Technical Research | April 19, 2012

Daily Technical Report

Sensex (17392) / NIFTY (5300)

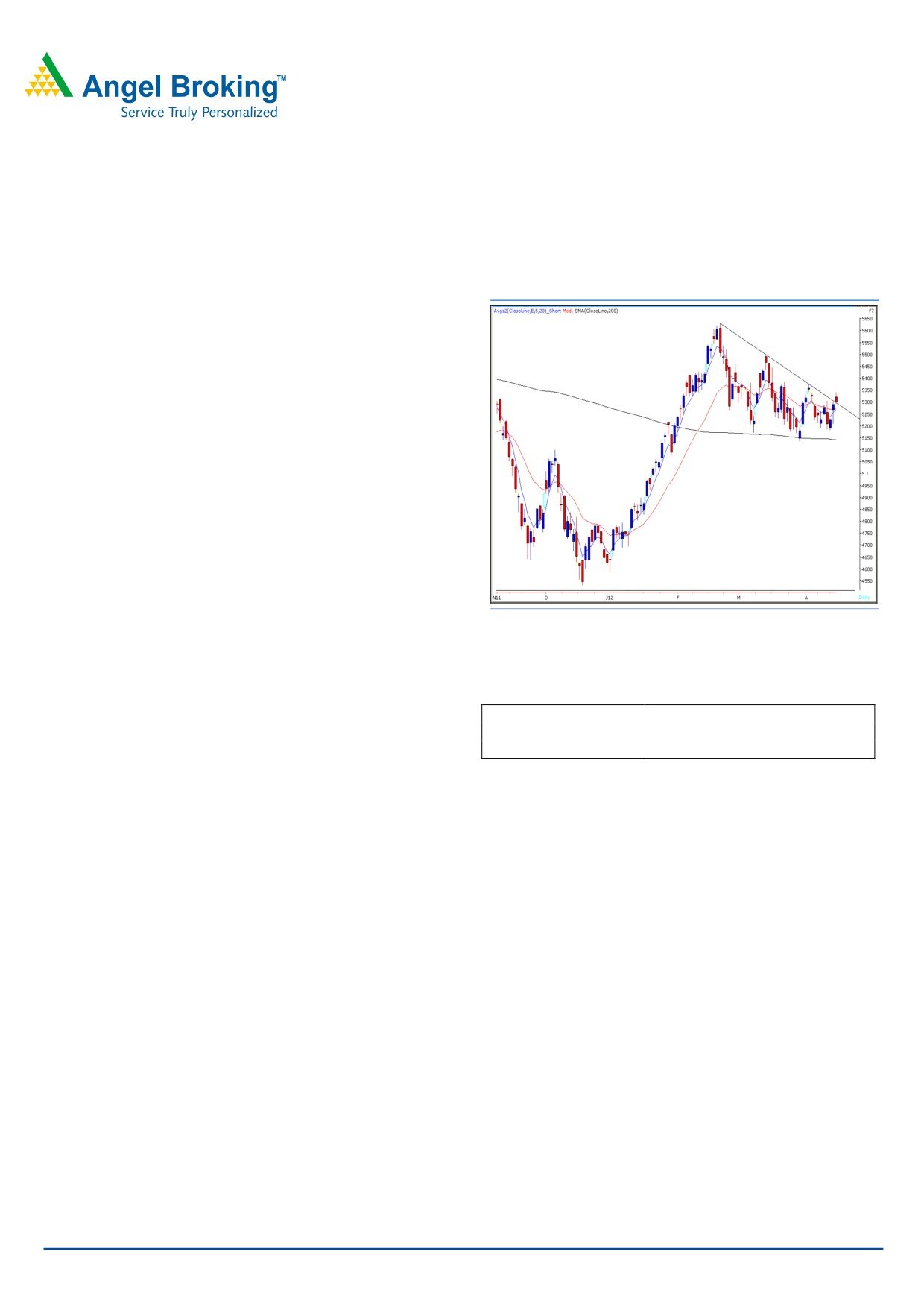

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark indices opened on a higher note

in-line with positive cues from US and European bourses.

Subsequently, minor profit booking in selective large cap

counters dragged indices to close at the 5300 mark. On the

sectoral front, Auto and Health Care counters were among

the major gainers, whereas Realty counters ended on the

losing side. The advance to decline ratio was strongly in

favor of advancing counters (A=1625 D=1251) (Source -

Formation:

• The 200-day SMA (Simple Moving Average) and 20-

day EMA (Exponential Moving Average) have now shifted to

Source: Falcon

17100 / 5150 and 17324 / 5271, respectively.

• The ‘20-Week EMA’ is placed at 17200 / 5200 level.

Actionable points:

• We are witnessing a ‘Downward Sloping Trend Line’

breakout around 17400 / 5300 level.

View

Positive Above 5307

Expected Targets

5330 - 5379

Support Levels

5240 - 5170

Trading strategy:

Yesterday, we witnessed a gap up opening well above the

mentioned ‘Downward Sloping Trend Line’ resistance of

17400 / 5300 level, indices slipped nominally towards the

end of the session. This move above 5300 can be construed

as a breakout above the resistance zone and signals high

probability of an upside move. Going forward, once indices

manage to sustain above 17400 / 5307, they are likely to

rally towards the next resistance zone of -17664 - 17687/

5380 - 5386. O the downside, 17371 - 17293 / 5293 -

5266 will now act as a decent support for the markets.

For Private Circulation Only |

1

Technical Research | April 19, 2012

Bank Nifty Outlook - (10512)

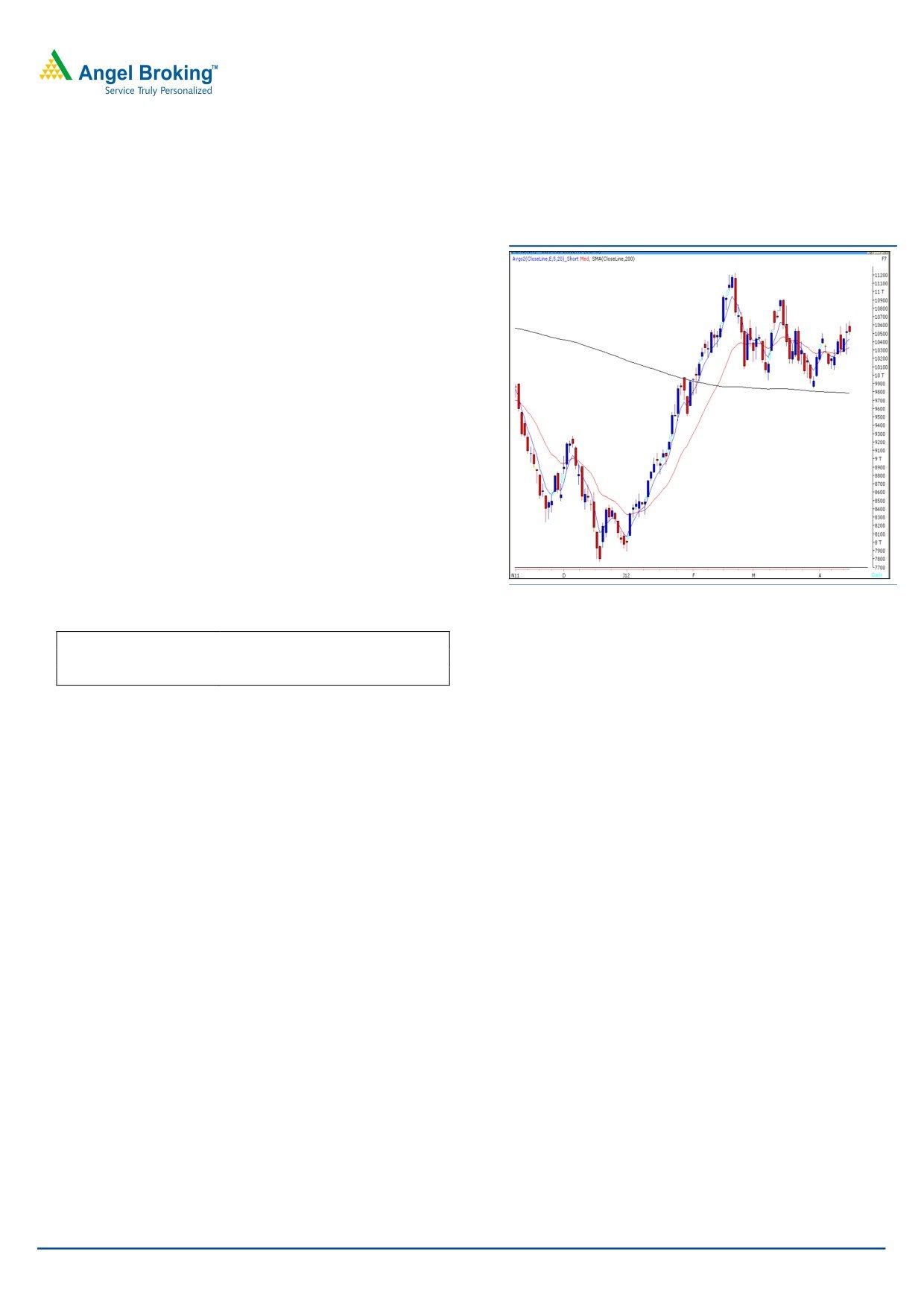

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened on a flat note and traded in

a narrow range throughout the session. We are

witnessing a “Spinning Top” candlestick pattern which is a

sign of indecisiveness prevailing at current levels. We are

even witnessing a negative crossover in “RSI

-

Smoothened” oscillator on the hourly chart. Hence, we

reiterate our view that the index is in a trading range of

10650 - 10150. Only a sustainable move outside the

mentioned range will dictate a clear direction of the

trend. Thus on the upside 10625 - 10650 levels are likely

to act as resistance zone and on the downside 10350 -

10250 levels are likely to act as support in coming

trading session.

Actionable points:

Source: Falcon

View

Neutral

Resistance Levels

10625 - 10650

Support Levels

10350 - 10250

For Private Circulation Only |

2

Technical Research | April 19, 2012

Positive Bias:

Positive

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Above

Target

View will change below

ONGC

271.30

266.7

268.3

273.4

280

269

ESCORTS

76.7

75.6

74.2

78

81

View will change below 74

For Private Circulation Only |

3

Technical Research | April 19, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,278

17,335

17,429

17,486

17,580

NIFTY

5,263

5,282

5,312

5,330

5,360

BANKNIFTY

10,380

10,446

10,546

10,612

10,712

ACC

1,242

1,270

1,289

1,317

1,336

AMBUJACEM

160

163

166

169

171

AXISBANK

1,167

1,181

1,204

1,219

1,241

BAJAJ-AUTO

1,653

1,684

1,710

1,741

1,767

BHARTIARTL

317

319

323

325

329

BHEL

255

258

263

265

270

BPCL

686

692

697

703

707

CAIRN

336

343

347

354

359

CIPLA

309

311

316

318

322

COALINDIA

342

345

349

353

357

DLF

194

198

203

206

211

DRREDDY

1,737

1,752

1,767

1,782

1,796

GAIL

357

362

369

374

381

HCLTECH

480

487

499

506

518

HDFC

672

676

683

687

695

HDFCBANK

530

534

537

541

544

HEROMOTOCO

2,110

2,126

2,144

2,160

2,178

HINDALCO

127

129

131

132

134

HINDUNILVR

419

421

422

425

426

ICICIBANK

864

872

886

895

908

IDFC

127

129

133

135

139

INFY

2,329

2,350

2,376

2,398

2,424

ITC

236

239

244

246

251

JINDALSTEL

504

509

514

520

525

JPASSOCIAT

80

81

83

84

85

KOTAKBANK

569

574

582

587

594

LT

1,299

1,312

1,331

1,344

1,364

M&M

683

687

691

696

699

MARUTI

1,333

1,343

1,355

1,364

1,376

NTPC

166

167

168

169

171

ONGC

267

269

271

273

276

PNB

907

916

927

935

946

POWERGRID

112

113

114

115

116

RANBAXY

502

505

509

513

517

RCOM

84

85

88

89

92

RELIANCE

735

742

749

756

763

RELINFRA

567

573

584

590

601

RPOWER

115

116

118

120

122

SAIL

95

96

97

98

99

SBIN

2,238

2,265

2,302

2,329

2,367

SESAGOA

188

190

192

193

195

SIEMENS

808

819

830

841

851

STER

108

108

110

111

112

SUNPHARMA

582

589

595

603

609

SUZLON

24

24

24

24

25

TATAMOTORS

300

305

308

313

316

TATAPOWER

103

105

106

108

109

TATASTEEL

458

462

467

470

475

TCS

1,081

1,089

1,102

1,110

1,123

WIPRO

422

425

427

430

432

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No: INB 010996539

For Private Circulation Only |