Daily Technical Report

August 21, 2012

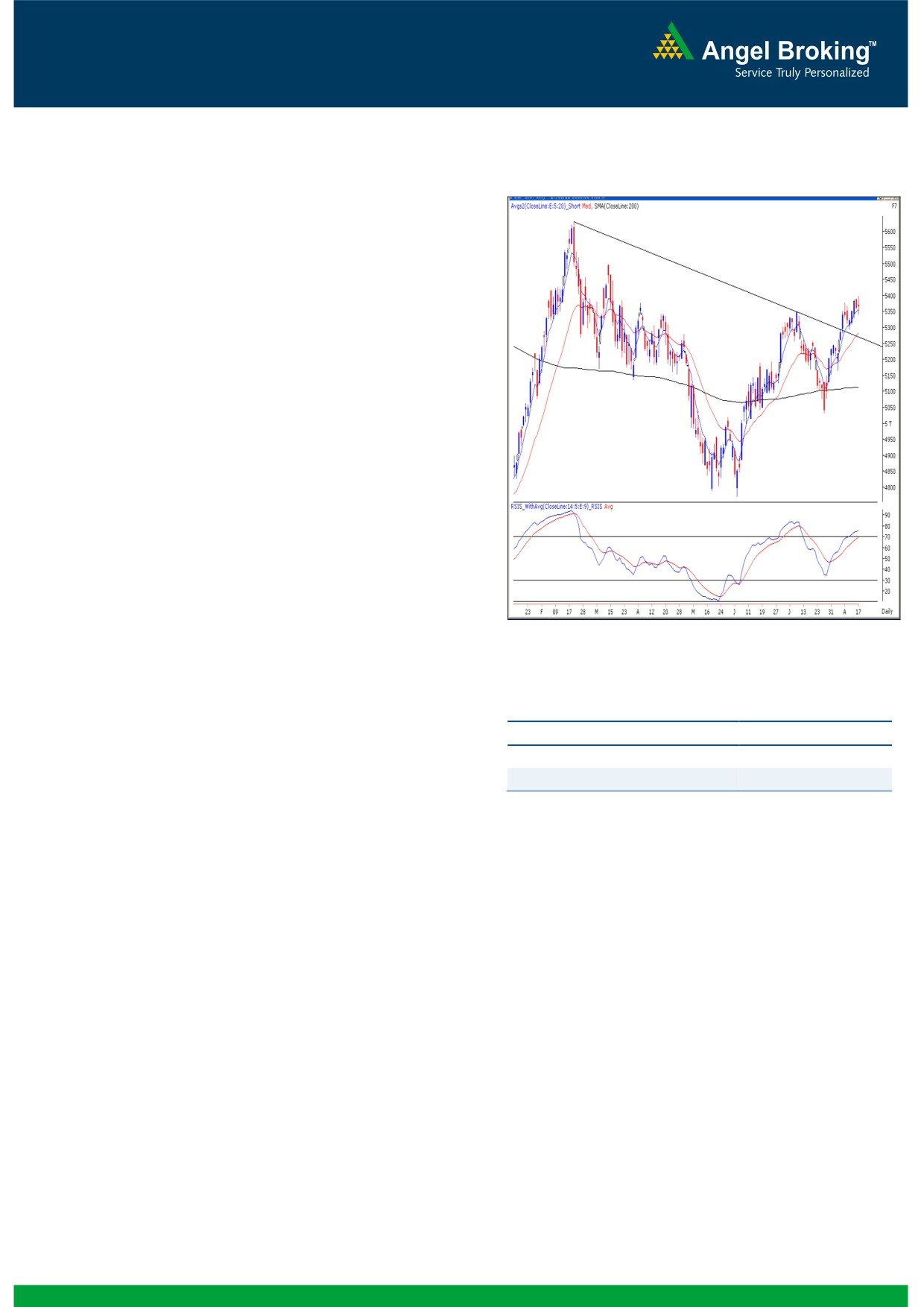

Exhibit 1: Nifty Daily Chart

Sensex (17691) / NIFTY (5366)

On Friday, our benchmark indices closed flat after

CAG reports which were tabled in the Rajya Sabha,

led to loss in early momentum. The Nifty made an

intraday high of 5399.95 but yet again failed to close

above 5400 mark. On sectoral front, FMCG, IT and

TECK counters were among the major gainers,

whereas Realty, Power and Metal counters ended on

the losing side. The advance to decline ratio was in

favor of declining counters (A=1344 D=1498)

Formation

On the weekly chart, the indices have precisely

closed at the “Downward Sloping Trend Line”

resistance near 17802 / 5391 formed by joining

the highs of 21109 / 6339 (November 5, 2010)

- 18524 / 5630 (February 24, 2012).

The ’20-day EMA’ and the ’200-day SMA’ are

placed at 17400 / 5280 and 16900 / 5110

Source: Falcon

levels, respectively.

A weekly closing above 17727 / 5386 level

Actionable points:

would confirm a ‘Higher Top - Higher Bottom’

formation on the weekly chart after August 28,

View

Neutral

2009.

Resistance Levels

5391 - 5425

The candlestick pattern on the daily chart

Support Levels

5329 - 5290

resembles a “Spinning Top” and indicates

uncertainty at current levels.

This may push indices significantly higher to test their

next resistance levels of 17900 - 18050 / 5450 -

Trading strategy:

5500 and the possibility of testing further higher

For the third consecutive week, our benchmark indices

levels cannot be ruled out. At this juncture, the daily

have closed in the positive territory. However, the

chart candlestick pattern depicts a ‘Spinning Top’

formation. This pattern signifies skepticism amongst

‘Higher Top Higher Bottom’ structure in weekly chart

market participants. Hence, unfortunately if markets

is yet to be confirmed as our markets struggle to

sustain below Friday’s low of 17622 / 5356 level,

decisively cross and close above the 17727 / 5386

then we may witness a sideways corrective price

level. Going forward, we continue to maintain our

action in coming trading sessions. In this case,

view that bulls should wait for a closing above 17727

indices may test 17471 / 5294 level. A breach of

/ 5386 level to aggressively create long positions. This

17471 / 5294 will indicate complete loss of current

would also confirm a breakout from the “Downward

positive momentum and our benchmark indices may

Sloping Trend Line” formed by joining the highs of

drift towards 17313 - 17208 / 5260 - 5220.

21109 / 6339 (November 5, 2010) - 18524 / 5630

(February 24, 2012). Strong buying by the bulls is

expected once markets close above 17727 / 5386.

1

Daily Technical Report

August 21, 2012

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10418)

Once again on Friday, we saw range bound activity in

the Bank Nifty in line with the broader markets where

the index closed near the initial opening level. At this

juncture, we are not witnessing any major changes in

price pattern on the daily chart of the index. Hence,

we reiterate our view that going forward, the Bank

Nifty is expected to trade in mentioned range of

10240 - 10622. Within the range, if Bank Nifty

sustains below Friday’s low of

10355, then the

negative momentum is likely to increase further and in

this scenario, the support level of 10240 may be

tested. Conversely, 10506 - 10551 - 10641 levels

would act as intermediate resistance levels for Bank

Nifty.

Actionable points:

View

Neutral

Resistance Levels

10506- 10551 - 10641

Source: Falcon

Support Levels

10355 - 10240

2

Daily Technical Report

August 21, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,526

17,609

17,705

17,787

17,884

NIFTY

5,311

5,339

5,369

5,397

5,428

BANKNIFTY

10,275

10,346

10,426

10,498

10,577

ACC

1,310

1,318

1,328

1,336

1,347

AMBUJACEM

183

186

190

193

197

ASIANPAINT

3,623

3,651

3,691

3,718

3,758

AXISBANK

1,092

1,101

1,111

1,120

1,131

BAJAJ-AUTO

1,668

1,682

1,694

1,708

1,720

BANKBARODA

626

631

638

644

650

BHARTIARTL

257

259

262

265

268

BHEL

224

227

230

232

235

BPCL

333

337

342

346

351

CAIRN

327

331

335

339

343

CIPLA

349

352

355

358

362

COALINDIA

344

347

352

355

359

DLF

202

205

211

214

219

DRREDDY

1,627

1,648

1,664

1,685

1,701

GAIL

352

356

363

368

375

GRASIM

2,981

3,001

3,017

3,037

3,053

HCLTECH

553

555

557

560

562

HDFC

706

710

714

718

723

HDFCBANK

586

591

596

601

607

HEROMOTOCO

1,914

1,924

1,936

1,946

1,958

HINDALCO

110

112

115

116

119

HINDUNILVR

489

496

501

508

513

ICICIBANK

944

953

961

970

978

IDFC

138

139

142

143

145

INFY

2,302

2,327

2,341

2,365

2,379

ITC

256

259

261

264

267

JINDALSTEL

381

391

409

419

436

JPASSOCIAT

73

74

75

77

78

KOTAKBANK

580

585

589

594

599

LT

1,424

1,438

1,460

1,474

1,496

M&M

751

760

769

779

788

MARUTI

1,158

1,168

1,181

1,191

1,205

NTPC

165

166

169

170

173

ONGC

277

279

283

285

289

PNB

717

722

729

735

742

POWERGRID

114

116

118

120

123

RANBAXY

503

510

515

521

527

RELIANCE

802

809

817

824

832

RELINFRA

489

500

518

529

547

SAIL

81

82

84

85

86

SBIN

1,864

1,881

1,899

1,915

1,934

SESAGOA

182

185

188

190

194

SIEMENS

648

653

658

664

669

STER

106

108

110

111

113

SUNPHARMA

653

657

662

667

672

TATAMOTORS

233

237

240

243

247

TATAPOWER

90

94

98

102

106

TATASTEEL

386

391

396

400

406

TCS

1,255

1,267

1,276

1,287

1,296

WIPRO

344

349

352

357

360

3

Daily Technical Report

August 21, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4