Daily Technical Report

June 29, 2012

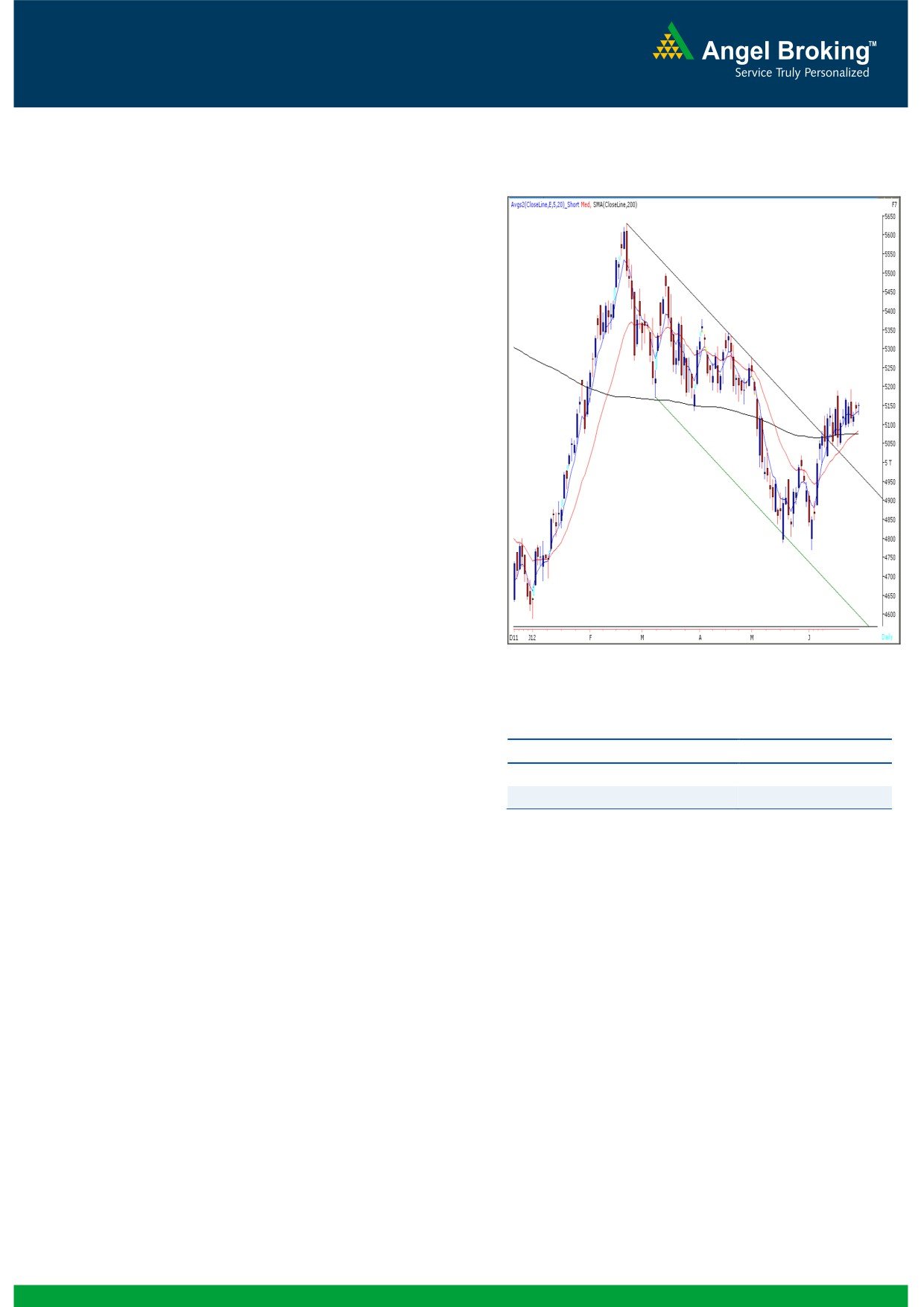

Exhibit 1: Nifty Daily Chart

Sensex (16991) / NIFTY (5149)

Yet another trading session of the week opened on a

flat note and despite being a derivative expiry session,

we witnessed an extremely range bound trading

session. Eventually, markets closed near the

5150

mark. On sectoral front, FMCG, Power and PSU

stayed firm during yesterday’s session; whereas Oil &

Gas and Banking sectors ended with a nominal loss.

The advance to decline ratio was marginally in favor

of advancing counters (A=1461 D=1312) (Source -

Formation

The 200-day SMA (Simple Moving Average) and

20-day EMA (Exponential Moving Average) have

now shifted to 16803 / 5075 and 16691 /

5061, respectively.

The ‘20-Week EMA’ is placed at 16854 / 5108

level.

On the daily chart, indices are trading well

above the upper range of ‘Downward Sloping

Source: Falcon

Channel’ drawn by joining two highs of February

22, 2012 - April 19, 2012 and low of March 7,

Actionable points:

2012.

View

Bullish Above 5165

The positive crossover in weekly ‘RSI’ momentum

oscillator and weekly ‘3 & 8 EMA’ is still intact.

Expected Target

5190- 5225 - 5280

Also, the weekly ‘RSI-Smoothened’ is now

Support Levels

5125 - 5093

positively poised.

Trading strategy:

Yesterday, even on a derivative expiry session, we

witnessed lackluster activity and our benchmark

indices are still in the trading range of 16800 -

17131 / 5090 - 5195. Hence, our view remains

unchanged. Only a sustainable move outside this

trading range would dictate a clear direction of the

trend. Within the range, on the upside 17030 -

17131 / 5160 - 5195 levels are likely to act as

immediate intraday resistance in coming trading

session. However, the crucial support remains at

16799 / 5093. A sustainable move below this level

may reinforce selling pressure and indices may then

correct towards 16553 - 16636 / 5041 - 5015

levels.

