Daily Technical Report

May 23, 2012

Sensex (16026) / NIFTY (4861)

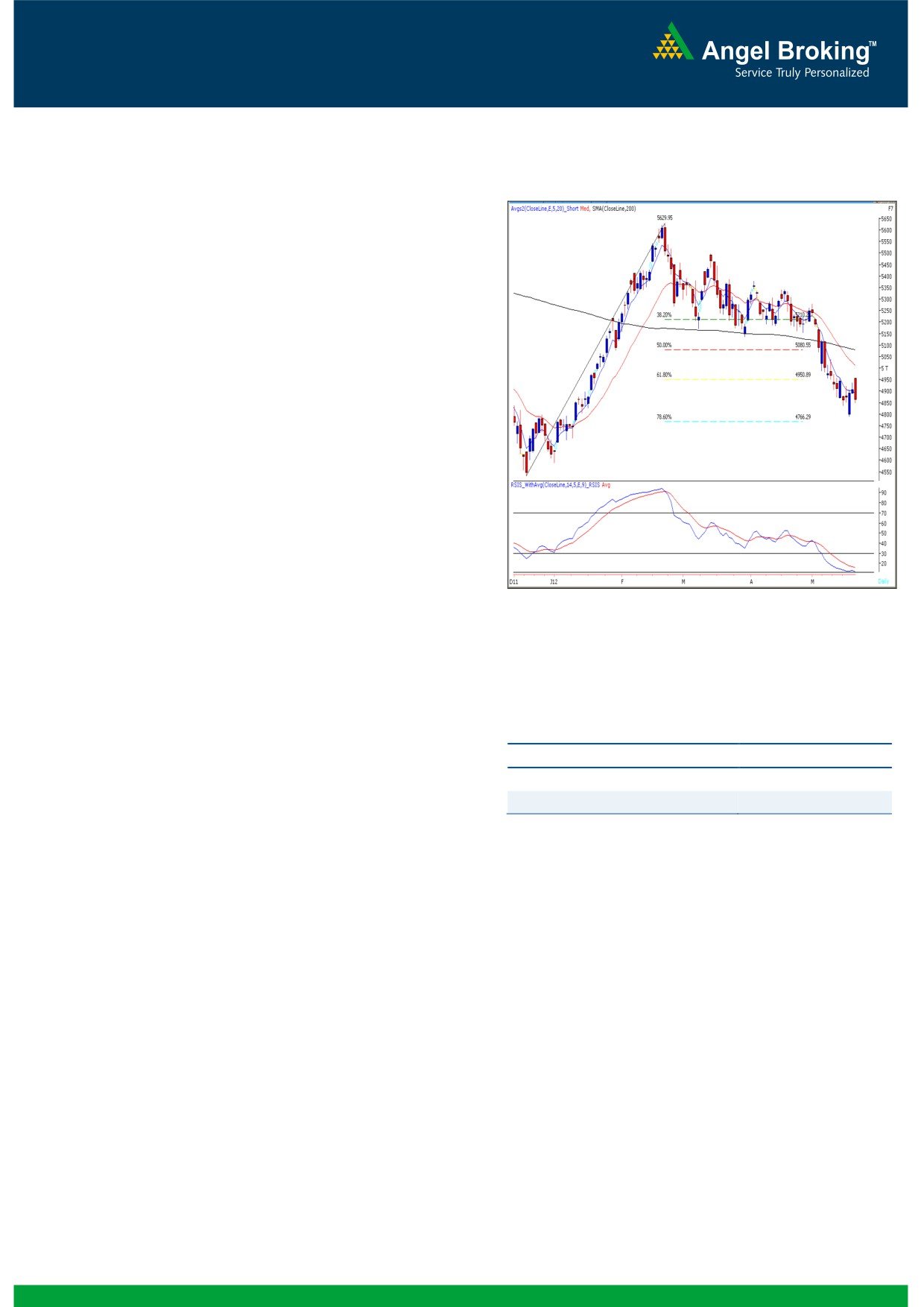

Exhibit 1: Nifty Daily Chart

Yesterday, markets opened significantly higher in-line

strong cues from European and US bourses. However,

once again sharp rupee depreciation continued to

spoil the upward momentum. As a result, indices

drifted sharply from the day’s high to close almost at

the lowest point of the day. On sectoral front, Metal,

Banking and Power corrected sharply during

yesterday’s session; whereas Teck and IT counters

ended on the gaining side. The advance to decline

ratio was strongly in favor of declining counters

Formation

The 200-day SMA (Simple Moving Average) and

20-day EMA (Exponential Moving Average) have

now shifted to 16837 / 5079 and 16532 /

5009, respectively.

The ‘20-Week EMA’ is placed at 17000 / 5150

Source: Falcon

level.

Indices have now tested the 15860 / 4766 level,

which is the 78.6% Fibonacci Retracement level

of the rise from

15135

/

4531 (Low on

December 23, 2011) to 18524 / 5630 (High on

Actionable points:

February 22, 2012).

View

Neutral

The daily ‘RSI - Smoothened’ oscillator is placed

Resistance Levels

4938 - 4957

well inside the oversold territory.

Support Levels

4840 - 4759

The candlestick pattern on the weekly chart

represents a bullish “Hammer”.

Conversely, Friday’s low of 15809 / 4789 is likely

Trading strategy:

to act as a decent support in coming trading

sessions.

Yesterday, markets opened on an optimistic note after

a flat closing on Monday's session. However,

significant rupee depreciation during the second half

had a negative impact on equity markets as we lost

all early gains and eventually closed in the negative

territory. Going forward, we maintain our view that,

although the daily chart continues to be in a lower top

lower bottom formation, due to extreme oversold

condition of 'RSI-Smoothened', we may not witness a

sharp correction in the markets. If indices manage to

sustain above last week's high of 16391 / 4957, then

they are likely to test 16700 - 16840 / 5050 - 5090

levels.

1

Daily Technical Report

May 23, 2012

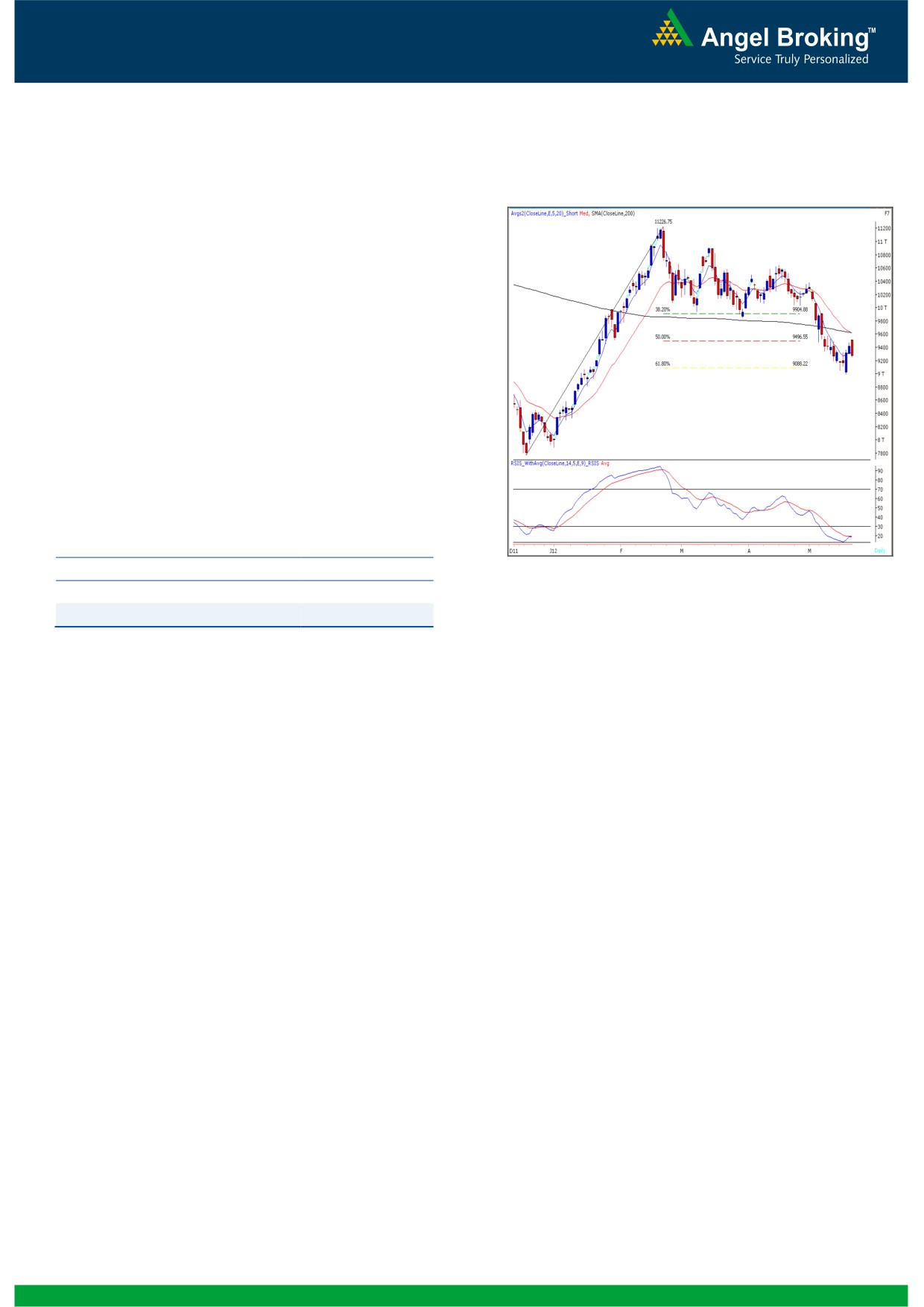

Bank Nifty Outlook - (9269)

Yesterday, Bank Nifty opened on with an upside gap

Exhibit 2: Bank Nifty Daily Chart

and traded in a narrow range during first half of the

session but pared early gains to close near the low

point of the day. As stated in our previous report we

witnessed a pullback from the mentioned resistance

level of 9533. The positive crossover in “Stochastic”

and “RSI” momentum oscillator on the daily chart

mentioned in our previous reports is still intact.

However, the momentum oscillators on the hourly

chart are negatively poised. As the momentum

oscillators on the hourly and daily chart paint a mixed

picture we expect the ongoing volatility to continue.

Thus, going forward 9377 - 9427 are likely to act as

resistance and on the downside 9194 - 9108 are

likely to act as support in coming trading session.

Actionable points:

