Technical Research | February 09, 2012

Daily Technical Report

Sensex (17707) / NIFTY (5368)

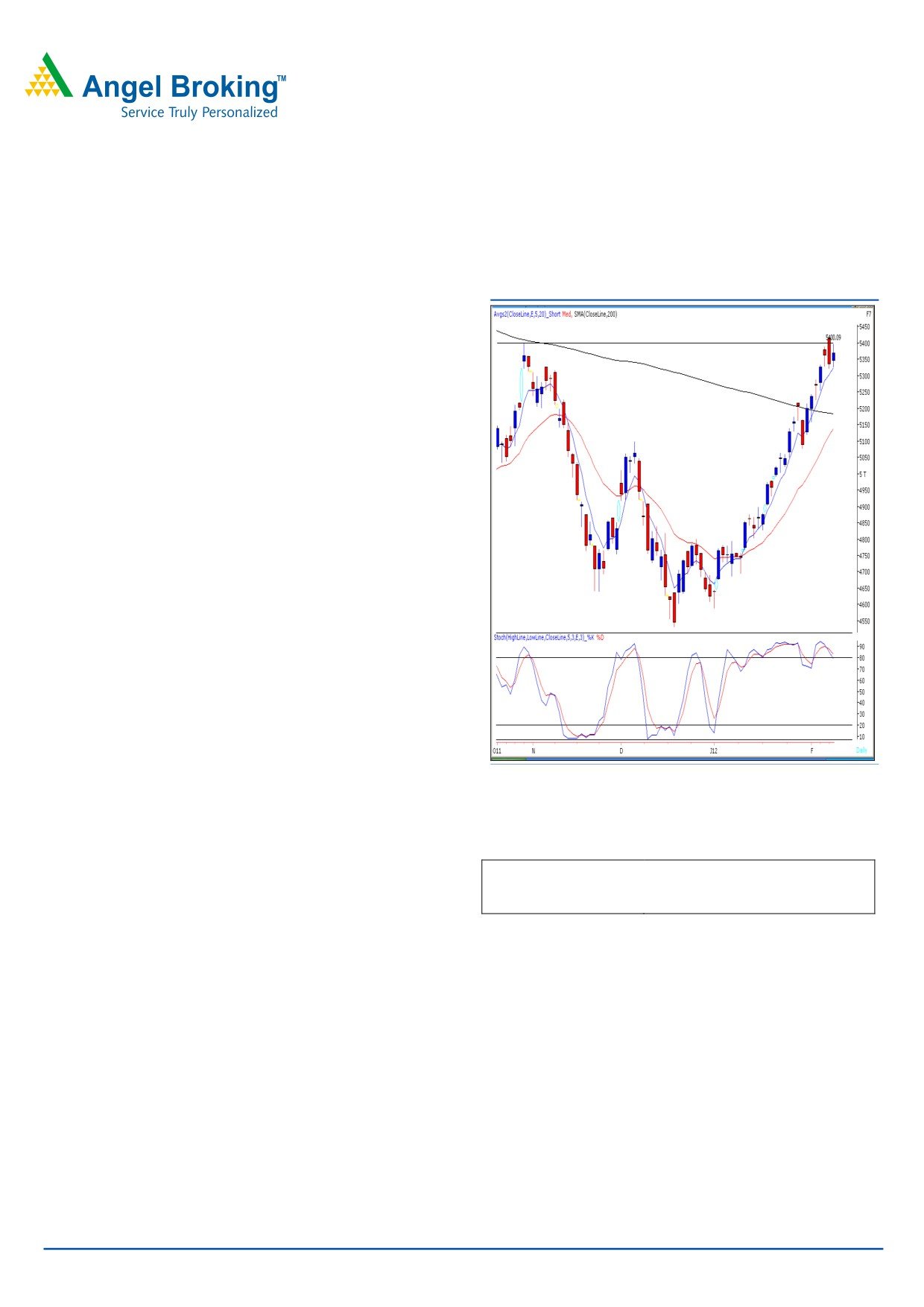

Exhibit 1: Nifty Daily Chart

After nearly 5 - 6 trading sessions, yesterday markets

opened on a flat note and traded with extreme volatility to

close in green. On the sectoral front, Consumer Durables,

Realty and IT counters were among the major gainers,

whereas Health Care and Banking sectors ended with a

nominal loss. The advance to decline ratio was in favor of

advancing counters. (A=1723 D=1157) (Source

-

Formation:

• Indices are hovering around “Horizontal Line”

resistance of 17908 / 5400.

• The “RSI-Smoothened” oscillator on daily chart is

placed in extreme overbought territory.

• Tuesday’s price action indicates a “Bearish Engulfing”

pattern.

• The momentum oscillator on the daily chart viz., the

“Stochastic” is negatively poised.

Source: Falcon

• The daily chart exhibits a “Spinning Top” formation.

Actionable points:

Trading strategy:

View

Bearish below 5322

After a quiet opening, indices made another attempt of

Expected Targets

5290 - 5225

crossing 5400 mark. We observed strong selling pressure

Resistance levels

5414

near this stiff resistance which dragged indices lower to test

hourly 20 EMA. However, a sharp recovery towards the

Therefore, violation of 17582 / 5322 level may attract

latter part of the session led indices to close with decent

strong selling pressure and indices may slide towards

gains. Yesterday’s candle resembles a “Spinning Top”

17504 - 17308 / 5290 - 5225 levels. On the upside,

Japanese candlestick pattern. A combination of this pattern

17908 / 5414 level is likely to act as a strong resistance for

with the “Engulfing Bearish” pattern formed on Tuesday’s

the markets.

session indicates loss of positive momentum and uncertainty

among the market participants. Further, we continue to

mention that the “RSI-Smoothened” oscillator is placed well

inside the overbought territory and the “Stochastic”

oscillator is negatively poised.

For Private Circulation Only |

1

Technical Research | February 09, 2012

Bank Nifty Outlook - (10320)

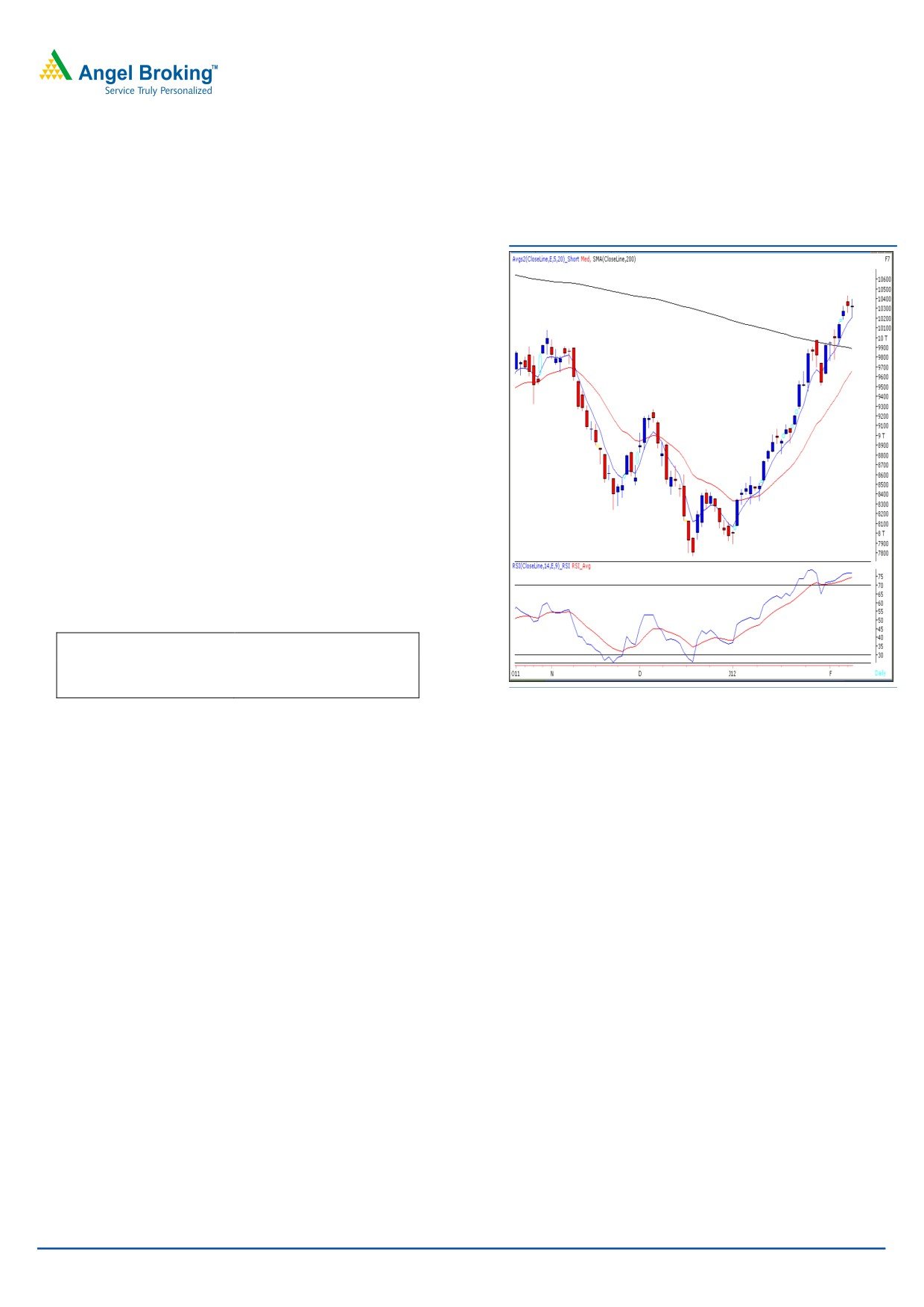

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened on a flat note and traded with

extreme volatility throughout the day to close near the initial

opening level. We are witnessing a “Doji” candle stick

formation which is a sign of indecision in the minds of the

bulls and the bears. We are now of the opinion that the

index is in a broad range of 10180 - 10430 levels and only

a sustainable move outside the said range will dictate the

direction of the trend. However we reiterate our view, on the

Daily chart; we are witnessing a possibility of negative

divergence in “RSI” oscillator which is coupled with other

overbought momentum oscillators. Thus the chances of a

breakdown are higher as compared to that of a breakout.

However traders are advised to wait for further confirmatory

signals before taking aggressive positions. On the upside

resistance of 10430 - 10517 remains intact.

Actionable points:

View

Neutral

Resistance Levels

10430 - 10517

Support Levels

10180 - 9916

Source: Falcon

For Private Circulation Only |

2

Technical Research | February 09, 2012

Positive Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

Uflex

138

137.6

132.6

151

View will change below 127

IL&FS Eng.

84

79.3

72.1

93

View will change below 73

Venky’s India

473.4

451

430.8

520

View will change below 431

For Private Circulation Only |

3

Technical Research | February 09, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,469

17,588

17,699

17,818

17,928

NIFTY

5,292

5,330

5,363

5,402

5,435

BANKNIFTY

10,117

10,218

10,310

10,412

10,503

ACC

1,315

1,350

1,371

1,406

1,428

AMBUJACEM

172

174

177

180

182

AXISBANK

1,085

1,106

1,124

1,145

1,162

BAJAJ-AUTO

1,617

1,633

1,648

1,664

1,678

BHARTIARTL

340

347

358

366

377

BHEL

253

257

262

266

270

BPCL

559

569

574

584

589

CAIRN

362

367

372

378

382

CIPLA

344

348

352

356

360

COALINDIA

322

328

332

337

341

DLF

226

231

234

239

243

DRREDDY

1,575

1,598

1,616

1,639

1,657

GAIL

371

382

388

398

405

HCLTECH

457

462

465

470

473

HDFC

681

689

695

702

708

HDFCBANK

495

502

510

517

525

HEROMOTOCO

1,931

1,964

1,987

2,021

2,043

HINDALCO

149

155

159

165

169

HINDUNILVR

380

384

387

391

394

ICICIBANK

902

911

920

930

939

IDFC

135

137

138

140

142

INFY

2,724

2,746

2,764

2,787

2,805

ITC

199

202

205

207

210

JINDALSTEL

562

572

586

595

609

JPASSOCIAT

73

75

76

79

80

KOTAKBANK

521

527

533

539

545

LT

1,336

1,352

1,366

1,382

1,396

M&M

660

673

686

699

711

MARUTI

1,229

1,248

1,264

1,283

1,299

NTPC

174

176

177

179

181

ONGC

275

279

283

287

290

PNB

962

971

984

994

1,006

POWERGRID

104

106

108

110

113

RANBAXY

444

449

455

460

465

RCOM

87

90

92

95

97

RELIANCE

836

847

856

867

876

RELINFRA

536

564

580

607

624

RPOWER

98

100

101

103

104

SAIL

102

103

106

107

110

SBIN

2,128

2,153

2,170

2,195

2,213

SESAGOA

212

220

226

233

239

SIEMENS

763

774

781

792

799

STER

120

122

124

126

128

SUNPHARMA

530

540

548

558

565

SUZLON

29

29

30

30

31

TATAMOTORS

242

246

250

254

258

TATAPOWER

104

106

107

110

111

TATASTEEL

432

441

452

461

471

TCS

1,203

1,211

1,219

1,227

1,235

WIPRO

423

429

434

439

444

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |