Please refer to important disclosures at the end of this report

1

Delhivery is the largest and fastest growing fully integrated logistics services

player in India. Company has a reach of 17,488 pin codes, having infrastructure

of 14.2 million₹ square feet with more than 3,836 number of delivery points.

Company offers five types of transportation services- Express Parcel services, Part

Truck Load services, Truck Load services, Supply chain services and Cross Border

services. Express Parcel services contribute more than 62% of FY2021 revenue

and Part Truck Load services contribute 11.5%. Company having total client base

of 23,113 majority of which includes e-commerce marketplaces etc.

Positives: (a) Delhivery provides integrated solutions for logistics, with a market

share of 22% in express parcel. (b) Having In-house logistics technology stack to

meet the dynamic needs of modern supply chains. (c) Delhivery operates a pan-

India network and provides their services in 17,488 Pin codes which represents

more than 90% of India Pin codes.

Investment concerns: (a) Any slowdown in e-commerce business in India will

impact Delhivery revenue as 62% of FY2021 revenue comes from Express Parcel

services. (b) Dependency on top-5 customers, which contributes 41% of company

revenue. (c) Company recently launched Delhivery Direct, which is a C2C

shipping service, it may be difficult for the company to gain market share due to

competition.

Outlook & Valuation: Based on annualized FY22 numbers, the IPO is priced at

EV/Sales of 4.8x and Price to Book value of 5.2x at the upper price band of the

IPO. For 9MFY22 company has reported EBITDA loss of ₹232 crores and Net

loss of ₹891 crores. In the Indian markets, no other peer group has same

business model as Delhivery. Company has reported good revenue growth of

82% in 9MFY2022 and it is expected that company may turn EBITDA positive by

FY2022 end. Given the expensive valuation, we are assigning a NEUTRAL

recommendation to the Delhivery IPO

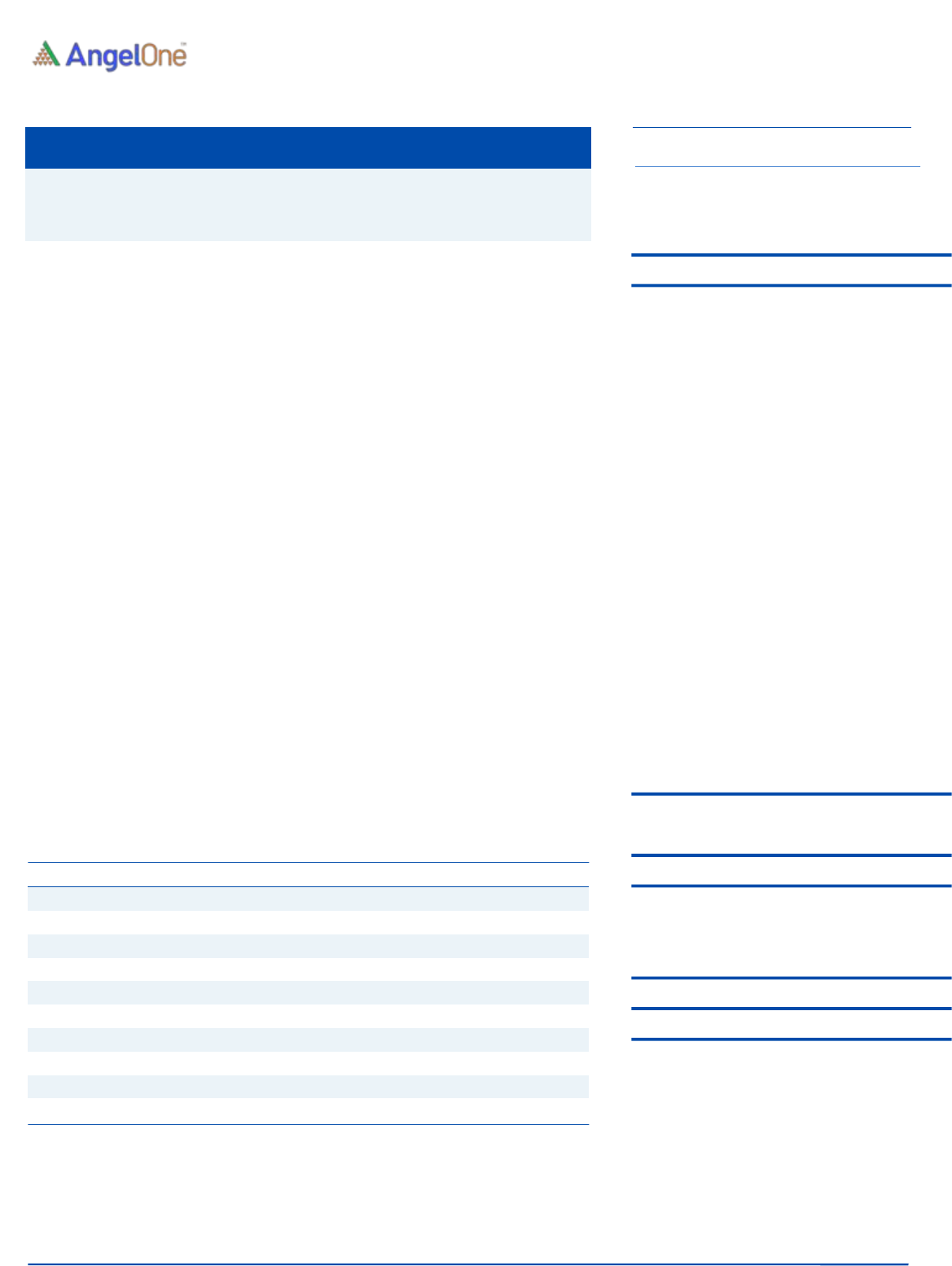

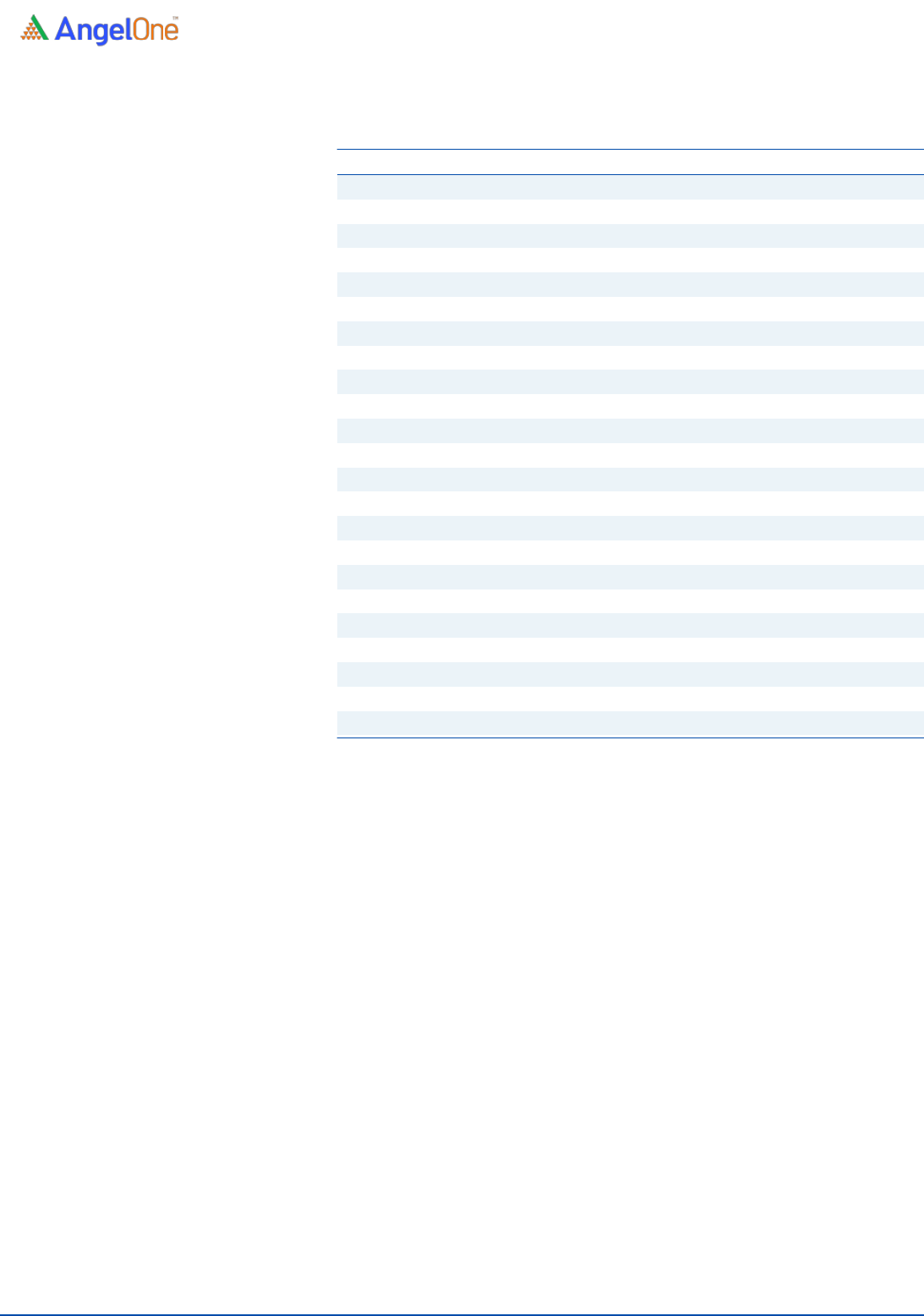

Exhibit 1: Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

9MFY21

9MFY22

Net Sales

1,654

2,781

3,647

2,644

4,811

% chg

-

68.1

31.1

82.0

Net Profit

(1,783.3)

(268.7)

(415.7)

(297.5)

(891.1)

% chg

-

(84.9)

54.7

199.5

EBITDA (%)

(95.4)

1.3

1.9

2.4

(9.0)

EPS

(47.2)

(5.2)

(8.5)

(5.8)

(15.4)

P/E (x)

-

-

-

-

-

P/BV (x)

9.2

9.9

11.0

10.7

5.2

EV/EBITDA

-

853.1

446.1

370.8

-

EV/Sales

18.0

11.0

8.4

8.7

4.8

Source: Company, Angel Research

NEUTRAL

Issue Open: May 11, 2022

Issue Close: May 13, 2022

QIBs 75%

Non-Institutional 15%

Retail 10%

Promoters 0.0%

Public 100.0%

Offer for sale:₹1,235 cr

Issue Details

Face Value: ₹1

Present Eq. Paid up Capital: ₹21.7cr

Post Issue Shareholding Pattern

Fresh Issue: ₹4,000 cr

Issue size (amount): ₹5,235 cr

Price Band: ₹462-487

Lot Size: 30 shares

Post-issue mkt.cap:

₹33,678*– 35,284cr**

Promoter holding Pre-Issue: 0%

Promoter holding Post-Issue: 0%

*Calculated on lower price band

** Calculated on upper price band

Book Building

DELHIVERY LIMITED IPO

f

IPO Note | Logistics

May 9, 2022

DELHIVERY LIMITED| IPO Note

May 09, 2022

2

Company background

Delhivery was originally incorporated as “SSN Logistics Private Limited”, in

2011. Delhivery is largest and fastest growing fully integrated logistics services

player in India by revenue as of FY2021. Company was founded in Gurgaon

by Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil

Bharati. The company is a professionally managed company and does not have

an identifiable promoter in terms of SEBI ICDR Regulations and the Companies

Act.

Delhivery Limited aims to build the operating system for company Delhivery

business is guided by 3 operating principles a) People-centricity: Their

infrastructure, network and technology enable them to solve supply-chain

problems that affect millions of people every day. b) Growth through

partnership: Systemic change requires cooperation and collaboration. c)

Efficiency, always: Saving money for their customers allows them to do more

with what they have. They strive relentlessly for efficiency and for new ways to

reduce costs throughout the supply chain. For example, their cost of 1 kg parcel

from Delhi to Mumbai has decrease by 15% in last 2 years.

Key Points

1) As of December 2021, Delhivery covers 17,488 pin codes in India,

nearly 90.6% of total pin codes in India.

2) As of now company has shipped more than 1.2 Bn express parcels in

India, more than 1.1 Mn tons of PTL freight shipped and more than

160K truck load trips completed by the company.

3) Company having market share of 22% in overall e-commerce parcel in

Q3FY22.

4) Company having more than 11,000 network partners and having total

team size of 86,000 employees.

5) Company having total client base of 23,113 majority of which includes

e-commerce marketplaces, direct-to-consumer e-tailers. Company

focuses on the B2C business model but recently company has also

launched C2C services.

6) As of 31st December 2022, company having logistics infrastructures of

14.27 Mn Sq.Ft and having 8000 trucks out of which 300 trucks owned

by the company.