View

Neutral

Source: Falcon

Resistance Levels

9377 - 9427

Support Levels

9194 - 9108

2

Daily Technical Report

May 23, 2012

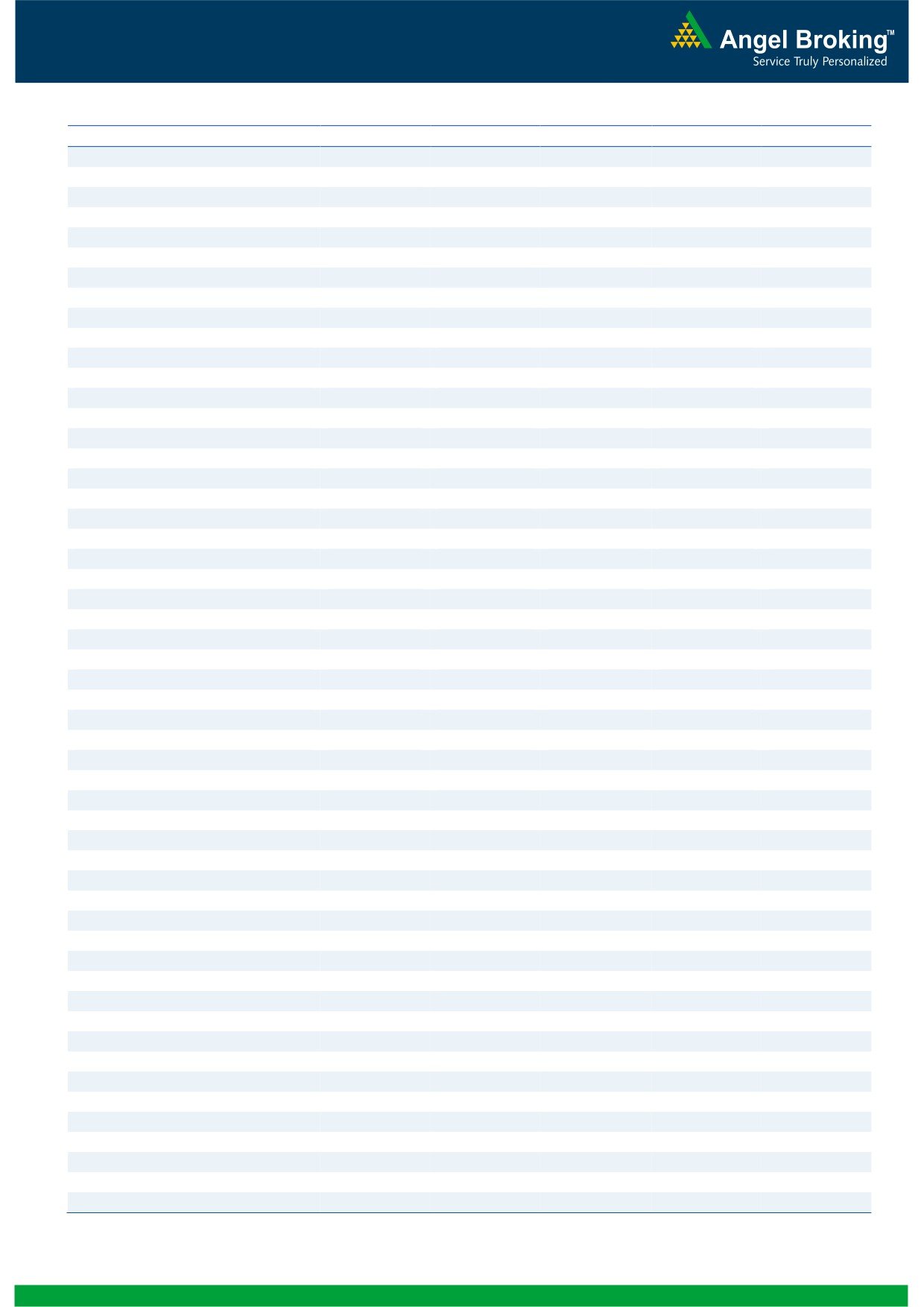

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

15,765

15,896

16,131

16,262

16,497

NIFTY

4,782

4,821

4,889

4,928

4,995

BANKNIFTY

9,079

9,174

9,348

9,443

9,617

ACC

1,105

1,118

1,138

1,150

1,170

AMBUJACEM

136

138

142

144

147

ASIANPAINT

3,598

3,637

3,696

3,735

3,794

AXISBANK

945

955

969

979

993

BAJAJ-AUTO

1,470

1,489

1,513

1,531

1,556

BANKBARODA

648

659

669

680

690

BHARTIARTL

290

293

296

299

302

BHEL

203

206

210

212

216

BPCL

714

721

731

739

749

CAIRN

314

319

327

333

340

CIPLA

307

309

313

315

319

COALINDIA

299

302

309

312

318

DLF

179

183

188

191

197

DRREDDY

1,616

1,638

1,667

1,689

1,718

GAIL

302

308

317

323

332

GRASIM

2,319

2,356

2,402

2,438

2,484

HCLTECH

472

480

487

495

502

HDFC

628

635

644

652

661

HDFCBANK

476

482

494

501

512

HEROMOTOCO

1,811

1,832

1,863

1,884

1,916

HINDALCO

103

