Technical Research | February 08, 2012

Daily Technical Report

Sensex (17623) / NIFTY (5335)

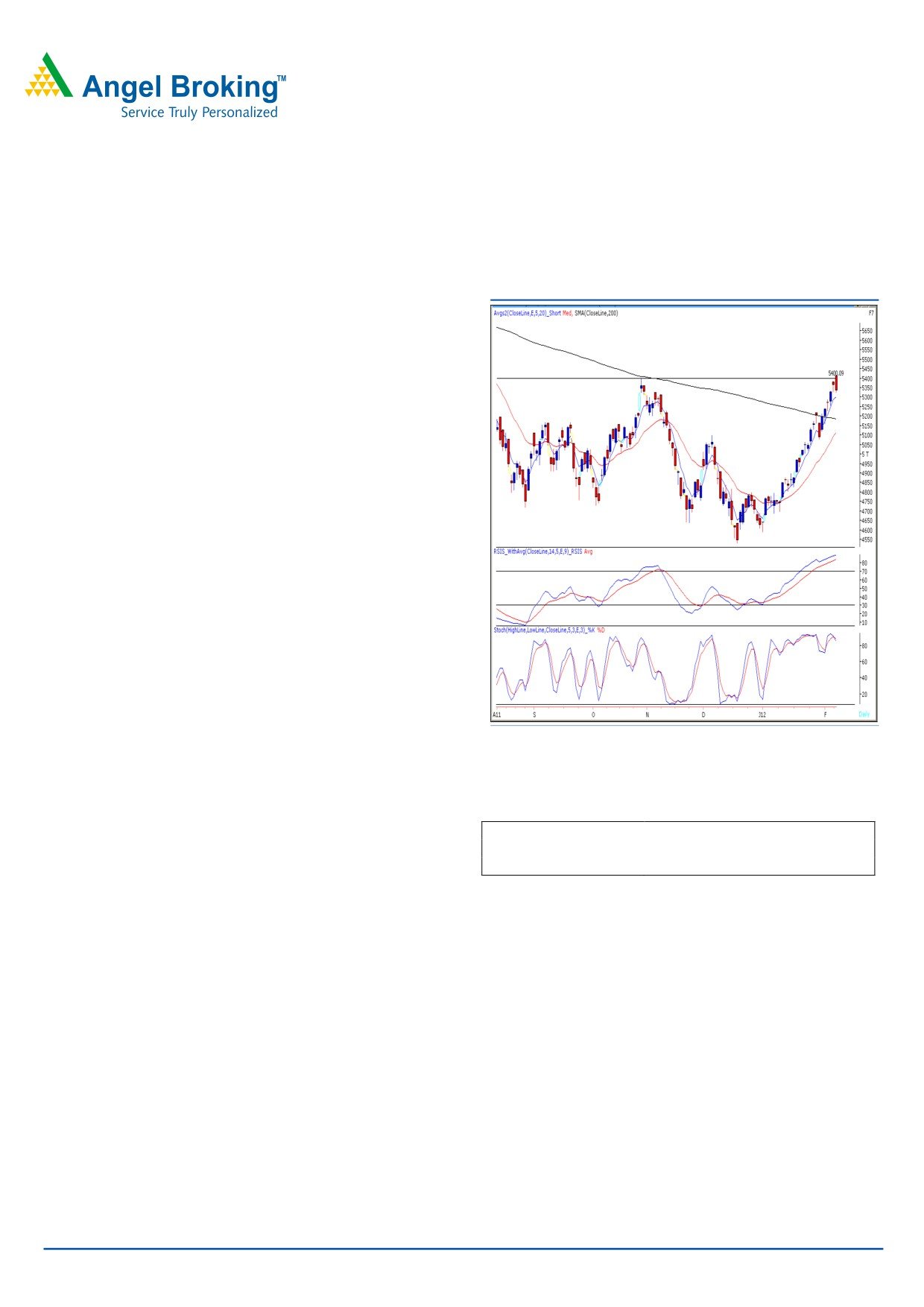

Exhibit 1: Nifty Daily Chart

Yesterday Indices opened higher in-line with strong cues

from Asian markets but failed to sustain at higher levels and

corrected sharply during the second half to close marginally

above the day’s low. On the sectoral front, Capital Goods,

Realty and Power counters were among the major losers,

whereas Oil & Gas and Consumer Durables sectors ended

on a gaining side. The advance to decline ratio was in favor

of declining counters. (A=1247 D=1630) (Source

-

Formation:

• Indices are hovering around “Horizontal Line”

resistance of 17908 / 5400.

• Monday’s candle resembled a “Hanging Man”. This is

a bearish pattern but requires confirmation.

