Technical Research | January 30, 2012

Daily Technical Report

Sensex (17234) / NIFTY (5205)

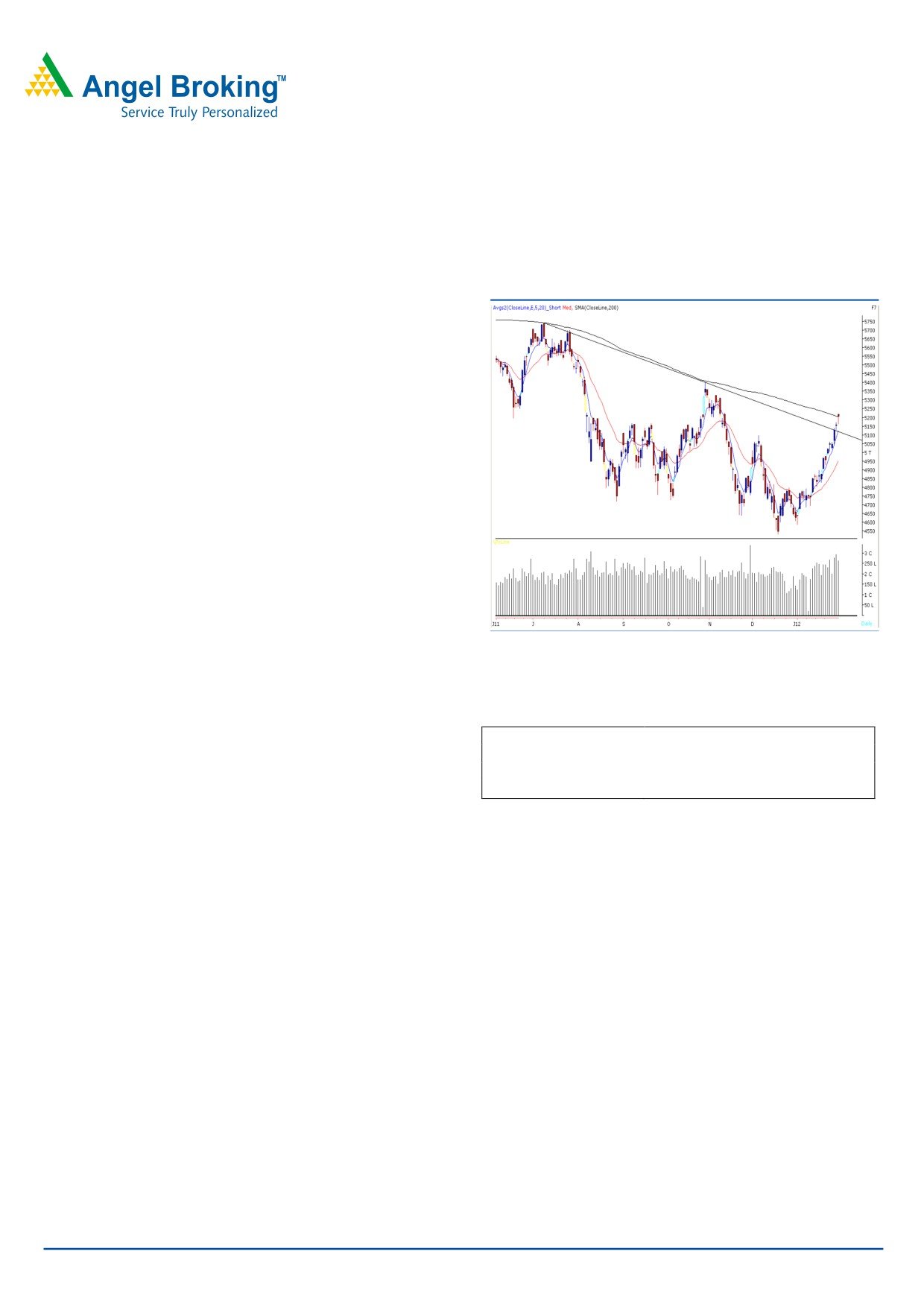

Exhibit 1: Nifty Daily Chart

On Friday, once again for the third consecutive session,

markets opened with an upside gap and traded with

extreme choppiness. Hence, indices closed around the 200-

day SMA placed at 17332 / 5202 level. On the sectoral

front, Metal, PSU and Teck counters were among the major

gainers, whereas Capital goods ended with a marginal

loss. The advance to decline ratio was strongly in favor of

advancing counters. (A=1808 D=1040) (Source

-

Formation:

• The positive crossover on weekly “RSI - Smoothened”

oscillator is still intact.

• ADX (9) indicator on the weekly chart is positively

poised.

Source: Falcon

• Indices have broken out from the “Downward Sloping

Trend Line” drawn by joining July 8, 2011, weekly high of

19132 / 5740 and October 28, 2011, weekly high of

Actionable points:

17908 / 5400.

