Technical Research | April 27, 2012

Daily Technical Report

Sensex (17131) / NIFTY (5189)

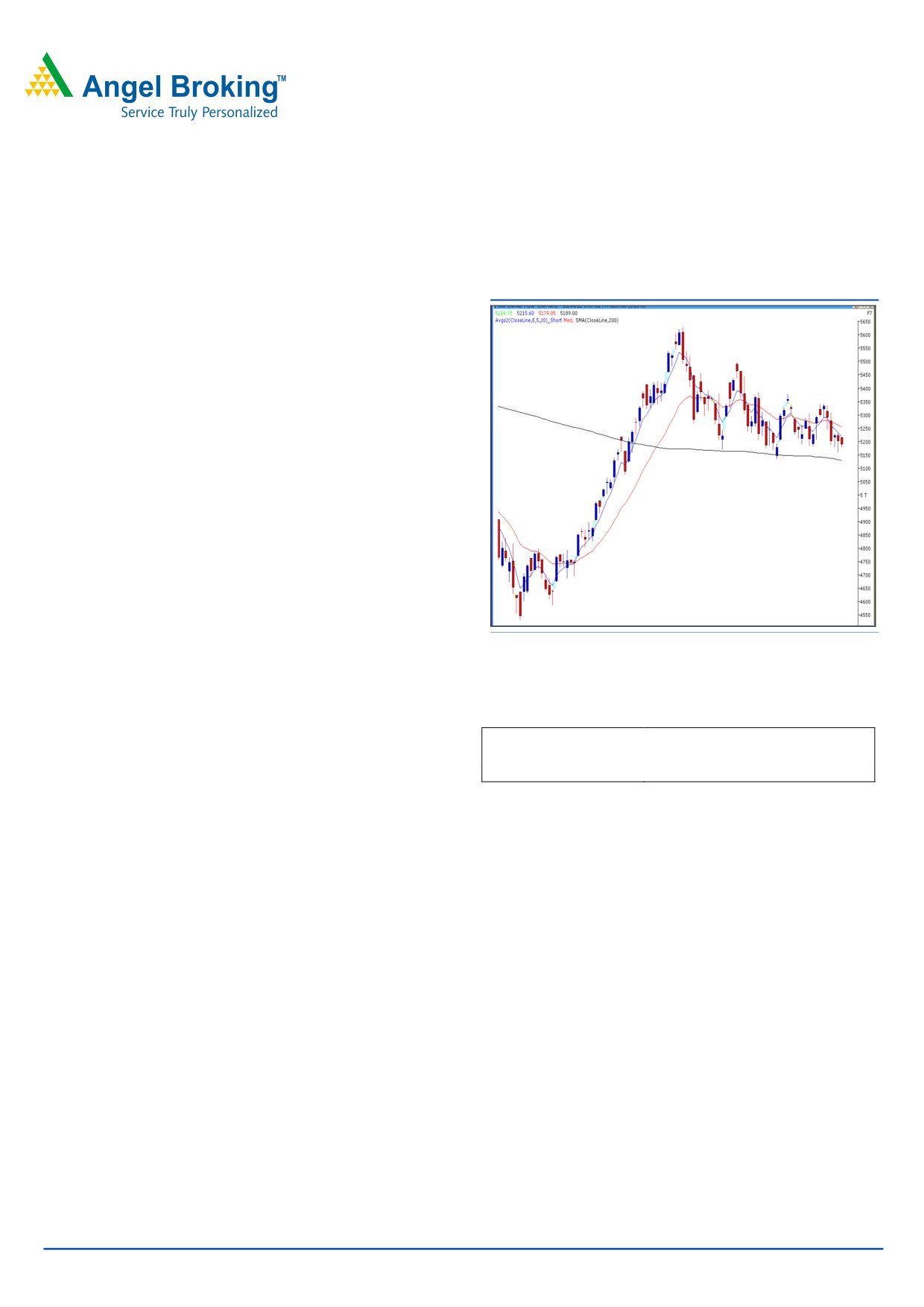

Exhibit 1: Nifty Daily Chart

Yesterday, for the third consecutive session, indices opened

on flat note. Likewise previous few trading sessions, markets

remained under narrow range throughout the session.

Surprisingly, we did not witness any volatility during

yesterday’s session as generally observed on other

derivative expiry sessions. On sectoral front, Power, Realty

and Auto counters were among the major losers, whereas

defensive sectors like, IT and FMCG ended in the positive

territory. The advance to decline ratio was in favor of

declining counters (A=1109 D=1321) (Source

-

Formation:

• The 200-day SMA (Simple Moving Average) and 20-day

Source: Falcon

EMA (Exponential Moving Average) have now shifted to

17050 / 5135 and 17400 / 5300, respectively.

• The ‘20-Week EMA’ is placed at 17200 / 5180 level.

Actionable points:

View

Neutral

Resistance levels

5236 - 5311

Trading strategy:

Support Level

5135

Despite being a derivative expiry, we witnessed a very

narrow trading range during yesterday’s session. Going

forward, our view remains unchanged and the lackluster

movement is likely to be witnessed until we breakout from

the trading range of

5340

-

5135. Meanwhile, the

immediate resistance level is seen at 17250 / 5236. A

move beyond this may push indices higher to test 17444 /

5311 level. Conversely, ‘200-day SMA’ level of 16930 /

5135 is likely to provide decent support for the markets.

For Private Circulation Only |

1

Technical Research | April 27, 2012

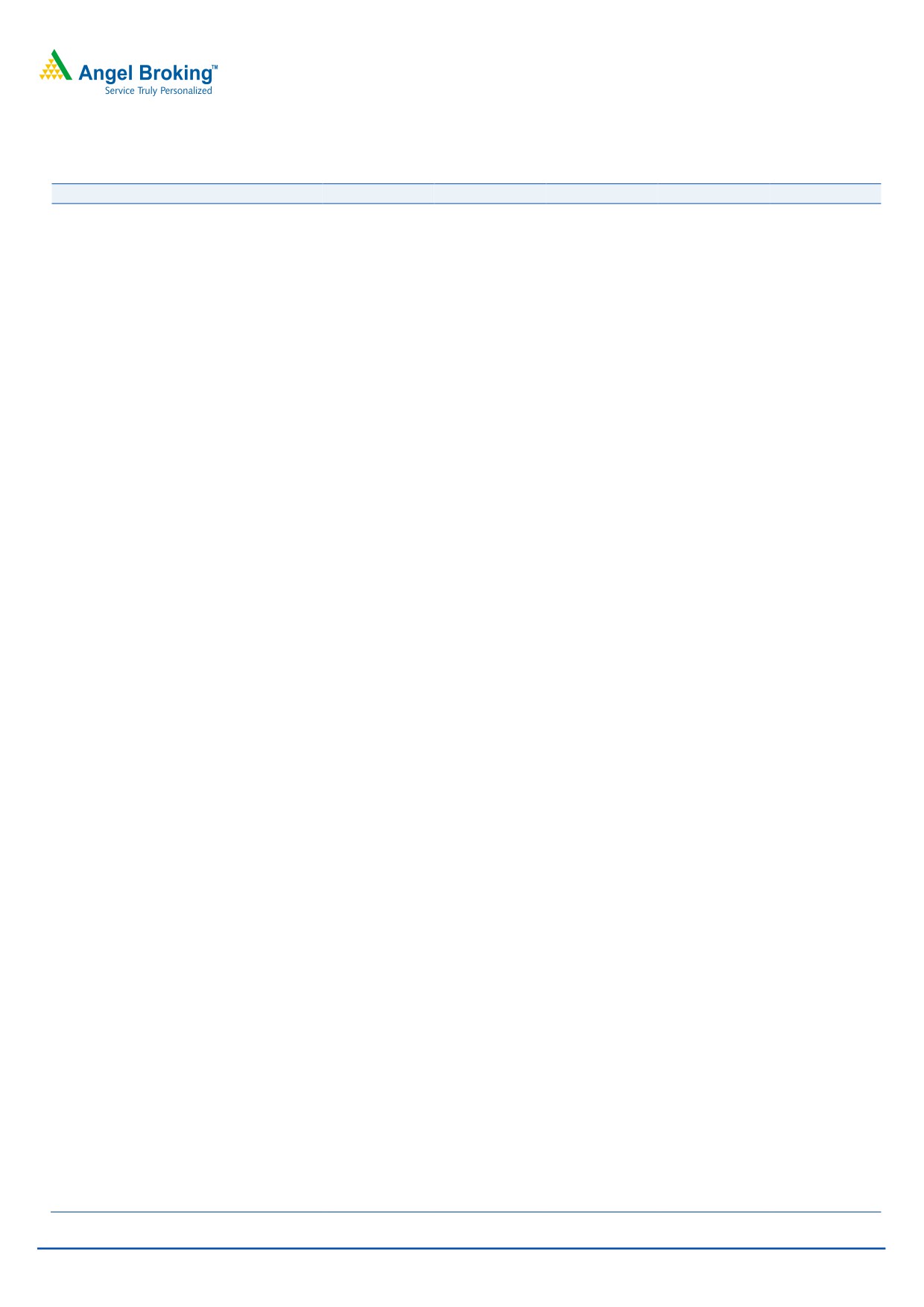

Bank Nifty Outlook - (10128)

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened on a flat note in line with

our benchmark indices and traded in a narrow range

throughout the session. The negative crossover in “RSI -

Smoothened” momentum oscillator on the daily chart

mentioned in our previous report is still intact. We

reiterate our view, that the momentum oscillator “RSI -

Smoothened” on the hourly chart is placed in an extreme

oversold condition and possibility of a bounce back

cannot be ruled out. The trading range of 10600 -

10150 mentioned in our previous reports has been

breached as the index managed to close marginally

below it. However, this breach cannot be qualified as a

signal to sell as the breakdown is on thin volumes. On the

upside

10280

-

10345 levels are likely to act as

resistance whereas 10083 - 10040 levels may act as

support.

Source: Falcon

Actionable points:

View

Neutral

Resistance Levels

10280 - 10345

Support Levels

10040 - 9985

For Private Circulation Only |

2

Technical Research | April 27, 2012

Positive Bias:

Positive

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Above

Target

Reliance

View will change below

745.05

739.8

745.1

749

776

Industries

733

For Private Circulation Only |

3

Technical Research | April 27, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,027

17,079

17,136

17,188

17,245

NIFTY

5,158

5,174

5,195

5,210

5,231

BANKNIFTY

10,025

10,076

10,135

10,187

10,246

ACC

1,182

1,201

1,213

1,231

1,243

AMBUJACEM

147

149

151

152

154

AXISBANK

1,064

1,076

1,087

1,098

1,110

BAJAJ-AUTO

1,558

1,582

1,625

1,650

1,693

BHARTIARTL

299

304

310

315

322

BHEL

225

228

231

234

236

BPCL

637

649

669

681

700

CAIRN

324

331

340

346

355

CIPLA

299

304

310

314

320

COALINDIA

337

348

355

367

374

DLF

177

179

184

186

191

DRREDDY

1,744

1,759

1,775

1,791

1,807

GAIL

311

317

328

334

345

HCLTECH

489

495

502

509

516

HDFC

668

671

675

679

683

HDFCBANK

532

536

543

547

554

HEROMOTOCO

2,083

2,126

2,190

2,233

2,296

HINDALCO

112

114

118

120

123

HINDUNILVR

408

411

416

419

423

ICICIBANK

831

836

841

846

851

IDFC

117

118

121

122

125

INFY

2,323

2,339

2,359

2,376

2,396

ITC

242

246

248

251

253

JINDALSTEL

466

477

489

500

512

JPASSOCIAT

69

71

72

74

76

KOTAKBANK

554

568

577

592

601

LT

1,205

1,216

1,227

1,238

1,249

M&M

692

698

706

712

720

MARUTI

1,349

1,366

1,382

1,399

1,415

NTPC

157

159

163

165

168

ONGC

260

262

264

267

269

PNB

814

829

856

872

898

POWERGRID

105

107

109

110

112

RANBAXY

494

500

508

514

522

RCOM

74

75

77

78

80

RELIANCE

727

736

743

752

758

RELINFRA

503

509

520

527

537

RPOWER

98

100

103

105

107

SAIL

95

96

98

100

102

SBIN

2,111

2,137

2,162

2,188

2,213

SESAGOA

181

183

186

188

191

SIEMENS

755

764

772

781

789

STER

102

103

107

109

112

SUNPHARMA

582

590

595

602

607

SUZLON

22

22

22

23

23

TATAMOTORS

307

310

313

315

318

TATAPOWER

98

100

104

106

109

TATASTEEL

457

462

468

473

479

TCS

1,150

1,172

1,187

1,210

1,224

WIPRO

390

397

405

411

419

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No: INB 010996539

For Private Circulation Only |