Technical Research | December 21, 2011

Daily Technical Report

Sensex (15175) / NIFTY (4544)

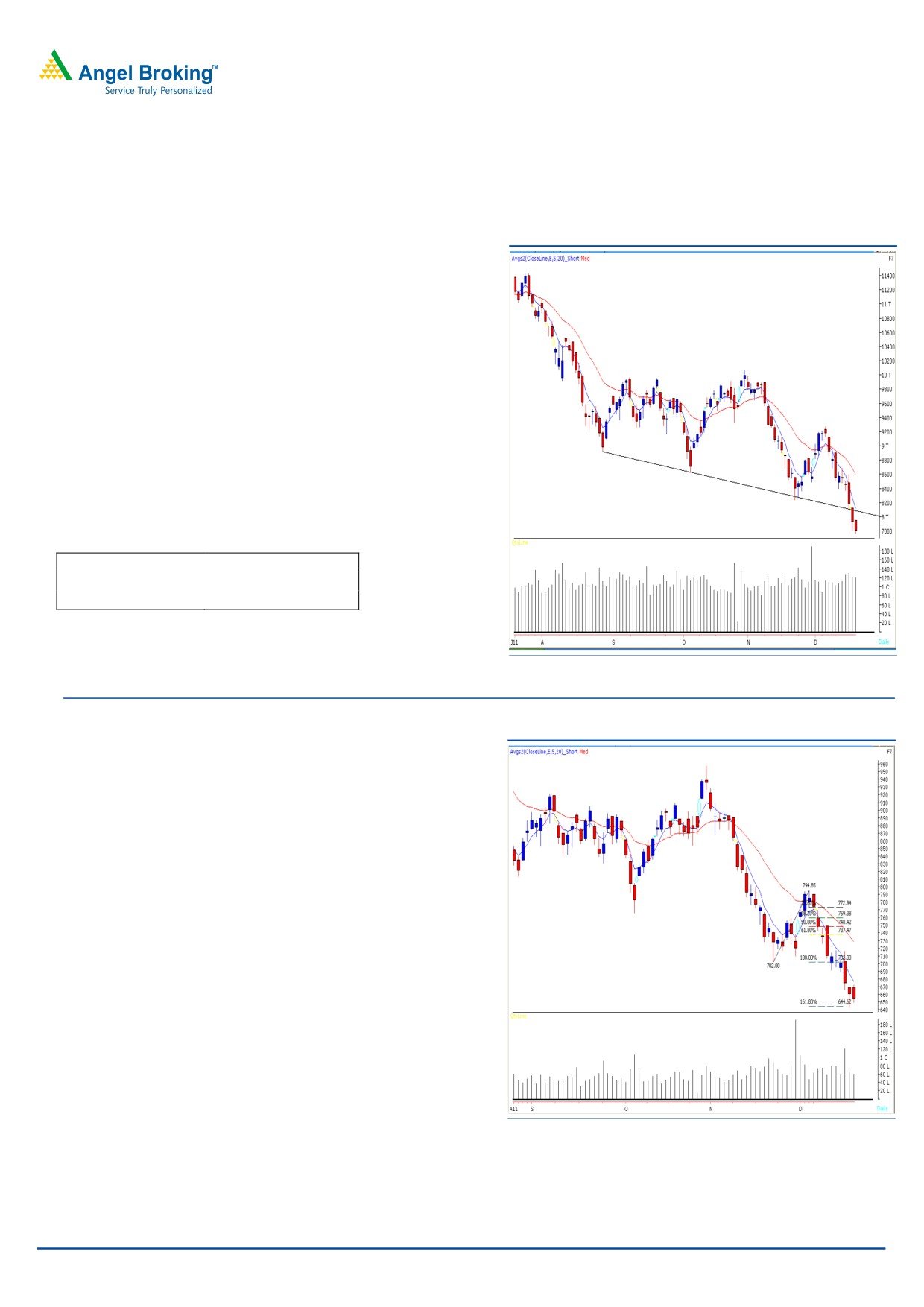

Exhibit 1: Nifty Daily Chart

Yesterday markets opened on a flat note and traded with

immense volatility throughout the session. A sharp

correction during the last hour forced indices to break

previous low of 15190 / 4555 and close marginally below

this level. On the sectoral front, Capital Goods, Metal and

Realty were among the major losers, whereas FMCG sector

ended on a gaining side. The advance to decline ratio was

strongly in favor of declining counters. (A=862 D=1877).