DELHIVERY LIMITED| IPO Note

May 09, 2022

3

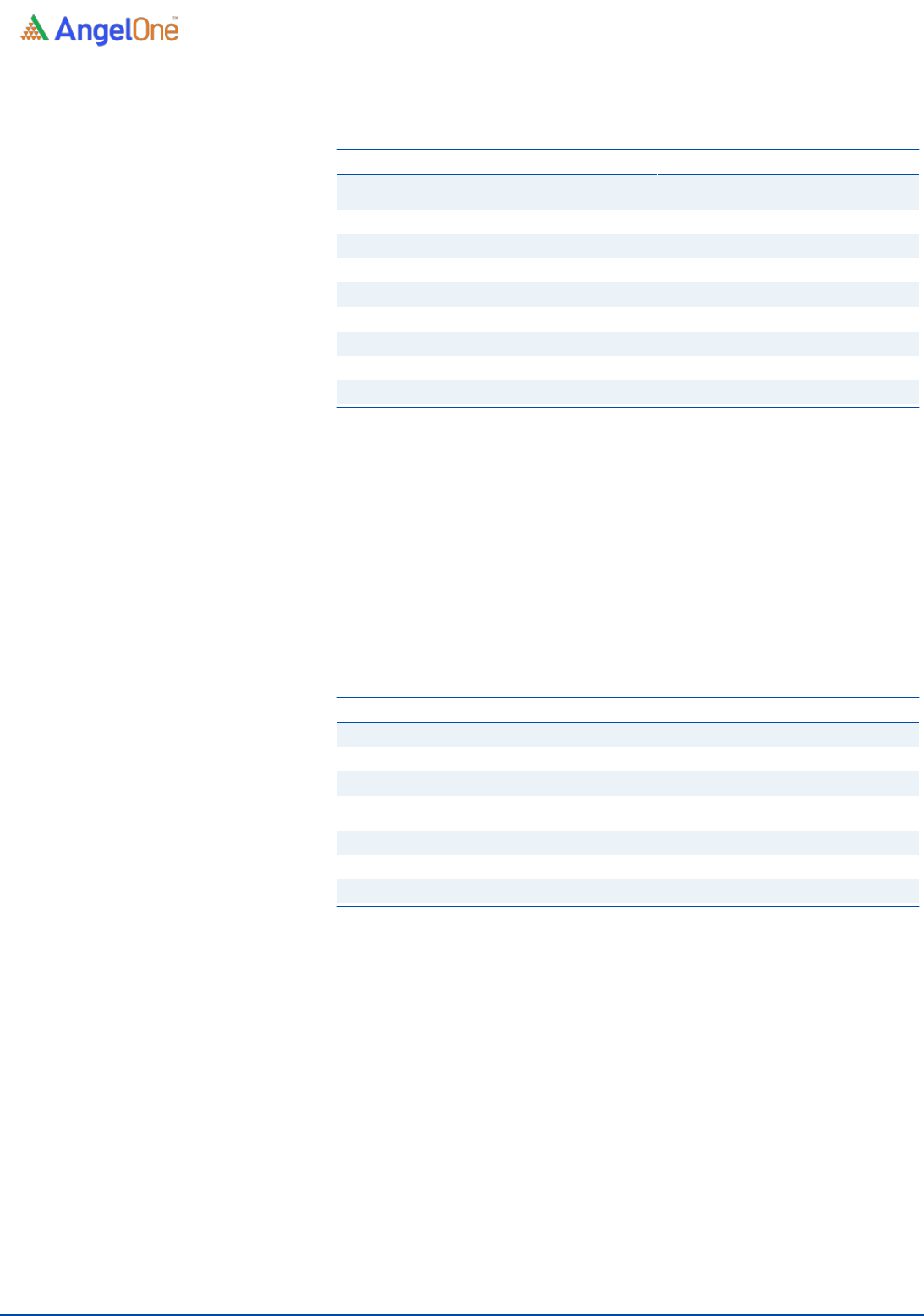

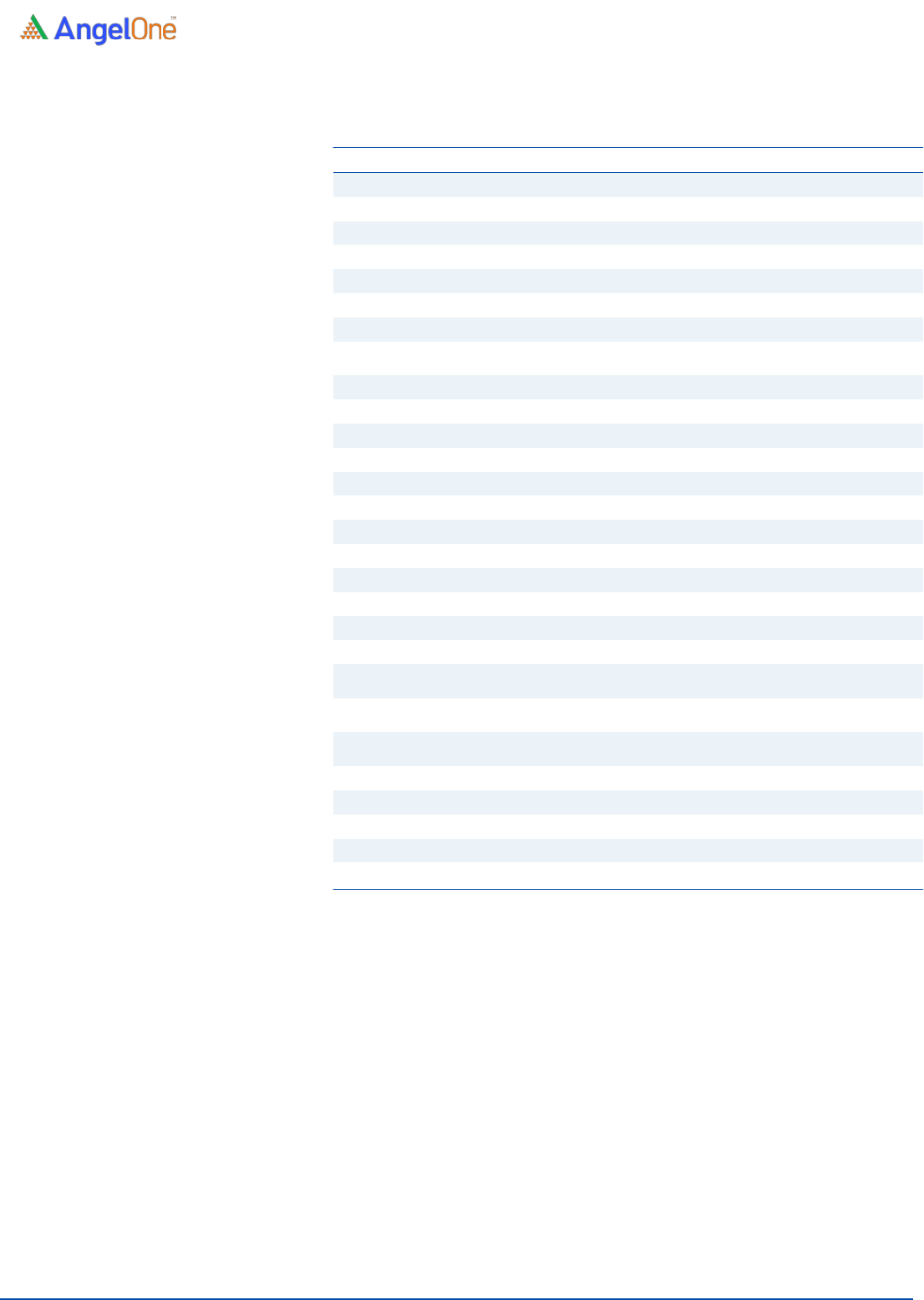

Exhibit 1: Revenue from Operations

9MFY2022

FY2021

FY2020

Business verticals

Sales

(₹ in Cr)

% to Total

Sales

(₹ in Cr)

% to Total

Sales

(₹ in Cr)

% to Total

Revenue from

Express Parcel services

2,959

61.5%

2,551

62.3%

1,929

69.4%

Part Truck Load services

864

18.0%

384

11.5%

231

8.3%

Truck Load services

185

3.9%

214

6.4%

366

13.2%

Supply chain services

351

7.3%

390

11.7%

215

7.7%

Cross Border services

264

5.5%

96

2.9%

34

1.2%

Sale of traded goods

187

3.9%

11

0.3%

6

0.2%

Total

4,811

100.0%

3,647

100.0%

2,781

100.0%

Source: Company, Angel Research

Revenue from Express Parcel services has increased from ₹1,929 crores in

FY2020 to ₹2,959 crores in 9MFY2022 and contributes 61.5% of total revenue.

Revenue from Part Truck Load services has also increased significantly in last the

3 years, in 9MFY2022 it contributes 18% of companies total revenue and after

the acquisition of Spoton, we expect PTL will be a growth trigger for the

company.

Exhibit 2: Operation Performance

9MFY2022

FY2021

FY2020

FY2019

PIN code reach

17488

16677

15875

13485

Infrastructure (Mn sq ft)

14.2

12.23

9.85

5.96

No. of gateways

82

88

83

73

Rated Automated Sort Capacity

(in million parcels/day)

3.7

2.62

2.26

1.58

Number of delivery points

3836

3382

2973

2258

Team size

86184

53086

40416

28830

No. of Active Customers

23113

16741

7957

4867

Source: Company, Angel Research

Company has shown a good improvement in its operation performance. Pin

code reach has increase by 29.7% in last 3 years to 17,488 pin codes in India.

Infrastructure in million square feet has increase by 138% at 14.2 Mn sqft.

Number of active customers has also increase from 4,867 to 23,113 in last 3

years.

DELHIVERY LIMITED| IPO Note

May 09, 2022

4

Issue details

Delhivery Limited is raising ₹5,235 cr out of which fresh issue is of ₹4,000 cr

and OFS of ₹1,235 crores in the price band of ₹462-₹487 per share.

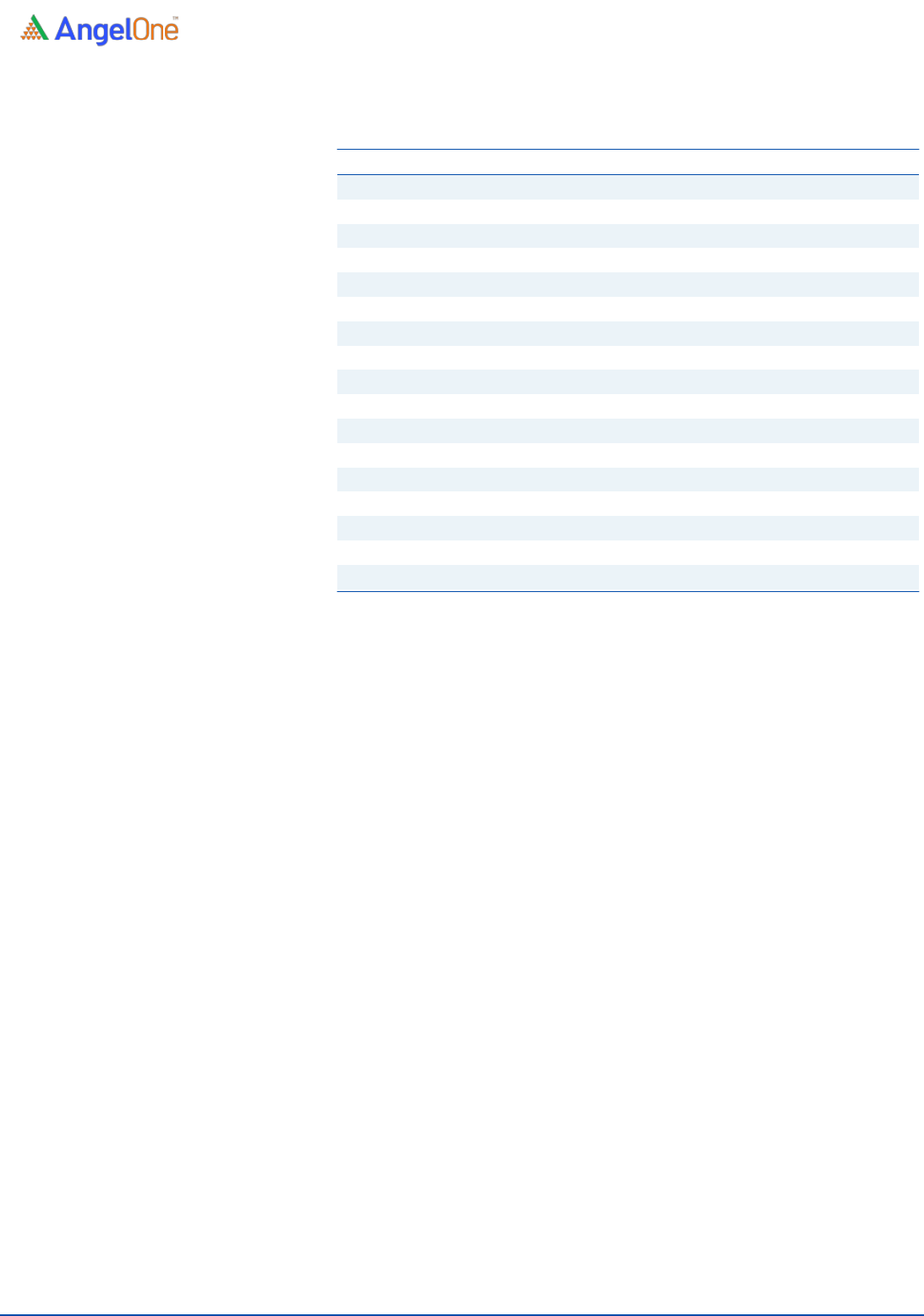

Exhibit 3: Pre & Post Shareholding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Public Selling Shareholders

25,56,61,300

39.8%

23,02,96,714

31.8%

Public Others

38,67,04,527

60.2%

49,42,04,637

68.2%

Total

64,23,65,827

100.0%

72,45,01,351

100.0%

Source: Company, Angel Research

Objectives of the Offer

Organic growth initiatives (₹2,000Cr).