105

109

111

114

HINDUNILVR

418

421

425

428

432

ICICIBANK

782

791

808

818

834

IDFC

115

116

119

121

124

INFY

2,300

2,320

2,344

2,365

2,389

ITC

225

229

234

238

243

JINDALSTEL

449

456

465

471

480

JPASSOCIAT

58

60

62

64

66

KOTAKBANK

534

542

556

564

578

LT

1,119

1,139

1,175

1,195

1,231

M&M

623

631

643

651

664

MARUTI

1,093

1,123

1,174

1,205

1,255

NTPC

138

140

142

144

147

ONGC

240

242

247

249

254

PNB

709

715

723

729

737

POWERGRID

102

103

104

104

105

RANBAXY

475

484

490

499

505

RELIANCE

679

685

695

701

711

RELINFRA

428

435

448

456

468

SAIL

90

91

92

93

94

SBIN

1,861

1,900

1,970

2,009

2,079

SESAGOA

175

179

188

193

201

SIEMENS

646

658

679

691

711

STER

91

93

98

100

104

SUNPHARMA

556

565

581

590

606

TATAMOTORS

260

262

266

269

272

TATAPOWER

85

88

92

95

100

TATASTEEL

389

394

402

407

415

TCS

1,199

1,211

1,226

1,238

1,253

WIPRO

376

379

383

386

390

3

Daily Technical Report

May 23, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4