1

Daily Technical Report

June 29, 2012

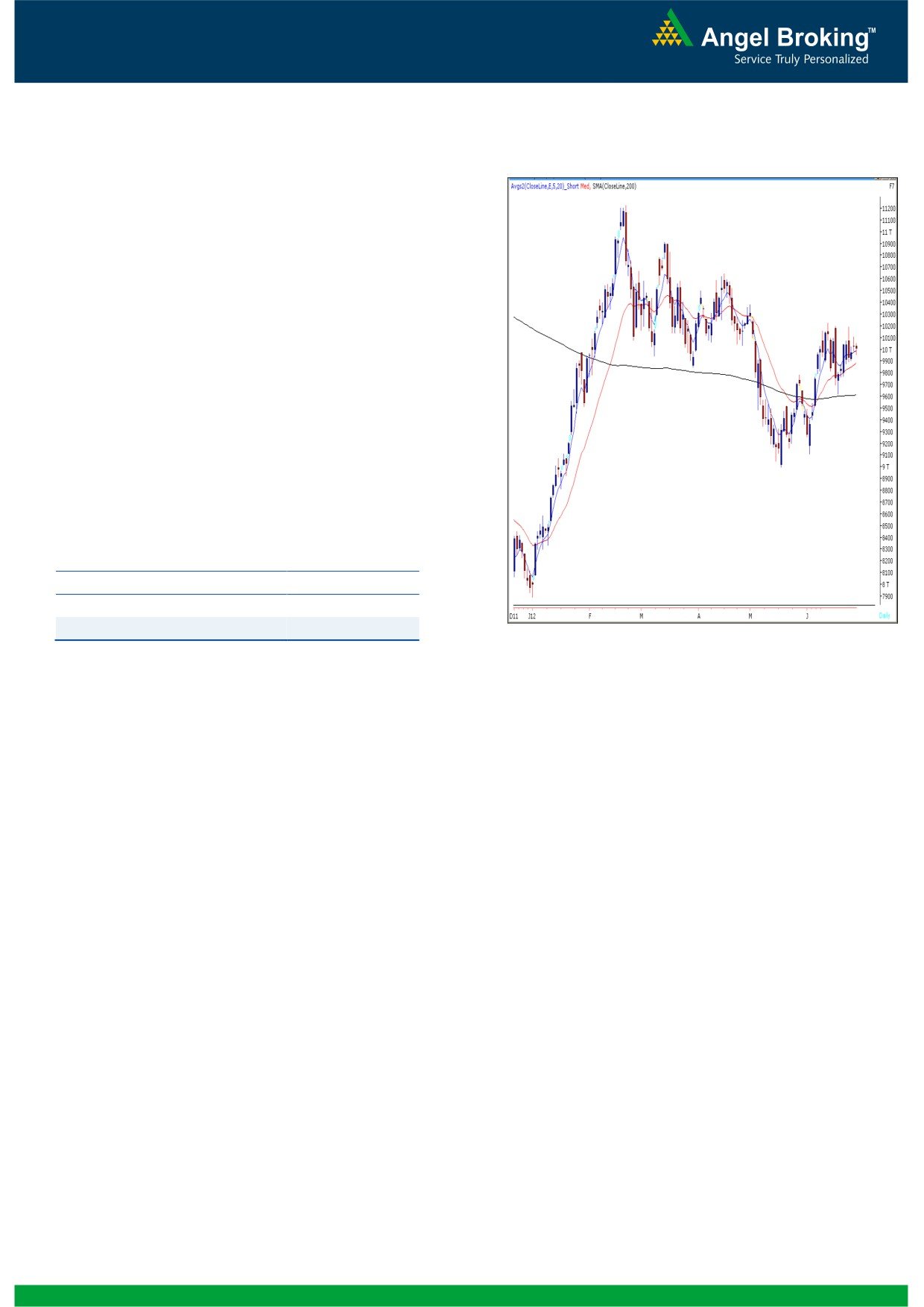

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10004)

Yesterday, Bank Nifty opened on a flat note in line

with our benchmark indices and traded in a narrow

range throughout the session. There is no significant

change in the chart formation for Bank Nifty as the

range of

9760

-

10230 is still intact. Only a

sustainable move outside the said range will dictate a

clear direction of the trend.

For the second

consecutive we are witnessing a narrow range body

formation, which indicates indecisiveness prevailing at

current levels. Within the mentioned range 10055 -

10110 are likely to act as resistance and 9900 -

9870 levels are likely to act as support, in coming

trading session. Positional traders holding long

positions can hold with a stop loss of 9800 level

(Closing basis) on Bank Nifty spot.

Actionable points:

View

Neutral

Resistance Levels

10055 - 10110

Support Levels

9900 - 9870

Source: Falcon

2

Daily Technical Report

June 29, 2012

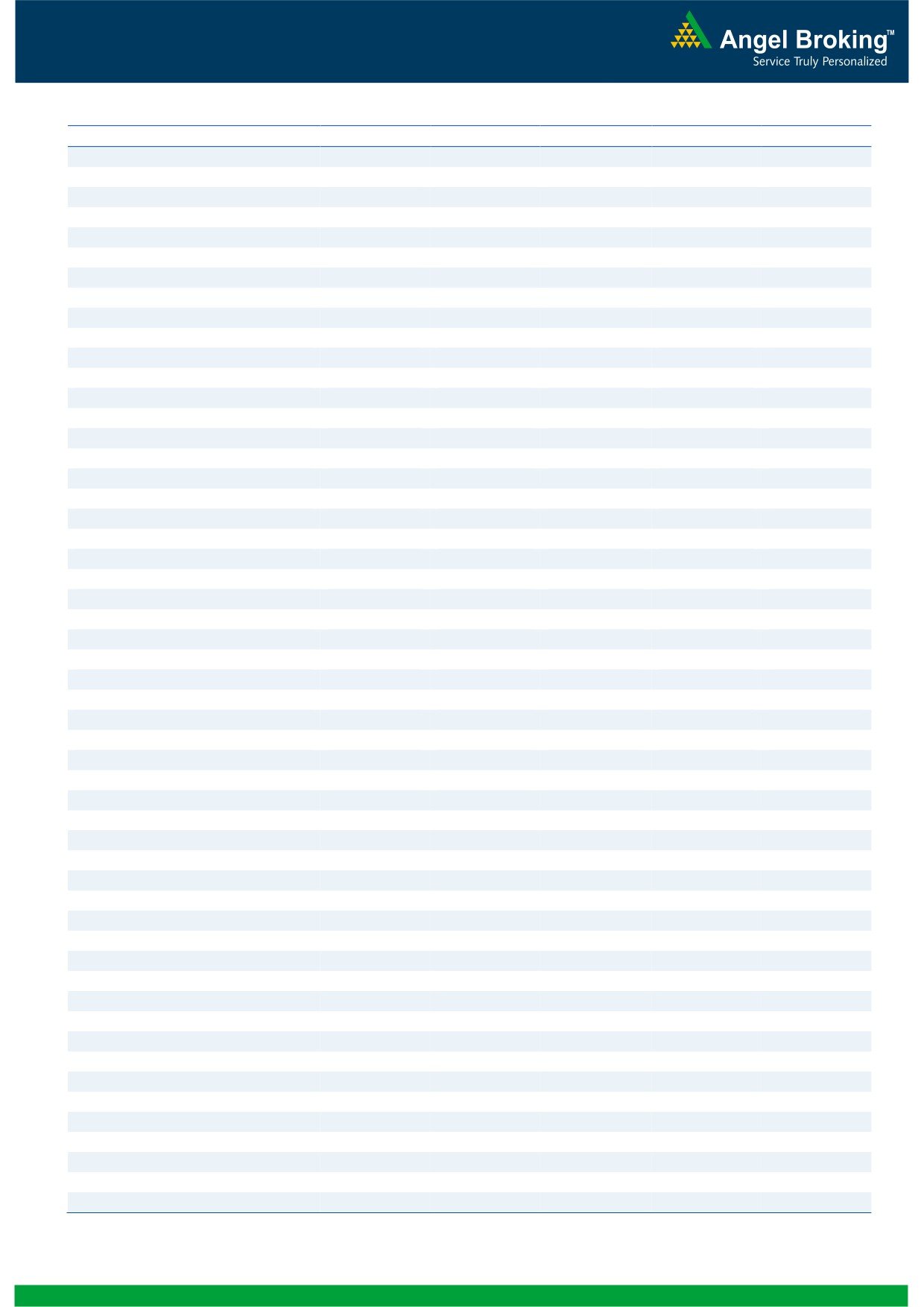

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

16,866

16,928

16,981

17,043

17,096

NIFTY

5,111

5,130

5,145

5,164

5,178

BANKNIFTY

9,900

9,952

10,002

10,054

10,104

ACC

1,194

1,209

1,218

1,233

1,243

AMBUJACEM

167

170

173

176

179

ASIANPAINT

3,689

3,719

3,768

3,798

3,847

AXISBANK

956

967

979

990

1,002

BAJAJ-AUTO

1,532

1,541

1,554

1,563

1,576

BANKBARODA

709

715

720

726

731

BHARTIARTL

300

302

304

306

309

BHEL

218

219

221

223

225

BPCL

734

743

750

759

766

CAIRN

323

325

327

329

331

CIPLA

304

306

308

310

312

COALINDIA

339

344

346

351

353

DLF

190

192

194

196

198

DRREDDY

1,589

1,600

1,611

1,622

1,633

GAIL

332

339

348

355

365

GRASIM

2,527

2,551

2,575

2,599

2,623

HCLTECH

446

453

462

468

477

HDFC

638

641

645

649

653

HDFCBANK

539

544

548

553

558

HEROMOTOCO

2,016

2,052

2,075

2,111

2,134

HINDALCO

112

114

116

117

120

HINDUNILVR

447

449

452

454

457

ICICIBANK

842

850

860

867

877

IDFC

130

131

133

134

136

INFY

2,424

2,449

2,473

2,497

2,522

ITC

245

248

250

254

256

JINDALSTEL

425

429

432

436

439

JPASSOCIAT

69

70

71

72

73

KOTAKBANK

563

570

575

581

586

LT

1,323

1,333

1,347

1,358

1,372

M&M

676

684

693

700

709

MARUTI

1,099

1,110

1,121

1,132

1,143

NTPC

153

156

157

159

160

ONGC

274

276

278

280

281

PNB

778

783

787

792

796

POWERGRID

108

109

110

111

112

RANBAXY

481

484

488

492

496

RELIANCE

710

715

721

726

733

RELINFRA

518

527

538

547

557

SAIL

87

88

88

89

90

SBIN

2,049

2,073

2,099

2,124

2,149

SESAGOA

178

182

188

192

198

SIEMENS

700

708

715

722

729

STER

95

96

99

100

103

SUNPHARMA

606

611

618

623

630

TATAMOTORS

229

235

238

244

248

TATAPOWER

97

98

99

100

100

TATASTEEL

416

422

427

433

438

TCS

1,225

1,242

1,253

1,270

1,281

WIPRO

395

397

398

400

402

3

Daily Technical Report

June 29, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4