Inorganic growth funding (₹1,000Cr).

General corporate purposes (₹1,000Cr).

Key Management Personnel

1. Deepak Kapoor is the Chairman and Non-Executive Independent

Director of the company. He was previously associated with

PricewaterhouseCoopers Pvt Ltd as Chairman and Chief Executive

Officer.

2. Sahil Barua is the Managing Director and Chief Executive Officer of

the company. He has previously been associated with Bain & Company

India Pvt Ltd as Consultant.

3. Sandeep Kumar Barasia is the Executive Director and Chief Business

Officer of the company. He was previously associated with Bain &

Company India Pvt Ltd as a Vice-President (Partner).

4. Kapil Bharati is the Executive Director and Chief Technology Officer of

the company. He has previously served as Founder and Chief

Technology Officer at Athena Information Solutions Pvt Ltd and as

Senior Manager Technology at Sapient and Publicis Sapient.

5. Donald Francis Colleran is the Non-Executive Nominee Director of the

company as a nominee of FedEx. He presently holds the position of

President & CEO of FedEx Express.

6. Munish Ravinder Varma is the Non-Executive Nominee Director of the

company as a nominee of SVF Doorbell (Cayman) Ltd. He currently

serves as Managing Partner at SoftBank Investment Advisers.

DELHIVERY LIMITED| IPO Note

May 09, 2022

5

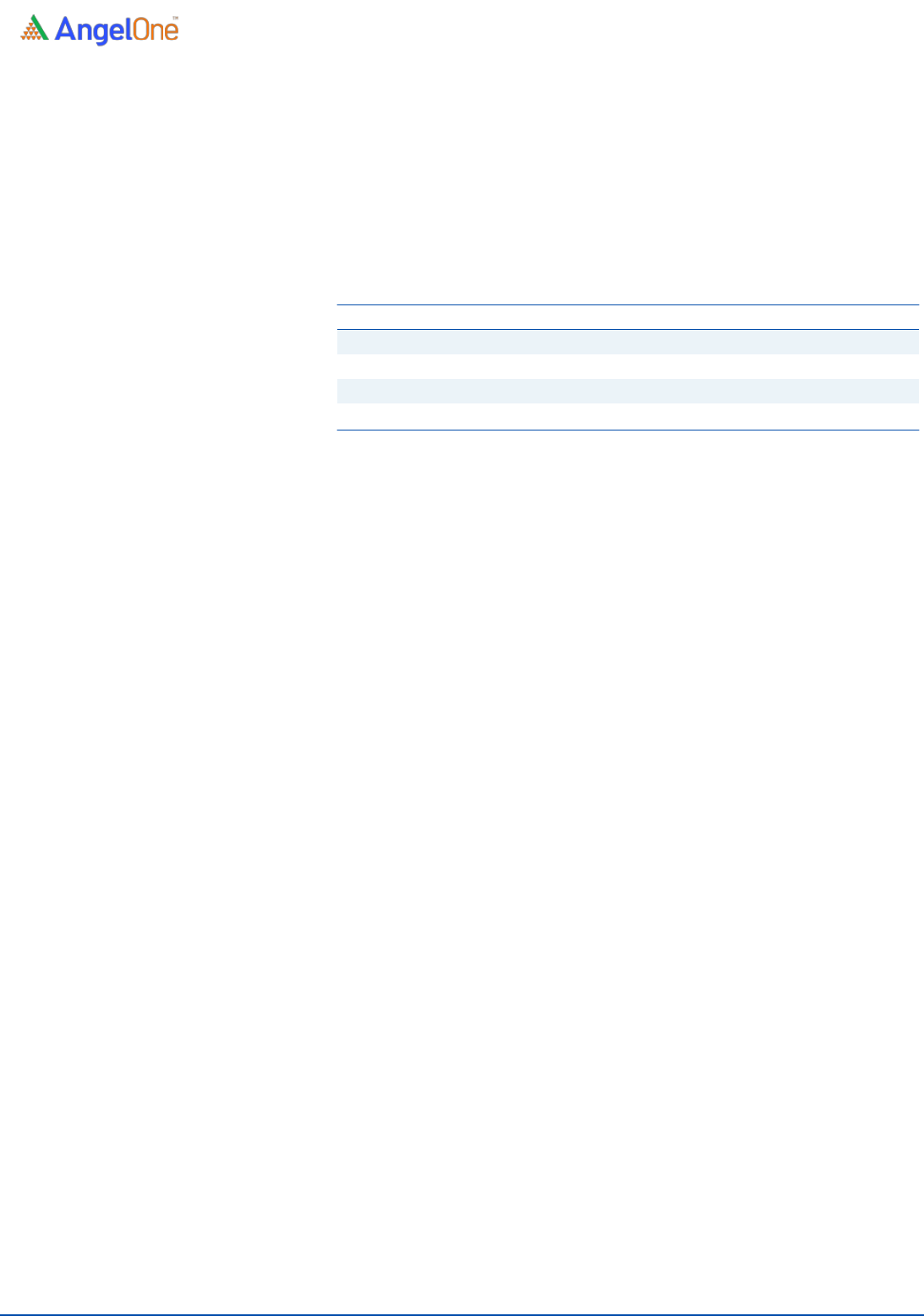

Consolidated Profit & Loss Account

Y/E March (₹ cr)