Formation

• On the Daily chart, we are witnessing a “Downward

Sloping Trend Line” joining two lows of 15760 - 15479 /

4728 - 4639.

Source: Falcon

Trading strategy:

Actionable points:

Indices opened on a quiet note and tried crossing the

resistance at 15440 / 4623 but failed to sustain at higher

View

Neutral

levels as strong selling pressure intensified during the latter

Resistance levels

4638 - 4672

part of the session. As a result indices breached the low of a

Support levels

4531 - 4430

“bullish Hammer” and negated the bullish implication of

the pattern. However, considering the positive global cues it

is likely that our markets may open on a positive note. On

the upside, 15450 / 4638 level is expected to act as the first

resistance level. A move beyond this may push indices

higher to test 15590 - 15750 / 4672 - 4730 levels. On the

downside, a fall below 15135 / 4531 may lead indices to

drift towards 14870 / 4430 levels.

For Private Circulation Only |

1

Technical Research | December 21, 2011

Bank Nifty Outlook - (7799)

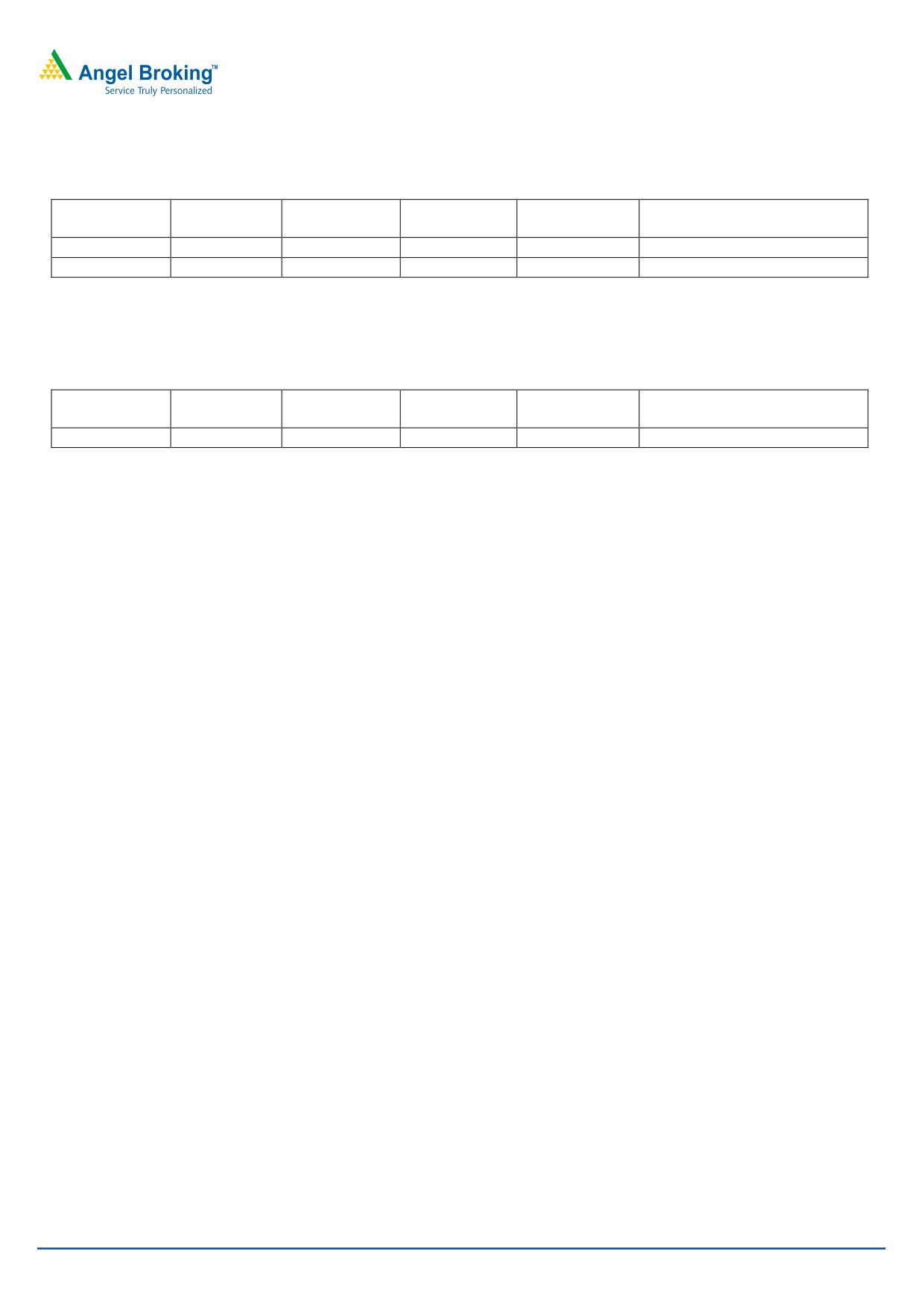

Exhibit 2: Bank Nifty Daily Chart

Bank nifty opened on a flat note and traded with extreme

volatility throughout the session to close marginally below

yesterday’s low of 7801. As mentioned in our previous

reports the rising “ADX

(14)” currently at

27.71, is

suggesting that the downtrend is getting stronger. On the

contrary the “”RSI - Smoothened” oscillator on the hourly

chart is placed in an extreme oversold condition. Thus a

possibility of a pullback cannot be ruled out. On the upside

7961 - 8085 levels are likely to act as resistance levels for

the day. On the downside 7728 - 7600 levels are likely to

act as support in coming trading session.

Actionable points:

View

Neutral

Resistance Level

8107 - 8172

Support Level

7801 - 7600

Source: Falcon

Stock Recommendations:

