Daily Technical Report

June 14, 2012

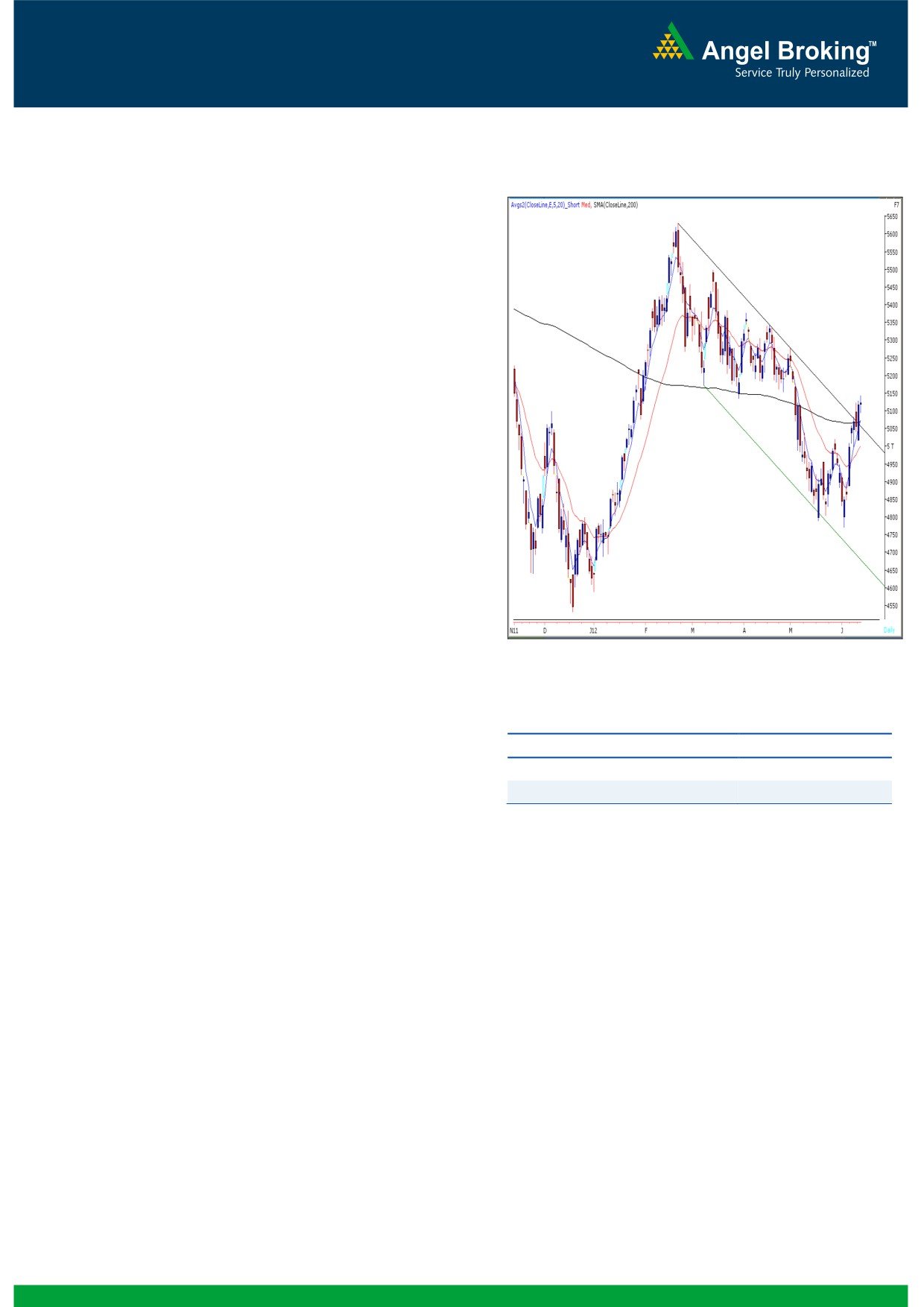

Exhibit 1: Nifty Daily Chart

Sensex (16881) / NIFTY (5121)

Yesterday, our benchmark indices opened on a flat

note in-line with mixed global cues. Further, indices

traded in a narrow range with extreme choppiness to

eventually close near the initial opening level. On

sectoral front, Consumer Goods, FMCG and

Healthcare counters were among the major gainers;

whereas Realty, Auto and Consumer Durables ended

on a losing side. The advance to decline ratio was

marginally in favor of advancing counters (A=1400

Formation

The 200-day SMA (Simple Moving Average) and

20-day EMA (Exponential Moving Average) have

now shifted to 16800 / 5070 and 16380 /

4967, respectively.

