Daily Technical Report

July 16, 2012

Exhibit 1: Nifty Daily Chart

Sensex (17214) / NIFTY (5227)

On Friday, our benchmark indices opened on a

strong note and rallied higher in the morning trade

but lost momentum during the second half to close

near day’s low. On the sectoral front, Consumer

Durables, Realty and Metal counters were among the

major losers; whereas FMCG and Oil & Gas sector

ended with nominal gain. The advance to decline

ratio was marginally in favor of declining counters

Formation

The weekly 61.8% Fibonacci retracement of the

fall from 18524 /5630 (February 22, 2012) -

15749 / 4770 (June 4, 2012) is seen at 17464 /

5302.

On the weekly chart, we are witnessing a

“Downward Sloping Trend Line” resistance near

17687 / 5386 formed by joining the highs of

21109 / 6339 (November 5, 2010) - 18524 /

5630 (February 24, 2012).

A horizontal consolidation band is observed in

Source: Falcon

the range of 17034 / 5159 and 17635 / 5350.

Actionable points:

The ‘20 day EMA’ is placed at 17200 / 5218

level.

View

Neutral

Resistance Levels

5262 - 5300

Trading strategy:

Support Levels

5217 - 5189 - 5159

On the back of few domestic events and global

Considering the chart structure of the major stocks

uncertainties during the week, we witnessed sideways

within the Index, and the fact that the weekly

consolidation in our markets. At this juncture, we are

stochastic oscillator is in the overbought zone, we are

observing that our markets have taken support

of the opinion that a similar consolidation phase is

precisely at ‘20-day EMA’ during the last two trading

likely over the next few days. The current ongoing

sessions of the week. A sustainable move below this

uptrend is likely to resume once the indices close

level may drag the Indices lower towards the gap

above 17635 / 5350 level. In this scenario, we

area (17135 - 17034 / 5189 - 5159 levels) formed

expect indices to march towards the levels of 17687 -

on 29thJune 2012. A fall towards the mentioned gap

18041 / 5386 - 5500. As mentioned in our previous

area would mean that the index is likely to

reports, we advise Positional traders to book partial

consolidate further within the range of 17034 / 5159

profits on a rise towards 5350 and hold balance

and

17635

/

5350. This could also mean a

positions in Nifty by keeping a trailing stop loss at

prolonged phase of lackluster activity within the

5090 (Nifty spot).

mentioned range. One may note that the markets

consolidated for the entire month of April within the

very same range before a decisive move could be

seen.

1

Daily Technical Report

July 16, 2012

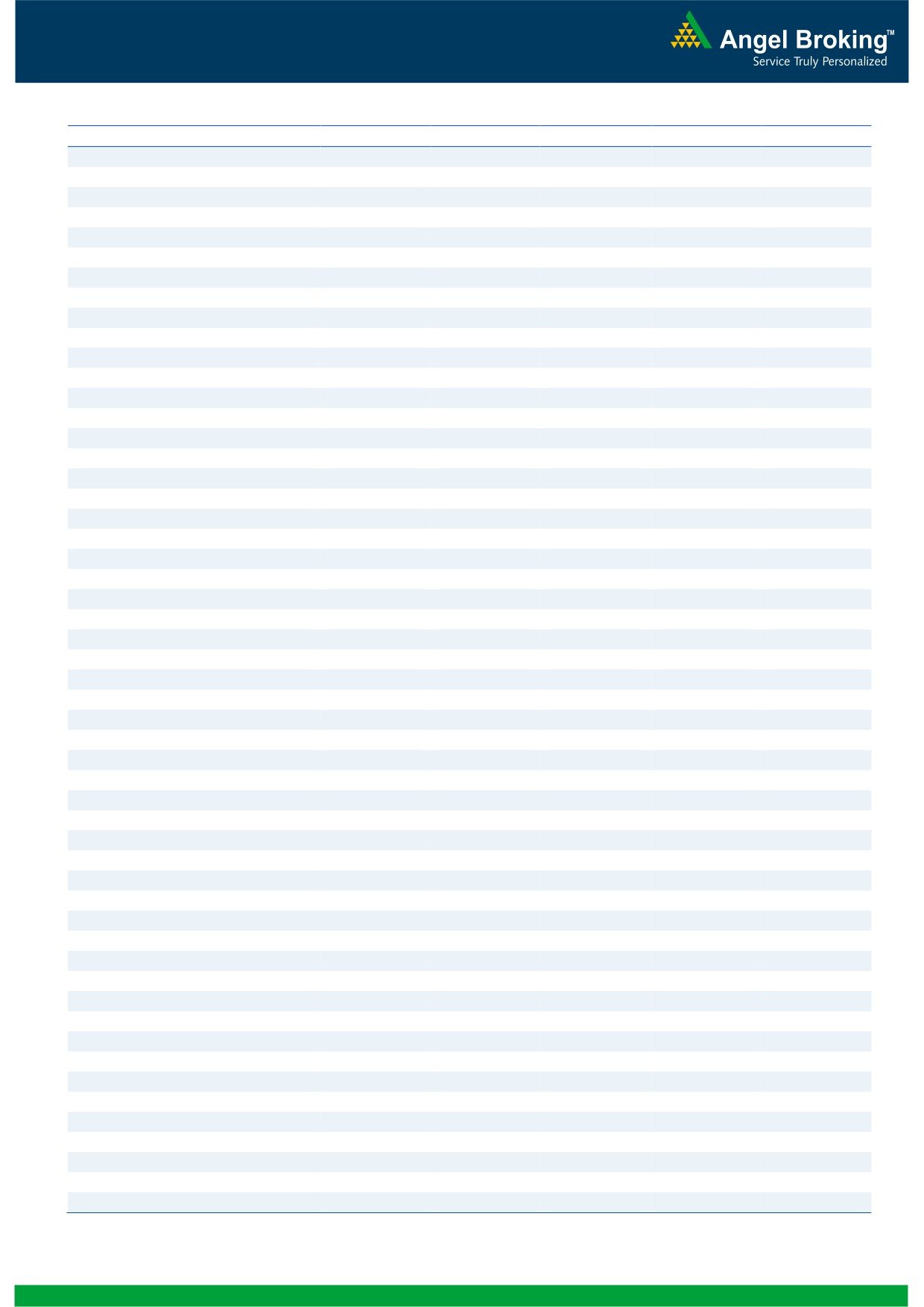

Bank Nifty Outlook - (10594)

Exhibit 2: Bank Nifty Weekly Chart

On Friday, Bank Nifty opened on a flat note and

traded in a narrow range during first half of the

session. However, during the second half selling

pressure in select banking heavyweights led the index

to close near the lowest point of the day. The

momentum oscillators on the daily chart continue with

their sell signal. Moreover, we are witnessing a

“Bearish Harami” candlestick pattern on the weekly

chart near 78.6% Fibonacci retracement of the fall

from February

24,

2012

- May

18,

2012. The

mentioned pattern requires confirmation in the form

of daily closing below the 10524 mark. Thus going

forward a fall below 10524 level is likely to attract

further selling pressure and the Index may drift lower

to test 10440 - 10338 levels. On the upside 10715 -

10740 levels may act as resistance levels in coming

trading session. Broadly we expect the index to trade

in the range of 10782 - 10303 for the coming week.

Actionable points:

View

Bearish Below 10524

Source: Falcon

Expected Targets

10440 - 10365

Resistance Levels

10670 - 10700

2

Daily Technical Report

July 16, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,086

17,150

17,246

17,310

17,407

NIFTY

5,187

5,207

5,237

5,257

5,287

BANKNIFTY

10,480

10,537

10,626

10,683

10,773

ACC

1,252

1,258

1,266

1,272

1,279

AMBUJACEM

166

167

169

170

172

ASIANPAINT

3,661

3,685

3,718

3,742

3,775

AXISBANK

1,011

1,023

1,042

1,054

1,074

BAJAJ-AUTO

1,476

1,488

1,496

1,507

1,515

BANKBARODA

707

713

723

728

738

BHARTIARTL

305

306

308

310

311

BHEL

228

230

231

233

235

BPCL

380

383

388

392

397

CAIRN

313

314

316

317

319

CIPLA

323

326

329

332

335

COALINDIA

351

352

355

356

359

DLF

204

206

209

211

215

DRREDDY

1,624

1,635

1,650

1,661

1,676

GAIL

358

361

364

367

370

GRASIM

2,608

2,623

2,647

2,662

2,685

HCLTECH

479

481

485

488

492

HDFC

672

674

677

679

682

HDFCBANK

578

583

587

591

596

HEROMOTOCO

2,056

2,071

2,081

2,096

2,106

HINDALCO

117

119

122

123

126

HINDUNILVR

438

439

442

444

447

ICICIBANK

915

921

929

934

942

IDFC

135

136

138

139

140

INFY

2,195

2,212

2,236

2,253

2,276

ITC

249

251

253

255

257

JINDALSTEL

412

422

436

445

460

JPASSOCIAT

76

77

78

79

80

KOTAKBANK

594

599

604

609

614

LT

1,388

1,397

1,410

1,418

1,431

M&M

712

716

720

724

729

MARUTI

1,157

1,170

1,189

1,203

1,221

NTPC

157

159

160

161

162

ONGC

279

282

284

287

289

PNB

814

829

844

859

874

POWERGRID

111

112

112

113

114

RANBAXY

486

488

491

493

496

RELIANCE

709

714

720

725

732

RELINFRA

535

541

550

556

565

SAIL

92

92

93

93

94

SBIN

2,132

2,155

2,194

2,218

2,257

SESAGOA

186

188

192

194

198

SIEMENS

683

691

702

709

720

STER

101

102

104

105

107

SUNPHARMA

610

613

617

621

625

TATAMOTORS

232

234

236

238

240

TATAPOWER

96

97

99

101

103

TATASTEEL

418

422

427

431

436

TCS

1,218

1,234

1,259

1,275

1,300

WIPRO

352

356

360

363

368

3

Daily Technical Report

July 16, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4