Derivative Report

September 08, 2015

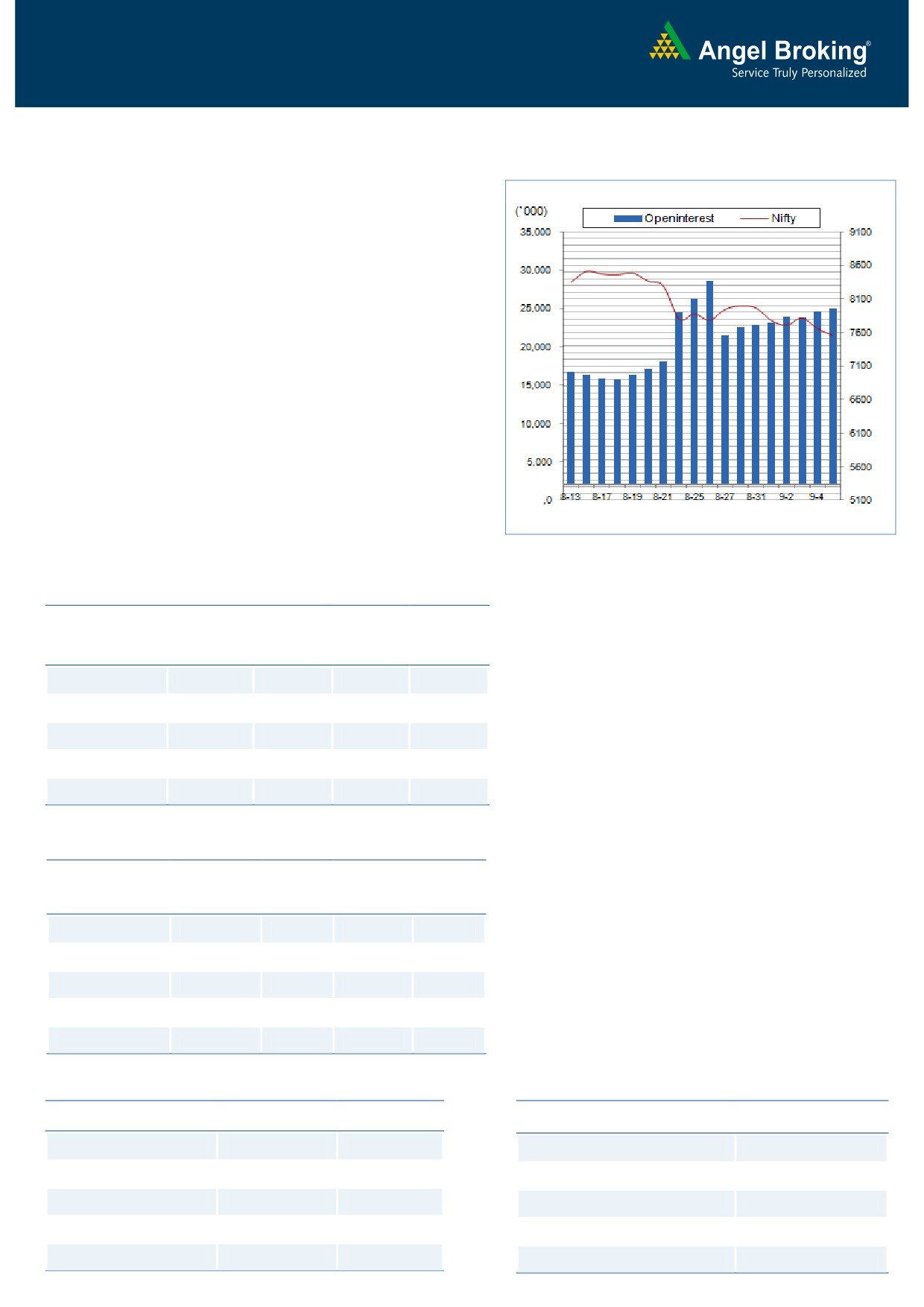

Nifty Vs OI

Comments

The Nifty futures open interest has increased by 2.02%

BankNifty futures open interest has increased by 7.62% as

market closed at 7558.80 levels.

The Nifty September future closed at a premium of 15.70

points against a premium of 9.30 points. The October

series closed at a premium of 53.80 points.

The Implied Volatility of at the money options has

increased from 26.11% to 26.96%.

Nifty PCR-OI has decreased from 0.96 to 0.95 levels.

The total OI of the market is Rs. 2,20,830/- cr. and the

stock futures OI is Rs. 53,987/- cr.

Few of the liquid counters where we have seen high cost of

carry are UNITECH, UPL, ANDHRABANK, DABUR and

AMARAJABAT.

View

OI Gainers

FIIs were net sellers in both cash market segment

OI

PRICE

and in Index Futures. They sold equities to the tune

SCRIP

OI

CHANGE

PRICE

CHANGE

(%)

(%)

of Rs. 826 crores and Index Futures of worth Rs.

1087 crores with rise in OI, suggesting

JSWENERGY

5076000

8.00

67.85

-5.30

continuation of fresh short formation in last trading

DIVISLAB

734050

7.27

2097.90

-4.10

session.

MOTHERSUMI

6389250

6.16

278.20

-5.29

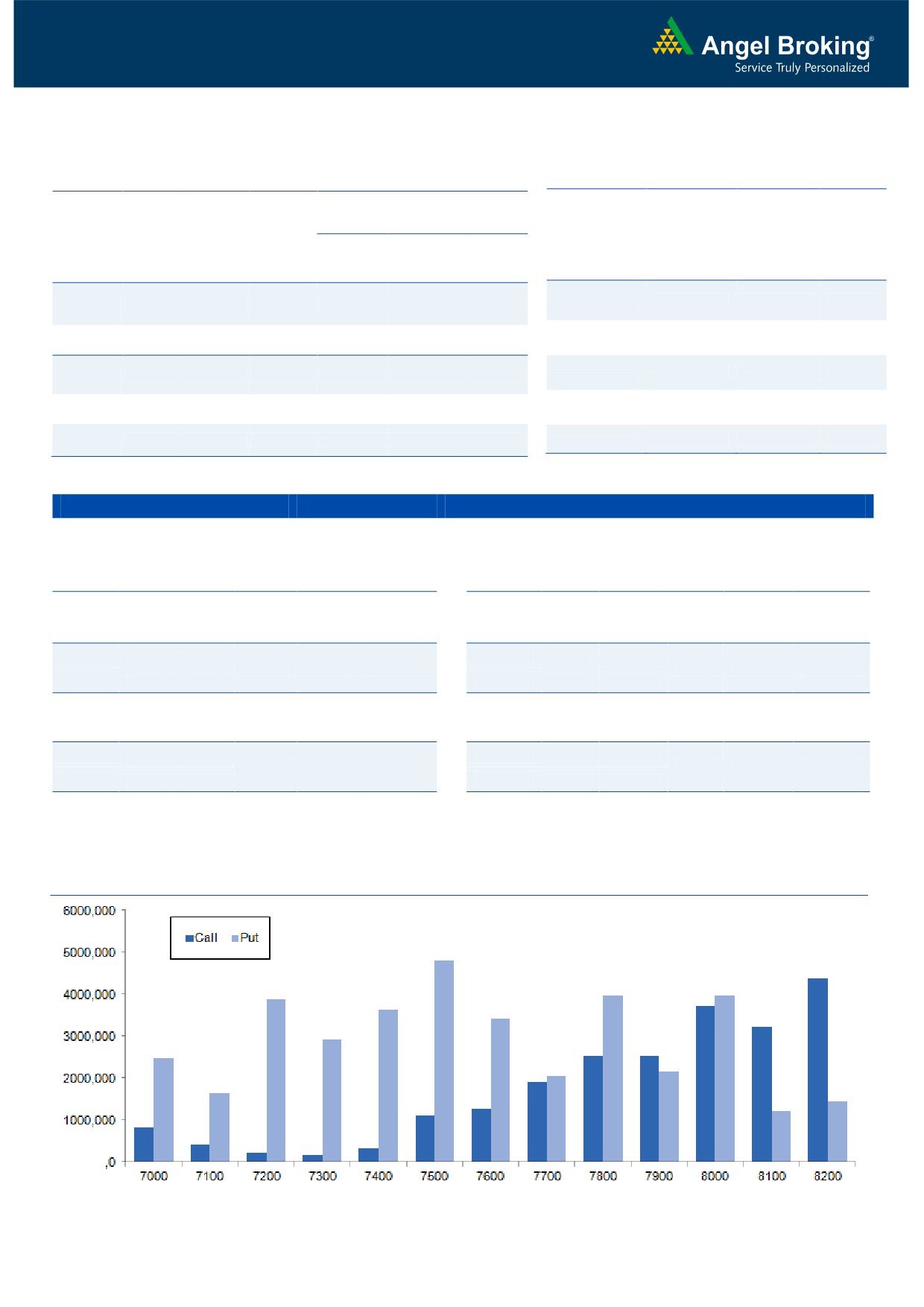

In Index Options, they were net sellers of Rs. 609

crores with rise in OI. In call options we saw build-

KSCL

1246000

6.13

455.35

0.46

up in the range of 7600-7900 strikes, wherein

ICICIBANK

57887800

6.10

250.25

-3.34

7600 call option added good amount of open

interest expecting some bounce in Nifty. On the

other hand in put options,

7200-7600 strikes

OI Losers

added good amount of build-up, followed by

unwinding in 7800 put options. Maximum OI is

OI

PRICE

SCRIP

OI

CHANGE

PRICE

CHANGE

seen in 8500 call and 7500 put options.

(%)

(%)

We are witnessing continuous selling in equities by

PIDILITIND

470000

-7.75

555.40

-0.54

bigger hands and majority of positions in Nifty and

COLPAL

538500

-5.05

1848.00

-2.24

BankNifty futures are shorts. We believe it’s a sell

on rise market, one should avoid bottom fishing.

VOLTAS

5179000

-4.71

253.85

-0.29

SYNDIBANK

9340000

-4.54

77.30

-0.83

INDUSINDBK

4588350

-4.26

820.50

-1.52

Put-Call Ratio

Historical Volatility

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

0.95

0.86

SRTRANSFIN

48.38

BANKNIFTY

0.56

0.61

STAR

67.99

SBIN

0.40

0.39

IDFC

40.95

RELIANCE

0.51

0.48

COLPAL

24.28

LT

0.43

0.38

APOLLOHOSP

42.87

1

Derivative Report

September 08, 2015

Strategy Date

Symbol

Strategy

Status

August 31, 2015

HINDALCO

Long Call

Active

September 07, 2015

RELIANCE

Short Strangle

Active

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager with SEBI. It

also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in

terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates including its relatives/analyst

do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as

they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume,

as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to

be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only.

Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update

on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in

the stocks recommended in this report.

For Private Circulation Only

SEBI Registration No: INB 010996539

3