View

Bearish

Sell Only below

5162

• Indices are now nearing another “Downward Sloping

Expected target

5110 - 5050

Trend Line” drawn by joining November 12, 2010, weekly

Resistance level

5220

high of 21076 / 6336 and July 29, 2011, weekly high of

18945 / 5702.

The placement of this trend line almost coincides with the

• The 200-day SMA is placed at 17332 / 5202 level.

200-day SMA placed around 17332 / 5202. Therefore,

• Friday’s candle resembled a “Hanging Man”. This is a

markets are hovering around the stiff resistance zone of

bearish pattern and requires confirmation.

17384 - 17332 / 5220 - 5202. Further, we are now

observing a candlestick pattern, which resembles a

Trading strategy:

“Hanging Man”. The said pattern gives a bearish

The week opened on a quiet note, but the RBI’s Monetary

implication and needs a confirmation in the form of closing

Policy on January 24, 2012, gave a boost to the markets.

below the low of the “Hanging Man”, which is 17106 /

This was followed by a strong rally in Reliance Industries

5162. In this scenario, indices may lose the current positive

along with some of the Capital Goods and IT counters.

momentum and may slide towards 16757 - 16447 / 5055

Hence, markets have closed well above the “Downward

- 4955 levels. Conversely, the positive crossover in weekly

Sloping Trend Line” drawn by joining July 8, 2011, weekly

“RSI-Smoothened” oscillator is still intact along with the

high of 19132 / 5740 and October 28, 2011, weekly high

positively poised daily ADX (9) indicator. The impact of

of 17908 / 5400. Indices are now heading towards another

these technical evidences would be seen after a sustainable

“Downward Sloping Trend Line” drawn by joining

move beyond 17384 / 5220 level. In this case, indices may

November 10, 2010, weekly high of 21076 / 6336 and

rally towards the next resistance levels of 17702 - 17908 /

July 29, 2011, weekly high of 18945 / 5702.

5326 - 5400.

For Private Circulation Only |

1

Technical Research | January 30, 2012

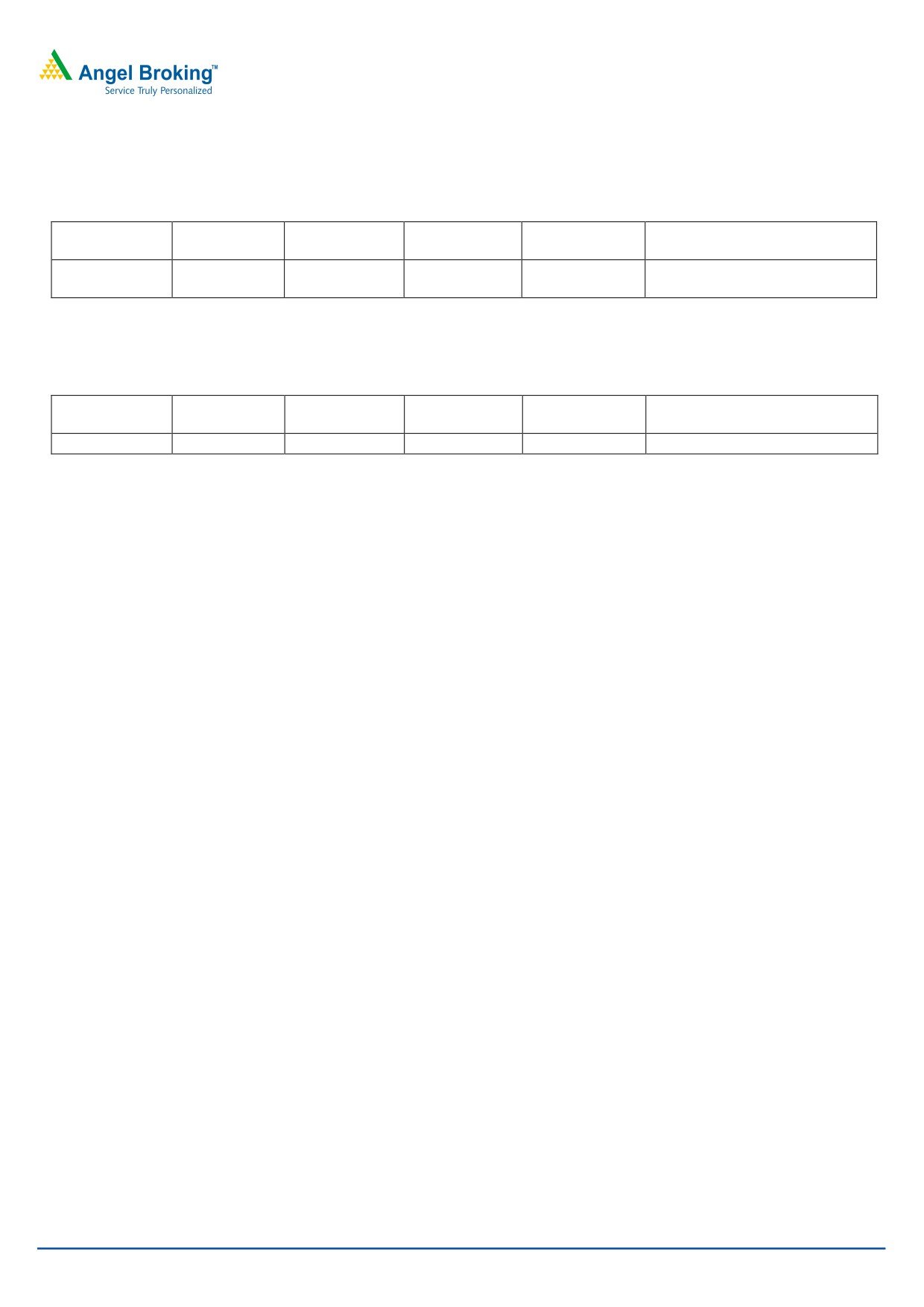

Bank Nifty Outlook - (9814)

Exhibit 2: Bank Nifty Daily Chart

On Friday’s session, Bank Nifty opened near our

mentioned resistance level of

9967, where selling

pressure was witnessed which dragged the index to close

well below the 9900 mark. We had mentioned in our

previous reports, that the momentum oscillators are

placed in an overbought zone. We are now witnessing

negative crossover in momentum oscillator “RSI and

Stochastic”. Thus, if Bank Nifty manages to sustain below

Friday’s low of 9701 then it is likely to test 9527 - 9390

levels. On the upside 9970 level is likely to act as

resistance in coming trading session.

Actionable points:

View

Negative Below 9701

Expected Target

9527 - 9390

Resistance Levels

9970

Source: Falcon

For Private Circulation Only |

2

Technical Research | January 30, 2012

Positive Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

JINDAL

212.7

203.7

192.9

235

View will change below 195

POLYFILMS

Negative Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

DLF

211.6

213.8

202.6

204.50

View will change above 224.55

For Private Circulation Only |

3

Technical Research | January 30, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,047

17,141

17,200

17,293

17,352

NIFTY

5,140

5,172

5,195

5,227

5,249

BANKNIFTY

9,560

9,687

9,828

9,955

10,096

ACC

1,157

1,174

1,191

1,208

1,225

AMBUJACEM

160

161

163

164

166

AXISBANK

1,047

1,060

1,070

1,083

1,093

BAJAJ-AUTO

1,478

1,509

1,555

1,586

1,632

BHARTIARTL

353

364

370

381

387

BHEL

260

267

276

283

292

BPCL

563

570

579

586

595

CAIRN

343

348

352

357

361

CIPLA

338

342

345

349

352

DLF

202

207

216

220

229

DRREDDY

1,484

1,565

1,616

1,697

1,748

GAIL

362

367

371

377

381

HCLTECH

416

422

426

432

436

HDFC

683

692

704

713

725

HDFCBANK

465

475

489

499

514

HEROMOTOCO

1,744

1,781

1,828

1,865

1,912

HINDALCO

140

142

145

147

150

HINDUNILVR

375

383

391

399

407

ICICIBANK

855

871

881

898

907

IDFC

124

128

130

134

136

INFY

2,667

2,696

2,715

2,745

2,764

ITC

195

199

203

206

211

JINDALSTEL

507

518

534

546

562

JPASSOCIAT

68

69

72

73

75

KOTAKBANK

474

484

493

502

511

LT

1,305

1,343

1,366

1,404

1,426

M&M

650

675

690

715

730

MARUTI

1,137

1,174

1,196

1,233

1,256

NTPC

169

172

175

178

181

ONGC

245

262

271

288

297

PNB

941

956

979

994

1,017

POWERGRID

99

101

103

105

107

RANBAXY

432

438

448

454

464

RCOM

93

95

96

98

99

RELCAPITAL

326

334

343

351

360

RELIANCE

787

804

816

833

845

RELINFRA

491

511

522

542

553

RPOWER

93

95

97

99

101

SAIL

95

100

104

109

112

SBIN

1,991

2,016

2,043

2,068

2,095

SESAGOA

197

206

211

220

225

SIEMENS

736

745

752

761

769

STER

113

117

119

123

125

SUNPHARMA

516

522

528

534

540

SUZLON

27

28

28

29

30

TATAMOTORS

229

235

238

243

247

TATAPOWER

103

104

105

107

108

TATASTEEL

441

450

456

465

471

TCS

1,089

1,099

1,110

1,120

1,130

WIPRO

412

415

419

421

425

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |