Daily Technical Report

June 28, 2012

Sensex (16968) / NIFTY (5142)

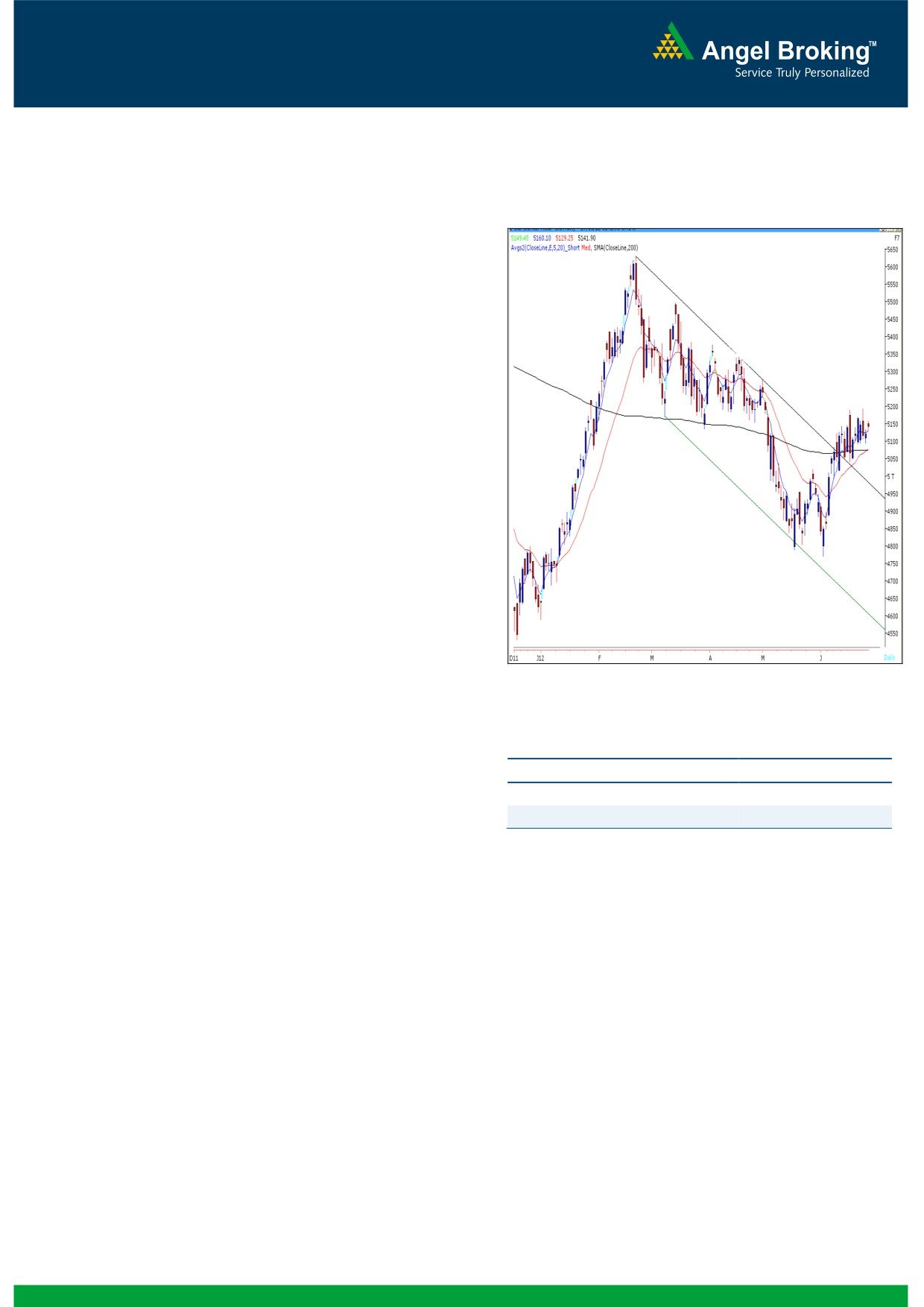

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark indices opened marginally

higher on the back of positive cues from some Asian

bourses. Subsequently, indices moved in a narrow

range throughout the session to eventually close

marginally in the green. On sectoral front, Oil & Gas,

Power and PSU stocks bounced during yesterday’s

session; whereas Consumer Durables and FMCG

sectors remained under pressure. The advance to

decline ratio was marginally in favor of advancing

counters

(A=1380

D=1346 (Source

-

Formation

The 200-day SMA (Simple Moving Average) and

20-day EMA (Exponential Moving Average) have

now shifted to 16803 / 5075 and 16691 /

5061, respectively.

The ‘20-Week EMA’ is placed at 16854 / 5108

level.

On the daily chart, indices are trading well

above the upper range of ‘Downward Sloping

Source: Falcon

Channel’ drawn by joining two highs of February

Actionable points:

22, 2012 - April 19, 2012 and low of March 7,

2012.

View

Bullish Above 5160

The positive crossover in weekly ‘RSI’ momentum

oscillator and weekly ‘3 & 8 EMA’ is still intact.

Expected Target

5195

Also, the weekly ‘RSI-Smoothened’ is now

Support Levels

5093 - 5041 - 5015

positively poised.

Today’s session is likely to trade with some volatility

Trading strategy:

and choppiness due to June series derivatives expiry.

Hence, traders are advised to trade with cautious

In-line with other global indices, our markets too

approach.

opened marginally higher and traded with positive

bias throughout the session; the movement witnessed

was extremely lackluster although overall volumes

surged on account of derivative expiry. Our view

remains unchanged as the trading range is still intact.

The crucial support remains at 16799 / 5093. Only a

sustainable move below this level may reinforce

selling pressure and indices may then correct towards

16553 - 16636 / 5041 - 5015 levels. On the upside,

17030 - 17131 / 5160 - 5195 levels are likely to act

as immediate intraday resistance in coming trading

session.

1

Daily Technical Report

June 28, 2012

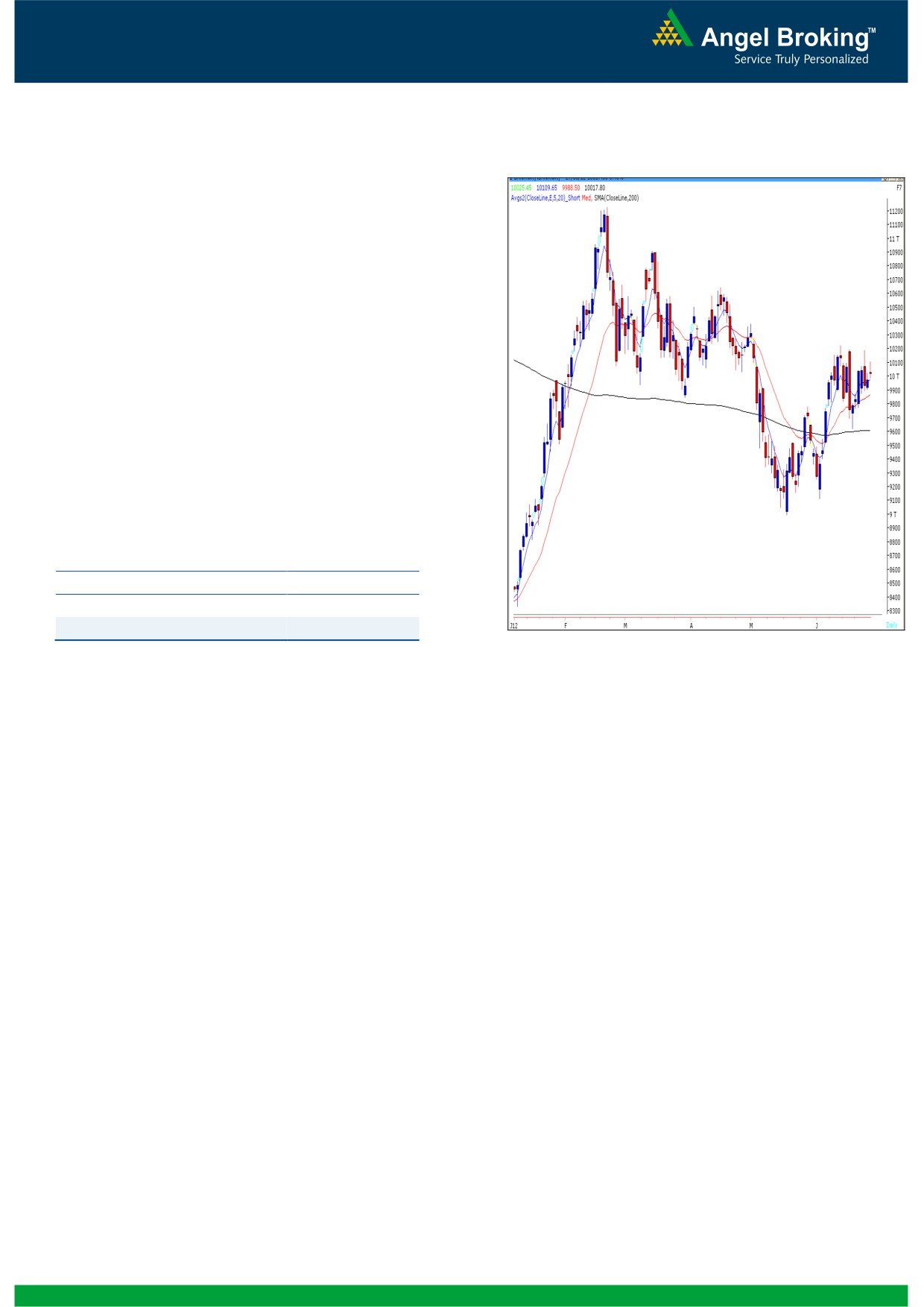

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10018)

Yesterday, Bank Nifty opened with an upside gap in

line with our benchmark indices and traded in a

narrow range throughout the session. There is no

significant change in the chart formation for Bank

Nifty except for the formation of a “Doji” candlestick

pattern, which represents the indecisiveness prevailing

at current levels. Hence, we reiterate our view that the

index is likely to trade in the range of 9760 - 10230.

Only a sustainable move outside the said range will

dictate a clear direction of the trend. Within the

mentioned range 10130 - 10170 is likely to act as

resistance and 9873 - 9800 is likely to act as support

in coming trading session. Positional traders holding

long positions can hold with a stop loss of 9800 level

(Closing basis) on Bank Nifty spot.

Actionable points:

View

Neutral

Resistance Levels

10080 - 10130

Support Levels

9873 - 9800

Source: Falcon

2

Daily Technical Report

June 28, 2012

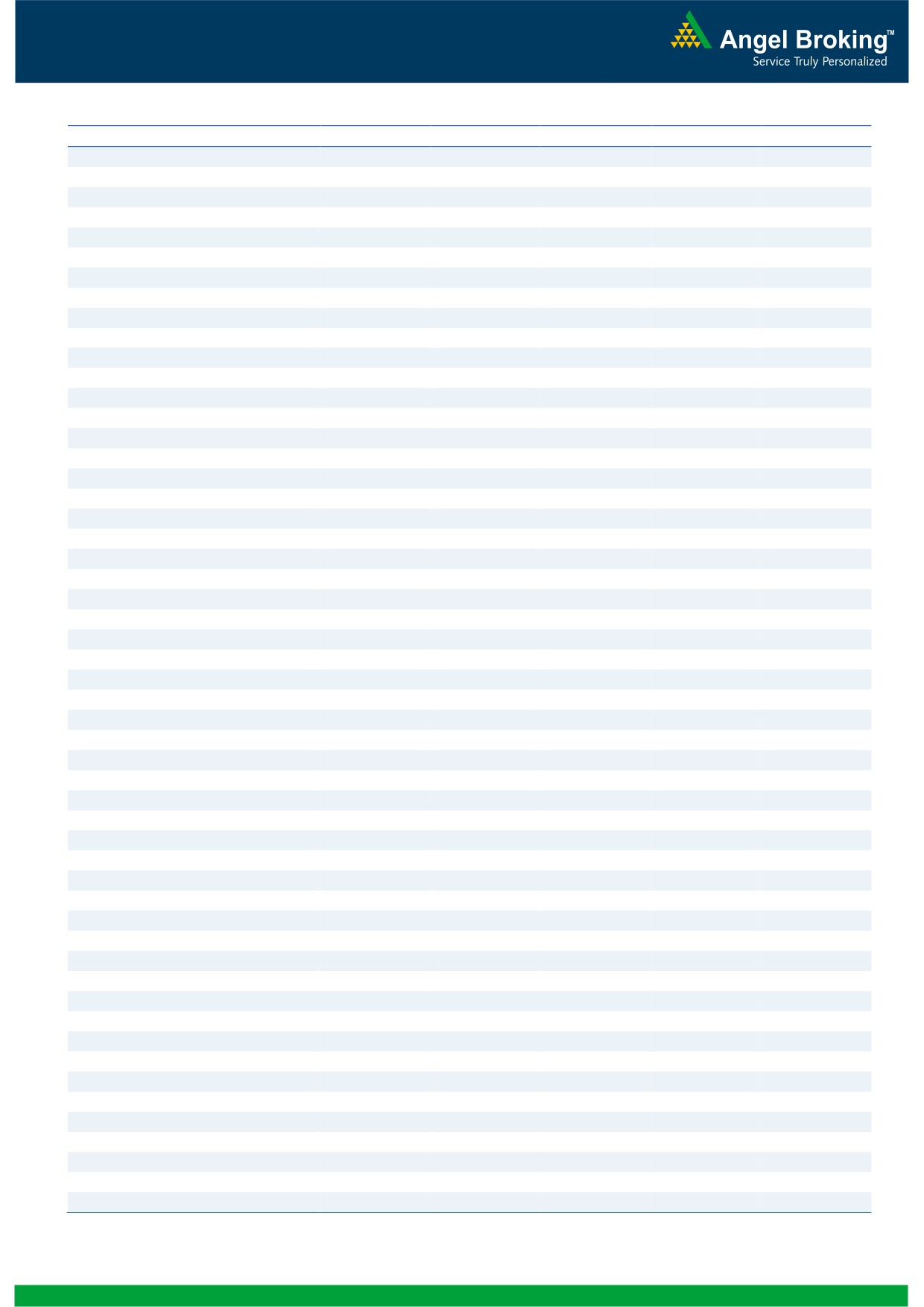

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

16,877

16,923

16,976

17,021

17,074

NIFTY

5,113

5,127

5,144

5,158

5,175

BANKNIFTY

9,918

9,968

10,039

10,089

10,160

ACC

1,187

1,196

1,213

1,222

1,239

AMBUJACEM

167

169

171

172

175

ASIANPAINT

3,743

3,760

3,778

3,795

3,813

AXISBANK

987

994

1,005

1,012

1,023

BAJAJ-AUTO

1,543

1,551

1,560

1,568

1,577

BANKBARODA

709

713

716

720

724

BHARTIARTL

300

303

305

308

310

BHEL

218

219

221

222

223

BPCL

739

745

749

754

759

CAIRN

318

322

328

332

338

CIPLA

303

306

308

311

313

COALINDIA

336

340

342

345

348

DLF

189

191

192

194

195

DRREDDY

1,593

1,601

1,608

1,616

1,623

GAIL

350

352

356

358

362

GRASIM

2,424

2,493

2,591

2,660

2,757

HCLTECH

456

463

467

474

478

HDFC

640

642

645

648

651

HDFCBANK

541

545

550

554

559

HEROMOTOCO

2,028

2,042

2,056

2,070

2,085

HINDALCO

115

116

117

118

119

HINDUNILVR

446

449

452

455

458

ICICIBANK

842

847

855

860

868

IDFC

130

132

134

137

139

INFY

2,437

2,453

2,464

2,479

2,490

ITC

246

247

248

249

251

JINDALSTEL

425

428

431

434

437

JPASSOCIAT

67

68

70

71

72

KOTAKBANK

553

562

573

582

594

LT

1,331

1,339

1,352

1,360

1,373

M&M

677

685

693

701

709

MARUTI

1,103

1,112

1,118

1,127

1,133

NTPC

153

154

155

156

158

ONGC

271

274

276

280

282

PNB

775

780

785

790

795

POWERGRID

108

109

110

111

112

RANBAXY

481

484

488

491

495

RELIANCE

712

717

723

729

735

RELINFRA

535

540

546

551

557

SAIL

87

88

89

89

90

SBIN

2,083

2,098

2,118

2,133

2,153

SESAGOA

183

187

190

194

197

SIEMENS

697

702

710

715

723

STER

97

99

99

101

101

SUNPHARMA

611

617

622

628

633

TATAMOTORS

231

235

242

246

253

TATAPOWER

96

97

98

99

101

TATASTEEL

408

415

418

424

428

TCS

1,225

1,236

1,247

1,258

1,270

WIPRO

394

397

401

403

407

3

Daily Technical Report

June 28, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4