• The “RSI-Smoothened” oscillator on daily chart is

placed in extreme overbought territory.

• The daily chart depicts a “Bearish Engulfing” pattern.

Source: Falcon

• The momentum oscillator on the daily chart viz., the

“Stochastic” is negatively poised.

Trading strategy:

Actionable points:

View

Bearish below 5322

We witnessed yet another gap up opening mainly on the

Expected Targets

5290 - 5225

back of positive sentiments across global. However, markets

Resistance levels

5414

pared early gains and a relatively sharp down move during

the second half led indices to close marginally above the

low of the “Hanging Man” pattern formed on Monday’s

session. Also, yesterday’s candle resembles a “Bearish

Engulfing” pattern but requires confirmation. The said

pattern will be confirmed on the violation of 17582 / 5322

level. In addition, the “Stochastic” oscillator on the daily

chart is negatively poised. As a result of this, a sustainable

move below 17582 / 5322 level may reinforce the selling

pressure and indices may slide towards 17504 - 17308 /

5290 - 5225 levels. On the upside, 17908 / 5414 level is

likely to act as a strong resistance for the markets.

For Private Circulation Only |

1

Technical Research | February 08, 2012

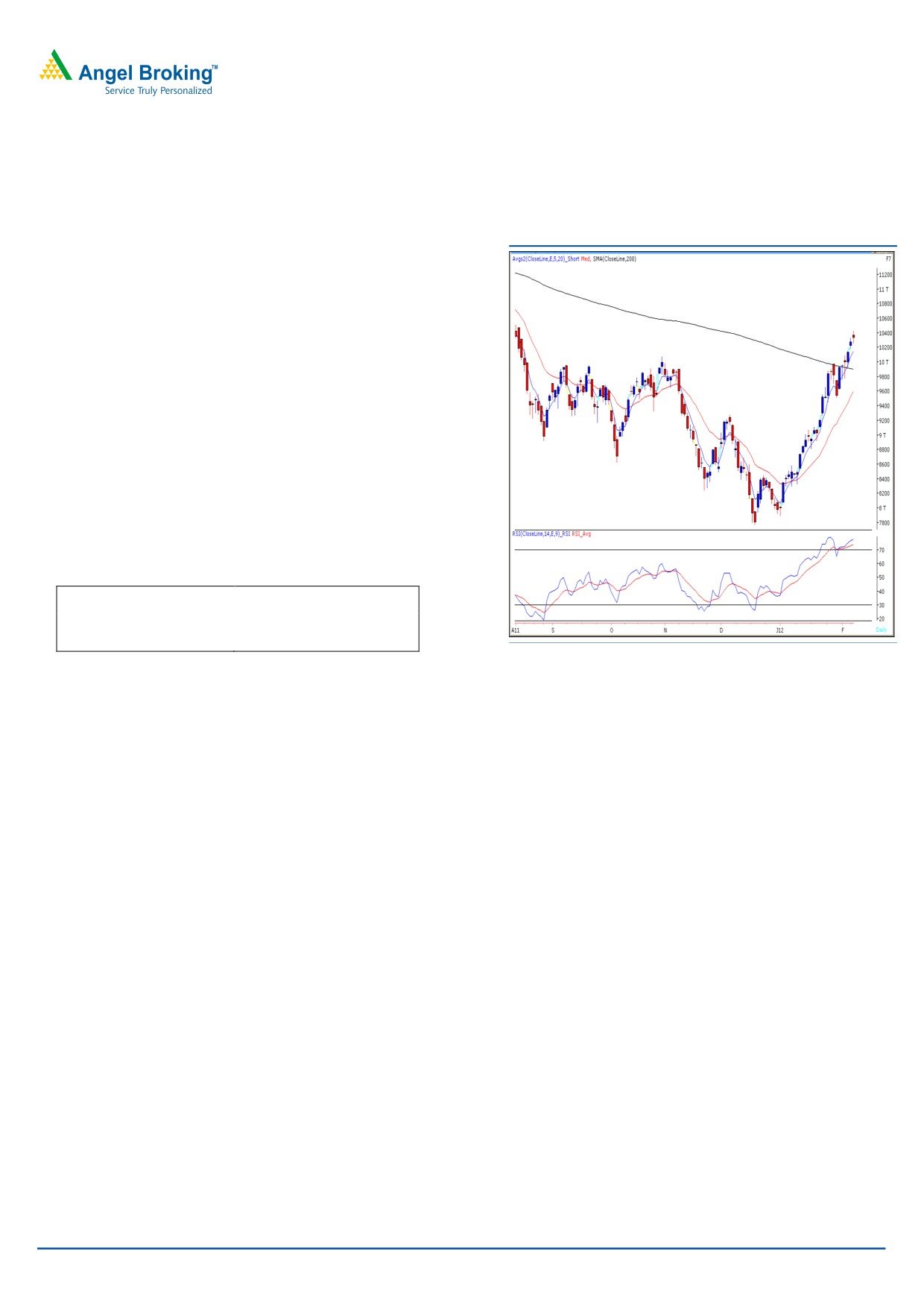

Bank Nifty Outlook - (10325)

Exhibit 2: Bank Nifty Daily Chart

Yesterday, Bank Nifty opened up with an upside gap but

closed marginally below the mentioned resistance level of

10350. For the second consecutive session we are witnessing

a narrow range body formation, which is a sign of

uncertainty prevailing at current levels. We reiterate our view,

on the Daily chart; we are witnessing a possibility of negative

divergence in “RSI” oscillator which is coupled with other

overbought momentum oscillators. Hence a chance of minor

correction cannot be ruled out. On the downside, if Bank

Nifty trades convincingly below yesterday’s low of

10260

then it is likely to drift towards 10100 - 9916 levels. On the

upside the levels of 10430 - 10516 are likely to act as

resistance for the day.

Actionable points:

View

Neutral

Resistance Levels

10430 - 10516

Support Levels

10260 - 10100 - 9916

Source: Falcon

For Private Circulation Only |

2

Technical Research | February 08, 2012

Positive Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

ITC

205.4

202.9

203.2

208

View will change below 202

Negative Bias:

Expected

Stock Name

CMP

5 Day EMA

20 Day EMA

Remarks

Target

Reliance

374.5

372.5

337.8

356

View will change above 390

Capital

For Private Circulation Only |

3

Technical Research | February 08, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,429

17,526

17,679

17,775

17,929

NIFTY

5,267

5,301

5,357

5,391

5,448

BANKNIFTY

10,169

10,247

10,338

10,416

10,508

ACC

1,270

1,315

1,344

1,389

1,418

AMBUJACEM

173

175

179

181

184

AXISBANK

1,087

1,100

1,113

1,126

1,138

BAJAJ-AUTO

1,604

1,621

1,640

1,657

1,676

BHARTIARTL

365

372

381

388

397

BHEL

248

254

264

270

280

BPCL

553

560

573

581

594

CAIRN

354

360

366

372

377

CIPLA

346

350

355

359

364

COALINDIA

318

322

328

332

339

DLF

222

225

231

235

241

DRREDDY

1,600

1,617

1,647

1,664

1,694

GAIL

369

374

382

388

396

HCLTECH

451

456

462

467

474

HDFC

667

676

693

702

718

HDFCBANK

504

506

511

514

518

HEROMOTOCO

1,895

1,922

1,968

1,996

2,041

HINDALCO

148

151

155

158

162

HINDUNILVR

373

377

383

387

393

ICICIBANK

916

927

937

947

957

IDFC

130

133

138

141

145

INFY

2,657

2,692

2,749

2,784

2,840

ITC

201

203

205

207

208

JINDALSTEL

552

563

577

588

602

JPASSOCIAT

71

73

76

77

81

KOTAKBANK

509

522

530

544

552

LT

1,319

1,337

1,366

1,384

1,413

M&M

663

676

699

712

734

MARUTI

1,228

1,237

1,250

1,259

1,272

NTPC

172

174

176

178

180

ONGC

276

281

284

289

293

PNB

965

974

984

993

1,003

POWERGRID

105

106

108

110

112

RANBAXY

447

452

455

460

463

RCOM

87

89

92

94

96

RELIANCE

825

835

844

853

862

RELINFRA

533

542

552

562

572

RPOWER

94

97

99

102

104

SAIL

103

104

107

109

111

SBIN

2,119

2,136

2,162

2,179

2,205

SESAGOA

211

216

225

230

239

SIEMENS

759

768

779

788

799

STER

118

120

124

126

129

SUNPHARMA

521

533

544

556

567

SUZLON

28

28

29

30

31

TATAMOTORS

244

247

251

254

258

TATAPOWER

105

106

108

109

110

TATASTEEL

435

443

458

466

480

TCS

1,182

1,190

1,200

1,208

1,218

WIPRO

423

426

428

431

434

Technical Research Team

For Private Circulation Only |

4

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Mehul Kothari

Technical Analyst

Ankur Lakhotia

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be

subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are

inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of

information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No

one can use the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the

securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to

determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as

non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis

centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals

and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update

the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and

employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other

reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any

forward-looking statements are not predictions and may be subject to change without notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time

to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other

transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest

with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |