOTAKBANK,

BANKBARODA,

PNB

and

HEROMOTOCO.

Put-Call Ratio

Historical Volatility

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

1.01

1.02

TITAN

44.91

BANKNIFTY

0.98

0.76

UNIONBANK

62.99

SBIN

0.52

0.50

BAJAJ-AUTO

27.92

RELIANCE

0.45

0.42

PNB

38.98

AXISBANK

0.58

0.40

BANKINDIA

51.84

1

Derivative Report

Aug 22, 2014

Strategy Date

Symbol

Strategy

Status

04-08-2014

BANKNIFTY

Ratio Put Spread

Open

11-08-2014

NIFTY

Long Put

Loss booked on 12-08-2014.

18-08-2014

BHEL

Ratio Bull Call Spread

Open

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in

this document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment

banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of

this report or in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to

the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates

may have investment positions in the stocks recommended in this report.

Derivative Research Team

For Private Circulation Only

SEBI Registration No: INB 010996539

3