FY19

FY20

FY21

9MFY21

9MFY22

Total operating income

1,654

2,781

3,647

2,644

4,811

% chg

-

68

31

82

Total Expenditure

3,272

2,953

3,769

2,744

5,346

Freight & handling cost

1,251

2,184

2,778

2,026

3,479

Employee Benefit Expense

345

491

611

439

973

Other Expenses

1,677

278

380

280

894

EBITDA

(1,618)

(172)

(123)

(100)

(535)

(% of Net Sales)

(98)

(6)

(3)

(4)

(11)

Depreciation& Amortization

170

256

355

255

388

EBIT

(1,788)

(428)

(478)

(355)

(923)

(% of Net Sales)

(108)

(15)

(13)

(13)

(19)

Interest & other Charges

35.8

49.2

88.6

63.9

76.2

Exceptional items

-

-

41.3

41.3

-

Other Income

41.0

208.1

191.8

162.7

100.9

(% of Sales)

2.5

7.5

5.3

6.2

2.1

Recurring PBT

(1,783)

(269)

(416)

(297)

(899)

(% of Net Sales)

(108)

(10)

(11)

(11)

(19)

Tax

-

(0)

-

-

(8)

PAT

(1,783)

(269)

(416)

(297)

(891)

(% of Net Sales)

(108)

(10)

(11)

(11)

(19)

EPS

(47.2)

(5.2)

(8.5)

(5.8)

(15.4)

Source: Company, Angel Research

DELHIVERY LIMITED| IPO Note

May 09, 2022

6

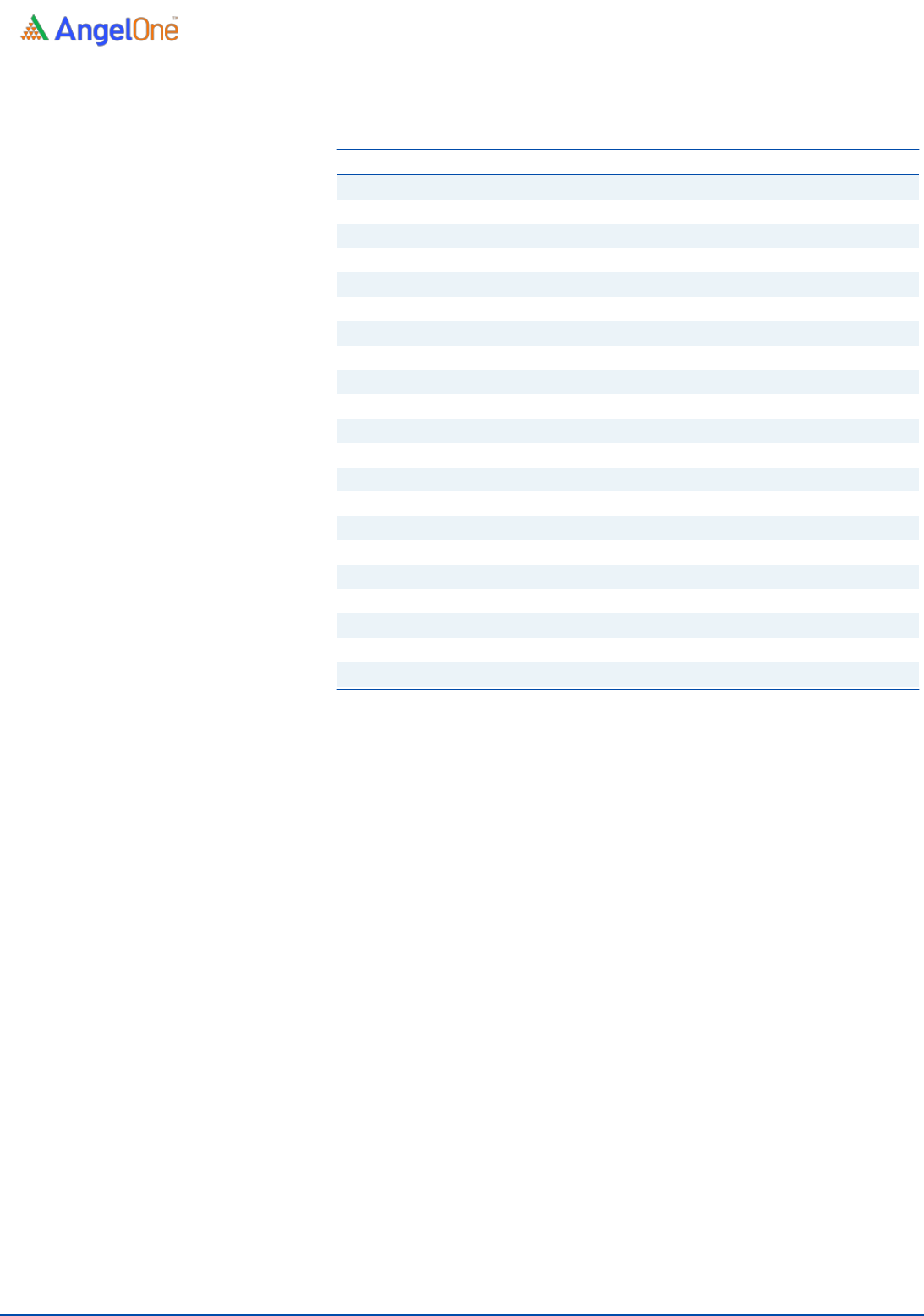

Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

9MFY21

9MFY22

SOURCES OF FUNDS

Equity Share Capital

1.0

1.0

1.6

1.6

21.7

Instruments entirely equity in nature

39

39

35

35

43

Other equity

3,348

3,130

2,800

2,878

5,916

Shareholders Funds

3,388

3,170

2,837

2,915

5,980

Total Loans

278

487

785

789

865

Other liabilities

13

17

22

21

41

Total Liabilities

3,680

3,674

3,644

3,726

6,886

APPLICATION OF FUNDS

Net Block

459

741

1,098

1,145

1,465

Goodwill

29

30

33

29

1,794

Financial assets

231

903

509

519

670

Non Current Assets

720

1,673

1,639

1,693

3,929

Current Assets

3,270

2,573

2,830

2,949

4,336

Sundry Debtors

215

601

595

756

892

Investments

1,130

810

708

807

1,737

Inventories

22.6

17.8

25.9

24.1

31.8

Cash & Bank Balance

1,859

1,053

1,359

1,241

1,392

Other Assets

43

90

143

121

283

Current liabilities

383

683

954

1,059

1,544

Net Current Assets

2,887

1,889

1,877

1,890

2,792

Other Non Current Asset

73

111

128

143

165

Total Assets

3680

3674

3644

3726

6886

Source: Company, Angel Research

DELHIVERY LIMITED| IPO Note

May 09, 2022

7

Consolidated Cash Flow Statement

Y/E March (₹cr)

FY19

FY20

FY21

9MFY21

9MFY22

Profit before tax

(1,783)

(269)

(416)

(297)

(899)

Depreciation

170

256

355

255

388

Change in Working Capital

(173)

(529)

(40)

(186)

(591)

Interest Expense

10

11

20

14

18

Interest Income

(32)

(142)

(115)

(90)

(45)

Share based payment expense

38

49

72

42

217

Fair value gain on investment

(1)

(13)

(33)

(39)

(19)

Fair value loss on financial

liabilities

1,481

-

9

-

300

Direct Tax Paid

(23)

(45)

(18)

(32)

2

Others

71

49

170

142

120

Cash Flow from Operations

(243)

(634)

5

(192)

(509)

(Inc.)/ Dec. in Fixed Assets

(157)

(214)

(249)

(189)

(567)

Payment towards acquisition

(27)

(4)

(4)

-

(1,387)

Bank deposits

111

(831)

413

388

185

Interest received

32

95

75

57

112

Investments

(900)

20

102

102

(982)

Cash Flow from Investing

(939)

(933)

338

358

(2,639)

Procees/Repayment of Borrowing

27

64

13

33

(138)

Dividend paid on equity shares

(9)

(11)

(21)

(13)

(17)

Repayment of lease liability

(88)

(130)

(212)

(155)

(195)

Proceeds from issue of equity

shares

-

1

10

1

846

Proceeds from issue of equity

instruments

2,890

-

-

-

2,550

Proceeds short-term borrowings

(net)

39

58

53

90

42

Others

-

-

9

-

96

Cash Flow from Financing

2,858

(17)

(147)

(44)

3,184

Inc./(Dec.) in Cash

1,676

(1,583)

196

123

36

Opening Cash balances

(14)

1,663

79

79

276

Closing Cash balances

1,663

79

276

202

311

Source: Company, Angel Research

DELHIVERY LIMITED| IPO Note

May 09, 2022

8

Financial Ratios

Y/E March

FY19

FY20

FY21

9MFY21

9MFY22

Valuation Ratio (x)

P/E

-

-

-

-

-

P/BV

9.2

9.9

11.0

10.7

5.2

EV/Sales

18.0

11.0

8.4

8.7

4.8

EV/EBITDA

-

853

446

371

-

Per Share Data (Rs)

EPS (fully diluted )

(47.2)

(5.2)

(8.5)

(5.8)

(15.4)

Cash EPS

(25.1)

(0.2)

(1.0)

(0.7)

(8.1)

Book Value

52.7

49.4

44.2

45.4

93.1

DPS

1.0

1.0

-

2.0

-

Number of share

64.2

64.2

64.2

64.2

64.2

Turnover ratios (x)

Asset Turnover (net)

3.6

3.9

3.6

3.4

4.6

Receivables (days)

47.4

78.9

59.5

78.3

67.7

Inventory Days

20.5

10.9

10.9

10.7

6.5

Payables (days)

46.2

45.7

58.1

67.3

61.7

Working capital cycle (days)

21.7

44.2

12.3

21.6

12.5

Source: Company, Angel Research

DELHIVERY LIMITED| IPO Note

May 09, 2022

9

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make s uch

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking

or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel

or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection

with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.