The ‘20-Week EMA’ is placed at 16830 / 5100

level.

Indices have taken a support near 15860 /

Source: Falcon

4766 level, which is the

78.6% Fibonacci

Retracement level of the rise from 15135 / 4531

(Low on December 23, 2011) to 18524 / 5630

(High on February 22, 2012).

Actionable points:

View

Bullish above 5145

On the daily chart, indices are trading near the

Resistance Levels

5177 - 5200

upper range of ‘Downward Sloping Channel’

Support Levels

5095 - 5058

drawn by joining two highs of February 22,

2012 - April 19, 2012 and low of March 7,

2012.

We expect the Indices to meet the target of 17400 /

The weekly ‘RSI’ momentum oscillator is

5270 in the next few sessions. The resistance for the

signaling a positive crossover.

day is seen at 17121 / 5177 levels. On the lower

side, 16792 - 16680 / 5095 - 5058 may provide

decent support for the day.

Trading strategy:

Tuesday's sharp bounce was followed by a range

bound session yesterday as indices traded in a narrow

band of about a percent. Going forward, our view

remains unchanged as yesterday's session does not

significantly alter the underlying bullish trend. Hence,

we reiterate that a sustainable move above 16944 / -

5145 would lead to a 'Downward Sloping Channel'

breakout and would result in enhanced buying

interest among market participants.

1

Daily Technical Report

June 14, 2012

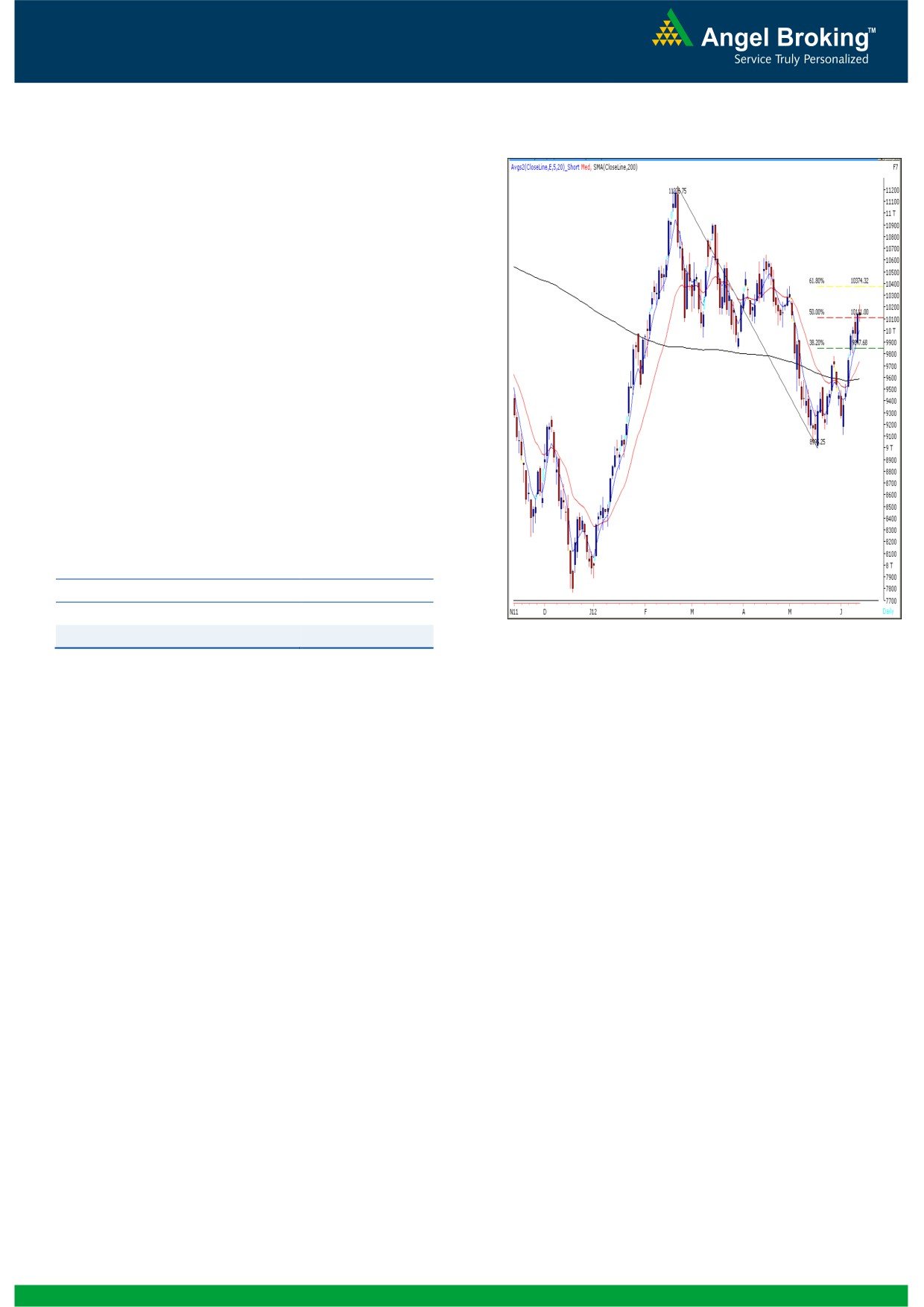

Bank Nifty Outlook - (10128)

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened on a flat note and

traded in a narrow range throughout the session. The

index tested the resistance level of 10230 and drifted

lower to close near the initial opening level. The

candlestick formed yesterday is a “Spinning Top” and

indicates indecisiveness

/ consolidation at current

levels. We are now witnessing a negative crossover in

“Stochastic” momentum oscillator on the daily chart

coupled with a negative divergence in “RSI”

momentum oscillator on the hourly chart. These are

early warning signals that indicate that in case the

Bank Nifty sustains below yesterday’s low of 10075,

the Index may lose buying momentum and it is likely

to then drift towards 9898 - 9809 levels. On the

other hand, a move beyond 10230 level would signal

further upside and the Index may then head towards

the swing high of 10380 over the next few sessions.

Actionable points:

View

Bullish Above 10230

Expected Target

10382

Support Levels

10000 - 9893

Source: Falcon

2

Daily Technical Report

June 14, 2012

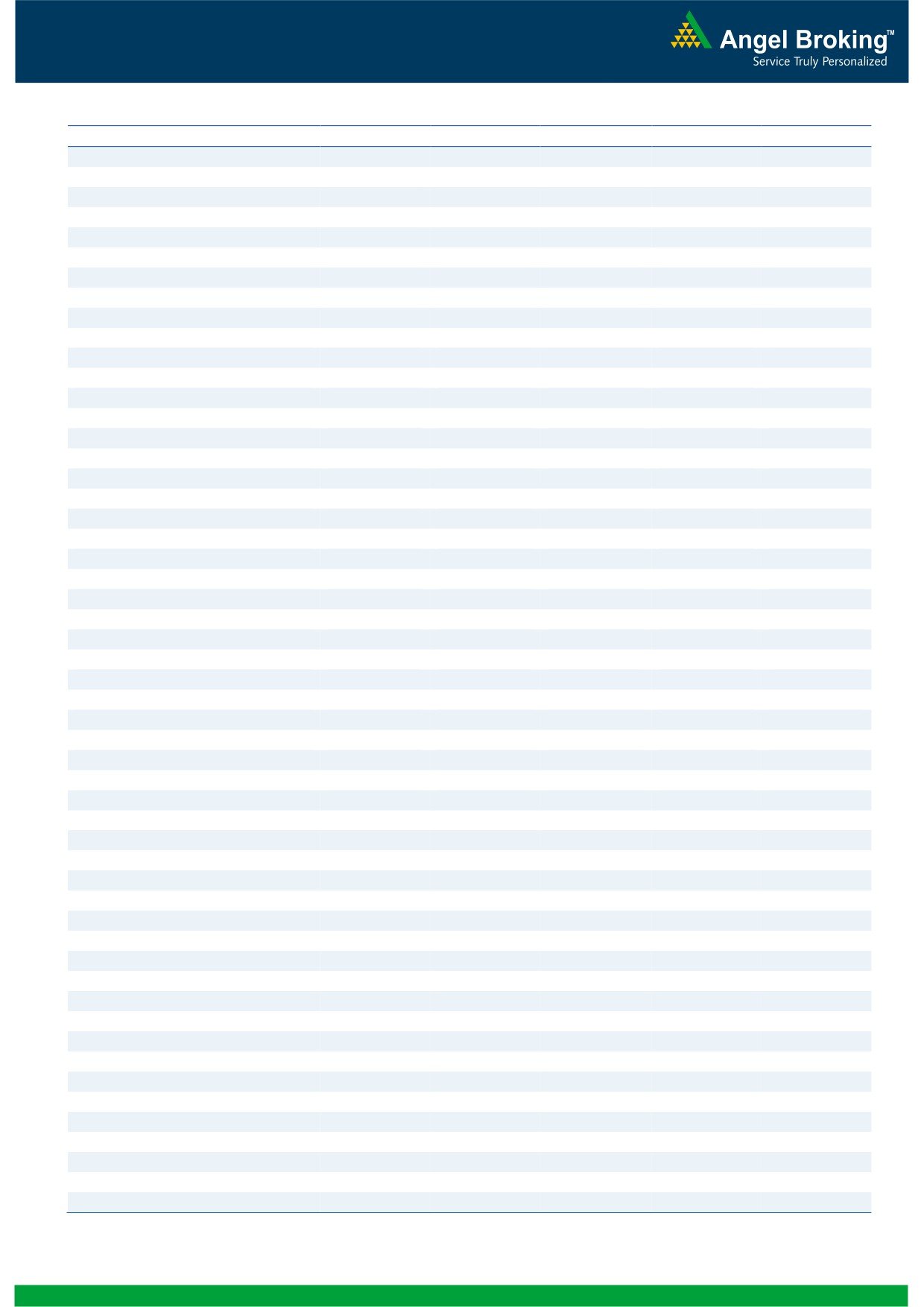

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

16,721

16,801

16,872

16,952

17,024

NIFTY

5,071

5,096

5,121

5,146

5,170

BANKNIFTY

9,993

10,061

10,143

10,210

10,292

ACC

1,161

1,170

1,183

1,193

1,205

AMBUJACEM

156

160

162

166

168

ASIANPAINT

3,828

3,853

3,887

3,912

3,946

AXISBANK

1,026

1,035

1,049

1,058

1,072

BAJAJ-AUTO

1,527

1,544

1,561

1,578

1,595

BANKBARODA

706

713

722

729

738

BHARTIARTL

302

305

309

312

316

BHEL

214

218

221

224

227

BPCL

723

728

733

738

743

CAIRN

316

319

321

324

326

CIPLA

300

302

304

306

308

COALINDIA

327

330

336

339

344

DLF

192

194

197

199

202

DRREDDY

1,550

1,559

1,575

1,584

1,600

GAIL

331

334

338

341

345

GRASIM

2,340

2,357

2,376

2,393

2,412

HCLTECH

481

486

490

495

499

HDFC

651

653

657

660

663

HDFCBANK

532

537

545

550

557

HEROMOTOCO

1,909

1,932

1,968

1,990

2,027

HINDALCO

120

121

123

124

126

HINDUNILVR

426

437

443

453

459

ICICIBANK

825

837

847

860

870

IDFC

132

133

135

136

138

INFY

2,420

2,445

2,467

2,493

2,515

ITC

241

243

244

245

246

JINDALSTEL

427

434

439

446

451

JPASSOCIAT

68

69

70

71

72

KOTAKBANK

579

582

588

591

597

LT

1,271

1,310

1,341

1,381

1,411

M&M

668

675

683

691

699

MARUTI

1,077

1,092

1,118

1,134

1,160

NTPC

151

153

155

157

160

ONGC

255

262

266

273

276

PNB

799

807

812

820

825

POWERGRID

106

107

108

108

109

RANBAXY

471

476

481

486

491

RELIANCE

706

711

718

723

729

RELINFRA

503

510

520

527

537

SAIL

93

94

95

96

97

SBIN

2,161

2,193

2,219

2,251

2,277

SESAGOA

183

185

188

190

193

SIEMENS

673

685

691

703

709

STER

98

100

102

104

107

SUNPHARMA

573

583

589

599

605

TATAMOTORS

231

234

239

242

247

TATAPOWER

92

93

95

96

98

TATASTEEL

407

409

413

416

419

TCS

1,234

1,242

1,251

1,259

1,268

WIPRO

391

394

396

399

401

3

Daily Technical Report

June 14, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4