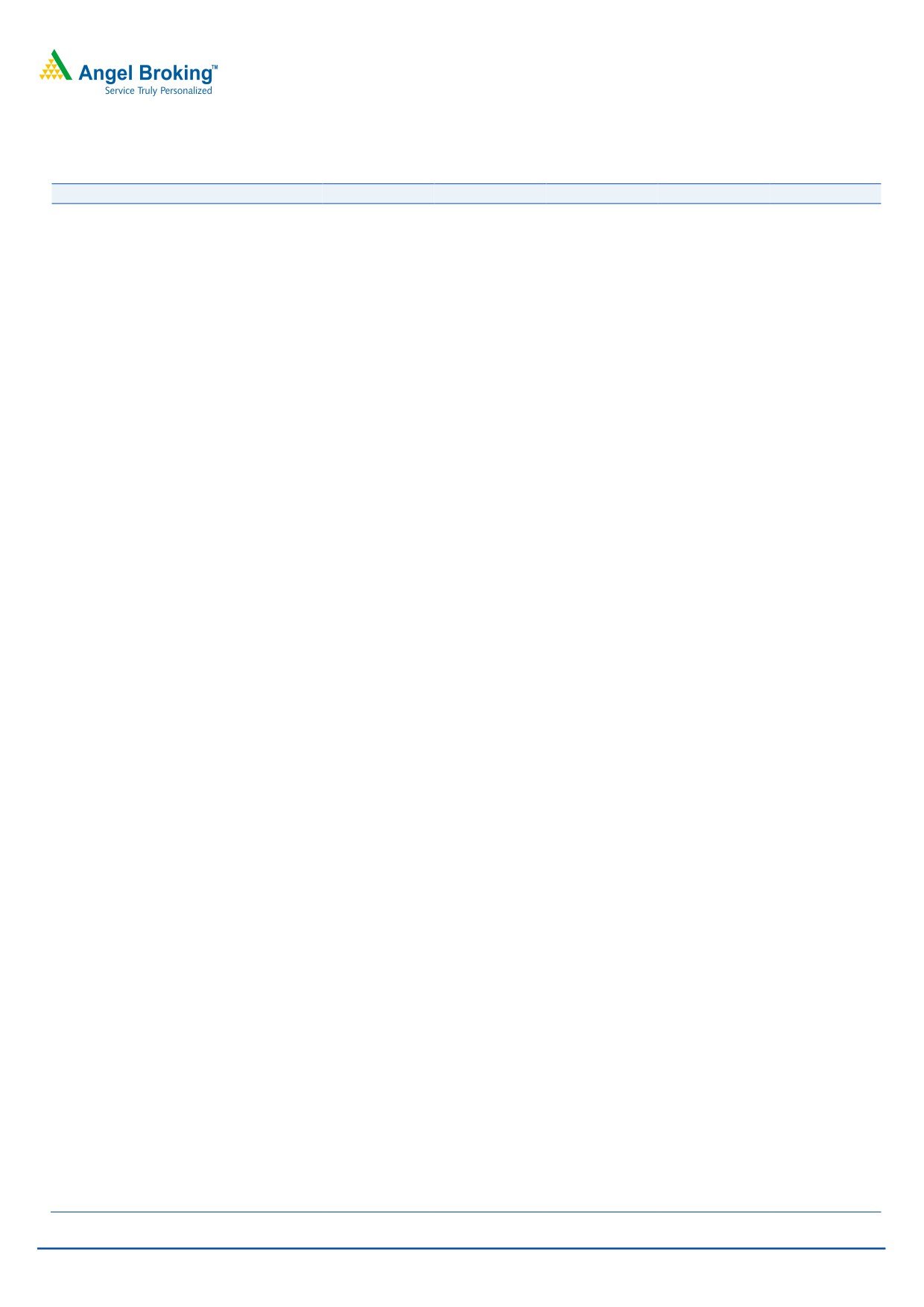

Exhibit 3: ICICI Bank(December Futures)

Stock - ICICI Bank (December Futures)

Action - Buy

Last close

` 654.40

Buy Above

` 670

Stop Loss

` 649.80

Target

` 710

Justification - On the Daily chart, the stock has taken a

support near 161.8% retracement of the rise from ` 702 to

` 794.85 and has formed a “Hammer” candle pattern

during Monday’s session. The “RSI - Smoothend” oscillator

on the hourly chart is positively poised. We advise buying

the stock ONLY above ` 670 for a target of ` 710 in

coming 5 - 6 trading sessions.

Source: Falcon

For Private Circulation Only |

2

Technical Research | December 21, 2011

Positive Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

Ranbaxy

394.55

392.4

419.9

419

View will change below 382

Dabur

97.2

96.7

96.7

100.2

View will change below 95.1

Negative Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

Bajaj-Auto

1600.65

1634.4

1660.6

1566

View will change above 1626

For Private Circulation Only |

3

Technical Research | December 21, 2011

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

14,941

15,058

15,253

15,370

15,565

NIFTY

4,465

4,504

4,571

4,611

4,677

BANKNIFTY

7,647

7,723

7,842

7,918

8,038

ACC

1,056

1,079

1,107

1,130

1,158

AMBUJACEM

144

146

151

154

158

AXISBANK

780

800

829

849

878

BAJAJ-AUTO

1,552

1,576

1,619

1,643

1,686

BHARTIARTL

307

315

327

336

348

BHEL

216

222

230

236

244

BPCL

468

484

513

529

557

CAIRN

302

306

311

315

319

CIPLA

322

325

330

334

338

DLF

178

182

187

191

197

DRREDDY

1,541

1,554

1,576

1,590

1,611

GAIL

370

374

379

383

387

HCLTECH

370

380

398

409

426

HDFC

613

618

623

629

634

HDFCBANK

396

405

413

423

431

HEROMOTOCO

1,704

1,757

1,841

1,894

1,978

HINDALCO

113

116

121

124

129

HINDUNILVR

390

393

398

402

406

ICICIBANK

635

644

658

667

680

IDFC

97

99

102

104

106

INFY

2,626

2,647

2,673

2,694

2,720

ITC

197

198

199

201

202

JINDALSTEL

454

467

486

499

517

JPASSOCIAT

49

51

55

57

60

KOTAKBANK

420

432

453

465

485

LT

931

955

994

1,017

1,056

M&M

621

635

647

661

673

MARUTI

899

908

917

926

935

NTPC

149

152

157

160

165

ONGC

246

249

252

256

258

PNB

748

763

786

801

824

POWERGRID

95

96

98

99

101

RANBAXY

375

385

392

402

408

RCOM

58

60

63

65

68

RELCAPITAL

221

227

236

242

250

RELIANCE

689

701

721

734

754

RELINFRA

335

341

349

355

363

RPOWER

67

69

71

73

75

SAIL

74

76

77

79

80

SBIN

1,522

1,550

1,600

1,628

1,677

SESAGOA

140

145

153

158

166

SIEMENS

613

622

635

644

658

STER

85

86

89

91

93

SUNPHARMA

488

494

504

510

520

SUZLON

17

17

18

18

19

TATAMOTORS

170

172

177

179

183

TATAPOWER

75

78

83

86

91

TATASTEEL

324

333

350

359

376

TCS

1,115

1,124

1,138

1,147

1,160

WIPRO

383

390

398

405

413

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |