Technical Research | April 25, 2012

Daily Technical Report

Sensex (17207) / NIFTY (5223)

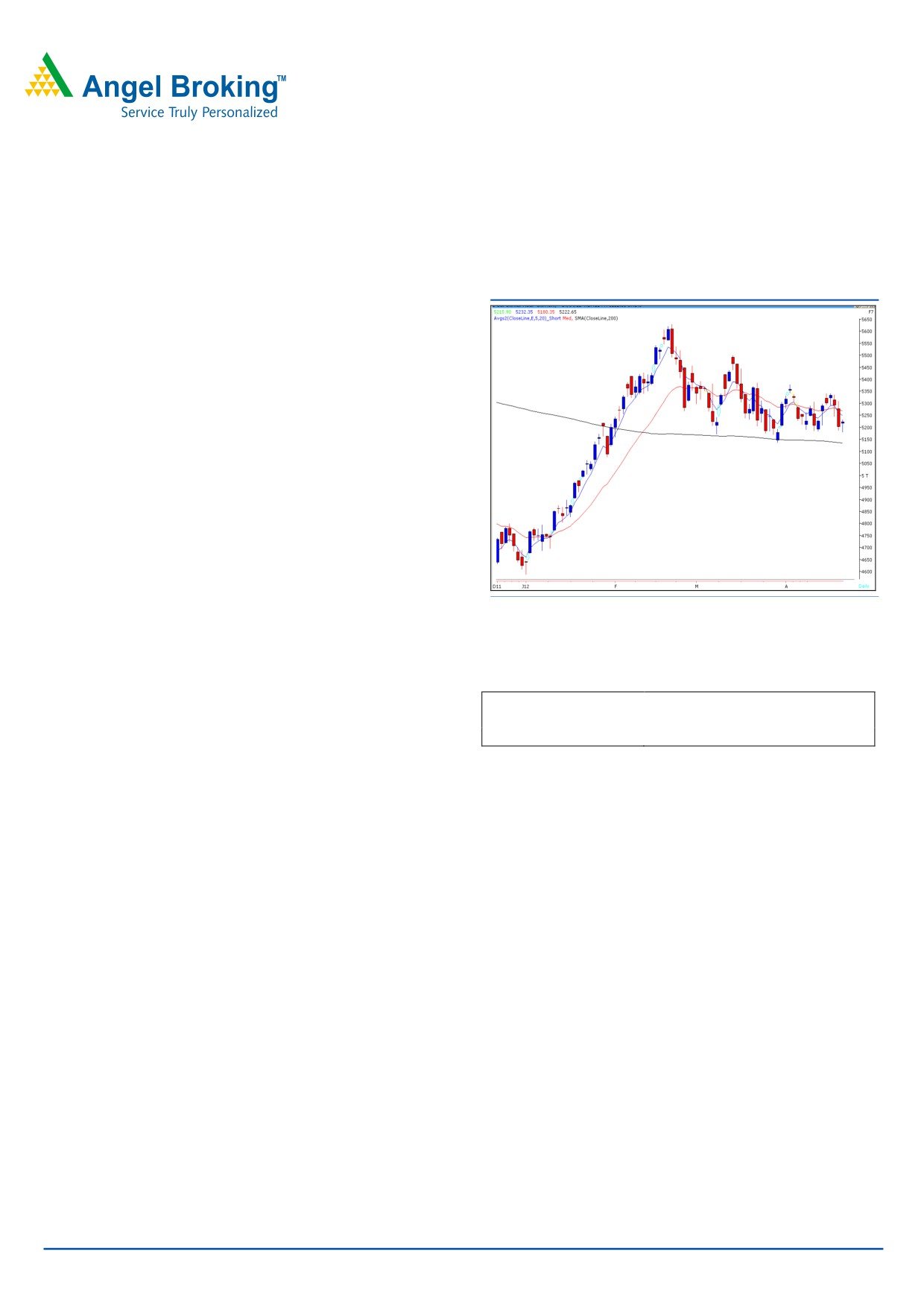

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark indices opened on a flat note

and traded with choppiness throughout the day. A minor

bounce towards the latter part of the session led indices to

close near day’s high. On sectoral front, IT and TECK

counters were among the major gainers, whereas

Consumer Goods counter ended with a marginal loss. The

advance to decline ratio was in marginally favour of

declining counters (A=1330 D=1398) (Source

-

Formation:

• The 200-day SMA (Simple Moving Average) and 20-day

EMA (Exponential Moving Average) have now shifted to

17050 / 5135 and 17400 / 5300, respectively.

Source: Falcon

• The ‘20-Week EMA’ is placed at 17200 / 5180 level.

Actionable points:

Trading strategy:

View

Neutral

Resistance level

5232 - 5311

Yesterday, we witnessed a flat opening in-line with global

Support Levels

5180 - 5135

cues. Subsequently, indices moved in a very narrow range

of 17047 - 17247 / 5180 - 5232. Going forward, we

reiterate our view that 17047 / 5180 levels are likely to

provide decent support for the market. Only a fall below

these levels on the back of strong volumes may reinforce

negative momentum and indices then may slide to test

16920 / 5135 level. On the upside, Monday's high of

17445 / 5311 may act as immediate resistance for the

markets. A move beyond this may push indices higher to

test 17664 / 5380 levels.

For Private Circulation Only |

1

Technical Research | April 25, 2012

Bank Nifty Outlook - (10215)

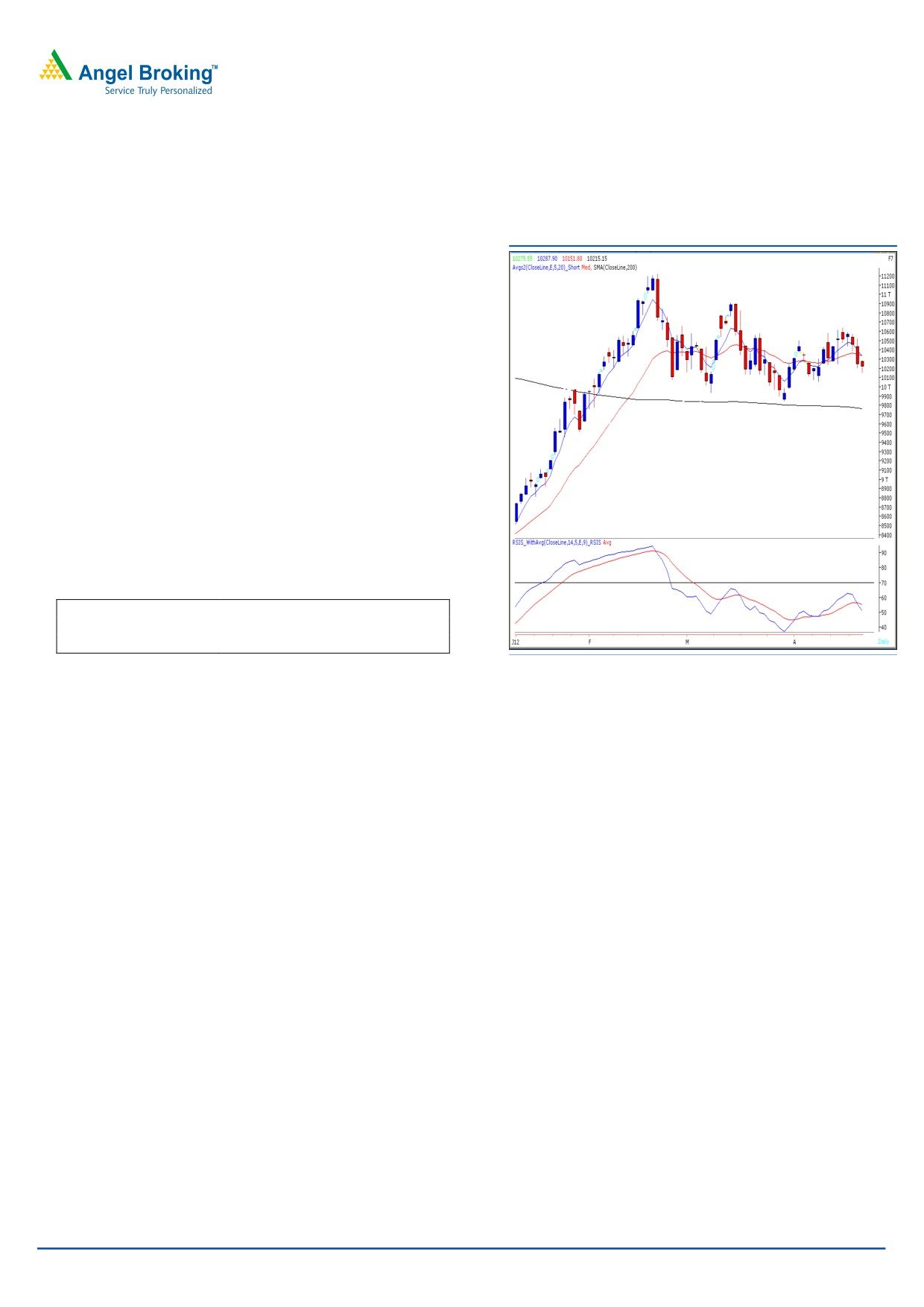

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened on a flat note traded in a

narrow range throughout the session. The index tested the

mentioned support level of 10150 and bounced back.

The negative crossover in “RSI - Smoothened” momentum

oscillator on the daily chart mentioned in our previous

report is still intact. On the contrary, the momentum

oscillator “RSI - Smoothened” on the hourly chart is

placed in an extreme oversold condition and possibility of

a bounce back cannot be ruled out. The trading range of

10600 - 10150 mentioned in our previous reports is still

intact. On the upside 10325 - 10375 level is likely to act

as resistance in coming trading session. On the downside

support is likely act 10125 - 10060.

Actionable points:

View

Neutral

Resistance Levels

10325 - 10375

Support Levels

10125 - 10060

Source: Falcon

For Private Circulation Only |

2

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No: INB 010996539

For Private Circulation Only |